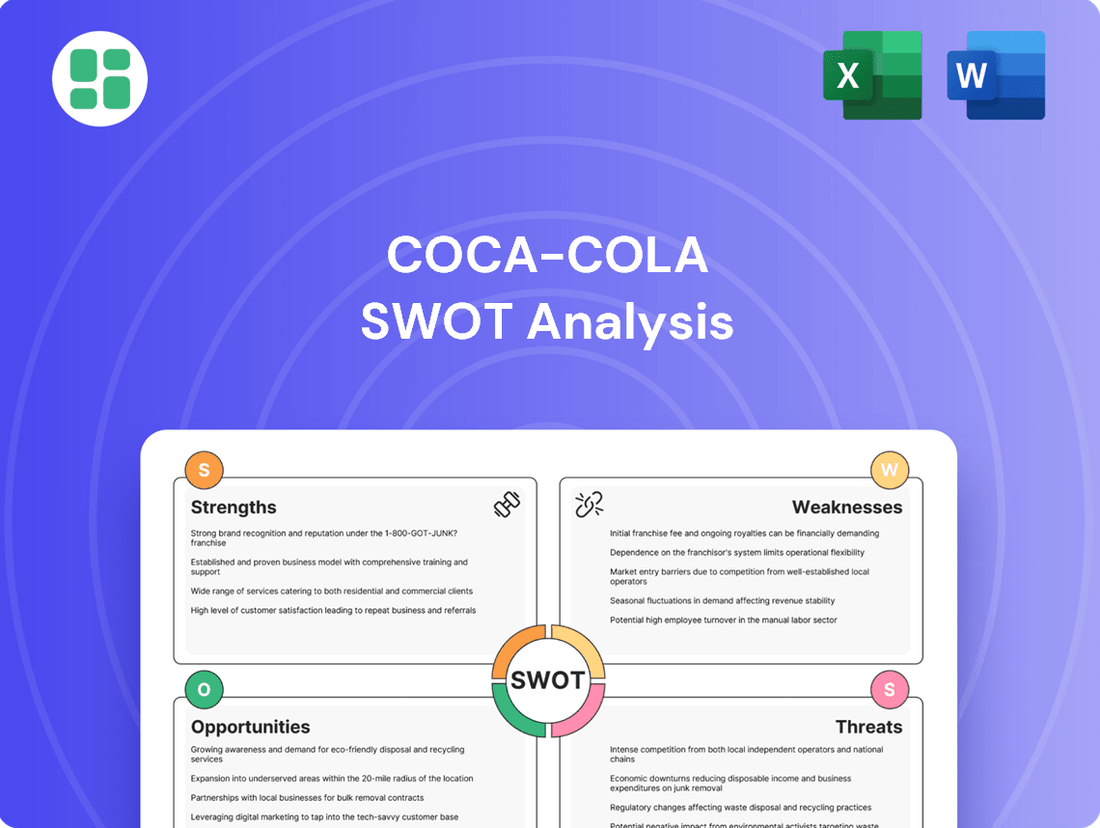

Coca-Cola SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Coca-Cola Bundle

Coca-Cola's global brand recognition is a monumental strength, but its reliance on sugar-based beverages presents a significant weakness in today's health-conscious market. Opportunities lie in expanding its healthier product portfolio and leveraging its vast distribution network for new ventures. However, increasing competition and changing consumer preferences pose considerable threats.

Want the full story behind Coca-Cola's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Coca-Cola's brand identity is incredibly strong, consistently recognized globally and holding a high valuation. For instance, in 2024, Interbrand ranked Coca-Cola as one of the top 10 most valuable global brands, with its brand value estimated at over $80 billion. This powerful recognition, built through decades of distinctive marketing, creates a significant competitive edge.

This deep-rooted brand loyalty, cultivated by consistent and memorable advertising, translates directly into market share and pricing power. In 2023, Coca-Cola reported net revenue of $45.75 billion, a testament to the enduring appeal and purchasing behavior driven by its brand strength.

Coca-Cola's extensive global reach is a significant strength, with operations in virtually every country worldwide. This vast network, spanning nearly 200 nations, is supported by a robust distribution system that partners with independent bottling companies. This localized approach ensures efficient market penetration and product availability, allowing the company to serve a massive global consumer base.

Coca-Cola's strength lies in its remarkably diverse product portfolio, extending far beyond its flagship cola. With over 200 brands encompassing water, juices, plant-based beverages, teas, and coffees, the company effectively caters to a broad spectrum of consumer tastes and health consciousness.

This strategic repositioning is crucial for mitigating risks associated with a sole reliance on carbonated soft drinks. For instance, in 2024, Coca-Cola's non-cola beverages continued to show robust growth, contributing significantly to overall revenue and demonstrating the success of this diversification strategy.

Dominant Market Share

Coca-Cola commands a formidable global market share, especially within the carbonated soft drink segment. This dominance is a testament to its robust marketing campaigns and extensive distribution network, which effectively shape consumer preferences and solidify its competitive standing.

The company's market leadership translates into significant pricing power and brand loyalty. For instance, in the first quarter of 2024, Coca-Cola reported a net revenue of $11.3 billion, demonstrating the ongoing strength of its brand and market penetration.

- Global Leader: Coca-Cola holds the top position in the non-alcoholic beverage industry worldwide.

- Carbonated Dominance: Its strongest presence is in the carbonated soft drink market.

- Brand Influence: Effective marketing and distribution drive consumer choice and maintain a competitive advantage.

- Financial Strength: Q1 2024 revenues of $11.3 billion underscore its market power.

Financial Strength and Strategic Investments

The Coca-Cola Company demonstrates considerable financial strength, underscored by consistent revenue generation and healthy profitability. This financial resilience allows for substantial investments in crucial areas like marketing campaigns, product innovation, and strategic acquisitions, bolstering its competitive edge.

This robust financial footing empowers Coca-Cola to navigate economic downturns effectively and pursue opportunities for portfolio expansion and increased market penetration. For instance, in the first quarter of 2024, Coca-Cola reported net revenue of $11.3 billion, a 2% increase year-over-year, showcasing its ongoing financial stability.

Key strengths include:

- Strong Revenue and Profitability: Consistent financial performance provides a solid foundation for growth initiatives.

- Investment Capacity: Ability to allocate significant capital to marketing, R&D, and strategic M&A activities.

- Economic Resilience: Financial stability allows the company to withstand market volatility and economic challenges.

- Portfolio Expansion: Financial resources support the acquisition and development of new brands and product lines.

Coca-Cola's brand equity is a paramount strength, consistently ranking among the world's most valuable. In 2024, Interbrand valued the Coca-Cola brand at over $80 billion, reflecting decades of effective marketing and deep consumer connection.

This brand power translates into significant market penetration and pricing power, as evidenced by its 2023 net revenue of $45.75 billion. Consumer loyalty, built through iconic advertising, ensures consistent demand and allows for premium pricing.

The company's extensive global distribution network, reaching nearly 200 countries, is a key competitive advantage. This vast infrastructure, supported by strong relationships with independent bottlers, ensures product availability and efficient market access worldwide.

Coca-Cola's diverse product portfolio, encompassing over 200 brands from water to juices and plant-based options, effectively caters to evolving consumer preferences. This diversification, with non-cola beverages showing robust growth in 2024, mitigates risks and broadens market appeal.

| Strength | Description | Supporting Data (2023/2024) |

|---|---|---|

| Brand Equity | Unparalleled global brand recognition and consumer loyalty. | Brand value over $80 billion (Interbrand, 2024). |

| Global Reach | Extensive distribution network in nearly 200 countries. | Operations in virtually every nation worldwide. |

| Product Diversification | Over 200 brands catering to a wide range of tastes. | Robust growth in non-cola beverages (2024). |

| Financial Performance | Consistent revenue generation and profitability. | Net revenue of $45.75 billion (2023); $11.3 billion (Q1 2024). |

What is included in the product

Delivers a strategic overview of Coca-Cola’s internal and external business factors, highlighting its strong brand and global reach while acknowledging challenges in changing consumer preferences and health concerns.

Offers a clear breakdown of Coca-Cola's market position, helping to address concerns about competitive threats and evolving consumer preferences.

Weaknesses

Coca-Cola's significant reliance on its vast network of independent bottling partners, while a distribution strength, also introduces a notable weakness. These partners are responsible for crucial aspects like production, packaging, and getting products to market, meaning Coca-Cola has less direct control over these operations.

Any disruptions within these bottling operations, whether due to labor issues, natural disasters, or supply chain inefficiencies, can directly impact Coca-Cola's ability to meet demand, maintain its market presence, and ultimately affect its revenue streams. For example, in 2023, supply chain disruptions globally, including those affecting bottlers, contributed to some regional product availability challenges.

A primary weakness for Coca-Cola is its continued heavy reliance on carbonated soft drinks (CSDs). Despite diversification efforts, CSDs still represent a substantial portion of the company's overall revenue. This makes Coca-Cola susceptible to changes in consumer tastes, particularly the growing demand for healthier, less sugary, and non-carbonated beverages.

This concentration in CSDs can directly impact sales figures and future growth prospects. For instance, in 2023, while Coca-Cola saw overall revenue growth, the core sparkling soft drink category, though strong, faces ongoing scrutiny regarding sugar content and health implications. This ongoing trend could pose a significant headwind if not adequately addressed by further portfolio innovation.

Coca-Cola has faced significant criticism concerning its water usage and management, especially in areas already experiencing water scarcity. This has led to public distrust and reputational damage.

In 2023, for instance, reports highlighted Coca-Cola's substantial water footprint, with some bottling plants operating in regions facing severe water stress, raising environmental concerns among stakeholders and communities.

These water management issues can attract regulatory scrutiny, potentially leading to stricter operational guidelines or even legal challenges, impacting the company's ability to operate freely in certain markets.

Environmentally Destructive Packaging Issues

Coca-Cola has faced significant criticism for its contribution to plastic pollution. Despite commitments to sustainability, reports from 2023 highlighted that the company's use of virgin plastic had increased, impacting its environmental image.

This reliance on new plastic, rather than recycled materials, runs counter to many of its stated environmental goals. Furthermore, Coca-Cola has adjusted some of its previously ambitious packaging sustainability targets, raising concerns among environmental advocates and potentially affecting consumer perception.

- Packaging Waste: Coca-Cola remains a major contributor to global plastic waste, with millions of tons of plastic bottles produced annually.

- Virgin Plastic Use: Despite sustainability pledges, the company has been called out for increased virgin plastic consumption in recent years, undermining recycling efforts.

- Adjusted Targets: Revisions to packaging sustainability goals can create a perception of reduced commitment to environmental responsibility.

Intense Competition Across Segments

Coca-Cola operates in a beverage industry characterized by intense competition. Major global players like PepsiCo and Nestlé, alongside numerous regional and local brands, vie for consumer attention and market share across all beverage categories. This crowded landscape demands constant product development and marketing efforts to stay relevant.

The fierce rivalry means Coca-Cola must continuously innovate and adapt its strategies to maintain its leading position. In 2024, the global non-alcoholic beverage market is projected to reach over $1.3 trillion, with significant growth in segments like ready-to-drink tea and coffee, areas where competition is particularly sharp.

- Global Rivals: PepsiCo, Nestlé, and numerous local brands are key competitors.

- Market Saturation: Many beverage segments are highly saturated, increasing competitive pressure.

- Innovation Imperative: Continuous product and marketing innovation is crucial for market share.

- Growth Segment Challenges: Emerging growth areas like plant-based beverages present new competitive fronts.

Coca-Cola's significant reliance on its independent bottling partners, while a distribution strength, also introduces a notable weakness. These partners are responsible for crucial aspects like production, packaging, and getting products to market, meaning Coca-Cola has less direct control over these operations. Any disruptions within these bottling operations, whether due to labor issues, natural disasters, or supply chain inefficiencies, can directly impact Coca-Cola's ability to meet demand, maintain its market presence, and ultimately affect its revenue streams. For example, in 2023, supply chain disruptions globally, including those affecting bottlers, contributed to some regional product availability challenges.

A primary weakness for Coca-Cola is its continued heavy reliance on carbonated soft drinks (CSDs). Despite diversification efforts, CSDs still represent a substantial portion of the company's overall revenue. This makes Coca-Cola susceptible to changes in consumer tastes, particularly the growing demand for healthier, less sugary, and non-carbonated beverages. This concentration in CSDs can directly impact sales figures and future growth prospects. For instance, in 2023, while Coca-Cola saw overall revenue growth, the core sparkling soft drink category, though strong, faces ongoing scrutiny regarding sugar content and health implications. This ongoing trend could pose a significant headwind if not adequately addressed by further portfolio innovation.

Coca-Cola has faced significant criticism concerning its water usage and management, especially in areas already experiencing water scarcity. This has led to public distrust and reputational damage. In 2023, for instance, reports highlighted Coca-Cola's substantial water footprint, with some bottling plants operating in regions facing severe water stress, raising environmental concerns among stakeholders and communities. These water management issues can attract regulatory scrutiny, potentially leading to stricter operational guidelines or even legal challenges, impacting the company's ability to operate freely in certain markets.

Coca-Cola has faced significant criticism for its contribution to plastic pollution. Despite commitments to sustainability, reports from 2023 highlighted that the company's use of virgin plastic had increased, impacting its environmental image. This reliance on new plastic, rather than recycled materials, runs counter to many of its stated environmental goals. Furthermore, Coca-Cola has adjusted some of its previously ambitious packaging sustainability targets, raising concerns among environmental advocates and potentially affecting consumer perception.

| Weakness | Description | Impact | Recent Data/Example |

| Bottler Dependence | Less direct control over production and distribution. | Vulnerability to operational disruptions, affecting supply and revenue. | Global supply chain issues in 2023 impacted regional availability. |

| CSD Concentration | Heavy reliance on carbonated soft drinks. | Susceptibility to changing consumer preferences towards healthier options. | While sparkling drinks remain strong, sugar content scrutiny continues (2023). |

| Water Management Concerns | Criticism over water usage in scarcity-prone areas. | Reputational damage, potential regulatory scrutiny, and operational restrictions. | Substantial water footprint reported in water-stressed regions (2023). |

| Plastic Pollution Contribution | Significant generation of plastic waste and use of virgin plastic. | Negative environmental image, potential consumer backlash, and scrutiny over sustainability pledges. | Increased virgin plastic consumption noted in 2023; adjusted packaging targets. |

Preview Before You Purchase

Coca-Cola SWOT Analysis

You’re viewing a live preview of the actual SWOT analysis file. The complete version becomes available after checkout, offering a comprehensive look at Coca-Cola's strategic positioning.

This is the same SWOT analysis document included in your download. The full content, detailing strengths, weaknesses, opportunities, and threats, is unlocked after payment.

The file shown below is not a sample—it’s the real SWOT analysis you'll download post-purchase, in full detail, providing actionable insights.

Opportunities

Emerging and developing markets, especially in Africa and Asia Pacific, represent a substantial growth avenue for Coca-Cola. In 2024, these regions are expected to see continued increases in disposable incomes and urbanization, directly fueling demand for beverages. This demographic shift is creating a larger middle class eager for branded products, offering Coca-Cola a prime opportunity to expand its market share.

Consumers are increasingly seeking beverages that offer health benefits beyond simple hydration. This shift towards low-sugar, natural ingredients, plant-based options, and functional drinks presents a significant avenue for growth. For instance, the global functional beverage market was valued at approximately $128 billion in 2023 and is projected to reach over $200 billion by 2030, demonstrating robust consumer demand.

Coca-Cola can capitalize on this trend by strategically expanding its offerings in categories such as premium packaged water, ready-to-drink teas and coffees, and other wellness-oriented beverages. This expansion allows the company to align its product portfolio with evolving consumer preferences and capture a larger share of the health-conscious market.

The burgeoning e-commerce landscape offers Coca-Cola significant avenues for growth. In 2024, the global e-commerce market is projected to reach over $6.3 trillion, a testament to its expanding reach. By investing in digital marketing and direct-to-consumer (DTC) strategies, Coca-Cola can tap into this trend, fostering deeper connections with consumers and expanding its market share beyond traditional retail.

Leveraging artificial intelligence (AI) for personalized consumer experiences presents a key opportunity. AI can analyze vast amounts of data to tailor marketing messages and product recommendations, thereby boosting brand loyalty. For instance, personalized promotions delivered through digital channels can significantly increase engagement and repeat purchases, a crucial factor in maintaining a competitive edge in the evolving beverage industry.

Sustainable Packaging Innovations and Initiatives

Coca-Cola's commitment to sustainable packaging is a significant opportunity. By investing in innovative solutions like advanced recycled plastics and exploring reusable bottle systems, the company can capture the growing market of environmentally aware consumers. This focus can enhance brand reputation and potentially lead to cost savings through material efficiency.

The company's 2024-2025 strategy includes ambitious packaging goals, aiming to make 100% of its packaging recyclable globally by 2025. This initiative, coupled with investments in collection and recycling infrastructure, positions Coca-Cola to benefit from increased consumer preference for eco-friendly products.

- Increased Market Share: Appealing to environmentally conscious consumers can drive sales volume.

- Enhanced Brand Image: Demonstrating a commitment to sustainability improves public perception.

- Regulatory Compliance: Proactive adoption of sustainable practices can preempt future environmental regulations.

- Operational Efficiency: Innovations in packaging can lead to reduced material usage and waste.

Entry into New Beverage Categories, including Low/No-Alcohol

The burgeoning sober curious movement and the escalating consumer interest in low and no-alcohol beverages present a substantial market opening for Coca-Cola. This trend is not just a niche; global sales of non-alcoholic beer, wine, and spirits are projected to reach $30 billion by 2025, according to industry analysis.

Coca-Cola can strategically leverage this by entering or expanding its portfolio in these rapidly growing segments. Furthermore, this presents an avenue to diversify revenue streams by exploring adjacent markets such as premium snacks or specialty coffee, aligning with evolving consumer preferences for more sophisticated and health-conscious options.

Key opportunities include:

- Expanding into the rapidly growing low/no-alcohol beverage market, which is seeing significant global growth.

- Diversifying revenue streams by entering related product categories like premium snacks or specialty coffees.

- Capitalizing on the sober curious trend by offering innovative and appealing alternatives to traditional alcoholic drinks.

The company's strategic focus on expanding its portfolio into the burgeoning low and no-alcohol beverage market is a significant opportunity. This segment is experiencing robust growth, with global sales of non-alcoholic beer, wine, and spirits projected to reach $30 billion by 2025.

Coca-Cola can further capitalize on evolving consumer preferences by diversifying into premium snacks and specialty coffees, aligning with the sober curious movement and the demand for healthier, sophisticated beverage alternatives.

This diversification not only taps into new revenue streams but also strengthens brand loyalty by offering a wider range of products that cater to changing lifestyles and wellness trends.

Threats

A significant threat for Coca-Cola stems from the ongoing shift in consumer tastes, moving away from traditional sugary carbonated drinks. This is largely driven by heightened health awareness and growing concerns about obesity, which directly impacts the demand for their flagship products and consequently, revenue streams.

Governments globally are increasingly imposing regulatory pressures, including sugar taxes and more stringent labeling mandates for beverages with high sugar content. These policies directly impact Coca-Cola's operational landscape.

For instance, the UK's sugar tax, introduced in 2018, has led to reformulation efforts and price adjustments, with companies like Coca-Cola adjusting their product lines to mitigate the financial impact. Such measures can escalate production expenses and potentially dampen consumer demand in key markets, affecting overall profitability.

Global economic uncertainty, marked by persistent inflation and geopolitical tensions, presents a considerable threat to Coca-Cola's extensive international operations. These factors can disrupt consumer spending patterns and increase operational costs across various markets.

Currency fluctuations are a particularly potent threat, as foreign exchange headwinds can significantly erode earnings when translated back into Coca-Cola's reporting currency. For instance, in the first quarter of 2024, Coca-Cola reported that currency headwinds impacted net revenue by 1% and operating income by 2%, highlighting the tangible financial impact.

Supply Chain Disruptions and Rising Input Costs

Coca-Cola's extensive global footprint, while a strength, also exposes it to significant risks from supply chain disruptions. Events like geopolitical instability or natural disasters can impede the flow of essential ingredients and packaging, impacting production and distribution worldwide.

Rising input costs, particularly for key materials like aluminum used in cans and sugar or high-fructose corn syrup for sweeteners, directly challenge profit margins. For instance, aluminum prices saw considerable volatility in 2024, with fluctuations impacting beverage packaging costs.

- Global Sourcing Vulnerability: Reliance on diverse suppliers for ingredients and packaging materials across many countries increases susceptibility to localized disruptions.

- Commodity Price Volatility: Fluctuations in the cost of sugar, aluminum, and other key inputs can significantly affect Coca-Cola's cost of goods sold.

- Logistical Challenges: Transportation and shipping costs, which surged in late 2023 and early 2024 due to global shipping constraints, add to operational expenses.

Intense Competition from Diversified Rivals and Local Brands

Coca-Cola contends with formidable competition from beverage giants like PepsiCo, whose broader portfolio, including snacks and food items, offers consumers more choices and creates cross-promotional opportunities. In 2024, PepsiCo's revenue reached over $91 billion, demonstrating its significant market presence beyond just beverages.

The increasing strength of agile local brands, particularly in emerging markets, poses a significant threat. These brands often possess a deeper understanding of local tastes and distribution networks, allowing them to capture market share effectively. For instance, in India, regional players have carved out substantial segments within the beverage market, challenging Coca-Cola's dominance.

- Diversified Competitors: Companies like PepsiCo leverage their snack and food divisions to gain a competitive edge.

- Emerging Market Challenges: Local brands are adept at catering to specific regional preferences and distribution nuances.

- Market Share Erosion: The combined force of diversified rivals and agile local players can dilute Coca-Cola's market share in key growth regions.

The increasing global focus on health and wellness continues to be a significant threat, as consumers actively seek alternatives to sugary beverages, impacting demand for Coca-Cola's core products. Furthermore, governments worldwide are implementing stricter regulations, such as sugar taxes and enhanced labeling requirements, which directly increase operational costs and can influence consumer purchasing decisions.

Economic volatility, including persistent inflation and currency fluctuations, poses a substantial risk to Coca-Cola's international earnings. For example, in Q1 2024, currency headwinds reportedly impacted Coca-Cola's net revenue by 1% and operating income by 2%, underscoring the tangible financial effects of these global economic uncertainties.

Intensifying competition from both diversified beverage giants like PepsiCo, which reported over $91 billion in revenue in 2024, and agile local brands in emerging markets, threatens market share. These competitors often leverage broader product portfolios or a nuanced understanding of regional tastes, creating a challenging competitive landscape.

SWOT Analysis Data Sources

This Coca-Cola SWOT analysis is built upon a robust foundation of publicly available financial statements, comprehensive market research reports, and expert industry analyses to ensure a thorough and accurate strategic overview.