Coca-Cola Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Coca-Cola Bundle

Coca-Cola faces moderate buyer power due to brand loyalty, yet intense rivalry from PepsiCo and private labels. The threat of new entrants is low, but the availability of substitutes like water and juices presents a challenge.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Coca-Cola’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Coca-Cola's vast scale, with annual procurement spending of $22.4 billion in 2024, means it's a significant customer for its roughly 150 global suppliers of key raw materials. This substantial purchasing power often shifts leverage towards Coca-Cola, diminishing the individual bargaining strength of most suppliers.

While many of Coca-Cola's raw materials are commodities, the company's unique flavor formulas and specialized ingredient needs can elevate the bargaining power of certain suppliers. For instance, switching a supplier for a proprietary sweetener or a specific flavor extract could incur costs ranging from an estimated $3.5 million to $8.2 million, making it challenging for Coca-Cola to easily change providers for these critical inputs.

Coca-Cola's bargaining power with suppliers is influenced by its long-term contracts. For instance, sugar contracts often span around 6 years, incorporating annual adjustments tied to the Consumer Price Index (CPI). Similarly, packaging agreements typically last about 5 years and feature pricing that can be adjusted based on supplier performance.

Threat of Forward Integration

The threat of forward integration by Coca-Cola's suppliers is generally low. Suppliers of key raw materials, such as sugar producers or aluminum can manufacturers, typically do not possess the extensive bottling, global distribution networks, and sophisticated marketing capabilities that Coca-Cola commands. Their expertise lies in commodity production, not in the complex consumer packaged goods industry.

For instance, while aluminum prices can fluctuate, impacting Coca-Cola's cost of goods sold, the aluminum producers themselves are unlikely to enter the beverage market. They lack the brand recognition, consumer loyalty, and established retail relationships that are crucial for success in the beverage sector. In 2024, the global aluminum market saw significant demand, but this did not translate into suppliers attempting to bottle and sell beverages.

- Suppliers' Core Competencies: Focus on raw material extraction and processing, not finished beverage production.

- Infrastructure Gap: Lack of bottling plants, extensive distribution channels, and global marketing reach.

- Brand and Consumer Access: Absence of established brand equity and direct access to consumers.

- Market Entry Barriers: High capital investment and regulatory hurdles for entering the beverage industry.

Sustainable Sourcing and Supplier Relationships

Coca-Cola actively cultivates strong, long-term partnerships with its suppliers, often prioritizing local sourcing and integrating sustainable practices into these relationships. This collaborative strategy, exemplified by initiatives in sustainable agriculture and rigorous ESG supplier screening, aims to foster mutual benefit and shared objectives.

By moving beyond purely transactional interactions, Coca-Cola seeks to build a more integrated supply chain where shared sustainability goals and partnership longevity can temper the suppliers' inherent bargaining power. For instance, in 2023, Coca-Cola reported that over 90% of its key agricultural commodities were sourced from countries with robust sustainability programs, reflecting this strategic emphasis.

- Sustainable Agriculture Focus: Coca-Cola's commitment to sustainable agriculture, as seen in its partnerships for sourcing ingredients like sugar and fruit, can lead to more stable supply and potentially reduced price volatility.

- ESG Screening: Implementing Environmental, Social, and Governance (ESG) screening for suppliers in 2024 helps ensure alignment with Coca-Cola's values, potentially creating a more loyal supplier base.

- Local Sourcing Benefits: Prioritizing local suppliers, where feasible, can shorten lead times and reduce transportation costs, thereby strengthening the relationship and potentially mitigating price increases.

- Partnership Mitigation: The emphasis on long-term partnerships and shared goals rather than short-term deals helps to reduce the suppliers' ability to leverage their position for higher prices.

Coca-Cola's immense purchasing volume, with $22.4 billion in procurement spending in 2024, generally gives it significant leverage over its suppliers, limiting their individual bargaining power. However, the unique nature of some ingredients, where switching suppliers could cost between $3.5 million and $8.2 million, grants certain specialized suppliers more influence.

Long-term contracts, typically around 6 years for sugar and 5 years for packaging, often include price adjustments tied to market indices, which can moderate supplier power. Furthermore, Coca-Cola's suppliers lack the capabilities for forward integration into beverage production due to high barriers like distribution networks and brand building.

| Factor | Impact on Coca-Cola | Supplier Bargaining Power Level |

|---|---|---|

| Purchasing Volume ($22.4B in 2024) | Reduces supplier power due to scale | Low |

| Proprietary Ingredients | Increases power of specific suppliers | Moderate |

| Switching Costs ($3.5M - $8.2M) | Increases supplier power for specialized inputs | Moderate |

| Long-Term Contracts (5-6 years) | Stabilizes prices, moderates power | Low to Moderate |

| Supplier Integration Threat | Minimal due to Coca-Cola's infrastructure | Very Low |

What is included in the product

This analysis provides a comprehensive examination of the competitive forces shaping Coca-Cola's industry, revealing the intensity of rivalry, buyer and supplier power, threat of new entrants, and the impact of substitutes.

Instantly visualize the competitive landscape for Coca-Cola, pinpointing key threats and opportunities across all five forces for strategic clarity.

Customers Bargaining Power

The concentration of large retail chains significantly amplifies customer bargaining power. Giants like Walmart command immense purchasing volume, allowing them to negotiate favorable terms with suppliers. In 2022, Walmart’s purchases of Coca-Cola products alone reached an impressive $9.5 billion, underscoring the substantial leverage these major distributors hold.

Coca-Cola's vast global reach, serving customers in over 200 countries, presents a fragmented customer landscape. This diversity is evident in its revenue streams, with retail chains accounting for 45%, restaurants and food service for 22%, convenience stores for 18%, and vending machines for 10%.

While large retail chains can exert some influence due to their volume, Coca-Cola's extensive distribution network across countless smaller outlets and direct sales to individual consumers significantly diminishes the overall bargaining power of any single customer or customer segment.

Coca-Cola's formidable brand loyalty significantly curbs customer bargaining power. Consumers often choose Coca-Cola not just for the beverage itself, but for the associated brand experience and perceived quality, making price a less dominant factor in their purchasing decisions. This deep-rooted loyalty means individual customers have limited leverage to demand lower prices, as the brand's equity provides a buffer against such pressures.

Switching Costs for Customers

For individual consumers, the bargaining power of customers is quite low regarding switching costs. They can readily opt for other soft drinks or beverages without significant effort or expense, as the market offers abundant alternatives. This ease of switching generally limits their ability to demand lower prices or better terms from Coca-Cola.

However, for large commercial buyers, such as major fast-food chains or bottling partners, the dynamic shifts slightly. While these entities purchase in massive volumes, giving them some leverage, their power is significantly tempered by Coca-Cola's strong brand equity and established consumer loyalty. This loyalty means that even large customers may hesitate to switch away from Coca-Cola products for fear of alienating their own customer base.

- Low Switching Costs for End Consumers: Individual buyers face negligible costs when choosing a different beverage brand, enabling easy substitution.

- Brand Loyalty as a Counterbalance: Coca-Cola's extensive brand recognition and consumer preference mitigate the bargaining power of even large commercial customers.

- Volume Discounts vs. Brand Strength: While large clients can negotiate based on volume, Coca-Cola's brand loyalty often prevents them from demanding significantly lower prices or exclusive terms.

Focus on Affordability and Value

Customers are increasingly prioritizing affordability and value, a trend amplified by ongoing inflation. This puts pressure on Coca-Cola to carefully manage its pricing, ensuring its products remain accessible while also covering rising costs, particularly in markets facing currency devaluation.

For instance, in 2024, many regions experienced significant inflation, forcing companies like Coca-Cola to implement price adjustments. This dynamic directly impacts consumer purchasing decisions, making price sensitivity a key factor in their choices.

- Price Sensitivity: Consumers are more likely to switch brands or reduce consumption if prices rise too steeply.

- Value Perception: Coca-Cola must continuously demonstrate the value proposition of its beverages beyond just the price point.

- Competitive Landscape: Competitors offering lower-priced alternatives can capitalize on this customer focus on affordability.

- Economic Factors: Broader economic conditions, including wage growth and consumer confidence, heavily influence how much customers are willing to spend on non-essential items like soft drinks.

While individual consumers have low bargaining power due to Coca-Cola's strong brand, large retail chains and commercial buyers can exert some influence through sheer purchase volume. However, Coca-Cola's global brand recognition and consumer loyalty often temper this power, preventing drastic price concessions.

The increasing consumer focus on affordability, especially in 2024 due to inflation in many regions, means Coca-Cola must balance pricing strategies to remain competitive. This price sensitivity can lead consumers to switch to cheaper alternatives if Coca-Cola's products become too expensive.

Coca-Cola's extensive distribution network, reaching over 200 countries, creates a fragmented customer base. This diversity, with retail chains making up 45% of its revenue, means that while large players have leverage, the sheer number of smaller outlets limits the overall power of any single customer segment.

| Customer Segment | Revenue Share (Approx.) | Bargaining Power Factors |

|---|---|---|

| Retail Chains | 45% | High volume purchases, negotiation leverage |

| Restaurants & Food Service | 22% | Volume, but often tied to specific partnerships |

| Convenience Stores | 18% | Lower individual volume, fragmented |

| Vending Machines | 10% | Low individual volume, highly fragmented |

| Individual Consumers | <15% (estimated) | Low individual volume, high price sensitivity, low switching costs |

Preview the Actual Deliverable

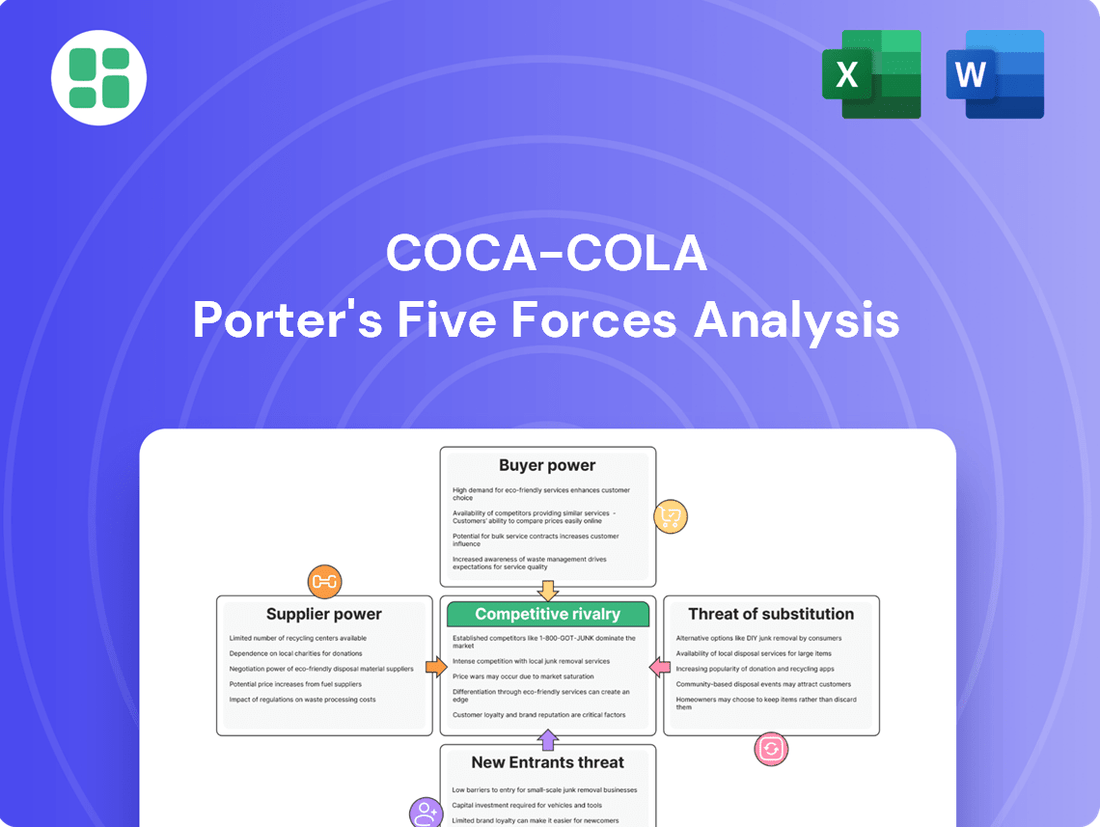

Coca-Cola Porter's Five Forces Analysis

This preview shows the exact Coca-Cola Porter's Five Forces Analysis you'll receive immediately after purchase—no surprises, no placeholders. You'll gain a comprehensive understanding of the competitive landscape, including the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the beverage industry. This professionally written analysis is fully formatted and ready for your immediate use.

Rivalry Among Competitors

Coca-Cola's competitive landscape is fiercely contested, with PepsiCo standing as its most formidable rival. Both beverage giants engage in aggressive marketing campaigns and continuous product innovation to capture consumer attention and market share. This rivalry isn't just about soda; it spans a vast array of beverages, from juices to bottled water.

Beyond PepsiCo, companies like Keurig Dr Pepper and Nestlé also contribute to the intense rivalry by offering a diverse range of beverage options. In 2023, Coca-Cola's global revenue reached $45.75 billion, while PepsiCo reported $91.47 billion, highlighting the scale of their competitive battle. This intense competition forces constant strategic adjustments and significant investment in brand building.

Coca-Cola and its primary competitors, such as PepsiCo, boast extensive and diversified product lines that extend far beyond their signature sodas. This strategic move into categories like bottled water, juices, teas, coffees, and even energy drinks significantly broadens the competitive landscape. For instance, Coca-Cola's own portfolio evolution, focusing on hydration, sports, tea & coffee, and juice segments, directly pits it against a wider array of specialized beverage makers.

The beverage industry is intensely competitive, with companies like Coca-Cola constantly innovating to meet shifting consumer demands, especially the increasing preference for healthier, low-sugar, and functional drinks. This dynamic means staying ahead requires agility and a keen understanding of what consumers want next.

In 2024, this translates into a race to introduce novel flavors, incorporate beneficial ingredients like prebiotics, and adopt eco-friendly packaging solutions. For instance, Coca-Cola's own portfolio expansion, including brands like Topo Chico Hard Seltzer and its focus on plant-based options, reflects this strategic pivot to capture evolving market segments and maintain brand relevance.

Extensive Distribution Networks and Global Presence

Coca-Cola's vast distribution network, reaching over 200 countries, is a formidable asset, bolstered by its powerful brand. This global reach allows for efficient product placement and accessibility, a key differentiator in the beverage market. In 2024, Coca-Cola continued to leverage this, ensuring its products are readily available to consumers worldwide.

However, competitive rivalry remains intense due to rivals also boasting robust distribution capabilities. Companies like PepsiCo actively compete for prime shelf space and market share across all territories. This ongoing battle for consumer visibility necessitates continuous investment in logistics and marketing to maintain and expand market penetration.

- Global Reach: Coca-Cola operates in over 200 countries, a testament to its extensive distribution infrastructure.

- Brand Strength: Its globally recognized brand name drives consumer demand and supports market penetration efforts.

- Competitive Landscape: Major competitors like PepsiCo possess similar strengths in distribution, leading to fierce competition for market access.

- Market Penetration: The rivalry centers on securing and expanding shelf space and consumer accessibility in diverse global markets.

Marketing and Brand Investment

Coca-Cola's competitive rivalry is intensified by significant marketing and brand investment. The company consistently dedicates substantial resources to advertising, with its global marketing spend often reaching billions annually. For instance, in 2023, Coca-Cola's marketing expenses were reported to be around $4.2 billion, underscoring a relentless commitment to maintaining brand visibility and emotional connection with consumers worldwide. This continuous investment fuels iconic branding and fosters strong customer loyalty, which is essential in a market where competitors also pour vast sums into promotional activities.

This high level of marketing expenditure creates a barrier to entry and intensifies rivalry among established players. Coca-Cola's strategy often focuses on emotional storytelling and leveraging its heritage, a tactic that requires ongoing financial commitment to remain effective. Competitors like PepsiCo also maintain robust marketing budgets, engaging in similar global campaigns and brand-building initiatives. This dynamic means that brands must constantly innovate and invest to capture and retain consumer attention, making market share gains a hard-fought battle.

- Global Marketing Spend: Coca-Cola's marketing budget in 2023 was approximately $4.2 billion, highlighting the scale of investment in brand promotion.

- Brand Loyalty: Effective global campaigns, emphasizing emotional storytelling and iconic branding, are key to Coca-Cola's strategy for building and maintaining strong customer loyalty.

- Competitive Landscape: Rivalry is fierce as competitors, including PepsiCo, also invest heavily in marketing, creating a need for continuous brand reinforcement and innovation.

- Market Dominance: Sustained investment in marketing is critical for Coca-Cola to defend its market dominance against aggressive promotional activities from its competitors.

Coca-Cola's competitive rivalry is intense, primarily driven by its long-standing battle with PepsiCo. Both giants invest heavily in marketing and product innovation across a broad beverage spectrum, from sodas to healthier alternatives. This rivalry extends to securing prime distribution channels and shelf space globally, a constant effort to capture consumer attention and maintain market share.

| Competitor | 2023 Revenue (USD Billions) | Key Beverage Categories |

| PepsiCo | 91.47 | Carbonated Soft Drinks, Snacks, Juices, Water, Teas, Coffee |

| Keurig Dr Pepper | 14.10 | Coffee, Carbonated Soft Drinks, Juices, Water |

| Nestlé | 93.00 (Beverage Division Estimate) | Water, Coffee, Dairy Beverages, Health Science Beverages |

SSubstitutes Threaten

The sheer breadth of non-alcoholic beverage choices presents a significant threat of substitutes for Coca-Cola. Consumers can easily opt for water, juices, teas, coffee, milk, or energy drinks to satisfy their thirst and refreshment needs, diminishing the unique appeal of traditional soft drinks. In 2024, the global bottled water market alone was projected to reach over $300 billion, demonstrating a substantial alternative preference among consumers.

The rising tide of health and wellness among consumers presents a significant threat of substitutes for Coca-Cola. This trend is fueling a strong demand for beverages that are low-calorie, sugar-free, and offer functional benefits. For instance, the global market for functional beverages, including those with added vitamins, minerals, and probiotics, was projected to reach over $200 billion by 2024, indicating a substantial shift in consumer preference.

The beverage market is experiencing a significant shift with the rise of innovative, 'better-for-you' (BFY) options. These include prebiotic sodas, enhanced electrolyte drinks, and a growing array of plant-based alternatives, all directly challenging Coca-Cola's established product lines. For instance, the global functional beverages market, which encompasses many BFY products, was valued at approximately $127 billion in 2023 and is projected to grow substantially, indicating a strong consumer demand for healthier choices.

Low Switching Costs for Consumers

Consumers can easily switch between beverages, meaning Coca-Cola faces a significant threat from substitutes. The cost and effort involved in changing from one soft drink to another, or to an entirely different beverage category like water or juice, are minimal. This low switching cost makes it simple for consumers to explore alternatives, directly impacting Coca-Cola's customer loyalty and market share.

The ease with which consumers can choose alternatives like bottled water, iced tea, or fruit juices instead of Coca-Cola products puts constant pressure on the company. This dynamic necessitates continuous innovation in product offerings and marketing to maintain brand appeal and customer engagement. For instance, the global bottled water market alone was valued at over $300 billion in 2023 and is projected to grow, highlighting a substantial and accessible substitute.

- Low Switching Costs: Consumers can easily shift to alternatives like water, tea, or juice without significant financial or effort barriers.

- Competitive Pressure: This ease of substitution forces Coca-Cola to constantly innovate and maintain strong brand appeal.

- Market Dynamics: The vast and growing market for non-soda beverages, such as the global bottled water market exceeding $300 billion in 2023, underscores the threat.

Homemade and Specialty Alternatives

The increasing popularity of homemade beverages, such as fresh smoothies and pressed juices, presents a significant threat of substitutes for Coca-Cola. These options appeal to consumers seeking natural ingredients and personalized health benefits, diverting demand from traditional packaged drinks.

The growth of specialty non-alcoholic beverage bars further intensifies this threat. These establishments offer unique flavor profiles and artisanal creations, catering to consumers looking for novel experiences and higher-quality ingredients, which can pull market share away from mass-produced beverages.

- Consumer shift towards health and wellness: A 2023 NielsenIQ report indicated that 60% of consumers are actively seeking healthier beverage options, which can include fresh juices and smoothies.

- Rise of craft and specialty drinks: The global market for specialty coffee and tea, often perceived as premium alternatives, was valued at over $100 billion in 2023 and is projected to grow.

- Customization and experience economy: Consumers are increasingly willing to pay a premium for customized products and unique consumption experiences, a trend well-served by specialty beverage bars.

The sheer variety of readily available beverages, from bottled water to juices and coffee, poses a significant threat of substitutes for Coca-Cola. Consumers can easily switch to these alternatives without much effort or cost, impacting brand loyalty. In 2024, the global bottled water market was projected to exceed $300 billion, showcasing a substantial consumer preference for alternatives.

Health consciousness is a major driver for substitute beverages, with consumers increasingly seeking low-sugar, functional drinks. The global functional beverage market was expected to surpass $200 billion by 2024, highlighting a clear shift away from traditional sugary soft drinks. This trend is further amplified by the rise of innovative options like prebiotic sodas and plant-based alternatives.

| Beverage Category | 2023 Market Value (USD Billions) | Projected 2024 Growth | Key Substitute Attributes |

|---|---|---|---|

| Bottled Water | 300+ | Significant | Health, Hydration, Zero Calories |

| Juices & Smoothies | N/A (Part of broader beverage market) | Strong | Natural Ingredients, Vitamins, Freshness |

| Functional Beverages | 127 | Substantial | Low Sugar, Added Nutrients, Health Benefits |

| Coffee & Tea (Specialty) | 100+ | Growing | Premium Experience, Natural Stimulant, Flavor Variety |

Entrants Threaten

The threat of new entrants in the global beverage market, particularly for a giant like Coca-Cola, is significantly mitigated by incredibly high capital requirements. Imagine trying to build a global bottling and distribution infrastructure from scratch; it's a monumental task. This means new players need deep pockets just to get started.

For instance, establishing a comprehensive distribution network that can rival Coca-Cola's reach, which spans over 200 countries and territories, demands billions in investment. Think about the fleets of trucks, warehousing facilities, and relationships with retailers worldwide. This scale of investment is a formidable barrier, effectively deterring many potential competitors from even entering the arena.

Furthermore, the marketing and brand-building necessary to compete in the beverage sector are also extremely capital-intensive. Coca-Cola's brand recognition is a result of decades of consistent, massive advertising spend. In 2024, Coca-Cola continued its substantial investment in marketing, with reported global advertising expenditures in the billions of dollars, a figure that is exceptionally difficult for a new entrant to match or overcome.

Coca-Cola's formidable brand loyalty and recognition represent a significant barrier to new entrants. With a brand valuation estimated to be in the tens of billions of dollars, and a history of over 130 years, Coca-Cola has cultivated deep-seated trust and preference among consumers globally. A new competitor would face immense challenges and require substantial investment over a prolonged period to even approach Coca-Cola's level of brand equity, making market penetration exceptionally difficult.

Coca-Cola's extensive distribution network, reaching over 200 countries through a vast web of independent bottling partners, presents a formidable barrier to entry. Newcomers struggle to replicate this reach, making it incredibly difficult to secure comparable shelf space and achieve widespread market penetration. In 2024, Coca-Cola's global beverage volume sales continued to demonstrate the strength of this network, underscoring the challenge for any aspiring competitor.

Economies of Scale and Cost Advantages

The threat of new entrants for Coca-Cola is significantly lowered by the immense economies of scale enjoyed by established players. Coca-Cola's vast global production and distribution network allows for substantial cost advantages per unit. For instance, in 2024, Coca-Cola's operational efficiency, driven by its scale, translates to lower per-unit manufacturing and logistics costs compared to any potential newcomer.

New entrants would find it incredibly challenging to match these cost efficiencies. They would need to invest heavily to build a comparable infrastructure, making it difficult to compete on price against a company that can leverage its existing, massive scale. This cost barrier is a critical deterrent.

- Economies of Scale: Coca-Cola's global operations allow for bulk purchasing of ingredients and packaging, leading to lower per-unit costs.

- Distribution Network: An extensive, pre-established distribution system provides a significant cost advantage that new entrants cannot easily replicate.

- Procurement Power: Coca-Cola's sheer volume of purchases gives it considerable bargaining power with suppliers, securing favorable pricing.

Regulatory Environment and Health Trends

The threat of new entrants for Coca-Cola, while generally low due to established brand loyalty and distribution networks, is subtly influenced by evolving regulatory landscapes and health-conscious consumer shifts. New players must navigate a complex environment where taxes on sugary beverages, like those implemented in various regions, can impact pricing and profitability from the outset. For instance, the UK's sugar tax, introduced in 2018 and expanded in 2022, has reshaped product formulations and consumer choices, presenting a hurdle for newcomers without established, healthier alternatives.

Furthermore, the persistent and growing consumer demand for healthier beverage options necessitates that any new entrant must invest heavily in product innovation and marketing to align with these trends. This is not merely about offering a sugar-free option, but about developing a portfolio that resonates with consumers actively seeking reduced sugar, natural ingredients, and functional benefits.

- Regulatory Hurdles: New entrants face potential upfront costs and strategic adjustments due to taxes on sugary drinks, a trend seen globally.

- Health Trend Adaptation: Success requires immediate investment in healthier product lines and marketing to meet strong consumer demand for wellness-oriented beverages.

- Market Positioning Challenge: Entrants must differentiate themselves not just on taste but on health credentials and ethical sourcing to gain traction against established giants.

The threat of new entrants for Coca-Cola remains low due to significant barriers like massive capital requirements for global infrastructure and marketing, coupled with strong brand loyalty built over decades. Economies of scale also provide a substantial cost advantage, making it difficult for newcomers to compete on price.

New entrants face challenges in replicating Coca-Cola's extensive distribution network, which reaches over 200 countries. In 2024, the company's continued global beverage volume sales highlight the difficulty for new players to gain comparable market penetration and shelf space.

| Barrier Type | Description | Impact on New Entrants |

|---|---|---|

| Capital Requirements | Establishing global bottling, distribution, and marketing infrastructure requires billions. | Extremely high, deterring most potential entrants. |

| Brand Loyalty & Equity | Over 130 years of history and massive marketing spend create deep consumer trust. | Requires immense, sustained investment to build comparable brand recognition. |

| Economies of Scale | Bulk purchasing and efficient global operations lead to lower per-unit costs. | New entrants struggle to match cost efficiencies, impacting pricing competitiveness. |

| Distribution Network | Vast, established network through bottling partners provides unparalleled reach. | Replication is nearly impossible, hindering market access and shelf presence. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Coca-Cola is built upon a foundation of diverse and reliable data. We draw heavily from Coca-Cola's annual reports and SEC filings, alongside industry-specific market research from firms like Statista and IBISWorld, to capture competitive dynamics and financial health.