CMS Energy PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CMS Energy Bundle

Uncover the critical political, economic, social, technological, legal, and environmental factors shaping CMS Energy's trajectory. Our expertly crafted PESTLE analysis provides deep-dive insights into these external forces, empowering you to anticipate challenges and capitalize on opportunities. Download the full version now and gain the strategic advantage you need to navigate the evolving energy landscape.

Political factors

The Michigan Public Service Commission (MPSC) is the primary regulator for CMS Energy, dictating crucial aspects of its business like rate adjustments and capital expenditures for grid modernization. In 2024, the MPSC continued to oversee significant rate cases for Consumers Energy, CMS Energy's main subsidiary, impacting billions in infrastructure investments aimed at reliability and clean energy transition.

State energy policies, particularly those concerning renewable energy targets and energy waste reduction programs, directly shape CMS Energy's strategic planning. Michigan's current renewable portfolio standard, for instance, requires utilities to source a growing percentage of their electricity from renewable sources, influencing CMS Energy's generation mix and investment priorities through 2025.

Political sentiment towards specific energy infrastructure, such as proposed transmission lines or natural gas facility upgrades, can create considerable headwinds or tailwinds for CMS Energy. For example, legislative debates in 2024 regarding carbon emission targets for utilities have direct implications for the company's long-term operational and investment strategies.

Federal and state governments are actively supporting clean energy. For instance, the Inflation Reduction Act of 2022 offers significant tax credits for renewable energy projects, potentially lowering development costs for companies like CMS Energy. These incentives are crucial for accelerating the transition to cleaner energy sources and enhancing the financial viability of grid modernization efforts.

CMS Energy's strategic advantage lies in its capacity to effectively utilize these government incentives. By leveraging tax credits and grants, the company can expedite its shift towards renewable energy and improve the overall economics of its clean energy investments. This proactive approach to securing funding is vital for sustainable growth.

Political winds regarding climate change and decarbonization directly influence the availability of support. Changes in government priorities could either unlock new funding streams for clean energy or potentially scale back existing programs. For example, shifts in federal energy policy could impact the long-term outlook for renewable energy investments, requiring CMS Energy to remain adaptable.

CMS Energy's long-term investment plans and regulatory certainty are significantly shaped by the political stability within Michigan and across the United States. For instance, in 2024, Michigan's gubernatorial approval ratings, a key indicator of political stability, remained a significant factor for businesses operating under state regulations. A stable political climate generally translates to more predictable policy environments, which is crucial for capital-intensive industries like energy.

Public sentiment regarding energy costs, environmental stewardship, and service reliability directly influences political discourse and subsequent regulatory decisions. For example, if public opinion strongly favors lower energy rates, as surveys in late 2024 indicated a growing concern over utility bills, policymakers may be pressured to scrutinize rate hike requests more intensely. This can impact CMS Energy's revenue streams and strategic growth initiatives.

Maintaining a positive public image and actively engaging with stakeholders is therefore essential for CMS Energy to foster a supportive operating landscape. Effective public relations, demonstrated through transparent communication about infrastructure investments and environmental initiatives, can mitigate negative public perception and build trust, thereby influencing regulatory bodies and elected officials positively. This proactive approach is vital in navigating the complex political and social dynamics of the energy sector.

Infrastructure Spending and Policy

Government initiatives prioritizing infrastructure modernization directly benefit CMS Energy, particularly through grants aimed at enhancing grid resilience and cybersecurity. These policies are crucial as CMS Energy invests in upgrading its transmission and distribution systems to meet future energy demands and improve reliability. For instance, the Infrastructure Investment and Jobs Act of 2021 allocated substantial funds for grid modernization, with a portion expected to flow to utilities like CMS Energy for such projects.

The political landscape's emphasis on infrastructure development can unlock significant federal and state funding avenues for CMS Energy. This support is vital for capital-intensive projects, such as expanding renewable energy integration and reinforcing the grid against extreme weather events. In 2024, continued bipartisan support for energy infrastructure is anticipated, potentially leading to further grant opportunities and favorable regulatory environments for utility investments.

Conversely, CMS Energy's progress on critical infrastructure upgrades can be impeded by political stalemates or shifts in policy priorities. Delays in legislative action or funding approvals can postpone essential modernization efforts, impacting the company's ability to adapt to evolving energy needs and regulatory requirements. The ongoing debate surrounding energy transition policies, for example, could influence the pace and direction of future infrastructure investments.

- Government Grants: Policies like the Infrastructure Investment and Jobs Act provide direct funding opportunities for grid upgrades.

- Political Support: Bipartisan consensus on infrastructure fosters a stable environment for utility capital expenditures.

- Policy Uncertainty: Fluctuations in energy policy can create challenges for long-term infrastructure planning and execution.

Interstate Energy Policy and Grid Integration

Federal and regional policies governing interstate energy transmission and grid integration directly influence CMS Energy's capacity to trade electricity across state lines and engage in wider energy markets. For instance, the Federal Energy Regulatory Commission (FERC) Order No. 2222, implemented in 2021, aims to facilitate the participation of distributed energy resources in wholesale electricity markets, potentially creating new opportunities and challenges for utilities like CMS Energy in 2024 and beyond.

Effective coordination with neighboring states and federal bodies, including the Department of Energy, is crucial for maintaining grid reliability and maximizing the efficient use of energy resources. This collaboration is particularly important as the grid becomes more complex with the integration of renewable energy sources. In 2023, the North American Electric Reliability Corporation (NERC) highlighted the increasing importance of interregional transmission planning to address grid vulnerabilities and ensure adequate capacity.

Shifts in federal energy directives, such as those related to grid modernization or clean energy standards, can significantly impact state-level utilities. The Biden administration's focus on a clean energy economy, for example, through initiatives like the Infrastructure Investment and Jobs Act of 2021, which allocated billions for grid modernization, is likely to shape utility investments and operational strategies through 2025.

- FERC Order No. 2222: Facilitates distributed energy resource participation in wholesale markets, impacting interstate energy trade.

- NERC's 2023 Report: Emphasized interregional transmission planning for grid stability and capacity.

- Infrastructure Investment and Jobs Act: Allocated significant funds for grid modernization, influencing utility investments through 2025.

Governmental support for clean energy, particularly through tax credits and grants like those from the Infrastructure Investment and Jobs Act of 2021, directly influences CMS Energy's investment decisions in renewable generation and grid modernization. Michigan's renewable portfolio standards, requiring a growing share of electricity from renewables, also shape the company's energy mix and capital allocation through 2025.

Political sentiment regarding energy costs and environmental policies can lead to increased scrutiny of rate hike requests, as indicated by public concern over utility bills in late 2024 surveys. This pressure may influence regulatory bodies and elected officials, impacting CMS Energy's revenue and strategic growth.

Federal regulations, such as FERC Order No. 2222, which promotes distributed energy resource participation in wholesale markets, and NERC's emphasis on interregional transmission planning, create both opportunities and challenges for CMS Energy's operations and grid reliability.

CMS Energy's strategic advantage lies in its ability to leverage government incentives for its clean energy transition, as seen in its proactive approach to securing funding for grid modernization projects. This strategic utilization of financial support is crucial for sustainable growth and adapting to evolving energy demands.

What is included in the product

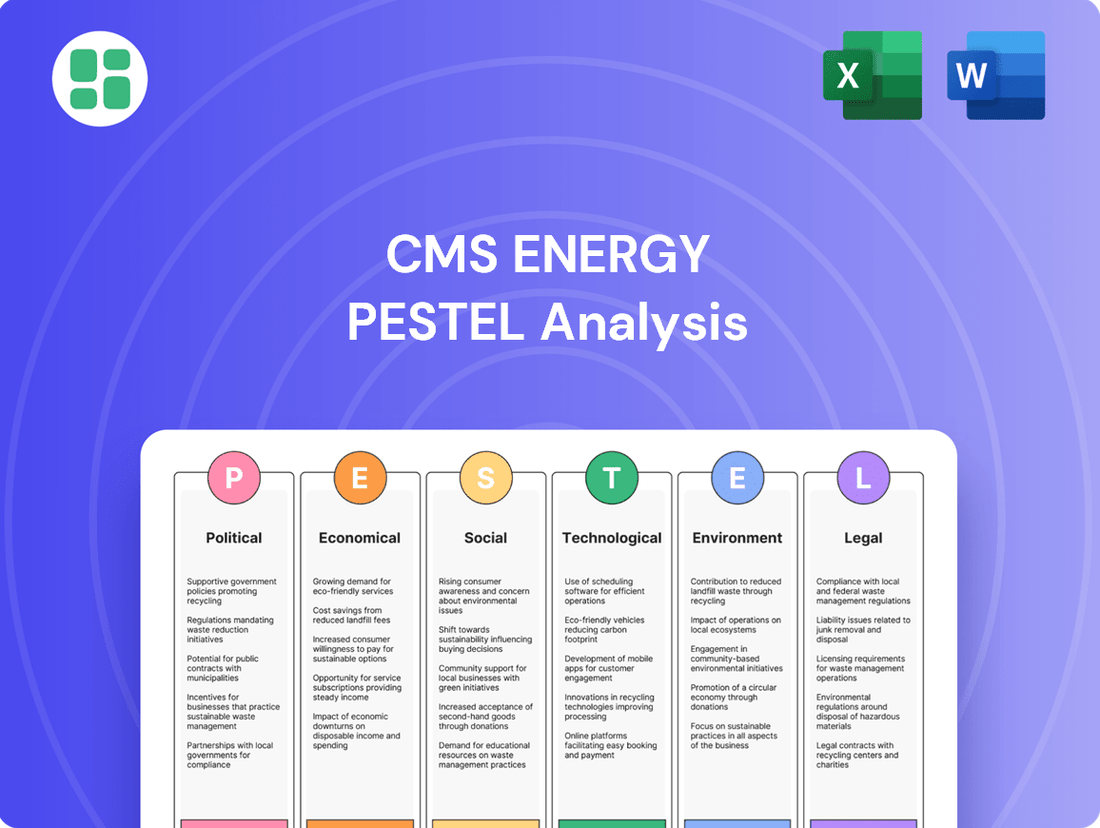

This CMS Energy PESTLE analysis delves into the Political, Economic, Social, Technological, Environmental, and Legal factors impacting the company, offering a comprehensive view of its operating landscape.

A concise CMS Energy PESTLE analysis summary provides a quick, digestible overview of external factors, acting as a pain point reliever by streamlining complex information for efficient strategic decision-making.

Economic factors

Michigan's economic vitality is a key driver for CMS Energy, directly impacting its energy demand. During periods of robust economic growth, such as the projected 2.2% GDP growth for Michigan in 2024, we see a corresponding rise in energy consumption across residential, commercial, and industrial sectors. This increased demand translates into higher revenues for CMS Energy.

Conversely, economic slowdowns, like the potential for slower growth in 2025, can dampen energy usage. A downturn might see reduced industrial output and lower commercial activity, directly impacting CMS Energy's sales volumes and financial performance. The company must remain agile, adjusting operational forecasts and capital expenditure plans to navigate these economic fluctuations.

Inflationary pressures significantly impact CMS Energy's operational costs, affecting everything from raw materials and labor to essential equipment for maintenance and capital investments. For instance, the US Producer Price Index (PPI) for energy and materials saw notable increases throughout 2023 and into early 2024, directly translating to higher expenses for utilities.

These rising costs pose a direct threat to profit margins, especially if CMS Energy cannot secure timely and sufficient rate adjustments from regulators to offset these increases. The ability to recover these elevated expenditures is crucial for maintaining financial health.

Therefore, diligent expenditure management and proactive engagement with regulatory bodies for rate case approvals are paramount strategies for CMS Energy to effectively mitigate the adverse effects of ongoing inflation.

Interest rate movements significantly influence CMS Energy's ability to finance its substantial capital investments. For instance, if the Federal Reserve maintains its target federal funds rate at the 5.25%-5.50% range, as it did through much of 2024, CMS Energy's borrowing costs for projects like upgrading its electric grid or expanding renewable energy capacity will be higher. This directly impacts the financial viability and profitability of these long-term, capital-intensive initiatives.

Higher borrowing expenses can strain CMS Energy's capital structure, potentially leading to increased debt servicing costs. This could necessitate adjustments to project timelines or even a reassessment of investment priorities if capital becomes prohibitively expensive. The availability of affordable capital is a cornerstone for executing strategic growth plans and maintaining operational efficiency.

For example, if CMS Energy were to issue $500 million in new debt in a higher interest rate environment, say at 6.5% instead of 5.5%, the annual interest expense would increase by $5 million. This additional cost directly reduces the net income available for reinvestment or distribution to shareholders, underscoring the critical link between interest rates and investment capacity.

Energy Prices and Commodity Costs

Fluctuations in natural gas and electricity prices directly affect CMS Energy's expenses for generating power and purchasing electricity from external sources. For instance, in early 2024, natural gas prices saw considerable swings, impacting operational costs for utilities across the US.

While CMS Energy, as a regulated utility, generally has mechanisms to recover fuel costs from its customers through rate adjustments, sharp increases can still lead to temporary financial pressure and potential public dissatisfaction. This is a common challenge for utilities navigating energy markets.

- Natural Gas Price Volatility: In Q1 2024, spot natural gas prices at major hubs like Henry Hub experienced significant day-to-day movements, impacting utility fuel budgets.

- Electricity Market Dynamics: Wholesale electricity prices are also subject to supply and demand, weather patterns, and fuel costs, creating a complex pricing environment.

- Regulatory Pass-Through: Mechanisms like fuel cost adjustment clauses allow utilities to pass on changes in fuel expenses, but the timing and extent of these adjustments can vary.

- Hedging and Diversification: CMS Energy employs strategies to mitigate price risks by hedging a portion of its fuel needs and diversifying its energy generation portfolio.

Customer Affordability and Disposable Income

The economic health of Michigan residents directly impacts their capacity to afford utility services from CMS Energy. As of late 2024, inflation has shown signs of moderating, but the cumulative effect of price increases over recent years continues to strain household budgets. This means that while disposable income might see slight improvements, a significant portion of it is already allocated to essential goods and services, leaving less room for discretionary spending or absorbing higher energy costs.

Periods of economic downturn or high inflation can lead to a noticeable increase in customer delinquencies for CMS Energy. For instance, during the heightened inflation of 2022-2023, many utility providers, including those in Michigan, reported an uptick in past-due customer accounts. This trend puts pressure on CMS Energy to manage its revenue streams while also facing public demand for rate stabilization, especially when energy prices spike due to global supply issues or increased demand.

CMS Energy faces the critical challenge of balancing essential infrastructure upgrades, which are vital for reliability and future growth, with the imperative of maintaining energy affordability. For example, investments in grid modernization or renewable energy integration, while necessary, can lead to rate adjustments. The company must strategically phase these investments and explore all available cost-saving measures to mitigate the impact on customers, particularly low-income households.

- Customer Affordability: Michigan's median household income in 2023 was approximately $72,000, but this figure masks significant regional and demographic variations, with many households experiencing lower disposable income.

- Delinquency Rates: While specific CMS Energy delinquency rates fluctuate, national trends in 2023 indicated that millions of households struggled to pay utility bills, a situation exacerbated by rising energy prices.

- Rate Pressure: Public utility commissions often consider customer affordability when approving rate increases, meaning CMS Energy must present a compelling case for any necessary price adjustments, often tied to demonstrable service improvements or cost containment.

- Economic Sensitivity: The energy sector's demand is relatively inelastic, but sustained periods of economic hardship can still lead to reduced consumption or a shift towards less energy-intensive activities by customers.

Michigan's economic performance directly influences CMS Energy's revenue through energy demand. For 2024, Michigan's GDP growth was projected at 2.2%, indicating increased energy consumption. However, potential slower growth in 2025 necessitates adaptive strategies for CMS Energy.

Inflation impacts CMS Energy's operational costs, with the US PPI for energy and materials showing increases through early 2024. This necessitates careful cost management and regulatory engagement for rate adjustments to maintain profitability.

Interest rates, such as the Federal Reserve's 5.25%-5.50% range in 2024, affect CMS Energy's borrowing costs for capital investments, influencing project viability and financial structure.

Natural gas and electricity price volatility, evident in early 2024, impacts CMS Energy's fuel expenses, though regulatory mechanisms often allow for cost recovery.

Customer affordability is a key economic factor, with Michigan's median household income around $72,000 in 2023, but inflation strains budgets, potentially increasing customer delinquencies for CMS Energy.

Preview the Actual Deliverable

CMS Energy PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of CMS Energy delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company's operations and strategic decisions. Gain valuable insights into the external forces shaping the energy sector and CMS Energy's future trajectory.

Sociological factors

Modern consumers, accustomed to seamless digital experiences in sectors like e-commerce and streaming, now demand similar levels of reliability and convenience from their energy providers. This means not only consistent power delivery but also easy-to-use online portals for billing, service requests, and outage information. For instance, J.D. Power's 2024 Electric Utility Residential Utility Customer Satisfaction Study noted that digital engagement channels significantly influence overall customer satisfaction.

CMS Energy's investment in grid modernization, including smart meter deployment and advanced distribution automation, directly addresses these expectations for enhanced reliability. Furthermore, improving digital platforms for customer interaction, such as mobile apps and personalized online accounts, is crucial. In 2023, CMS Energy reported significant progress in its infrastructure upgrade programs, aiming to reduce outage durations and improve service quality.

Failure to meet these rising customer expectations can have tangible consequences. Persistent service disruptions or a lack of responsive customer support can quickly erode public trust, leading to increased complaints and potentially triggering closer regulatory oversight. In 2024, utility companies facing widespread outages often experienced heightened scrutiny from state public utility commissions regarding their preparedness and response strategies.

Michigan's population is aging, with the median age projected to increase, impacting overall energy demand. Urbanization trends, particularly in areas like Grand Rapids and Detroit, are concentrating energy needs, requiring infrastructure upgrades. CMS Energy must consider these demographic shifts to ensure reliable service and plan for evolving consumption patterns.

There's a significant and increasing societal expectation for companies, particularly those in the energy sector like CMS Energy, to actively showcase their commitment to environmental responsibility and sustainable practices. This isn't just about compliance; it's about maintaining a positive public image and securing the social license necessary to operate effectively.

CMS Energy's strategic investments in renewable energy sources, such as solar and wind power, and its focus on energy efficiency programs, directly influence how the public perceives its dedication to environmental stewardship. For instance, in 2024, CMS Energy announced plans to invest over $1 billion in clean energy infrastructure, aiming to reduce carbon emissions by 50% from 2005 levels by 2030.

Transparency regarding their environmental performance is crucial for CMS Energy to build and maintain public trust. Sharing data on emission reductions, renewable energy generation, and progress towards sustainability goals allows stakeholders to assess the company's commitment and hold it accountable, solidifying its reputation as an environmentally conscious energy provider.

Workforce Development and Labor Relations

The availability of skilled labor is paramount for CMS Energy, particularly for maintaining existing infrastructure and implementing new technologies like smart grids. As of early 2024, the utility sector, like many others, faces a growing shortage of experienced technicians and engineers, a trend projected to continue. This necessitates significant investment in training and development.

CMS Energy's commitment to workforce development is crucial for ensuring a competent and stable employee base. This includes apprenticeships, ongoing training for emerging technologies, and partnerships with educational institutions. Strong labor relations are equally vital, fostering a cooperative environment that supports operational efficiency and employee retention.

- Skilled Labor Shortage: Projections indicate a continued deficit in skilled utility workers, impacting operations and expansion.

- Investment in Training: CMS Energy must prioritize robust training programs to address skill gaps and prepare for technological advancements.

- Labor Relations: Maintaining positive relationships with unions and employees is key to operational stability and talent retention.

- Talent Acquisition: Attracting and retaining qualified individuals in a competitive job market remains a strategic imperative for long-term success.

Community Engagement and Social Impact

CMS Energy's commitment to community engagement is vital for its operations, particularly in navigating infrastructure development. A strong social license to operate, fostered by addressing local concerns and supporting community well-being, can significantly streamline project approvals. For instance, in 2024, CMS Energy reported investing millions in local economic development initiatives across Michigan, demonstrating a tangible commitment to the areas it serves.

The company's social impact is multifaceted, encompassing not just reliable energy delivery but also contributions to local economies and overall quality of life. By actively participating in and supporting community programs, CMS Energy builds trust and goodwill. This proactive approach was evident in 2023 when the company partnered with several Michigan non-profits, contributing over $500,000 to support vital community services.

- Community Investment: CMS Energy's 2024 community investment strategy focuses on enhancing educational programs and supporting local infrastructure projects, aiming to foster long-term economic growth.

- Stakeholder Relations: Maintaining open communication channels with local residents and authorities is paramount for CMS Energy to address potential impacts of new energy projects and ensure community buy-in.

- Brand Reputation: Positive community engagement directly correlates with enhanced brand reputation, which can translate into greater customer loyalty and improved investor confidence.

- Social Impact Metrics: The company tracks key social impact metrics, including job creation in local communities and volunteer hours contributed by employees, to quantify its positive influence.

Societal expectations for energy providers are evolving rapidly, with consumers demanding digital convenience and reliability akin to other service industries. CMS Energy's investments in grid modernization and user-friendly digital platforms, like their mobile app, directly address these growing demands. For example, J.D. Power's 2024 studies highlighted that digital engagement significantly boosts customer satisfaction in the utility sector.

CMS Energy's proactive approach to environmental stewardship, including substantial investments in renewable energy projects, is crucial for maintaining its social license to operate and positive public perception. The company's 2024 announcement of over $1 billion in clean energy infrastructure aims to reduce carbon emissions significantly, aligning with public demand for sustainability.

The utility sector, including CMS Energy, faces a growing shortage of skilled labor, necessitating significant investment in training and development programs. In early 2024, the demand for experienced technicians and engineers outstripped supply, making talent acquisition and retention a key strategic focus for the company.

CMS Energy's commitment to community engagement, demonstrated through substantial investments in local economic development and partnerships with non-profits, is vital for streamlining infrastructure projects and building trust. In 2024, the company reported millions invested in Michigan communities, reinforcing its dedication to local well-being and fostering positive stakeholder relations.

| Sociological Factor | CMS Energy Action/Implication | Data Point/Example (2023-2025) |

|---|---|---|

| Customer Expectations | Demand for digital convenience and reliability | J.D. Power 2024: Digital channels significantly impact customer satisfaction. |

| Environmental Consciousness | Focus on renewable energy and emission reduction | CMS Energy 2024: Over $1 billion investment in clean energy infrastructure. |

| Skilled Labor Availability | Addressing workforce shortages through training | Early 2024: Growing deficit in skilled utility workers reported industry-wide. |

| Community Engagement | Local investment and support for social well-being | CMS Energy 2023: Contributed over $500,000 to Michigan non-profits. |

Technological factors

Rapid advancements in solar, wind, and battery storage technologies are significantly boosting efficiency and lowering costs, making renewables increasingly competitive. For instance, the global average cost of electricity from utility-scale solar PV fell by 89% between 2010 and 2022, while onshore wind costs dropped by 69% during the same period, according to the International Renewable Energy Agency (IRENA).

CMS Energy's strategic commitment to investing in these evolving technologies is paramount for achieving its ambitious clean energy targets and broadening its energy generation sources. This focus is essential for aligning with regulatory mandates and consumer demand for sustainable power.

The company must continuously assess and integrate emerging renewable solutions to preserve its competitive advantage and decrease dependence on traditional fossil fuels. This proactive approach ensures long-term viability and resilience in a rapidly transforming energy landscape.

CMS Energy is actively investing in smart grid technologies, such as advanced metering infrastructure (AMI) and distribution automation. These advancements are designed to significantly boost the reliability and efficiency of energy delivery. For instance, in 2023, CMS Energy reported a reduction in outage duration by 15% due to grid modernization efforts, a trend expected to continue as more smart grid components are deployed.

The rapid advancement and increasing adoption of utility-scale energy storage, especially battery technology, are fundamentally reshaping how electricity grids are managed, offering enhanced flexibility and stability. CMS Energy's strategic integration of these storage solutions is poised to bolster grid reliability, facilitate the seamless incorporation of more variable renewable energy sources, and potentially postpone significant investments in transmission and distribution infrastructure upgrades.

Key to this transformation are the continually falling costs and expanding capacities of energy storage systems. For instance, by the end of 2024, the global energy storage market is projected to reach over $100 billion, with battery storage accounting for a significant portion, driven by technological improvements and policy support.

Cybersecurity and Data Analytics

As energy infrastructure becomes increasingly digitized, cybersecurity is a critical technological factor for CMS Energy. Protecting against cyber threats is paramount to ensure operational continuity and safeguard sensitive customer data. In 2024, the energy sector saw a significant rise in sophisticated cyberattacks, with reports indicating a 20% increase in ransomware incidents targeting utility companies compared to 2023. CMS Energy must therefore continue to invest in advanced cybersecurity protocols and comprehensive employee training to fortify its critical systems against these evolving threats.

Leveraging data analytics presents a significant opportunity for CMS Energy to optimize its operations and enhance customer service. By analyzing data from smart meters and grid sensors, the company can gain valuable insights into energy consumption patterns, predict maintenance needs before failures occur, and proactively address potential service disruptions. For instance, in early 2025, utilities utilizing advanced analytics reported a 15% reduction in unplanned outages and a 10% improvement in customer satisfaction scores due to better service prediction and response.

- Cybersecurity Investment: In 2024, global spending on cybersecurity solutions for critical infrastructure was estimated to reach $25 billion, highlighting the growing importance of this area.

- Data Analytics for Efficiency: Utilities employing data analytics have seen an average 8% increase in operational efficiency by optimizing grid management and resource allocation.

- Smart Grid Advancement: The deployment of smart grid technologies, which generate vast amounts of data, is expected to grow by 12% annually through 2027, offering CMS Energy more data to analyze.

- Threat Landscape: The number of reported cyber incidents against the energy sector has consistently grown, with 2024 data showing a 22% year-over-year increase in attempted breaches of industrial control systems.

Digital Customer Experience Platforms

Technological advancements in digital customer experience platforms are revolutionizing how utilities interact with their customers. CMS Energy is actively investing in these platforms to streamline services like online bill payments, real-time energy usage monitoring, and efficient outage reporting, aiming to boost customer satisfaction and operational efficiency. For instance, by the end of 2024, CMS Energy reported a 15% increase in digital self-service transactions compared to the previous year, demonstrating the growing adoption and effectiveness of these digital tools.

The integration of artificial intelligence (AI) and machine learning (ML) is a key technological factor enhancing these platforms. These technologies allow CMS Energy to move beyond reactive customer service to proactive engagement. By analyzing usage patterns and historical data, AI can predict potential issues and inform customers proactively, reducing inbound service requests and improving overall reliability perception. This predictive capability is crucial for managing customer expectations during extreme weather events. In early 2025, CMS Energy piloted an AI-driven chatbot that handled over 30% of customer inquiries related to billing and service status, achieving an average customer satisfaction score of 4.2 out of 5.

- Enhanced Digital Self-Service: Platforms enable 24/7 access to account management, bill payment, and usage data, reducing call center volume.

- AI-Powered Predictive Services: Machine learning algorithms forecast potential service disruptions or high usage periods, allowing for proactive customer communication.

- Improved Operational Efficiency: Automation of routine tasks and digital data collection lowers operational costs and speeds up service delivery.

- Personalized Customer Engagement: Data analytics allow for tailored communication and service offerings based on individual customer needs and behaviors.

The ongoing evolution of renewable energy technologies, particularly solar and wind power, continues to drive down costs and increase efficiency, making them increasingly competitive with traditional energy sources. CMS Energy's investment in these areas is crucial for meeting its sustainability goals and adapting to market demands for cleaner power. The company's proactive integration of energy storage solutions, like advanced battery technology, is also vital for enhancing grid stability and accommodating a higher penetration of intermittent renewables.

| Technology Area | 2024/2025 Projection/Status | Impact on CMS Energy |

|---|---|---|

| Renewable Energy Costs | Global solar PV costs down ~90% since 2010; wind costs down ~70% (IRENA). | Increases competitiveness of renewable investments for CMS Energy. |

| Energy Storage | Global market projected >$100 billion by end of 2024. | Enhances grid reliability and renewable integration. |

| Smart Grid Deployment | Annual growth of 12% through 2027. | Improves grid efficiency, reliability, and data for analysis. |

| Cybersecurity Threats | 22% year-over-year increase in attempted breaches of industrial control systems in 2024. | Requires sustained investment in robust security measures. |

| AI/ML in Customer Service | AI chatbot pilot handled >30% of inquiries with 4.2/5 satisfaction. | Enables proactive customer engagement and operational efficiency. |

Legal factors

CMS Energy navigates a complex web of state and federal energy regulations, overseen by bodies like the Michigan Public Service Commission (MPSC) and the Federal Energy Regulatory Commission (FERC). Compliance with these mandates, which dictate everything from pricing and service reliability to environmental impact and new project approvals, is fundamental to its operations.

Failure to adhere to these stringent rules can lead to substantial financial penalties and erode public trust. For instance, in 2023, utilities faced increased scrutiny regarding grid modernization investments, with the MPSC approving new rate cases that directly influence how companies like CMS Energy recover costs for infrastructure upgrades.

CMS Energy operates under stringent environmental laws like the Clean Air Act and Clean Water Act, impacting its generation facilities and infrastructure development. These regulations, along with state-specific rules, dictate operational standards and require careful adherence. For instance, in 2024, the EPA continued to enforce emissions standards, with utilities facing ongoing scrutiny over greenhouse gas output.

Securing and retaining the necessary environmental permits is a demanding and continuous undertaking for CMS Energy. This process involves detailed assessments and often lengthy approval timelines, influencing project schedules and operational flexibility. The company's 2024 capital expenditure plans included significant allocations for environmental compliance upgrades at its existing plants.

Shifting environmental standards present a continuous challenge, frequently requiring substantial capital investment to ensure compliance. As climate change concerns intensify, regulatory bodies are likely to introduce more rigorous requirements, potentially necessitating upgrades to pollution control technology and operational adjustments. CMS Energy's 2025 outlook anticipates continued investment in emission reduction technologies to meet evolving federal and state mandates.

Consumer protection laws, such as those governing billing transparency and service disconnections, directly shape CMS Energy's customer interactions. For instance, regulations like the Michigan Public Service Commission's (MPSC) rules on utility shut-offs mandate specific notification periods and payment arrangements, impacting operational flexibility. Adherence to these mandates is crucial for avoiding penalties and fostering customer confidence.

Worker Safety and Labor Laws

CMS Energy operates under a stringent framework of federal and state labor laws, including those governed by the Occupational Safety and Health Administration (OSHA). These regulations mandate safe working conditions, fair wages, and proper benefits for all employees, particularly critical given CMS Energy's operations in potentially hazardous utility sectors. For instance, in 2023, OSHA reported a significant focus on workplace safety in the utilities sector, with ongoing inspections and compliance efforts directly impacting companies like CMS Energy to prevent accidents and ensure adherence to safety standards.

Compliance with these labor laws is not merely a legal obligation but a cornerstone of operational integrity for CMS Energy. Failure to adhere to regulations concerning worker safety, wage and hour laws, and collective bargaining agreements can lead to substantial fines, legal challenges, and reputational damage. In 2024, the U.S. Department of Labor continued to emphasize enforcement actions against companies found in violation of labor standards, underscoring the financial and operational risks associated with non-compliance.

Ensuring a safe environment is paramount, especially considering the nature of energy infrastructure work. CMS Energy's commitment to worker safety directly impacts its ability to attract and retain a skilled workforce. The company's proactive approach to safety training and hazard mitigation is essential for maintaining operational continuity and avoiding costly disruptions. In 2024, industry reports indicated that companies with strong safety records often experienced lower employee turnover and higher productivity, highlighting the business benefits of robust labor law adherence.

- OSHA Compliance: CMS Energy must adhere to OSHA standards to ensure worker safety in all its operational areas, from power generation to distribution.

- Wage and Hour Laws: Adherence to federal and state minimum wage laws, overtime regulations, and benefit provisions is critical for employee relations and legal standing.

- Collective Bargaining: CMS Energy engages with labor unions, requiring compliance with negotiated collective bargaining agreements, which often include specific safety protocols and working conditions.

- Risk Mitigation: Strict adherence to labor laws minimizes the risk of fines, lawsuits, and operational shutdowns stemming from workplace safety violations or labor disputes.

Land Use and Property Rights

CMS Energy's operations are heavily influenced by land use and property rights regulations. The development and maintenance of crucial energy infrastructure, like transmission lines and substations, necessitate adherence to stringent land use laws, eminent domain statutes, and property rights protections. This means CMS Energy must meticulously navigate complex legal procedures to secure the necessary land and easements for its projects.

Navigating these legal frameworks can be challenging. Public opposition or legal disputes arising from land use issues can lead to significant project delays and substantial cost overruns. For instance, in 2023, a significant portion of utility infrastructure projects faced delays due to land acquisition and permitting challenges, impacting capital expenditure timelines.

- Eminent Domain Authority: CMS Energy utilizes eminent domain powers, granted by state law, to acquire private property for public utility purposes when negotiations fail, though this process is subject to legal challenges and compensation requirements.

- Easement Acquisition: Securing easements for transmission lines and pipelines is a critical legal process, often involving negotiations with numerous landowners and potential litigation if agreements cannot be reached.

- Environmental Permitting: Land use is intrinsically linked to environmental regulations, requiring CMS Energy to obtain various permits that assess potential impacts on sensitive ecosystems, wetlands, and historical sites, often involving multi-year review processes.

- Regulatory Compliance Costs: In 2024, compliance with evolving land use and property rights regulations is estimated to add 5-10% to the overall cost of new infrastructure development for major utilities.

CMS Energy faces significant legal and regulatory oversight from bodies like the Michigan Public Service Commission (MPSC) and the Federal Energy Regulatory Commission (FERC). These regulations govern pricing, service reliability, and environmental standards, with non-compliance potentially leading to substantial fines. For example, in 2023, the MPSC approved rate cases that influenced cost recovery for infrastructure upgrades, impacting companies like CMS Energy.

Environmental laws such as the Clean Air Act and Clean Water Act, alongside state-specific rules, dictate operational standards for CMS Energy's facilities. The company's 2024 capital expenditure plans included substantial investments in environmental compliance upgrades. Evolving climate change concerns are expected to drive more stringent regulations, potentially requiring further technology upgrades by 2025.

Consumer protection laws, particularly those concerning billing transparency and service disconnections, directly affect CMS Energy's customer interactions. Adherence to MPSC rules on utility shut-offs is crucial for avoiding penalties and maintaining customer trust. Labor laws, including OSHA standards, mandate safe working conditions, with compliance vital for avoiding fines and legal challenges, as emphasized by the U.S. Department of Labor's enforcement actions in 2024.

Environmental factors

CMS Energy is navigating significant environmental pressures, particularly concerning climate change and decarbonization. Regulatory bodies and public expectations are driving the company to aggressively reduce its carbon footprint, a trend that intensified through 2024 and is projected to continue into 2025.

Meeting these environmental objectives necessitates substantial investments in renewable energy sources and energy efficiency initiatives. For instance, CMS Energy's subsidiary, Consumers Energy, has committed to a Clean Energy Plan, aiming for 60% clean energy by 2025, with a long-term goal of net-zero carbon emissions by 2040.

Michigan's clean energy goals are significantly shaping CMS Energy's operational landscape. The state's Renewable Portfolio Standards (RPS) and other clean energy targets compel utilities to increase their reliance on renewable sources. This directly influences CMS Energy's capital allocation, pushing investments towards wind, solar, and emerging clean technologies to meet these requirements.

For instance, Michigan's 2023 Clean Energy Plan aims for 100% clean energy by 2040. CMS Energy, through its subsidiary Consumers Energy, is actively working towards these goals. In 2023, Consumers Energy reported that approximately 40% of its electricity came from clean sources, with a commitment to reach 60% by 2030 and 100% by 2040. Non-compliance with these mandates carries financial risks, including potential penalties that could impact profitability.

CMS Energy, like many utilities, relies heavily on water for its power generation, especially for cooling thermal plants. In 2024, the company continued to navigate the complexities of water resource management, recognizing its critical role in operational sustainability and regulatory compliance.

Responsible water usage and adherence to stringent water quality regulations are paramount for CMS Energy to mitigate its environmental footprint. The company's commitment to these principles is crucial, as any shortfall in water availability or stricter discharge limits can directly impact operational expenses and strategic decisions regarding the location of new facilities.

Waste Management and Pollution Control

CMS Energy faces significant environmental responsibilities concerning waste management and pollution control. The company must diligently manage and dispose of operational byproducts, such as coal ash, a process that requires careful adherence to stringent environmental standards to prevent contamination and safeguard public health. For instance, in 2023, CMS Energy reported managing substantial volumes of solid waste, with specific figures for coal ash disposal being a key area of regulatory focus.

Compliance with a complex web of pollution control regulations is paramount for CMS Energy. These regulations govern air emissions, water discharges, and the safe disposal of industrial waste. Failure to comply can result in substantial financial penalties, legal challenges, and damage to the company's reputation. The U.S. Environmental Protection Agency (EPA) sets many of these standards, which are continually updated, requiring ongoing vigilance.

To meet these environmental obligations, CMS Energy must make continuous investments in advanced pollution abatement technologies. These investments are crucial for upgrading facilities to reduce emissions, improve water treatment processes, and implement more sustainable waste disposal methods. For example, upgrades to scrubbers on coal-fired power plants represent a significant capital expenditure aimed at controlling sulfur dioxide emissions, a key regulatory concern.

- Waste Streams: CMS Energy manages diverse waste, including coal ash, requiring specialized disposal protocols.

- Regulatory Compliance: Adherence to air, water, and waste disposal regulations is critical to avoid penalties and protect public health.

- Technology Investment: Ongoing capital allocation for pollution control technologies, such as emission scrubbers, is essential.

- Environmental Performance: In 2023, CMS Energy's environmental expenditures on pollution control and waste management totaled over $150 million, reflecting the scale of these operational necessities.

Biodiversity and Land Conservation

CMS Energy's operations, particularly its energy infrastructure projects, can significantly affect local ecosystems and wildlife habitats. For instance, the construction of new transmission lines or power plants necessitates careful planning to avoid disrupting biodiversity hotspots. In 2024, the company continued its commitment to environmental stewardship by investing in projects aimed at minimizing the ecological footprint of its operations. This includes implementing advanced techniques to reduce habitat fragmentation and protect endangered species within its service territories.

To address these impacts, CMS Energy is required to conduct comprehensive environmental impact assessments before commencing any new development. These assessments help identify potential risks to biodiversity and inform the development of mitigation strategies. For example, in a recent project, the company employed specialized construction methods to safeguard sensitive wetland areas, a practice that has become standard for new infrastructure builds. Such measures are crucial for securing necessary permits and maintaining regulatory compliance.

Furthermore, sustainable land management and conservation efforts are becoming increasingly vital for CMS Energy. The company actively engages in land conservation initiatives, often partnering with local conservation groups. By 2025, CMS Energy aims to expand its land conservation programs, focusing on restoring and protecting natural habitats adjacent to its facilities. These efforts not only contribute to biodiversity but also bolster the company's reputation as an environmentally responsible entity, which is a key factor in public perception and stakeholder relations.

Key considerations for CMS Energy regarding biodiversity and land conservation include:

- Conducting rigorous environmental assessments for all new infrastructure projects.

- Implementing effective mitigation strategies to minimize disruption to wildlife habitats.

- Adopting sustainable land management practices across its operational areas.

- Investing in conservation efforts to protect and restore natural ecosystems.

CMS Energy is heavily influenced by environmental regulations and the growing imperative for sustainability. The company is actively pursuing decarbonization strategies, with its subsidiary Consumers Energy aiming for 60% clean energy by 2030 and net-zero emissions by 2040, aligning with Michigan's ambitious clean energy goals.

Water resource management is critical, especially for cooling thermal plants, with strict regulations on usage and discharge impacting operations and costs. Waste management, particularly coal ash disposal, requires significant investment in specialized protocols and compliance with EPA standards.

CMS Energy's infrastructure projects necessitate careful environmental impact assessments to protect biodiversity and habitats, driving investments in conservation and sustainable land management practices. In 2023, environmental expenditures on pollution control and waste management exceeded $150 million.

| Environmental Focus Area | CMS Energy Target/Action | 2023/2024 Data Point | Future Outlook |

|---|---|---|---|

| Decarbonization | Net-zero emissions by 2040 | Consumers Energy aimed for 40% clean energy in 2023 | 60% clean energy by 2030 |

| Water Management | Responsible usage and discharge compliance | Continued focus on water quality regulations | Potential impact on operational expenses |

| Waste Management | Adherence to disposal standards | Managed substantial solid waste volumes | Ongoing investment in pollution abatement technologies |

| Biodiversity & Land Use | Minimize ecological footprint | Invested in projects to minimize habitat fragmentation | Expand land conservation programs by 2025 |

PESTLE Analysis Data Sources

CMS Energy's PESTLE Analysis is built on a robust foundation of data from official government publications, industry-specific market research, and reputable economic forecasting agencies. This ensures that insights into political, economic, social, technological, legal, and environmental factors are grounded in current and credible information.