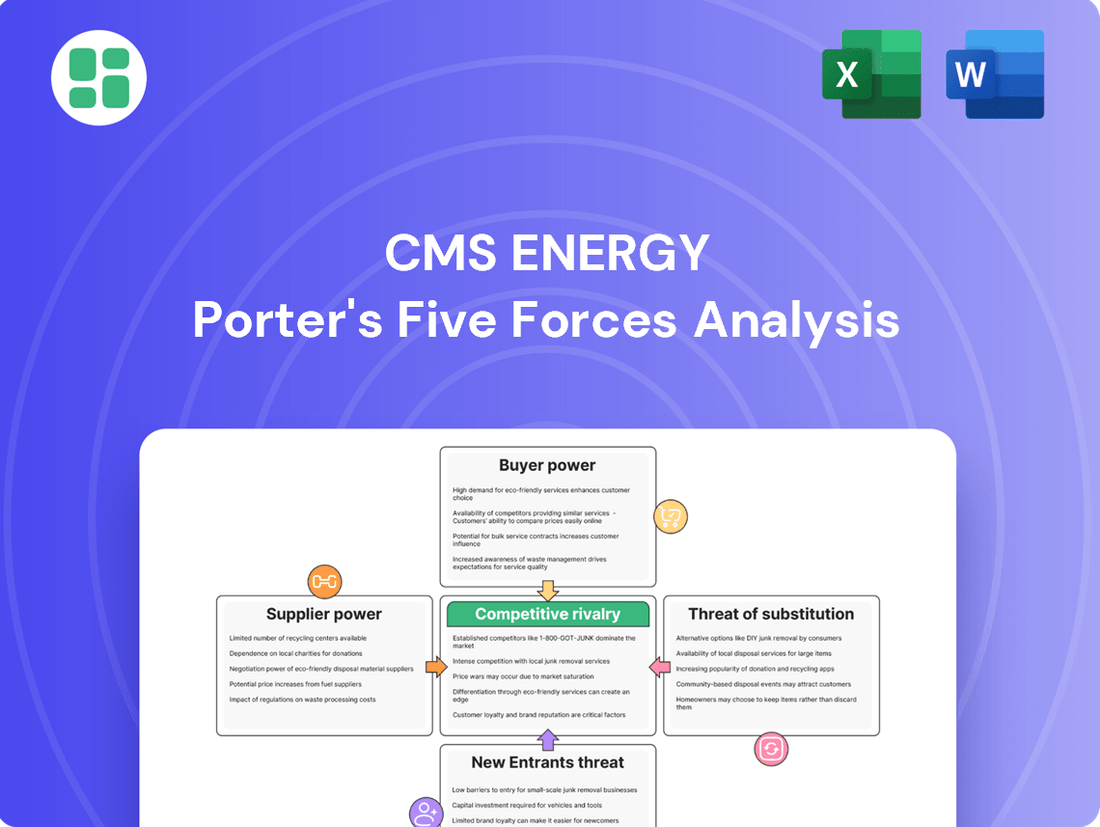

CMS Energy Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CMS Energy Bundle

CMS Energy operates within a dynamic utility sector, facing moderate threats from new entrants and intense rivalry among established players. Understanding the nuances of buyer power and the bargaining strength of suppliers is crucial for navigating this landscape.

The complete report reveals the real forces shaping CMS Energy’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

CMS Energy's move away from coal by 2025 significantly alters its supplier landscape. The company is shifting from a concentrated reliance on a few large coal suppliers to a broader base of natural gas providers and a growing number of renewable energy component suppliers.

This diversification, driven by investments in solar and wind, means CMS Energy will engage with a more varied set of suppliers for its energy generation needs. For instance, plans include adding 9 gigawatts of solar and 2.8 gigawatts of wind power between 2025 and 2045, necessitating relationships with numerous equipment and service providers in the renewable sector.

Suppliers of specialized equipment and advanced technology for grid modernization, such as those providing smart grid components and automated systems, likely hold significant bargaining power. CMS Energy's substantial investments, including a $1 billion grid strengthening program and extensive infrastructure upgrades, create a strong demand for these highly specific and often costly inputs.

The bargaining power of suppliers is significantly influenced by the availability of skilled labor and specialized contractors, particularly for large-scale infrastructure projects. CMS Energy's extensive work, like the 135 miles of natural gas system upgrades in 2024 which employed over 600 individuals, highlights a dependence on this skilled workforce.

The demand for workers in renewable energy construction and grid modernization projects directly impacts the cost and accessibility of these essential services. A tight labor market can empower these specialized contractors, allowing them to command higher prices for their expertise, thereby increasing supplier power for CMS Energy.

Regulatory Influence on Supply Chain Decisions

Michigan's drive towards 100% clean electricity by 2040, a significant mandate, directly influences CMS Energy's supply chain. This pushes the company to favor suppliers providing renewable energy technologies and compliant solutions, thereby enhancing the bargaining power of those in the clean energy sector.

The state's proactive stance on clean energy, coupled with federal incentives like those from the Inflation Reduction Act, further solidifies the position of suppliers aligning with these green initiatives. This regulatory environment shapes CMS Energy's procurement strategies, potentially increasing costs for non-compliant inputs.

- Regulatory Mandates: Michigan's 2040 clean energy target and interim renewable energy goals increase demand for compliant suppliers.

- Federal Incentives: The Inflation Reduction Act amplifies the attractiveness and competitive edge of clean energy technology suppliers.

- Supplier Leverage: Suppliers offering solutions that meet stringent environmental and renewable energy standards gain increased bargaining power.

- Procurement Shift: CMS Energy's strategy must adapt to prioritize these green-focused suppliers, potentially altering cost structures.

Domestic Supply Chain and Global Market Impacts

CMS Energy's commitment to sourcing around 90% of its supply chain domestically is a strategic move to shield itself from global trade volatility and international supply chain disruptions. This focus on domestic suppliers, particularly within Michigan, supports local economic growth and job creation.

While this domestic concentration offers significant resilience, it could potentially narrow CMS Energy's supplier pool and, in some instances, lead to higher procurement costs compared to a strategy that leverages global sourcing opportunities. For example, in 2024, the cost of key materials for utility infrastructure, such as copper and steel, saw fluctuations influenced by domestic production levels and demand.

- Domestic Sourcing: Approximately 90% of CMS Energy's supply chain is domestic.

- Resilience vs. Cost: Domestic focus enhances resilience but may limit options and increase costs.

- Economic Alignment: Strategy supports Michigan's economic development goals.

- Market Factors: 2024 saw material cost fluctuations impacting utility procurement.

CMS Energy's supplier bargaining power is shifting as it moves away from coal and embraces renewables, impacting its procurement strategies. The company's significant investments in grid modernization and clean energy projects, like the 9 gigawatts of planned solar capacity, create demand for specialized suppliers, enhancing their leverage.

Michigan's aggressive clean energy targets, aiming for 100% clean electricity by 2040, coupled with federal incentives like the Inflation Reduction Act, further empower suppliers of compliant renewable technologies. This regulatory push means CMS Energy must prioritize these green-focused vendors, potentially increasing costs for non-compliant inputs.

CMS Energy's strategic focus on sourcing approximately 90% of its supply chain domestically, while bolstering resilience, could limit supplier options and potentially increase procurement costs, as seen with 2024 fluctuations in domestic material prices like copper and steel.

| Factor | Impact on Supplier Bargaining Power | CMS Energy Context |

| Shift to Renewables | Increases power of specialized renewable tech suppliers | 9 GW solar, 2.8 GW wind planned by 2045 |

| Regulatory Mandates | Empowers suppliers meeting clean energy standards | Michigan's 2040 clean energy goal |

| Domestic Sourcing | Potentially limits options, may increase costs | ~90% domestic supply chain; 2024 material cost fluctuations |

| Grid Modernization Investment | Strengthens power of suppliers of advanced grid components | $1 billion grid strengthening program |

What is included in the product

CMS Energy's Porter's Five Forces analysis reveals the intensity of rivalry, buyer and supplier power, threat of new entrants, and the impact of substitutes on its regulated utility and independent power generation businesses.

Instantly grasp CMS Energy's competitive landscape with a clear, one-sheet summary of all five forces—perfect for quick decision-making.

Customers Bargaining Power

As a regulated utility, Consumers Energy holds a near-monopoly in its Michigan service areas for electricity and natural gas. This means most residential and small business customers have no other choice for their essential energy supply. In 2023, Consumers Energy served approximately 6.7 million customers across Michigan, highlighting the vast customer base within this limited competitive landscape.

Customers' bargaining power is significantly influenced by regulatory oversight, particularly from the Michigan Public Service Commission (MPSC) which governs Consumers Energy's rates and service standards. This commission acts as a crucial intermediary, ensuring customer interests are considered during rate increase requests.

Customers can indirectly wield influence during rate cases through participation in public hearings and the involvement of advocacy groups. These forums allow for scrutiny of proposed rate hikes and operational strategies, impacting the MPSC's final decisions.

For instance, in recent rate case proceedings, the MPSC has balanced utility investment needs with the imperative of customer affordability, demonstrating their active role in moderating customer power. Discussions around future rate adjustments continue to highlight this dynamic.

Michigan's energy waste reduction plans, including Consumers Energy's efficiency programs, significantly boost customer bargaining power. These initiatives, aiming for specific savings targets like 1.5% for electric and 0.875% for natural gas utilities from 2026, equip customers to lower their energy bills and consumption. This increased control over usage directly impacts the utility's demand, giving customers more leverage.

Demand for Clean Energy and Reliability

The growing demand for clean energy and enhanced grid reliability significantly strengthens the bargaining power of CMS Energy's customers. Societal and regulatory pressures pushing for sustainability give customers a louder voice in dictating the utility's investment strategies. For instance, CMS Energy's 2024 capital expenditure plan includes substantial allocations towards renewable energy projects and grid modernization, directly reflecting these customer-driven priorities.

CMS Energy's proactive investments in renewable sources and infrastructure upgrades are largely a response to customer expectations for environmentally responsible and dependable service. The company's focus on reducing power outage durations and improving restoration times, as seen in their 2023 performance metrics showing a 15% decrease in average outage duration, directly addresses customer demands for greater reliability.

- Customer Influence: Increasing societal and regulatory focus on clean energy and grid reliability empowers customers to influence utility investment priorities.

- CMS Energy's Response: Significant investments in renewables and grid modernization by CMS Energy are driven by customer expectations for sustainable and reliable service.

- Reliability Focus: Initiatives to restore power quickly and reduce outages directly address customer demands for improved service reliability.

Negotiating Power of Large Commercial and Industrial Customers

While individual residential customers have minimal sway, large commercial and industrial clients, particularly those with substantial energy needs such as burgeoning data centers, possess greater bargaining power. These major consumers can negotiate bespoke energy supply agreements or explore on-site generation options, compelling utilities like CMS Energy to offer competitive pricing and customized energy solutions to secure or attract their business. CMS Energy's recent deal with a new data center exemplifies this trend, demonstrating how significant demand can translate into negotiation leverage.

This bargaining power is amplified when these large customers have viable alternatives, such as investing in their own power generation or switching to different energy providers if regulations permit. For instance, a large manufacturing plant might invest in co-generation facilities, reducing its reliance on the utility and thereby strengthening its negotiating position for the remaining power it requires. This can lead to pressure on CMS Energy to offer more favorable contract terms, including lower per-unit costs or guaranteed capacity availability.

- Large C&I customers can negotiate customized energy contracts, influencing pricing and service levels.

- The potential for self-generation or switching providers increases customer leverage.

- CMS Energy's agreement with a new data center underscores the impact of significant energy demand on negotiations.

- Utilities must balance competitive offers with the need to maintain profitability when dealing with powerful industrial clients.

The bargaining power of customers for CMS Energy is generally low for individual residential users due to the regulated near-monopoly status. However, this power increases significantly for large commercial and industrial (C&I) clients who have the potential for self-generation or can negotiate customized energy contracts. CMS Energy's strategic responses, like its 2024 capital investments in renewables and grid modernization, reflect an acknowledgment of evolving customer expectations for sustainability and reliability.

| Customer Segment | Bargaining Power Factors | CMS Energy's Strategic Response |

|---|---|---|

| Residential | Limited choice, regulated rates | Focus on efficiency programs (e.g., 1.5% electric, 0.875% natural gas savings targets) |

| Large C&I | Potential for self-generation, negotiation leverage | Customized energy contracts, competitive pricing (e.g., data center agreements) |

| All Customers | Demand for clean energy, grid reliability | Investment in renewables, grid modernization, improved outage restoration (15% reduction in 2023) |

Full Version Awaits

CMS Energy Porter's Five Forces Analysis

This preview showcases the complete CMS Energy Porter's Five Forces Analysis, offering a detailed examination of competitive forces within the utility sector. You're viewing the exact, professionally formatted document that will be instantly available for download upon purchase, ensuring no surprises. This comprehensive analysis is ready for immediate use, providing valuable strategic insights without any additional setup or customization required.

Rivalry Among Competitors

CMS Energy, through its subsidiary Consumers Energy, functions as a regulated monopoly in its core electricity and natural gas distribution services across Michigan. This structure inherently limits direct competition, as other utility providers are typically barred from serving the same customers within its established territories. Consequently, the traditional competitive rivalry seen in many industries is largely absent in these fundamental service areas.

CMS Energy faces intense competition not from direct customer rivals, but from numerous other regulated utilities and energy firms vying for the same pool of investor capital. This competition directly impacts its ability to fund significant capital expenditures, such as its planned investments in grid modernization and renewable energy infrastructure.

In 2024, utilities are navigating a landscape where attracting investment is paramount for growth. Companies like CMS Energy must demonstrate robust financial health and a compelling strategy to stand out. For instance, CMS Energy's 2024 capital expenditure plan, exceeding $4 billion, highlights the substantial funding required, making investor appeal a critical factor.

Maintaining investor confidence hinges on consistent earnings growth and a clear, attractive investment thesis. Utilities that can effectively communicate their long-term value proposition, particularly in areas like clean energy transition and operational efficiency, are better positioned to secure the necessary capital in a competitive market.

In the regulated utility sector, competitive rivalry heavily centers on achieving operational efficiency and unwavering reliability. CMS Energy actively pursues national leadership in sustainability and world-class performance, with a strong focus on enhancing grid reliability and minimizing outage durations.

This drive for excellence is evident as utilities are routinely benchmarked against peers using key performance indicators such as the System Average Interruption Duration Index (SAIDI) and System Average Interruption Frequency Index (SAIFI). For instance, in 2023, CMS Energy reported improvements in SAIDI, bringing it closer to industry best practices, a testament to their ongoing efforts in operational enhancement.

Rivalry in Renewable Energy Development and Procurement

CMS Energy faces intense rivalry as it grows its renewable energy operations. Other developers and utilities are also vying for the best locations, access to the grid, and contracts to buy the power generated. This competition is particularly evident in processes like the competitive-bid annual solicitation for solar capacity, where multiple entities submit proposals.

The company's significant targets for new solar and wind energy mean it's actively engaged in a crowded marketplace for these crucial renewable assets and development projects. This dynamic environment necessitates strategic positioning to secure desirable opportunities.

- Competitive Bidding: CMS Energy participates in competitive bid processes for renewable energy projects, such as the annual solicitation for solar capacity, facing numerous other developers.

- Resource Competition: The company competes with rivals for prime development sites and essential interconnection rights, which are critical for bringing renewable energy projects online.

- Contract Acquisition: Securing Power Purchase Agreements (PPAs) is another area of fierce competition, as CMS Energy and its peers aim to lock in long-term revenue streams for their renewable energy output.

Indirect Competition from Emerging Energy Solutions

Emerging energy solutions, like solar panels and battery storage, present an indirect competitive threat to CMS Energy. These distributed energy resources (DERs) can reduce customer reliance on the traditional grid, impacting CMS Energy's load. For instance, by 2023, residential solar installations in the US continued to grow, with the Solar Energy Industries Association reporting significant capacity additions.

CMS Energy needs to proactively address this by integrating DERs into its strategy and promoting energy efficiency. This means developing programs that allow customers to benefit from or participate in these new energy paradigms. Failing to adapt could lead to a gradual erosion of their customer base and revenue streams as consumers opt for self-generation or reduced consumption.

CMS Energy's response to this indirect competition is crucial for its long-term viability. They are investing in grid modernization and exploring new service offerings to retain customers. For example, utility companies are increasingly offering demand response programs and exploring partnerships with DER providers to manage this evolving landscape effectively.

- Indirect Rivalry: Distributed energy resources (DERs) and energy efficiency technologies reduce demand for grid-supplied power.

- CMS Energy's Adaptation: Must integrate DERs and promote energy conservation to avoid losing load.

- Market Trends: Residential solar installations saw continued growth through 2023, impacting traditional utility models.

While CMS Energy operates as a regulated monopoly in its core utility services, competitive rivalry intensifies in areas like attracting investor capital and developing renewable energy projects. The company must differentiate itself through strong financial performance and strategic positioning in the burgeoning clean energy market. For instance, CMS Energy's significant 2024 capital expenditure plan, exceeding $4 billion, underscores the critical need to secure investor confidence amidst a competitive funding landscape.

CMS Energy faces competition for investor dollars with other utilities, all seeking capital for growth and modernization. Success in securing this capital depends on demonstrating consistent earnings and a clear vision, especially regarding the clean energy transition. Utilities that effectively communicate their long-term value proposition are better positioned to attract investment, a crucial factor given the substantial funding needs for projects like grid upgrades.

The renewable energy sector sees CMS Energy competing with numerous developers for prime sites, grid interconnection access, and power purchase agreements. This competition is evident in processes like annual solar capacity solicitations, where multiple entities vie for contracts. The company's ambitious renewable energy targets mean it actively engages in a crowded marketplace for these vital assets.

| Area of Competition | Nature of Rivalry | CMS Energy's Strategy |

|---|---|---|

| Investor Capital | Competition with other utilities for funding | Demonstrate strong financials, clear clean energy strategy, consistent earnings growth |

| Renewable Energy Development | Competition for sites, grid access, PPAs | Strategic positioning, participation in competitive solicitations |

| Operational Efficiency | Benchmarking against peers on reliability metrics | Focus on enhancing grid reliability, minimizing outages (e.g., SAIDI, SAIFI) |

SSubstitutes Threaten

The growing affordability and accessibility of customer-sited renewable energy, like rooftop solar, presents a substantial threat to CMS Energy. As more customers generate their own power, their demand for grid electricity decreases, directly impacting the utility's sales volume. This trend is amplified by supportive policies and incentives.

In 2024, the continued decline in solar panel costs, coupled with federal tax credits from the Inflation Reduction Act, makes distributed generation increasingly attractive for Michigan residents and businesses. This can lead to a significant reduction in the customer base relying solely on CMS Energy for their power needs.

Energy efficiency and demand reduction programs present a significant threat of substitutes for utility companies like CMS Energy. These initiatives encourage customers to consume less energy, directly impacting a utility's core business. For instance, investments in energy-efficient appliances, improved insulation, and smart home technologies allow consumers to reduce their reliance on grid-supplied power.

Michigan's regulatory environment actively supports these substitutes. State laws mandate that utilities implement and regularly update energy waste reduction plans. These plans are designed to achieve measurable year-over-year energy savings, further incentivizing customers to adopt conservation measures and thereby reducing the demand for traditional utility services.

Advancements in battery storage technology are a significant threat to traditional utilities like CMS Energy. Customers can now store electricity generated from various sources, including their own solar panels, and use it when grid prices are high or during outages. This reduces their reliance on the central utility for consistent power supply. For instance, by the end of 2023, residential battery storage installations in the US saw substantial growth, with projections indicating continued expansion throughout 2024 and beyond.

The rise of microgrids presents another formidable substitute. These localized energy systems can operate independently of the main grid, providing power to specific communities, campuses, or industrial parks. This capability allows them to bypass the central utility altogether for essential power needs, directly impacting demand for CMS Energy's services. The global microgrid market is expected to grow significantly, with estimates suggesting a compound annual growth rate of over 15% from 2023 to 2028, highlighting the increasing adoption of these alternative solutions.

Alternative Heating and Cooling Technologies

The threat of substitutes for CMS Energy's core offerings, primarily natural gas and electricity, is growing, particularly from alternative heating and cooling technologies. While not a direct replacement for all utility services, the increasing adoption of systems like geothermal or advanced heat pumps can significantly reduce the demand for traditional energy sources for climate control. This trend is further amplified by state-level initiatives promoting electrification, which encourages consumers to switch away from fossil fuels for heating and other household needs.

These shifts represent a tangible threat to CMS Energy's revenue streams. For instance, the U.S. Department of Energy reported that by the end of 2023, over 1.5 million homes had installed geothermal heat pumps, a number projected to grow significantly as efficiency and cost-effectiveness improve. Similarly, the market for air-source heat pumps saw a substantial increase in sales in 2023, with many utilities offering incentives for their installation. This growing preference for electric-powered, high-efficiency climate solutions directly competes with the natural gas and electricity volumes CMS Energy sells for these applications.

- Growing Adoption of Geothermal Systems: Over 1.5 million U.S. homes had geothermal heat pumps by the end of 2023, a trend expected to continue.

- Increased Heat Pump Sales: The market for air-source heat pumps experienced a notable sales surge in 2023, indicating a shift towards electric heating solutions.

- Electrification Initiatives: Government policies encouraging the electrification of appliances and equipment directly challenge the demand for fossil fuel-based energy.

Self-Generation by Large Industrial Consumers

Large industrial consumers, driven by a desire for cost savings and energy independence, are increasingly exploring self-generation options. These customers, representing a significant portion of CMS Energy's load, can invest in on-site power solutions like combined heat and power (CHP) plants or extensive solar installations. This shift directly threatens CMS Energy's revenue streams by reducing the demand for its delivered electricity.

The economic viability of self-generation for industrial users is often tied to fluctuating energy prices and the declining costs of renewable technologies. For instance, in 2024, the levelized cost of energy (LCOE) for utility-scale solar PV continued its downward trend, making it a more attractive alternative for large-scale power users. This trend directly impacts utilities like CMS Energy.

- Significant Load Loss Potential: Industrial self-generation can lead to a substantial reduction in the electricity CMS Energy sells to its largest customers.

- Cost-Driven Decisions: Industrial consumers often prioritize cost predictability and reduction, making self-generation a compelling option when utility rates are perceived as high or volatile.

- Technological Advancements: The increasing efficiency and decreasing costs of technologies like solar PV and battery storage further enhance the attractiveness of on-site generation for industrial clients.

- Energy Independence: Beyond cost, some industrial players seek greater control over their energy supply and resilience, which self-generation can provide.

The threat of substitutes for CMS Energy is multifaceted, stemming from advancements in distributed generation and energy efficiency. Customer-sited solar, coupled with battery storage, allows consumers to generate and store their own power, diminishing reliance on the utility grid. Furthermore, energy efficiency programs and the increasing adoption of electric heating solutions like heat pumps directly compete with traditional natural gas and electricity sales, impacting CMS Energy's core revenue streams.

| Substitute Technology | 2023/2024 Trend/Data | Impact on CMS Energy |

|---|---|---|

| Rooftop Solar | Continued cost declines and federal tax credits made solar more accessible in 2024. | Reduces demand for grid electricity, impacting sales volume. |

| Battery Storage | Residential installations saw substantial growth by end of 2023, with continued expansion projected. | Enables greater energy independence, reducing reliance on utility for consistent power. |

| Heat Pumps (Geothermal & Air-Source) | Over 1.5 million U.S. homes had geothermal by end of 2023; air-source sales surged in 2023. | Decreases demand for natural gas and electricity used for heating. |

| Industrial Self-Generation (e.g., Solar PV, CHP) | Declining LCOE for utility-scale solar in 2024 makes on-site generation more attractive. | Significant reduction in electricity demand from large industrial customers. |

Entrants Threaten

The energy utility sector, especially for companies like CMS Energy that handle generation, transmission, and distribution, requires massive upfront capital for infrastructure. Developing power plants, vast transmission networks, and distribution systems costs billions, presenting a formidable hurdle for any new player looking to enter the market.

For instance, CMS Energy has outlined a significant capital expenditure plan of approximately $20 billion for the period of 2025 through 2029. This substantial investment underscores the immense financial commitment necessary to establish and maintain operations in this industry, effectively deterring most potential new entrants.

New companies looking to enter the energy sector, particularly in Michigan where CMS Energy operates, face substantial regulatory barriers. The Michigan Public Service Commission (MPSC) mandates a complex and lengthy approval process for any new entrant seeking to establish generation, transmission, or distribution assets. This includes acquiring numerous licenses and permits, which can take years and significant investment to navigate.

Securing the necessary approvals and rate-setting authority is a critical, yet formidable, step for potential competitors. For instance, in 2023, the MPSC continued its rigorous review of new energy projects, with several large-scale renewable energy proposals undergoing extensive public hearings and environmental impact assessments before any approval could be considered, underscoring the difficulty for new players.

Established infrastructure and a loyal customer base present a significant barrier to new entrants. Incumbent utilities like Consumers Energy, with its 138 years of service, have invested heavily in extensive and well-maintained networks. Replicating this vast infrastructure is often economically prohibitive for newcomers.

Economies of Scale and Scope

Existing utilities like CMS Energy benefit from substantial economies of scale in their generation, transmission, and distribution networks. This means they can produce and deliver energy at a lower cost per unit compared to any new, smaller competitor trying to enter the market. For instance, CMS Energy's substantial investment in its infrastructure, including its 2023 capital expenditures of approximately $2.5 billion, underpins these scale advantages.

The integrated nature of CMS Energy's operations creates further economies of scope. This integration across the entire energy value chain, from generation to customer delivery, makes it incredibly challenging for new, specialized entrants to match their efficiency and cost-effectiveness. A new entrant would struggle to replicate this comprehensive operational model, facing higher initial costs and a less streamlined approach.

- Economies of Scale: CMS Energy leverages massive infrastructure investments, leading to lower per-unit operating costs in generation, transmission, and distribution.

- Economies of Scope: The company's integrated operations across the energy value chain provide cost efficiencies that are difficult for specialized new entrants to match.

- Capital Intensity: The high capital requirements to build and maintain utility infrastructure act as a significant barrier to entry, protecting established players.

Niche Entry vs. Full Utility Competition

The threat of new entrants for CMS Energy, particularly as a full-service utility, remains low. Establishing a complete utility infrastructure requires massive capital investment and regulatory hurdles, making direct, comprehensive competition highly improbable.

However, niche segments within the energy sector present a more accessible entry point for new players. These entrants typically focus on specific parts of the energy value chain, such as independent power production, energy services, or the development of localized microgrids.

- Independent Power Producers (IPPs): These companies develop and sell electricity, often from renewable sources, directly to utilities like CMS Energy. For example, in 2024, renewable energy capacity additions continued to grow, with solar and wind projects frequently being developed by third parties.

- Energy Services Companies (ESCOs): ESCOs offer energy efficiency solutions, demand response programs, and other energy management services to commercial and industrial customers, sometimes in partnership with or in competition with utility offerings.

- Microgrid Developers: The increasing interest in grid resilience and localized energy solutions has led to the emergence of companies specializing in microgrid development, which can serve specific campuses or communities.

The threat of new entrants for CMS Energy as a comprehensive utility provider is significantly low due to immense capital requirements and stringent regulatory oversight. For instance, CMS Energy's planned capital expenditures of approximately $20 billion between 2025 and 2029 highlight the scale of investment needed, a substantial deterrent for newcomers.

While direct competition across the entire utility spectrum is unlikely, new entrants can target niche markets. These often involve independent power generation, energy efficiency services, or microgrid development, areas where the barriers to entry are less formidable than establishing a full-scale utility operation.

| Niche Market | Description | Example of Entry in 2024 |

|---|---|---|

| Independent Power Producers (IPPs) | Develop and sell electricity, often from renewables. | Continued growth in solar and wind farm development by third-party entities selling power to utilities. |

| Energy Services Companies (ESCOs) | Offer energy efficiency and management solutions. | Increased focus on demand-side management and energy optimization services for commercial clients. |

| Microgrid Developers | Specialize in localized energy systems for resilience. | Projects focused on critical infrastructure and campuses seeking energy independence. |

Porter's Five Forces Analysis Data Sources

Our CMS Energy Porter's Five Forces analysis is built upon a foundation of publicly available financial reports, including annual and quarterly filings with the SEC, alongside industry-specific data from trade associations and regulatory bodies.