Clear Secure PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Clear Secure Bundle

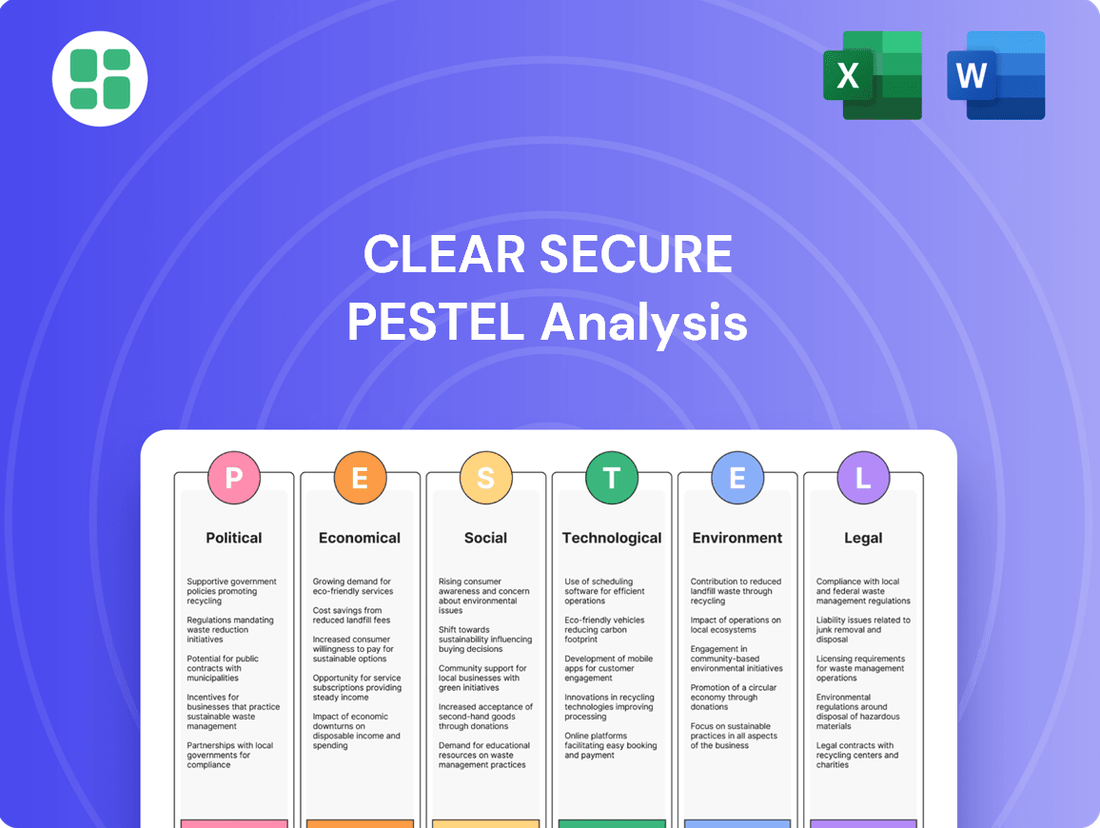

Navigate the complex external forces shaping Clear Secure's trajectory with our comprehensive PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental factors influencing their operations and future growth. Equip yourself with actionable intelligence to make informed strategic decisions. Download the full PESTLE analysis now and gain a critical competitive edge.

Political factors

Government regulations, particularly from the Transportation Security Administration (TSA) and the Department of Homeland Security (DHS), significantly shape CLEAR's operational landscape. Changes in security protocols or identity verification standards directly affect CLEAR Plus's service offerings and market access.

For instance, the TSA's ongoing efforts to enhance airport security post-pandemic, including potential updates to biometric screening technologies, could create new opportunities or necessitate adjustments for CLEAR. Adherence to these evolving mandates is crucial for CLEAR's continued ability to operate and expand its airport footprint.

The evolving political landscape concerning data privacy, particularly around biometric data, presents a critical factor for Clear Secure. Anticipated federal legislation in the US, building on existing state-level frameworks like California's CCPA/CPRA, could impose significant compliance burdens. For instance, the proposed American Data Privacy and Protection Act (ADPPA) aimed to establish a national standard, though its passage remains uncertain, highlighting the fragmented regulatory environment.

Clear Secure's growth is significantly influenced by government contracts, especially in airport security. For instance, the Transportation Security Administration (TSA), a key partner, manages significant security funding. Political decisions on infrastructure spending, like those potentially outlined in the Biden-Harris administration's infrastructure plans, directly impact Clear Secure's opportunities for expansion and revenue generation.

International Relations and Travel Policies

Geopolitical stability significantly impacts Clear Secure's core market by influencing international travel volumes. For instance, the ongoing geopolitical tensions in Eastern Europe and the Middle East, as of mid-2024, have led to rerouting of flights and, in some cases, reduced air traffic on certain routes, directly affecting the demand for security screening services at airports.

Changes in international travel policies, such as updated visa requirements or new travel advisories, can also dampen passenger numbers. The International Air Transport Association (IATA) projects global air passenger traffic to reach 4.7 billion in 2024, a substantial increase from 2023, but localized disruptions can still create significant headwinds for companies like Clear Secure.

- Geopolitical Instability: Ongoing conflicts and regional tensions can lead to flight cancellations and rerouting, reducing passenger volumes.

- Travel Bans & Advisories: Government-imposed travel restrictions directly decrease international travel, impacting demand for security services.

- Visa Requirements: Changes in visa policies can deter international travelers, affecting airport traffic and Clear Secure's market reach.

- International Expansion: Unfavorable political climates or complex regulatory environments can hinder Clear Secure's ability to expand its services into new international markets.

Lobbying Efforts and Industry Influence

Clear Secure actively participates in lobbying to shape regulations affecting aviation security and identity verification. Their engagement aims to foster an environment conducive to their technology and business expansion. For instance, in 2023, the Transportation Security Administration (TSA) continued to expand the use of biometric screening, a core area for Clear Secure, indicating a favorable policy direction influenced by industry advocacy.

The company's influence can directly impact the pace of technology adoption and the competitive landscape. Effective lobbying can lead to policies that streamline processes for biometric identification, potentially increasing Clear Secure's market share. Conversely, less favorable regulatory outcomes could hinder their growth strategies.

- Lobbying Spend: While specific 2024 lobbying figures for Clear Secure are not yet fully reported, the company's commitment to influencing policy is evident in its consistent engagement with lawmakers and regulatory bodies.

- Policy Impact: Favorable regulations, such as those promoting expedited airport screening, directly benefit Clear Secure's membership model and revenue streams.

- Industry Advocacy: Clear Secure is part of a broader industry advocating for technological advancements in security, aiming to create a more unified and efficient passenger experience.

Government policies on data privacy and biometric usage are paramount for Clear Secure. The ongoing debate around federal data privacy legislation in the U.S., with potential implications similar to California's CCPA/CPRA, could significantly impact how Clear Secure handles member data. For instance, the Transportation Security Administration's (TSA) evolving directives on identity verification and biometric screening directly influence CLEAR's operational capabilities and the expansion of its airport network.

| Policy Area | Impact on Clear Secure | 2024/2025 Outlook |

|---|---|---|

| Data Privacy Legislation | Compliance costs, potential restrictions on data usage | Increased scrutiny, possible new federal standards |

| Biometric Screening Mandates | Opportunities for integration, need for technological alignment | Continued expansion of biometric use by TSA |

| Airport Security Funding | Direct impact on infrastructure investment and partnership opportunities | Dependent on government infrastructure spending plans |

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors impacting Clear Secure, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers actionable insights for strategic decision-making by detailing how these forces create both opportunities and threats for the company.

Provides a clear, actionable understanding of external factors impacting Clear Secure, enabling proactive strategy adjustments and mitigating potential disruptions.

Economic factors

Consumer disposable income is a critical driver for services like CLEAR Plus. As of early 2024, many developed economies are experiencing moderate growth, with disposable incomes generally on an upward trend, which bodes well for discretionary spending on travel enhancements.

Economic prosperity directly fuels both leisure and business travel. For instance, in 2023, global travel spending saw a significant rebound, with projections for 2024 indicating continued expansion, suggesting a larger pool of potential CLEAR subscribers.

Conversely, economic downturns or high inflation can significantly dampen consumer spending. A contraction in disposable income often leads to reduced travel frequency and a reevaluation of non-essential service subscriptions, directly impacting CLEAR's revenue streams.

Clear Secure operates in a dynamic economic environment shaped by intense competition. Traditional airport security lines, while less convenient, represent a baseline competitive offering. More directly, programs like TSA PreCheck, managed by the government, offer a similar expedited screening experience, directly vying for the same customer segment. For instance, as of early 2024, TSA PreCheck boasts over 10 million members, indicating a substantial existing user base that Clear Secure must attract or differentiate itself from.

Emerging identity verification solutions also pose a competitive threat. As technology advances, new biometric and digital identity platforms could offer alternative or complementary ways for travelers to expedite airport processes, potentially fragmenting the market. Market saturation in high-traffic airports is another significant economic factor. If Clear Secure achieves widespread adoption in key locations, its ability to attract new subscribers may slow, impacting growth projections and potentially leading to more aggressive pricing strategies to maintain market share.

This competitive pressure can directly affect Clear Secure's pricing power and overall profitability. In 2023, Clear Secure reported revenue of $729 million, a significant increase from prior years, but sustained growth will depend on its ability to maintain a compelling value proposition against these diverse competitive forces. Aggressive pricing by rivals or a need to offer discounts to counter saturation could compress profit margins.

Rising inflation in 2024 and projected into 2025 directly impacts Clear Secure's bottom line. For instance, the U.S. Consumer Price Index (CPI) saw a significant increase, with annual inflation rates hovering around 3.1% in early 2024, impacting everything from employee compensation to the cost of advanced security technology.

These elevated costs for personnel, technology upkeep, and airport infrastructure leases necessitate careful financial management. Clear Secure must navigate these increased operational expenses while keeping its service pricing competitive to protect profit margins and ensure sustained economic viability.

Airport Infrastructure Investment

Economic investments in airport infrastructure, such as new terminal constructions and security system upgrades, directly benefit Clear Secure by creating new avenues for deploying its technology. For instance, the U.S. Department of Transportation's Airport Improvement Program (AIP) allocated approximately $3.3 billion in 2023, funding projects that often include enhanced security infrastructure where Clear Secure's solutions are relevant.

Conversely, a slowdown in airport capital expenditure could temper growth prospects for Clear Secure. If airports defer upgrades due to economic downturns or budget constraints, the pace of adoption for new security technologies might decelerate, impacting Clear Secure's market penetration.

- Airport Investment Trends: Global airport infrastructure spending is projected to reach hundreds of billions of dollars in the coming years, with a significant portion dedicated to modernization and security enhancements, presenting a substantial market for Clear Secure.

- Clear Secure's Market Position: As a provider of identity verification and security solutions, Clear Secure is well-positioned to capitalize on these infrastructure investments, particularly in areas like expedited screening and biometric passenger processing.

- Economic Sensitivity: The company's growth is intrinsically linked to the financial health of the aviation sector and the willingness of airports to invest in advanced security and passenger experience technologies.

Impact of Economic Recessions on Travel Volume

Economic recessions significantly dampen travel volume, affecting both business and leisure trips. This directly shrinks the potential customer base for services like CLEAR Plus, as discretionary spending tightens. For instance, during the COVID-19 pandemic's economic shock in 2020, global international tourist arrivals plunged by 73%, highlighting the sensitivity of travel to economic downturns.

CLEAR's resilience hinges on its capacity to retain its current membership base during these challenging periods. Demonstrating ongoing value and convenience becomes paramount when consumers are scrutinizing every expense. Subscription renewal rates are a key indicator of this ability to hold onto customers despite economic pressures.

- Reduced Disposable Income: Recessions typically lead to job losses and wage stagnation, leaving consumers with less money for non-essential services like expedited airport security.

- Corporate Travel Cuts: Businesses often slash travel budgets during downturns, impacting a significant segment of frequent travelers who might otherwise subscribe to CLEAR.

- Value Proposition Emphasis: CLEAR must clearly communicate its time-saving benefits to justify its cost when consumers are highly cost-conscious.

Economic growth directly correlates with increased travel demand, benefiting CLEAR. As of early 2024, many economies show moderate growth, boosting disposable incomes and encouraging both leisure and business travel. The aviation sector's recovery is a strong indicator, with global travel spending projected to continue expanding through 2024.

However, economic downturns and inflation pose significant risks. Reduced disposable income can lead consumers to cut back on non-essential services like CLEAR, impacting subscription renewals. For instance, elevated inflation in early 2024, with U.S. CPI around 3.1%, increases operational costs for CLEAR, such as employee compensation and technology expenses, squeezing profit margins if pricing cannot be adjusted.

Investments in airport infrastructure are a key economic driver for CLEAR. Projects funded by programs like the U.S. DOT's Airport Improvement Program, which allocated approximately $3.3 billion in 2023, often include security system upgrades, creating new deployment opportunities for CLEAR's technology.

| Economic Factor | Impact on CLEAR | Supporting Data (2023-2024) |

|---|---|---|

| Global Economic Growth | Increases travel demand and disposable income, boosting CLEAR subscriptions. | Global travel spending rebound in 2023, with continued expansion projected for 2024. |

| Inflation & Cost Pressures | Raises CLEAR's operational costs (wages, tech) and can reduce consumer spending on subscriptions. | U.S. CPI around 3.1% in early 2024. |

| Airport Infrastructure Investment | Creates opportunities for CLEAR to deploy its technology in upgraded airport security systems. | U.S. Airport Improvement Program allocated ~$3.3 billion in 2023 for airport projects. |

What You See Is What You Get

Clear Secure PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Clear Secure provides an in-depth look at the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. It's designed to offer actionable insights for strategic decision-making.

Sociological factors

Public perception of data privacy and security significantly impacts Clear Secure's adoption. Societal attitudes towards sharing biometric data for convenience are critical; a strong public preference for privacy over speed could hinder adoption. For instance, a 2024 Pew Research Center study indicated that while many Americans appreciate the convenience of facial recognition, a substantial portion remains concerned about how their biometric data is collected and used.

Clear Secure must continuously build trust and clearly communicate its data security practices to alleviate concerns among potential users, influencing their willingness to subscribe. Demonstrating robust data protection measures is paramount. In 2025, ongoing consumer surveys consistently show that data security is a top priority for individuals when considering services that handle personal information, often outweighing immediate convenience benefits.

Post-pandemic travel trends show a significant shift, with a notable increase in domestic tourism. For instance, in 2023, the U.S. saw domestic leisure travel spending reach an estimated $1.1 trillion, a figure that continues to grow, indicating a strong preference for local exploration. This trend directly impacts Clear Secure by potentially increasing demand for services catering to domestic travelers, such as secure luggage storage or expedited entry at various local attractions, not just airports.

Business travel is also undergoing a transformation. While some companies are mandating a return to in-person meetings, many have embraced hybrid models, leading to a reduction in overall business travel frequency. A 2024 survey indicated that 60% of businesses expect business travel to remain below pre-pandemic levels for the foreseeable future. This necessitates Clear Secure to adapt its service offerings, perhaps by developing more flexible subscription models or focusing on solutions that support remote workers and their travel needs.

Furthermore, travelers are increasingly prioritizing seamless and contactless experiences. A 2025 travel industry report highlighted that 75% of travelers consider ease of experience a top factor when choosing travel services. Clear Secure can leverage this by further investing in user-friendly mobile applications for booking and managing services, and by ensuring their physical touchpoints, like secure lockers or check-in kiosks, are efficient and minimize physical interaction, thereby enhancing customer satisfaction and loyalty.

Societal comfort with biometrics is growing, with a 2024 survey indicating 65% of consumers are willing to use facial recognition for faster checkouts. This broader acceptance is crucial for Clear Secure's expansion beyond airports into retail and entertainment venues.

Building and maintaining public trust in the security and accuracy of biometric data is paramount. Concerns about data breaches and potential misuse could hinder widespread adoption, impacting Clear's long-term growth strategy.

Demand for Convenience and Efficiency

Societal trends increasingly prioritize convenience and efficiency, directly impacting services like expedited airport security. Clear Secure's value proposition is built on meeting this demand, particularly for travelers facing time constraints. In 2024, the average wait time at TSA checkpoints across major US airports often exceeded 30 minutes during peak hours, underscoring the appeal of services that significantly reduce this burden.

The perceived time savings and stress reduction associated with Clear Secure's expedited screening process are key drivers of its subscription growth. As of early 2025, Clear Secure reported a membership base exceeding 20 million individuals, demonstrating a substantial market segment willing to pay for enhanced travel convenience.

- Growing Demand for Time Savings: Consumers are increasingly willing to pay for services that save them time, especially in high-stress environments like airports.

- Impact on Subscription Models: The convenience factor directly influences Clear Secure's ability to attract and retain members, contributing to its revenue growth.

- Competitive Landscape: While Clear Secure offers a premium service, the underlying societal demand for efficiency also fuels competition from other expedited screening programs.

Demographic Shifts in Air Travelers

The composition of air travelers is evolving, impacting how companies like Clear Secure approach their services. For instance, a growing segment of younger, digitally native travelers are increasingly comfortable with and expect seamless, technology-driven experiences, including biometric identification. This demographic shift suggests an opportunity for Clear Secure to further integrate and promote its advanced identity solutions.

Conversely, an aging traveler population may require more targeted communication and robust assurances about the privacy and security of their personal data. As of late 2024, the average age of frequent flyers continues to be a significant factor, with a notable portion of travelers over 55. Clear Secure must therefore balance innovation with clear, accessible information to cater to all age groups.

- Age Demographics: Travelers aged 18-34 are showing a higher propensity to adopt new technologies, with over 60% expressing interest in biometric boarding by 2025.

- Tech Adoption: Increased smartphone penetration and digital wallet usage among all age groups, including older demographics, presents opportunities for mobile-first identity verification.

- Income Influence: While not a direct demographic factor, income levels often correlate with travel frequency and willingness to pay for expedited security services, influencing Clear Secure's pricing and service tier strategies.

Societal comfort with biometric technology is a cornerstone for Clear Secure's growth, with a 2024 survey showing 65% of consumers open to facial recognition for faster checkouts. This acceptance extends beyond airports, opening doors in retail and entertainment. However, maintaining public trust in data security and accuracy remains paramount, as breaches could significantly impact adoption and Clear's strategic expansion.

The increasing demand for time-saving solutions, particularly in stressful environments like airports, directly fuels Clear Secure's subscription model. With average TSA wait times often exceeding 30 minutes in 2024, the value proposition of expedited screening is clear. As of early 2025, Clear Secure's membership base surpassed 20 million, reflecting a strong market appetite for convenience.

Traveler demographics are shifting, with younger, digitally savvy individuals expecting seamless, tech-driven experiences, including biometrics. Conversely, older travelers may require more accessible information regarding data privacy. Clear Secure must balance innovation with clear communication to cater to all age groups, considering that travelers aged 18-34 show over 60% interest in biometric boarding by 2025.

| Societal Factor | Impact on Clear Secure | Supporting Data (2024-2025) |

|---|---|---|

| Biometric Acceptance | Increased adoption in airports and potential for expansion into other sectors. | 65% consumer willingness for facial recognition checkout (2024 survey). |

| Demand for Convenience | Drives subscription growth and justifies premium pricing for time savings. | Average TSA wait times exceeding 30 mins (2024); 20M+ Clear Secure members (early 2025). |

| Demographic Shifts | Opportunity to leverage tech-savvy youth; need for clear communication with older travelers. | 60%+ interest in biometric boarding among 18-34 year olds by 2025. |

Technological factors

Continuous innovation in biometric modalities such as facial recognition, iris scans, and fingerprinting directly impacts Clear Secure's core identity verification and security services. Improvements in accuracy, speed, and cost-effectiveness of these technologies can significantly enhance their service offerings.

For instance, advancements in AI-powered facial recognition are making it more robust against spoofing attempts, a crucial factor for secure airport security. The global biometric market was valued at approximately $36.6 billion in 2023 and is projected to reach $131.8 billion by 2030, indicating substantial growth and investment in these technologies, which Clear Secure can leverage.

Clear Secure, as a custodian of highly sensitive biometric data, operates in an environment rife with escalating cybersecurity threats. The company's technological infrastructure must be fortified against constant attempts at data breaches and unauthorized access, making robust defenses paramount. For instance, in 2023, the global average cost of a data breach reached $4.45 million, highlighting the significant financial and reputational risks involved.

Maintaining member trust hinges on Clear Secure's ability to implement and continuously update advanced technological defenses, including encryption, multi-factor authentication, and intrusion detection systems. The company’s investment in cybersecurity is not merely a compliance issue but a core business imperative, directly impacting its ability to operate and grow. A single significant breach could lead to substantial financial penalties, loss of customer confidence, and severe operational disruptions, potentially costing millions in remediation and lost revenue.

Clear Secure's ability to integrate with existing airport infrastructure, such as passenger processing systems and security checkpoints, is paramount for widespread adoption. This technological compatibility allows for a smoother rollout and reduces the burden on airports to overhaul their current systems. For instance, in 2024, many airports are investing in upgrading their legacy IT systems, making solutions that can interface with these evolving platforms more attractive.

Scalability and Processing Power

Clear Secure's technological backbone requires robust scalability. This is crucial for managing the surge in users and transactions, particularly during busy travel periods. For instance, in 2023, Clear processed millions of identity verifications, a figure expected to grow significantly as they expand their airport and venue presence.

The processing power and network infrastructure are paramount. They directly influence the speed and dependability of Clear's identity verification services, which is a key driver of customer satisfaction. In late 2024, Clear announced upgrades to their biometric scanning technology, aiming to reduce verification times by an average of 15%.

- Scalability: Ability to handle millions of daily verifications, especially during peak travel seasons.

- Processing Power: Ensures rapid and reliable identity checks, enhancing user experience.

- Network Capabilities: Underpins the speed and uptime of the entire service.

- Technological Investment: Ongoing upgrades in 2024 aim to improve efficiency and capacity.

Emerging Technologies (AI, IoT) for Security

The integration of Artificial Intelligence (AI) and the Internet of Things (IoT) offers significant avenues for Clear Secure to bolster its security offerings. AI can dramatically improve threat detection accuracy and speed, while IoT enables more comprehensive, interconnected security systems.

Clear Secure can leverage AI for advanced fraud prevention, analyzing vast datasets to identify suspicious patterns in real-time. This not only protects the company but also enhances the customer experience by reducing friction for legitimate users. For instance, AI-powered biometric authentication can streamline identity verification processes, making them both more secure and user-friendly.

The adoption of IoT devices allows for the creation of a more robust and responsive security ecosystem. Connected sensors and cameras, managed through a unified platform, can provide a holistic view of security operations, enabling faster response times to incidents. This technological evolution is crucial in an era where sophisticated security threats are constantly emerging.

The market for AI in cybersecurity is projected for substantial growth. Estimates suggest the global AI in cybersecurity market could reach over $30 billion by 2025, highlighting the immense potential for companies like Clear Secure to capitalize on these advancements.

- AI-driven threat detection: Enhances accuracy and reduces false positives in identifying security breaches.

- IoT for connected security: Enables integrated, real-time monitoring and response across physical and digital assets.

- Personalized security experiences: Utilizes AI to tailor security measures and customer interactions.

- Fraud prevention: Leverages machine learning to detect and mitigate fraudulent activities more effectively.

Clear Secure's technological foundation is built on advanced biometric recognition systems, with ongoing innovation in areas like facial and fingerprint scanning directly impacting service quality and security. The global biometric market's projected growth, expected to reach $131.8 billion by 2030 from $36.6 billion in 2023, underscores the critical importance of these technologies for Clear Secure's expansion and competitiveness.

Legal factors

Clear Secure's operations are intrinsically tied to compliance with TSA and DHS regulations. These agencies dictate the security standards and operational protocols for identity verification systems used in airports, making adherence a legal imperative for Clear Secure's continued presence in these critical environments.

Failure to meet these evolving directives, which include requirements for biometric data handling and system approvals, could result in significant penalties or operational disruptions. For instance, the TSA's Security Directives are updated regularly, requiring companies like Clear Secure to invest in ongoing system validation and potential upgrades to maintain their certification and operational licenses.

Clear Secure's handling of sensitive biometric data places it squarely under the purview of evolving data privacy regulations. The California Consumer Privacy Act (CCPA), and its successor the California Privacy Rights Act (CPRA), impose strict requirements on how companies collect, use, and share personal information, including biometric data. Failure to comply can result in substantial penalties; for instance, CCPA violations can lead to fines of up to $7,500 per intentional violation.

Should Clear Secure expand its operations internationally, adherence to the General Data Protection Regulation (GDPR) becomes paramount. GDPR mandates robust data protection measures and grants individuals significant rights over their personal data. Non-compliance with GDPR can result in fines up to €20 million or 4% of global annual revenue, whichever is higher, as seen with various companies facing penalties in 2023 and 2024 for data breaches and privacy violations.

Clear Secure's marketing, pricing, and subscription models must comply with consumer protection regulations, such as the FTC Act in the U.S., which prohibit deceptive or unfair practices. These laws ensure that customers receive clear and accurate information about services and pricing, preventing misleading advertising. For instance, in 2023, the FTC reported over 2.1 million consumer complaints, highlighting the ongoing importance of adherence to these standards.

Anti-trust laws, like the Sherman Act and Clayton Act, could impact Clear Secure if its market share in expedited airport security screening grows substantially. Should Clear Secure achieve a dominant position, regulators might scrutinize its practices to prevent monopolistic behavior or unfair competition that could harm consumers or smaller competitors. For example, the U.S. Department of Justice actively pursues anti-trust cases to maintain market fairness.

Intellectual Property Rights and Patent Protection

Clear Secure's competitive edge hinges on safeguarding its proprietary biometric technology and identity verification methods through robust intellectual property rights, including patents. This legal shield is paramount for maintaining its market position and preventing competitors from replicating its innovations. For instance, as of early 2024, the company actively manages a portfolio of patents related to its unique scanning and verification processes.

The company faces potential risks from legal disputes concerning patent infringement or the misappropriation of trade secrets. Such litigation could disrupt operations, incur significant legal costs, and potentially weaken its market standing. For example, a hypothetical infringement claim could tie up resources that would otherwise be allocated to product development or expansion.

- Patent Portfolio Strength: Clear Secure's ability to secure and defend its patents directly impacts its long-term market exclusivity.

- Litigation Risk: The threat of lawsuits over intellectual property can be a significant financial and operational burden.

- Trade Secret Protection: Safeguarding confidential operational knowledge is as critical as patent protection for maintaining a competitive advantage.

Contractual Agreements with Airports and Venues

Clear Secure's business relies heavily on legally binding contracts with airports and venues like stadiums. These agreements are crucial as they outline the scope of services, how revenue is shared, who is responsible for what operations, and how liability is managed.

Any disagreement or failure to uphold these contracts can lead to serious legal battles and financial losses. For instance, in 2024, the transportation security industry saw a rise in contract disputes, with some companies facing significant penalties for non-compliance with service level agreements.

These contractual frameworks are essential for Clear Secure's operational stability and financial health.

- Contractual Basis: Clear Secure's operations are fundamentally governed by contracts with airports and entertainment venues.

- Key Contractual Terms: These agreements detail service provisions, revenue splits, operational duties, and liability clauses.

- Risk of Disputes: Breaches or disagreements within these contracts pose substantial legal and financial risks.

- Industry Trend: Contractual compliance and dispute resolution are critical focus areas in the security services sector as of 2024.

Clear Secure's operations are subject to a complex web of legal and regulatory frameworks, impacting everything from data handling to market conduct. Compliance with Transportation Security Administration (TSA) and Department of Homeland Security (DHS) regulations is non-negotiable, dictating security standards for airport identity verification systems. Failure to adhere to evolving directives, such as those concerning biometric data, can trigger penalties and operational halts, as seen with regular TSA Security Directive updates requiring ongoing system validation.

The company's handling of sensitive biometric data falls under stringent data privacy laws like the California Consumer Privacy Act (CCPA) and its successor, the California Privacy Rights Act (CPRA). Violations can lead to significant fines; for instance, CCPA violations can incur penalties of up to $7,500 per intentional infraction. Internationally, compliance with the General Data Protection Regulation (GDPR) is critical, with potential fines reaching €20 million or 4% of global annual revenue for non-compliance, a reality faced by numerous companies in 2023 and 2024.

Consumer protection laws, such as the FTC Act, govern Clear Secure's marketing and pricing, prohibiting deceptive practices and ensuring transparency. The FTC's ongoing efforts, highlighted by over 2.1 million consumer complaints in 2023, underscore the importance of adhering to these standards. Furthermore, anti-trust laws may scrutinize Clear Secure if its market dominance grows, aiming to prevent monopolistic behavior, a principle actively upheld by the U.S. Department of Justice.

Clear Secure's competitive edge is protected by its intellectual property, primarily patents covering its unique biometric technology. As of early 2024, the company actively manages a portfolio of patents. However, the risk of litigation over patent infringement or trade secret misappropriation remains, potentially leading to significant legal costs and operational disruptions.

| Regulatory Area | Key Legislation/Body | Potential Impact/Fine | 2023/2024 Relevance |

| Airport Security & Operations | TSA, DHS | Operational disruption, loss of certification | Ongoing updates to Security Directives |

| Data Privacy (US) | CCPA, CPRA | Up to $7,500 per intentional violation | Increasing enforcement and consumer awareness |

| Data Privacy (International) | GDPR | Up to €20 million or 4% global annual revenue | Continued high-profile enforcement actions |

| Consumer Protection | FTC Act | Fines for deceptive practices | 2.1 million+ consumer complaints in 2023 |

| Competition Law | Sherman Act, Clayton Act | Scrutiny of market dominance, potential penalties | Active DOJ anti-trust enforcement |

| Intellectual Property | Patent Law | Litigation costs, potential injunctions | Active patent portfolio management |

Environmental factors

The air travel industry, a sector intrinsically linked to Clear Secure's operations, is under growing scrutiny for its environmental impact. While Clear Secure itself doesn't directly emit significant carbon, the broader aviation sector's carbon footprint is a significant concern. For instance, in 2023, aviation accounted for approximately 2.5% of global CO2 emissions, a figure that continues to be a focus for regulators and the public.

These environmental pressures on aviation could translate into indirect impacts on Clear Secure. Increased focus on sustainability might lead to shifts in travel patterns, potentially affecting passenger volumes at airports. Furthermore, evolving environmental policies aimed at reducing aviation's carbon footprint could influence airport infrastructure development and operational efficiency, indirectly shaping the environment in which Clear Secure operates.

Airports are intensifying their commitment to sustainability, focusing on areas like energy efficiency and waste reduction. For example, in 2023, the Airports Council International (ACI) reported that 30% of airports globally have set net-zero carbon targets, with many investing in renewable energy sources and electric ground support equipment.

Clear Secure's technology, particularly its biometric screening systems, must consider these evolving environmental standards. This could mean adapting hardware to meet energy efficiency benchmarks or ensuring operational processes minimize environmental impact, potentially affecting the lifecycle costs and procurement strategies for their equipment within airport infrastructure.

Clear Secure's core technology, biometric identity verification, inherently reduces reliance on physical documents such as boarding passes and identification cards, directly contributing to a more paperless operational environment. This shift away from paper aligns with growing global sustainability initiatives.

By highlighting this environmental advantage, Clear Secure can effectively bolster its corporate social responsibility profile. This focus on reducing paper waste resonates strongly with environmentally aware consumers and aligns with the increasing demand for sustainable business practices across various industries.

Impact of Climate Change on Travel Infrastructure

Extreme weather events, increasingly frequent due to climate change, pose a significant threat to travel infrastructure. These disruptions, such as storms grounding flights or heatwaves impacting rail lines, can directly affect Clear Secure's operational efficiency and revenue streams by reducing passenger volume and creating logistical challenges. For instance, the summer of 2023 saw numerous flight cancellations across Europe due to heatwaves and thunderstorms, impacting millions of travelers.

The need for resilience planning within the travel sector is becoming paramount. Airports, airlines, and other transportation hubs are investing in infrastructure upgrades and operational adjustments to better withstand climate-related impacts. This includes measures like enhanced drainage systems, reinforced runways, and improved weather forecasting integration. The International Air Transport Association (IATA) has highlighted the growing financial burden of weather-related disruptions on airlines, estimating billions in losses annually.

Clear Secure, as a provider of security solutions within this ecosystem, must consider how these environmental shifts influence demand for its services. Increased travel volatility might necessitate more agile deployment of security personnel and technology. The focus is shifting towards proactive risk management and adaptive strategies to maintain seamless operations amidst unpredictable environmental conditions. The global aviation industry, for example, is exploring technologies to mitigate the impact of severe weather on flight schedules and passenger experience.

- Increased Flight Cancellations: In 2023, weather was a primary cause for over 10,000 flight cancellations in the US alone, impacting passenger flow and security screening demands.

- Infrastructure Resilience Investments: Major airports are allocating significant capital towards climate-proofing, with projects often running into hundreds of millions of dollars.

- Operational Adaptability: Security providers like Clear Secure need to develop flexible staffing models and deployable technology to respond to fluctuating passenger numbers caused by weather events.

- Growing Financial Impact: The economic cost of climate-related travel disruptions is estimated to be in the tens of billions globally each year, affecting all stakeholders in the travel industry.

Waste Management and Equipment Disposal

Clear Secure's operations, from manufacturing biometric kiosks to their eventual decommissioning, generate electronic waste. The company's commitment to sustainability hinges on managing this e-waste responsibly, a growing concern for investors and regulators alike. For instance, the global e-waste volume reached an estimated 53.6 million metric tons in 2019, and projections suggest it could hit 74 million metric tons by 2030, highlighting the scale of this environmental challenge.

The environmental impact of Clear Secure's physical infrastructure, including the lifecycle of their hardware, is under increasing scrutiny. Companies are expected to detail their waste reduction strategies and their approach to equipment disposal in sustainability reports. This includes exploring options like refurbishment, recycling, and responsible disposal of components containing hazardous materials.

- E-waste generation: Biometric kiosks and associated hardware create electronic waste throughout their lifecycle.

- Sustainability reporting: Responsible waste management is crucial for Clear Secure's corporate sustainability disclosures.

- Industry trends: Global e-waste is a significant environmental issue, with volumes projected to rise substantially.

- Disposal strategies: Options like recycling, refurbishment, and safe disposal of hazardous components are key considerations.

Environmental factors increasingly shape the travel industry, impacting Clear Secure's operational landscape. The growing focus on aviation's carbon footprint, which was around 2.5% of global CO2 emissions in 2023, necessitates adaptation. Airports are actively pursuing sustainability, with 30% aiming for net-zero targets by 2023, investing in renewables and electric equipment.

Climate change introduces volatility through extreme weather events, leading to widespread flight cancellations and disruptions. For example, summer 2023 saw significant weather-related cancellations impacting passenger volumes. This necessitates greater resilience and adaptability in security operations, with the travel sector investing heavily in climate-proofing infrastructure.

Clear Secure's technology offers an environmental advantage by reducing paper usage, aligning with sustainability goals. However, the company must also manage its own e-waste, a growing global concern with projected increases in volume. Responsible disposal and lifecycle management of hardware are critical for corporate social responsibility and investor confidence.

| Environmental Factor | Impact on Clear Secure | Relevant Data/Trend (2023/2024) |

|---|---|---|

| Aviation Emissions | Indirect pressure for efficiency and sustainability in airport operations. | Aviation accounted for ~2.5% of global CO2 emissions in 2023. |

| Airport Sustainability Initiatives | Need for Clear Secure's technology to align with energy efficiency and waste reduction goals. | 30% of airports had net-zero targets by 2023; investment in renewables. |

| Extreme Weather Events | Disruption to travel, affecting passenger flow and demand for security services. | Thousands of flight cancellations in 2023 due to weather, impacting passenger numbers. |

| E-Waste Management | Requirement for responsible disposal and lifecycle management of biometric hardware. | Global e-waste volume projected to reach 74 million metric tons by 2030. |

PESTLE Analysis Data Sources

Our Clear Secure PESTLE analysis is built upon a robust foundation of data from government agencies, international organizations, and reputable market research firms. We meticulously gather information on political stability, economic indicators, technological advancements, environmental regulations, and societal trends.