Clear Secure Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Clear Secure Bundle

Clear Secure navigates intense competition, with significant buyer power from travelers and a moderate threat from new entrants in the identity verification space. Understanding these dynamics is crucial for any stakeholder.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Clear Secure’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Clear Secure's reliance on a small group of specialized technology providers for its core biometric and document scanning hardware significantly concentrates bargaining power among these few entities. In 2024, the global identity verification technology market featured roughly seven major specialized providers, and Clear Secure depended on three of them for its primary hardware needs. This limited supplier base grants these providers considerable leverage in dictating pricing and contract terms, given their unique and essential offerings.

Clear Secure's reliance on a limited number of critical hardware manufacturers for its biometric scanning technology significantly influences supplier bargaining power. Companies like Thales Group, Gemalto NV, and Idemia are essential for Clear's operations, meaning any issues with these suppliers directly affect service delivery.

This dependence creates a vulnerability. For instance, supply chain disruptions for advanced technological components resulted in a notable 17.3% increase in component costs during 2023, highlighting the direct financial impact of supplier leverage on Clear Secure.

The bargaining power of suppliers presents a significant concern for Clear Secure, particularly regarding advanced technological components. A concentrated market for specialized microprocessors, with only four primary global suppliers, and for advanced sensors, with six key providers, creates a substantial risk.

This limited supplier base means Clear Secure has less leverage to negotiate favorable pricing or terms. Any disruptions from these few critical suppliers, whether due to production issues, geopolitical events, or increased demand elsewhere, could directly impact Clear Secure's operations and expansion plans.

For instance, if a key microprocessor supplier faces a production bottleneck in 2024, it could delay the rollout of new Clear Secure access points or impact the availability of essential hardware for existing infrastructure, potentially increasing costs due to scarcity.

High Switching Costs for Core Technologies

Clear Secure's reliance on specialized biometric and identity verification technologies significantly raises the stakes for switching providers. Implementing new core systems often entails substantial expenses related to integration, extensive employee retraining, and the potential for considerable operational disruptions.

- High Integration Costs: Integrating new biometric hardware and software into existing security infrastructure can be complex and costly, potentially running into millions of dollars for large-scale deployments.

- Training and Operational Downtime: Re-training thousands of employees on new systems and managing potential downtime during the transition period adds further expense and reduces operational efficiency.

- Proprietary Technology Lock-in: The proprietary nature of some of Clear Secure's current technology solutions creates a de facto lock-in, making it difficult and expensive to find comparable alternatives.

- Supplier Leverage: These high switching costs inherently empower Clear Secure's current technology suppliers, as the company faces significant penalties for seeking alternative solutions.

Supplier's Potential for Forward Integration

While not a primary concern for Clear Secure, some technology providers within the broader identity verification space might possess the capability to integrate forward. This could involve them expanding their offerings to directly compete with Clear Secure's comprehensive services. For instance, a company specializing in biometric data capture could potentially develop its own end-to-end identity verification platform.

This latent threat, even if not currently active, can subtly influence supplier negotiations. It encourages suppliers to maintain competitive pricing and favorable terms to avoid pushing Clear Secure towards developing in-house solutions or seeking alternative, more integrated partners. The potential for forward integration acts as a background check on supplier leverage.

- Potential for Forward Integration: Technology suppliers in the identity verification ecosystem could integrate forward to offer competing comprehensive services.

- Competitive Pricing Influence: This threat encourages suppliers to maintain competitive pricing to prevent Clear Secure from developing in-house capabilities.

- Strategic Consideration: Clear Secure must monitor this potential to manage supplier relationships effectively and ensure favorable terms.

Clear Secure's dependence on a concentrated supplier base for critical biometric hardware, such as specialized sensors and microprocessors, grants these suppliers significant bargaining power. This is amplified by high switching costs, including complex integration and retraining needs, which can run into millions of dollars for large deployments. The limited number of providers for essential components, with only a handful of global specialists, means Clear Secure has less leverage to negotiate favorable terms, making supply chain disruptions a notable risk. For example, in 2023, component cost increases reached 17.3%, illustrating the direct financial impact of supplier leverage.

| Supplier Category | Number of Key Providers (Global) | Impact on Clear Secure | Example Cost Impact (2023) |

|---|---|---|---|

| Specialized Microprocessors | 4 | High dependence, limited negotiation leverage | N/A (Specific data not publicly available for this component) |

| Advanced Biometric Sensors | 6 | Concentrated power, potential for price increases | N/A (Specific data not publicly available for this component) |

| Core Identity Verification Software Modules | 7 (Major Specialized Providers) | Essential for operations, dictates terms | N/A (Specific data not publicly available for this component) |

What is included in the product

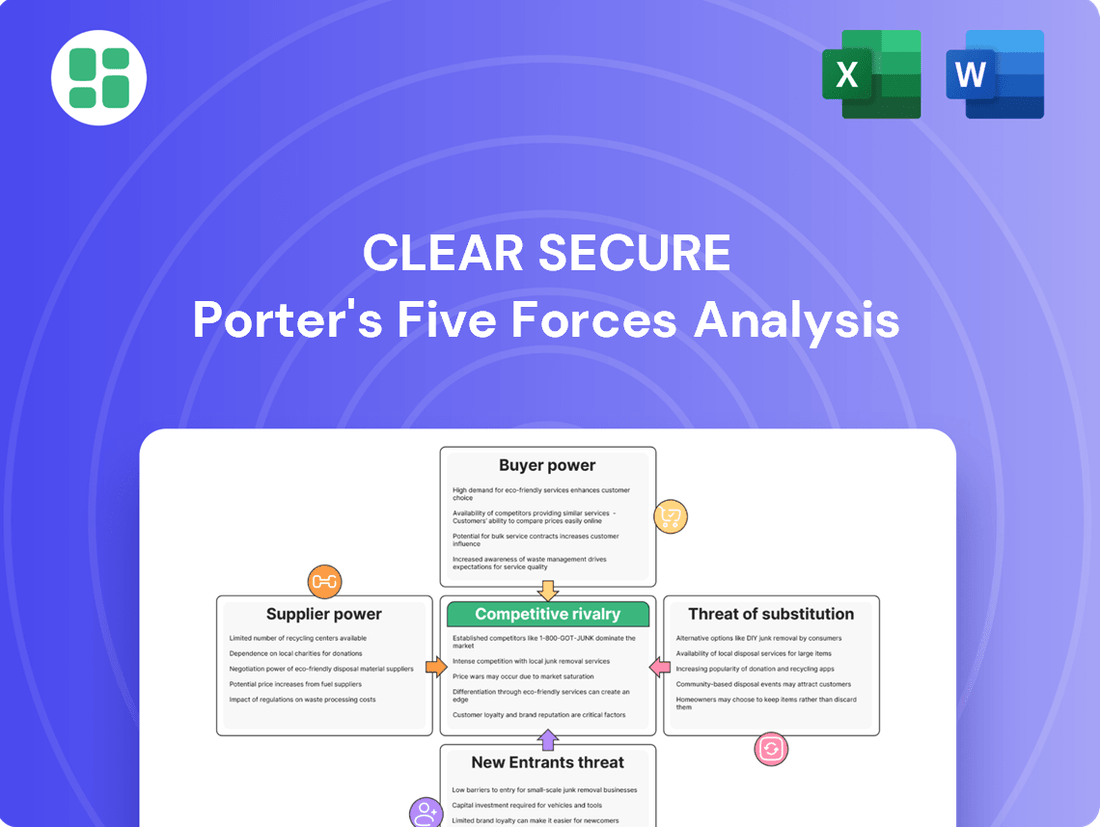

This analysis dissects the competitive landscape for Clear Secure by examining the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry among existing competitors.

Instantly identify and address competitive threats with a visual breakdown of each Porter's Five Forces, making strategic planning effortless.

Customers Bargaining Power

Clear Secure's subscription model, centered on CLEAR Plus, relies heavily on retaining its members. As of Q2 2025, the company reported 7.6 million CLEAR Plus members. The annual Net Member Retention rate stood at a solid 81.4% by the end of 2024, demonstrating a degree of customer loyalty.

However, the annual membership fee, approximately $189, means customers are constantly evaluating the value proposition. If competitors offer comparable or superior expedited security solutions at a lower price point, or if the perceived benefits of CLEAR Plus diminish, customers possess significant bargaining power to switch.

Customers, especially individual travelers, are quite sensitive to price. When CLEAR Plus, which costs $189 annually, is compared to TSA PreCheck, costing $78 for five years, the difference is stark. This makes price a critical factor for many.

The core value of CLEAR Plus for many users is the ability to skip lines, not necessarily a perceived increase in security. This focus on convenience means that the annual fee must be justified by the time saved, making price a significant driver of demand.

Clear Secure's customer base includes significant enterprise clients, with 66 of these customers having annual contract values over $100,000 as of Q4 2023. This concentration of large accounts, where the top 10 enterprise clients accounted for 42% of total annual recurring revenue, grants these major customers considerable bargaining power. The potential loss of even a single large client could have a material impact on Clear Secure's revenue, strengthening the leverage these customers hold in negotiations.

Availability of Alternatives and Federal Programs

Customers possess significant bargaining power due to the availability of alternatives to CLEAR Secure's expedited airport security. Federal programs such as TSA PreCheck offer a comparable, albeit different, expedited screening experience. In 2024, TSA PreCheck enrollment continued to grow, with millions of travelers opting for this government-provided service, directly competing with CLEAR's value proposition.

The existence of these alternatives, including the option to simply use standard, non-expedited security lines, limits CLEAR Secure's ability to unilaterally set prices or dictate terms of service. While CLEAR provides a unique biometric identification system, the fundamental need for expedited security can be met through other channels.

- TSA PreCheck Enrollment: Millions of travelers opted for TSA PreCheck in 2024, providing a direct alternative for expedited security.

- Government Programs: Federal programs offer comparable expedited screening, reducing reliance on private services.

- Customer Choice: The availability of multiple options empowers customers to choose the most cost-effective or convenient security solution.

- Price Sensitivity: Competition from alternatives can make CLEAR Secure more sensitive to pricing strategies, as customers can switch if prices become too high.

Low Switching Costs for Individual Members

For individual members, the direct cost of switching away from CLEAR Plus is quite low. They can easily cancel their subscription and opt for other expedited security programs like TSA PreCheck or simply use the standard airport security lines.

This low barrier to exit significantly enhances the bargaining power of these individual customers. If they feel the value proposition of CLEAR diminishes, or if more attractive alternatives become available, they can readily switch their allegiance.

- Low Monetary Cost: Cancelling a CLEAR Plus subscription typically involves no significant financial penalty.

- Ease of Transition: Moving to TSA PreCheck or standard lines requires minimal effort.

- Availability of Alternatives: The existence of TSA PreCheck and standard security lanes provides readily accessible substitutes.

The bargaining power of CLEAR Secure's customers is considerable, driven by the availability of alternatives and price sensitivity. For instance, while CLEAR Plus membership costs around $189 annually, TSA PreCheck, a government-backed alternative, costs $78 for a five-year enrollment, making it a significantly more budget-friendly option for many travelers in 2024.

| Factor | CLEAR Secure | Alternatives (e.g., TSA PreCheck) |

|---|---|---|

| Annual Cost (approx.) | $189 | $15.60 (equivalent annual cost for 5-year enrollment) |

| Value Proposition | Biometric identification, faster screening | Expedited security screening |

| Customer Switching Cost | Low | Low |

Full Version Awaits

Clear Secure Porter's Five Forces Analysis

This preview showcases the complete Porter's Five Forces analysis for Clear Secure, offering a detailed examination of the competitive landscape. The document you see here is precisely the same professionally formatted and ready-to-use analysis you will receive immediately after purchase. You can be confident that no placeholders or sample content are present; this is your actual deliverable, providing immediate value for your strategic planning.

Rivalry Among Competitors

The broader identity verification market, which Clear Secure is increasingly participating in beyond its airport roots, is notably fragmented. This means there are many companies, each offering different ways to verify who someone is, whether it's through fingerprints, checking documents, or spotting fake identities.

This wide array of competitors vying for attention across various specialized areas within identity verification signals a highly competitive landscape. For instance, in the biometric authentication space alone, numerous firms are developing advanced solutions.

The overall identity verification market is projected for substantial growth, with forecasts indicating it could reach $47.1 billion by 2028. Such a promising growth trajectory naturally draws in a multitude of new entrants and existing players, further intensifying the competitive rivalry.

In the expedited security space, Clear Secure’s primary rival isn't another company offering a direct line-cutting biometric service, but rather the federal government's TSA PreCheck program. While Clear uses biometrics for identity verification and access, TSA PreCheck offers expedited screening through known traveler status, with millions enrolled. As of early 2024, TSA PreCheck had over 15 million members, a substantial user base that represents a significant alternative for travelers seeking faster airport security.

Companies like IDEMIA operate within the broader airport security landscape, providing crucial services such as background checks for TSA PreCheck and manufacturing the ID-scanning machines used at airports. While they don't offer a direct competitor to Clear's membership-based expedited access, their role in the identity verification and security infrastructure makes them influential players in the overall ecosystem. IDEMIA is a global leader in identity solutions, processing billions of transactions annually.

The identity verification and airport security sectors are buzzing with innovation, driven by technologies like AI, machine learning, and advanced biometrics. This means companies like Clear Secure are constantly pushing the envelope. For instance, Clear Secure’s introduction of a reusable KYC solution and its strategic expansion into the healthcare sector highlight this commitment to staying ahead.

This relentless pursuit of new technologies fuels intense competition. Firms are pouring significant resources into research and development to maintain their edge. The need to constantly innovate means the rivalry among players in this space is particularly fierce, as each seeks to offer superior, more efficient, and secure solutions.

High Market Growth Attracts New Players

The airport security market is booming, with projections indicating it will reach $29.88 billion by 2032. This substantial growth, coupled with the identity verification market’s anticipated 13.1% compound annual growth rate from 2025 to 2035, signals a highly attractive landscape for businesses.

This rapid expansion naturally invites new entrants, intensifying competition. Established companies are likely to invest more in innovation and capacity to maintain their market share, while emerging players will seek to capture a piece of this expanding pie.

- Airport Security Market Growth: Expected to reach $29.88 billion by 2032.

- Identity Verification Market Growth: Projected CAGR of 13.1% from 2025 to 2035.

- Industry Attractiveness: High growth rates draw new competitors.

- Competitive Landscape: Intensified rivalry due to market expansion and new entrants.

Strategic Partnerships and Network Effects

Clear Secure's robust network of alliances with airlines, airports, and various venues, including recent expansions into healthcare and financial services, significantly bolsters its competitive standing. This interconnectedness fosters powerful network effects, where the platform's utility escalates with each new partner and member acquisition, creating a self-reinforcing growth cycle.

These strategic collaborations are crucial for enhancing user experience and operational efficiency. For instance, by integrating with more airlines, Clear Secure can streamline the travel process for its members, offering seamless identity verification across multiple touchpoints.

- Network Effect Value: As of early 2024, Clear Secure reported over 15 million members, a testament to the growing value derived from its expanding network.

- Partnership Growth: The company has consistently added new partners, aiming to embed its identity verification technology into a wider array of consumer interactions.

- Competitive Response: While Clear Secure leverages its network, rivals are also actively forging strategic partnerships, intensifying competition for market access and integration opportunities within the broader identity verification landscape.

Clear Secure faces intense rivalry, particularly from TSA PreCheck, which boasts over 15 million members as of early 2024, offering a similar expedited airport security experience. The broader identity verification market, projected to hit $47.1 billion by 2028, is highly fragmented with numerous specialized competitors.

Companies like IDEMIA, a global leader processing billions of transactions annually, play a significant role in the airport security ecosystem, even without directly competing for Clear’s membership model. The market's rapid growth, with the airport security sector expected to reach $29.88 billion by 2032, attracts constant innovation and new entrants, intensifying competition.

| Rival | Key Offering | Membership/Reach (as of early 2024) | Market Segment |

| TSA PreCheck | Expedited airport screening | Over 15 million members | Airport Security |

| IDEMIA | Identity solutions, background checks, ID scanning tech | Billions of transactions annually (global) | Identity Verification, Airport Security Infrastructure |

| Various Identity Verification Firms | Biometric authentication, document verification, fraud detection | Fragmented market, diverse reach | Broad Identity Verification |

SSubstitutes Threaten

The most direct substitute for Clear Secure's expedited airport security service is the traditional airport security line, including the TSA PreCheck line when not paired with Clear. Passengers can opt for these standard channels, which are typically free or less costly, such as TSA PreCheck. In 2024, the value proposition of Clear Plus membership hinges on whether the perceived time savings adequately justify its subscription fee.

The expansion of federal security programs like TSA PreCheck presents a significant threat of substitution for Clear Secure. If these government-backed initiatives improve their efficiency and speed, especially through wider adoption of biometric technology at checkpoints, they could directly compete with Clear's core offering. For instance, a substantial increase in TSA PreCheck enrollment, which reached over 17 million members by late 2023, could dilute the perceived advantage of Clear's expedited lanes.

Beyond airport security, the broader identity verification market presents a significant threat of substitutes for Clear Secure. Numerous alternative biometric and digital identity solutions exist, including those from other biometric providers and emerging decentralized identity models utilizing blockchain technology. For instance, the global digital identity solutions market was valued at approximately $25.5 billion in 2023 and is projected to reach $71.6 billion by 2028, indicating substantial competition and innovation in alternative verification methods.

Manual Identity Verification

Manual identity verification processes remain a significant substitute for Clear Secure's offerings, particularly as the company expands beyond airports into sectors like healthcare and financial services. These established, albeit less efficient, methods are often retained by businesses, especially for lower transaction volumes or when the investment in automated solutions doesn't immediately present a clear cost advantage. For example, many smaller clinics or regional banks might continue with paper-based or less sophisticated digital checks rather than adopting biometric or advanced digital verification systems.

The persistence of manual verification is underscored by the fact that many businesses have deeply integrated these workflows over years, making a switch a considerable undertaking. While Clear Secure offers enhanced speed and security, the inertia of existing systems and the perceived upfront cost of adoption can favor the status quo. This is particularly true in industries where regulatory compliance, rather than pure efficiency, dictates verification protocols, allowing manual checks to remain a viable, if slower, alternative.

- Prevalence of Manual Processes: Many businesses, especially in sectors like healthcare and finance, still rely on manual identity checks, representing a direct substitute.

- Cost-Benefit Analysis: For lower transaction volumes or where automation investment is high, manual methods can be perceived as more economical in the short term.

- Integration Inertia: Existing businesses often have deeply embedded manual verification systems, creating resistance to adopting new technologies.

- Regulatory Considerations: In some regulated industries, manual verification might still meet compliance requirements, reducing the immediate pressure to switch.

Emerging Contactless and Seamless Technologies

The airport security market is seeing a surge in contactless and seamless technologies, directly impacting the threat of substitutes for Clear Secure. Next-generation solutions such as self-service screening, AI-driven security analytics, and blockchain-based identity verification are becoming more prevalent.

As these advanced technologies are integrated by entities like the TSA or airport authorities, they can provide a streamlined passenger experience that may reduce reliance on dedicated services like Clear Secure. For instance, advancements in biometric screening integrated directly into airport gates could bypass the need for a separate membership to expedite passage.

- Self-Service Screening: Automated checkpoints reduce the need for human intervention, potentially offering a faster alternative.

- AI-Powered Analytics: Enhanced threat detection through AI could lead to more efficient overall security processes, diminishing the value proposition of expedited lanes.

- Blockchain Identity Verification: Secure and verifiable digital identities could simplify and speed up passenger processing across various touchpoints.

The threat of substitutes for Clear Secure is significant, stemming from both direct competitors and broader technological advancements. While Clear offers expedited airport security, traditional methods like TSA PreCheck, especially as it improves, pose a direct challenge. The global digital identity market's rapid growth, projected to reach $71.6 billion by 2028, highlights the increasing availability of alternative verification solutions. Furthermore, the continued reliance on manual verification processes in various sectors, due to integration inertia and cost considerations, represents another layer of substitution.

| Substitute Category | Examples | Key Considerations | Market Data/Trends |

|---|---|---|---|

| Traditional Airport Security | TSA PreCheck, Standard Security Lines | Cost, perceived efficiency, government investment | TSA PreCheck membership exceeded 17 million by late 2023. |

| Digital Identity Solutions | Biometric providers, Decentralized Identity (Blockchain) | Innovation, security, privacy, market adoption | Global digital identity market valued at $25.5 billion in 2023, projected to reach $71.6 billion by 2028. |

| Manual Verification Processes | Paper-based checks, less sophisticated digital systems | Integration inertia, cost-benefit for low volumes, regulatory compliance | Persistence in sectors like healthcare and finance due to established workflows. |

Entrants Threaten

Entering the secure identity platform market, particularly with advanced biometric technology, demands a substantial initial outlay for research, development, and robust infrastructure. For instance, Clear Secure's own market entry was estimated to involve initial investment costs between $15 million and $25 million to establish the necessary infrastructure.

Clear Secure's competitive advantage is significantly bolstered by its proprietary technology and a robust patent portfolio, which includes 23 active technology patents as of early 2024. This technological moat acts as a formidable barrier to entry, making it exceptionally challenging for potential new entrants to replicate Clear's advanced biometric identification and security screening solutions without incurring substantial research and development costs or securing licensing agreements.

Clear Secure's extensive network, encompassing over 100 airports, stadiums, and venues, alongside key partnerships with airlines and financial institutions, presents a formidable barrier to new entrants. Building these deep relationships takes considerable time and effort, creating a significant first-mover advantage.

Regulatory Hurdles and Compliance

The identity verification and airport security sectors are heavily regulated, demanding adherence to strict government policies and security standards. For instance, companies seeking to provide biometric screening solutions often need approvals from agencies like the Transportation Security Administration (TSA) in the United States.

Navigating these complex regulatory environments, securing necessary certifications, and complying with data privacy regulations such as GDPR and CCPA represent significant barriers. These compliance requirements translate into substantial upfront costs and can slow down market entry for new players. In 2024, the global identity verification market was valued at approximately $30 billion, with a significant portion of that driven by these regulatory demands.

- Regulatory Compliance Costs: New entrants must invest heavily in meeting TSA, GDPR, CCPA, and other relevant security and privacy standards.

- Certification Processes: Obtaining essential certifications can be time-consuming and expensive, often requiring extensive testing and validation.

- Data Security Mandates: Strict data handling and storage protocols add to operational complexity and cost, deterring potential new competitors.

- Evolving Standards: Keeping pace with constantly updated security protocols and technological requirements necessitates ongoing investment and adaptation.

Brand Recognition and Trust

Clear Secure has cultivated significant brand recognition and trust, particularly for its expedited airport security lanes. Establishing this level of consumer confidence in identity verification and security services is a substantial barrier for newcomers. For instance, in 2023, Clear Secure reported a 27% increase in revenue, reaching $398 million, underscoring the market's positive reception to its established brand.

New entrants face a considerable challenge in replicating Clear Secure's established reputation for security and reliability. The lengthy process of building trust in a sensitive sector requires extensive marketing investment and a consistent history of dependable service. This makes it difficult for new players to quickly attract and retain customers who prioritize proven security solutions.

- Brand Loyalty: Clear Secure's established trust fosters customer loyalty, making it harder for new entrants to poach existing members.

- Marketing Investment: Significant capital is required for new entrants to build comparable brand awareness and trust in the security sector.

- Operational Track Record: A proven history of secure and efficient operations is crucial, which new entrants lack initially.

The threat of new entrants for Clear Secure is moderate, primarily due to high capital requirements for infrastructure and technology development, as well as the need to build a strong brand reputation in a security-sensitive market. While the market is growing, the significant upfront investment and the established network effects create substantial hurdles for new players looking to enter.

| Barrier to Entry | Description | Impact on New Entrants |

|---|---|---|

| Capital Requirements | High initial investment for R&D, infrastructure, and regulatory compliance. | Significant financial barrier, requiring substantial funding. |

| Proprietary Technology & Patents | Clear Secure's 23 active technology patents as of early 2024 protect its unique biometric solutions. | Makes replication difficult and costly, necessitating licensing or innovation. |

| Network Effects & Partnerships | Over 100 airport/venue locations and partnerships with airlines/financial institutions. | Creates a strong first-mover advantage and customer lock-in. |

| Regulatory Hurdles | Strict government policies (e.g., TSA approvals) and data privacy laws (GDPR, CCPA). | Adds complexity, cost, and time to market entry. |

| Brand Reputation & Trust | Established trust in security and reliability, supported by 27% revenue growth in 2023. | Requires significant marketing and a proven track record to match. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Clear Secure is built upon a robust foundation of data, including publicly available financial reports, industry-specific market research, and insights from travel and technology trade publications. This blend ensures a comprehensive understanding of the competitive landscape.