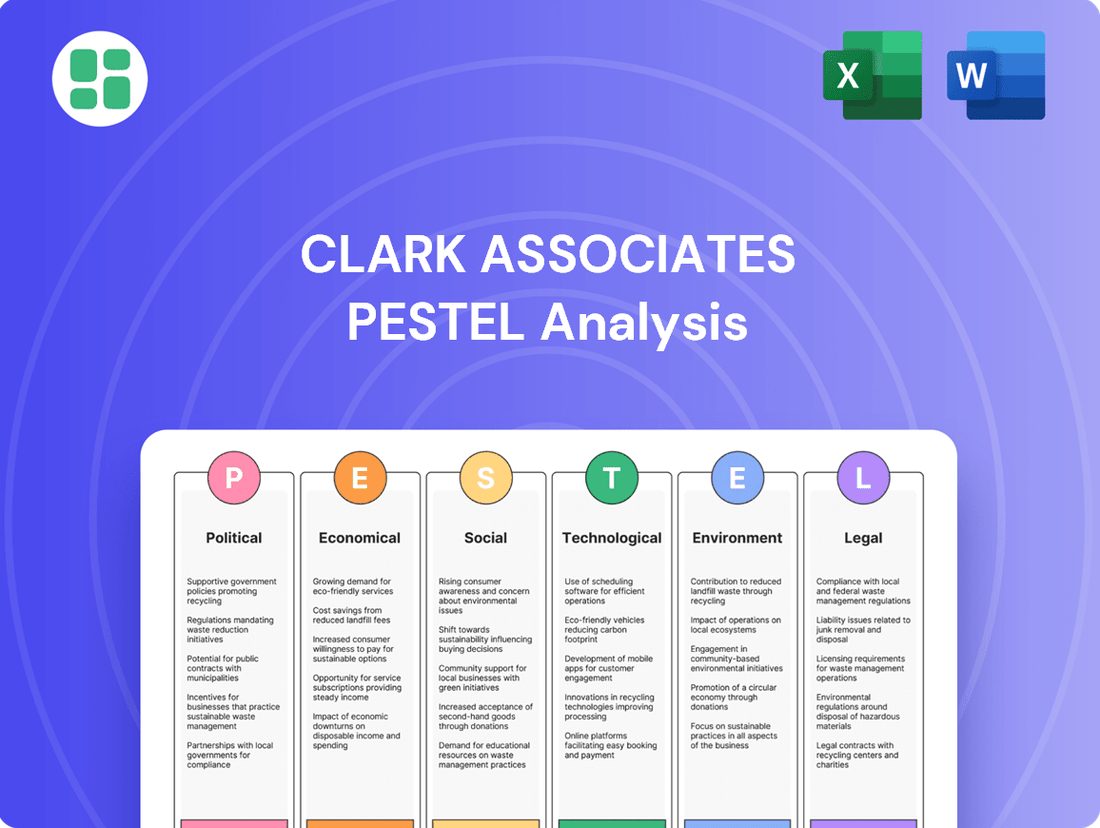

Clark Associates PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Clark Associates Bundle

Uncover the critical external factors shaping Clark Associates's trajectory with our comprehensive PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental forces at play to anticipate challenges and seize opportunities. Download the full version now to gain the strategic clarity needed to navigate this dynamic landscape and make informed decisions.

Political factors

Government spending on public services significantly impacts demand for foodservice equipment. For instance, the U.S. federal budget for fiscal year 2024 allocated substantial funds to education and health, which are key sectors for Clark Associates. An increase in funding for school lunch programs or hospital cafeterias directly translates to greater opportunities for equipment sales.

Fluctuations in state and local government budgets can create volatility in purchasing power. A 5% increase in a state's education budget for 2025, for example, could signal a stronger market for new kitchen installations in schools across that state. Conversely, budget cuts can dampen demand, making it crucial to track legislative appropriations and spending trends.

Clark Associates must closely monitor federal and state procurement policies, as these dictate how public institutions purchase goods. Changes in bidding processes or preferred vendor lists can alter market access. Understanding these policies helps in forecasting demand and adapting sales strategies to align with government fiscal cycles and priorities.

Fluctuations in international trade agreements and the imposition of tariffs on imported raw materials or finished goods can significantly impact Clark Associates' cost of goods sold. For instance, the U.S. imposed tariffs on steel and aluminum in 2018, which affected various manufacturing sectors. Anticipated tariff changes under a new U.S. administration in 2025 could lead to increased operational costs or necessitate adjustments in sourcing strategies for Clark Associates' light manufacturing and distributed products.

Evolving food safety regulations, such as updates to the Food Safety Modernization Act (FSMA) or new FDA rules, directly impact the specifications and compliance requirements for foodservice equipment and supplies. Clark Associates must ensure all manufactured and distributed products meet the latest health and safety standards.

Failure to comply with these regulations can lead to significant penalties, including product recalls and legal repercussions. For instance, the FDA reported over 1,000 food recalls in 2023 alone, highlighting the critical importance of adherence.

Labor Laws and Minimum Wage

Changes in labor laws, particularly minimum wage hikes, directly influence Clark Associates' operational expenses. For instance, a significant increase in the federal minimum wage, which has been a topic of discussion in the US, could raise labor costs across its distribution and manufacturing operations. This also affects the purchasing power and operational budgets of their restaurant and hospitality clients, potentially altering their demand for Clark Associates' products and services.

New regulations concerning worker benefits, such as paid sick leave or enhanced safety standards, could further add to Clark Associates' overhead. For example, if new federal mandates mirror state-level initiatives like those seen in California, requiring more comprehensive paid time off, the company would need to adjust its employee compensation and benefits packages. This also indirectly impacts clients by potentially increasing the cost of doing business in sectors that rely heavily on hourly labor.

- Federal Minimum Wage: As of mid-2024, the federal minimum wage in the United States remains at $7.25 per hour, a rate unchanged since 2009. However, numerous states and cities have implemented higher minimum wages, with some reaching $15 or more per hour.

- Impact on Labor Costs: A hypothetical increase in the federal minimum wage to $15 per hour could significantly boost labor expenses for companies like Clark Associates with large workforces in lower-wage roles.

- Client Spending: Higher labor costs for restaurant and hospitality clients may lead to reduced discretionary spending on equipment and supplies, impacting Clark Associates' sales volumes.

Political Stability and Regulatory Environment

Political stability within the United States is generally high, but shifts in policy direction can impact industries like foodservice equipment. The Biden administration, for instance, has focused on strengthening labor protections and environmental regulations, which could influence manufacturing and operational costs for companies like Clark Associates.

Potential deregulation, a recurring theme in some political discussions, could simplify compliance for businesses, potentially creating new opportunities for growth. However, the specific nature and timing of such changes remain uncertain, necessitating ongoing strategic monitoring.

Clark Associates operates within a framework where federal and state regulations govern various aspects of its business, from product safety standards to employment law. For example, the Occupational Safety and Health Administration (OSHA) sets workplace safety standards that directly affect manufacturing processes.

- Regulatory Landscape: The foodservice industry is subject to evolving regulations concerning food safety, energy efficiency (e.g., ENERGY STAR certifications), and emissions, which can influence product design and market demand.

- Policy Shifts: Discussions around potential tax policy changes or trade agreements can create both risks and opportunities for companies involved in manufacturing and international sales.

- Government Spending: Federal and state budgets, particularly those allocated to infrastructure, education, and healthcare, can indirectly affect consumer and business spending on foodservice equipment.

Government spending on public services, such as education and healthcare, directly influences demand for foodservice equipment, with federal budget allocations for fiscal year 2024 showing significant investment in these sectors. State and local budget fluctuations can create market volatility, as seen with potential increases in state education budgets for 2025 impacting school kitchen upgrades. Clark Associates must navigate federal and state procurement policies, as changes in bidding processes can affect market access and sales strategies.

What is included in the product

This PESTLE analysis examines the external macro-environmental influences impacting Clark Associates, covering Political, Economic, Social, Technological, Environmental, and Legal factors.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, translating complex external factors into actionable insights for Clark Associates.

Economic factors

The broader economic landscape, particularly GDP growth and consumer disposable income, significantly influences the restaurant, hotel, and hospitality industries that Clark Associates serves. A robust economy generally spurs new business establishments and equipment upgrades. For instance, the U.S. GDP grew at an annualized rate of 3.4% in the fourth quarter of 2023, indicating a healthy economic environment that supports increased spending on dining and lodging.

Conversely, economic downturns or recessions can lead to reduced investment in foodservice equipment as businesses tighten their belts. Consumer spending is a key driver; when consumers have more disposable income, they tend to dine out more frequently and travel, boosting demand for Clark Associates' products. In February 2024, U.S. retail sales, a proxy for consumer spending, increased by 0.6%, suggesting continued consumer confidence and spending power.

Persistent inflation, especially in food and labor, is squeezing foodservice operators, making them prioritize value and efficiency in their equipment choices. This trend directly influences demand for Clark Associates' products. For instance, the U.S. Consumer Price Index for food away from home saw a 5.1% increase in the year ending April 2024, highlighting the cost pressures faced by restaurants.

Clark Associates is not immune to these economic headwinds. The company is experiencing elevated raw material costs for its manufacturing processes and higher operational expenses related to distribution. This necessitates a careful approach to pricing strategies and robust cost management to maintain profitability and competitiveness in the market.

Clark Associates continues to grapple with persistent global supply chain disruptions, a significant economic factor impacting the foodservice equipment industry. Port congestion and elevated freight costs, which saw ocean freight rates from Asia to the US West Coast surge by over 100% in late 2023 compared to pre-pandemic levels, directly influence the cost and availability of essential components and finished goods.

Raw material shortages, particularly for steel and certain electronic components, further exacerbate these challenges. For instance, the average price of hot-rolled coil steel experienced volatility throughout 2024, impacting the manufacturing costs of many of Clark Associates' product lines. Navigating this volatile landscape is crucial for the company to ensure consistent inventory and maintain competitive pricing for its extensive catalog.

Interest Rates and Access to Capital

Interest rate fluctuations directly impact Clark Associates' customer base, particularly those in the foodservice and hospitality industries who often finance equipment and facility upgrades. For instance, if the Federal Reserve maintains its target range for the federal funds rate at 5.25%-5.50% through 2024 and into 2025, as indicated by projections, this could translate to higher borrowing costs for Clark's clients. This scenario might lead to a slowdown in capital expenditures as businesses face increased financing expenses, potentially dampening demand for Clark's products and services.

Conversely, a scenario where interest rates decline could stimulate investment. If, for example, inflation moderates and the Fed begins a rate-cutting cycle in late 2024 or early 2025, leading to lower prime rates, businesses might find it more attractive to borrow for expansion projects. This could boost demand for Clark Associates' offerings as customers are more willing and able to invest in new equipment and facilities.

- Federal Funds Rate Target: Maintained at 5.25%-5.50% through much of 2024, influencing borrowing costs.

- Impact on Investment: Higher rates can deter customer financing for equipment and expansions, potentially reducing demand for Clark Associates.

- Potential Stimulus: Lower interest rates, if they materialize in 2025, could encourage capital investment and increase demand.

Competitive Landscape and Market Share

The foodservice equipment and supplies distribution market is intensely competitive, and Clark Associates has firmly established itself as a leading entity within this sector. Its sustained market leadership is a testament to its strategic approach in a consolidating industry.

Clark Associates' position as the number one player on the '2025 Distribution Giants' list, with reported sales exceeding $3.6 billion in 2024, underscores its significant market share. This dominance necessitates ongoing advancements in product offerings and operational streamlining to maintain its competitive edge.

- Market Dominance: Clark Associates holds the top spot on the '2025 Distribution Giants' list.

- Significant Revenue: Achieved over $3.6 billion in sales during 2024.

- Industry Consolidation: Operates within a market experiencing ongoing mergers and acquisitions.

- Key Success Factors: Continuous innovation and operational efficiency are crucial for maintaining leadership.

Economic growth directly fuels the hospitality sector, influencing Clark Associates' sales. With U.S. GDP projected to grow by 2.3% in 2024 and 2.0% in 2025, the demand for restaurant and hotel services, and consequently equipment, is expected to remain strong.

Consumer spending, a key indicator, saw retail sales rise 0.6% in February 2024, reflecting ongoing confidence. However, persistent inflation, with food away from home prices up 5.1% year-over-year in April 2024, pressures operators to seek cost-effective solutions, impacting equipment purchasing decisions.

Interest rates remain a critical factor. The Federal Reserve's target rate holding at 5.25%-5.50% through 2024 increases borrowing costs for Clark's clients, potentially slowing capital expenditures. A shift towards rate cuts in 2025 could, however, stimulate investment in new equipment.

| Economic Factor | 2024 Projection/Data | 2025 Projection | Impact on Clark Associates |

|---|---|---|---|

| GDP Growth (Annualized) | 3.4% (Q4 2023) / 2.3% (2024 est.) | 2.0% (est.) | Supports demand for hospitality services and equipment. |

| Consumer Spending (Retail Sales) | +0.6% (Feb 2024) | Continued growth expected | Higher disposable income translates to increased dining and travel. |

| Inflation (Food Away From Home) | +5.1% (Apr 2024 YoY) | Moderating but still present | Operators seek value and efficiency, influencing equipment choices. |

| Federal Funds Rate Target | 5.25%-5.50% | Potential for cuts later in 2024/2025 | Higher rates increase borrowing costs; lower rates could boost investment. |

Preview the Actual Deliverable

Clark Associates PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Clark Associates provides an in-depth look at the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. You'll gain valuable insights to inform your strategic decisions.

Sociological factors

Consumer dining habits are in constant flux, with a growing preference for convenience driving demand for takeout and delivery services. This trend, which saw significant acceleration in recent years, means restaurants need equipment that supports efficient packaging and rapid preparation. For instance, the global food delivery market was valued at approximately $150 billion in 2023 and is projected to grow substantially, highlighting the need for specialized kitchen tools.

Beyond convenience, there's a noticeable shift towards healthier and plant-based meal options. This dietary evolution requires foodservice businesses to stock specialized equipment for preparing these items, such as high-performance blenders for smoothies and plant-based milk, or specific cooking surfaces for vegetables. The plant-based food market alone is expected to reach over $74 billion by 2030, indicating a substantial and growing customer base.

Societal focus on health and wellness is significantly reshaping the foodservice industry. Consumers increasingly seek out healthier options, driving demand for equipment that facilitates methods like steaming, baking, and air frying, rather than traditional frying. This shift directly impacts what restaurants and catering businesses need, influencing the types of ovens, steamers, and specialized cooking appliances Clark Associates offers.

Furthermore, the rise in diverse dietary needs, including plant-based, gluten-free, and allergen-specific diets, necessitates a broader range of ingredients and preparation tools. Clark Associates must ensure its product lines cater to these evolving culinary landscapes, stocking items that support specialized cooking and ingredient sourcing for these growing market segments. For instance, the global plant-based food market was valued at approximately $27 billion in 2023 and is projected to reach over $160 billion by 2030, highlighting the substantial growth in this area that foodservice operators are responding to.

Persistent labor shortages in the foodservice sector, particularly for skilled kitchen roles, are a significant societal trend. This scarcity directly influences Clark Associates' product strategy, pushing operators towards automation and efficiency-enhancing equipment.

For example, a 2024 survey indicated that 57% of restaurant owners cited staffing as their biggest challenge, a figure that has remained elevated since 2022. This societal pressure fuels demand for smart kitchen technology and multi-functional appliances that can reduce reliance on extensive staffing.

Demographic Shifts and Institutional Demand

Demographic shifts are significantly reshaping consumer behavior and institutional needs. An aging population, for instance, often translates to increased demand for healthcare services and products, a key area for Clark Associates. Conversely, the growing influence of Gen Z, known for its preference for healthier and more sustainable options, is driving broader market trends across all sectors, including food and beverage.

Clark Associates must adapt to these evolving demographics. For example, the U.S. Census Bureau projected that by 2034, individuals aged 65 and older will outnumber those under 18, presenting a substantial opportunity in the elder care market. Simultaneously, Gen Z, now comprising a significant portion of the consumer base, actively seeks out brands aligning with their values, impacting product development and marketing strategies for Clark Associates' diverse portfolio.

- Aging Population: Increased demand for healthcare and related services.

- Gen Z Influence: Drives preference for 'better-for-you' and sustainable products.

- Market Adaptation: Need for Clark Associates to align offerings with evolving consumer values.

Sustainability and Ethical Consumption Values

Growing consumer consciousness regarding environmental impact and ethical sourcing is a significant sociological factor affecting the foodservice industry. Customers are increasingly scrutinizing the origins of their food and the environmental footprint of businesses, driving demand for sustainable practices. This shift directly influences purchasing decisions, compelling companies like Clark Associates to adapt their offerings and operations.

This societal value translates into a tangible market demand. For instance, a 2024 survey indicated that 65% of consumers are willing to pay more for products from brands committed to sustainability. This trend encourages foodservice distributors to actively seek and promote eco-friendly equipment and packaging solutions, aligning with the values of a growing customer base.

- Consumer Demand for Sustainability: A significant portion of consumers now prioritize environmentally friendly and ethically produced goods.

- Influence on Business Practices: This societal value pressures businesses to adopt greener operations, from sourcing to waste management.

- Market Opportunity for Distributors: Companies like Clark Associates can leverage this trend by expanding their portfolio of sustainable products and solutions.

- Impact on Purchasing Decisions: Ethical consumption values are becoming a key driver in consumer choice within the foodservice sector.

Societal shifts towards health consciousness and convenience continue to shape dining habits, impacting equipment needs for foodservice operators. The growing demand for plant-based and allergen-free options, coupled with labor shortages, also necessitates adaptable and efficient kitchen solutions. Clark Associates must stay attuned to these evolving consumer preferences and operational challenges to remain competitive.

Technological factors

The foodservice industry is experiencing a surge in automation and robotics, particularly within commercial kitchens. Automated cooking systems, advanced beverage dispensers, and robotic food preparation solutions are becoming increasingly common. This technological shift is driven by the need for greater efficiency and cost savings.

Clark Associates' clientele are actively investing in these advancements. For instance, the market for commercial kitchen automation was projected to reach $10.8 billion in 2024, with a compound annual growth rate of 12.5% expected through 2030. This investment aims to directly address rising labor costs and the demand for consistent product quality.

The ongoing surge in e-commerce continues to reshape the foodservice equipment and supplies sector. Clark Associates' WebstaurantStore app demonstrated this trend by exceeding $100 million in sales in December 2024, highlighting the critical importance of digital channels.

To maintain a competitive edge, companies like Clark Associates must prioritize investments in user-friendly online platforms and streamlined digital ordering systems. Efficient logistics are also paramount to meet evolving customer expectations for timely delivery.

The rise of smart kitchen technology and Internet of Things (IoT) integration is transforming the foodservice industry. These connected appliances offer real-time performance monitoring, predictive maintenance capabilities, and remote control, significantly boosting operational efficiency. For instance, by 2025, the global smart kitchen market is projected to reach over $40 billion, indicating strong consumer and commercial adoption of these advanced solutions.

Advanced Manufacturing Techniques

Clark Associates can significantly enhance its light manufacturing operations by integrating advanced technologies. AI-driven automation, for instance, is projected to boost manufacturing productivity by up to 20% by 2025, according to industry reports from late 2024. This allows for more efficient production lines and reduced labor costs.

Furthermore, the adoption of 3D printing, also known as additive manufacturing, enables rapid prototyping and the creation of highly customized products. This technology is becoming increasingly cost-effective, with the global 3D printing market expected to reach $60 billion by 2026, up from an estimated $20 billion in 2023. This supports Clark Associates in offering bespoke solutions and faster product development cycles.

Digital twins, virtual replicas of physical assets, offer another avenue for improvement. By simulating manufacturing processes, Clark Associates can optimize workflows, predict maintenance needs, and reduce material waste. This leads to significant cost savings and improved operational reliability. The use of digital twins in manufacturing is anticipated to grow substantially, with many companies reporting a 10-15% reduction in operational costs through their implementation in 2024.

- AI-Driven Automation: Expected to increase manufacturing productivity by up to 20% by 2025.

- 3D Printing: Global market projected to reach $60 billion by 2026, enabling customization and faster prototyping.

- Digital Twins: Can reduce operational costs by 10-15% through process simulation and predictive maintenance.

Supply Chain Technology and Data Analytics

Clark Associates' investment in advanced supply chain technologies is a key technological factor. Implementing solutions like AI and blockchain is crucial for boosting product traceability, fine-tuning inventory levels, and making logistics smoother. For instance, in 2024, companies leveraging AI in their supply chains reported an average of 15% reduction in operational costs, according to a recent industry survey.

These technological upgrades enable Clark Associates to more effectively manage its wide-reaching distribution network. By using data analytics, the company can better predict customer demand, ensuring that products are delivered on time and with accuracy. This proactive approach is vital in a market where efficient delivery is a significant competitive advantage. In 2025, early adopters of predictive analytics in retail supply chains saw a 10% improvement in on-time delivery rates.

- Enhanced Traceability: Blockchain technology offers end-to-end visibility, reducing risks of counterfeit goods and improving recall management.

- Inventory Optimization: AI-powered forecasting helps minimize stockouts and overstocking, leading to better capital utilization.

- Logistics Efficiency: Advanced route optimization software and real-time tracking improve delivery times and reduce transportation costs.

- Data-Driven Decision Making: Analytics provide insights into supply chain performance, enabling continuous improvement and strategic adjustments.

Technological advancements are fundamentally reshaping the foodservice equipment and supply industry, impacting everything from kitchen operations to customer interaction. Clark Associates, through its WebstaurantStore platform, is at the forefront of this digital transformation, with the app exceeding $100 million in sales by December 2024, underscoring the critical role of e-commerce. The company is also leveraging AI-driven automation, which is projected to boost manufacturing productivity by up to 20% by 2025, alongside 3D printing for customized solutions and digital twins to optimize operations, aiming for a 10-15% reduction in operational costs.

| Technology | Projected Impact/Growth | Relevance for Clark Associates |

|---|---|---|

| AI-Driven Automation | Up to 20% productivity increase by 2025 | Enhances manufacturing efficiency and reduces labor costs. |

| 3D Printing | Global market to reach $60 billion by 2026 | Enables rapid prototyping and creation of customized products. |

| Digital Twins | 10-15% operational cost reduction | Optimizes workflows, predicts maintenance, and reduces waste. |

| E-commerce Platforms (WebstaurantStore) | >$100 million sales by Dec 2024 | Critical for reaching customers and driving sales growth. |

Legal factors

Clark Associates must rigorously follow food safety and hygiene rules, like the Food Safety Modernization Act (FSMA) and FDA guidelines. This is crucial for their role as a distributor and light manufacturer.

Compliance affects everything from product creation and manufacturing to how items are stored and shipped. Emerging regulations on tracking products and banning certain ingredients mean continuous adaptation.

For instance, the FDA's updated FSMA rules, fully implemented in recent years, place significant emphasis on preventive controls and supply chain oversight, directly impacting Clark Associates' operational procedures and supplier relationships.

Clark Associates operates under stringent product liability laws, making it accountable for the safety and performance of its manufactured and distributed equipment and supplies. This means any defects or failures that cause harm can lead to significant legal repercussions, including costly lawsuits and damages.

Adherence to evolving product safety standards and regulations is paramount for Clark Associates. For instance, in 2024, the U.S. Consumer Product Safety Commission (CPSC) continued to emphasize rigorous testing and compliance for a wide range of products, with potential fines for non-compliance and mandatory recalls that can severely impact brand reputation and financial performance.

Clark Associates, as a significant employer, navigates a dense landscape of labor and employment legislation. This includes adherence to federal and state minimum wage laws, which saw the US federal minimum wage at $7.25 per hour in 2024, though many states and cities have higher rates impacting operational expenses. Compliance with Occupational Safety and Health Administration (OSHA) standards is also critical, with OSHA enforcing regulations to ensure safe working conditions across all of Clark's operational sites.

These legal mandates directly shape Clark Associates' hiring strategies and employee management practices. For instance, non-discrimination laws ensure fair treatment in recruitment and promotion, while regulations concerning working hours and overtime, such as the Fair Labor Standards Act (FLSA), affect payroll costs and scheduling. The company's commitment to these laws influences its overall cost structure and its ability to attract and retain a diverse workforce.

Environmental Regulations

Environmental regulations are becoming increasingly stringent, affecting how Clark Associates handles waste, energy, emissions, and packaging. For instance, new state laws targeting plastic waste, like California's SB 54 which aims to reduce single-use plastics by 25% by 2032, directly influence packaging choices and necessitate shifts towards more sustainable materials. This means Clark Associates must invest in greener manufacturing and supply chain practices to stay compliant and appeal to environmentally conscious consumers.

Compliance with these evolving environmental standards requires significant capital outlay. Clark Associates may need to upgrade equipment to reduce emissions, implement advanced waste management systems, and source eco-friendly packaging. For example, the U.S. Environmental Protection Agency (EPA) continues to refine standards for industrial emissions, potentially increasing operational costs for manufacturers. These investments are crucial not only for legal adherence but also for building brand reputation and long-term market viability.

- Increased compliance costs due to stricter waste management and emissions standards.

- Mandatory adoption of sustainable packaging, impacting material sourcing and logistics.

- Potential for fines or penalties for non-compliance with environmental laws.

- Opportunities for innovation in eco-friendly product development and operational efficiency.

Data Privacy and E-commerce Regulations

Clark Associates, through its substantial e-commerce platform WebstaurantStore, navigates a complex landscape of data privacy and e-commerce regulations. Compliance with laws like the California Consumer Privacy Act (CCPA) and the General Data Protection Regulation (GDPR) is paramount, especially as these regulations continue to evolve. For instance, as of early 2024, CCPA enforcement has become more stringent, with increased focus on data subject rights and business obligations.

Protecting customer data and ensuring the security of online transactions are not just legal necessities but also critical for maintaining consumer trust and brand reputation. Failure to comply can result in significant financial penalties; for example, GDPR fines can reach up to 4% of global annual revenue or €20 million, whichever is higher. Clark Associates must therefore invest in robust cybersecurity measures and transparent data handling practices.

- Data Privacy Compliance: Adherence to CCPA, GDPR, and similar evolving global data protection laws is essential for Clark Associates' e-commerce operations.

- Consumer Trust: Secure online payment systems and diligent customer data protection are vital for maintaining and building consumer confidence.

- Legal Penalties: Non-compliance with data privacy regulations can lead to substantial fines, impacting profitability and operational continuity.

- Evolving Regulations: Staying abreast of new and updated e-commerce laws, including those related to online advertising and consumer rights, is a continuous challenge.

Clark Associates must navigate a complex web of consumer protection laws, ensuring fair advertising and product representation. Regulations like the Federal Trade Commission (FTC) Act prohibit deceptive practices, directly impacting marketing strategies for their diverse product lines. For instance, in 2024, the FTC continued its focus on preventing misleading claims in online advertising, a critical area for WebstaurantStore.

Environmental factors

Clark Associates faces increasing pressure to embed sustainability throughout its supply chain, influencing sourcing decisions and operational efficiency. This means a sharper focus on ethical sourcing of materials and minimizing the environmental impact of logistics. For instance, the global logistics sector, a significant contributor to emissions, saw its carbon footprint rise, underscoring the need for Clark Associates to explore greener transportation options and optimize delivery routes to mitigate this environmental factor.

Evaluating the environmental footprint of raw materials is crucial, as consumer and regulatory demands for eco-friendly products intensify. Companies are increasingly scrutinized for their material sourcing, pushing for recycled content and biodegradable alternatives. This trend is reflected in the growing market for sustainable materials, which is projected to reach hundreds of billions of dollars by 2025, signaling a significant shift in manufacturing and procurement strategies for businesses like Clark Associates.

Increasingly stringent energy efficiency standards for commercial kitchen equipment, often tied to ENERGY STAR certifications, are reshaping product development and purchasing decisions. This trend reflects both regulatory push and growing consumer demand for sustainability. For instance, in 2024, ENERGY STAR certified commercial ovens demonstrated up to 15% less energy consumption compared to standard models, a significant factor for operators aiming to reduce utility bills.

Clark Associates needs to actively feature and endorse energy-saving appliances to align with these evolving market expectations and provide tangible benefits to their clientele through reduced operational expenses. The market for energy-efficient commercial kitchen equipment is projected to see continued growth, with industry reports in late 2024 indicating a 7% year-over-year increase in demand for such products.

The growing pressure to minimize waste, especially food and packaging waste, is a critical environmental consideration for the foodservice sector. In 2023, the U.S. Environmental Protection Agency (EPA) reported that food waste accounted for over 30% of the municipal solid waste stream.

Clark Associates can address this by providing equipment that aids in waste reduction, such as efficient storage solutions and portion control tools. Promoting the use of recyclable or compostable packaging options for its customers also aligns with these environmental imperatives.

Adopting circular economy principles within Clark Associates' own operations, like refurbishing and reselling used equipment or optimizing logistics to reduce transport emissions, further strengthens its commitment to sustainability and can lead to cost savings, as seen in pilot programs by other industry players demonstrating up to 15% reduction in operational waste costs.

Climate Change and Carbon Footprint Reduction

Growing global awareness of climate change is compelling businesses like Clark Associates to actively reduce their carbon footprint, impacting everything from manufacturing to logistics. This pressure often translates into a need to optimize delivery routes, explore greener fleet options, and enhance energy efficiency within warehouses and production sites.

For instance, the transportation sector, a significant contributor to carbon emissions, is seeing increased scrutiny. In 2023, the International Energy Agency reported that emissions from global transport reached a new high, underscoring the urgency for companies to adopt more sustainable practices. Clark Associates might consider investments in electric vehicles for its fleet or explore partnerships for more efficient last-mile delivery solutions to mitigate these environmental impacts.

Clark Associates could also face direct regulatory or consumer pressure to adopt more sustainable manufacturing processes. This could involve:

- Investing in renewable energy sources for its facilities.

- Implementing waste reduction and recycling programs across operations.

- Sourcing materials from suppliers with strong environmental track records.

- Improving the energy efficiency of its manufacturing equipment and buildings.

Water Usage and Conservation

Water usage and conservation are becoming increasingly critical for businesses like Clark Associates, especially concerning commercial kitchen equipment and manufacturing. Regulations around water efficiency are tightening globally. For instance, in the US, the Energy Policy Act of 1992, and subsequent updates, set water efficiency standards for various appliances, impacting the design and marketing of kitchen equipment. Clark Associates can leverage this by focusing on distributing appliances that meet or exceed these standards.

Implementing water-saving measures within Clark Associates' own operations, such as in their manufacturing facilities or distribution centers, also demonstrates environmental responsibility. This could involve optimizing cooling systems or improving wastewater management. The company’s commitment to distributing water-efficient appliances directly addresses environmental stewardship, appealing to a growing segment of environmentally conscious consumers and businesses. By highlighting these efforts, Clark Associates can enhance its brand reputation and potentially reduce operational costs associated with water consumption.

- Regulatory Landscape: Compliance with evolving water efficiency standards, like those influenced by the Energy Policy Act, is crucial for product design and market access.

- Product Strategy: Prioritizing the distribution of water-efficient commercial kitchen appliances aligns with environmental goals and market demand.

- Operational Efficiency: Implementing water-saving initiatives within Clark Associates’ own facilities can lead to cost reductions and improved sustainability metrics.

- Market Differentiation: Demonstrating a commitment to water conservation can serve as a key differentiator in a competitive market.

Environmental factors significantly influence Clark Associates' operations, from sourcing to product development. Increasing consumer and regulatory demands for sustainability are pushing for eco-friendly materials and reduced waste. For instance, the U.S. EPA reported that food waste comprised over 30% of municipal solid waste in 2023, highlighting the need for waste-reducing equipment and packaging solutions.

Energy efficiency is another critical area, with standards like ENERGY STAR driving product innovation. In 2024, ENERGY STAR certified commercial ovens showed up to 15% less energy consumption, a key selling point for cost-conscious clients. Clark Associates' focus on these appliances aligns with market trends, with demand for energy-efficient equipment growing by an estimated 7% year-over-year in late 2024.

Water conservation also presents both challenges and opportunities. Regulations influenced by acts like the Energy Policy Act of 1992 require water-efficient appliances. By distributing such equipment and implementing water-saving measures internally, Clark Associates can enhance its brand reputation and operational efficiency.

| Environmental Factor | Impact on Clark Associates | Supporting Data/Trend (2023-2025) |

| Sustainability & Ethical Sourcing | Pressure to use recycled/biodegradable materials; optimize logistics for reduced emissions. | Global logistics carbon footprint rising; market for sustainable materials projected to reach hundreds of billions by 2025. |

| Energy Efficiency | Demand for ENERGY STAR certified equipment; need to promote energy-saving appliances. | ENERGY STAR ovens showed 15% less energy use (2024); 7% YoY growth in demand for energy-efficient commercial kitchen equipment (late 2024). |

| Waste Reduction | Need for equipment aiding food/packaging waste reduction; promoting recyclable packaging. | Food waste was >30% of municipal solid waste (2023, EPA). |

| Water Conservation | Compliance with water efficiency standards; distribution of water-saving appliances. | Energy Policy Act of 1992 influences appliance standards; growing consumer demand for water-efficient products. |

PESTLE Analysis Data Sources

Our PESTLE analysis for Clark Associates is built upon a robust foundation of data sourced from reputable industry publications, government economic reports, and leading market research firms. We meticulously gather information on political stability, economic indicators, technological advancements, environmental regulations, and societal trends to ensure a comprehensive and accurate assessment.