Clark Associates Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Clark Associates Bundle

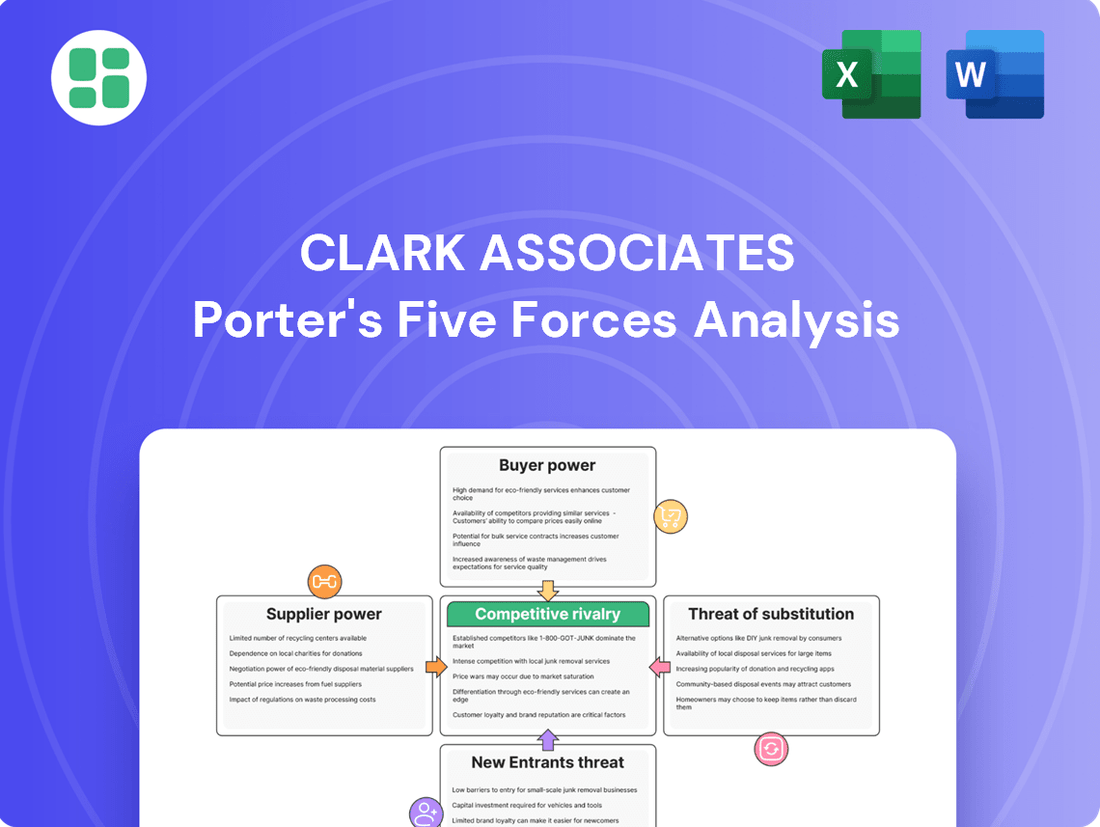

Clark Associates operates within a dynamic landscape shaped by intense rivalry, powerful buyers, and the constant threat of new entrants. Understanding these forces is crucial for any business aiming to thrive in their sector.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Clark Associates’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

The bargaining power of suppliers for Clark Associates is significantly influenced by how concentrated and specialized the market for their equipment and supplies is. If a few companies dominate the production of highly specialized or proprietary foodservice equipment, they can command higher prices and dictate terms more easily.

For instance, if Clark Associates relies on a limited number of manufacturers for unique refrigeration units or specialized cooking appliances, those suppliers hold considerable sway. This is particularly true if switching costs to alternative suppliers are high due to integration or unique specifications.

Conversely, for more common items like standard kitchenware, cleaning supplies, or basic ingredients, Clark Associates likely faces less supplier power. The availability of numerous alternative sources for these commoditized goods means suppliers have less leverage to increase prices or impose unfavorable terms.

Clark Associates, a significant distributor, likely encounters moderate switching costs when changing suppliers for essential equipment or high-volume goods. These costs can include the expense of reconfiguring supply chain operations, training employees on new product specifications, and the effort involved in renegotiating contracts. For instance, if Clark Associates were to switch from a major electronics component supplier, the integration of new part numbers and potential compatibility testing could represent a substantial undertaking.

The threat of suppliers integrating forward into distribution, selling directly to end-users, is a persistent consideration in the broad distribution sector. While some manufacturers might explore direct-to-consumer or direct-to-restaurant sales, the substantial investment in logistics, warehousing, and customer support typically makes complete forward integration a costly endeavor for many.

Clark Associates' robust distribution capabilities and established e-commerce presence, notably through WebstaurantStore.com, serve as a formidable deterrent against significant forward integration efforts by its suppliers. This infrastructure allows Clark Associates to efficiently manage the complexities of reaching a wide customer base, thereby mitigating this particular supplier bargaining power.

Importance of Clark Associates to Suppliers

Clark Associates' status as the nation's top distributor, achieving over $4 billion in revenue in 2024, makes them an indispensable partner for many foodservice equipment and supply manufacturers. This substantial market presence means suppliers rely heavily on Clark for a significant portion of their sales volume, creating a dependency that can influence negotiation dynamics.

The sheer scale of Clark Associates' purchasing power, underscored by their 2024 revenue figures, translates directly into considerable leverage during negotiations with suppliers. This enables them to negotiate advantageous pricing, payment terms, and other critical contract conditions, effectively reducing the bargaining power of those supplying them.

- Critical Sales Channel: For many foodservice equipment and supply manufacturers, Clark Associates represents a primary, if not the largest, sales channel.

- Volume Discounts: Clark's substantial order volumes allow them to demand and receive significant volume discounts, impacting supplier profitability.

- Market Access: Suppliers gain access to a vast customer base through Clark's extensive distribution network, a benefit they are willing to trade favorable terms for.

- Negotiating Leverage: The company's financial strength and market dominance provide a strong hand in negotiating terms, potentially squeezing supplier margins.

Availability of Substitute Inputs

The availability of substitute inputs significantly impacts the bargaining power of suppliers for Clark Associates. If raw materials for their light manufacturing or alternative brands for distributed products are readily available from multiple sources, Clark can more easily switch suppliers, thereby reducing any single supplier's leverage. For instance, in 2024, the foodservice supply market continued to demonstrate a high degree of fragmentation, with numerous manufacturers offering comparable equipment and consumables.

While certain specialized or proprietary equipment designs might limit the immediate availability of direct substitutes, the broader foodservice supply chain generally presents Clark with a wide array of alternative sourcing options. This allows Clark to strategically diversify its supplier base, mitigating the risk of over-reliance on any one entity. The sheer volume of suppliers in the market for common goods, such as disposables or standard kitchenware, means that no single supplier can typically dictate terms without facing competition.

Clark's ability to source from a diverse range of suppliers is a key factor in managing supplier power. For example, in the 2024 fiscal year, Clark reported sourcing from over 500 unique vendors across its various product categories. This extensive network provides flexibility, enabling the company to negotiate favorable terms and avoid being unduly pressured by any individual supplier's demands. The presence of readily available substitutes for many of its input needs directly translates to a lower bargaining power for those specific suppliers.

- Supplier Diversification: Clark's strategy of sourcing from over 500 vendors in 2024 limits the power of individual suppliers.

- Market Fragmentation: The foodservice supply market's high fragmentation in 2024 offers numerous alternatives for raw materials and distributed products.

- Impact on Negotiation: The availability of substitutes empowers Clark to negotiate better terms and reduce dependence on any single supplier.

- Mitigating Dependence: Clark can strategically diversify sourcing to avoid being overly reliant on suppliers, especially for common goods.

Clark Associates' substantial purchasing power, evidenced by its over $4 billion in revenue in 2024, significantly diminishes supplier bargaining power. As the nation's top distributor, suppliers depend on Clark for substantial sales volume, creating a leverage point for favorable pricing and terms.

The company's extensive distribution network and e-commerce platform, WebstaurantStore.com, act as a deterrent against suppliers integrating forward into direct sales, further balancing negotiation power.

With over 500 vendors in 2024, Clark's supplier diversification and the availability of substitutes for many common goods limit the leverage of individual suppliers, allowing for more advantageous contract negotiations.

| Factor | Impact on Supplier Bargaining Power | Clark Associates' Position (2024 Data) |

|---|---|---|

| Supplier Concentration & Specialization | High concentration of specialized suppliers increases their power. | Moderate; some specialized equipment but many common goods. |

| Switching Costs | High switching costs favor suppliers. | Moderate; operational adjustments needed for new suppliers. |

| Importance of Buyer to Supplier | When buyer is a key customer, supplier power is reduced. | High; Clark is a critical sales channel for many manufacturers. |

| Availability of Substitutes | Many substitutes reduce supplier power. | High; diverse sourcing and market fragmentation. |

What is included in the product

This analysis unpacks the competitive forces impacting Clark Associates, detailing the intensity of rivalry, the power of buyers and suppliers, the threat of new entrants, and the availability of substitutes.

Effortlessly identify and mitigate competitive threats with a clear, actionable overview of each Porter's Five Force, simplifying complex strategic analysis.

Customers Bargaining Power

Clark Associates' customers, including restaurants, hotels, healthcare, and educational institutions, are increasingly sensitive to price. This is driven by factors like rising food and labor expenses, making cost-conscious purchasing a necessity for many of these businesses.

The rise of online platforms, such as WebstaurantStore.com, significantly amplifies this price sensitivity. These platforms offer unparalleled price transparency, allowing customers to quickly compare offerings from various suppliers, putting pressure on Clark Associates to remain competitive on pricing.

The bargaining power of Clark Associates' customers is directly tied to their purchase volume. Large institutional buyers and major restaurant chains, key clients within Clark's specialty distribution channels, wield significant influence due to the sheer scale of their orders, often negotiating favorable terms and pricing.

While individual independent restaurants may have less direct leverage, their collective presence is substantial, and Clark's robust e-commerce platform ensures competitive pricing and easy accessibility for these smaller entities, mitigating their individual bargaining weakness.

Customers for foodservice equipment and supplies face a market brimming with options. They can readily source products from major broadline distributors such as Sysco and US Foods, as well as numerous specialized regional dealers and even directly from manufacturers. This abundance of alternatives significantly amplifies customer bargaining power.

The competitive landscape forces companies like Clark Associates to remain highly responsive to customer demands. With so many choices available, customers can easily switch suppliers if pricing, service, or product availability isn't up to par. For instance, in 2024, the foodservice distribution market continued to see robust competition, with major players actively vying for market share through aggressive pricing strategies and enhanced service offerings, directly impacting how suppliers like Clark Associates must operate.

Switching Costs for Customers

Switching costs for customers in the foodservice equipment and supplies sector are typically quite low, especially for standard, widely available items. This ease of switching directly impacts the bargaining power of customers.

The prevalence of online ordering platforms and the presence of numerous distributors mean that customers can readily compare prices and product offerings. For instance, a restaurant looking for basic kitchenware can easily find multiple suppliers online, often with next-day delivery options. This accessibility significantly reduces the friction associated with changing vendors.

While some customers might have established relationships or integrated ordering systems with specific suppliers, these are often not substantial enough to create a significant barrier to switching. The availability of competitive pricing and better service from a new vendor can quickly outweigh the minor inconvenience of changing.

Key factors contributing to low switching costs include:

- Ease of online comparison shopping: Numerous platforms allow for quick price and feature comparisons.

- Multiple supplier options: The market is fragmented, offering abundant choices for most foodservice needs.

- Standardized product offerings: Many essential items are commodities, easily sourced from various providers.

- Limited integration of supplier systems: Few customers rely on deeply embedded technology that ties them to a single supplier.

Importance of Clark's Products to Customer Operations

Clark Associates supplies essential equipment and supplies that are critical for the daily operations of its customers, particularly within commercial kitchens and the hospitality sector. These products are often fundamental to a business's ability to function, making Clark a key supplier for many.

However, the standardized nature of many of Clark's products means customers often prioritize factors like cost, reliability, and delivery speed over unique product features. This focus on value and efficiency gives customers significant leverage, as they can readily compare offerings and switch suppliers if a better deal or service is available.

- High Dependence, Low Switching Costs: Customers rely on Clark for operational necessities, but the availability of similar, standardized products from competitors means switching costs are generally low.

- Price Sensitivity: The emphasis on cost for many product categories empowers customers to negotiate prices or seek out lower-cost alternatives, directly impacting Clark's pricing power.

- Information Availability: The ease with which customers can access pricing and product information online further amplifies their bargaining power by facilitating comparison shopping.

Clark Associates' customers, primarily businesses in the foodservice and hospitality sectors, possess significant bargaining power. This is largely due to the availability of numerous alternative suppliers offering comparable, often standardized, products. The ease of comparing prices and offerings online, coupled with generally low switching costs, allows customers to readily shift their business if pricing or service levels are not met. In 2024, the competitive landscape in foodservice distribution remained intense, with distributors emphasizing value and service to retain clients, a trend that directly benefits customers by enhancing their negotiation leverage.

The bargaining power of Clark Associates' customers is amplified by their ability to easily compare prices and product specifications across a fragmented market. For example, a restaurant needing commercial kitchen equipment can swiftly identify multiple vendors online, often finding similar items at competitive price points. This transparency and accessibility empower buyers to demand better terms, as demonstrated by the continued aggressive pricing strategies observed among major foodservice suppliers throughout 2024 as they vied for market share.

Customers' leverage is further strengthened by the relatively low switching costs associated with changing suppliers for most foodservice equipment and supplies. Unless deeply integrated ordering systems are in place, the effort to switch is minimal, especially for standardized items. This reality forces suppliers like Clark Associates to remain highly competitive on price and service to maintain customer loyalty, as customers can easily pivot to alternatives that offer better value or more convenient delivery, a dynamic prevalent in the market as of mid-2025.

| Factor | Impact on Customer Bargaining Power | Clark Associates' Position |

|---|---|---|

| Number of Competitors | High (many broadline and specialized distributors) | Faces intense competition, limiting pricing power. |

| Availability of Substitutes | High (standardized products readily available) | Must differentiate on service or niche offerings. |

| Switching Costs | Low (minimal integration, easy online comparison) | Needs to offer compelling value to retain customers. |

| Customer Price Sensitivity | High (driven by operational costs, e.g., food and labor) | Must maintain competitive pricing to attract and retain clients. |

Same Document Delivered

Clark Associates Porter's Five Forces Analysis

This preview showcases the comprehensive Clark Associates Porter's Five Forces analysis, detailing the competitive landscape of the industry. The document you see here is the exact, professionally formatted report you will receive immediately after purchase, offering actionable insights without any alterations or missing sections.

Rivalry Among Competitors

The foodservice equipment and supplies distribution market is on a steady growth trajectory. Projections indicate the global foodservice equipment market could reach $42.95 billion by 2028, signaling ongoing demand.

However, this expansion unfolds within a largely mature industry. This maturity means established distributors are fiercely competing for their slice of the market, intensifying rivalry.

Competitive rivalry for Clark Associates is intense. The foodservice distribution market is populated by major national players such as Sysco, US Foods, and Performance Food Group, alongside a significant number of regional and specialized distributors. This creates a highly fragmented yet consolidated landscape where Clark, despite its size, faces constant pressure.

For instance, in 2023, Sysco reported net sales of $37.1 billion, US Foods achieved $34.1 billion, and Performance Food Group reached $29.1 billion. Clark Associates, while a substantial entity, operates within this competitive arena, necessitating continuous innovation and differentiation to maintain and grow its market share.

Clark Associates distinguishes itself in the competitive foodservice supply market through a broad product catalog, robust e-commerce operations via WebstaurantStore.com, and in-house light manufacturing. This multi-faceted approach allows them to offer more than just basic supplies, providing comprehensive solutions to their customers.

Competitors are also actively pursuing differentiation, focusing on value-added services like extended warranties and installation support, advanced technology for ordering and inventory management, and niche product specialization to capture specific market segments.

Exit Barriers

Exit barriers for foodservice distributors, including companies like Clark Associates, are generally moderate to high. This is largely due to the substantial capital required for specialized warehousing, extensive logistics networks, and maintaining significant inventory levels. These investments create a sticky situation for firms looking to leave the market.

For a large, established entity such as Clark Associates, the sheer scale of its operations and the specialized nature of its assets amplify these exit barriers. Divesting or re-purposing large, dedicated distribution centers and fleets is not a simple task. This difficulty in exiting the market can intensify competitive rivalry, as firms are less likely to withdraw even when facing challenging market conditions.

Consider the implications for a company like Clark Associates. In 2024, the foodservice distribution sector continued to see heavy investment in technology and infrastructure. For instance, many distributors are upgrading their fleets with more fuel-efficient and technologically advanced vehicles, and expanding cold chain capabilities. These are not assets easily liquidated or repurposed, thus locking companies into the industry.

- High Capital Investment: Significant funds are tied up in specialized warehouses, refrigerated trucks, and inventory management systems.

- Asset Specificity: Distribution centers and logistics fleets are often built for specific operational needs, making them difficult to sell or convert for other uses.

- Operational Scale: Larger companies like Clark Associates have a greater physical footprint and more complex supply chains, increasing the cost and complexity of an exit.

- Inventory Holding Costs: The need to maintain a wide range of products, often with specific storage requirements, represents a substantial ongoing investment that is hard to recover upon exit.

Competitive Strategies

Competitive rivalry within the retail sector, particularly for a company like Clark Associates, is intense and plays out through various strategic maneuvers. These include aggressive price competition, the strategic expansion of distribution networks to reach more customers, and significant investments in technology, such as e-commerce platforms and warehouse automation. Companies also differentiate themselves by offering value-added services that enhance the customer experience.

Clark Associates actively employs these strategies to maintain its competitive edge. Their commitment to fast delivery, a broad product assortment, and competitive pricing forms the core of their market approach. This is further reinforced by substantial investments in warehouse automation, aimed at improving efficiency and speed, which directly combats rivals in the fast-paced retail environment.

- Price Competition: Clark Associates strives to offer competitive pricing across its product lines, a common tactic to attract and retain customers in a crowded market.

- Distribution Network Expansion: The company continuously works to broaden its reach, ensuring products are accessible to a wider customer base through various channels.

- Technological Investments: Significant capital is allocated to e-commerce capabilities and automation technologies, enhancing operational efficiency and customer convenience.

- Value-Added Services: Clark focuses on services like fast delivery to provide a superior customer experience, setting itself apart from competitors.

The foodservice equipment and supplies market is characterized by fierce competition among major national distributors and numerous regional players. Clark Associates operates within this intensely competitive landscape, where differentiation through product breadth, e-commerce strength, and operational efficiency is crucial for market share. Competitors are also actively investing in technology and services to gain an edge.

| Competitor | 2023 Net Sales (USD Billions) | Key Differentiators |

|---|---|---|

| Sysco | 37.1 | Extensive product catalog, broad distribution network |

| US Foods | 34.1 | Focus on independent restaurants, diverse product offerings |

| Performance Food Group | 29.1 | Strong presence in foodservice and retail channels |

| Clark Associates (WebstaurantStore.com) | Not publicly disclosed in this context | E-commerce leadership, wide product selection, in-house manufacturing |

SSubstitutes Threaten

The threat of substitutes for Clark Associates' offerings stems from alternative methods customers can achieve kitchen functionality. For instance, the growing popularity of cloud kitchens or ghost kitchens means some operators may require less on-premise equipment, as they utilize shared or off-site facilities instead. This shift impacts the demand for traditional kitchen appliances and equipment.

The threat of substitutes for Clark Associates, particularly concerning direct sourcing, is relatively low. While larger customers, like major restaurant chains, could theoretically bypass distributors and buy directly from manufacturers, this path is often impractical. These chains typically lack the extensive logistical networks and warehousing infrastructure that distributors like Clark provide, making direct sourcing a difficult substitute for their core services.

The existence of a strong used foodservice equipment market presents a significant threat of substitutes for Clark Associates. This market provides a more budget-friendly alternative, especially appealing to startups and smaller operations that may not have the capital for brand-new machinery. For instance, in 2024, the global used equipment market is projected to grow, indicating a sustained demand for these lower-cost options.

While used equipment might not come with warranties or the most cutting-edge features, its primary advantage is its accessibility. This can directly siphon sales away from new equipment, particularly for businesses prioritizing cost savings over the latest technological advancements or energy efficiency improvements that new models often boast.

In-House Manufacturing or Repair

While some large hospitality chains might establish limited in-house manufacturing or robust repair shops for specific equipment, this rarely poses a significant threat to Clark Associates. These capabilities are typically not scalable to cover the vast array of products and specialized components that Clark supplies across the industry.

For instance, a hotel group might maintain a small workshop for basic furniture repairs or custom signage, but this doesn't replace the need for commercial-grade kitchen appliances, refrigeration units, or extensive tabletop collections that Clark offers. The capital investment and expertise required for comprehensive manufacturing or repair across Clark's product categories are prohibitive for most individual operators.

- Limited Scope: In-house capabilities are usually confined to a narrow range of products, unlike Clark's broad catalog.

- Scalability Issues: Most hospitality businesses lack the resources to scale internal manufacturing or repair to meet diverse equipment needs.

- Cost Prohibitive: Establishing and maintaining the necessary infrastructure and skilled labor for widespread in-house operations is often more expensive than outsourcing to specialists like Clark.

Digital Platforms and Marketplace Disruption

The rise of digital platforms and online marketplaces presents a significant threat of substitution for traditional distribution models. These platforms can offer buyers greater price transparency and direct access to a wider array of sellers, potentially bypassing established distributors. For instance, the growth of e-commerce in the foodservice equipment sector, where Clark Associates operates through WebstaurantStore.com, demonstrates this trend. In 2023, global e-commerce sales reached an estimated $6.3 trillion, highlighting the significant shift towards online purchasing across various industries.

While WebstaurantStore.com is a dominant force, the evolving digital landscape means new platforms could emerge, offering specialized services or catering to niche market segments. These emerging substitutes could chip away at Clark Associates' market share by providing alternative, potentially more efficient, or cost-effective channels for certain customer needs. The increasing digitalization of business operations means that any company not adapting to these shifts risks being outmaneuvered by more agile, digitally-native competitors.

- Digital platforms offer enhanced price transparency.

- Online marketplaces connect buyers directly with multiple sellers.

- WebstaurantStore.com, while strong, faces potential new digital competitors.

- Global e-commerce sales exceeded $6.3 trillion in 2023, indicating a major shift.

The threat of substitutes for Clark Associates is primarily driven by the availability of used equipment and the growing trend of direct sourcing by large chains, though the latter is often impractical due to logistical complexities. Emerging digital platforms also present a substitute channel for customers seeking price transparency and direct access to sellers, a trend underscored by the massive growth in global e-commerce.

| Substitute Type | Impact on Clark Associates | Supporting Data/Trend |

|---|---|---|

| Used Equipment Market | Significant | Growing demand, especially for cost-conscious startups. |

| Direct Sourcing (Large Chains) | Low | Impractical due to lack of extensive logistics and warehousing. |

| Digital Platforms/E-commerce | Moderate to High | Global e-commerce sales reached $6.3 trillion in 2023; platforms offer price transparency and direct access. |

Entrants Threaten

The foodservice equipment and supplies distribution sector demands considerable upfront capital. Establishing the necessary warehousing, managing inventory, setting up efficient logistics, and investing in robust technology infrastructure are all significant cost centers. For instance, Clark Associates, a major player, operates nearly 10 million square feet of warehouse space, highlighting the scale of investment required.

Newcomers must be prepared to deploy substantial financial resources to even begin competing. Without this financial muscle, it's extremely challenging to match the operational capabilities and market reach of established distributors who have already made these considerable capital outlays.

Established players like Clark Associates leverage substantial economies of scale, particularly in bulk purchasing and efficient logistics networks. For instance, in 2024, major appliance distributors often secure discounts of 10-15% on high-volume orders, a cost advantage new entrants would find difficult to match.

These scale efficiencies translate directly to lower per-unit costs in warehousing and transportation. A new competitor entering the market would face considerable upfront investment to build a comparable distribution infrastructure, hindering their ability to compete on price and product availability against established giants.

Securing access to established distribution channels presents a significant hurdle for potential new entrants in the food service equipment industry. Clark Associates has cultivated strong, long-standing relationships with both manufacturers and a broad customer base, including restaurants, hotels, and institutions, making it difficult for newcomers to replicate this network and reach diverse market segments effectively.

Brand Loyalty and Differentiation

Incumbents like Clark Associates, especially through its prominent WebstaurantStore.com platform, have successfully built significant brand recognition and fostered deep customer loyalty. This established trust means new competitors face a substantial hurdle in attracting customers.

New entrants would need to commit considerable resources to marketing and advertising campaigns to even begin to rival Clark Associates' visibility. Furthermore, they must offer truly compelling reasons for customers to switch, such as unique product offerings, superior service, or significantly lower prices, to overcome the inertia of existing loyalties.

- Brand Recognition: WebstaurantStore.com is a household name in the foodservice equipment industry, a testament to years of consistent marketing and customer satisfaction.

- Customer Loyalty Programs: Clark Associates likely employs loyalty programs and customer relationship management strategies that make it costly for customers to switch.

- Marketing Investment: A new entrant would need to budget millions in 2024 for digital and traditional marketing to gain comparable brand awareness to Clark Associates.

- Differentiation Strategy: Simply offering similar products at a slightly lower price is unlikely to be enough; differentiation in niche markets or service models is crucial.

Regulatory and Food Safety Compliance

The foodservice industry is heavily regulated, with new entrants needing to comply with numerous health, safety, and equipment standards. Navigating these complex requirements, such as HACCP plans and NSF certifications for equipment, represents a significant hurdle that established companies have already overcome. For instance, in 2024, the FDA’s Food Code continues to be a primary reference for food safety practices, requiring rigorous adherence from all operators.

New businesses must invest considerable time and resources to understand and implement these regulations, including obtaining necessary permits and licenses. This compliance burden can deter potential entrants, as failure to meet standards can lead to fines, closures, and reputational damage. Established players benefit from existing infrastructure and expertise in managing these ongoing regulatory demands.

- Regulatory Complexity: New entrants must master a web of local, state, and federal regulations concerning food handling, sanitation, and workplace safety.

- Capital Investment: Compliance often necessitates investment in certified equipment and facilities, adding to the initial startup costs.

- Established Expertise: Existing businesses have built-in knowledge and processes for maintaining compliance, giving them a competitive edge.

- Food Safety Standards: Adherence to evolving food safety protocols, like those outlined by the FDA, is non-negotiable and requires continuous training and oversight.

The threat of new entrants in the foodservice equipment and supplies distribution sector is moderate, primarily due to high capital requirements and established brand loyalty. Clark Associates, with its extensive infrastructure and strong online presence via WebstaurantStore.com, presents a formidable barrier. Newcomers need substantial funding to match existing operational scale and marketing reach.

The industry demands significant upfront investment in warehousing, inventory, and logistics, with companies like Clark Associates operating millions of square feet of space. In 2024, securing favorable terms from manufacturers, often involving volume discounts of 10-15%, is crucial for cost competitiveness, a feat difficult for nascent businesses.

Furthermore, established players benefit from strong brand recognition and customer loyalty, cultivated through years of service and marketing. Overcoming this inertia requires new entrants to invest heavily in differentiation and marketing to even gain traction against established names.

Regulatory compliance, covering food safety and equipment standards, also adds complexity and cost for new businesses. Navigating these requirements, such as FDA food code adherence, demands expertise and resources that incumbents already possess.

| Barrier to Entry | Impact on New Entrants | Clark Associates' Advantage |

|---|---|---|

| Capital Requirements | High upfront investment needed for operations. | Operates nearly 10 million sq ft of warehouse space. |

| Economies of Scale | Difficulty matching lower per-unit costs. | Secures 10-15% bulk order discounts (2024 estimate). |

| Brand Recognition & Loyalty | Challenging to attract customers from established brands. | Strong brand via WebstaurantStore.com; customer loyalty programs. |

| Distribution Channels | Limited access to established networks. | Cultivated long-standing relationships with manufacturers and customers. |

| Regulatory Compliance | Time and cost to meet health, safety, and equipment standards. | Existing infrastructure and expertise in compliance. |

Porter's Five Forces Analysis Data Sources

Our Clark Associates Porter's Five Forces analysis leverages data from industry-specific market research reports, financial filings of competitors, and proprietary customer surveys to provide a comprehensive view of the competitive landscape.