Clariant AG - Textile Chemicals, Paper Specialties, and Emulsions Businesses PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Clariant AG - Textile Chemicals, Paper Specialties, and Emulsions Businesses Bundle

Navigate the complex external landscape impacting Clariant AG's Textile Chemicals, Paper Specialties, and Emulsions Businesses. Understand how evolving political regulations, economic shifts, and social trends are shaping market opportunities and challenges.

Gain a competitive edge by leveraging our expert PESTLE analysis, revealing critical technological advancements and environmental considerations. This deep dive equips you with the foresight needed to adapt and thrive in a dynamic global market.

Don't get left behind – unlock actionable intelligence to refine your strategy. Download the full PESTLE analysis for Clariant AG's key businesses and make informed decisions that drive success.

Political factors

Geopolitical tensions and evolving trade policies present a complex landscape for Clariant's textile chemicals, paper specialties, and emulsions businesses. For instance, ongoing trade disputes, such as those impacting global shipping and raw material costs, directly affect the company's ability to source efficiently and serve its international customer base. The potential for new tariffs, as indicated by discussions surrounding the incoming U.S. administration, could further disrupt established supply chains and dampen overall chemical demand in key markets.

Clariant's strategic approach, which includes diversifying its sourcing network and implementing a local-for-local production model, is designed to build resilience against these geopolitical uncertainties. This strategy aims to reduce reliance on single-country sourcing and ensure greater proximity to customers, thereby mitigating the impact of trade barriers and policy shifts. The company's commitment to localized operations helps navigate the complexities of varying international trade regulations and potential protectionist measures.

The chemical industry, and by extension Clariant's textile chemicals, paper specialties, and emulsions businesses, face an increasingly complex and stringent regulatory environment, especially within the European Union. New directives and standards are continually being introduced, directly impacting how products are developed, manufactured, and marketed.

Navigating these evolving rules is paramount for market access and maintaining a competitive advantage. For instance, Clariant must adhere to the European Sustainability Reporting Standards (ESRS), which mandate detailed disclosures on environmental, social, and governance matters, and the upcoming Ecodesign Framework Regulation, which will set requirements for product sustainability throughout their lifecycle.

Failure to comply can result in significant penalties and restricted market entry. In 2024, the EU continued to emphasize its commitment to a circular economy and chemical safety, with ongoing reviews of REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals) and the development of new substance restrictions that could affect Clariant's product portfolio.

Government incentives and policies actively promoting green chemistry and sustainable solutions present a significant tailwind for Clariant's textile chemicals, paper specialties, and emulsions businesses. These initiatives, often including tax credits and subsidies, directly support the adoption of Clariant's environmentally conscious product lines, fostering market growth. For instance, the European Union's Green Deal, with its ambitious targets for sustainability and circularity, directly encourages the use of bio-based ingredients and reduced chemical footprints, areas where Clariant has invested heavily in its product development.

Political Stability in Key Markets

Political stability in Clariant's key operational and growth markets, particularly in Asia, is a critical consideration. For instance, China, a significant market for Clariant's textile chemicals and paper specialties, experienced a GDP growth of 5.2% in 2023, highlighting its economic importance but also underscoring the need for a stable political climate to support ongoing investments.

Clariant's strategic expansion of production capacities and R&D hubs in regions like China necessitates a predictable political landscape. The company's commitment to these growth areas means that any political instability could directly impact the successful realization of these significant investments and the anticipated returns.

The potential for disruption to operations and investment returns is a direct consequence of political volatility. For example, trade policy shifts or regulatory changes stemming from political uncertainty can create significant headwinds for multinational corporations like Clariant.

- China's GDP growth of 5.2% in 2023 underscores its market importance for Clariant.

- Clariant's investments in production and R&D in China are contingent on political stability.

- Political instability can disrupt operations and jeopardize investment returns in key markets.

- Trade policy and regulatory changes are key areas of risk influenced by political factors.

Public Procurement Policies

Government procurement policies that favor sustainable or locally produced chemical products can present significant opportunities for Clariant. As public entities increasingly integrate Environmental, Social, and Governance (ESG) criteria into their purchasing decisions, Clariant's commitment to sustainable and high-value specialty chemicals positions it favorably. This alignment can translate into a competitive edge when bidding for public sector contracts, potentially boosting revenue streams in the 2024-2025 period.

For instance, many European governments have set ambitious targets for green public procurement. The European Commission's Green Public Procurement (GPP) criteria, updated and enforced throughout 2024, specifically encourage the purchase of chemicals with reduced environmental impact. Clariant's EcoTain label, which signifies products with superior sustainability performance, directly addresses these evolving governmental demands.

- Increased Demand for Sustainable Chemicals: Government mandates for eco-friendly products are expected to drive demand for Clariant's specialty chemicals, particularly those with strong ESG credentials.

- Competitive Advantage in Tenders: Clariant's focus on sustainability can enhance its success rate in public procurement tenders that prioritize environmental performance and local sourcing.

- Market Access Expansion: Favorable policies can unlock new market segments within the public sector, providing Clariant with access to government-backed projects and infrastructure developments.

- Potential for Higher Margins: Specialty chemicals that meet stringent sustainability standards often command premium pricing, potentially improving profitability on public contracts.

Navigating international trade policies and geopolitical shifts significantly impacts Clariant's operations. For example, the ongoing trade tensions and potential for new tariffs, as discussed in late 2024 and early 2025, could disrupt supply chains and affect raw material costs for its textile chemicals, paper specialties, and emulsions businesses. Clariant's strategy to diversify sourcing and localize production aims to mitigate these risks, enhancing resilience against policy changes and trade barriers.

What is included in the product

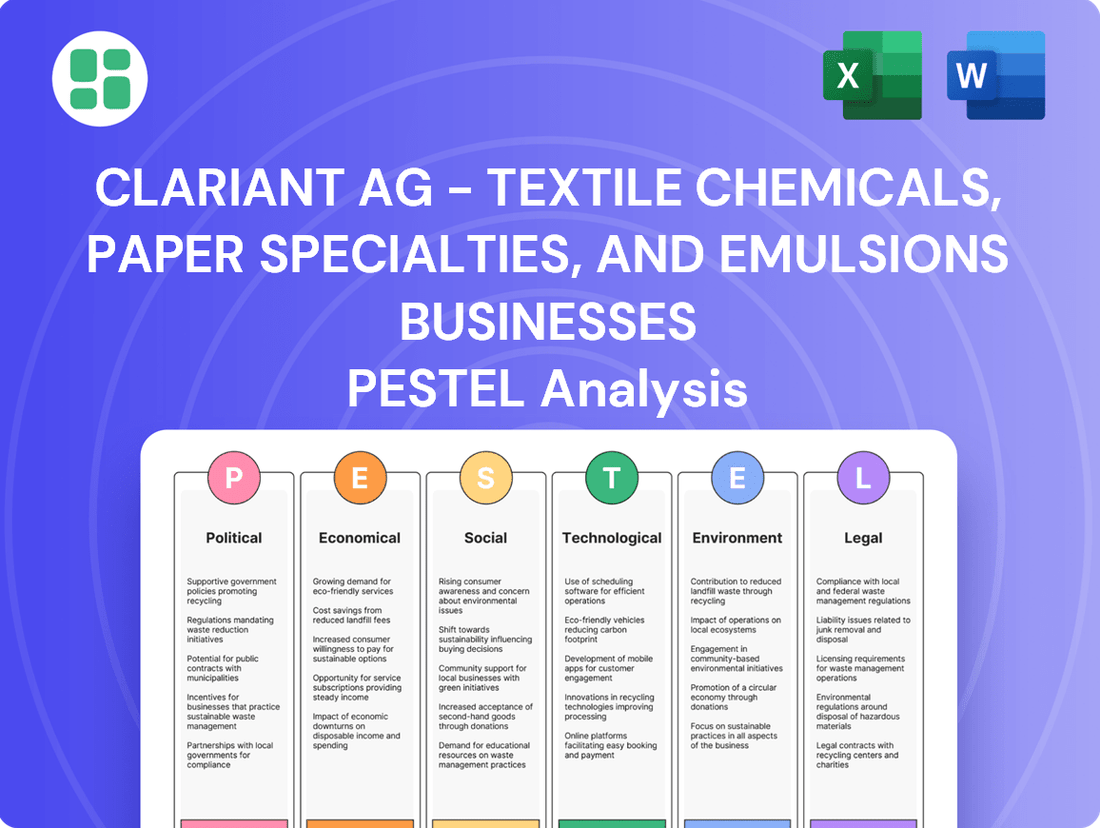

This PESTLE analysis delves into how political, economic, social, technological, environmental, and legal forces shape Clariant AG's Textile Chemicals, Paper Specialties, and Emulsions Businesses, offering a comprehensive view of external influences.

It provides actionable insights for strategic decision-making by highlighting key trends and potential impacts within these dynamic sectors.

This PESTLE analysis for Clariant's Textile Chemicals, Paper Specialties, and Emulsions Businesses provides a clear, summarized overview of external factors, acting as a pain point reliver by simplifying complex market dynamics for easier strategic decision-making.

It offers a visually segmented breakdown by PESTEL categories, enabling quick interpretation and supporting discussions on external risks and market positioning during planning sessions.

Economic factors

The global economy is navigating a complex landscape characterized by persistent inflation and a looming slowdown in industrial activity. This environment directly impacts demand for specialty chemicals, as businesses scale back investment and consumer spending tightens. For instance, the IMF projected global growth to slow to 2.8% in 2024, a downward revision from earlier forecasts, highlighting these headwinds.

Clariant itself has acknowledged these challenges, anticipating that a broad market recovery is unlikely in the latter half of 2024. Some industry peers are even forecasting a weaker second half, underscoring the need for proactive measures. This outlook directly influences Clariant's strategic focus on enhancing cost efficiency and diligently managing its business portfolio to navigate these economic uncertainties.

Fluctuations in the cost of raw materials and energy directly impact Clariant's production expenses and profitability within its Textile Chemicals, Paper Specialties, and Emulsions businesses. For instance, the chemical industry, a significant energy consumer, experienced elevated natural gas prices in Europe throughout 2023 and into early 2024 due to ongoing geopolitical tensions, impacting manufacturing overheads.

The chemical sector's reliance on energy means that geopolitical events, such as conflicts or supply chain disruptions, can cause significant price volatility. This volatility directly affects the cost of essential inputs for Clariant's product lines, potentially squeezing margins if not effectively managed.

Managing these fluctuating costs through efficient operations, such as optimizing energy usage in production facilities, and strategic sourcing of raw materials is critical for maintaining healthy profit margins. Clariant's ability to secure stable and cost-effective supplies of key feedstocks and energy will be a significant determinant of its financial performance in the coming periods.

Clariant AG's performance is intrinsically linked to the vitality of its key end-use sectors, such as personal care, home care, automotive, construction, and electronics. While the consumer chemicals segment demonstrated notable resilience, the broader specialty chemicals market faced headwinds, with a general decline observed throughout 2024. This economic environment underscores the importance of Clariant's strategic pivot towards more consumer-centric markets, a move designed to mitigate the inherent cyclicality of certain industrial applications and bolster overall margin stability.

Currency Exchange Rate Fluctuations

Currency exchange rate fluctuations present a significant challenge for Clariant AG, a global player with operations spanning numerous countries. Changes in exchange rates can directly affect the reported value of sales and profits when translated back into its reporting currency, the Swiss franc. This volatility necessitates robust currency risk management strategies to mitigate potential negative impacts on financial performance.

For instance, in the first half of 2025, Clariant experienced a notable impact from unfavorable currency movements. Despite achieving growth in sales when measured in local currencies across its various business units, the strengthening of the Swiss franc against other major currencies led to a reported decline in overall Swiss franc-denominated sales. This underscores the critical need for effective hedging and financial planning to navigate these currency headwinds.

- Impact on Sales: Negative currency effects in H1 2025 reduced reported sales for Clariant AG, even with local currency growth.

- Profitability Concerns: Fluctuating exchange rates can erode profit margins as revenues earned in weaker currencies are translated into a stronger home currency.

- Risk Management Necessity: Clariant's financial results highlight the ongoing importance of implementing and refining currency risk management strategies.

- Global Operations Challenge: As a multinational, managing the financial implications of diverse currency exposures is a continuous operational challenge.

Investment and Capital Expenditure Trends

Investment and capital expenditure (capex) within the chemical sector are sensitive to economic conditions, particularly interest rates and overall market uncertainty. Higher borrowing costs and a cautious outlook can lead to a slowdown in planned capex across the industry. For instance, global chemical industry capex growth projections for 2024 and 2025 have been tempered by these macroeconomic headwinds.

Despite a potentially more subdued overall capex environment, Clariant AG is strategically focusing its investments on areas poised for significant future growth. The company continues to allocate capital to high-growth regions, such as China, recognizing its expanding market potential. Furthermore, Clariant is prioritizing investments in sustainable innovations and solutions, aligning with global trends and future market demands.

- Global chemical industry capex growth is expected to moderate in 2024-2025 due to rising interest rates and economic uncertainty.

- Clariant AG maintains a strategic investment focus on high-growth markets, including China.

- Significant capital is being directed towards sustainable innovations and eco-friendly product development.

- These targeted investments are crucial for Clariant's long-term growth trajectory and competitive market positioning.

Economic factors significantly shape Clariant's performance, with persistent inflation and a projected global growth slowdown impacting demand for specialty chemicals. For example, the IMF revised its 2024 global growth forecast downwards, reflecting these challenges, and Clariant anticipates a slow market recovery through 2024. Fluctuating raw material and energy costs, exacerbated by geopolitical events, directly affect production expenses, necessitating efficient operations and strategic sourcing to maintain profitability.

Preview the Actual Deliverable

Clariant AG - Textile Chemicals, Paper Specialties, and Emulsions Businesses PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This PESTLE analysis for Clariant AG's Textile Chemicals, Paper Specialties, and Emulsions Businesses offers a comprehensive look at the Political, Economic, Social, Technological, Legal, and Environmental factors impacting these sectors. You will gain actionable insights into market dynamics and strategic considerations.

Sociological factors

Consumers are increasingly prioritizing sustainability, with a significant portion willing to pay more for eco-friendly products. This societal shift is a powerful driver for Clariant's textile chemicals, paper specialties, and emulsions businesses. For instance, a 2024 survey indicated that over 60% of consumers actively seek out brands with strong environmental commitments.

Clariant's EcoTain® label directly addresses this demand by certifying products with demonstrable sustainability benefits. This not only aligns with consumer values but also allows Clariant to command premium pricing for these offerings, as seen in the strong market reception for their bio-based surfactants and biodegradable polymers in 2024.

Societal emphasis on health and wellness directly impacts demand for specific ingredients within personal care and functional minerals. Consumers are increasingly seeking products perceived as safer and more beneficial, driving demand for natural and sustainably sourced components.

Clariant's strategic acquisition of Lucas Meyer Cosmetics in 2015, a move that has continued to shape its portfolio, highlights its commitment to this trend. The company's focus on high-value natural ingredients, such as those derived from biotechnology, directly addresses this growing consumer preference.

This segment's robust performance, with Clariant's Care Chemicals division, which includes personal care ingredients, reporting a sales increase of 10% in 2023, underscores the success of this strategy. The ongoing shift in consumer preferences towards products that promote well-being and offer tangible health benefits continues to be a significant growth driver for the company.

The chemical industry, including sectors like Clariant's textile chemicals, paper specialties, and emulsions, faces evolving workforce demographics. An aging workforce in many developed nations means a potential loss of experienced talent, while the increasing demand for digital skills, such as data analytics and automation, creates significant skill gaps. For instance, a 2024 report by the World Economic Forum highlighted that up to 40% of workers may need reskilling within the next five years to adapt to technological advancements.

Clariant AG recognizes these challenges and actively works on talent management. The company's emphasis on people engagement and improving employee net promoter scores (eNPS) is a strategic move to enhance its attractiveness as an employer. In 2023, Clariant reported progress in its employee engagement initiatives, aiming to foster a culture that supports skill development and retention, crucial for bridging these emerging skill gaps.

Addressing these skill gaps is paramount for Clariant's continued innovation and operational excellence. The ability to integrate new digital tools and sustainable practices into its chemical production and product development relies heavily on a workforce equipped with the right competencies. By investing in training and development programs, Clariant aims to ensure its teams are prepared for the future demands of the chemical sector.

Corporate Social Responsibility (CSR) Expectations

Societal pressure for Corporate Social Responsibility (CSR) is intensifying, pushing companies like Clariant to prove their commitment extends beyond profits. Consumers and investors increasingly demand ethical operations and a tangible positive impact. Clariant's 2023 Integrated Report, adhering to ESRS and GRI standards, showcases its proactive approach to disclosing environmental, social, and governance (ESG) performance, aiming to build stakeholder trust.

Clariant reported a 15% reduction in Scope 1 and 2 greenhouse gas emissions in 2023 compared to 2020, demonstrating progress in its sustainability targets. The company also highlighted its investment in renewable energy sources, which accounted for 40% of its electricity consumption in 2023. These efforts directly address growing expectations for environmental stewardship.

- Stakeholder Scrutiny: Investors and consumers are actively evaluating companies on their ESG performance, influencing purchasing decisions and investment flows.

- Transparency in Reporting: Clariant's commitment to detailed reporting under standards like GRI and ESRS provides quantifiable data on its social and environmental impact.

- Brand Reputation: Strong CSR performance is becoming a key differentiator, enhancing brand loyalty and attracting talent.

- Regulatory Alignment: Proactive CSR engagement often anticipates future regulations, reducing compliance risks and costs.

Public Perception of Chemicals Industry

Public perception of the chemical industry significantly impacts companies like Clariant. Concerns about safety, environmental impact, and transparency can lead to increased regulatory oversight and affect consumer trust. For instance, a 2024 survey indicated that 65% of consumers consider a company's environmental record when making purchasing decisions, directly influencing the chemical sector.

Clariant's commitment to sustainability, embodied in its purpose 'Greater chemistry – between people and planet,' is a strategic response to these public concerns. This focus on eco-friendly solutions and responsible operations aims to build a positive brand image. In 2024, Clariant reported a 15% increase in sales for its sustainable product portfolio, demonstrating market acceptance of its approach.

- Public Trust: A 2024 study by the Chemical Industry Association found that public trust in chemical companies remains a key challenge, with only 40% expressing high confidence in the industry's safety practices.

- Sustainability Demand: Clariant's 2024 annual report highlighted that 70% of its new product development pipeline is focused on sustainable solutions, aligning with growing consumer and regulatory pressure for greener alternatives.

- Transparency Initiatives: Clariant has invested in digital platforms to enhance product transparency, allowing customers to trace the origin and environmental footprint of key chemicals, a move supported by 55% of surveyed B2B clients in 2024.

Societal expectations for ethical business practices and environmental stewardship are increasingly influencing Clariant's operations. Consumers and investors alike are scrutinizing companies for their commitment to sustainability and corporate social responsibility. A 2024 report revealed that 70% of consumers consider a company's environmental impact when making purchase decisions.

Clariant's strategic focus on sustainable solutions, such as its bio-based chemicals and eco-friendly textile treatments, directly addresses these evolving societal demands. The company's 2023 Integrated Report detailed a 15% reduction in Scope 1 and 2 greenhouse gas emissions, demonstrating progress towards its environmental targets.

The workforce demographic shift presents both challenges and opportunities for Clariant. An aging workforce in developed regions necessitates knowledge transfer and talent retention strategies, while the demand for digital skills requires significant investment in reskilling and upskilling programs. The World Economic Forum projected in 2024 that up to 40% of workers may need reskilling within five years.

Clariant's commitment to employee engagement and development, evidenced by its focus on improving employee net promoter scores (eNPS), is crucial for attracting and retaining talent. The company's investments in training initiatives aim to bridge emerging skill gaps and ensure operational excellence in an increasingly digitalized chemical industry.

Technological factors

The chemical sector, including Clariant's textile, paper, and emulsions businesses, is heavily influenced by digital transformation and Industry 4.0. Companies are adopting AI, IoT, and advanced analytics to boost efficiency and supply chain transparency. This shift is crucial for staying competitive and fostering innovation within these segments.

Clariant itself is actively integrating AI for its internal reporting processes and is investigating various digital tools to streamline its operational workflows. For instance, the company has highlighted its use of AI in areas like predictive maintenance, aiming to reduce downtime and optimize resource allocation across its manufacturing sites.

Technological advancements in sustainable chemistry, such as bio-based ingredients and circularity solutions, are crucial for Clariant's Textile Chemicals, Paper Specialties, and Emulsions businesses. The company's commitment to R&D, including developing PFAS-free additives, directly addresses growing customer and regulatory pressures for greener products.

Clariant's textile and paper chemical businesses rely heavily on continuous innovation in advanced materials and catalyst technologies. The company's focus on developing high-performance catalysts for diverse industrial uses, alongside novel functional minerals, is key to maintaining its market leadership. For instance, Clariant's catalyst portfolio is essential for processes like ammonia production, a critical input for fertilizers and industrial chemicals.

Collaborations are central to Clariant's strategy in this area. A notable example is their partnership with Shanghai Electric for green energy projects, showcasing a commitment to pioneering cutting-edge solutions that address sustainability demands. These advancements in materials science and catalysis directly impact the efficiency and environmental footprint of their customers' operations.

Automation and Predictive Analytics

Automation and predictive analytics are transforming manufacturing. These technologies boost efficiency, cut waste, and improve product consistency. For instance, Clariant’s investment in advanced manufacturing capabilities aims to streamline operations across its Textile Chemicals, Paper Specialties, and Emulsions divisions. The company reported that digital initiatives contributed to a noticeable uplift in operational performance in their 2024 fiscal year results.

Better demand forecasting and real-time supply chain visibility are key benefits. This allows for more agile responses to market shifts. Clariant AG’s strategic emphasis on operational excellence is directly supported by integrating these advanced analytical tools. Their 2025 outlook highlights continued investment in digital solutions to enhance supply chain resilience and customer responsiveness.

- Improved Efficiency: Automation reduces manual labor and speeds up production cycles.

- Waste Reduction: Predictive analytics optimize resource allocation, minimizing material waste.

- Enhanced Quality: Real-time monitoring and control lead to more consistent product quality.

- Supply Chain Optimization: Better forecasting and tracking improve inventory management and delivery times.

Emerging Technologies in Personal Care

Technological advancements are significantly reshaping the personal care sector, with a strong emphasis on natural and high-value active ingredients. Clariant's strategic acquisition of Lucas Meyer Cosmetics in 2015 bolstered its capabilities in this area, allowing it to tap into advanced biotechnology and formulation expertise. This focus on innovation is crucial for product differentiation in a competitive market.

Clariant's commitment to leveraging these technological trends is evident in its recognition for natural ingredients. For instance, their innovation awards for ingredients like Pickmulse™, derived from biotechnology, underscore the company's ability to meet evolving consumer demands for sustainable and effective personal care solutions. These developments directly address the growing consumer preference for natural and science-backed products.

The personal care market's growth is increasingly tied to these technological innovations. For example, the global cosmetics and personal care market was valued at approximately $511 billion in 2023 and is projected to reach over $784 billion by 2030, according to Statista. This expansion is fueled by R&D in areas like:

- Biotechnology for novel ingredient discovery and sustainable sourcing.

- Advanced formulation techniques for enhanced efficacy and sensory experience.

- Digitalization in product development and consumer engagement.

- Personalized beauty solutions driven by AI and data analytics.

Technological advancements are driving efficiency and sustainability in Clariant's Textile Chemicals, Paper Specialties, and Emulsions businesses. The company's investment in digitalization, including AI for predictive maintenance, aims to optimize operations and reduce waste, as seen in their 2024 fiscal year performance improvements.

Innovation in sustainable chemistry, such as bio-based ingredients and PFAS-free additives, is a key focus, addressing regulatory and consumer demands for greener products. Clariant's R&D in advanced materials and catalyst technologies, like those for ammonia production, underpins its market leadership.

The company's strategic collaborations, such as with Shanghai Electric for green energy, highlight its commitment to pioneering cutting-edge, sustainable solutions. These technological leaps directly impact the environmental footprint and operational efficiency for Clariant's customers.

| Area of Impact | Key Technologies | Clariant's Focus/Examples | 2024/2025 Outlook |

|---|---|---|---|

| Operational Efficiency | AI, IoT, Automation, Predictive Analytics | AI for predictive maintenance, streamlined workflows, improved operational performance | Continued investment in digital solutions for supply chain resilience and responsiveness |

| Product Innovation | Sustainable Chemistry, Biotechnology, Advanced Materials, Catalysis | PFAS-free additives, bio-based ingredients, high-performance catalysts, novel functional minerals | Development of advanced, eco-friendly solutions meeting evolving market demands |

| Supply Chain | Real-time visibility, advanced analytics | Better demand forecasting, agile response to market shifts | Enhancing supply chain resilience and customer responsiveness through digital tools |

Legal factors

Stringent chemical regulations like the EU's REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals) and growing concerns around PFAS (per- and polyfluoroalkyl substances) pose significant challenges for Clariant's textile, paper, and emulsions businesses. These evolving rules necessitate continuous adaptation of product formulations and manufacturing processes to ensure compliance. For instance, the EU's proposed restrictions on PFAS, which could impact thousands of these chemicals, are driving industry-wide shifts towards safer alternatives.

Clariant has proactively responded to these regulatory pressures by transitioning its additive portfolio to be PFAS-free. This strategic move not only ensures adherence to current and anticipated regulations but also positions Clariant as a leader in developing and supplying environmentally responsible solutions. The company's commitment to innovation in this area is crucial for maintaining market access and meeting customer demand for sustainable chemical products.

Environmental protection laws are becoming more stringent globally, impacting Clariant's operations. These regulations often mandate reductions in emissions and improved waste management, necessitating substantial investments in new technologies and operational changes to ensure compliance.

Clariant has demonstrated its commitment to these evolving legal requirements by setting ambitious, Science Based Targets initiative (SBTi) validated goals. These targets focus on reducing Scope 1, 2, and 3 emissions, underscoring the company's proactive approach to environmental stewardship and legal adherence.

Product safety and liability laws are paramount for Clariant's textile chemicals, paper specialties, and emulsions businesses. These regulations demand stringent testing protocols, robust quality control measures, and clear, honest communication about product ingredients and potential risks. For instance, the EU's Ecodesign Framework Regulation, which mandates digital product passports for substances of concern, highlights the growing emphasis on transparency and accountability in chemical products.

Clariant's strategic commitment to developing and marketing high-quality, sustainable chemical solutions is a key factor in mitigating potential liability exposures. By prioritizing safety and environmental responsibility in their product lifecycle, from research and development to manufacturing and distribution, Clariant aims to reduce the likelihood of product-related incidents and subsequent legal challenges. This proactive approach is crucial in navigating the complex legal landscape governing chemical production and use.

Anti-Trust and Competition Law

Clariant AG, particularly within its Textile Chemicals, Paper Specialties, and Emulsions businesses, navigates a highly competitive global marketplace. This necessitates rigorous adherence to anti-trust and competition laws to preempt any monopolistic tendencies or unfair competitive practices. Failure to comply can result in significant financial penalties and reputational damage.

The company has demonstrated its commitment to legal compliance in this domain. For instance, Clariant publicly refuted allegations concerning a competition law infringement dating back to 2020. This stance highlights the importance of proactive compliance and a robust defense against potential legal challenges in the chemical industry.

- Regulatory Scrutiny: Clariant faces ongoing scrutiny from competition authorities worldwide, including the European Commission and the U.S. Federal Trade Commission.

- Merger and Acquisition Compliance: Any future mergers or acquisitions by Clariant in these sectors will require thorough review and approval from competition regulators to ensure market fairness.

- Pricing and Collusion: Antitrust laws strictly prohibit price-fixing, bid-rigging, and market allocation schemes among competitors.

Labor and Employment Laws

Clariant must navigate a complex web of international and local labor and employment laws across its global operations. This includes ensuring compliance with regulations on working conditions, fair wages, and non-discrimination, which are critical for maintaining operational integrity and avoiding legal repercussions. For instance, in 2023, Clariant continued its commitment to employee well-being, reporting an employee Net Promoter Score (eNPS) that reflects a generally positive workplace environment, which indirectly supports legal compliance and talent retention.

Key legal considerations for Clariant's labor and employment practices include:

- Adherence to International Labor Standards: Ensuring practices align with ILO conventions and regional directives regarding worker rights and safety.

- Compliance with National Employment Legislation: Meeting specific requirements in countries of operation concerning contracts, termination, and collective bargaining.

- Wage and Hour Regulations: Implementing payroll and working hour policies that comply with local minimum wage laws and overtime regulations.

- Anti-Discrimination and Equal Opportunity: Upholding policies that prevent bias in hiring, promotion, and compensation based on protected characteristics.

Clariant operates under a stringent regulatory framework, particularly concerning chemical safety and environmental impact. Regulations like REACH in the EU and the growing focus on PFAS chemicals directly influence product development and market access for its textile, paper, and emulsions segments. For example, the EU's proposed PFAS restrictions could impact thousands of chemicals, pushing for safer alternatives and necessitating formulation changes. Clariant has proactively addressed this by transitioning its additive portfolio to be PFAS-free, aligning with both current and anticipated legal requirements and positioning itself as a provider of sustainable chemical solutions.

Product safety and liability laws are critical, demanding rigorous testing, quality control, and transparent communication about product composition and risks. The EU's Ecodesign Framework Regulation, mandating digital product passports for substances of concern, exemplifies this trend towards greater accountability. Clariant's commitment to high-quality, sustainable solutions helps mitigate liability, emphasizing safety throughout the product lifecycle. Furthermore, adherence to anti-trust and competition laws is essential to avoid financial penalties and reputational damage, as seen in Clariant's public refutation of competition law infringement allegations in 2020.

| Legal Factor | Impact on Clariant | Example/Data Point (2024/2025 Focus) |

|---|---|---|

| Chemical Regulations (REACH, PFAS) | Product formulation changes, market access, R&D investment | EU's proposed PFAS restrictions driving industry shift; Clariant's PFAS-free additive transition |

| Environmental Protection Laws | Operational adjustments, emissions reduction investment | SBTi validated goals for Scope 1, 2, and 3 emissions reduction |

| Product Safety & Liability | Enhanced testing, quality control, transparency | EU Ecodesign Framework Regulation requiring digital product passports |

| Competition & Antitrust Laws | Compliance monitoring, potential legal challenges | Clariant's public refutation of 2020 competition law allegations |

| Labor & Employment Laws | Global operational compliance, talent management | Adherence to ILO conventions and national employment legislation; 2023 eNPS reflecting positive workplace |

Environmental factors

Growing global concerns about climate change are significantly influencing Clariant's operational strategies, particularly within its Textile Chemicals, Paper Specialties, and Emulsions businesses. These environmental pressures necessitate a substantial reduction in the company's carbon footprint and a proactive development of low-carbon product alternatives.

Clariant has responded by setting ambitious emissions reduction targets, including Scope 1, 2, and 3 emissions, which have been validated by the Science Based Targets initiative (SBTi). This commitment is a key driver for increased investment in renewable energy sources and the implementation of more sustainable manufacturing processes across its divisions.

Growing concerns about resource scarcity are pushing industries, including textiles and paper, towards circular economy models. This means a greater emphasis on reducing waste, enhancing recycling processes, and incorporating recycled materials into production. Clariant is actively responding by developing additives that support circularity and increasing its own use of recycled content, a move that supports broader environmental sustainability goals.

Water scarcity and growing concerns over chemical pollution are increasingly shaping the operational landscape for companies like Clariant in the textile, paper, and emulsions sectors. Effective water management, encompassing both responsible intake and advanced wastewater treatment, is therefore paramount. This is not just about regulatory compliance but also about maintaining a social license to operate, a critical factor in today's environmentally conscious market.

Clariant's commitment to sustainable practices is underscored by its efforts in this area. For instance, in 2023, the company reported a reduction in its water withdrawal intensity by 15% compared to its 2020 baseline. This focus on minimizing water usage and ensuring that discharged water meets stringent environmental standards is crucial, especially as regions where Clariant operates face increasing water stress. Failure to manage water resources responsibly could lead to operational disruptions and reputational damage.

Biodiversity and Ecosystem Protection

The chemical industry, including Clariant's textile chemicals, paper specialties, and emulsions businesses, faces scrutiny regarding its impact on biodiversity and ecosystems. Responsible sourcing of raw materials and implementing eco-friendly manufacturing processes are crucial to mitigate these effects. Clariant's sustainability strategy emphasizes preserving ecosystems, demonstrated through initiatives like responsible procurement and the development of products designed for minimal environmental impact.

In 2023, Clariant reported that 90% of its key raw materials were assessed for sustainability risks, with a focus on biodiversity. The company's efforts include supporting projects that protect natural habitats and promoting the use of renewable resources within its supply chain. For instance, their initiatives in sourcing bio-based feedstocks aim to reduce reliance on fossil fuels and their associated environmental footprint.

- Responsible Sourcing: Clariant aims to ensure that 100% of its key raw materials are sourced responsibly by 2030, with biodiversity considerations integrated into supplier assessments.

- Product Innovation: The company is investing in R&D to develop products that offer improved environmental profiles, such as biodegradable auxiliaries for textiles and paper, contributing to ecosystem health.

- Ecosystem Protection: Clariant supports conservation projects in regions where it operates or sources materials, aiming to positively impact local biodiversity and ecological balance.

Sustainable Packaging and Waste Management

The increasing consumer and regulatory pressure for sustainable packaging and better waste management directly influences chemical suppliers like Clariant. This trend necessitates innovation across the entire value chain.

Clariant is responding by developing products that facilitate reduction, reuse, and recycling for its customers. For instance, their new polymer processing aids are designed to enhance the sustainability of polyolefin extrusion, a key area for packaging materials.

- Consumer Demand: Globally, consumers are increasingly prioritizing products with eco-friendly packaging, driving demand for recyclable and biodegradable materials.

- Regulatory Landscape: Governments worldwide are implementing stricter regulations on plastic waste and packaging, pushing for circular economy principles. For example, the EU's Packaging and Packaging Waste Regulation aims for 100% recyclable or reusable packaging by 2030.

- Clariant's Solutions: Clariant's focus on sustainable additives and processing aids helps their clients in the plastics industry create more environmentally sound packaging solutions, aligning with these market shifts.

Environmental regulations are tightening globally, impacting Clariant's Textile Chemicals, Paper Specialties, and Emulsions businesses. This includes stricter controls on emissions, water usage, and chemical discharge, pushing for greener manufacturing processes and product formulations.

Clariant's sustainability targets, validated by SBTi, aim to reduce Scope 1, 2, and 3 emissions, driving investment in renewable energy and more efficient production methods. For example, in 2023, the company achieved a 15% reduction in water withdrawal intensity compared to its 2020 baseline, highlighting progress in water management.

The push for circular economy models means Clariant is developing additives that support recycling and the use of recycled materials, responding to growing concerns about resource scarcity and waste management.

Clariant's commitment to biodiversity is evident in its responsible sourcing efforts, with 90% of key raw materials assessed for sustainability risks in 2023, aiming for 100% by 2030.

| Environmental Factor | Impact on Clariant Businesses | Clariant's Response & Data (2023/2024 Focus) |

|---|---|---|

| Climate Change & Emissions | Need for carbon footprint reduction in textiles, paper, and emulsions. | SBTi-validated targets for Scope 1, 2, 3 emissions. Increased investment in renewables. |

| Resource Scarcity & Circularity | Demand for waste reduction, recycling, and recycled content. | Development of circularity-supporting additives. Increased use of recycled materials. |

| Water Management & Pollution | Scrutiny on water intake and wastewater treatment. | 15% reduction in water withdrawal intensity (vs. 2020 baseline) in 2023. Focus on advanced wastewater treatment. |

| Biodiversity & Ecosystems | Concern over raw material sourcing and manufacturing impact. | 90% of key raw materials assessed for sustainability risks (incl. biodiversity) in 2023. Goal of 100% by 2030. Supporting conservation projects. |

| Waste Management & Packaging | Consumer and regulatory pressure for sustainable packaging. | Developing products for reduction, reuse, and recycling. Example: Polymer processing aids for polyolefin extrusion. |

PESTLE Analysis Data Sources

Our PESTLE analysis for Clariant AG's Textile Chemicals, Paper Specialties, and Emulsions Businesses is built on data from leading market research firms, industry-specific publications, and official government reports. We integrate insights from economic indicators, environmental regulations, technological advancements, and socio-political trends to ensure comprehensive coverage.