Civista Bank SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Civista Bank Bundle

Civista Bank's current SWOT analysis highlights its strong community ties and customer loyalty as key strengths, but also points to potential challenges in adapting to rapid technological shifts and increasing competition from digital-first banks. Understanding these dynamics is crucial for anyone looking to invest or strategize within the regional banking sector.

Want the full story behind Civista Bank's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Civista Bank's strength lies in its community-centric relationship banking, a tradition dating back to 1884. This deep-rooted commitment to local communities across Ohio, Southeastern Indiana, and Northern Kentucky fosters strong customer relationships and tailored financial solutions.

This focus on personalized service and local needs sets Civista apart from larger, less personal financial institutions. It cultivates trust and loyalty, which translates into organic deposit growth and a stable, dependable client base.

Civista Bank's strength lies in its extensive financial services portfolio, encompassing everything from basic checking and savings accounts to specialized commercial lending and wealth management. This comprehensive approach allows them to serve a broad customer base, from individuals seeking mortgages to businesses requiring equipment financing nationwide through their Civista Leasing and Finance Division.

This wide range of offerings, including diverse deposit products and various loan types, positions Civista to capitalize on cross-selling opportunities and build deeper customer relationships. For instance, a business client securing commercial lending might also be a prospect for wealth management services, thereby diversifying revenue streams and increasing client stickiness.

Civista Bank's credit quality remains a significant strength, evidenced by consistently low delinquency and charge-off rates. In 2024, the bank maintained a healthy allowance for loan losses relative to its total loans, underscoring a prudent approach to risk management.

The bank's proactive asset management is also a key advantage. Throughout 2024, Civista Bank experienced notable growth across its loan segments, including commercial loans, non-owner occupied commercial real estate, residential real estate, and real estate construction loans. This expansion, coupled with disciplined underwriting, bolsters financial stability and mitigates risk, even amidst fluctuating interest rates.

Strategic Growth Initiatives and Capital Position

Civista Bancshares is actively driving growth through strategic initiatives like digital transformation and investing in its talent. The bank is also focused on expanding its deposit base by fostering strong customer relationships. This proactive approach is designed to build a more robust and competitive financial institution.

A key element of this strategy is the recent acquisition of The Farmers Savings Bank, a move expected to bolster Civista's presence in Northeast Ohio. This acquisition is anticipated to bring in valuable low-cost deposits and increase lending capacity, directly supporting the bank's expansion goals. The deal is expected to close in the first half of 2024.

Furthermore, Civista recently completed a common equity capital raise, significantly strengthening its financial foundation. This capital infusion provides the necessary resources to underwrite planned expansion efforts and fuel organic growth initiatives throughout 2024 and beyond.

- Strategic Focus: Digital transformation, talent development, and deposit base expansion.

- Acquisition: The Farmers Savings Bank acquisition to enhance Ohio presence and deposit funding.

- Capital Strength: Recent common equity raise bolsters capital for growth initiatives.

- 2024 Outlook: Initiatives are positioned to support planned expansion and organic growth.

Improved Financial Performance and Efficiency

Civista Bank has demonstrated a robust improvement in its financial performance and operational efficiency. In the first half of 2025, the bank reported significant gains in net income and earnings per share when compared to the same period in 2024, alongside an expansion of its net interest margin. This upward financial trajectory is further supported by a concerted effort in expense management, which has successfully lowered the bank's efficiency ratio.

These positive financial indicators are complemented by a strategic reduction in reliance on wholesale funding, driven by successful deposit growth initiatives. This shift not only strengthens the bank's funding profile but also underscores effective operational management. The commitment to enhancing shareholder value is evident in the increased quarterly dividends paid out, reflecting confidence in sustained profitability and operational strength.

- Increased Net Income and EPS: Q1 and Q2 2025 saw notable year-over-year growth in these key profitability metrics.

- Improved Net Interest Margin: Indicating better profitability on its lending activities.

- Enhanced Efficiency Ratio: Resulting from successful expense management strategies.

- Reduced Wholesale Funding Reliance: Achieved through strong deposit growth, bolstering financial stability.

Civista Bank’s community-focused approach, a cornerstone since 1884, cultivates deep customer loyalty and allows for tailored financial solutions across Ohio, Southeastern Indiana, and Northern Kentucky. This personalized service fosters organic deposit growth and a stable client base, differentiating it from larger institutions.

The bank offers a comprehensive suite of financial services, from everyday banking to specialized commercial lending and wealth management, serving a diverse clientele nationwide through its Leasing and Finance Division. This broad product range facilitates cross-selling opportunities, enhancing client relationships and revenue diversification.

Civista Bank maintains strong credit quality, characterized by consistently low delinquency and charge-off rates, supported by a prudent allowance for loan losses. In the first half of 2025, the bank reported a significant increase in net income and earnings per share compared to 2024, coupled with an expanding net interest margin and a lower efficiency ratio due to effective expense management.

| Metric | 2024 (Approx.) | H1 2025 (Actual) |

|---|---|---|

| Net Income Growth (YoY) | Stable | Significant Increase |

| Net Interest Margin | Healthy | Expanding |

| Efficiency Ratio | Competitive | Lowered |

| Deposit Growth | Positive | Strong |

What is included in the product

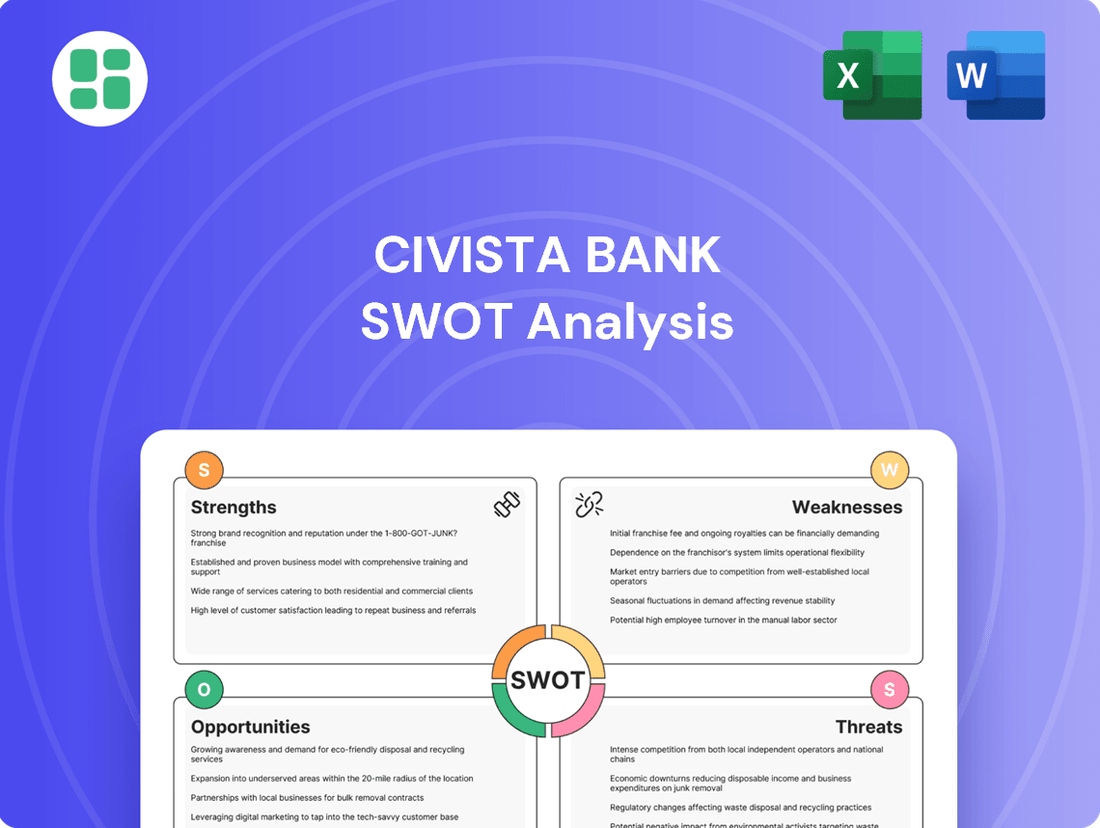

Delivers a strategic overview of Civista Bank’s internal and external business factors, identifying key strengths, weaknesses, opportunities, and threats to inform its competitive positioning.

Provides a clear, actionable framework for Civista Bank to identify and leverage its competitive advantages while mitigating potential threats.

Weaknesses

Civista Bank's geographic concentration, with 42 branches primarily in Ohio, Southeastern Indiana, and Northern Kentucky, presents a significant weakness. This limited operational footprint makes the bank particularly vulnerable to localized economic downturns. For instance, a significant slowdown in manufacturing in Ohio, a key sector for the region, could disproportionately affect Civista's loan portfolio and deposit base compared to a bank with a national presence.

Civista Bank's profitability is sensitive to interest rate changes. Despite efforts to manage funding costs, the bank's net interest margin (NIM) felt pressure from elevated rates and heightened competition for deposits throughout 2023 and into early 2024. This trend, where customers move funds to higher-yielding accounts, directly impacts the bank's ability to maintain strong margins.

While Civista Bank anticipates a positive trend for its NIM in 2025, the inherent volatility of the interest rate environment remains a significant weakness. Unexpected shifts in rates could negatively affect net interest income, creating ongoing uncertainty for financial planning and performance. For instance, if rates were to rise unexpectedly again in late 2024 or 2025, it could again increase funding costs more rapidly than asset yields adjust.

Civista Bank contends with formidable competition from larger national banks that leverage extensive resources, diverse product portfolios, and often more attractive interest rates. For instance, as of Q1 2024, the top five U.S. banks held over $10 trillion in assets, dwarfing Civista's scale.

The burgeoning fintech sector also poses a significant challenge, with companies like Chime and SoFi offering innovative digital platforms and user-friendly services that appeal to a growing segment of digitally-native consumers. These agile competitors frequently introduce cutting-edge features, making it difficult for traditional banks like Civista to keep pace with evolving customer expectations for seamless, tech-driven banking experiences.

Potential Operational Inefficiencies and Technology Lag

While Civista Bank is actively investing in digital transformation, community banks, including Civista, can grapple with operational inefficiencies stemming from legacy systems and manual workflows. Keeping pace with rapid technological advancements and evolving customer expectations for seamless digital interactions demands significant and continuous capital outlay. For instance, in 2023, the banking sector saw a substantial increase in IT spending, with many institutions allocating over 15% of their operating budget to technology upgrades to combat such lags.

Delays in the complete implementation and integration of modern banking platforms can lead to slower operational speeds, elevated costs, and a potentially compromised customer experience when contrasted with nimbler, more technologically adept competitors. This lag can manifest in several key areas:

- Slower transaction processing times compared to fintechs with fully integrated digital infrastructure.

- Higher operational costs due to the need for manual workarounds or maintaining older, less efficient systems.

- Potential for data silos hindering a unified view of customer interactions and operational performance.

- Increased vulnerability to cybersecurity threats if legacy systems are not adequately updated or secured.

Lower Brand Recognition Outside Core Markets

Civista Bank's status as a regional community bank inherently limits its brand recognition outside its core markets of Ohio, Indiana, and Kentucky. This can present a hurdle when considering expansion into new, non-contiguous territories or when trying to attract customers who prefer the familiarity of larger, nationally recognized banks. For instance, as of the first quarter of 2024, Civista reported total assets of $3.5 billion, a scale that, while significant regionally, doesn't carry the same widespread name recognition as institutions with hundreds of billions in assets.

Building substantial brand awareness and fostering trust in unfamiliar geographic areas demands considerable marketing expenditure and a prolonged period. This investment requirement could potentially slow down or impede rapid growth initiatives beyond Civista's current operational footprint. The challenge lies in overcoming the inertia of established competitor brands and effectively communicating Civista's value proposition to a new audience.

This limited brand recognition can translate into higher customer acquisition costs in new markets compared to existing ones. Potential customers in unserved regions may not be aware of Civista's offerings or may require more convincing to switch from their current financial providers. This necessitates a strategic approach to marketing and community engagement to build the necessary trust and visibility.

The reliance on local market presence means that Civista's growth trajectory is closely tied to the economic health and competitive landscape of Ohio, Indiana, and Kentucky. Diversifying its brand reach is crucial for mitigating risks associated with regional economic downturns or increased competition within its established territories.

Civista Bank's concentrated geographic footprint, with a strong presence in Ohio, Indiana, and Kentucky, makes it susceptible to regional economic fluctuations. A downturn in these specific areas could disproportionately impact its financial performance. For example, a significant slowdown in manufacturing, a key sector in Ohio, could directly affect Civista's loan portfolio and deposit base, unlike a bank with a wider national reach.

What You See Is What You Get

Civista Bank SWOT Analysis

This is the actual Civista Bank SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. It provides a comprehensive overview of the bank's internal strengths and weaknesses, as well as external opportunities and threats. This detailed report is designed to offer actionable insights for strategic planning.

Opportunities

Civista Bank has a prime opportunity to deepen its investment in digital transformation, particularly in areas like real-time fraud detection and process automation. These advancements are key to elevating the customer experience and boosting operational efficiency. For instance, the recent launch of Mantle, a new digital deposit account system, demonstrates a strategic move to capture a broader online customer base, extending reach beyond physical branches.

By embracing cutting-edge technologies such as artificial intelligence and automation, Civista Bank can significantly streamline its internal processes. This not only reduces the likelihood of manual errors but also promises to enhance customer interactions, thereby strengthening its competitive standing in the rapidly changing financial sector. In 2024, the banking industry saw continued growth in digital adoption, with reports indicating that over 70% of consumers now prefer digital channels for routine banking tasks, a trend Civista Bank is well-positioned to capitalize on.

The banking sector, especially among regional players, is experiencing a surge in mergers and acquisitions. This trend offers Civista a prime opportunity to grow its market share and asset base. For instance, the FDIC reported that M&A activity in the banking sector saw a notable increase in 2023 compared to previous years, with several deals involving regional banks.

Civista's recent acquisition of The Farmers Savings Bank exemplifies this strategic growth. This move not only added valuable branches and a stable base of low-cost deposits but also enhanced its lending capabilities. Such consolidations are crucial for regional banks aiming for greater scale and broader geographic presence.

By pursuing further acquisitions of smaller banks, Civista can achieve significant economies of scale, diversify its operational footprint, and solidify its market position. This strategy is particularly timely given discussions around potential regulatory adjustments that could favor larger, more consolidated regional banking entities.

Civista Bank is well-positioned to benefit from a shifting interest rate landscape. With the Federal Reserve indicating potential rate cuts in 2025 and a steeper yield curve, the bank's net interest margin is likely to expand further. This scenario is particularly advantageous for regional banks that can leverage their deposit base effectively.

The banking sector is also observing positive trends in loan demand. Projections suggest mid-single-digit loan growth for the remainder of fiscal year 2025, with an acceleration to high-single-digit expansion anticipated in 2026. This burgeoning loan activity provides a significant avenue for growth.

Furthermore, the strategic deployment of liquidity resulting from recent acquisitions presents a prime opportunity for Civista Bank. This influx of capital, combined with the favorable interest rate environment and growing loan demand, creates a potent combination for enhanced lending operations and improved profitability in the coming years.

Deepening Customer Relationships through Cross-Selling

Civista Bank's focus on fostering robust customer relationships presents a prime opportunity to expand its product offerings through cross-selling. By leveraging its understanding of individual and business client needs, the bank can effectively introduce services like wealth management, commercial equipment financing, or tailored business loans.

This approach not only boosts revenue per customer and customer loyalty but also optimizes marketing spend by reducing the need for new client acquisition. For instance, a business client utilizing commercial loans might be an ideal candidate for treasury management services, increasing the overall value of the relationship.

- Increased Revenue Per Customer: Cross-selling can significantly lift the average revenue generated from each existing client.

- Enhanced Customer Retention: Offering a wider suite of relevant products makes it harder for customers to leave for competitors.

- Reduced Customer Acquisition Costs: It's generally more cost-effective to sell more to existing customers than to acquire new ones.

- Deeper Customer Insights: As more products are utilized, the bank gains a more comprehensive view of customer behavior, enabling even more targeted cross-selling.

Expansion into Adjacent Markets and Niche Services

Civista Bank can leverage its community banking strengths by expanding into neighboring regions or focusing on specific underserved market segments. The acquisition of The Farmers Savings Bank in late 2023, for instance, broadened its operational reach into Northeast Ohio, indicating a strategic move towards geographic diversification.

This expansion strategy can be further enhanced by identifying niche services or specialized lending opportunities where community banks typically excel, such as small business financing. By targeting these areas, Civista can grow its market share effectively while staying true to its community-centric model.

- Geographic Expansion: Building on the Farmers Savings Bank acquisition, Civista can explore other adjacent communities with similar demographic profiles and economic needs.

- Niche Market Focus: Identifying and catering to specific underserved sectors, like agricultural lending or specialized small business loans, offers a pathway to increased market penetration.

- Community Banking Model Advantage: Civista's established reputation for personalized service and local understanding provides a competitive edge in new community-focused markets.

Civista Bank has a significant opportunity to capitalize on the growing trend of mergers and acquisitions within the regional banking sector. By strategically acquiring smaller institutions, Civista can expand its market share, increase its asset base, and achieve greater economies of scale. The FDIC's 2023 data indicated a rise in such M&A activities, highlighting a favorable environment for consolidation.

The bank can also leverage its digital transformation initiatives to attract a wider customer base and improve operational efficiency. With over 70% of consumers preferring digital channels for banking in 2024, enhancing online services, like the new Mantle digital deposit account system, is crucial for growth. Furthermore, a favorable interest rate environment, with potential Fed rate cuts anticipated in 2025, offers a chance to expand net interest margins.

Civista's strength in fostering customer relationships presents a prime opportunity for cross-selling additional financial products, thereby increasing revenue per customer and enhancing loyalty. Expanding into neighboring regions, building on the successful acquisition of The Farmers Savings Bank, also offers a clear path for geographic diversification and capturing new market segments.

| Opportunity Area | Key Driver | Potential Impact | Supporting Data/Trend |

|---|---|---|---|

| M&A Activity | Industry Consolidation | Market Share Growth, Economies of Scale | Increased M&A in regional banking sector (FDIC, 2023) |

| Digital Transformation | Customer Preference for Digital Channels | Expanded Customer Base, Operational Efficiency | >70% of consumers prefer digital banking (2024) |

| Interest Rate Environment | Potential Fed Rate Cuts (2025) | Expanded Net Interest Margins | Steeper yield curve projections |

| Cross-Selling | Strong Customer Relationships | Increased Revenue Per Customer, Customer Loyalty | Optimized marketing spend |

| Geographic Expansion | Community Banking Model | Market Diversification, New Segment Capture | Farmers Savings Bank acquisition (late 2023) into Northeast Ohio |

Threats

Economic downturns pose a significant threat to Civista Bank. Recessions can elevate credit risks, especially within commercial real estate and consumer loan portfolios, leading to higher delinquency rates. For instance, as of Q1 2024, the Federal Reserve's stress tests indicated that a severe recession could lead to a substantial increase in non-performing loans across the banking sector.

While Civista has historically demonstrated robust credit quality, widespread economic instability and tighter lending criteria could dampen loan demand. This environment might also result in increased loan charge-offs, potentially necessitating larger provisions for loan losses. Such a scenario could indeed put pressure on Civista's earnings growth trajectory.

The competition for customer deposits is intensifying, with larger banks frequently leveraging their scale to offer more appealing interest rates. This dynamic pressures smaller institutions like Civista, potentially leading to deposit outflows. For instance, in the first quarter of 2024, the average interest rate on interest-bearing deposits for community banks saw an uptick, reflecting this broader trend.

Civista has directly felt this pressure, experiencing a noticeable increase in its deposit costs. Furthermore, there's been a strategic shift from cheaper non-interest-bearing deposits to more expensive interest-bearing accounts, which directly impacts the bank's net interest margin. This cost of funds is a critical factor for profitability.

Navigating this environment requires a delicate balance. Civista must remain competitive with its deposit rates to retain and attract funds, ensuring sufficient liquidity. Simultaneously, managing these rising funding costs is paramount, especially if interest rates remain high or fluctuate unpredictably, to sustain loan growth and overall financial health.

Civista Bank, like all financial institutions, faces significant cybersecurity and data privacy risks. The threat of cyberattacks is a constant concern, especially given the sensitive customer data it handles. In 2024, the financial services sector continued to see escalating cyber threats, with the average cost of a data breach reported to be in the millions of dollars, impacting institutions of all sizes.

A successful breach could result in substantial financial losses for Civista Bank, including recovery costs and potential regulatory fines. Beyond the immediate financial impact, the reputational damage from a data privacy incident can be severe, eroding customer trust. Maintaining state-of-the-art cybersecurity defenses is therefore a critical and ongoing operational necessity.

Regulatory Changes and Compliance Costs

Civista Bank, like all financial institutions, faces significant threats from evolving regulatory landscapes. Changes in policies, such as those affecting overdraft fees, have already impacted non-interest income streams. For instance, the Consumer Financial Protection Bureau's (CFPB) ongoing scrutiny of overdraft fees, which intensified in 2023 and continued into 2024, has pressured banks to reduce or eliminate certain fee structures, directly impacting revenue.

Future regulatory shifts, particularly concerning capital requirements, consumer protection, and data security, could necessitate substantial investments. For example, potential increases in capital adequacy ratios, driven by global regulatory bodies like the Basel Committee on Banking Supervision, could require banks to hold more capital, potentially limiting lending capacity or affecting return on equity. The cost of implementing and maintaining compliance with new data privacy regulations, such as those mirroring GDPR or CCPA, also represents a significant operational burden and financial outlay.

- Increased Compliance Costs: Banks must allocate resources to understand, implement, and monitor new regulations, leading to higher operational expenses.

- Impact on Fee Income: Regulatory actions targeting specific fee structures, like overdraft fees, can directly reduce a bank's non-interest income.

- Capital Requirement Adjustments: Changes in capital adequacy ratios could necessitate holding more capital, potentially affecting profitability and lending strategies.

- Data Security and Privacy Investments: Adhering to stricter data protection laws requires ongoing investment in technology and personnel.

Disruption from Financial Technology (FinTech) Innovations

The relentless evolution of financial technology presents a significant challenge to established banking institutions like Civista. Fintech firms are agile, often unburdened by legacy systems, allowing them to quickly deploy innovative digital solutions that cater to modern consumer preferences. These specialized services, particularly in areas like peer-to-peer lending and streamlined payment processing, can siphon off profitable segments of the market. For instance, the global digital payments market was projected to reach over $3.6 trillion in 2024, a testament to the rapid growth and adoption of fintech-driven solutions.

Civista's ongoing investments in digital transformation are crucial, but the speed at which fintech companies can iterate and capture market share, especially among younger, tech-forward demographics, necessitates a proactive and adaptive strategy. Failing to keep pace with these advancements, such as integrating advanced AI for personalized customer experiences or offering seamless digital onboarding processes, risks a gradual erosion of Civista's competitive edge and customer base. The bank must not only invest but also foster a culture of continuous innovation to counter the disruptive potential of fintech.

Key areas of fintech disruption impacting traditional banks include:

- Digital Payments: Fintech solutions offer faster, cheaper, and more convenient payment methods, challenging traditional card networks and bank transfers.

- Online Lending: P2P lending platforms and digital lenders provide quicker access to credit, often with more flexible terms than traditional banks.

- Neobanks: Digital-only banks attract customers with low fees, intuitive mobile apps, and innovative features, directly competing for deposits and transactional business.

- WealthTech: Robo-advisors and digital investment platforms democratize access to investment management, posing a threat to traditional wealth management services.

The intensifying competition for customer deposits, driven by larger banks offering more attractive rates, poses a significant threat to Civista Bank's funding costs and net interest margin. This dynamic pressures smaller institutions to increase their own deposit rates, impacting profitability.

Civista Bank faces substantial cybersecurity and data privacy risks, with cyberattacks a constant concern due to the sensitive customer data handled. A breach could lead to significant financial losses, recovery costs, regulatory fines, and severe reputational damage, eroding customer trust.

Evolving regulatory landscapes, including potential changes to capital requirements and consumer protection laws, necessitate ongoing investments and can impact fee income and lending capacity. For instance, increased scrutiny on overdraft fees has already affected non-interest income streams for many banks.

The rapid advancement of financial technology (fintech) presents a challenge as agile firms offer innovative digital solutions, potentially siphoning off profitable market segments like digital payments and online lending, requiring Civista to adapt quickly.

SWOT Analysis Data Sources

This Civista Bank SWOT analysis is built upon a foundation of comprehensive data, including the bank's official financial statements, recent market research reports, and expert industry commentary to provide a robust and insightful assessment.