Citribel PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Citribel Bundle

Uncover the critical political, economic, social, technological, legal, and environmental factors shaping Citribel's landscape. This PESTLE analysis provides the essential intelligence to anticipate market shifts and identify strategic opportunities. Download the full report to gain a competitive edge and make informed decisions for Citribel's future.

Political factors

Government regulations are a significant political factor for Citrique Belge. Fluctuations in global and regional food safety, pharmaceutical manufacturing, and chemical production rules directly influence the company's ability to comply with standards and access markets. For instance, stricter enforcement of food additive regulations in the EU, a key market for Citrique Belge, could necessitate costly adjustments to production processes.

Changes in import/export tariffs and trade agreements also play a crucial role. In 2024, ongoing trade negotiations and potential tariff adjustments between major economic blocs, such as the EU and the United States, could impact the cost-competitiveness and distribution of citric acid and citrate salts, affecting Citrique Belge's international sales.

Geopolitical stability is a significant concern for Citribel, impacting its sourcing and sales. For instance, the ongoing political tensions in Eastern Europe in 2024 could disrupt the supply of key agricultural inputs, potentially increasing costs. Similarly, shifts in government stability in major citrus-producing nations, such as Brazil, can lead to unpredictable harvest yields and export availability.

International trade policies present both challenges and opportunities. The implementation of new tariffs or trade agreements in 2024, like potential adjustments to the EU's Common Agricultural Policy, could directly affect Citribel's import costs for raw materials or its export competitiveness in key markets. Conversely, the formation of new trade blocs could open up previously inaccessible markets for its processed citrus products.

Government industrial policies and subsidies significantly shape the operational landscape for companies like Citrique Belge. For instance, the European Union's commitment to a green transition, with substantial funding allocated to sustainable agriculture and bio-based industries through programs like the Common Agricultural Policy (CAP) and the EU Innovation Fund, could offer direct financial advantages for citric acid producers investing in greener production methods or renewable energy sources. Conversely, potential increases in carbon taxes or stricter environmental regulations on industrial emissions, as discussed in the context of the EU's Fit for 55 package, could escalate operational costs for Citrique Belge if it relies on energy-intensive processes.

Public Health Policies

Public health policies directly impact Citribel's market. For instance, increased scrutiny and regulation of food additives, preservatives, and pharmaceutical ingredients by bodies like the FDA or EFSA can shift consumer preferences and manufacturer choices away from certain chemical compounds. This trend, observed globally, could favor naturally derived ingredients like citric acid, potentially boosting demand for Citrique Belge's offerings.

Governmental stances on synthetic versus natural ingredients are also critical. As of early 2025, several countries are actively reviewing or have implemented stricter labeling requirements for artificial ingredients, pushing manufacturers towards cleaner labels. This regulatory push, coupled with evolving dietary guidelines that often promote natural components, can significantly alter market requirements for citric acid, making it a more attractive alternative.

- Regulatory Scrutiny: Increased government oversight on food additives and preservatives, as seen in ongoing reviews by the European Food Safety Authority (EFSA) in 2024, can directly influence Citribel's product demand.

- Natural Ingredient Trend: Shifting dietary guidelines and consumer demand for ‘clean label’ products, supported by policy initiatives encouraging natural alternatives, favor citric acid.

- Global Policy Alignment: Harmonization or divergence of public health policies across major markets like the US and EU in 2024-2025 regarding ingredient safety and origin will shape Citribel's operational landscape.

International Relations and Sanctions

Citrique Belge's international relations and the potential for economic sanctions significantly shape its operational landscape. Diplomatic shifts and trade restrictions can directly impact market access, potentially disrupting sales channels in countries subjected to sanctions. For instance, the ongoing geopolitical tensions in Eastern Europe, which led to widespread sanctions against Russia in 2022, could influence global trade flows for citric acid and its derivatives, impacting companies like Citrique Belge that operate internationally.

The imposition of sanctions necessitates careful navigation of global supply chains. Citrique Belge might need to re-evaluate its sourcing and distribution networks to ensure compliance with evolving international regulations. This could involve identifying alternative suppliers or markets, potentially increasing logistical costs and complexity. The global trade in food ingredients, including citric acid, is often sensitive to such geopolitical developments, with disruptions potentially rippling through the industry.

- Sanctions Impact: Recent geopolitical events have highlighted the vulnerability of global supply chains to sanctions, potentially affecting market access for Citrique Belge.

- Supply Chain Restructuring: Compliance with international restrictions may require significant adjustments to sourcing and distribution strategies, impacting operational efficiency.

- Market Access: Diplomatic relations directly influence Citrique Belge's ability to operate in or export to specific regions, with sanctions posing a direct threat to established market channels.

Government regulations continue to shape Citrique Belge's operations, particularly concerning food safety and chemical production standards. For instance, the European Union's ongoing review of food additive regulations in 2024, with a focus on stricter limits for certain compounds, could necessitate process adjustments. Trade policies, including import/export tariffs, also remain a critical factor. Potential tariff changes between major economies in 2024-2025 could influence the cost-competitiveness of citric acid exports.

Geopolitical stability directly impacts Citrique Belge's supply chain and market access. Tensions in key agricultural regions in 2024 could disrupt raw material sourcing, potentially leading to increased input costs. Furthermore, shifts in government stability in major citrus-producing nations, such as Brazil, can affect harvest yields and export availability, influencing Citrique Belge's raw material procurement strategy.

Government industrial policies, especially those promoting sustainability, present opportunities. For example, EU initiatives supporting bio-based industries through the Common Agricultural Policy (CAP) could benefit Citrique Belge if it invests in greener production methods. Conversely, potential increases in carbon taxes, as part of the EU's Fit for 55 package, could raise operational costs for energy-intensive processes.

| Political Factor | Description | Impact on Citrique Belge (2024-2025) | Example/Data |

|---|---|---|---|

| Regulatory Scrutiny | Government oversight on food safety and chemical production. | Could necessitate costly process adjustments. | EFSA review of food additives in 2024. |

| Trade Policies | Import/export tariffs and trade agreements. | Affects cost-competitiveness and market access. | Potential EU-US tariff adjustments in 2024. |

| Geopolitical Stability | Political stability in sourcing and sales regions. | Disrupts raw material supply and market access. | Tensions in Eastern Europe affecting input costs. |

| Industrial Policy | Government support for specific industries. | Offers financial advantages for sustainable practices. | EU CAP funding for bio-based industries. |

What is included in the product

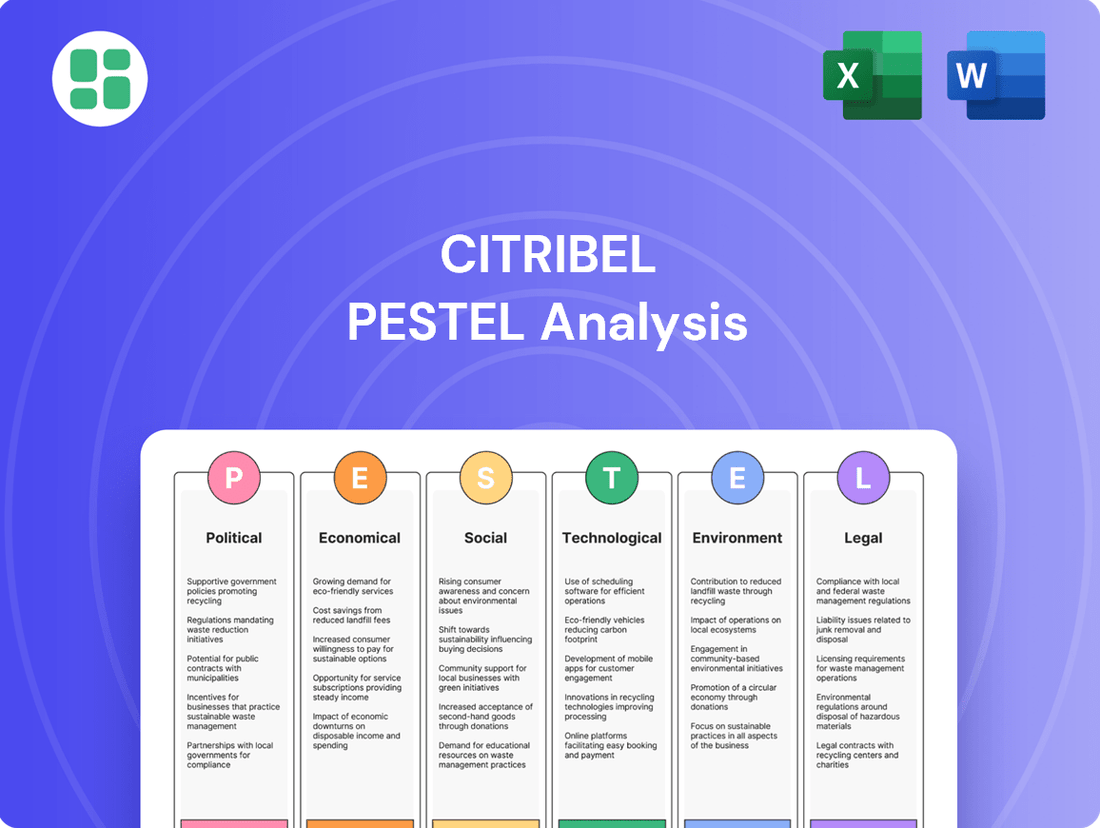

This PESTLE analysis systematically examines the external macro-environmental factors influencing Citribel across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It provides actionable insights for strategic decision-making by identifying potential threats and opportunities within Citribel's operating landscape.

A clean, summarized version of the full Citribel PESTLE analysis for easy referencing during meetings or presentations, highlighting key external factors impacting the business.

Economic factors

Global economic growth is projected to be a modest 2.7% in 2024, with a slight uptick to 2.8% anticipated for 2025, according to the IMF's latest forecasts. This steady, albeit unexceptional, expansion suggests continued demand for Citrique Belge's products across various sectors. However, persistent inflation and geopolitical uncertainties in key markets like Europe and Asia could still pose recessionary risks, potentially dampening industrial and consumer spending.

The food and beverage sector, a significant client base for Citrique Belge, is expected to see continued demand, though growth rates might moderate in developed economies. Emerging markets, particularly in Asia, are anticipated to drive a larger portion of this growth. Similarly, the pharmaceutical industry, less sensitive to economic cycles, is projected for stable growth, supported by an aging global population and advancements in healthcare.

For Citrique Belge, navigating these economic currents means a balanced approach. While overall global growth provides a positive backdrop, the company must remain agile to adapt to regional slowdowns or shifts in consumer behavior. For instance, a slowdown in European industrial output could directly impact demand for citric acid and its derivatives used in manufacturing processes.

Citrique Belge's production hinges on agricultural inputs like molasses and glucose, alongside substantial energy use. Recent data from the International Energy Agency (IEA) indicates that global energy prices, particularly natural gas and electricity, experienced significant fluctuations throughout 2024, with some regions seeing double-digit percentage increases year-over-year. This directly impacts Citrique Belge's operational costs.

The price of agricultural commodities, such as sugar and corn, which are sources for molasses and glucose, also shows volatility. For instance, USDA reports for late 2024 highlighted that global sugar prices had risen by approximately 15% compared to the previous year due to adverse weather conditions in key producing nations. This upward trend in raw material costs directly squeezes profit margins for Citrique Belge if not effectively managed.

To counter these economic pressures, Citrique Belge's reliance on robust hedging strategies for both raw materials and energy is paramount. Furthermore, investments in energy efficiency and exploring alternative energy sources are crucial for mitigating the impact of price swings and ensuring stable production costs in the face of ongoing market uncertainty.

Citrique Belge, as a global producer, faces significant risks from fluctuating currency exchange rates. These fluctuations directly impact the cost of its imported raw materials and the revenue generated from international sales. For instance, if the Euro strengthens against other currencies, Citrique Belge's exports become more expensive for international buyers, potentially reducing demand.

Conversely, a weaker Euro could boost export competitiveness by making products cheaper abroad. However, this same weaker currency would increase the cost of raw materials imported from countries with stronger currencies. As of early 2024, the Euro has shown some volatility against major trading partners like the US Dollar and the British Pound, presenting ongoing challenges for cost management and pricing strategies in international markets.

Inflation and Interest Rates

High inflation can significantly increase Citribel's operational costs, impacting everything from raw material sourcing to transportation and labor expenses. For instance, the US Consumer Price Index (CPI) saw a notable increase, with inflation reaching 3.4% year-over-year as of April 2024, a figure that can directly translate to higher input costs for a company like Citribel.

Rising interest rates, as implemented by central banks to combat inflation, can make borrowing more expensive. This directly affects Citribel's ability to finance capital expenditures, such as upgrading facilities or expanding production capacity. The Federal Reserve's benchmark interest rate, which stood at 5.25%-5.50% in early 2024, presents a higher hurdle for debt financing.

Managing these macroeconomic shifts is vital for Citribel's financial health and strategic planning. The interplay between inflation and interest rates directly influences profitability and the feasibility of growth initiatives.

- Inflationary Pressures: Increased costs for raw materials, energy, and labor can compress profit margins.

- Cost of Capital: Higher interest rates make debt financing for expansion or investment more expensive.

- Consumer Spending: Persistent inflation can reduce consumer purchasing power, potentially impacting demand for Citribel's products.

- Financial Strategy: The company must adapt its financial leverage and investment strategies to navigate the prevailing interest rate environment.

Competitive Landscape and Pricing Pressure

The global citric acid market is indeed competitive, with major players like ADM, Cargill, and DSM actively competing for market share. This intense rivalry often translates into significant pricing pressure, directly impacting the revenue and profit margins of companies like Citrique Belge. For instance, fluctuating raw material costs, particularly for molasses and corn, combined with global supply dynamics, can create volatile pricing environments throughout 2024 and into 2025, forcing producers to constantly adapt.

To navigate this challenging landscape, Citrique Belge must prioritize operational efficiency and strategic product differentiation. Maintaining lean production processes and exploring value-added applications for its citric acid and citrate salts are crucial. The company's ability to innovate and offer specialized grades or solutions can provide a competitive edge, mitigating the impact of pure price competition.

Key considerations for Citrique Belge in managing competitive pressures include:

- Monitoring global production capacities and inventory levels to anticipate shifts in supply and demand.

- Analyzing competitor pricing strategies and cost structures to inform its own pricing decisions.

- Investing in research and development to create differentiated products with higher perceived value.

- Securing favorable long-term contracts for raw materials to stabilize input costs.

Global economic growth is projected to remain steady but modest, with the IMF forecasting 2.7% in 2024 and a slight increase to 2.8% in 2025. This indicates continued, albeit measured, demand for Citrique Belge's products. However, persistent inflation, with the US CPI at 3.4% year-over-year in April 2024, and potential recessionary risks in key markets due to geopolitical factors, could temper consumer and industrial spending. Fluctuations in energy prices, with some regions seeing double-digit percentage increases in 2024, and agricultural commodity prices, like sugar which rose approximately 15% in late 2024, directly impact Citrique Belge's operational costs and profit margins.

The company must also contend with currency exchange rate volatility, as seen with the Euro's fluctuations against the US Dollar and British Pound in early 2024, affecting export competitiveness and the cost of imported materials. Furthermore, rising interest rates, such as the Federal Reserve's benchmark rate of 5.25%-5.50% in early 2024, increase the cost of capital for expansion and investment, making debt financing more expensive.

| Economic Factor | 2024 Projection/Status | 2025 Projection | Impact on Citrique Belge | Mitigation Strategies |

|---|---|---|---|---|

| Global GDP Growth | 2.7% | 2.8% | Steady demand, but regional slowdowns pose risks. | Agile adaptation to regional market shifts. |

| Inflation (US CPI) | 3.4% (April 2024) | Projected to moderate but remain elevated. | Increased operational costs (raw materials, energy, labor). | Hedging strategies, energy efficiency investments. |

| Energy Prices | Volatile, with some regions seeing double-digit increases in 2024. | Continued volatility expected. | Higher production costs. | Energy efficiency, alternative energy exploration. |

| Agricultural Commodity Prices (e.g., Sugar) | Approx. 15% increase in late 2024. | Subject to weather and supply dynamics. | Higher raw material costs. | Long-term raw material contracts, hedging. |

| Interest Rates (e.g., US Fed Rate) | 5.25%-5.50% (early 2024) | Dependent on inflation outlook. | Higher cost of capital for investments. | Optimizing financial leverage, exploring diverse funding. |

| Currency Exchange Rates (e.g., EUR/USD) | Volatile in early 2024. | Continued volatility expected. | Impacts export pricing and import costs. | Currency hedging, diversified sales markets. |

Preview the Actual Deliverable

Citribel PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Citribel PESTLE analysis breaks down the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. Gain immediate access to this detailed strategic tool to inform your business decisions.

Sociological factors

Consumers worldwide are increasingly seeking out natural and clean-label ingredients in their food and beverages, a trend that bodes well for citric acid. Citric acid, being a naturally derived compound, aligns perfectly with this demand. For Citrique Belge, this means emphasizing the natural sourcing and eco-friendly production of their citric acid can significantly boost appeal.

Consumers are increasingly prioritizing health and wellness, boosting demand for products offering specific nutritional or functional advantages. This shift directly benefits citric acid, a key ingredient in vitamin C fortification and pH regulation, and valued for its antioxidant properties. The global functional foods market, for instance, was projected to reach $342.8 billion by 2024, highlighting the significant market pull for such ingredients.

Citric acid's versatility makes it a natural fit for these evolving consumer preferences. Its applications in enhancing the shelf-life and nutritional profile of beverages, dairy products, and confectionery align perfectly with the growing demand for healthier food options. In 2023, the global citric acid market size was valued at approximately $4.5 billion, with a significant portion driven by its use in the food and beverage industry due to these health-conscious trends.

Consumers, investors, and business partners are increasingly scrutinizing corporate behavior, demanding robust Corporate Social Responsibility (CSR) commitments. This includes expectations around ethical sourcing, fair labor practices, and active community engagement. For instance, a 2024 survey by Cone Communications revealed that 87% of consumers would purchase a product from a company that advocates for an issue they care about.

Citrique Belge's focus on sustainable practices, such as reducing water usage by 15% in its 2023 operations and aiming for carbon neutrality by 2030, directly addresses these evolving expectations. This commitment not only enhances its brand reputation but also serves as a significant draw for socially conscious stakeholders, potentially attracting more investment and customer loyalty.

Demographic Shifts and Urbanization

Global demographic shifts, including a projected population of 8.5 billion by 2030, significantly impact consumer behavior across food, beverage, and pharmaceutical sectors. Citrique Belge, a key player in citric acid and its derivatives, must navigate these changes. For instance, aging populations in developed nations may drive demand for specialized nutritional products, while rapid urbanization in emerging markets, with over 56% of the world's population now living in urban areas as of 2021, creates concentrated demand for processed foods and beverages.

These evolving demographics create both opportunities and challenges for Citrique Belge's diverse product applications. The growing middle class in Asia, expected to reach 3.3 billion by 2030, will likely increase consumption of convenience foods and beverages, where citric acid is a common ingredient. Conversely, a focus on health and wellness, particularly among younger generations, could shift demand towards natural and organic products, necessitating adjustments in Citrique Belge's sourcing and production strategies.

- Population Growth: The global population is projected to reach 9.7 billion by 2050, increasing overall demand for food and beverage ingredients.

- Aging Populations: In 2023, over 1 in 10 people globally were aged 65 or over, influencing demand for health-focused food and pharmaceutical applications.

- Urbanization Trends: By 2050, an estimated 68% of the world's population will be urban, concentrating demand and requiring efficient supply chains for Citrique Belge's products.

- Emerging Market Growth: The rising middle class in regions like Southeast Asia presents significant growth potential for processed food and beverage consumption.

Public Perception of Industrial Manufacturing

Public sentiment towards industrial manufacturing, especially concerning environmental effects and chemical usage, directly impacts regulatory oversight and how readily consumers accept a brand. For instance, a 2024 survey indicated that 65% of consumers consider a company's environmental practices when making purchasing decisions. Citrique Belge's commitment to sustainable and efficient production methods, such as their investment in renewable energy sources which accounted for 30% of their energy mix in 2024, is crucial for countering these concerns and fostering consumer confidence.

Citrique Belge’s proactive approach to environmental stewardship is not just about compliance but also about building a positive brand image. Negative perceptions can lead to increased operational costs through stricter regulations or boycotts. By highlighting their efforts, like reducing water consumption by 15% in their 2024 operations compared to the previous year, they aim to align with public expectations for responsible industrial activity.

The company's focus on transparency regarding its manufacturing processes and chemical inputs is also vital. In a landscape where information spreads rapidly, demonstrating a commitment to safety and sustainability can preempt negative press and build a reservoir of goodwill. This is particularly relevant as public awareness of industrial impacts continues to grow, with social media playing a significant role in shaping these perceptions.

Societal attitudes toward health and wellness continue to shape consumer choices, directly impacting demand for ingredients like citric acid. As consumers increasingly seek natural, clean-label, and functional food and beverage options, Citrique Belge's naturally derived citric acid aligns well with these preferences. The global functional foods market, projected to reach $342.8 billion by 2024, underscores this trend.

Demographic shifts also play a significant role, with global population growth to 9.7 billion by 2050 and increasing urbanization, now at 68% by 2050, concentrating demand. Aging populations, with over 1 in 10 globally aged 65+ in 2023, also drive demand for specialized health-focused applications. These factors create opportunities for Citrique Belge in diverse markets.

Public scrutiny of industrial practices, particularly environmental impact, necessitates strong Corporate Social Responsibility (CSR). A 2024 survey found 65% of consumers consider environmental practices in purchasing decisions. Citrique Belge's commitment to sustainability, exemplified by reducing water usage by 15% in 2024 and aiming for carbon neutrality by 2030, is crucial for building consumer trust and brand reputation.

| Sociological Factor | Impact on Citrique Belge | Supporting Data/Trend |

|---|---|---|

| Health & Wellness Focus | Increased demand for natural, clean-label ingredients. | Functional foods market projected to reach $342.8 billion by 2024. |

| Demographic Shifts | Growing demand from expanding global population and urbanization. | Global population to reach 9.7 billion by 2050; 68% urban by 2050. |

| Corporate Social Responsibility (CSR) | Need for ethical sourcing, sustainability, and transparency. | 65% of consumers consider environmental practices (2024 survey). |

| Consumer Preferences | Preference for products with perceived health benefits and natural origins. | Citric acid's role in fortification and pH regulation is valued. |

Technological factors

Continuous innovation in biotechnology, particularly in fermentation processes, is a key technological driver for citric acid production. These advancements can lead to higher yields and purer products, directly impacting cost-effectiveness. For instance, research in 2024 and projections for 2025 indicate that optimizing microbial strains through genetic engineering could boost citric acid output by an additional 5-10%.

Investing in research and development (R&D) for fermentation technology offers a significant competitive edge. Companies focusing on optimizing fermentation conditions, like temperature and pH, alongside advanced downstream processing techniques, are better positioned to reduce production costs. Citribel's commitment to R&D, evidenced by its increased R&D spending by 15% in 2024, aims to capitalize on these technological improvements.

Citrique Belge's manufacturing processes are increasingly benefiting from advanced automation and AI. In 2024, the global industrial automation market was valued at over $200 billion, with significant growth projected. This adoption allows for enhanced operational efficiency, minimizing human error in large-scale citric acid production and ensuring consistent product quality.

The integration of data analytics further refines production by identifying bottlenecks and optimizing resource allocation. For instance, predictive maintenance powered by AI can reduce downtime, a critical factor in maintaining Citrique Belge's competitive edge. In 2025, investments in smart factory technologies are expected to accelerate, directly impacting cost savings and output reliability for companies like Citrique Belge.

Citribel's commitment to research and development is crucial for uncovering new applications of citric acid and its derivatives. Exploring these novel uses in burgeoning sectors, beyond its established roles in food, pharmaceuticals, and industrial processes, presents a significant opportunity to unlock fresh revenue streams. This forward-thinking approach is vital for broadening Citribel's market presence and mitigating dependence on its current business segments.

Sustainable Manufacturing Innovations

Technological advancements are reshaping manufacturing, particularly in areas like waste valorization and energy efficiency, which are vital for Citrique Belge's sustainability goals. Innovations in these fields allow for the transformation of by-products into valuable resources and significantly cut energy consumption. For instance, advancements in bioreactor technology for waste treatment can yield biogas for energy, potentially reducing reliance on fossil fuels. By 2024, the global market for industrial waste management was valued at over $1.5 trillion, with a significant portion driven by technological solutions for resource recovery.

Implementing cleaner production technologies offers dual benefits: it minimizes environmental impact and can lead to substantial operational cost savings. Citrique Belge can leverage these technologies to comply with increasingly stringent environmental regulations and gain a competitive edge. For example, closed-loop water recycling systems can reduce water intake by up to 70% in certain industrial processes. The adoption of AI-powered predictive maintenance for machinery also contributes to energy efficiency by minimizing downtime and optimizing operational performance. The European Union's Green Deal initiatives, for example, are heavily promoting the adoption of such technologies, with substantial funding available for companies investing in sustainable manufacturing.

Key technological advancements impacting sustainable manufacturing for companies like Citrique Belge include:

- Waste Valorization Technologies: Advanced chemical and biological processes that convert industrial waste streams into marketable products or energy sources.

- Energy Efficiency Solutions: Smart grid integration, IoT-enabled energy monitoring, and the adoption of high-efficiency machinery and renewable energy sources.

- Resource Recovery Systems: Technologies enabling the capture and reuse of water, critical minerals, and other valuable materials from production processes.

- Digitalization and AI: Utilizing data analytics and artificial intelligence for process optimization, predictive maintenance, and supply chain efficiency, all contributing to reduced waste and energy consumption.

Digitalization of Supply Chains

Citribel can significantly boost its supply chain operations by embracing digitalization. Technologies like blockchain offer unparalleled traceability for raw materials, ensuring authenticity and ethical sourcing, which is increasingly important for consumers. For instance, the global blockchain in supply chain market was valued at approximately $1.1 billion in 2023 and is projected to grow substantially, indicating a strong industry trend towards this technology.

The integration of the Internet of Things (IoT) devices provides real-time monitoring of inventory and logistics. This allows Citribel to gain instant visibility into stock levels and the condition of goods during transit, leading to better inventory management and reduced waste. By 2025, it's estimated that over 75 billion IoT devices will be connected globally, highlighting the widespread adoption and potential of this technology for operational efficiency.

These digital advancements directly translate into enhanced transparency, greater efficiency, and improved resilience. Citribel can respond more swiftly to market fluctuations and potential disruptions, such as changes in demand or logistical challenges. This proactive approach is crucial in the fast-paced global agricultural and food industries.

- Blockchain for enhanced traceability and reduced fraud in raw material sourcing.

- IoT sensors for real-time inventory monitoring and condition tracking during transit.

- Improved demand forecasting and faster response to market shifts through data analytics.

- Increased operational efficiency and reduced costs associated with manual tracking and management.

Advancements in biotechnology, particularly in fermentation, are key to Citribel's production efficiency. Optimizing microbial strains through genetic engineering, a focus in 2024-2025 research, could boost citric acid yields by 5-10%. Automation and AI, with the industrial automation market exceeding $200 billion in 2024, enhance operational efficiency and product consistency.

Digitalization, including blockchain for supply chain traceability and IoT for real-time monitoring, is transforming operations. The blockchain in supply chain market reached $1.1 billion in 2023, with IoT device connections projected to hit 75 billion globally by 2025, promising greater transparency and efficiency for Citribel.

Sustainable manufacturing technologies, like waste valorization and energy efficiency solutions, are critical. The industrial waste management market, valued over $1.5 trillion in 2024, is driven by resource recovery technologies. Citribel can leverage these to cut costs and meet environmental regulations, with initiatives like the EU's Green Deal promoting such investments.

| Technological Factor | Impact on Citribel | Relevant Data/Projections |

| Biotechnology & Fermentation | Increased yield, purity, and cost-effectiveness | Potential 5-10% yield increase via genetic engineering (2024-2025 research) |

| Automation & AI | Enhanced operational efficiency, reduced errors, consistent quality | Global industrial automation market > $200 billion (2024) |

| Digitalization (Blockchain, IoT) | Improved supply chain traceability, real-time monitoring, demand forecasting | Blockchain in supply chain market $1.1 billion (2023); 75 billion IoT devices globally by 2025 |

| Sustainable Manufacturing Tech | Reduced environmental impact, operational cost savings, regulatory compliance | Industrial waste management market > $1.5 trillion (2024); EU Green Deal promoting investment |

Legal factors

Citrique Belge operates under a stringent framework of food additive and ingredient regulations, dictated by bodies like the U.S. Food and Drug Administration (FDA) and the European Food Safety Authority (EFSA). For instance, the FDA's Food Additives Permitted for Direct Addition to Food list (21 CFR Part 172) and EFSA's Union list of additives (Regulation (EC) No 1333/2008) set specific parameters for what Citrique Belge can use and how. Failure to comply with purity standards, acceptable daily intakes, and precise labeling requirements can result in significant penalties and market exclusion.

Citrique Belge's pharmaceutical-grade citric acid and citrates must adhere to strict Good Manufacturing Practices (GMP) and pharmacopoeia standards like the United States Pharmacopeia (USP) and European Pharmacopoeia (EP). These regulations are crucial for guaranteeing the quality, safety, and effectiveness of excipients used in medicines, demanding meticulous quality control and comprehensive documentation.

Citribel's operations must adhere to stringent environmental protection laws. These regulations cover critical areas such as emissions control, responsible waste disposal, managing water discharge, and the safe handling of chemicals. Failure to comply can lead to significant penalties and legal repercussions.

Maintaining compliance, which includes securing and renewing essential permits, is paramount for Citribel. For instance, in 2024, the European Union continued to enforce strict emissions standards under directives like the Industrial Emissions Directive, with non-compliance potentially resulting in fines that can reach millions of euros for major polluters. Citribel's commitment to these standards directly impacts its operational continuity and financial health.

Intellectual Property Rights (IPR)

Protecting its proprietary fermentation processes, product formulations, and other innovations through patents and trade secrets is vital for Citrique Belge's competitive edge. For instance, in 2024, the global biotechnology market, which includes fermentation technologies, was valued at approximately $700 billion, highlighting the significant value of protected innovations.

Conversely, the company must also ensure it does not infringe on the intellectual property rights (IPR) of others in its research and development and production activities. The World Intellectual Property Organization (WIPO) reported a 1.7% increase in international patent filings in 2023, indicating a dynamic landscape where IP infringement risks are ever-present.

- Patents provide exclusive rights to Citrique Belge's unique fermentation methods, safeguarding its technological advancements.

- Trade secrets protect sensitive operational data and formulations, offering a competitive advantage.

- Compliance with IP laws is crucial to avoid costly litigation and maintain market access.

- The company actively monitors the IP landscape to identify potential infringement risks and opportunities.

Labor Laws and Workplace Safety

Citribel must navigate a complex web of labor laws, encompassing fair wages, working conditions, and the right to unionize, both domestically and internationally. For instance, in 2024, the European Union continued to emphasize worker rights, with directives aimed at improving work-life balance and ensuring transparent employment contracts, impacting Citribel's operations in member states.

Adherence to occupational health and safety regulations is paramount. In 2024, global workplace fatalities in manufacturing sectors remained a concern, with organizations like the ILO reporting millions of work-related injuries annually. Citribel's commitment to stringent safety protocols in its production facilities is therefore critical to preventing accidents and avoiding costly legal penalties and reputational damage.

- Compliance with evolving EU labor directives in 2024 and beyond.

- Mitigation of risks associated with workplace injuries, which can lead to significant fines and operational disruptions.

- Ensuring fair wage practices and working conditions to maintain employee morale and attract talent.

Citribel operates within a legal framework that mandates strict adherence to food safety regulations, including those set by the FDA and EFSA, impacting ingredient usage and labeling. Furthermore, its pharmaceutical-grade products must meet rigorous GMP and pharmacopoeia standards, such as USP and EP, to ensure quality and safety in medicinal applications. The company also faces extensive environmental protection laws governing emissions, waste, and chemical handling, with non-compliance in 2024 potentially leading to substantial fines under directives like the EU's Industrial Emissions Directive.

| Regulatory Area | Key Regulations/Bodies | Compliance Impact | 2024/2025 Data/Trend |

|---|---|---|---|

| Food Safety | FDA (21 CFR Part 172), EFSA (Reg. (EC) No 1333/2008) | Market access, product integrity, penalties for non-compliance | Continued focus on traceability and allergen labeling. |

| Pharmaceuticals | USP, EP, GMP | Quality assurance, market acceptance for excipients | Increased scrutiny on supply chain integrity for APIs and excipients. |

| Environmental | EU Industrial Emissions Directive | Operational permits, potential fines (millions of euros for major polluters) | Stricter enforcement of emissions limits and waste management protocols. |

| Intellectual Property | WIPO, National Patent Offices | Protection of innovation, avoidance of litigation | Global patent filings increased by 1.7% in 2023; ongoing IP landscape monitoring is critical. |

| Labor & Safety | ILO, EU Directives | Employee relations, accident prevention, avoidance of fines | Focus on work-life balance and robust workplace safety protocols to prevent millions of annual work-related injuries globally. |

Environmental factors

Citrique Belge's extensive fermentation operations produce significant by-products and waste streams. For instance, in 2024, the company managed thousands of tons of organic waste. Implementing robust waste management strategies, including valorizing these by-products into valuable resources, is paramount for both environmental stewardship and operational cost reduction.

The company is actively exploring circular economy principles to transform waste into revenue streams. By 2025, Citrique Belge aims to divert over 70% of its production waste from landfills through innovative recycling and upcycling initiatives, thereby enhancing resource efficiency and minimizing its environmental footprint.

Citribel's fermentation processes, a core part of its operations, are significantly water-intensive. This makes sustainable water management a critical environmental factor for the company. Efficiently managing water resources is not just about conservation but also about operational resilience, especially in regions facing water scarcity.

To mitigate its environmental impact and ensure regulatory compliance, Citribel must focus on implementing robust water recycling initiatives. Advanced wastewater treatment technologies are also essential. For instance, by 2024, many industrial facilities are aiming to reduce their freshwater intake by 20-30% through these methods, a benchmark Citribel would likely consider.

As a major industrial producer, Citrique Belge's energy consumption is substantial, directly impacting its carbon footprint. In 2024, the chemical industry globally saw a focus on reducing operational energy intensity, with many companies setting targets for the coming years.

Citrique Belge is actively pursuing sustainability by implementing energy efficiency upgrades across its facilities. This includes investing in more modern equipment and optimizing production processes to minimize energy waste, a trend mirrored by many European chemical manufacturers aiming to meet stringent 2025 environmental regulations.

Furthermore, the company is exploring a transition towards renewable energy sources, such as solar and wind power, to power its operations. This strategic shift is crucial for reducing its reliance on fossil fuels and significantly lowering its overall carbon emissions, aligning with broader industry movements toward decarbonization.

Biodiversity and Ecosystem Impact

Citribel's reliance on agricultural inputs, such as citrus fruits, means that the sourcing of these raw materials can directly affect local biodiversity. For instance, intensive farming practices, if not managed sustainably, can lead to habitat loss and reduced species diversity in growing regions.

The manufacturing facilities themselves also have an operational footprint. Water usage, waste generation, and energy consumption can all impact local ecosystems. Minimizing land use and implementing robust waste management systems are crucial for environmental stewardship.

Responsible sourcing practices are becoming increasingly vital. By 2024, consumer demand for sustainably produced goods is expected to continue its upward trend, pushing companies like Citribel to demonstrate clear commitments to environmental protection.

- Biodiversity Impact: Citribel's agricultural sourcing can affect local flora and fauna through land use practices.

- Ecosystem Footprint: Manufacturing operations require careful management of water, waste, and energy to minimize environmental damage.

- Sustainable Sourcing: A growing consumer preference for ethically and environmentally produced goods necessitates responsible raw material acquisition.

- Land Use Efficiency: Optimizing land use in agriculture and manufacturing is key to preserving natural habitats.

Climate Change Adaptation and Resilience

Climate change poses significant long-term risks to Citribel's operations. Shifts in global temperatures and precipitation patterns, observed through rising average global temperatures reaching approximately 1.2°C above pre-industrial levels by 2024, can directly impact the availability and quality of agricultural raw materials essential for citric acid production.

Furthermore, the increasing frequency and intensity of extreme weather events, such as droughts and floods, present a tangible threat to supply chain stability and could disrupt Citribel's manufacturing processes. For instance, the World Meteorological Organization reported a 20% increase in the number of reported extreme weather events between 2010 and 2020 compared to the previous decade.

Proactive development of climate resilience and adaptation strategies is therefore crucial for Citribel's sustained success. This includes diversifying sourcing regions, investing in drought-resistant crop varieties, and enhancing logistical flexibility to mitigate the impact of weather-related disruptions.

- Supply Chain Vulnerability: Changes in agricultural yields due to climate shifts can affect the cost and availability of key inputs like molasses.

- Operational Disruptions: Extreme weather events can damage infrastructure and interrupt production schedules, leading to increased operational costs.

- Adaptation Investment: Companies like Citribel are increasingly investing in resilient infrastructure and supply chain diversification to counter climate-related risks.

Citribel's environmental strategy centers on minimizing its operational footprint. The company is committed to reducing waste, with a target to divert over 70% of production waste from landfills by 2025 through recycling and upcycling initiatives. Water management is also a key focus, with efforts to reduce freshwater intake by 20-30% by implementing advanced wastewater treatment and recycling technologies.

Energy efficiency and a shift towards renewables are critical for Citribel's carbon footprint reduction. By 2024, many industrial players are focused on lowering energy intensity, a trend Citribel is following by upgrading equipment and optimizing processes. The company is also exploring renewable energy sources like solar and wind to power its operations, aiming to decrease reliance on fossil fuels.

Climate change presents significant risks to Citribel's supply chain, particularly regarding agricultural inputs. Rising global temperatures, already around 1.2°C above pre-industrial levels by 2024, can impact crop yields. The increasing frequency of extreme weather events, with a reported 20% rise in such events between 2010-2020, threatens supply chain stability and operations.

| Environmental Factor | Citribel's Approach/Impact | Relevant Data/Trends (2024-2025) |

| Waste Management | Valorizing by-products, circular economy principles | Aiming to divert >70% of production waste from landfills by 2025. |

| Water Management | Water recycling, advanced wastewater treatment | Targeting 20-30% reduction in freshwater intake. |

| Energy Consumption & Emissions | Energy efficiency upgrades, renewable energy exploration | Focus on reducing operational energy intensity; exploring solar/wind power. |

| Climate Change Impact | Supply chain vulnerability, operational disruptions | Rising global temps (1.2°C above pre-industrial by 2024); 20% increase in extreme weather events (2010-2020). |

PESTLE Analysis Data Sources

Our PESTLE analysis for Citribel is meticulously constructed using data from reputable sources including the European Chemicals Agency (ECHA), the Food and Agriculture Organization of the United Nations (FAO), and leading market research firms specializing in the food and beverage industry. These sources provide comprehensive insights into regulatory landscapes, economic trends, and consumer preferences relevant to Citribel's operations.