Citribel Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Citribel Bundle

Citribel operates in a market shaped by moderate buyer power and a significant threat from substitute products, impacting its pricing flexibility. Understanding these dynamics is crucial for any stakeholder looking to navigate its competitive landscape.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Citribel’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Citribel's reliance on specific carbohydrate feedstocks like molasses or corn-based glucose syrup, alongside specialized microbial strains, highlights a key vulnerability. If the market for these essential inputs is dominated by a small number of suppliers, those suppliers gain significant leverage. This concentration means Citribel has fewer alternatives, potentially leading to higher input costs.

The price volatility of agricultural commodities such as sugar and corn, which are foundational to these feedstocks, directly influences Citribel's manufacturing expenses. For instance, in 2024, global sugar prices experienced notable fluctuations due to weather patterns and supply chain disruptions in major producing regions, directly impacting the cost of molasses for companies like Citribel.

The cost and complexity for Citribel to switch its primary raw material suppliers, like molasses or corn syrup, significantly impacts supplier bargaining power. If changing suppliers requires substantial retooling, process modifications, or revalidation for pharmaceutical-grade inputs, it strengthens the suppliers' position.

For instance, if Citribel faces a 10% increase in molasses prices, and switching suppliers incurs $1 million in revalidation costs and a 3-month production halt, suppliers gain considerable leverage. Citribel's commitment to sustainable sourcing further narrows its supplier choices, potentially concentrating power among a few certified providers.

While basic carbohydrate feedstocks like molasses or corn syrup might appear to be commodities, their specific quality, consistency, and origin can significantly differentiate them. For Citribel, a supplier offering a feedstock with a consistently lower impurity profile, for instance, could lead to higher fermentation yields, directly impacting production costs. In 2024, the global market for food-grade corn syrup saw prices fluctuate, with premium, non-GMO varieties commanding higher premiums due to perceived quality advantages.

Furthermore, Citribel's reliance on proprietary microbial strains for its fermentation processes introduces another layer of supplier power. If these strains are highly specialized and developed through significant R&D, the entities holding these patents or exclusive licenses possess considerable leverage. The development and maintenance of such advanced microbial cultures represent a substantial investment, making their availability a critical factor for Citribel's competitive edge.

Threat of Forward Integration by Suppliers

The threat of forward integration by Citribel's suppliers is a significant consideration. If these suppliers, for instance, those providing essential raw materials like molasses or corn steep liquor, possess the capability and motivation to enter citric acid production themselves, they could transition from mere suppliers to direct competitors. This would dramatically amplify their leverage, as they would then control both the supply of inputs and the finished product market.

However, the citric acid industry, particularly for large-scale fermentation, demands substantial capital investment and specialized technical knowledge. These high barriers to entry can deter many potential new players, including suppliers, from attempting forward integration. For example, establishing a state-of-the-art fermentation facility can cost tens of millions of dollars, a significant hurdle for most raw material providers.

- High Capital Requirements: Building a citric acid production plant can cost upwards of $50 million, deterring many suppliers.

- Technical Expertise Needed: Successful fermentation requires advanced biochemical engineering skills, not typically found in raw material suppliers.

- Market Access Challenges: Suppliers would need to establish distribution networks and customer relationships to compete effectively in the citric acid market.

Importance of Citribel to Suppliers

Citribel's position as a major global producer of citric acid and citrate salts means it is a substantial buyer for its raw material suppliers. For instance, in 2024, the global citric acid market was valued at approximately USD 4.2 billion, with Citribel holding a notable share. This scale implies that many suppliers depend on Citribel for a significant portion of their sales.

When a company like Citribel represents a large chunk of a supplier's business, that supplier's ability to dictate terms, or their bargaining power, is naturally reduced. They are more inclined to offer competitive pricing and maintain a strong relationship to secure Citribel's continued patronage, rather than risk losing a key customer. This dynamic helps Citribel manage its input costs effectively.

- Significant Customer Base: Citribel's global production capacity makes it a vital client for many raw material providers.

- Revenue Dependence: Suppliers whose revenue is heavily reliant on Citribel may have less leverage in price negotiations.

- Incentive for Cooperation: Suppliers are motivated to maintain favorable terms to retain Citribel’s business.

- Market Influence: Citribel's purchasing volume can influence supplier pricing strategies within the citric acid supply chain.

Citribel's bargaining power with its suppliers is influenced by the concentration of suppliers, the cost of switching, and the threat of forward integration. While Citribel is a major buyer, potentially reducing supplier leverage, the specialized nature of some inputs and the cost of changing suppliers can still grant suppliers significant power.

In 2024, the global citric acid market was valued at approximately USD 4.2 billion, with Citribel holding a significant share, making it a crucial client for many raw material providers. This scale generally reduces supplier bargaining power as they depend on Citribel's business.

However, specialized microbial strains or high-quality, differentiated carbohydrate feedstocks can still give certain suppliers leverage. For example, premium, non-GMO corn syrup varieties saw price increases in 2024 due to demand for quality advantages.

| Factor | Impact on Supplier Bargaining Power | Citribel's Position (2024 Data) |

|---|---|---|

| Supplier Concentration | High if few suppliers exist for specialized inputs. | Moderate; some inputs are specialized, others more commoditized. |

| Switching Costs | High if retooling or revalidation is needed. | Significant for pharmaceutical-grade inputs. |

| Forward Integration Threat | Low due to high capital and technical barriers. | Low; Citribel's scale and expertise deter integration. |

| Citribel's Buyer Power | Lowers supplier power due to volume. | High; Citribel is a major global producer. |

What is included in the product

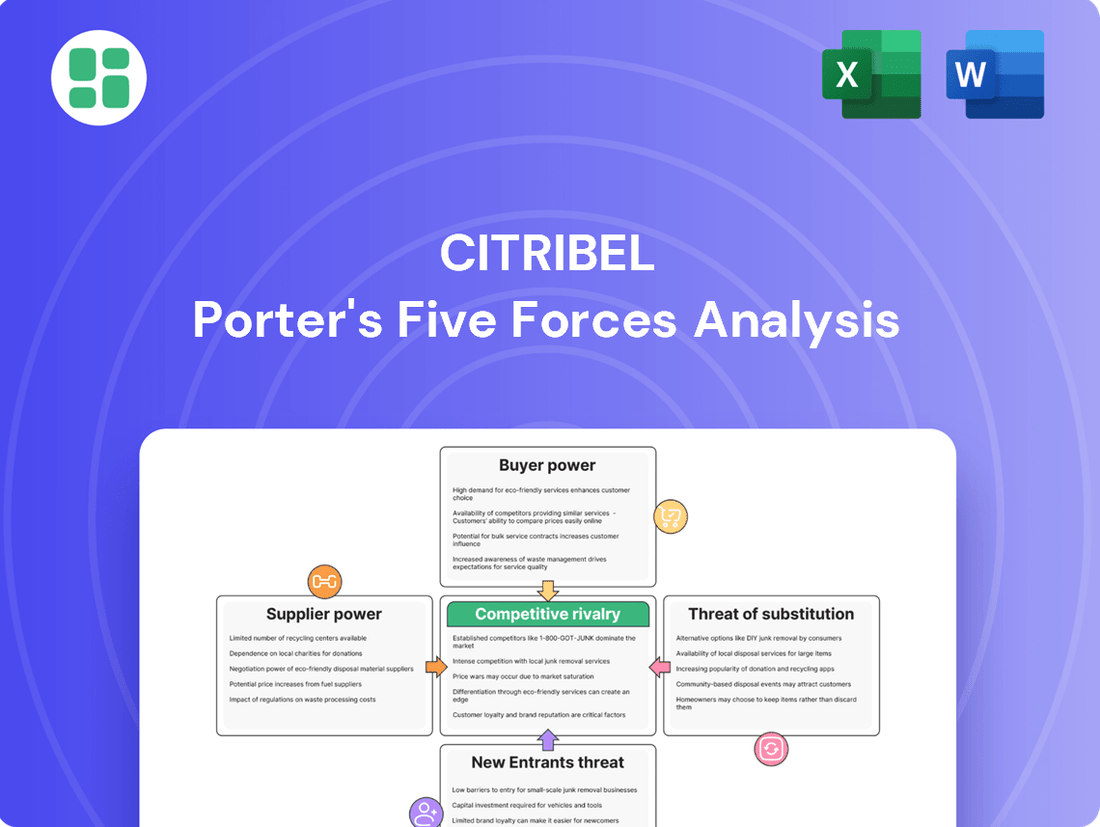

Citribel's Porter's Five Forces Analysis provides a comprehensive examination of the competitive landscape, detailing the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants, and the potential for substitute products.

Effortlessly visualize competitive intensity with a dynamic, interactive spider chart that highlights key pressures from suppliers, buyers, rivals, new entrants, and substitutes.

Customers Bargaining Power

Citribel's customers are spread across various industries, including food and beverage, pharmaceuticals, and industrial applications. The food and beverage sector, in particular, represents the largest market share for citric acid consumption, indicating its significant role in Citribel's customer base.

The bargaining power of these customers can be substantial, especially for large, consolidated buyers. Major food and beverage corporations and pharmaceutical giants, due to their high-volume purchases of citric acid, possess considerable leverage to negotiate pricing and favorable terms, directly impacting Citribel's profit margins.

Customer switching costs for Citribel are a critical factor in understanding their bargaining power. If it's simple and cheap for buyers to switch to other citric acid providers or even different types of acidulants, their ability to negotiate better terms with Citribel grows significantly.

The citric acid market is largely characterized by undifferentiated products, meaning customers generally face low switching costs. This commodity-like nature of citric acid means that a buyer can easily move from one supplier to another without incurring substantial expenses or facing significant operational disruptions.

While Citribel's commitment to sustainable practices could offer some differentiation, the inherent price sensitivity in the market means that customers will still heavily weigh cost when making purchasing decisions. For example, in 2024, the global citric acid market was valued at approximately USD 4.2 billion, with growth driven by demand in food and beverages, where price is a major consideration.

Customer price sensitivity for citric acid is a key factor in Citribel's bargaining power of customers. If citric acid represents a substantial portion of a customer's total production costs, they will likely push harder for lower prices. For instance, in the beverage industry, where citric acid is a significant ingredient, buyers will closely scrutinize pricing.

Availability of Substitute Products for Customers

Customers wield significant bargaining power when readily available substitute products exist. For Citribel, this means that if consumers can easily find and switch to alternative acids, their ability to negotiate prices or demand better terms increases. This dynamic directly influences Citribel's pricing strategies and market position.

While citric acid is a staple in many industries, particularly food and beverage, several substitutes can fulfill similar functions. These include malic acid, tartaric acid, and lactic acid. Furthermore, for certain applications, natural alternatives like lemon juice or vinegar offer viable options, thereby enhancing customer leverage.

- Availability of Substitutes: The presence of multiple alternative acids and natural ingredients provides customers with choices, diminishing Citribel's pricing power.

- Switching Costs: For many applications, the cost and effort for customers to switch from citric acid to a substitute are relatively low, further empowering them.

- Market Impact: In 2024, the global market for food additives, including organic acids, saw continued growth, but also increasing competition from both established players and emerging natural alternatives, putting pressure on pricing.

Threat of Backward Integration by Customers

Large customers, particularly those in the pharmaceutical and food industries with robust R&D and existing fermentation capabilities, may explore producing citric acid internally. This potential for backward integration, even if not fully realized, grants them significant bargaining power when negotiating prices and terms with Citribel.

For instance, major food and beverage companies, which represent a substantial portion of the citric acid market, could leverage their scale and technical expertise to assess the feasibility of in-house production. This threat is amplified if these customers have substantial capital to invest in new manufacturing processes, potentially reducing their reliance on external suppliers like Citribel.

Consider the global citric acid market, valued at approximately $4.2 billion in 2023 and projected to reach over $5.5 billion by 2028. A significant portion of this market is held by a few large buyers. If even a small percentage of these major players decide to integrate backward, it could materially impact Citribel's market share and pricing power.

- Customer Leverage: The possibility of customers producing citric acid themselves increases their bargaining strength with Citribel.

- Industry Concentration: A concentrated customer base, especially with large players in pharmaceuticals and food, heightens the backward integration threat.

- Market Dynamics: In 2023, the citric acid market size was estimated at $4.2 billion, with large buyers holding significant purchasing power.

- Investment Threshold: The substantial capital and technical expertise required for backward integration act as a barrier, but major conglomerates may still pursue it.

Citribel's customers, particularly large players in the food and beverage sector, exert significant bargaining power. This is driven by the commodity nature of citric acid, low switching costs, and the availability of substitutes like malic and tartaric acid, all of which empower buyers to negotiate prices aggressively.

The substantial size of key customers means they can command favorable terms, directly impacting Citribel's profitability. In 2024, the global citric acid market, valued at approximately USD 4.2 billion, saw continued demand from these sectors, but also intensified competition, further amplifying customer leverage.

The potential for backward integration by major buyers, who possess the capital and technical expertise, represents a latent threat that reinforces their bargaining position. This dynamic forces Citribel to remain competitive on price and service to retain its customer base.

| Factor | Impact on Citribel | Supporting Data (2024) |

| Customer Concentration | High leverage for large buyers | Major food/beverage companies dominate demand |

| Switching Costs | Low, enabling easy supplier changes | Undifferentiated product nature |

| Availability of Substitutes | Weakens Citribel's pricing power | Malic acid, tartaric acid, natural alternatives |

| Price Sensitivity | Buyers push for lower costs | Citric acid is a significant input cost in beverages |

Same Document Delivered

Citribel Porter's Five Forces Analysis

This preview showcases the complete Citribel Porter's Five Forces Analysis, offering a detailed examination of competitive forces within the industry. The document you see here is precisely what you will receive immediately after purchase, ensuring full transparency and no hidden content. You can confidently expect to download this professionally formatted and ready-to-use analysis without any alterations or missing sections.

Rivalry Among Competitors

The global citric acid market exhibits moderate consolidation, featuring several substantial multinational corporations actively competing. Key players such as Cargill Incorporated, Shandong Ensign Industry Co., Ltd., Jungbunzlauer Suisse AG, COFCO Corporation, and RZBC Group Co., Ltd. operate on a large scale, intensifying the competition for market dominance.

The global citric acid market is expected to see consistent growth, with projected compound annual growth rates (CAGRs) between 3.1% and 5.92% in the near future. This expansion presents opportunities, but the existing competitive landscape means that rapid capacity increases could outstrip demand, leading to downward pressure on prices.

In this environment, aggressive market share acquisition by competitors can further intensify price competition. For instance, if major players in the citric acid industry decide to significantly boost production without a corresponding surge in demand, it could trigger a price war, impacting profitability for all involved.

While citric acid can be seen as a commodity, Citribel's focus on advanced fermentation and sustainable production methods aims to set it apart. This differentiation can build customer loyalty, moving beyond pure price-based competition.

Exit Barriers for Competitors

High exit barriers are a significant factor in the citric acid market, often forcing companies to remain operational even when profitability is low. This is largely due to the substantial capital investment required for specialized fermentation plants and the associated infrastructure. For instance, building a modern citric acid production facility can easily run into tens or even hundreds of millions of dollars, making it difficult to divest or repurpose the assets without significant losses. This situation can lead to sustained overcapacity within the industry, as firms strive to recoup their sunk costs, ultimately intensifying price competition among existing players.

- Significant Capital Investment: The citric acid industry demands heavy upfront investment in fermentation technology and specialized production facilities, creating a high barrier to exit.

- Sunk Cost Fallacy: Companies may continue production at reduced profitability to avoid the immediate realization of substantial sunk costs, prolonging market oversupply.

- Intensified Price Competition: The reluctance to exit due to high barriers fuels a competitive environment where price becomes a primary differentiator, even in periods of low demand or margins.

Industry Cost Structure and Capacity

The citric acid industry is inherently capital-intensive, requiring substantial upfront investment in production facilities. This high fixed cost structure means that companies must operate at or near full capacity to achieve profitability. Citribel, as a significant player, likely benefits from economies of scale, which can lower its per-unit production costs compared to smaller competitors.

However, the industry's capacity utilization is a critical factor influencing competitive rivalry. If the global citric acid market experiences overcapacity, companies may resort to aggressive pricing strategies to fill their production lines. This can lead to price wars, eroding profit margins for all participants, including Citribel.

- High Capital Investment: Production of citric acid requires significant investment in fermentation and purification equipment, creating a barrier to entry and favoring established, large-scale producers.

- Economies of Scale: Larger production volumes allow companies like Citribel to spread fixed costs over more units, leading to lower per-unit costs and a competitive advantage.

- Impact of Overcapacity: In periods of market oversupply, the pressure to utilize expensive assets can trigger price competition, reducing profitability across the industry. For example, fluctuations in global demand and new capacity additions can create such scenarios.

Competitive rivalry in the citric acid market is notably intense due to the presence of large, established players like Cargill and Shandong Ensign Industry, alongside significant regional producers. This crowded field, combined with a commodity-like nature of the product, often leads to price-based competition.

The market's growth projections, while positive, also contribute to rivalry. If new capacity additions outpace demand growth, it can trigger aggressive pricing to maintain market share and utilize existing assets, as seen when overcapacity pressures emerge.

Citribel differentiates itself through advanced fermentation and sustainability, aiming to move beyond pure price competition by fostering customer loyalty. However, high exit barriers, stemming from substantial capital investments in specialized plants, mean companies may continue production even at lower profitability, thus sustaining competitive pressure.

| Key Competitor | Estimated Market Share (2024) | Key Strength |

|---|---|---|

| Cargill Incorporated | 15-20% | Global distribution, diverse product portfolio |

| Shandong Ensign Industry Co., Ltd. | 10-15% | Large-scale production, cost efficiency |

| Jungbunzlauer Suisse AG | 8-12% | Specialty ingredients, high-quality standards |

| COFCO Corporation | 5-8% | Strong presence in Asian markets, integrated supply chain |

| RZBC Group Co., Ltd. | 5-8% | Significant production capacity, competitive pricing |

SSubstitutes Threaten

Citric acid, a key ingredient in many products, faces significant competition from other acidulants. Malic acid, lactic acid, tartaric acid, and phosphoric acid are readily available substitutes that perform similar functions in food, beverages, and pharmaceuticals. These alternatives can regulate pH, preserve products, and enhance flavors, making them viable options for manufacturers.

The choice between citric acid and its substitutes often hinges on several factors. Application-specific needs are paramount, as some acidulants may offer superior performance in certain formulations. Cost-effectiveness is another major driver; for instance, while citric acid prices can fluctuate, the market for alternative acidulants remains competitive. Consumer preferences also play a role, with some markets showing a growing demand for naturally derived or specific taste profiles that certain substitutes might better provide.

The threat of substitutes for Citribel is considerable when these alternatives provide similar or better performance at a more attractive price point. For instance, in certain food and beverage applications, consumers might opt for less expensive synthetic citric acid or natural alternatives like lemon juice or vinegar if the cost advantage is substantial enough to offset any minor perceived differences in flavor or functionality. In 2024, the global citric acid market, a primary substitute, was valued at approximately $4.5 billion, indicating a robust competitive landscape.

The ease and cost for customers to switch from citric acid to alternative ingredients significantly influence the threat of substitutes. If adopting a substitute requires extensive reformulation, obtaining new regulatory approvals, or implementing substantial process modifications, the switching costs are considered high, thereby diminishing the threat.

For many applications, particularly those involving simple ingredient replacement, the costs and complexities associated with switching can be quite minimal. This low barrier to entry for substitutes poses a greater competitive challenge to citric acid producers.

For instance, in the beverage industry, a major consumer of citric acid, the cost of replacing citric acid with malic acid or lactic acid can be relatively low if the taste profile and stability requirements can be met without extensive product redesign. However, in pharmaceuticals or specialized food applications, the regulatory hurdles and quality control implications can make switching significantly more expensive and time-consuming.

Technological Advancements in Substitute Production

Technological advancements can significantly impact the threat of substitutes for citric acid. Innovations in producing alternative acidulants or new preservation and flavoring technologies can increase this threat. For instance, breakthroughs in biotechnology could enable more efficient production of other organic acids or entirely new ingredients that effectively replace citric acid in various applications.

Consider the potential for synthetic biology to create cost-effective replacements for natural citric acid production. As of early 2024, research into microbial fermentation for producing various organic acids continues to advance, potentially lowering production costs for substitutes. This could make them more competitive against traditionally produced citric acid, especially in large-volume applications like food and beverages.

- Biotechnology advancements: Innovations in synthetic biology and fermentation processes could lead to more efficient and cheaper production of alternative acidulants.

- New ingredient development: Emerging preservation and flavoring technologies might introduce novel ingredients that offer similar functionalities to citric acid, but with different cost structures or performance profiles.

- Cost competitiveness: As substitute production technologies mature, their cost-effectiveness could directly challenge citric acid's market position, particularly in price-sensitive sectors.

- Market penetration: Successful technological leaps in substitute production could allow them to capture market share from citric acid, especially in applications where performance parity is achieved.

Regulatory and Consumer Preference Shifts

Shifting regulatory environments and evolving consumer tastes present a significant threat from substitutes for citric acid. Growing demand for 'clean label' products and a preference for natural ingredients could lead consumers to favor alternatives perceived as more natural, even if citric acid itself holds GRAS status. For instance, the global natural food colors market, a potential substitute area, was valued at approximately USD 1.8 billion in 2023 and is projected to grow, indicating a market shift that could impact citric acid demand.

These changes can manifest in several ways:

- Regulatory Scrutiny: While citric acid is generally safe, any future regulatory re-evaluation or stricter labeling requirements for food additives could make alternatives more appealing.

- Consumer Perception: Negative consumer perception of 'artificial' or 'chemically derived' ingredients, even if unfounded for citric acid, can drive demand for perceived natural substitutes like malic acid or lactic acid derived from fermentation.

- Market Trends: The increasing popularity of fermented products and ingredients derived from specific fruits or vegetables could offer direct substitutes for certain applications where citric acid is currently used for flavor or preservation.

The threat of substitutes for Citribel is significant due to the availability of various acidulants like malic, lactic, and tartaric acids, which offer similar functionalities in food, beverages, and pharmaceuticals. These alternatives can impact Citribel's market share, especially when they provide comparable performance at a lower cost or cater to specific consumer preferences for natural ingredients. The global citric acid market was valued at approximately $4.5 billion in 2024, highlighting the competitive intensity from these substitutes.

Switching costs for manufacturers are generally low for many applications, making it easier for them to adopt alternative acidulants. For instance, in the beverage sector, replacing citric acid with malic or lactic acid often involves minimal reformulation. However, in more sensitive industries like pharmaceuticals, the regulatory and quality control implications can increase switching costs, thereby mitigating the threat.

Technological advancements, particularly in biotechnology and synthetic biology, are continuously improving the production efficiency and cost-effectiveness of alternative acidulants. Innovations in fermentation processes could lead to cheaper substitutes, directly challenging citric acid's market position, especially in price-sensitive segments. The market for natural food colors, a related substitute area, was valued at approximately USD 1.8 billion in 2023, indicating a growing consumer shift towards alternatives.

| Substitute Acidulant | Key Applications | Potential Advantages | Market Trend Indicator |

| Malic Acid | Confectionery, beverages, dairy | Tartness, flavor enhancement | Growing demand for natural flavors |

| Lactic Acid | Dairy products, baked goods, meat | Preservation, flavor, pH control | Increasing use in fermented foods |

| Tartaric Acid | Baking, wine, confectionery | Acidity, leavening agent | Stable demand in traditional uses |

| Phosphoric Acid | Beverages (cola), processed foods | Acidity, preservative | Subject to regulatory scrutiny in some regions |

Entrants Threaten

The production of citric acid via fermentation is a capital-intensive endeavor. Significant upfront investment is necessary for specialized bioreactors, advanced purification systems, and robust infrastructure.

Industry benchmarks indicate that a minimum economic plant capacity for citric acid production is around 20,000 tons annually. The cost of establishing such a facility can easily run into tens of millions of euros, presenting a formidable financial hurdle for aspiring new entrants.

As a major global producer, Citribel leverages significant economies of scale across its operations. This includes production, where larger volumes lead to lower per-unit costs, and distribution, where established networks reduce shipping expenses. Furthermore, its substantial purchasing power for raw materials, like citric acid and its derivatives, allows for better pricing than smaller competitors can secure.

New entrants face a substantial hurdle in matching these cost efficiencies. Without comparable large-scale operations, they would likely incur higher per-unit production and procurement costs. For example, in 2024, the global citric acid market, a key input for many of Citribel's products, was valued at approximately $4.2 billion, with major players benefiting from bulk purchasing power that new, smaller entities cannot replicate.

This inherent cost disadvantage for new entrants acts as a significant barrier. They would need to invest heavily to achieve the scale necessary to compete on price, which is often prohibitive. This makes it difficult for them to gain market share rapidly, especially against an established player like Citribel that has already optimized its cost structure over years of operation.

Citribel's use of a sophisticated fermentation process highlights a significant barrier to entry for new competitors. This process likely involves proprietary technology, specialized microbial strains, and deep operational expertise.

Developing or acquiring such advanced capabilities requires substantial investment in research and development, alongside considerable time, effectively protecting established players like Citribel from immediate threats. For instance, the global biotechnology market, which encompasses fermentation technologies, was valued at approximately $470 billion in 2023 and is projected to grow, indicating the scale of investment needed to compete in technologically advanced sectors.

Regulatory Hurdles and Certifications

The citric acid and citrate salts Citribel produces are critical components in heavily regulated sectors like food, beverages, and pharmaceuticals. New companies entering this market must navigate complex and expensive regulatory approval pathways, adhere to strict quality benchmarks such as USP and FCC standards, and obtain numerous certifications. These requirements significantly increase the initial investment and time-to-market, effectively deterring potential new competitors.

These regulatory and certification demands act as substantial barriers to entry in the citric acid market. For instance, obtaining Food and Drug Administration (FDA) approval for food-grade ingredients can take months, if not years, and involves rigorous testing and documentation. Similarly, pharmaceutical-grade citric acid requires compliance with Good Manufacturing Practices (GMP), adding further layers of complexity and cost.

- Stringent Regulatory Approvals: Industries like food and pharmaceuticals demand extensive compliance with health and safety regulations.

- High Quality Standards: Meeting established quality benchmarks such as United States Pharmacopeia (USP) and Food Chemicals Codex (FCC) is mandatory.

- Costly Certification Processes: Obtaining necessary certifications for production and product safety involves significant financial outlay and time.

- Time-Intensive Compliance: The lengthy duration of regulatory reviews and certification procedures delays market entry for new players.

Established Distribution Channels and Brand Reputation

Established players like Citribel benefit from robust global distribution channels, a critical barrier for newcomers. For instance, Citribel's extensive network allows for efficient product reach across continents, a feat requiring substantial investment and time to replicate.

New entrants would struggle to build comparable distribution infrastructure and secure shelf space against established brands. This is compounded by the significant brand loyalty and trust Citribel has cultivated over years of consistent quality and reliable supply, making it difficult for unproven entities to gain traction.

- Established Distribution: Citribel leverages existing global networks, making market entry costly for new competitors.

- Brand Reputation: Decades of proven quality and reliability foster customer loyalty, a difficult asset for new entrants to acquire.

- Customer Relationships: Long-standing ties with diverse customer segments create a significant hurdle for new players seeking market access.

The threat of new entrants for Citribel is moderate, primarily due to the significant capital requirements and established technological expertise in citric acid production. Building a new, competitive facility demands tens of millions of euros, a substantial financial barrier. Furthermore, mastering the complex fermentation processes and navigating stringent regulatory environments for food and pharmaceutical applications presents considerable challenges.

New companies must overcome high initial investment costs for specialized equipment and R&D, alongside lengthy regulatory approval processes. Citribel's economies of scale, achieved through large-scale production and purchasing power, create a cost advantage that new entrants would find difficult to match. For instance, the global citric acid market's approximately $4.2 billion valuation in 2024 highlights the scale of operations where established players benefit from bulk purchasing.

The threat is further mitigated by Citribel's established distribution networks and strong brand reputation, which new entrants would need considerable time and investment to replicate. While the market is attractive, the combination of capital intensity, technological know-how, regulatory hurdles, and existing competitive advantages makes entry challenging for new players.

| Barrier Type | Description | Impact on New Entrants |

| Capital Requirements | Establishing a 20,000-ton annual capacity citric acid plant costs tens of millions of euros. | High barrier; requires substantial upfront investment. |

| Technology & Expertise | Proprietary fermentation processes and specialized microbial strains require significant R&D and operational know-how. | High barrier; difficult to replicate advanced capabilities. |

| Regulatory Compliance | Navigating strict health and safety regulations (e.g., FDA, USP, FCC) for food and pharmaceutical grades is time-consuming and costly. | High barrier; delays market entry and increases initial costs. |

| Economies of Scale | Citribel benefits from lower per-unit costs due to large-scale production and purchasing power. | High barrier; new entrants face cost disadvantages. |

| Distribution & Brand Loyalty | Established global networks and years of cultivated customer trust are difficult for newcomers to build. | Moderate to High barrier; acquisition of market access and customer base is challenging. |

Porter's Five Forces Analysis Data Sources

Our Citribel Porter's Five Forces analysis is built upon a foundation of diverse and credible data. We leverage company annual reports, investor presentations, and direct competitor websites to understand their strategies and market positioning. Complementing this, we utilize industry-specific market research reports and trade publications to gauge market trends, customer behavior, and the intensity of rivalry.