China Citic Bank PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

China Citic Bank Bundle

China Citic Bank operates within a dynamic environment shaped by significant political shifts, evolving economic policies, and rapid technological advancements. Understanding these external forces is crucial for strategic planning and risk mitigation.

Gain an edge with our in-depth PESTEL Analysis—crafted specifically for China Citic Bank. Discover how external forces are shaping the company’s future, and use these insights to strengthen your own market strategy. Download the full version now and get actionable intelligence at your fingertips.

Political factors

The Chinese government's substantial ownership in China CITIC Bank, often exceeding 50% through various state-controlled entities, directly shapes the bank's strategic trajectory and operational mandates. This state influence is evident in lending priorities, which frequently align with national development plans, such as supporting key industries or infrastructure projects. For instance, in 2023, state-owned banks were instrumental in directing credit towards strategic sectors identified by the government, impacting overall loan growth and profitability for institutions like CITIC.

The stability and direction of China's financial regulatory policies are crucial for China CITIC Bank. For instance, the People's Bank of China's (PBOC) monetary policy decisions, such as interest rate adjustments, directly influence the bank's lending margins and profitability. In 2024, the PBOC maintained a relatively accommodative stance, with the benchmark Loan Prime Rate (LPR) seeing gradual reductions, aiming to stimulate economic activity.

Changes in credit allocation guidelines and financial market reforms also present both opportunities and constraints. For example, government initiatives to support green finance or technology innovation can open new avenues for lending and investment for banks like China CITIC. Conversely, stricter capital adequacy requirements or deleveraging campaigns can impact the bank's growth trajectory and risk management strategies.

A clear understanding of these policy shifts is vital for anticipating future business conditions. For example, the ongoing digital yuan pilot programs, expected to expand further in 2025, could reshape payment systems and create new service offerings for the bank. Adapting strategies to align with these evolving regulatory landscapes is key to maintaining a competitive edge.

Rising geopolitical tensions, particularly between major global powers, directly impact China CITIC Bank's international operations. For instance, the ongoing trade friction between the United States and China, which intensified in 2023 and continues into 2024, creates uncertainty for cross-border transactions and access to capital markets. Any escalation in sanctions or trade disputes could necessitate significant strategic adjustments for the bank's overseas branches and its international clientele.

Anti-Corruption Campaigns and Governance

China's ongoing anti-corruption initiatives, particularly within the financial sector, directly impact the governance and operational frameworks of institutions like China Citic Bank. These campaigns are designed to enhance transparency and mitigate systemic risks, which often translates into more stringent compliance mandates and heightened oversight of lending activities and leadership behavior.

Adherence to strong governance principles is paramount for securing regulatory approval and preserving public confidence. For instance, the Central Commission for Discipline Inspection (CCDI) has been a key driver of these efforts, with reports in early 2024 indicating continued focus on financial institutions to root out malfeasance. This environment necessitates robust internal controls and ethical conduct to ensure sustained operational stability and market reputation.

- Increased Regulatory Scrutiny: Banks face enhanced checks on lending practices and executive decision-making.

- Focus on Transparency: Campaigns push for clearer reporting and accountability in financial dealings.

- Compliance Costs: Implementing stricter governance may lead to higher operational expenses for banks.

- Risk Mitigation: Ultimately, these efforts aim to reduce the likelihood of financial misconduct and systemic instability.

Financial Sector Liberalization Pace

The ongoing liberalization of China's financial sector, a key political factor, directly shapes the competitive environment for China CITIC Bank. As regulations ease, allowing greater foreign participation and the potential relaxation of capital controls, the bank faces both expanded opportunities and heightened rivalry. This dynamic necessitates a keen strategic focus to maintain and grow market share.

For instance, the gradual opening of China's banking sector saw foreign banks increasing their presence and offerings. In 2023, foreign-funded institutions held approximately 2.5% of China's total banking assets, a figure that is expected to grow as liberalization continues. This increased competition pressures domestic players like CITIC Bank to innovate and enhance their service offerings to remain competitive.

- Increased Competition: Easing of foreign ownership limits and market access for international financial institutions intensifies competition.

- Opportunities for Growth: Liberalization can open avenues for partnerships, technology adoption, and access to global capital markets.

- Regulatory Adaptation: CITIC Bank must continually adapt its strategies to evolving regulatory frameworks governing foreign investment and capital flows.

- Strategic Positioning: Proactive engagement with liberalization trends is crucial for CITIC Bank to leverage new market opportunities and mitigate competitive threats.

Government policy directly influences China CITIC Bank's operations, with state ownership guiding strategic lending towards national priorities. For example, in 2023, state-backed initiatives channeled credit into key sectors, impacting loan growth for major banks. The People's Bank of China's monetary policy, including 2024's gradual LPR reductions, also affects the bank's profitability.

Financial market reforms and regulatory shifts present both opportunities and challenges. Initiatives promoting green finance or technological innovation can create new lending avenues, while stricter capital requirements might temper growth. The expansion of digital yuan pilot programs by 2025 could also reshape payment systems and service offerings.

Geopolitical tensions, such as ongoing US-China trade friction, create uncertainty for CITIC Bank's international activities, potentially impacting cross-border transactions and market access. China's anti-corruption drive also necessitates robust internal controls and compliance, as highlighted by continued focus from the CCDI in early 2024.

The liberalization of China's financial sector is increasing competition, as foreign banks expanded their presence, holding around 2.5% of banking assets in 2023. This trend pressures domestic institutions like CITIC Bank to innovate and adapt to evolving regulatory frameworks governing foreign investment and capital flows to maintain market share.

What is included in the product

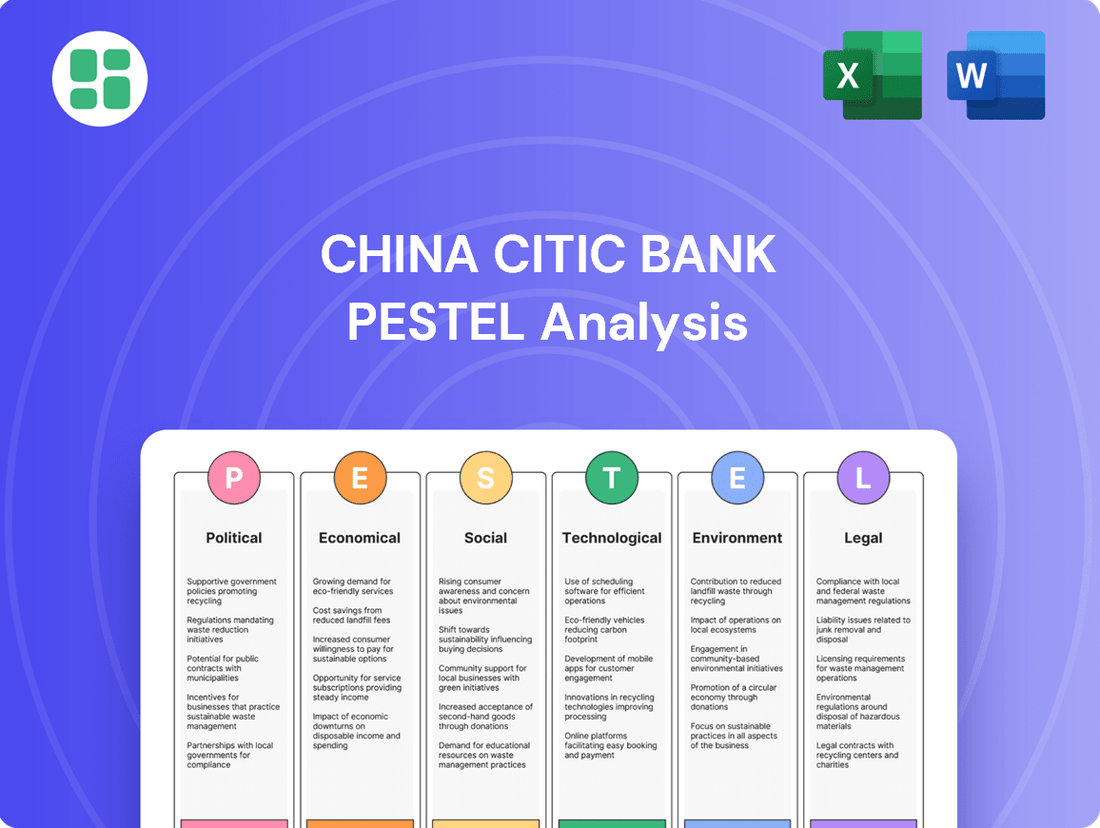

This PESTLE analysis examines the external macro-environmental factors impacting China Citic Bank, detailing how Political, Economic, Social, Technological, Environmental, and Legal forces present both challenges and strategic opportunities.

It provides a comprehensive overview for stakeholders to understand the dynamic landscape influencing the bank's operations and future growth.

This PESTLE analysis of China Citic Bank offers a clear, summarized version of external factors, simplifying complex market dynamics for efficient decision-making during strategic planning.

It provides a visually segmented breakdown of Political, Economic, Social, Technological, Environmental, and Legal influences, enabling quick identification of opportunities and threats for China Citic Bank.

Economic factors

China's economic trajectory is a critical factor for China CITIC Bank. The nation's GDP growth, projected to be around 5% for 2024, directly impacts the bank's operational environment. A robust economy translates to greater demand for loans and financial services, while a slowdown could increase credit risk.

Analyzing key economic indicators like industrial production, which saw a 6.2% year-on-year increase in the first two months of 2024, offers a snapshot of China CITIC Bank's core market health. Strong consumer spending, evidenced by retail sales growth, also fuels opportunities in wealth management and consumer banking.

China's benchmark lending rates, set by the People's Bank of China (PBOC), are a critical factor for China Citic Bank. For instance, the PBOC maintained its Loan Prime Rate (LPR) at 3.45% for one-year loans and 3.95% for five-year loans as of early 2024, reflecting a stable but accommodative monetary policy. This environment directly impacts the bank's net interest margin, the difference between interest income and interest expense.

The PBOC's monetary policy decisions, including adjustments to reserve requirement ratios and open market operations, shape the overall liquidity in the banking system. Lower interest rates, as seen in recent periods, tend to compress net interest margins by reducing the yield on assets, but they can also stimulate loan demand, potentially boosting overall lending volumes. Conversely, higher rates could expand margins but might slow down borrowing activity, affecting the bank's growth trajectory.

Financial institutions like China Citic Bank must closely track PBOC announcements and policy shifts. For example, the PBOC's decision in late 2023 to cut the reserve requirement ratio for banks by 0.5 percentage points injected significant liquidity into the market, aiming to support economic growth. Such actions are vital for financial forecasting, helping the bank anticipate changes in funding costs and lending opportunities.

China has navigated a complex inflation landscape. In 2023, consumer price inflation averaged around 0.2%, a notably low figure, contrasting with global trends. This subdued inflation can impact the real value of assets and liabilities for China CITIC Bank, influencing its purchasing power and investment returns.

While low inflation generally supports stable asset values, it can also signal weaker consumer demand. Should deflationary pressures emerge, the bank could face challenges such as reduced economic activity and a higher risk of debt defaults, necessitating careful asset-liability management to mitigate these risks.

Exchange Rate Fluctuations

Exchange rate fluctuations significantly impact China CITIC Bank's financial performance, particularly its foreign currency denominated assets and liabilities. For instance, in early 2024, the Chinese Yuan (CNY) experienced periods of volatility against the US Dollar (USD) and Euro (EUR). A stronger Yuan can make it cheaper for the bank to service foreign debt but can also make Chinese exports, and by extension, the bank's international business, less competitive.

Conversely, a weaker Yuan can boost the attractiveness of Chinese exports and international trade activities, potentially increasing demand for the bank's trade finance services. However, it also increases the cost of repaying foreign-denominated debt. For example, if CITIC Bank holds substantial USD-denominated assets, a depreciation of the Yuan against the USD would translate into higher reported asset values in Yuan terms.

- Yuan's performance: The CNY experienced a notable depreciation against the USD in late 2023 and early 2024, trading around 7.1-7.3 CNY per USD, impacting the bank's balance sheet translation.

- International transactions: Exchange rate volatility directly affects the profitability of CITIC Bank's international trade finance and cross-border payment services.

- Currency risk management: Effective hedging strategies are crucial for CITIC Bank to mitigate potential losses arising from adverse currency movements on its international portfolio.

Household Income and Consumer Spending

The growth in household disposable income and consumer spending in China directly impacts demand for China Citic Bank's retail banking products like loans, credit cards, and wealth management services. A strong economic performance translates to increased consumer confidence and a greater willingness to engage with financial institutions for these offerings.

In 2024, China's economic growth is projected to remain resilient, with household disposable income expected to see continued upward trends, supporting robust consumer spending. This positive environment is a significant tailwind for the retail banking sector.

- Household disposable income growth: Expected to remain a key driver for consumer spending.

- Consumer spending patterns: Shift towards higher-value goods and services benefits retail banking.

- Retail banking product demand: Loans, credit cards, and wealth management services are poised for growth.

- Consumer confidence indices: Monitoring these indicators provides insight into future demand for financial products.

China's economic performance remains a primary driver for China CITIC Bank. The nation's GDP growth, projected around 5% for 2024, directly influences loan demand and credit risk. Industrial production, showing a 6.2% year-on-year rise in early 2024, indicates market health and opportunities for the bank.

Monetary policy, guided by the People's Bank of China (PBOC), significantly shapes the banking landscape. The PBOC's decision to maintain the Loan Prime Rate (LPR) at 3.45% for one-year loans and 3.95% for five-year loans in early 2024 impacts China CITIC Bank's net interest margins and lending volumes.

Inflationary trends, with China's 2023 average CPI at a low 0.2%, affect the real value of assets and liabilities for China CITIC Bank, potentially signaling weaker consumer demand.

| Economic Indicator | Period | Value | Implication for China CITIC Bank |

| GDP Growth (Projected) | 2024 | ~5% | Supports loan demand and financial service activity |

| Industrial Production (YoY) | Jan-Feb 2024 | +6.2% | Indicates robust activity in core sectors |

| 1-Year Loan Prime Rate (LPR) | Early 2024 | 3.45% | Affects net interest margins and borrowing costs |

| Consumer Price Index (CPI) | 2023 Average | 0.2% | Low inflation may signal subdued consumer demand |

Preview the Actual Deliverable

China Citic Bank PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of China Citic Bank delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting its operations. Understand the strategic landscape and potential challenges and opportunities for this major financial institution.

Sociological factors

China's rapid urbanization, with over 65% of its population residing in urban areas by the end of 2024, fuels demand for financial services. This includes increased need for mortgages, personal loans, and wealth management products as more citizens engage with the formal financial system. For instance, the urban population grew by 11.9 million in 2023 alone, indicating sustained growth in this sector.

Demographic shifts, particularly the aging population which is projected to reach 400 million by 2035, present significant opportunities for China CITIC Bank. This trend necessitates a focus on retirement planning services, pension funds, and specialized financial products catering to the elderly, such as healthcare financing and annuity products.

Chinese consumers are increasingly sophisticated, with a growing demand for digital-first financial solutions. By 2024, mobile payment penetration in China was estimated to be over 90%, highlighting a significant shift towards tech-savvy financial interactions. This evolving behavior necessitates that banks like China Citic Bank offer seamless mobile banking, personalized investment platforms, and accessible financial advisory services to meet customer expectations and remain competitive.

China's burgeoning middle and upper classes are driving significant wealth accumulation, creating a fertile ground for wealth management and private banking. By the end of 2024, it's projected that China's high-net-worth individual population will continue its upward trajectory, presenting substantial opportunities for financial institutions like China Citic Bank to expand their premium service offerings.

However, the persistent wealth gap in China means that while some segments are rapidly accumulating assets, others still rely on more fundamental banking services. This disparity necessitates a nuanced approach to product development, ensuring that China Citic Bank can cater to both the sophisticated needs of the affluent and the essential requirements of the broader population to achieve widespread market penetration.

Public Trust and Reputation

Public trust is a cornerstone for any financial institution, and China CITIC Bank is no exception. In 2024, consumer awareness regarding financial risks and data security has reached new heights, making trust a critical differentiator.

Negative publicity stemming from data breaches, instances of mis-selling, or financial misconduct can have a swift and detrimental impact on China CITIC Bank's reputation. This erosion of trust can directly translate into customer attrition, as individuals seek more secure and reliable banking partners. For instance, a significant data breach reported in late 2023 affecting a major competitor led to a noticeable shift in customer deposits towards institutions perceived as more secure.

- Reputation Management: Proactive communication and swift resolution of any customer concerns are vital.

- Data Security: Investing in robust cybersecurity measures is paramount to prevent breaches and maintain customer confidence.

- Ethical Conduct: Upholding high ethical standards in all operations builds a foundation of trust.

- Transparency: Open communication about policies, fees, and any potential issues fosters a transparent banking environment.

Cultural Values and Social Norms

Traditional Chinese cultural values, like a strong emphasis on saving and meticulous family financial planning, significantly shape how consumers interact with banking products and make financial decisions. For instance, data from the People's Bank of China in late 2023 indicated that household savings deposits continued to grow robustly, reflecting this ingrained preference. China CITIC Bank can leverage this by crafting marketing campaigns and product features that resonate with these deeply held norms, fostering stronger customer connections.

By aligning its banking services with these cultural expectations, China CITIC Bank can expect to see enhanced customer engagement and build lasting loyalty. This approach acknowledges that financial behavior is not solely driven by economic factors but also by deeply embedded societal values. This understanding is crucial for developing effective strategies in the dynamic Chinese market.

- High Savings Rate: Chinese households consistently exhibit high savings rates, often exceeding 40% of disposable income, a trend that continues into 2024, influencing demand for wealth management and long-term deposit products.

- Family-Centric Finance: Financial decisions are frequently made with the family's collective well-being in mind, impacting product uptake for joint accounts, education savings plans, and elder care provisions.

- Trust and Reputation: Cultural emphasis on guanxi (relationships and connections) means that trust and the bank's reputation are paramount, driving customer acquisition and retention through reliable service and community engagement.

Sociological factors significantly influence China CITIC Bank's operations, driven by rapid urbanization and evolving consumer behaviors. The increasing digital adoption, with mobile payment penetration exceeding 90% in 2024, necessitates a strong online presence and seamless digital banking solutions.

The aging demographic, projected to reach 400 million by 2035, creates a demand for specialized financial products like retirement planning and healthcare financing. Simultaneously, a growing middle and upper class, with accumulating wealth, fuels opportunities in wealth management and private banking services.

Cultural emphasis on saving, with household savings rates often exceeding 40% in 2024, shapes product demand towards wealth accumulation and long-term deposits. Trust and reputation are paramount, influenced by strong family financial planning and the importance of guanxi in business relationships.

| Sociological Factor | Description | Impact on China CITIC Bank | Supporting Data (2023-2024) |

| Urbanization | Shift of population to cities | Increased demand for mortgages, loans, wealth management | Urban population grew by 11.9 million in 2023; Over 65% urban population by end of 2024 |

| Demographics (Aging) | Growing elderly population | Opportunities in retirement, healthcare, and annuity products | Projected 400 million elderly by 2035 |

| Consumer Sophistication & Digitalization | Preference for digital and tech-savvy solutions | Need for robust mobile banking, personalized platforms | Mobile payment penetration over 90% in 2024 |

| Wealth Accumulation | Growth of middle and upper classes | Expansion opportunities in wealth management and private banking | Continued upward trajectory of high-net-worth individuals |

| Cultural Values (Saving) | Emphasis on saving and family financial planning | Demand for savings products, long-term deposits, family-oriented finance | Household savings deposits continued robust growth in late 2023; Savings rates exceeding 40% |

Technological factors

China CITIC Bank is navigating a landscape dramatically altered by digital transformation and the widespread adoption of mobile banking. As of early 2024, China's mobile payment penetration continues to soar, with platforms like Alipay and WeChat Pay deeply integrated into daily life, pushing traditional banks to innovate rapidly. This trend means that for China CITIC Bank, enhancing its mobile app and online platforms isn't just about convenience; it's a critical factor for customer retention and attracting new users in a highly competitive market.

Investing in user-friendly mobile applications and comprehensive online self-service portals is paramount for China CITIC Bank to meet evolving customer demands for seamless and accessible banking. The bank’s commitment to digital channels is reflected in its ongoing efforts to expand features and improve the user experience, aiming to provide a competitive edge. A robust digital infrastructure is no longer an option but a necessity for survival and growth in the contemporary financial services sector.

The burgeoning FinTech sector in China presents a dynamic landscape for China CITIC Bank. Companies like Ant Group and Tencent's WeChat Pay have revolutionized digital payments, with mobile payment transactions in China reaching an estimated $38.6 trillion in 2023, according to Statista. This intense competition necessitates strategic adaptation for traditional banks.

China CITIC Bank must actively engage with FinTech advancements, whether through strategic partnerships or internal innovation, to maintain its market position. By embracing new technologies for lending and wealth management, the bank can enhance operational efficiency and customer engagement, mirroring the agility demonstrated by FinTech disruptors.

China CITIC Bank is actively integrating artificial intelligence and big data analytics to sharpen its competitive edge. These technologies are instrumental in refining risk assessment models, allowing for more precise credit scoring and fraud detection, which is crucial in a dynamic financial landscape. For instance, by analyzing vast datasets, the bank can identify subtle patterns indicative of potential financial crime, bolstering security for its customers.

The bank is also leveraging AI for highly personalized marketing campaigns and customer service. By understanding individual customer behavior and preferences through data analytics, China CITIC Bank can offer tailored financial products and services, enhancing customer satisfaction and loyalty. This data-driven approach extends to operational efficiency, with AI automating routine tasks and optimizing internal processes, thereby reducing costs and improving service delivery speed.

In 2024, the banking sector's investment in AI and data analytics is projected to grow significantly. China CITIC Bank's strategic deployment of these tools is expected to yield substantial improvements in its ability to make informed, data-backed decisions, ultimately driving profitability and market share in the evolving digital economy.

Cybersecurity and Data Privacy

As financial transactions increasingly move online, robust cybersecurity and stringent data privacy protocols are paramount for China CITIC Bank. The bank must protect customer data from breaches and cyberattacks, which is not only a regulatory necessity but also crucial for maintaining customer trust and its reputation. This necessitates continuous investment in advanced security infrastructure to combat evolving threats.

China's cybersecurity landscape saw significant developments in 2024 and early 2025. The Cybersecurity Review Office of the Cyberspace Administration of China (CAC) continued to enforce regulations like the Cybersecurity Law and Data Security Law, imposing substantial fines for non-compliance. For instance, in 2024, several companies faced penalties for data mishandling, highlighting the strict enforcement environment.

- Increased Regulatory Scrutiny: China's regulators are intensifying oversight on data handling and cybersecurity practices within the financial sector.

- Customer Trust as a Key Asset: Protecting sensitive financial information is directly linked to customer confidence and the bank's brand image.

- Investment in Advanced Security: China CITIC Bank must allocate significant resources to cutting-edge cybersecurity technologies and talent to mitigate risks.

- Evolving Threat Landscape: The bank needs to stay ahead of sophisticated cyber threats, including ransomware and phishing attacks targeting financial institutions.

Blockchain and Distributed Ledger Technology

Blockchain and Distributed Ledger Technology (DLT) present significant opportunities for China Citic Bank to streamline operations. Potential applications include faster cross-border payments, enhanced security for record-keeping, and the use of smart contracts, which could fundamentally change traditional banking. For instance, by mid-2024, several major banks globally were piloting DLT for trade finance, reporting potential cost reductions of up to 30%.

Investing in and exploring these emerging technologies is crucial for China Citic Bank to secure long-term competitive advantages and achieve greater operational efficiencies. By staying informed about DLT advancements, the bank can position itself for future innovation and maintain a leading edge in the evolving financial landscape. The global DLT market is projected to reach over $20 billion by 2025, indicating substantial growth and adoption potential.

Key areas where blockchain and DLT can impact China Citic Bank include:

- Enhanced Payment Systems: Facilitating quicker and more cost-effective cross-border transactions.

- Improved Security and Transparency: Creating immutable records for greater data integrity and fraud prevention.

- Streamlined Processes: Automating complex financial agreements through smart contracts, reducing manual intervention.

China CITIC Bank is actively leveraging artificial intelligence and big data analytics to refine risk assessment, enhance fraud detection, and personalize customer experiences. The bank's strategic deployment of these tools in 2024 and early 2025 is geared towards making more informed, data-backed decisions to boost profitability and market share.

The bank is also focusing on advanced cybersecurity and data privacy, recognizing their critical role in maintaining customer trust and regulatory compliance. With China's Cybersecurity Review Office of the Cyberspace Administration of China enforcing strict data handling regulations, China CITIC Bank must continuously invest in cutting-edge security measures to combat evolving cyber threats.

Emerging technologies like blockchain and Distributed Ledger Technology (DLT) offer significant opportunities for China CITIC Bank to improve payment systems, enhance security, and streamline complex financial processes through smart contracts. The global DLT market's projected growth to over $20 billion by 2025 underscores the potential for these innovations to drive operational efficiencies and competitive advantages.

Legal factors

China CITIC Bank navigates a complex regulatory landscape, primarily shaped by the People's Bank of China and the China Banking and Insurance Regulatory Commission (CBIRC). These bodies enforce strict prudential standards, including capital adequacy ratios, liquidity coverage ratios, and rigorous asset quality assessments. For instance, as of late 2024, major Chinese banks, including CITIC, were expected to maintain a capital adequacy ratio well above the Basel III minimums, often exceeding 12%, to ensure financial stability.

Adherence to these evolving regulations is non-negotiable for maintaining operational licenses and avoiding significant penalties. The CBIRC's ongoing focus on risk management and consumer protection means banks must continuously adapt their internal controls and reporting mechanisms. Failure to comply can lead to operational restrictions, reputational damage, and substantial fines, impacting profitability and market confidence.

China CITIC Bank operates under stringent Anti-Money Laundering (AML) and Counter-Terrorism Financing (CTF) laws, necessitating sophisticated systems for transaction monitoring and customer due diligence. Failure to comply can lead to substantial fines; for instance, in 2023, Chinese financial institutions faced increased scrutiny and regulatory actions related to AML compliance, with penalties often running into millions of dollars for significant breaches.

The bank must continually invest in training its staff and updating its AML/CTF protocols to align with evolving regulatory frameworks, ensuring robust defenses against illicit financial activities. This proactive approach is crucial as regulators globally, including in China, are enhancing their enforcement capabilities and data analytics to detect financial crime more effectively.

China Citic Bank must strictly adhere to evolving data protection and privacy regulations. The Cybersecurity Law and the Personal Information Protection Law (PIPL) are paramount, dictating how customer data can be collected, stored, processed, and transferred. For instance, PIPL, which came into effect in November 2021, sets stringent requirements for obtaining consent and ensuring data security.

Consumer Protection Laws and Financial Ombudsman

Consumer protection laws in China, such as the Consumer Rights Protection Law, significantly shape how financial institutions like China CITIC Bank operate. These regulations mandate clear disclosure of product terms, prohibit misleading advertising, and establish robust complaint resolution mechanisms. For instance, the China Banking and Insurance Regulatory Commission (CBIRC) has issued guidelines emphasizing fair treatment of consumers, particularly concerning fees and charges, which banks must adhere to.

The presence of financial ombudsman services or similar dispute resolution bodies further strengthens consumer safeguards. These entities provide an avenue for customers to seek redress outside of traditional court proceedings, fostering a more efficient and accessible complaint process. In 2023, reports indicated a rise in consumer complaints related to digital banking services, prompting regulatory bodies to reinforce data security and privacy requirements for financial providers, including China CITIC Bank.

- Mandatory Transparency: Laws require clear communication of product features, risks, and fees to prevent mis-selling.

- Complaint Handling: Regulations outline specific procedures for addressing customer grievances promptly and fairly.

- Fair Treatment: Financial institutions must ensure equitable practices across all customer interactions, avoiding discriminatory or exploitative behavior.

- Regulatory Oversight: Bodies like the CBIRC actively monitor compliance and can impose penalties for violations of consumer protection laws.

International Regulatory Compliance and Sanctions

China CITIC Bank faces significant legal hurdles in its international operations, particularly concerning compliance with global regulatory frameworks and sanctions. For instance, adhering to the Office of Foreign Assets Control (OFAC) sanctions is paramount for any bank engaging in cross-border transactions, especially given the evolving geopolitical landscape. Failure to comply can result in substantial fines and reputational damage, impacting market access.

Navigating these diverse legal requirements is not just about avoiding penalties; it's about maintaining the bank's ability to operate within the international financial system. In 2024, the global regulatory environment continues to tighten, with increased scrutiny on anti-money laundering (AML) and know-your-customer (KYC) protocols. China CITIC Bank's commitment to a strong international compliance framework is therefore essential for its continued growth and stability.

- OFAC Sanctions Compliance: Strict adherence to OFAC regulations is critical to avoid penalties on international transactions.

- Global Regulatory Landscape: Keeping abreast of evolving international banking regulations, including AML and KYC standards, is a continuous challenge.

- Cross-Border Transaction Scrutiny: Increased oversight on international financial flows necessitates robust reporting and due diligence procedures.

- Reputational Risk Management: Non-compliance can lead to severe reputational damage, impacting investor confidence and market access.

China CITIC Bank must navigate a complex web of legal frameworks, including stringent consumer protection laws and data privacy regulations like PIPL. These laws mandate transparency in product offerings and fair treatment of customers, with regulators like the CBIRC actively enforcing compliance. For instance, in 2023, the CBIRC issued directives emphasizing fair fee structures, impacting how banks communicate charges to consumers.

Environmental factors

China's commitment to green finance is accelerating, with the People's Bank of China (PBOC) and other regulators actively promoting sustainable development. This push directly influences China CITIC Bank's operations, steering its lending and investment towards environmentally sound projects. For instance, by the end of 2023, outstanding green loans in China reached approximately 31.04 trillion yuan, a significant increase that highlights the growing market for such financing.

Consequently, China CITIC Bank is increasingly incentivized and mandated to integrate environmental risk assessments into its financing decisions and to actively support green initiatives. This strategic shift presents a substantial opportunity for the bank to develop and market innovative green financial products and services, tapping into a rapidly expanding segment of the financial market.

China Citic Bank, like all financial institutions, faces significant physical risks from climate change. Extreme weather events, such as floods and droughts, could directly impact the bank's loan portfolios, especially in agriculture and real estate sectors heavily reliant on stable environmental conditions. For instance, a severe drought in a key agricultural region could lead to widespread loan defaults.

Conversely, the global shift towards a low-carbon economy presents substantial opportunities for China Citic Bank. The bank can finance the development of renewable energy projects, such as solar and wind farms, and support energy efficiency upgrades in industries. By 2024, China's investment in green finance is expected to reach trillions of yuan, offering a vast market for sustainable lending.

Effectively assessing and managing these climate-related financial risks and opportunities is becoming paramount for China Citic Bank's long-term stability and growth. The bank's ability to integrate climate considerations into its risk management frameworks and lending strategies will be crucial in navigating the evolving regulatory landscape and meeting investor expectations for environmental, social, and governance (ESG) performance.

China CITIC Bank's commitment to Environmental, Social, and Governance (ESG) standards is a critical factor for its investor relations and reputation. Investors and stakeholders are closely examining the bank's environmental stewardship, social impact, and governance structures. For instance, as of the first half of 2024, the bank reported a significant increase in its green finance portfolio, reflecting a growing emphasis on environmental responsibility.

Resource Scarcity and Pollution Regulations

China's ongoing efforts to combat resource scarcity and pollution, particularly evident in its 2024-2025 environmental policy landscape, directly influence financial institutions like China Citic Bank. Stricter regulations on water usage, emissions, and waste management can elevate operational expenses for the bank and its industrial clientele. For instance, the nation's commitment to carbon neutrality targets, with significant investment directed towards green energy, may reduce lending opportunities in traditional heavy industries while creating new avenues in sustainable finance.

The bank faces increasing pressure to integrate environmental, social, and governance (ESG) principles into its lending practices and internal operations. This includes actively promoting green finance products and services to clients, thereby encouraging a shift towards more sustainable business models. Failure to adapt could lead to reputational damage and missed market opportunities, especially as global investors increasingly prioritize ESG performance. By mid-2024, China's financial regulators continued to emphasize the importance of green finance, with reports indicating substantial growth in green bond issuance and lending for environmental projects.

- Increased compliance costs: Stricter pollution control measures can lead to higher operating expenses for both the bank and its borrowers in sectors like manufacturing and energy.

- Shift in lending portfolio: A growing emphasis on sustainability may prompt China Citic Bank to reallocate capital away from carbon-intensive industries towards green technologies and renewable energy projects.

- ESG integration: The bank is expected to enhance its ESG reporting and integrate sustainability criteria into its risk assessment and credit approval processes.

- Green finance growth: Opportunities are expanding in areas like green bonds and loans, reflecting China's national strategy to achieve its climate goals by 2060.

Corporate Social Responsibility (CSR) and Brand Image

China CITIC Bank's engagement in Corporate Social Responsibility (CSR) is increasingly vital for its brand image. By actively participating in environmental protection initiatives and community development, the bank can cultivate a more favorable public perception. This focus on sustainability is not just about good deeds; it's a strategic move to build trust and attract a broader customer base, including those who prioritize ethical business practices.

A demonstrated commitment to environmental responsibility, for instance, can resonate strongly with both consumers and investors. In 2024, reports indicated a growing preference among Chinese consumers for brands with strong sustainability credentials. This trend suggests that China CITIC Bank's investment in green financing and eco-friendly operations could directly translate into enhanced brand loyalty and a stronger market position. Such efforts contribute to long-term value creation by fostering a positive reputation in an increasingly conscientious market.

- Enhanced Brand Reputation: CSR activities, particularly in environmental stewardship, bolster China CITIC Bank's public image.

- Attracting Conscious Consumers: A commitment to sustainability can draw in customers who prioritize ethical banking.

- Investor Appeal: Environmentally responsible practices can attract ESG-focused investors, improving access to capital.

- Long-Term Value: Positive brand perception built on CSR contributes to sustained business growth and stakeholder value.

China's environmental regulations are becoming more stringent, impacting China CITIC Bank's operations and lending practices. The nation's drive towards carbon neutrality by 2060 necessitates significant shifts in industrial financing, creating both challenges and opportunities for the bank. For example, China's green finance market saw substantial growth, with outstanding green loans reaching approximately 31.04 trillion yuan by the end of 2023, indicating a clear direction for financial institutions.

This regulatory environment incentivizes China CITIC Bank to increase its focus on green financing and sustainable investments. The bank must integrate environmental risk assessments into its credit processes and develop new financial products that support eco-friendly initiatives. By mid-2024, regulators continued to emphasize green finance, with reports showing significant increases in green bond issuances and lending for environmental projects.

The physical risks associated with climate change, such as extreme weather events, also pose a threat to China CITIC Bank's loan portfolios, particularly in sectors like agriculture and real estate. Conversely, the global transition to a low-carbon economy presents opportunities for the bank to finance renewable energy projects and energy efficiency upgrades, with China's investment in green finance projected to reach trillions of yuan in 2024.

| Environmental Factor | Impact on China CITIC Bank | Supporting Data/Trend (2023-2024) |

|---|---|---|

| Stricter Environmental Regulations | Increased compliance costs, potential shift in lending towards green sectors. | China's commitment to carbon neutrality by 2060. |

| Climate Change Risks | Potential loan defaults in vulnerable sectors (e.g., agriculture, real estate) due to extreme weather. | Growing frequency of extreme weather events impacting economic stability. |

| Green Finance Growth | Opportunities in financing renewable energy, energy efficiency, and green bonds. | Outstanding green loans reached ~31.04 trillion yuan by end of 2023; significant regulatory emphasis on green finance in H1 2024. |

| ESG Investor Demand | Pressure to integrate ESG principles into operations and reporting for investor appeal. | Increased investor preference for companies with strong sustainability credentials. |

PESTLE Analysis Data Sources

Our China Citic Bank PESTLE Analysis is built on comprehensive data from official Chinese government sources, international financial institutions like the IMF and World Bank, and reputable industry research firms. We incorporate economic indicators, regulatory updates, and market trend reports to provide a well-rounded view.