China Citic Bank Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

China Citic Bank Bundle

China Citic Bank navigates a complex landscape shaped by intense competition and evolving customer demands. Understanding the interplay of buyer power, supplier influence, and the threat of new entrants is crucial for its strategic positioning.

The complete report reveals the real forces shaping China Citic Bank’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

China Citic Bank, like other financial institutions, relies heavily on a diverse range of capital sources. Its primary funding comes from customer deposits, which represented a significant portion of its liabilities in recent years. For instance, as of the end of 2023, China Citic Bank’s total deposits reached approximately RMB 6.3 trillion.

Beyond deposits, the bank also taps into interbank markets and issues various debt instruments in capital markets to secure funds. If these funding channels become constrained or if market participants demand higher returns due to economic uncertainty or increased risk perception, the bank's cost of capital will rise. This directly impacts its profitability and its ability to offer competitive lending rates to customers.

Technology providers, including software vendors, hardware manufacturers, and cybersecurity firms, hold significant bargaining power over China Citic Bank. Their leverage is amplified when they offer specialized solutions or when the market has a limited number of capable suppliers for essential banking systems. For instance, the increasing reliance on cloud infrastructure and advanced AI-driven analytics means banks like Citic are dependent on a few key players for these mission-critical digital transformation initiatives.

China Citic Bank, like many financial institutions, faces significant bargaining power from its human capital. The availability and cost of skilled banking professionals, particularly in areas like IT, risk management, and financial analysis, directly influence operational efficiency and innovation. A tight labor market for these specialized roles can drive up salary and benefit costs, impacting profitability.

Regulatory Bodies & Compliance Services

Regulatory bodies and compliance services exert significant influence, akin to supplier power, over China Citic Bank. These entities establish the operational framework and mandate adherence to various rules, impacting the bank's strategic decisions and cost structures.

The increasing complexity and stringency of financial regulations globally, including in China, necessitate substantial investment in compliance infrastructure and expertise. For instance, in 2023, the People's Bank of China continued to emphasize robust risk management and data security, requiring banks like Citic to allocate more resources to these areas. This can translate into higher operational expenses and a reduced ability to pursue certain business initiatives, effectively giving regulators a form of bargaining power.

- Increased Compliance Costs: Expenses related to regulatory reporting, anti-money laundering (AML) checks, and cybersecurity measures are substantial, impacting profitability.

- Operational Constraints: Strict capital adequacy ratios and liquidity requirements limit the bank's lending capacity and product development.

- Demand for Specialized Services: The need for external legal, audit, and consulting firms specializing in financial compliance adds another layer of cost and dependency.

Infrastructure & Real Estate Providers

Infrastructure and real estate providers, such as landlords for branch networks and data centers, along with utility companies, hold significant bargaining power over China Citic Bank. This is particularly true in prime urban locations where competition for suitable commercial space is intense. For instance, in 2024, prime office rental rates in major Chinese cities like Shanghai and Beijing continued to see upward pressure, potentially increasing operational costs for banks with extensive physical footprints.

When alternative providers are scarce or the bank requires specialized facilities, these suppliers can leverage their position to dictate rental costs and service charges. This directly impacts China Citic Bank's operational overheads and can constrain its ability to expand its branch network or upgrade its technological infrastructure efficiently. The reliance on specific data center providers or utility services in certain regions can further amplify this supplier power.

- High Rental Costs in Prime Locations: In 2024, average commercial property rental costs in Beijing's central business districts remained elevated, impacting banks' fixed operational expenses.

- Limited Data Center Alternatives: Specialized data center services, crucial for financial institutions, often have few comparable providers, giving existing suppliers leverage.

- Utility Dependence: Reliable power and internet connectivity are non-negotiable for banking operations, making utility providers essential partners with inherent bargaining strength.

- Impact on Expansion: Increased infrastructure costs can deter or slow down China Citic Bank's strategic expansion plans, affecting market reach and customer accessibility.

The bargaining power of suppliers for China Citic Bank is moderate, primarily stemming from critical technology providers and specialized human capital. While customer deposits form the largest liability, the bank's operational efficiency and innovation are significantly influenced by the availability and cost of skilled IT professionals and advanced software solutions. For instance, the demand for AI and cloud expertise in 2024 has driven up compensation for these roles.

The bank's reliance on a limited number of vendors for core banking systems and cybersecurity software grants these suppliers considerable leverage. Disruptions or price increases from these key technology partners can directly impact Citic Bank's service delivery and security posture.

Furthermore, the increasing stringency of financial regulations means that compliance and audit service providers also wield significant influence. The need for specialized legal and consulting expertise to navigate complex regulatory landscapes, such as those emphasized by the People's Bank of China in 2023, creates a dependency that suppliers can exploit.

| Supplier Category | Key Dependencies | Impact on Citic Bank | 2024 Trend/Data Point |

|---|---|---|---|

| Technology Providers (Software/Hardware) | Core banking systems, AI/ML platforms, cybersecurity | Increased costs for essential digital transformation, potential service disruptions | Rising demand for cloud and AI talent increased IT staffing costs by an estimated 8-12% in the financial sector. |

| Specialized Human Capital | IT specialists, risk managers, financial analysts | Higher labor costs, potential talent shortages impacting innovation | Salaries for cybersecurity professionals in China saw a year-over-year increase of approximately 15% in early 2024. |

| Regulatory & Compliance Services | Legal counsel, auditors, consulting firms | Increased operational expenses, adherence to stringent mandates | Banks allocated an estimated 5-10% of their operating budget to compliance in 2023, a figure expected to hold or rise in 2024. |

What is included in the product

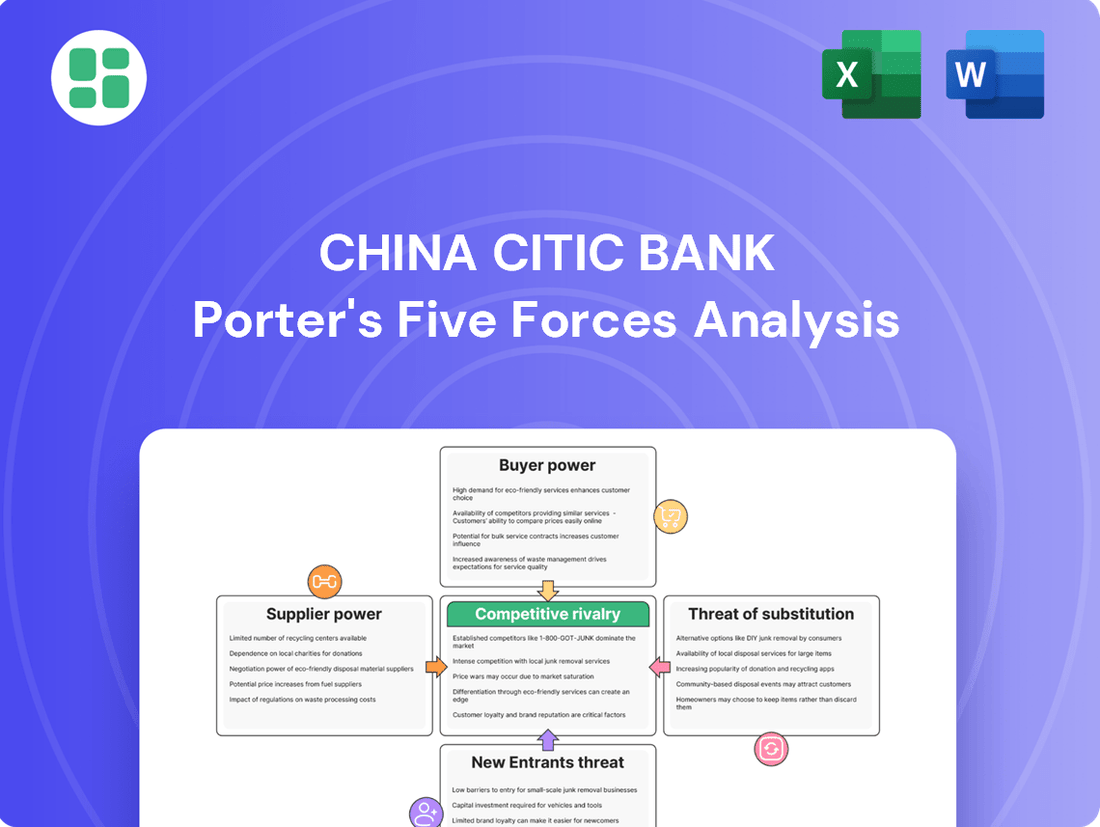

This analysis explores the competitive forces impacting China Citic Bank, detailing the intensity of rivalry, buyer and supplier power, threat of new entrants, and the impact of substitutes.

A dynamic visualization of competitive pressures—instantly identify and address China Citic Bank's strategic challenges.

Customers Bargaining Power

Customer switching costs for China Citic Bank are a critical factor in their bargaining power. If it's easy for customers, both individuals and businesses, to move their money and services to a competitor, they have more sway. This ease of switching means banks must constantly offer attractive rates and superior service to keep their clientele.

For instance, in 2023, the average time for a retail customer to switch banks in China was reported to be around 1-2 weeks, indicating relatively low switching friction for basic accounts. This allows customers to readily compare offerings and move if they find better deals, putting pressure on China Citic Bank to remain competitive in its pricing and service quality.

Customers of China Citic Bank, like those of many financial institutions, benefit from increasing information availability and transparency. This means it's easier than ever for individuals and businesses to compare interest rates, fees, and the range of services offered by different banks. For example, online comparison tools and financial news outlets in 2024 provide readily accessible data on lending rates and deposit yields across the banking sector.

This heightened transparency empowers customers. They can more easily identify banks offering more competitive terms, which in turn puts pressure on institutions like China Citic Bank to offer better deals. In 2023, the average personal loan interest rate in China hovered around 4.5-6.5%, demonstrating a competitive landscape where customers can shop around for the best rates.

The digital shift has significantly amplified this effect. With many banking services moving online, customers can access and compare information with just a few clicks. This ease of comparison reduces the switching costs for customers and forces banks to maintain competitive pricing and service quality to retain their customer base, potentially impacting profit margins.

China Citic Bank's bargaining power of customers is significantly influenced by customer concentration. If a few large corporate clients or a substantial portion of deposits are held by a small number of customers, these entities wield considerable leverage.

This concentrated customer base can negotiate for better terms, lower fees, or preferential interest rates, directly impacting the bank's profitability. For example, in 2023, while specific deposit concentration data for China Citic Bank isn't publicly detailed in a way that isolates this factor, the broader trend in China's banking sector shows a growing reliance on large institutional deposits. This trend inherently amplifies the bargaining power of these key clients.

Price Sensitivity of Services

China Citic Bank, like all financial institutions, faces significant customer price sensitivity, particularly concerning loan interest rates and deposit yields. In 2024, with ongoing economic adjustments and a competitive banking landscape, customers are keenly aware of interest rate differentials offered by various banks. This heightened sensitivity forces China Citic Bank to maintain competitive pricing to attract and retain deposits and lending business, which can directly impact its net interest margins.

The fees associated with banking services, such as transaction fees, account maintenance charges, and wealth management product fees, also contribute to customer price sensitivity. Customers can easily compare these fees across different banks, especially with the proliferation of digital banking platforms offering transparent pricing. For instance, a slight increase in ATM withdrawal fees or a new charge on digital transfers could prompt customers to switch to a competitor with more favorable fee structures.

- Customer Price Sensitivity: Customers actively compare interest rates on loans and deposits, as well as banking service fees across institutions.

- Competitive Pressure: In China's dynamic banking sector, banks must offer competitive rates and fees to attract and retain customers, impacting profitability.

- Margin Compression: High price sensitivity can force banks like China Citic Bank to lower margins on services to remain competitive.

- Impact of Digitalization: Digital platforms enhance price transparency, making it easier for customers to switch providers based on cost.

Access to Alternative Channels

Customers increasingly have access to alternative channels for financial services, reducing their reliance on traditional banks like China Citic Bank. This allows them to seek out competitors or even bypass intermediaries altogether.

For instance, the growth of peer-to-peer lending platforms and direct investment opportunities in capital markets means that individuals and businesses can secure funding or manage their investments without necessarily engaging with a bank. In 2024, the global fintech market continued its rapid expansion, with alternative lending platforms facilitating billions in transactions, directly challenging traditional banking models.

- Availability of Non-Bank Financial Services: Customers can access a wider array of financial products and services from fintech companies, investment platforms, and other non-traditional providers.

- Direct Access to Capital Markets: Sophisticated customers can directly invest in stocks, bonds, and other securities, bypassing the need for bank intermediation for wealth management.

- Reduced Dependence on Traditional Banks: As alternative channels mature, customers' dependence on banks for loans, investments, and payments diminishes, amplifying their bargaining power.

- Increased Competition for Banks: The proliferation of these alternative channels intensifies competition, forcing banks like China Citic Bank to offer more competitive rates and services to retain customers.

The bargaining power of customers for China Citic Bank is substantial due to low switching costs and high price sensitivity. Customers can easily compare rates and fees across institutions, especially with digital platforms. This forces banks to offer competitive pricing, impacting margins.

| Factor | Impact on China Citic Bank | 2023/2024 Data/Trend |

|---|---|---|

| Switching Costs | Low switching costs empower customers to move easily. | Retail customer bank switching time in China: 1-2 weeks (2023). |

| Information Transparency | Easy access to comparative data strengthens customer leverage. | Online tools provide real-time rate comparisons across banks (2024). |

| Price Sensitivity | Customers are highly sensitive to loan rates, deposit yields, and fees. | Personal loan rates in China: 4.5-6.5% (2023). |

| Alternative Channels | Fintech and direct market access reduce reliance on traditional banks. | Global fintech market expansion facilitates billions in transactions (2024). |

Preview the Actual Deliverable

China Citic Bank Porter's Five Forces Analysis

This preview showcases the comprehensive Porter's Five Forces Analysis for China Citic Bank, detailing the competitive landscape and strategic implications you will receive immediately after purchase. The document you see here is the exact, fully formatted analysis, ready for your immediate use, providing deep insights into the threats of new entrants, the bargaining power of buyers and suppliers, the intensity of rivalry, and the threat of substitute products. You're looking at the actual document; once you complete your purchase, you’ll get instant access to this exact file, enabling you to leverage its strategic information without delay.

Rivalry Among Competitors

China Citic Bank faces intense competition from a vast and varied landscape of financial institutions within China. This includes not only the massive state-owned banks like Industrial and Commercial Bank of China (ICBC) and China Construction Bank, but also a growing number of joint-stock banks, regional city commercial banks, and an increasing presence of foreign banks seeking to expand their footprint.

This sheer volume and diversity of players means that the battle for customers and market share is particularly fierce. For instance, as of the end of 2023, China's banking sector comprised over 4,000 banking institutions, highlighting the crowded nature of the market. This intense rivalry often forces banks like China Citic to adopt aggressive pricing strategies, innovative product development, and enhanced customer service to differentiate themselves and capture a larger portion of the market.

China's banking sector experienced robust growth in recent years, with total assets of commercial banks reaching approximately 250 trillion yuan by the end of 2023. This expansion, while significant, is moderating compared to earlier periods, indicating a shift towards a more mature market. As the industry growth rate slows, competition intensifies, forcing established players like China Citic Bank to vie more aggressively for market share rather than simply capitalizing on overall market expansion.

China Citic Bank, like many financial institutions, faces intense competition where the ability to differentiate products and services is key. If offerings are largely standardized, like basic savings accounts, competition often boils down to price, driving up rivalry among banks.

However, unique services, such as specialized wealth management platforms or advanced digital banking solutions, can significantly reduce direct price competition. For instance, in 2024, many Chinese banks are investing heavily in AI-driven personalized financial advice and integrated lifestyle services to stand out, moving beyond traditional deposit and lending.

Exit Barriers

China Citic Bank, like other major Chinese banks, faces substantial exit barriers. These include significant investments in physical branches and technology infrastructure, which are difficult to liquidate without substantial loss. Regulatory requirements also impose obligations that make a swift exit challenging.

These high exit barriers can contribute to persistent overcapacity within the Chinese banking sector. When it's difficult for underperforming banks to leave, they may continue to operate, leading to intensified competition for market share and customer deposits. This was evident in 2023, where despite some consolidation efforts, the number of banking institutions remained high, putting pressure on profitability.

- Significant Fixed Assets: Chinese banks typically operate extensive branch networks and invest heavily in IT systems, making divestment costly.

- Regulatory Obligations: Strict regulations govern bank closures, requiring approvals and adherence to specific procedures that prolong the exit process.

- Social Responsibilities: Banks often have implicit or explicit social responsibilities, such as supporting local economies or providing essential financial services, which can discourage outright closure.

Strategic Stakes and Commitments

The strategic stakes for China Citic Bank and its competitors are substantial, particularly concerning market leadership in key segments like corporate banking and wealth management. Banks view maintaining or increasing their share in these profitable areas as vital for long-term growth and profitability.

This intense focus on market position drives aggressive investment and competition. For instance, in 2023, major Chinese banks, including Citic Bank, continued to heavily invest in digital transformation and customer service enhancements to capture and retain market share.

- Market Leadership Importance: Banks prioritize leadership in high-growth sectors such as digital payments and green finance, leading to intensified competition.

- Strategic Segment Focus: Citic Bank's commitment to its retail banking and investment banking divisions means significant resources are allocated to outmaneuver rivals in these areas.

- Escalated Rivalry: When market share is perceived as critical, banks are more likely to engage in price wars or aggressive marketing campaigns, directly impacting profitability and increasing overall industry rivalry.

Competitive rivalry is a defining characteristic of China's banking sector, impacting China Citic Bank significantly. The market is densely populated with over 4,000 banking institutions as of late 2023, ranging from massive state-owned entities to smaller city commercial banks and foreign entrants. This crowded environment necessitates constant innovation and competitive pricing to secure market share.

Growth in total assets of commercial banks reached approximately 250 trillion yuan by the end of 2023, but the slowing growth rate means banks must fight harder for customers. Differentiation through specialized services, like AI-driven financial advice or advanced digital platforms, is becoming crucial to avoid purely price-based competition, a trend heavily pursued by banks in 2024.

The strategic importance of market leadership in segments like wealth management fuels aggressive competition, with banks like China Citic Bank investing heavily in digital transformation and customer service enhancements to gain an edge.

| Metric | Value (End of 2023) | Implication for Rivalry |

|---|---|---|

| Number of Banking Institutions in China | Over 4,000 | High market saturation, intense competition. |

| Total Assets of Commercial Banks | ~250 Trillion Yuan | Indicates a large market, but moderating growth intensifies share battles. |

| Investment in Digital Transformation | Significant across major banks | Banks are competing on service quality and innovation, not just price. |

SSubstitutes Threaten

Fintech solutions, particularly mobile payment platforms like Alipay and WeChat Pay, pose a significant threat to China Citic Bank. These non-bank entities offer convenient payment services that often bypass traditional bank accounts, directly impacting the bank's fee income from transfers and card services. By mid-2024, these platforms facilitated trillions of dollars in transactions, demonstrating their widespread adoption and ability to capture market share from traditional banking services.

Peer-to-peer (P2P) lending platforms present a significant threat to traditional banks like China Citic Bank by directly connecting borrowers with lenders, bypassing bank intermediation. These platforms can attract a substantial portion of loan demand, particularly for consumer and small business financing, thereby reducing the volume of lending opportunities available to banks.

In 2023, the global P2P lending market was valued at approximately $100 billion, with projections indicating continued growth. This growth signifies a tangible shift in borrowing behavior, where individuals and small businesses increasingly turn to P2P platforms for faster access to capital and potentially more competitive rates, directly impacting banks' market share in these segments.

Large corporations and sophisticated investors increasingly bypass traditional banks for financing by issuing bonds or equity directly in capital markets. This trend reduces their reliance on bank loans, directly impacting a bank's corporate lending revenue streams. For instance, in 2024, global corporate bond issuance continued to be robust, providing a viable alternative to bank financing for many large entities.

Wealth Management by Non-Bank Institutions

The threat of substitutes in wealth management for China Citic Bank is significant, primarily from non-bank institutions. These include asset management firms, insurance companies, and burgeoning online investment platforms that offer a diverse range of investment products and personalized wealth advisory services. For instance, by the end of 2023, China's asset management industry saw its total assets under management reach approximately RMB 150 trillion, showcasing the scale of competition.

These entities directly compete for customer savings and investments, potentially siphoning assets away from traditional bank wealth management products. This diversion of funds can directly impact China Citic Bank's fee income streams and its crucial deposit base, as customers seek alternative, often more specialized or digitally accessible, financial solutions.

- Asset Management Firms: Offer specialized investment strategies and products, attracting high-net-worth individuals and institutional investors.

- Insurance Companies: Provide wealth accumulation products like universal life insurance and annuities, often with tax advantages.

- Online Investment Platforms (Fintech): Deliver user-friendly interfaces, lower fees, and robo-advisory services, appealing to a younger demographic and smaller investors.

Digital-only Banks and Neo-banks

Digital-only banks and neo-banks present a significant threat by offering streamlined, often lower-cost services without the overhead of physical branches. These agile players are particularly adept at attracting younger, tech-savvy demographics who value convenience and digital integration.

In 2024, the digital banking sector continued its rapid expansion. For instance, by the end of Q1 2024, the number of active digital-only bank accounts globally had surpassed 300 million, indicating a substantial shift in consumer preference. These new entrants can quickly adapt to market changes and customer demands, directly challenging the established customer base and operational models of traditional institutions like China Citic Bank.

- Lean Operational Models: Digital banks operate with significantly lower overhead costs compared to traditional banks, allowing them to offer more competitive interest rates and lower fees, thereby attracting price-sensitive customers.

- Enhanced Customer Experience: They leverage advanced technology for user-friendly interfaces, faster transaction processing, and personalized financial management tools, appealing to a digitally native customer base.

- Agility and Innovation: Neo-banks can introduce new products and services more rapidly than legacy banks, responding quickly to evolving consumer needs and technological advancements in the financial sector.

- Market Share Erosion: By capturing a growing segment of the retail banking market, particularly among younger demographics, digital-only banks can gradually erode the market share of traditional banks, impacting revenue streams and long-term growth prospects.

The threat of substitutes for China Citic Bank is multifaceted, primarily stemming from non-traditional financial service providers. Fintech platforms, P2P lending, direct capital market access for corporations, and digital-only banks all offer alternative ways for customers to manage their money, borrow, and invest, often with greater convenience or lower costs.

These substitutes directly challenge China Citic Bank's traditional revenue streams, including transaction fees, interest income from loans, and wealth management fees. For instance, by the end of 2023, the total assets under management in China's asset management industry neared RMB 150 trillion, highlighting the significant competition for customer deposits and investments.

The increasing adoption of digital-only banks, with over 300 million active global accounts by Q1 2024, further underscores this threat. These new entrants leverage lean operations and enhanced customer experiences to attract a growing segment of the banking market, particularly younger demographics.

The following table illustrates the competitive landscape of substitutes impacting traditional banking services.

| Substitute Type | Key Features | Impact on Traditional Banks | Market Penetration Example (as of late 2023/early 2024) |

|---|---|---|---|

| Fintech Payment Platforms | Convenience, bypassing traditional accounts | Reduced fee income (transfers, card services) | Trillions of dollars in transactions facilitated mid-2024 |

| P2P Lending Platforms | Direct borrower-lender connection | Reduced loan origination volume | Global P2P market valued ~ $100 billion in 2023 |

| Capital Markets (Bonds/Equity) | Direct financing for large corporations | Lower corporate lending revenue | Robust global corporate bond issuance in 2024 |

| Digital-Only Banks/Neo-banks | Lower costs, enhanced digital experience | Erosion of retail market share, deposit base | Over 300 million active global digital-only accounts by Q1 2024 |

Entrants Threaten

The banking sector in China, including for institutions like China Citic Bank, faces substantial regulatory hurdles. Obtaining a banking license is an intricate and lengthy process, demanding significant capital reserves and a rigorous demonstration of compliance with a complex web of rules and standards. This stringent environment effectively deters most potential new entrants from even attempting to enter the market.

The capital requirements for establishing a new bank in China, like China Citic Bank, are incredibly high. New entrants must meet stringent minimum capital ratios mandated by regulators, such as the China Banking and Insurance Regulatory Commission (CBIRC). For instance, as of recent data, commercial banks generally need a core tier-one capital ratio of at least 7.5% and a total capital ratio of 10.5%.

Beyond regulatory capital, the actual financial investment to build out a competitive operational infrastructure is immense. This includes significant outlays for advanced technology platforms, a network of physical branches or digital service centers, and maintaining sufficient liquidity to meet customer demands and regulatory obligations. This substantial capital barrier effectively deters most potential new entrants from even attempting to compete with established players like China Citic Bank.

China Citic Bank, like other established players, benefits from significant brand loyalty and trust built over decades. New entrants struggle to replicate this deep-seated confidence, particularly in a sector where financial security and reliability are paramount. This makes it difficult for newcomers to attract customers away from trusted institutions.

Economies of Scale and Network Effects

China Citic Bank, like other established financial institutions, benefits significantly from economies of scale. This means their larger operational size allows for lower per-unit costs in areas like technology investment, marketing, and regulatory compliance. For instance, in 2023, the total assets of China's banking sector reached approximately 260 trillion yuan, a testament to the scale of operations that new entrants would struggle to match.

Network effects also present a substantial barrier. A large, existing customer base and extensive branch and ATM networks provide unparalleled convenience and accessibility. This widespread reach makes it challenging for new banks to attract customers who value the established infrastructure and service points offered by incumbents like China Citic Bank.

- Economies of Scale: Established banks can spread fixed costs over a larger volume of business, leading to lower average costs per transaction or service.

- Network Effects: The value of a bank's services increases with the number of customers and access points, creating a self-reinforcing advantage for incumbents.

- Customer Loyalty: Existing customers are often hesitant to switch due to the inconvenience of changing banking relationships and the trust built with established institutions.

- Capital Requirements: The sheer amount of capital required to establish a bank and compete with existing players, particularly in areas like technology and compliance, is a significant deterrent for new entrants.

Access to Funding and Liquidity

New entrants in China's banking sector face significant hurdles in accessing stable funding and maintaining adequate liquidity. Without an established deposit base, which is crucial for low-cost funding, and lacking deep interbank relationships, new banks struggle to secure the necessary capital to operate and manage financial risks. For instance, by the end of 2023, the total deposit balance in China's financial institutions reached ¥258.5 trillion, a figure that new, unproven entities cannot easily tap into.

This difficulty in attracting deposits directly impacts a new bank's liquidity position. Established banks benefit from years of customer trust and a wide branch network, allowing them to attract and retain deposits more effectively. In contrast, new entrants must compete aggressively for limited funding, often at higher costs, which can erode profitability and hinder growth. The People's Bank of China's reserve requirement ratio, which stood at 7% for most large banks in early 2024, also means that a significant portion of available funds is held in reserve, further tightening liquidity for those without substantial deposit inflows.

- Funding Gap: New banks must overcome the challenge of building a substantial and stable deposit base, a key differentiator for incumbents.

- Liquidity Management: Without established deposit streams, managing short-term liquidity needs becomes a constant and costly concern for new entrants.

- Interbank Market Access: Limited history and reputation can restrict access to the interbank lending market, a vital source of short-term liquidity for financial institutions.

The threat of new entrants for China Citic Bank is considerably low due to the immense capital requirements and stringent regulatory environment in China's banking sector. Obtaining a banking license is a complex and costly endeavor, demanding substantial financial reserves and adherence to a rigorous compliance framework. This high barrier to entry effectively deters most potential competitors from even attempting to establish a presence.

Established players like China Citic Bank also benefit from significant economies of scale and strong network effects. Their vast operational size allows for lower per-unit costs, and an extensive customer base coupled with a wide branch and ATM network provides unparalleled convenience. For instance, in 2023, China's banking sector held total assets of approximately 260 trillion yuan, a scale that new entrants would find extremely difficult to match.

Furthermore, new entrants face considerable challenges in securing stable funding and maintaining adequate liquidity without an established deposit base or deep interbank relationships. By the end of 2023, China's financial institutions held ¥258.5 trillion in deposits, a crucial funding source that is difficult for newcomers to access. This funding gap makes it challenging for new banks to compete effectively and manage financial risks.

| Barrier | Description | Impact on New Entrants | Relevant Data (2023/Early 2024) |

| Capital Requirements | High minimum capital ratios and investment in infrastructure | Deters entry due to prohibitive costs | Core Tier-1 Capital Ratio: ~7.5% (general) |

| Economies of Scale | Lower average costs due to large operations | New entrants struggle to achieve cost competitiveness | Total Assets: ~260 trillion yuan |

| Network Effects | Value of services increases with customer base and access points | Established incumbents offer superior convenience and reach | Extensive branch and ATM networks |

| Funding & Liquidity | Difficulty in attracting deposits and accessing interbank markets | Limits operational capacity and increases funding costs | Total Deposits: ~258.5 trillion yuan |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for China Citic Bank is built upon a foundation of comprehensive data, including the bank's annual reports, filings with the China Banking and Insurance Regulatory Commission (CBIRC), and reports from reputable financial data providers like Wind Information and S&P Global Market Intelligence.