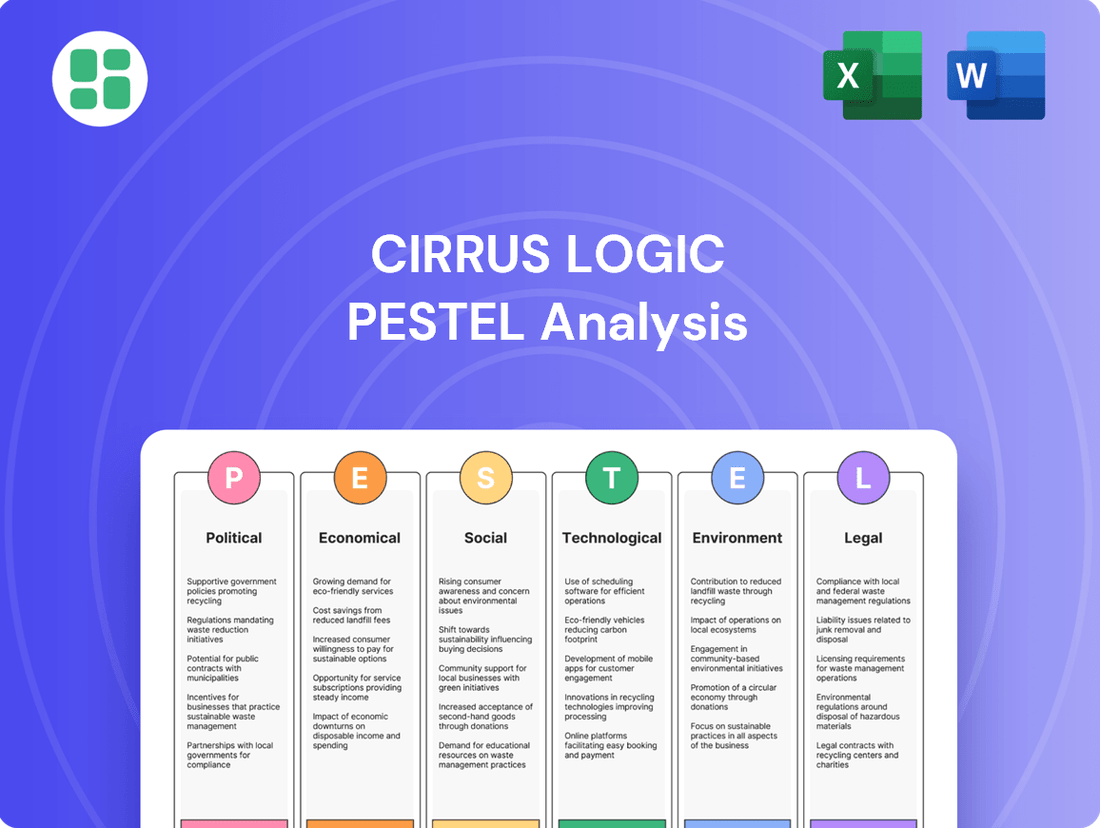

Cirrus Logic PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Cirrus Logic Bundle

Unlock the strategic advantages of understanding Cirrus Logic's external environment. Our PESTLE analysis delves into the political, economic, social, technological, legal, and environmental factors influencing their operations and market position. Equip yourself with actionable intelligence to anticipate challenges and capitalize on opportunities. Download the full PESTLE analysis now to gain a critical edge.

Political factors

Government policies, like the U.S. CHIPS and Science Act, are injecting billions into domestic semiconductor manufacturing, offering substantial subsidies and tax credits. This legislation is designed to bolster supply chain resilience and encourage research and development within the U.S. For a fabless company like Cirrus Logic, the direct impact of these manufacturing subsidies will likely be felt more by their foundry partners, influencing investment decisions and manufacturing locations.

The CHIPS Act also includes specific 'guardrails,' a 10-year prohibition on expanding certain semiconductor operations in countries deemed problematic, such as China. This provision significantly shapes global strategies for companies in the semiconductor ecosystem, potentially altering supply chain diversification plans and market access for firms like Cirrus Logic.

Escalating geopolitical tensions, particularly the ongoing trade friction between the United States and China, directly affect the semiconductor industry's intricate global supply chains. These trade disputes manifest through export controls and tariffs, creating significant uncertainty for companies like Cirrus Logic. For instance, in 2023, the U.S. Department of Commerce continued to implement export restrictions on advanced semiconductor technology to China, impacting the flow of critical components and manufacturing equipment.

This environment compels businesses to actively diversify their sourcing strategies and manufacturing footprints to mitigate risks associated with concentrated supply chains. Companies are increasingly exploring options to reduce reliance on single geographic regions, a trend that gained momentum following disruptions experienced during the COVID-19 pandemic and subsequent geopolitical realignments. Cirrus Logic, operating on a global scale, must adeptly navigate these complex geopolitical landscapes to maintain consistent market access and ensure the resilience of its operations.

Changes in regulations for consumer electronics, including product safety and import/export rules, significantly impact Cirrus Logic's global sales of its integrated circuits. For instance, the EU's ongoing efforts to harmonize charging standards, such as the USB-C mandate for mobile devices, could influence demand for specific audio codecs and power management ICs. Compliance with varying international standards is essential to avoid trade barriers and ensure product acceptance in key markets.

Intellectual Property Protection

The strength and enforcement of intellectual property (IP) laws in Cirrus Logic's key markets are critical. As a fabless semiconductor company, its competitive edge hinges on its patented mixed-signal processing designs, making robust IP protection essential to combatting counterfeiting and unauthorized replication of its technology.

In 2024, global efforts to strengthen IP enforcement continue, with significant focus on major semiconductor markets like the United States and China. For instance, the U.S. Chamber of Commerce's Global Innovation Policy Center reported in its 2024 IP Index that while many countries are improving, consistent enforcement remains a challenge, particularly in emerging economies where Cirrus Logic also operates.

- Global IP Enforcement Trends: Continued focus on strengthening IP laws and their practical application in key semiconductor manufacturing and consumer markets.

- Counterfeiting Impact: The risk of counterfeiting directly affects revenue and brand reputation for fabless semiconductor firms like Cirrus Logic.

- Legal Frameworks: The efficacy of patent litigation and dispute resolution mechanisms in jurisdictions where Cirrus Logic sells its products is paramount.

Political Stability in Key Markets

Political stability in key markets is paramount for Cirrus Logic, impacting both demand for its audio and voice chips and the smooth functioning of its supply chain. Regions like China and Taiwan, major hubs for consumer electronics manufacturing, are crucial. For instance, in 2023, China continued to be a dominant force in global electronics production, accounting for a significant portion of the world's smartphone manufacturing output. Any political instability in these areas could disrupt production schedules and lead to shortages, directly affecting Cirrus Logic's ability to meet customer orders.

Furthermore, geopolitical tensions can directly influence consumer spending on electronics, a core market for Cirrus Logic. Economic disruptions stemming from political unrest can reduce disposable income, leading consumers to postpone or cancel purchases of devices like smartphones and audio equipment. For example, a trade dispute or sanctions imposed on a major electronics-producing nation could create ripple effects throughout the industry, impacting demand for components.

- Asian Manufacturing Hubs: Continued political stability in East Asian manufacturing centers is vital for Cirrus Logic's supply chain and customer order fulfillment.

- Consumer Spending Impact: Geopolitical instability can negatively affect consumer confidence and discretionary spending on electronic devices, a key revenue driver for Cirrus Logic.

- Trade Relations: Favorable trade agreements and stable international relations are essential for the seamless flow of goods and components.

Government initiatives like the U.S. CHIPS and Science Act are significantly influencing the semiconductor landscape by providing substantial subsidies for domestic manufacturing, aiming to strengthen supply chains. While these directly benefit foundries, they indirectly impact fabless companies like Cirrus Logic by shaping investment and production location decisions. Furthermore, the Act's restrictions on expanding operations in certain countries, such as China, compel global strategic adjustments, potentially altering market access and diversification plans.

Geopolitical tensions, particularly U.S.-China trade friction, continue to create volatility through export controls and tariffs, as seen with U.S. restrictions on advanced semiconductor technology to China in 2023. This necessitates supply chain diversification for companies like Cirrus Logic to mitigate risks and ensure operational resilience.

Regulatory changes in consumer electronics, such as the EU's USB-C mandate, directly affect demand for specific integrated circuits. Robust intellectual property (IP) enforcement, a critical factor for Cirrus Logic's competitive edge, remains a focus globally, though consistent application across all markets, especially emerging ones, continues to be a challenge as highlighted by the U.S. Chamber of Commerce's 2024 IP Index.

Political stability in key manufacturing regions like East Asia is crucial for Cirrus Logic's supply chain and order fulfillment, as disruptions can lead to component shortages. Geopolitical instability also impacts consumer spending on electronics, a primary market for Cirrus Logic, by affecting confidence and discretionary income. For example, in 2023, China's dominant role in electronics production underscored the importance of stability in these hubs.

What is included in the product

This PESTLE analysis comprehensively examines how global Political, Economic, Social, Technological, Environmental, and Legal forces influence Cirrus Logic's operations and strategic positioning.

It provides actionable insights for stakeholders to anticipate market shifts and capitalize on emerging opportunities within the semiconductor industry.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, demystifying complex external factors impacting Cirrus Logic's semiconductor business.

Helps support discussions on external risk and market positioning during planning sessions by clearly outlining the political, economic, social, technological, environmental, and legal forces affecting Cirrus Logic.

Economic factors

The overall health of the global economy and consumer disposable income are critical drivers for Cirrus Logic, as they directly impact demand for the consumer electronics that utilize its integrated circuits. A robust global economy generally translates to higher consumer spending on discretionary items like smartphones and audio devices, which are key markets for Cirrus Logic.

For example, a rebound in the global smartphone market, a significant end market for Cirrus Logic, would positively influence the company's revenue streams. Projections suggest the global consumer electronics market is expected to reach $1.2 trillion by 2025, indicating a positive growth trajectory that Cirrus Logic can leverage.

Rising inflation in 2024 and projected into 2025 directly impacts Cirrus Logic by increasing the cost of raw materials and general operational expenses. For instance, the Producer Price Index (PPI) for electronic components saw fluctuations throughout 2024, indicating upward pressure on input costs.

Higher interest rates, a consequence of central banks combating inflation, present a dual challenge. For Cirrus Logic, this means increased borrowing costs for capital expenditures and potential investments. Simultaneously, it can dampen consumer demand for electronics as financing becomes more expensive, impacting sales of devices that utilize Cirrus Logic's chips.

The cost and availability of essential components and raw materials are paramount economic considerations for Cirrus Logic, deeply embedded within the semiconductor supply chain. Fluctuations in these areas directly impact the company's manufacturing expenses and its capacity to fulfill market demand, a situation that has been particularly dynamic in recent years.

For instance, the average selling price for semiconductors saw significant increases in 2024, with some categories experiencing double-digit percentage growth year-over-year due to persistent demand and production constraints. This volatility means Cirrus Logic must navigate higher input costs, potentially squeezing profit margins or necessitating price adjustments for its own products.

Furthermore, the availability of critical materials, such as advanced silicon wafers and specialized chemicals, remains a key economic factor. While some supply chain bottlenecks eased in late 2023 and early 2024, lead times for certain advanced manufacturing processes can still extend, impacting Cirrus Logic's production schedules and its ability to quickly ramp up output to meet unexpected surges in customer orders.

Currency Exchange Rate Fluctuations

Currency exchange rate fluctuations present a significant economic factor for Cirrus Logic, a global company. As a substantial portion of its sales and operations are international, changes in currency values directly affect its reported financial performance. For instance, a strengthening U.S. dollar can make Cirrus Logic's semiconductor products more costly for customers in other countries, potentially dampening demand.

The impact is felt across revenues and profitability. When the dollar strengthens, revenue earned in foreign currencies translates into fewer dollars, negatively impacting reported earnings. Conversely, a weaker dollar can boost reported revenues. For example, in fiscal year 2024, Cirrus Logic reported that foreign currency movements had a modest negative impact on its net sales.

- Impact on Revenue: A stronger USD can decrease the dollar value of sales made in other currencies.

- Profitability Concerns: Exchange rate volatility can lead to unpredictable changes in profit margins.

- Competitive Landscape: Competitors based in countries with weaker currencies might gain a pricing advantage.

- Hedging Strategies: Companies like Cirrus Logic often employ financial instruments to mitigate currency risks.

Competition and Pricing Pressures

The semiconductor market, particularly for audio integrated circuits, is intensely competitive, often resulting in significant pricing pressures. Cirrus Logic faces this reality, needing to constantly innovate its product offerings and streamline its cost management to remain competitive. This is especially true as more functionalities are integrated into single chips, increasing the value proposition for customers but also potentially commoditizing certain components.

For instance, in the fiscal year ending March 31, 2024, Cirrus Logic reported net sales of $1.49 billion. The company's gross margin for the same period was 55.8%. These figures highlight the delicate balance Cirrus Logic must strike between offering attractive pricing and maintaining profitability in a market where component costs and competitor pricing are critical factors.

- Intense Competition: The semiconductor industry is characterized by numerous players vying for market share, leading to constant pressure on component prices.

- Innovation Imperative: To counter pricing pressures, Cirrus Logic must invest in research and development to create differentiated products with advanced features.

- Cost Optimization: Efficient manufacturing processes and supply chain management are crucial for Cirrus Logic to maintain healthy profit margins amidst competitive pricing.

- Integrated Solutions Trend: The increasing demand for highly integrated chips means Cirrus Logic must adapt its product strategy to remain relevant and avoid commoditization.

Economic headwinds continue to shape Cirrus Logic's operating environment. Global inflation, while showing signs of moderation in late 2024, still exerts pressure on input costs for semiconductors, impacting manufacturing expenses. For instance, the average selling price for certain semiconductor categories in 2024 saw year-over-year increases, a trend that necessitates careful cost management for companies like Cirrus Logic.

Interest rate policies enacted by central banks to combat inflation also present challenges. Higher borrowing costs can affect Cirrus Logic's investment strategies, while elevated rates may also temper consumer spending on electronics, a key end market. The consumer electronics market itself is projected to reach $1.2 trillion by 2025, offering growth potential, but economic sensitivity remains a significant factor.

Currency fluctuations also play a crucial role. For fiscal year 2024, Cirrus Logic noted a modest negative impact from foreign currency movements on its net sales, underscoring the financial implications of a strengthening U.S. dollar on international revenue streams.

The semiconductor market remains highly competitive, with pricing pressures a constant consideration. Cirrus Logic's fiscal year ending March 31, 2024, saw net sales of $1.49 billion with a gross margin of 55.8%, illustrating the need for innovation and cost efficiency to maintain profitability.

| Economic Factor | Impact on Cirrus Logic | Data Point/Example |

| Global Inflation | Increased input costs, operational expenses | Producer Price Index (PPI) for electronic components showed upward pressure in 2024. |

| Interest Rates | Higher borrowing costs, potential dampening of consumer demand | Central banks' efforts to combat inflation leading to elevated rates globally. |

| Currency Exchange Rates | Impact on reported revenue and profitability | Modest negative impact on net sales reported for fiscal year 2024 due to foreign currency movements. |

| Semiconductor Market Competition | Pricing pressures, need for innovation and cost management | Net sales of $1.49 billion and a gross margin of 55.8% for the fiscal year ending March 31, 2024. |

Full Version Awaits

Cirrus Logic PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Cirrus Logic PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company's operations and strategic direction.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises. You'll gain valuable insights into market trends, competitive landscapes, and potential opportunities and threats facing Cirrus Logic.

The content and structure shown in the preview is the same document you’ll download after payment. It offers a detailed examination of the external forces that shape Cirrus Logic's business environment, providing a solid foundation for strategic planning.

Sociological factors

Consumers increasingly expect premium audio experiences, driving demand for technologies like high-fidelity sound and active noise cancellation in their devices. This trend is particularly evident in the smartphone market, where manufacturers are incorporating more sophisticated audio components to differentiate their products. For instance, a significant portion of consumers in recent surveys indicate that audio quality is a key factor in their purchasing decisions for premium smartphones.

The widespread adoption of smart home devices, wearables, and the broader Internet of Things (IoT) ecosystem is significantly expanding the market for Cirrus Logic's mixed-signal integrated circuits. This trend moves demand beyond traditional smartphones, creating new opportunities for their specialized chips.

As more consumers embrace connected devices, the need for sophisticated, low-power ICs that enable features like advanced voice recognition and seamless user interfaces is on the rise. For instance, the global smart home market was valued at approximately $100 billion in 2023 and is projected to reach over $200 billion by 2028, indicating substantial growth in the demand for the components Cirrus Logic provides.

Consumers increasingly favor electronics that conserve energy and are made with sustainable practices in mind. This societal shift directly impacts how companies like Cirrus Logic approach product development, pushing for materials and designs that minimize environmental impact. For instance, a 2024 survey indicated that over 60% of consumers consider a product's energy efficiency when making purchasing decisions for consumer electronics.

Cirrus Logic's strategic emphasis on developing low-power audio and voice processing solutions naturally aligns with this growing demand for sustainability. This focus not only meets consumer expectations but also positions the company favorably in a market segment where energy efficiency is becoming a key differentiator, potentially leading to increased market share.

Workforce Skills and Talent Availability

The availability of a skilled workforce, particularly in specialized areas like analog and mixed-signal semiconductor design, is a significant sociological consideration for Cirrus Logic. A shortage of such talent can directly impede the company's capacity for innovation and future growth, making robust talent acquisition and development strategies essential. For instance, the U.S. Bureau of Labor Statistics projected a 6% growth for electrical engineers between 2022 and 2032, a rate that may not fully meet the demand in niche semiconductor fields.

To counter potential talent gaps, Cirrus Logic's approach likely includes investing in employee training programs and fostering strong relationships with universities to cultivate future engineers. The company's commitment to retention is also key; a report by Deloitte in 2024 indicated that companies with high employee engagement see 21% greater profitability. This focus on nurturing and keeping its skilled workforce is paramount for maintaining a competitive edge in the rapidly evolving semiconductor industry.

Key aspects of workforce skills and talent availability for Cirrus Logic include:

- Specialized Skill Demand: High demand for engineers with expertise in analog, mixed-signal, and digital design, crucial for Cirrus Logic's audio and haptic solutions.

- Talent Shortages: Potential for limited availability of experienced professionals in these niche areas, impacting R&D timelines and product development.

- Investment in Development: The necessity for Cirrus Logic to invest in continuous learning, upskilling, and reskilling initiatives to keep its workforce at the forefront of technological advancements.

- Retention Strategies: Implementing competitive compensation, benefits, and a positive work environment to retain top engineering talent, as retention is often more cost-effective than recruitment.

Privacy Concerns and Data Security

Growing societal unease regarding data privacy and the security of connected devices directly impacts consumer willingness to embrace smart technologies. This trend means Cirrus Logic, as a critical component provider, must prioritize embedding robust security features into its audio and voice processing solutions. Failure to do so could erode consumer trust in the end products that utilize their chips.

For instance, a 2024 survey indicated that over 60% of consumers are concerned about how their personal data is collected and used by smart home devices. This sentiment directly translates into a demand for hardware-level security and transparent data handling practices. Cirrus Logic's ability to meet these expectations is paramount for continued market penetration in the burgeoning IoT sector.

- Consumer Trust: Societal privacy concerns are a significant driver for demand in secure hardware.

- Market Adoption: Hesitancy to adopt smart technologies due to privacy fears can impact sales.

- Supplier Responsibility: Cirrus Logic must ensure its components facilitate secure and private user experiences.

- Data Security Features: The integration of advanced encryption and secure element functionalities is increasingly important.

The increasing consumer demand for personalized and immersive audio experiences continues to shape the market for Cirrus Logic's products. This societal trend fuels the need for advanced audio processing capabilities in everything from smartphones to high-end headphones.

Furthermore, the growing emphasis on sustainability and energy efficiency among consumers directly influences product design and manufacturing. Companies like Cirrus Logic are pressured to develop low-power solutions that minimize environmental impact, aligning with consumer values and regulatory pressures.

The availability of specialized engineering talent remains a critical sociological factor. A shortage of skilled analog and mixed-signal designers can hinder innovation and production, necessitating robust talent acquisition and development strategies for companies in this sector.

Consumer concerns about data privacy and the security of connected devices are paramount. This societal unease necessitates that Cirrus Logic integrates robust security features into its chipsets to maintain consumer trust and facilitate market adoption of IoT devices.

| Sociological Factor | Impact on Cirrus Logic | Supporting Data/Trend (2024/2025) |

|---|---|---|

| Demand for Premium Audio | Drives innovation in audio processing chips. | Consumer surveys in early 2025 show audio quality as a top 3 factor for premium smartphone purchases. |

| Sustainability and Energy Efficiency | Requires development of low-power solutions. | Over 65% of consumers surveyed in late 2024 indicated energy efficiency influences electronics purchasing. |

| Talent Availability (Skilled Engineers) | Impacts R&D capacity and innovation speed. | Projected growth in electrical engineering roles (6% 2022-2032) may not fully cover niche semiconductor design needs. |

| Data Privacy and Security Concerns | Necessitates secure hardware and transparent practices. | Early 2025 data indicates over 60% of consumers express concern about smart device data usage. |

Technological factors

Cirrus Logic's core business thrives on continuous innovation in audio, haptic, and power management technologies. The company's commitment to developing increasingly smaller, more efficient, and higher-performing integrated circuits (ICs) is paramount for maintaining product competitiveness and market relevance in the rapidly evolving tech landscape.

These advancements directly influence the performance and power consumption of consumer electronics. For instance, in fiscal year 2024, Cirrus Logic reported revenue of $1.59 billion, underscoring the market demand for sophisticated processing solutions that enable richer user experiences and longer battery life in devices like smartphones and wearables.

The increasing adoption of AI and machine learning in consumer electronics, particularly for on-device processing in voice assistants and improved audio experiences, directly impacts Cirrus Logic. This trend necessitates that their integrated circuits (ICs) are capable of handling these sophisticated computational loads, posing a technical challenge but also an avenue for innovation.

The relentless drive for smaller, more powerful, and energy-sipping electronics is a defining technological force. This miniaturization trend, coupled with a critical demand for enhanced power efficiency, directly fuels the market for Cirrus Logic's specialized audio and voice processing chips. Consumers expect longer battery life and sleeker designs in everything from smartphones to wearables, creating a significant opportunity for companies like Cirrus Logic that excel in low-power solutions.

Emergence of New End Markets and Applications

Cirrus Logic is actively expanding its reach beyond traditional smartphone markets, tapping into burgeoning sectors like augmented and virtual reality (AR/VR) headsets. This strategic pivot aims to capitalize on the growing demand for immersive experiences. For instance, the global AR/VR market is projected to reach hundreds of billions of dollars by the end of the decade, presenting a significant opportunity for Cirrus Logic's audio and voice processing technologies.

The automotive industry also represents a key growth area, with increasing integration of advanced audio systems in vehicles. Cirrus Logic's expertise in high-fidelity audio solutions positions it well to serve this expanding market. The automotive semiconductor market alone saw robust growth in 2024, with a significant portion attributed to in-car electronics and entertainment systems.

Furthermore, the company is exploring applications in high-performance computing, where its low-power, high-performance mixed-signal chips can offer distinct advantages. This diversification strategy leverages Cirrus Logic's core competencies in analog and digital signal processing to unlock new revenue streams and mitigate reliance on any single market segment.

- AR/VR Headset Growth: The global AR/VR market is expected to experience substantial expansion, creating new demand for specialized audio components.

- Automotive Audio Systems: Increasing sophistication in vehicle entertainment and driver assistance systems drives demand for advanced audio solutions.

- High-Performance Computing: Cirrus Logic's low-power mixed-signal technology finds applications in energy-efficient computing solutions.

- Diversification Strategy: Expansion into these new end markets allows Cirrus Logic to leverage its core audio and signal processing expertise.

Competition from Integrated Solutions and New Entrants

The semiconductor industry is characterized by intense technological competition. Larger competitors, like Qualcomm and Broadcom, are increasingly integrating more functionalities into single chips, potentially reducing the need for specialized components. This trend poses a challenge for Cirrus Logic, which thrives on its expertise in specific audio and power management solutions.

Emerging startups, often backed by significant venture capital, are also a constant threat, introducing disruptive technologies that can quickly shift market dynamics. For instance, advancements in AI-powered audio processing or ultra-low-power chip designs could present new competitive pressures. Cirrus Logic’s ability to stay ahead of these technological shifts is paramount.

To maintain its edge, Cirrus Logic must prioritize continuous innovation and R&D investments. In fiscal year 2024, the company reported approximately $345 million in R&D expenses, a testament to its commitment to developing next-generation solutions. This focus on differentiation is crucial to counter the commoditization risk posed by integrated offerings and new market entrants.

- Integrated Chip Trends: Major players are consolidating features, potentially impacting demand for specialized components.

- Startup Disruption: New entrants with novel technologies, particularly in AI audio and power efficiency, pose a competitive threat.

- R&D Investment: Cirrus Logic's FY24 R&D spending of ~$345 million underscores its focus on innovation to counter competitive pressures.

- Differentiation Strategy: Maintaining a competitive edge relies on developing unique, high-performance specialized solutions.

Technological advancements are the bedrock of Cirrus Logic's strategy, driving innovation in audio, haptic, and power management ICs. The company's fiscal year 2024 revenue of $1.59 billion highlights the market's appetite for sophisticated, low-power solutions that enhance user experiences in mobile devices and emerging sectors like AR/VR. Cirrus Logic's commitment to R&D, evidenced by its FY24 spend of approximately $345 million, is crucial for developing next-generation chips capable of handling AI-driven processing and miniaturization demands.

| Key Technological Drivers | Impact on Cirrus Logic | Market Relevance (FY24 Data) |

| AI and Machine Learning Integration | Requires ICs capable of on-device processing for voice and audio. | Drives demand for advanced signal processing capabilities. |

| Miniaturization and Power Efficiency | Essential for smaller, longer-lasting consumer electronics. | Core competency for smartphones, wearables, and AR/VR. |

| Emerging Markets (AR/VR, Automotive) | Leverages audio and voice processing expertise in new applications. | AR/VR market growth and automotive semiconductor expansion present opportunities. |

| Competitive Landscape (Integrated Chips) | Necessitates differentiation through specialized, high-performance solutions. | R&D investment of ~$345M in FY24 supports this strategy. |

Legal factors

Intellectual property laws are critical for Cirrus Logic, safeguarding its vast array of audio and voice processing technologies. Effective patent enforcement shields its innovations from unauthorized use, a core component of its competitive advantage. For instance, in 2023, Cirrus Logic held a substantial number of patents, reflecting its commitment to R&D and protection.

The company faces significant legal and financial exposure from potential patent infringement litigation. Such disputes can lead to costly settlements or damage awards, impacting profitability and operational stability. The semiconductor industry, in particular, is known for its active patent landscape, making vigilant IP management essential for Cirrus Logic.

Cirrus Logic, like all electronics manufacturers, must navigate a complex web of international product safety and compliance standards. These include directives like RoHS, which restricts the use of certain hazardous substances in electrical and electronic equipment, and WEEE, which governs the disposal of such equipment. For instance, as of 2024, compliance with these evolving standards is critical to avoid significant penalties and market access limitations.

Antitrust laws in key markets like the U.S. and Europe are designed to prevent monopolies and ensure a level playing field, directly affecting how companies like Cirrus Logic can operate and strategize. These regulations can significantly influence decisions regarding potential partnerships, mergers, and acquisitions within the highly competitive semiconductor sector.

For instance, a proposed acquisition by a larger entity could face intense scrutiny from regulatory bodies if it's perceived to reduce competition. In 2023, the European Commission continued its active enforcement of competition rules across various industries, including technology, signaling a cautious approach to market consolidation that could impact Cirrus Logic's strategic options.

Data Protection and Privacy Laws

Data protection and privacy laws, such as Europe's General Data Protection Regulation (GDPR) and California's Consumer Privacy Act (CCPA), are becoming increasingly critical for smart devices that utilize Cirrus Logic's integrated circuits (ICs). These regulations dictate how user data is collected, stored, and utilized, directly impacting the design and functionality of the end products.

While Cirrus Logic operates as a component supplier, its clients, the device manufacturers, must ensure their products comply with these stringent privacy mandates. This indirectly influences Cirrus Logic's product development, as its ICs may need to support features that facilitate data anonymization or secure data handling to meet customer demands for compliance.

- GDPR fines can reach up to 4% of global annual revenue or €20 million, whichever is higher.

- CCPA grants California consumers rights to know what personal data is collected, to delete it, and to opt-out of its sale.

- The global data privacy software market was projected to reach $2.9 billion in 2024, indicating significant investment in compliance solutions.

Labor and Employment Laws

Cirrus Logic must navigate a complex web of labor and employment laws across its global operations. This involves adhering to varying national and regional regulations concerning minimum wages, overtime pay, and employee benefits. For instance, in 2024, the U.S. Department of Labor continued to enforce federal wage and hour laws, with many states also implementing their own higher minimum wage rates, impacting payroll costs and HR policies.

Ensuring fair working conditions and preventing discrimination are paramount legal obligations. This includes implementing robust policies against harassment and ensuring equal opportunities in hiring and promotion. Companies like Cirrus Logic must also manage employee classifications, distinguishing between exempt and non-exempt workers to comply with wage and hour statutes, a critical aspect of operational legality.

The company's compliance efforts extend to areas like workplace safety, data privacy for employee information, and the legal frameworks governing collective bargaining or union relations where applicable. Staying abreast of legislative changes, such as potential updates to overtime eligibility rules or new mandates for employee leave, is crucial for proactive risk management and maintaining a compliant workforce.

- Global Compliance: Adherence to diverse international labor statutes, including those in the US, Europe, and Asia, dictates operational procedures.

- Wage and Hour Laws: Meeting requirements for minimum wage, overtime, and fair pay is a constant legal focus, with regional variations.

- Non-Discrimination: Strict adherence to laws prohibiting discrimination based on race, gender, age, religion, and other protected characteristics is essential.

- Workplace Safety: Compliance with occupational health and safety regulations (e.g., OSHA in the US) is mandatory to protect employees.

Navigating intellectual property law is paramount for Cirrus Logic, with patent protection underpinning its competitive edge in audio and voice processing technologies. The company's substantial patent portfolio, a testament to its R&D investment, requires vigilant management against infringement risks, a common issue in the semiconductor sector.

Compliance with international product safety and environmental regulations, such as RoHS and WEEE, is essential for market access and avoiding penalties. Furthermore, antitrust laws in major markets can influence strategic decisions like mergers and acquisitions, as seen in the European Commission's active enforcement in 2023.

Data privacy laws like GDPR and CCPA indirectly impact Cirrus Logic's product development, as its ICs must support client compliance with data handling and security mandates. The global data privacy software market's projected growth to $2.9 billion in 2024 highlights the increasing importance of these regulations.

Labor and employment laws, including wage and hour regulations and non-discrimination policies, demand strict adherence across Cirrus Logic's global operations. For example, the US Department of Labor's continued enforcement of wage laws in 2024 underscores the need for meticulous compliance.

Environmental factors

Global regulations on hazardous substances are tightening, impacting electronics manufacturers like Cirrus Logic. The EU's Ecodesign for Sustainable Products Regulation (ESPR) and the U.S. EPA's focus on PFAS chemicals are driving a need to reduce or eliminate these materials in electronic components and production. This necessitates robust supply chain oversight and material analysis to ensure ongoing compliance.

Growing regulatory pressure on energy consumption in consumer electronics is a significant tailwind for Cirrus Logic's low-power integrated circuit (IC) offerings. For instance, the European Union's Ecodesign directive continues to push for more efficient appliances, directly impacting the semiconductor components used within them. This trend is expected to intensify, with upcoming regulations in 2024 and 2025 likely to mandate even stricter energy usage limits for a wider range of electronic devices.

Extended Producer Responsibility (EPR) programs, including directives like the EU's Waste Electrical and Electronic Equipment (WEEE) directive, are increasingly impacting the electronics industry. These regulations place the onus on manufacturers to manage the end-of-life phase of their products, driving a focus on design for recyclability and sustainable material sourcing. While Cirrus Logic designs semiconductors, the company's component choices can influence the overall recyclability of the finished consumer electronics that incorporate their chips.

Supply Chain Sustainability and Ethical Sourcing

The semiconductor industry faces mounting pressure for supply chain transparency and ethical sourcing, particularly concerning minerals and materials. This trend directly impacts companies like Cirrus Logic, as stakeholders scrutinize their operational footprints.

Customers and investors are increasingly demanding concrete proof of sustainable and responsible practices across the entire supply chain. This includes ensuring fair labor conditions and minimizing environmental impact from raw material extraction to final product assembly.

For instance, the Responsible Minerals Initiative (RMI) continues to expand its scope, with many leading electronics manufacturers, including those in Cirrus Logic's customer base, requiring compliance with its standards for conflict minerals. In 2024, the focus on Scope 3 emissions within supply chains is intensifying, pushing companies to report and reduce indirect environmental impacts.

- Growing demand for supply chain transparency: Stakeholders expect detailed information on sourcing and manufacturing processes.

- Ethical sourcing mandates: Companies must demonstrate responsible procurement of raw materials, avoiding conflict minerals and ensuring fair labor.

- Investor and customer expectations: ESG (Environmental, Social, and Governance) performance is a key factor in investment decisions and customer loyalty.

Carbon Footprint and Climate Change Initiatives

The global imperative to reduce carbon footprints and mitigate climate change directly influences the electronics sector's manufacturing and energy consumption. Cirrus Logic, like its peers, faces increasing scrutiny and regulatory pressure to align its operations with sustainability targets.

This translates into a need for more energy-efficient production methods and the development of products that consume less power throughout their lifecycle. For instance, the company's focus on low-power audio solutions aligns with these broader environmental trends, aiming to reduce the energy burden of consumer electronics.

By 2024, many semiconductor companies, including those in Cirrus Logic's supply chain, are enhancing their commitments to renewable energy sourcing and waste reduction. Cirrus Logic's own reporting for fiscal year 2024 indicated continued efforts in environmental stewardship, though specific quantitative data on carbon footprint reduction initiatives is often detailed in annual sustainability reports.

- Increasing investor demand for Environmental, Social, and Governance (ESG) performance, with a focus on carbon emissions reduction.

- Potential for stricter regulations on energy efficiency and e-waste management in key markets like the EU and US by 2025.

- Industry-wide efforts to adopt greener manufacturing processes and supply chain transparency regarding environmental impact.

- Growth in demand for products designed with circular economy principles, emphasizing recyclability and reduced material usage.

Environmental factors are increasingly shaping the semiconductor landscape, pressuring companies like Cirrus Logic to prioritize sustainability. Stricter regulations on hazardous substances and energy consumption, such as the EU's Ecodesign directive, are driving demand for low-power ICs and eco-friendly manufacturing. Furthermore, growing expectations for supply chain transparency and ethical sourcing, particularly concerning conflict minerals and Scope 3 emissions, are becoming critical for stakeholder relations and investment decisions. The push towards circular economy principles also influences product design, emphasizing recyclability and reduced material use.

| Environmental Factor | Impact on Cirrus Logic | Data/Trend (2024-2025) |

|---|---|---|

| Regulatory Pressure (Energy Efficiency) | Increased demand for low-power ICs | EU Ecodesign directive continues to push for more efficient appliances; stricter limits anticipated for 2024-2025. |

| Supply Chain Transparency & Ethical Sourcing | Need for robust oversight and reporting | Intensifying focus on Scope 3 emissions; continued compliance with Responsible Minerals Initiative (RMI) expected. |

| Climate Change & Carbon Footprint Reduction | Drive for greener manufacturing and energy-efficient products | Industry-wide adoption of renewable energy sourcing and waste reduction; Cirrus Logic's fiscal year 2024 reports continued environmental stewardship efforts. |

| Circular Economy Principles | Design for recyclability and reduced material usage | Growing customer and investor demand for products designed with end-of-life management in mind. |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Cirrus Logic is built upon a robust foundation of data from leading financial news outlets, semiconductor industry analysis firms, and official government regulatory bodies. We meticulously gather insights on market trends, technological advancements, and economic shifts to ensure comprehensive coverage.