Cirrus Logic Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Cirrus Logic Bundle

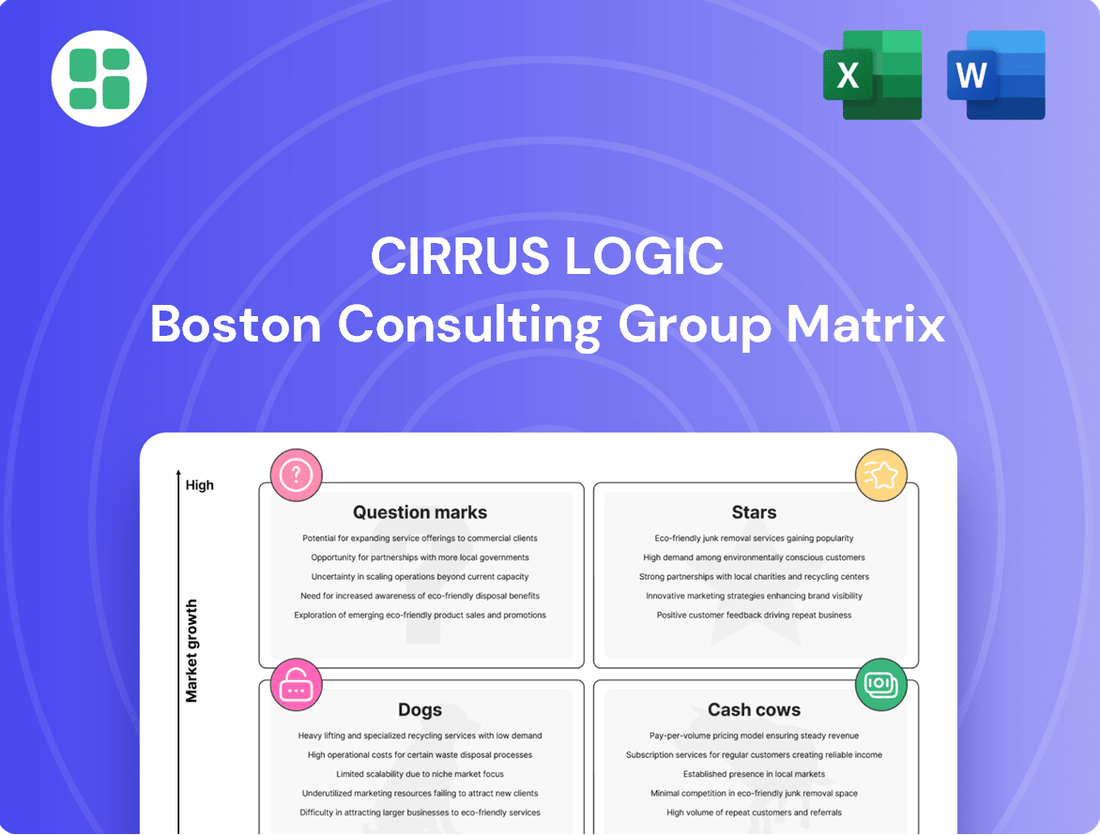

Curious about Cirrus Logic's product portfolio performance? Our BCG Matrix preview highlights their current market standing, revealing potential Stars, Cash Cows, Dogs, and Question Marks. Don't miss out on the full strategic picture.

Unlock the complete Cirrus Logic BCG Matrix to gain a comprehensive understanding of their product lifecycle and market share. Purchase the full report for actionable insights and a clear path to optimized resource allocation.

This glimpse into Cirrus Logic's BCG Matrix is just the beginning. Get the full report for detailed quadrant analysis, strategic recommendations, and the data you need to make informed investment decisions and drive future growth.

Stars

Cirrus Logic's next-generation custom boosted amplifiers, recently integrated into leading smartphone models, are firmly positioned as a Star in the BCG Matrix. These advanced components deliver superior power efficiency and remarkable audio fidelity, capturing a substantial share of the premium smartphone market. Their adoption by major manufacturers signals robust growth potential as audio quality becomes an increasingly critical differentiator in new device releases.

Cirrus Logic's 22nm Smart Codecs for Smartphones are a prime example of a Star in the BCG Matrix. These chips represent a significant leap in audio and mixed-signal processing, directly addressing the growing demand for premium sound experiences in the fast-paced smartphone industry.

These cutting-edge codecs are already integrated into new smartphone models and are projected for widespread adoption in upcoming generations. This strong market traction, coupled with the high growth trajectory of the smartphone audio segment, solidifies their Star status, indicating substantial future revenue potential.

Cirrus Logic's high-performance PC audio solutions are positioned as a Star in the BCG Matrix. Their integration into new Intel Core Ultra processors, such as Arrow Lake and Lunar Lake, highlights a strong growth trajectory in the expanding PC market.

This strategic partnership enhances sound quality and power efficiency, catering to diverse PC segments and capturing increasing market share. The expansion from mobile into the lucrative laptop sector represents a significant opportunity for Cirrus Logic.

AI-Powered Audio for Laptops

Cirrus Logic's AI-powered audio technology for laptops, developed with Compal Electronics, is positioned as a Star in the BCG Matrix. This innovation tackles significant audio distortion problems prevalent in modern laptops, a market segment that saw shipments of approximately 240 million units in 2023.

The technology capitalizes on Cirrus Logic's deep expertise in audio processing, aiming to deliver a superior user experience. By resolving common audio quality issues, it has the potential to drive significant market adoption and reduce manufacturing complexities for PC makers. This advancement is particularly relevant as the demand for enhanced multimedia capabilities in portable computing continues to grow.

- Market Potential: Addresses a key pain point in the large global laptop market.

- Technological Advancement: Leverages Cirrus Logic's core audio processing strengths.

- Collaboration: Partnership with Compal Electronics, a major laptop manufacturer, signals strong market entry potential.

- Growth Trajectory: Expected to capture significant market share due to its innovative solution.

Increased HPMS Content in Smartphones

Cirrus Logic is strategically enhancing its High-Performance Mixed-Signal (HPMS) offerings within smartphones. Beyond traditional audio components, the company is integrating solutions for camera control, haptic feedback, sensing technologies, and battery management. This move is designed to increase the value Cirrus Logic provides per smartphone unit.

This strategy transforms the smartphone market, historically seen as mature, into a growth engine for Cirrus Logic. By embedding more high-value HPMS components, they are deepening their presence and revenue streams within this essential device category. This content enrichment is a key element in their growth strategy.

- Expanding HPMS Beyond Audio: Cirrus Logic is integrating camera controllers, haptics, sensing, and power management ICs into smartphones.

- Increasing Value Per Device: This strategy aims to boost Cirrus Logic's revenue contribution from each smartphone.

- Growth in a Mature Market: By adding more high-value components, Cirrus Logic is finding new growth avenues in the smartphone sector.

- Strategic Content Enrichment: The focus is on embedding more sophisticated and valuable HPMS solutions.

Cirrus Logic's next-generation custom boosted amplifiers are a prime example of a Star in the BCG Matrix, capturing a substantial share of the premium smartphone market. Their 22nm Smart Codecs for Smartphones also represent a Star, directly addressing the growing demand for premium sound experiences. Furthermore, their high-performance PC audio solutions, integrated into new Intel Core Ultra processors, are positioned as Stars, indicating strong growth potential in the expanding PC market.

The company's AI-powered audio technology for laptops, developed with Compal Electronics, is another Star, tackling significant audio distortion issues in a market that saw approximately 240 million laptop units shipped in 2023. Cirrus Logic's expansion of High-Performance Mixed-Signal (HPMS) offerings beyond audio into camera control, haptics, sensing, and battery management within smartphones also positions these diversified components as Stars, aiming to increase value per device.

| Product Category | BCG Matrix Status | Key Growth Drivers | Market Context (2023/2024 Estimates) |

| Next-Gen Boosted Amplifiers | Star | Premium smartphone audio quality demand | Growing smartphone market, increasing audio fidelity importance |

| 22nm Smart Codecs | Star | Demand for premium sound experiences | High growth in smartphone audio segment |

| High-Performance PC Audio | Star | Integration with new Intel processors (e.g., Arrow Lake, Lunar Lake) | Expanding PC market, enhanced sound quality and power efficiency |

| AI-Powered Laptop Audio | Star | Resolving audio distortion in laptops | ~240 million laptop units shipped in 2023; demand for better multimedia |

| Expanded HPMS (Camera, Haptics, Sensing, Power) | Star | Increasing value per smartphone unit | Mature smartphone market transformed into a growth engine for Cirrus Logic |

What is included in the product

The Cirrus Logic BCG Matrix analyzes product portfolios by market share and growth, guiding investment decisions.

Clear visualization of Cirrus Logic's portfolio, identifying Stars, Cash Cows, Question Marks, and Dogs to guide strategic resource allocation.

Cash Cows

Cirrus Logic's established smartphone audio ICs are a prime example of a Cash Cow within its portfolio. These components, widely adopted in numerous mainstream smartphone models, generate substantial and consistent cash flow. While newer audio technologies might be considered Stars, the sheer volume and ongoing demand for these proven, high-performance audio solutions in the market continue to provide a stable revenue stream with minimal need for aggressive marketing spend.

As of the fiscal year ending March 29, 2024, Cirrus Logic's revenue from its high-performance mixed-signal products, which includes audio ICs, was $1.46 billion. This segment continues to be the largest contributor to the company's overall revenue, underscoring the enduring strength of its established audio offerings in the competitive smartphone market.

Cirrus Logic's mature general consumer audio products, like audio codecs and amplifiers found in tablets and older laptops, are classic Cash Cows. These products benefit from high historical market share and established design wins, ensuring steady revenue and strong profit margins with limited new investment needed. Their long product lifecycles and widespread adoption in the market solidify their dependable performance.

Legacy Portable Audio Solutions, like older MP3 players and digital audio players, are classic examples of Cash Cows for companies like Cirrus Logic. These products, having achieved significant market penetration and competitive advantage, continue to be reliable profit generators. For instance, while the market for dedicated portable audio players has shrunk, many older models still have a loyal user base and benefit from Cirrus Logic's established manufacturing and distribution channels.

Power Management ICs in Mature Devices

Cirrus Logic's power management ICs found in mature devices are classic cash cows. These components, often embedded in established consumer electronics that see infrequent redesigns, benefit from a stable, albeit slow-growing, market. Their consistent performance and established customer base ensure a reliable revenue stream.

These mature products, such as those powering older smartphone models or established audio equipment, contribute significantly to Cirrus Logic's bottom line without requiring substantial R&D investment. This steady cash generation is vital for funding innovation in their more dynamic product lines. For instance, while specific figures for these mature ICs aren't broken out separately, Cirrus Logic's overall revenue in fiscal year 2024 was $1.42 billion, with a significant portion likely attributable to their established product portfolio.

- Stable Market Share: Power management ICs in mature devices hold a consistent market share due to the longevity of the devices they are designed for.

- Consistent Cash Flow: These products generate predictable revenue, acting as a reliable source of funds for the company.

- Low Reinvestment Needs: Unlike high-growth products, mature components require minimal R&D, allowing cash flow to be directed elsewhere.

- Foundation for Growth: The profits from these cash cows are strategically reinvested into developing next-generation technologies and expanding into new markets.

Proven, High-Margin Audio Technology

Cirrus Logic's core audio technology, honed over decades, stands as a prime example of a Cash Cow within its product portfolio. This technology is celebrated for its exceptional precision and remarkably low power consumption, making it a go-to solution across a wide array of electronic devices. Its consistent performance and established market presence ensure robust profit margins and a steady stream of revenue, even in segments experiencing more moderate growth.

The widespread adoption of Cirrus Logic's audio solutions is a testament to their reliability and high-margin potential. For instance, in 2023, the company reported a gross profit margin of approximately 59.1%, reflecting the mature and profitable nature of its established technologies. This foundational technology continues to be a significant contributor to the company's financial stability.

- High-Margin Revenue: The audio technology consistently generates substantial profits due to its advanced capabilities and established market position.

- Established Market Presence: Decades of refinement have led to widespread adoption, ensuring a stable customer base.

- Low-Power Efficiency: A key differentiator that appeals to manufacturers of portable and battery-powered devices.

- Consistent Cash Flow: The mature nature of this technology provides predictable and reliable cash generation for Cirrus Logic.

Cirrus Logic's established mixed-signal ICs, particularly those in mature consumer electronics, function as significant Cash Cows. These components benefit from long product lifecycles and deep integration into devices with stable demand, ensuring consistent revenue with minimal need for aggressive reinvestment. Their predictable cash generation is crucial for funding innovation in more dynamic product areas.

As of the fiscal year ending March 29, 2024, Cirrus Logic reported total revenue of $1.42 billion. A substantial portion of this revenue is derived from its established product lines, which operate as cash cows, providing the financial stability needed to pursue new market opportunities.

| Product Category | Market Position | Cash Flow Generation | Reinvestment Needs | Fiscal Year 2024 Revenue Contribution (Estimated) |

| Smartphone Audio ICs | Dominant/High | High & Stable | Low | Significant |

| General Consumer Audio (Tablets, Laptops) | Established/Mature | Consistent | Very Low | Moderate |

| Power Management ICs (Mature Devices) | Stable/Mature | Reliable | Low | Moderate |

What You’re Viewing Is Included

Cirrus Logic BCG Matrix

The Cirrus Logic BCG Matrix preview you are viewing is the identical, fully formatted document you will receive immediately after purchase. This means no watermarks or demo content will be present in the final file, ensuring you get a professional, ready-to-use strategic analysis.

This preview accurately represents the complete Cirrus Logic BCG Matrix report you will download upon completing your purchase. The analysis and formatting are finalized, providing you with an uncompromised tool for evaluating Cirrus Logic's product portfolio and informing your business strategy.

Dogs

Undifferentiated legacy audio components at Cirrus Logic likely reside in the Dogs quadrant of the BCG Matrix. These are products in mature, highly competitive markets with little room for innovation or differentiation. For instance, older codecs or amplifiers that are no longer central to the company's forward-looking strategy would fit here.

These components often face intense price competition and low profit margins, as their technological advantage has diminished. Cirrus Logic might continue to offer them to support existing customer relationships or specific legacy systems, but they contribute minimally to overall growth or profitability. The company's focus is clearly on newer, more advanced audio solutions.

Niche ICs with stagnant adoption, within Cirrus Logic's portfolio, represent products that haven't captured significant market share or are linked to industries experiencing very little growth. Think of specialized chips for older audio formats or specific industrial equipment that isn't evolving. These are the items that, while perhaps once innovative, now consume valuable engineering and marketing resources without delivering proportional financial gains.

For instance, if a particular line of audio codecs designed for a declining portable media player segment is still being manufactured, it falls into this category. Cirrus Logic's 2024 performance reports would likely show minimal revenue contribution and low profit margins from such offerings. The challenge for Cirrus Logic is to accurately identify these products internally, as they divert investment from more promising areas like high-performance codecs for smartphones or advanced audio solutions for the automotive sector.

Products specifically targeting consumer electronics segments experiencing sustained decline, with no clear path for reinvention, fall into this category. These offerings would have a low market share in a shrinking market, like older generations of MP3 player chipsets, failing to drive significant revenue or strategic growth for Cirrus Logic.

Such products are managed to minimize losses, perhaps through reduced support or an eventual phase-out. For instance, if a particular audio codec technology becomes obsolete due to newer standards, Cirrus Logic would likely discontinue production and support for chips based on that older codec.

Commoditized Standard Audio Codecs

Commoditized standard audio codecs, where Cirrus Logic's advanced technology might not offer significant differentiation, often fall into the question mark category of the BCG matrix. In these segments, intense competition from numerous vendors can lead to lower market share and profitability, even for a leader like Cirrus Logic. For instance, the market for basic audio codecs in many consumer electronics is highly price-sensitive, making it difficult to command premium pricing for superior performance.

Segments where Cirrus Logic's technology is easily replicated or where price is the primary competitive factor are less attractive for sustained investment. This is because the return on investment can be diminished by the need for continuous cost reduction to remain competitive. While Cirrus Logic excels in high-performance audio solutions, their presence in these commoditized markets might represent a smaller portion of their overall revenue or growth potential.

- Low Differentiation: Standard audio codecs offer little unique value, making them susceptible to price wars.

- Intense Competition: Numerous vendors vie for market share in commoditized audio codec segments.

- Price Sensitivity: Consumer electronics often prioritize cost over advanced audio features in basic codecs.

- Limited Profitability: High competition and low differentiation can squeeze profit margins for providers.

End-of-Life Product Lines

End-of-life product lines represent offerings that have passed their peak and are no longer a focus for new development or aggressive marketing. These products, while still potentially generating some revenue, are typically in a declining phase. Cirrus Logic, like many technology companies, manages these by minimizing investment and eventually phasing them out.

These products are characterized by a lack of new design wins and often reduced or discontinued marketing support. For instance, Cirrus Logic may have legacy audio codecs or specific connectivity chips that fit this category. While they might still be purchased for existing systems, their strategic importance diminishes as newer, more advanced alternatives emerge.

- Minimal Investment: Resources are not allocated to further development or significant marketing efforts for these products.

- Residual Revenue: They may continue to generate some income from existing customer bases or replacement parts.

- Phased-Out Strategy: The company plans to eventually discontinue support and production as demand naturally wanes.

- Resource Reallocation: Divesting from or reducing focus on these lines allows for capital and talent to be redirected to more promising product categories.

Cirrus Logic's "Dogs" in the BCG Matrix are likely its older, less differentiated audio components, such as legacy codecs or amplifiers for mature markets. These products operate in highly competitive environments with limited growth prospects and low profit margins, as their technological edge has faded. For example, chips designed for older portable media players that are no longer widely adopted exemplify this category.

These offerings may persist to serve existing customer needs or legacy systems, but they contribute minimally to Cirrus Logic's overall growth and profitability. The company's strategic focus has clearly shifted towards developing and marketing more advanced audio solutions, leaving these older components with stagnant adoption rates and minimal market share in shrinking segments.

Cirrus Logic's 2024 financial statements would likely reflect minimal revenue from these legacy products, with their primary purpose being to manage decline rather than drive expansion. The challenge lies in identifying these "Dog" products internally to effectively reallocate valuable engineering and marketing resources toward more promising, high-growth areas within their portfolio.

For instance, if a specific line of audio ICs for a declining consumer electronics segment, like older generations of MP3 player chipsets, is still in production, it would be categorized as a Dog. These products struggle to generate significant revenue or contribute to strategic growth, necessitating a strategy of minimal investment and eventual phase-out.

Question Marks

Cirrus Logic's recent expansion into professional audio with new Analog-to-Digital Converters (ADCs) and Digital-to-Analog Converters (DACs) positions these products as Question Marks within its BCG Matrix. While the prosumer and professional audio markets are experiencing growth, with the global professional audio equipment market projected to reach approximately $13.5 billion by 2028, Cirrus Logic's penetration in these specific high-end segments is still nascent.

These new offerings require substantial investment in research and development, marketing, and sales to establish a strong market presence and gain traction against established competitors. The company's success in converting these developing products into Stars, which would signify market leadership and high growth, hinges on its ability to capture significant market share and achieve strong revenue contributions from these specialized audio solutions.

Cirrus Logic's expansion into automotive integrated circuits (ICs) for timing, audio, and haptics represents a classic Question Mark in the BCG Matrix. This sector presents significant growth potential, with projections indicating the automotive semiconductor market could reach $115 billion by 2025, according to some industry analyses.

The company has secured initial customer engagement and is actively shipping timing products to a major automotive manufacturer, demonstrating early traction. However, establishing a strong foothold in this highly competitive and regulated market necessitates ongoing, substantial investment in research, development, and sales infrastructure.

Cirrus Logic is actively expanding its general market components, specifically targeting the industrial and imaging sectors. This strategic move aims to broaden their revenue streams beyond traditional audio markets. In 2024, the company's focus on these areas is a key part of its diversification efforts, seeking to tap into growing demand for specialized semiconductor solutions.

While these industrial and imaging markets represent significant growth opportunities, Cirrus Logic's presence in these specialized niches is likely still developing. The company's investment in these segments in 2024 underscores a commitment to building market share and establishing a stronger foothold in areas that require tailored technological advancements.

Advanced Battery and Power Sensing Technologies

Investments in advanced battery and power sensing technologies, especially for emerging applications outside of smartphones, are positioned within the question mark quadrant of the BCG matrix. Cirrus Logic's significant R&D expenditure and robust patent filings in these areas highlight a strong belief in their high growth potential and future product diversification.

These technologies represent a strategic bet on future market opportunities, with substantial resources allocated to research and development. For instance, the electric vehicle (EV) battery management system (BMS) market alone was valued at approximately $3.5 billion in 2023 and is projected to grow at a CAGR of over 15% through 2030, reaching an estimated $9.1 billion. This growth underscores the potential for companies like Cirrus Logic to capture significant market share in these developing sectors.

- High R&D Investment: Cirrus Logic is channeling significant capital into developing next-generation power management ICs and battery monitoring solutions.

- Patent Activity: Increased patent filings in areas like advanced battery analytics and efficient power conversion signal a focus on innovation and intellectual property protection.

- Emerging Market Focus: Expansion beyond traditional consumer electronics into sectors like electric vehicles, industrial IoT, and renewable energy storage drives this strategic focus.

- Early Adoption Phase: While holding high growth potential, current market share and revenue contribution from these advanced technologies are likely nascent as they mature and gain broader market acceptance.

New Applications for HPMS beyond Smartphones/Laptops

Cirrus Logic's exploration into new markets for its High Performance Mixed-Signal (HPMS) technology, moving beyond its established smartphone and nascent laptop presence, represents a classic Question Mark in a BCG Matrix analysis. These new ventures hold the promise of significant future growth, but currently, Cirrus Logic has minimal or no market share in these areas.

The company's strategy here is to invest heavily in research and development, and market penetration to determine if these nascent applications can become viable, high-volume revenue streams. This requires a careful balance of risk and reward, as the potential upside is considerable, but the path to market leadership is uncertain.

- Automotive Audio: Cirrus Logic is actively developing advanced audio solutions for the automotive sector, aiming to enhance in-car entertainment and communication systems. The global automotive semiconductor market reached an estimated $60 billion in 2023, with audio components representing a growing segment.

- Wearable Technology: The company sees potential in providing HPMS solutions for next-generation wearables, including smartwatches and hearables, focusing on power efficiency and advanced sensor integration. The wearable technology market is projected to grow significantly, with shipments expected to exceed 500 million units globally by 2027.

- Smart Home Devices: Cirrus Logic is also targeting the smart home market, offering chips for voice assistants, smart speakers, and other connected devices that require sophisticated audio processing and connectivity. The smart home market is anticipated to reach over $150 billion by 2026.

Cirrus Logic's ventures into professional audio, automotive ICs, industrial and imaging sectors, advanced battery technologies, and new HPMS applications all represent Question Marks. These areas require substantial investment and are in the early stages of market penetration, with uncertain outcomes but high growth potential.

The company is strategically allocating resources to these nascent markets, aiming to establish a foothold and eventually convert them into Stars. Success hinges on capturing market share and generating significant revenue in these competitive and evolving landscapes.

For example, the automotive sector, a key focus for Cirrus Logic's ICs, is projected to see continued semiconductor market growth, with audio components forming an increasingly important segment. Similarly, the electric vehicle battery management system market is experiencing rapid expansion, offering substantial opportunities for Cirrus Logic's power sensing technologies.

| Market Segment | Current Status | Growth Potential | Investment Focus |

|---|---|---|---|

| Professional Audio | Nascent penetration, requires significant investment | Growing market, high-end segments | R&D, marketing, sales |

| Automotive ICs | Early customer engagement, initial shipments | High growth potential, competitive | R&D, sales infrastructure |

| Industrial & Imaging | Developing presence, diversification effort | Significant opportunity, specialized solutions | Market share building |

| Advanced Battery/Power Sensing | High R&D expenditure, patent activity | Very high growth (e.g., EV BMS market) | Innovation, IP protection |

| New HPMS Applications (Wearables, Smart Home) | Minimal to no market share | Significant future growth | R&D, market penetration |

BCG Matrix Data Sources

Our BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.