China International Capital Corporation Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

China International Capital Corporation Bundle

China International Capital Corporation (CICC) operates within a dynamic financial services landscape, shaped by intense competition and evolving regulatory frameworks. Understanding the interplay of buyer power, supplier leverage, and the threat of substitutes is crucial for navigating this market.

The complete report reveals the real forces shaping China International Capital Corporation’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

China International Capital Corporation (CICC) operates in a sector where access to top talent is paramount. The firm's success hinges on its highly skilled investment bankers, traders, and research analysts. These professionals are the backbone of CICC's ability to provide sophisticated financial services and insights.

The market for these specialized financial experts is intensely competitive. There's a limited pool of individuals with the requisite expertise, particularly in China's rapidly evolving financial landscape and on a global scale. This scarcity, combined with robust demand from various financial institutions, significantly amplifies the bargaining power of these top-tier professionals.

Consequently, these talented individuals can command higher compensation packages and more attractive benefits. For instance, in 2024, average compensation for senior investment bankers in major financial hubs often exceeded $500,000 annually, with bonuses playing a substantial role. CICC, like its peers, must continuously offer competitive remuneration and compelling career advancement paths to attract and retain this critical talent, thereby safeguarding its competitive advantage.

Technology and data providers hold significant sway over financial institutions like CICC. The sophisticated nature of modern financial services, including trading and analysis, demands advanced software, robust data analytics, and real-time market information. In 2024, the global financial technology market was valued at over $120 billion, highlighting the critical role of these tech enablers.

Companies offering unique or hard-to-replicate proprietary software, high-speed trading systems, or exclusive financial data sets can command considerable power. For instance, a provider of a specialized algorithmic trading platform that significantly boosts transaction efficiency might be indispensable. CICC, therefore, needs to cultivate strong relationships with its key technology vendors and consider strategic investments in its own internal technology development to reduce dependence on external suppliers and mitigate potential cost increases or service disruptions.

Regulatory bodies in China, such as the National Financial Regulatory Administration (NFRA) and the People's Bank of China (PBOC), exert significant influence by imposing stringent compliance requirements. These regulations act as a critical input, shaping CICC's operational framework and incurring costs associated with adherence.

The demand for specialized legal and compliance services to navigate China's complex and dynamic financial regulatory landscape grants these service providers considerable bargaining power. In 2024, the increasing complexity of financial products and cross-border regulations means CICC likely faces higher costs for expert consultation to ensure full compliance.

Global Market Infrastructure

China International Capital Corporation's (CICC) reliance on global market infrastructure, including exchanges, clearing houses, and payment systems, grants significant bargaining power to the suppliers of these critical services. The concentration of major providers in this space limits CICC's ability to negotiate favorable terms for its extensive cross-border transactions and market access. For example, in 2024, the global financial infrastructure landscape continues to be dominated by a few key players, making it challenging for any single financial institution to exert substantial leverage.

The limited number of global providers for essential services like trading platforms and settlement systems means CICC faces a concentrated supplier base. This can translate into higher costs and less flexibility when securing access to international markets. In 2024, the ongoing consolidation within the financial technology and infrastructure sectors further reinforces the position of these dominant suppliers.

- Concentrated Supplier Base: A few large global entities control critical market infrastructure, reducing CICC's negotiation power.

- Limited Alternatives: The scarcity of comparable alternative infrastructure providers restricts CICC's options for cross-border operations.

- Increased Costs: Dependence on a few powerful suppliers can lead to higher fees for market access and transaction processing for CICC.

Research and Information Sources

The bargaining power of suppliers for China International Capital Corporation (CICC) is significantly influenced by the availability and cost of high-quality, independent research and market insights. Specialized research firms and financial news agencies are key suppliers of this critical intelligence. Their ability to provide unique, in-depth analysis can give them considerable leverage over CICC, impacting the expense and accessibility of essential data for advisory and investment decisions.

For instance, in 2024, the demand for granular data on emerging sectors like artificial intelligence and renewable energy has driven up the costs for premium research subscriptions. Firms that possess proprietary data sets or advanced analytical capabilities are in a strong position to command higher prices. CICC, like other financial institutions, must navigate these supplier dynamics to ensure it has the most accurate and timely information.

- Reliance on Specialized Data Providers: CICC's need for niche market data, such as detailed sector-specific performance metrics or geopolitical risk assessments, makes it reliant on a limited number of specialized research providers.

- Cost of Premium Research: The fees charged by top-tier financial news outlets and independent research houses, which often provide exclusive content and analysis, represent a significant operational cost for CICC.

- Impact of Data Quality: The bargaining power of suppliers is amplified when the quality and uniqueness of their research are indispensable for CICC's competitive edge in its advisory and investment functions.

- Market Consolidation: If the market for financial research experiences consolidation, the remaining dominant players could exert greater pricing power over their clients, including CICC.

The bargaining power of suppliers for China International Capital Corporation (CICC) is notably high due to the concentrated nature of critical market infrastructure providers. These suppliers, such as global exchanges and clearing houses, are essential for CICC's cross-border operations, limiting CICC's ability to negotiate favorable terms.

In 2024, the financial infrastructure landscape remains dominated by a few key players, making it difficult for any single institution to exert substantial leverage. This concentration means CICC faces higher fees for market access and transaction processing, as alternatives are scarce.

Furthermore, CICC's reliance on specialized research and data providers, particularly for niche sectors in 2024, amplifies supplier power. Firms with unique data sets or advanced analytics can command premium prices, impacting CICC's operational costs and competitive edge.

What is included in the product

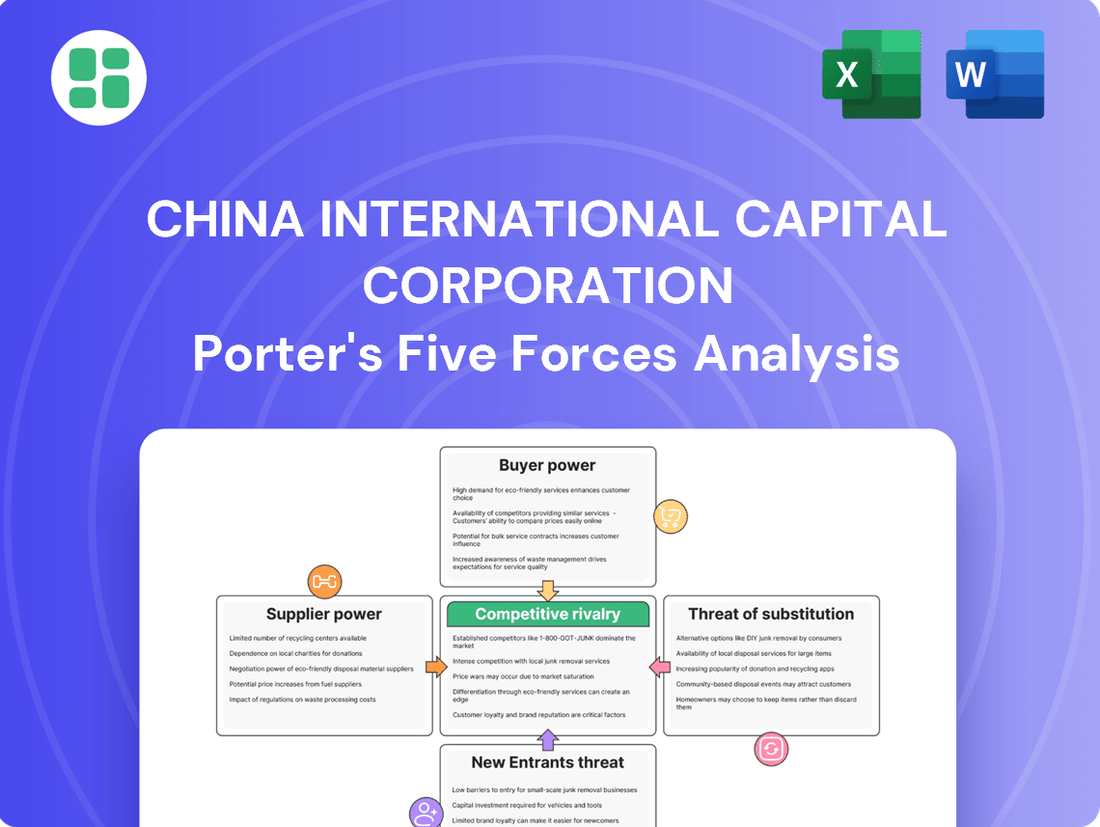

Uncovers key drivers of competition, customer influence, and market entry risks tailored to China International Capital Corporation's position in the investment banking and financial services sector.

Gain immediate clarity on CICC's competitive landscape with a visual breakdown of each force, simplifying complex strategic analysis for faster, more informed decisions.

Customers Bargaining Power

High-Net-Worth Individuals (HNWIs) in China represent a significant segment for China International Capital Corporation (CICC), and their bargaining power is considerable. These clients typically possess diverse and complex financial needs, ranging from investment management and estate planning to philanthropic endeavors. This complexity often necessitates highly personalized and bespoke wealth management services, pushing CICC to deliver specialized solutions. By 2024, the number of HNWIs in China continued to grow, with estimates suggesting over 5 million individuals meeting this definition, managing substantial liquid assets.

The ability of HNWIs to shift substantial portions of their wealth between financial institutions, or to demand highly tailored investment products, grants them significant leverage. This power compels CICC to maintain competitive fee structures and offer attractive returns on investments. Furthermore, CICC must continually innovate its service offerings to meet the evolving demands of this discerning client base, ensuring client retention and attracting new affluent customers. For instance, in 2023, wealth management fees for affluent clients in China saw increased competition, with some firms adjusting their pricing models to retain market share.

Large corporate and institutional clients, especially those involved in major capital raises or mergers and acquisitions, frequently initiate competitive bidding among investment banks. This scale of business, coupled with the presence of numerous capable financial institutions, grants them substantial power to negotiate fees and service conditions. For instance, in 2024, major IPOs saw investment banks competing fiercely, with fee structures often adjusted based on the client's size and the deal's complexity.

The availability of alternative service providers significantly impacts CICC's bargaining power with its customers. China's financial services sector is robust, featuring a multitude of domestic and international investment banks, commercial banks with established investment banking divisions, and specialized boutique advisory firms. This dense competitive environment provides customers, from large corporations to individual investors, with a broad spectrum of choices when seeking financial services.

Customers can readily compare offerings, fees, and expertise across various institutions. For instance, in 2024, the Chinese securities market saw continued growth in both domestic players like CITIC Securities and international firms expanding their presence, intensifying competition. This ease of switching providers if CICC's services are perceived as less competitive or too costly directly empowers customers, forcing CICC to remain agile and value-driven in its service delivery.

Low Switching Costs for Certain Services

For certain standardized financial products offered by China International Capital Corporation (CICC), the costs associated with customers switching to a competitor remain relatively low. This ease of switching significantly amplifies customer bargaining power.

This dynamic compels CICC to prioritize continuous innovation and elevate its service quality to cultivate and retain client loyalty. For instance, in the first half of 2024, the wealth management sector in China saw increased competition, with digital platforms offering comparable services at competitive price points, highlighting the pressure on established players like CICC.

- Low Switching Costs: Customers can readily move between providers for standardized financial products like basic brokerage accounts or simple investment funds.

- Increased Customer Power: This ease of transition gives customers more leverage in negotiating terms or seeking better value elsewhere.

- Need for Innovation: CICC must constantly improve its offerings and customer experience to prevent customer attrition in a competitive landscape.

Client Sophistication and Financial Literacy

China International Capital Corporation (CICC) serves a sophisticated clientele, including institutional investors and seasoned business strategists. This audience, characterized by high financial literacy, thoroughly understands market dynamics and financial instruments. Their ability to critically assess CICC's services means they can effectively negotiate terms, demanding optimal value and performance for their capital and strategic partnerships.

This elevated client sophistication directly impacts CICC's bargaining power. For instance, in 2024, the average assets under management for institutional investors in China's asset management sector reached significant figures, indicating a substantial capacity for negotiation. These clients are adept at comparing fees, performance metrics, and service quality across various financial institutions, compelling CICC to offer competitive and transparent pricing.

- Informed Negotiations: Clients leverage their deep market knowledge to scrutinize CICC's transaction fees, advisory charges, and product offerings, pushing for more favorable terms.

- Performance Benchmarking: Sophisticated investors actively benchmark CICC's investment returns and service delivery against industry peers, using this data to drive negotiation leverage.

- Demand for Value-Added Services: Beyond basic transactions, these clients expect CICC to provide comprehensive research, strategic insights, and customized solutions, influencing the perceived value and pricing.

The bargaining power of customers for China International Capital Corporation (CICC) is substantial due to the competitive landscape and the sophistication of its client base. High-net-worth individuals and large institutional clients possess significant leverage, able to switch providers or demand tailored services, compelling CICC to offer competitive pricing and innovative solutions. For example, in 2024, the number of HNWIs in China exceeded 5 million, managing vast liquid assets, and major IPOs saw intense competition among investment banks on fee structures.

The ease with which customers can switch providers for standardized financial products further amplifies their power. This necessitates CICC's focus on continuous service improvement and innovation to retain clients, especially as digital platforms offer comparable services at competitive prices. The wealth management sector in China experienced heightened competition in the first half of 2024, pressuring established players.

Sophisticated clients, armed with deep market knowledge, actively scrutinize CICC's fees and performance, benchmarking against peers to negotiate favorable terms and demanding value-added services. This informed approach ensures CICC must remain transparent and deliver superior value to maintain its client relationships.

| Customer Segment | Leverage Factors | Impact on CICC | 2024 Data/Trend |

|---|---|---|---|

| High-Net-Worth Individuals (HNWIs) | Diverse financial needs, ability to shift wealth, demand for bespoke services | Pressure on fees, need for service innovation and competitive returns | Over 5 million HNWIs in China; continued growth in wealth management sector |

| Large Corporate & Institutional Clients | Scale of business, competitive bidding for capital raises/M&A | Negotiation power on fees and service conditions | Intense competition on fees for major IPOs in 2024 |

| General Investors (Standardized Products) | Low switching costs for basic products, availability of alternatives | Need for competitive pricing and superior customer experience | Digital platforms offering comparable services at competitive prices |

Preview Before You Purchase

China International Capital Corporation Porter's Five Forces Analysis

This preview showcases the complete Porter's Five Forces analysis for China International Capital Corporation, offering an in-depth examination of competitive forces. The document you see here is the exact, professionally formatted report you will receive immediately after purchase, ensuring no discrepancies or missing information. You can confidently acquire this detailed strategic assessment, ready for immediate application to your business insights.

Rivalry Among Competitors

China International Capital Corporation (CICC) faces intense competition from formidable domestic rivals such as CITIC Securities, China Galaxy Securities, and Huatai Securities. These established players vie fiercely for market share across key financial services, including investment banking, securities trading, and wealth management.

In 2023, CITIC Securities reported operating revenue of RMB 211.1 billion, demonstrating its significant scale and market presence. Similarly, China Galaxy Securities and Huatai Securities also command substantial market influence, actively competing with CICC for mandates and client relationships within the rapidly evolving Chinese financial landscape.

While China International Capital Corporation (CICC) holds a strong position domestically, the landscape is increasingly shaped by international investment banks. These global players are actively increasing their market share in China, particularly in complex cross-border deals and the development of sophisticated financial products. This growing international presence directly intensifies the competition for securing lucrative transactions and attracting top financial talent.

The market for significant financial transactions, such as initial public offerings (IPOs), mergers and acquisitions (M&A), and substantial bond issuances, is incredibly competitive. Investment banks, including China International Capital Corporation (CICC), are locked in a constant struggle to win these high-profile deals.

This intense rivalry forces banks to engage in aggressive bidding strategies and invest heavily in cultivating strong client relationships. Securing these mandates often means facing pressure to lower fees, which can impact profitability and margins for all players involved.

Differentiation Through Specialization and Technology

Firms in the financial services sector, including China International Capital Corporation (CICC), actively pursue differentiation. This often involves developing deep expertise in specific industries like technology or healthcare, alongside creating novel financial products. The adoption of advanced digital platforms is also a key strategy to stand out.

CICC's commitment to innovation is evident in its investments. For instance, the company has been actively developing and implementing AI-driven analytics and trading platforms. These technological advancements are designed to enhance efficiency, provide superior insights, and ultimately offer a competitive edge in the market.

- Specialized Sector Expertise: CICC targets niche areas like technology and healthcare for deeper client engagement.

- Innovative Financial Products: Development of new financial instruments to meet evolving market demands.

- Digital Platform Advancement: Investment in AI-driven analytics and trading systems to improve service delivery and operational efficiency.

- Competitive Edge: Technology adoption aims to provide CICC with a distinct advantage over rivals.

Regulatory Environment and Policy Influence

The regulatory environment in China is a powerful force shaping competition within the financial services sector, directly impacting firms like China International Capital Corporation (CICC). Government policies and directives can significantly alter the competitive landscape by encouraging or discouraging certain business practices, mergers, or market entries.

Policy shifts, such as those aimed at fostering industry consolidation or implementing financial market reforms, directly influence how CICC and its rivals position themselves. For instance, directives promoting digital finance or stricter capital requirements can redefine competitive advantages and necessitate strategic adjustments.

- Policy Influence: Chinese regulators have actively guided the financial sector, for example, by encouraging consolidation in certain areas to create larger, more competitive national champions.

- Regulatory Changes: In 2024, ongoing reforms in areas like wealth management and capital markets continue to set new compliance standards and operational parameters for all financial institutions.

- Market Share Impact: Regulatory approvals for new products or services, or changes in foreign ownership rules, can swiftly alter market share dynamics among domestic and international players.

Competitive rivalry is a significant factor for CICC, with domestic giants like CITIC Securities, China Galaxy Securities, and Huatai Securities actively competing across all major financial service segments. These firms, with substantial revenues in 2023 – CITIC Securities alone reported RMB 211.1 billion – are locked in a perpetual battle for market share and client mandates. The intensifying presence of international investment banks, particularly in complex cross-border transactions and sophisticated product development, further heightens this rivalry, pushing all players to innovate and refine their strategies to maintain a competitive edge.

| Competitor | 2023 Revenue (RMB Billion) | Key Competitive Areas |

|---|---|---|

| CITIC Securities | 211.1 | Investment Banking, Securities Trading, Wealth Management |

| China Galaxy Securities | [Data not provided in source] | Securities Trading, Investment Banking |

| Huatai Securities | [Data not provided in source] | Investment Banking, Wealth Management |

SSubstitutes Threaten

Corporations are increasingly exploring direct capital market access, bypassing traditional investment banks. For instance, in 2023, the total value of direct listings on major exchanges like the NYSE and Nasdaq continued to grow, offering companies an alternative to IPOs. This trend directly challenges the underwriting services CICC traditionally provides, as companies can now raise significant capital through private placements or by issuing corporate bonds directly via digital platforms, reducing reliance on intermediaries.

The proliferation of digital investment platforms and robo-advisors presents a significant threat of substitution for traditional wealth management services offered by firms like China International Capital Corporation (CICC). These digital alternatives, particularly appealing to mass affluent and younger demographics, provide automated, low-cost investment solutions that directly compete with human-advised models.

By 2024, the global robo-advisory market was projected to exceed $2.5 trillion in assets under management, demonstrating a clear shift in client preference towards these more accessible and cost-effective options. This trend forces traditional players to innovate and adapt their service offerings to remain competitive.

Large corporations are increasingly building robust internal corporate development teams. These teams are equipped to manage mergers and acquisitions independently, diminishing the need for external advisory services from firms like CICC. For instance, in 2024, many Fortune 500 companies expanded their M&A departments, demonstrating this trend.

Alternative Financing Methods like Private Equity and Venture Capital

The rise of alternative financing methods presents a significant threat to traditional investment banking services, including those offered by China International Capital Corporation (CICC). Companies increasingly bypass public markets, opting for private equity, venture capital, and direct lending from non-bank institutions for their capital needs.

This shift is driven by factors like faster deal execution and greater flexibility often found in private financing arrangements. For instance, the global private equity market saw substantial activity, with deal values reaching hundreds of billions of dollars in recent years, indicating a strong appetite for these alternative avenues.

CICC, like other investment banks, faces competition from these alternative sources which can offer tailored solutions and potentially lower costs for certain types of businesses. The increasing sophistication and accessibility of these private markets mean that fewer companies may rely on IPOs or traditional debt offerings facilitated by investment banks.

- Growing Private Equity and Venture Capital Investments: Global private equity fundraising reached record levels in 2023, with significant capital available for deployment, directly competing with traditional IPO markets.

- Direct Lending Expansion: Non-bank lenders have become major players, providing substantial amounts of capital directly to companies, often at competitive terms compared to traditional bank loans or public offerings.

- Company Preferences for Private Markets: Many growth-stage companies now prefer the speed and control offered by private capital raises over the disclosure and regulatory burdens of public markets.

Self-Directed Investing and Financial Information Platforms

The rise of self-directed investing platforms poses a significant threat to traditional financial services like those offered by CICC. High-net-worth individuals and retail investors now have unprecedented access to vast amounts of financial data and sophisticated trading tools online, empowering them to manage their own portfolios effectively. This accessibility diminishes their reliance on wealth management and brokerage services, potentially impacting CICC's client base and revenue streams.

In 2024, the digital investment landscape continued to expand, with many platforms offering commission-free trading and a wealth of research. For instance, the number of active retail investors in China has been steadily growing, with a significant portion utilizing online platforms for their investment activities. This trend suggests a sustained shift towards self-service, directly challenging the need for intermediaries.

- Increased Accessibility: Online platforms provide easy access to market data, research reports, and trading execution for a broad range of investors.

- Cost-Effectiveness: Many digital platforms offer lower fees or commission-free trading compared to traditional brokerage services.

- Investor Empowerment: Advanced analytical tools and educational resources available online enable investors to make more informed decisions independently.

- Growth in Fintech: The rapid development of financial technology continues to introduce innovative solutions that further facilitate self-directed investing.

Companies are increasingly bypassing traditional investment banks by accessing capital markets directly or through alternative financing. This trend is fueled by the growth of private equity, venture capital, and direct lending, which offer faster execution and greater flexibility. For example, global private equity fundraising hit record levels in 2023, with substantial capital available for deployment, directly competing with IPO markets.

Entrants Threaten

Establishing a full-service investment bank like China International Capital Corporation (CICC) demands immense capital. Think about the costs for cutting-edge trading platforms, robust cybersecurity, and attracting top-tier talent. These aren't small figures, creating a significant hurdle for any newcomer.

New players must also overcome the challenge of achieving economies of scale. Larger, established firms can spread their fixed costs over a greater volume of business, leading to lower per-unit costs. For instance, in 2023, the total revenue for the Chinese securities industry reached approximately 1.6 trillion yuan, with the top firms handling a disproportionately large share of deals, demonstrating this scale advantage.

The financial services sector in China operates under a robust and intricate regulatory environment. New companies looking to enter must contend with stringent licensing procedures for core activities like investment banking, securities trading, and asset management, making it a significant barrier.

For instance, in 2023, the China Securities Regulatory Commission (CSRC) continued to emphasize compliance and risk management, imposing new guidelines on information disclosure and corporate governance that new entrants must meticulously adhere to. These requirements demand substantial investment in legal, compliance, and operational infrastructure, effectively deterring smaller or less capitalized players.

China International Capital Corporation (CICC) thrives on deeply ingrained client relationships, cultivated over years with major corporations, financial institutions, and affluent individuals. This trust, built on a consistent track record of successful deal execution and advisory services, presents a significant barrier to newcomers. For instance, CICC's strong presence in the Chinese IPO market, where it advised on 18 listings in 2023, generating approximately $2.1 billion in proceeds, highlights the value of these established connections.

New entrants face the daunting challenge of replicating this network. They must commit substantial capital and time to fostering similar levels of trust and brand recognition. Without this, attracting and retaining clients, especially for complex financial transactions, becomes exceedingly difficult, effectively deterring potential competitors from entering the market.

Scarcity of Specialized Talent and Expertise

The investment banking sector, particularly in China, faces a significant hurdle in the scarcity of highly specialized talent. This is crucial for firms like China International Capital Corporation (CICC) as new entrants struggle to acquire the deep expertise needed in areas like mergers and acquisitions, capital markets, and research. Attracting and retaining these seasoned professionals is a major challenge for any newcomer without an established brand or competitive compensation packages.

The demand for experienced investment bankers in China continues to outstrip supply. In 2024, the average base salary for an investment banking associate in Shanghai was reported to be around RMB 400,000 to RMB 600,000 annually, with bonuses potentially doubling this figure. This high cost of talent makes it difficult for new firms to build a competitive team. Furthermore, the regulatory landscape and the need for deep understanding of local market nuances add another layer of complexity, requiring specialized knowledge that is not easily replicated.

- Talent Gap: A shortage of experienced professionals in M&A, capital markets, and research hinders new entrants.

- Compensation Challenges: High salary expectations and bonus structures for experienced bankers make it costly for new firms to compete.

- Reputation Barrier: New firms lack the established reputation and track record needed to attract top-tier talent away from established players like CICC.

- Market Nuances: Navigating China's unique regulatory environment and market dynamics requires specialized, hard-to-find expertise.

Technological Investment and Innovation Pace

The financial services sector, particularly in China, is experiencing a significant technological acceleration. Companies like Ant Group and Tencent are heavily investing in artificial intelligence and blockchain, with estimates suggesting that fintech investment in China reached over $100 billion in 2023 alone. This rapid innovation cycle means new entrants must commit substantial capital to develop or acquire cutting-edge technologies, creating a high barrier to entry.

The need to match or exceed the technological prowess of established players, who are already leveraging AI for risk assessment and personalized financial advice, significantly increases the upfront investment required for new entrants. For example, developing sophisticated AI algorithms for credit scoring can cost millions of dollars in data acquisition, model training, and talent acquisition. This technological arms race makes it challenging for newcomers to compete effectively without considerable financial backing and expertise.

- High R&D Expenditure: New entrants face substantial research and development costs to build competitive technological capabilities in areas like AI-driven wealth management and digital payment systems.

- Talent Acquisition Costs: Securing skilled AI engineers, data scientists, and cybersecurity experts is highly competitive and expensive, with top talent commanding salaries well into the hundreds of thousands of dollars annually.

- Infrastructure Investment: Building robust and scalable IT infrastructure, including cloud computing and data analytics platforms, represents another significant capital outlay for potential new market participants.

The threat of new entrants into China's investment banking sector, where CICC operates, is considerably low. Significant capital requirements for technology, talent, and regulatory compliance create substantial upfront barriers. Furthermore, established players benefit from economies of scale and deep-rooted client relationships, making it difficult for newcomers to gain traction and compete effectively.

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for China International Capital Corporation is built on a foundation of comprehensive data, including CICC's annual reports, industry-specific research from reputable financial news outlets, and government regulatory filings. This ensures a robust understanding of the competitive landscape.