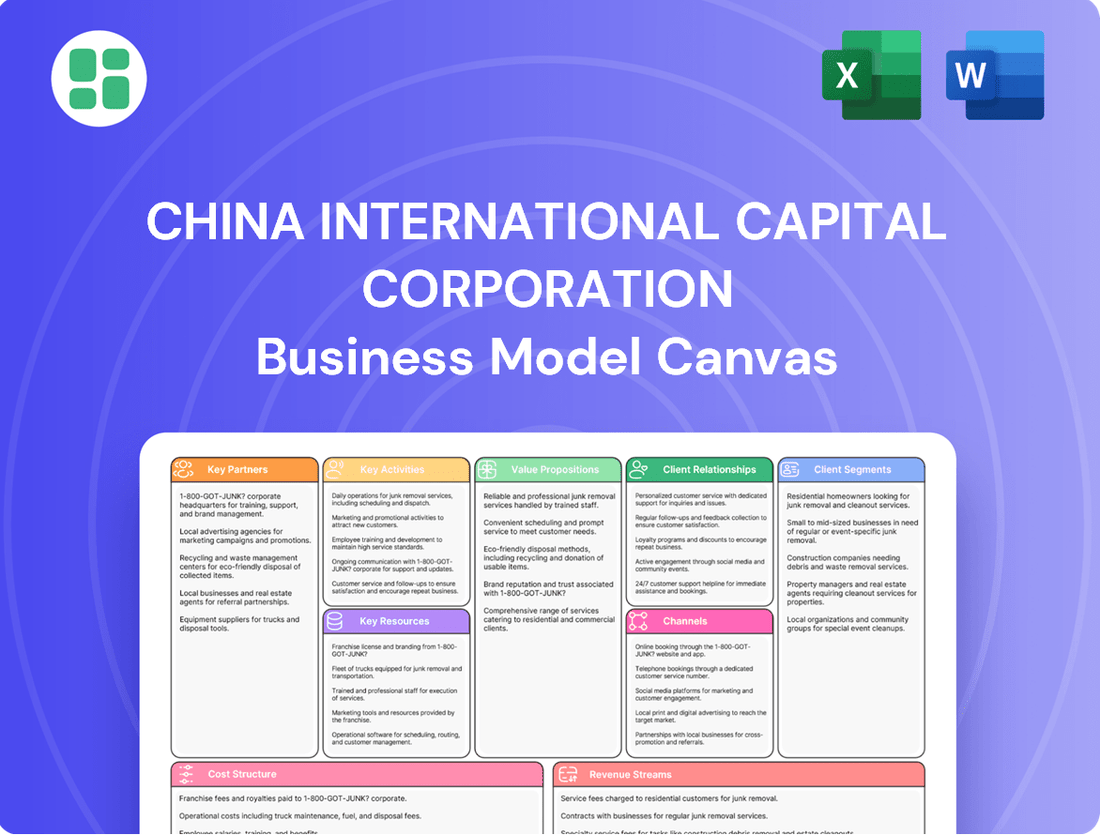

China International Capital Corporation Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

China International Capital Corporation Bundle

Unlock the core strategies of China International Capital Corporation with our comprehensive Business Model Canvas. This detailed analysis breaks down their customer relationships, revenue streams, and key resources, offering a clear roadmap to their success. For anyone seeking to understand or replicate this financial powerhouse's approach, this is an essential resource.

Partnerships

CICC cultivates strategic alliances with prominent domestic and international financial institutions, including major banks and insurance companies. These collaborations are vital for expanding CICC's service portfolio and market penetration.

Through these partnerships, CICC engages in syndicated lending, joint underwriting of securities, and cross-referrals for specialized financial products. This synergy enhances CICC's transaction capacity and strengthens its market influence, as seen in its role in significant capital market activities.

For instance, in 2024, CICC's involvement in large-scale capital raising and complex mergers and acquisitions frequently leveraged these deep relationships with key financial players, underscoring their importance in executing high-value transactions and expanding its competitive edge.

CICC actively collaborates with Chinese and international regulatory bodies, such as the China Securities Regulatory Commission (CSRC) and the Securities and Exchange Commission (SEC), to ensure strict adherence to evolving financial regulations. This proactive engagement, exemplified by their participation in industry working groups throughout 2024, guarantees smooth market operations and fosters trust.

Strategic alliances with government-affiliated investment funds, including those managed by the National Council for Social Security Fund, and major state-owned enterprises are crucial for CICC. These partnerships, which saw CICC advising on several significant infrastructure deals in 2024, secure mandates for large-scale national projects and allow CICC to leverage policy tailwinds, particularly for initiatives like the Belt and Road Initiative.

China International Capital Corporation (CICC) actively partners with technology and fintech providers to bolster its digital infrastructure. These collaborations are crucial for upgrading trading systems and enhancing its online service platforms, ensuring CICC remains at the forefront of digital financial services.

By integrating advanced technologies, CICC aims to deliver innovative financial solutions and boost operational efficiency. For instance, the firm is investing in AI-driven analytics to provide more sophisticated insights and improve algorithmic trading capabilities, a key strategy in the competitive 2024 financial market.

Global Investment Funds and Asset Managers

China International Capital Corporation (CICC) actively cultivates strategic alliances with prominent global investment funds and asset managers. These collaborations are pivotal for unlocking co-investment prospects, especially within complex cross-border mergers and acquisitions and private equity transactions. For instance, in 2024, CICC continued to leverage these partnerships to facilitate significant inbound and outbound capital flows, tapping into international financial markets.

These vital relationships grant CICC enhanced access to substantial international capital pools and specialized expertise, which is crucial for navigating diverse investment landscapes. Furthermore, these connections serve as a conduit to a broad spectrum of large-scale asset managers, diversifying CICC's investor base and deal origination capabilities. This network allows CICC to effectively bridge domestic opportunities with global financial resources.

Key aspects of these partnerships include:

- Co-Investment Opportunities: Facilitating joint ventures and shared investments in high-value deals, particularly in sectors experiencing robust cross-border activity.

- Access to International Capital: Enabling CICC to tap into global liquidity for its clients and its own investment strategies.

- Expertise Exchange: Gaining insights into international best practices and market trends from experienced global fund managers.

- Deal Sourcing and Execution: Broadening the scope of potential transactions and enhancing the ability to execute complex international deals efficiently.

Industry Associations and Professional Networks

Engaging with industry associations and professional networks is crucial for China International Capital Corporation (CICC) to maintain its pulse on the financial landscape. These affiliations provide CICC with invaluable insights into evolving market trends, upcoming regulatory shifts, and emerging business opportunities across China and globally.

These partnerships act as vital conduits for thought leadership and brand enhancement. By actively participating in forums and discussions, CICC solidifies its reputation as a knowledgeable and influential player in the financial sector. For instance, CICC's involvement in events like the Asian Financial Forum (AFF) in January 2024, which convened over 3,000 participants, showcases its commitment to these collaborative platforms.

- Market Intelligence: Access to real-time data and expert analysis from organizations like the Securities Association of China.

- Regulatory Foresight: Early awareness of policy changes impacting financial services, allowing for proactive strategy adjustments.

- Talent Development: Opportunities to connect with emerging talent and industry experts through networking events and professional development programs.

- Brand Advocacy: Strengthening CICC's image and influence through participation in industry-wide initiatives and thought leadership contributions.

CICC's key partnerships extend to technology and fintech providers, crucial for enhancing its digital capabilities. These alliances fuel advancements in trading platforms and online service offerings, ensuring CICC remains competitive in the digital financial services arena.

In 2024, CICC's strategic focus on technology integration saw collaborations aimed at leveraging AI for advanced analytics and algorithmic trading, boosting operational efficiency and delivering innovative client solutions.

These technology partnerships are vital for CICC to maintain its edge in a rapidly evolving financial market, offering sophisticated insights and improved transaction capabilities.

What is included in the product

This Business Model Canvas provides a strategic overview of China International Capital Corporation (CICC), detailing its key customer segments, value propositions, and revenue streams within the financial services industry.

It outlines CICC's operational structure, including its key partners, activities, and cost structure, offering a comprehensive framework for understanding its business strategy.

The China International Capital Corporation Business Model Canvas acts as a pain point reliever by providing a structured, visual overview that clarifies complex financial services, making strategic planning and communication more efficient.

It offers a concise, one-page snapshot of CICC's operations, simplifying the identification of key value propositions and customer segments to address market challenges.

Activities

China International Capital Corporation's investment banking operations are central to its business model, focusing on facilitating capital raising for corporations through initial public offerings (IPOs), equity placements, and bond issuances. These activities are crucial for companies seeking to access public markets or secure debt financing.

Furthermore, CICC offers extensive advisory services, guiding clients through complex mergers and acquisitions (M&A), corporate restructuring, and privatization efforts. These advisory functions are vital for strategic corporate development and financial optimization.

In 2024, CICC demonstrated significant market presence, ranking as a top bookrunner for domestic equity capital markets (ECM) deals. The firm also solidified its position as a leading financial advisor for M&A transactions, underscoring its active role in shaping corporate landscapes.

Securities trading and brokerage form a core function for CICC, involving the execution of client orders across diverse markets like equities, bonds, currencies, and commodities. This activity is crucial for facilitating capital flow and providing liquidity.

Beyond client services, CICC actively participates in proprietary trading, utilizing its deep market understanding and robust research to generate returns. As of the first half of 2024, the firm reported significant growth in its wealth management and brokerage segments, indicating strong client activity.

CICC's investment in technology is evident through its self-developed algorithmic trading systems for stocks, which aim to improve execution efficiency and capture market opportunities. This technological edge is vital in today's fast-paced trading environment.

China International Capital Corporation (CICC) offers extensive wealth management services, catering to high-net-worth individuals with personalized investment strategies and financial planning. These services encompass sophisticated asset allocation advice across a broad spectrum of investment vehicles, including fixed income, equities, and alternative investments. By mid-2024, CICC's Wealth Management division had successfully engaged with more than 7.73 million customers, demonstrating significant reach and client trust.

Asset Management

CICC's asset management arm is deeply involved in managing a diverse array of investment funds. This includes everything from mutual funds accessible to the general public to private funds tailored for sophisticated investors, as well as specialized investment products designed for specific market needs. Their client base spans both large institutional investors and individual savers.

A significant focus for CICC Fund Management is its mutual fund business. They have consistently held a leading position in terms of Assets Under Management (AUM) within the Real Estate Investment Trust (REITs) sector. For instance, by the end of 2023, CICC Fund Management’s AUM in REITs reached a substantial figure, underscoring their dominance in this niche market.

- Managing a comprehensive suite of investment vehicles, encompassing mutual funds, private equity, and bespoke investment solutions for a wide client spectrum.

- Leading the REITs market, with CICC Fund Management demonstrating strong performance and a significant share of AUM in this rapidly growing asset class.

- Driving innovation in fund products, catering to evolving investor preferences and market opportunities.

Research and Analysis

China International Capital Corporation (CICC) places significant emphasis on producing in-depth market research, economic analysis, and industry reports. These outputs are crucial for equipping clients with valuable insights and informing CICC's strategic investment decisions. For instance, CICC's research arm consistently publishes detailed analyses on sectors ranging from technology to consumer goods, often cited by market participants.

The CICC Global Institute plays a pivotal role in this activity, actively working to enhance its social influence and cultivate a robust brand reputation in public policy research. This focus helps shape discourse and provides a foundation for CICC's advisory services. In 2024, the institute continued its tradition of releasing comprehensive reports on key economic trends impacting China and global markets.

- In-depth Market Research: CICC's research teams generate detailed reports covering various industries, providing granular data and forecasts.

- Economic Analysis: The firm's economists offer macroeconomic outlooks and analyses of policy impacts, essential for strategic planning.

- Industry Reports: CICC publishes sector-specific reports that often become benchmarks for understanding market dynamics.

- CICC Global Institute: This arm focuses on public policy research, aiming to increase its social impact and brand recognition.

CICC's investment research and advisory services are a cornerstone of its business. The firm produces comprehensive market analyses, economic forecasts, and industry-specific reports, which are vital for informing client investment decisions and CICC's own strategies. For example, CICC's research on the technology sector in 2024 provided critical insights into emerging trends and investment opportunities.

The CICC Global Institute further amplifies this by focusing on public policy research, aiming to enhance its societal impact and brand. This strategic focus ensures CICC remains at the forefront of understanding and influencing economic and policy landscapes, providing a distinct advantage in its advisory capacities.

| Key Research & Advisory Activities | Description | 2024 Highlights/Data |

| Market Research | Detailed analysis of various industries and market trends. | Consistent publication of sector-specific reports, often cited by industry professionals. |

| Economic Analysis | Macroeconomic outlooks and policy impact assessments. | Provided comprehensive reports on China's economic performance and global market influences. |

| CICC Global Institute | Public policy research to enhance social influence and brand. | Continued release of influential reports on economic policy and development. |

Preview Before You Purchase

Business Model Canvas

The Business Model Canvas you are previewing is the exact document you will receive upon purchase, offering a comprehensive overview of China International Capital Corporation's strategic framework. This is not a sample or mockup; it's a direct representation of the final, ready-to-use deliverable. You'll gain full access to this detailed analysis, allowing you to understand and apply CICC's business model effectively.

Resources

Human capital is the bedrock of China International Capital Corporation (CICC). The firm relies on a deep bench of highly skilled professionals, including investment bankers, financial analysts, portfolio managers, and research specialists. These experts bring invaluable industry knowledge, cultivate crucial client relationships, and possess the execution capabilities essential for navigating complex financial transactions.

CICC's commitment to talent is evident in its substantial workforce. The company oversees a team of over 2,000 investment bankers, underscoring the significant investment in human expertise required to deliver its comprehensive suite of financial services.

China International Capital Corporation (CICC) leverages its strong brand reputation as a premier investment bank with deep Chinese origins and a significant global presence. This established image is crucial for attracting high-value clients and top-tier talent, both domestically and internationally.

CICC's extensive network, boasting over 200 securities business offices across China and strategically located international branches, amplifies its market reach. This vast infrastructure facilitates unparalleled client access and strengthens its competitive position in diverse financial markets.

CICC leverages proprietary technology and data analytics as a cornerstone of its business model. This includes advanced trading platforms and sophisticated risk management systems, essential for delivering efficient and effective financial services to its diverse clientele.

The company's commitment to technological innovation is evident in its substantial investments in AI-driven analytics and cutting-edge trading platforms. CICC has developed its own proprietary algorithms specifically for stock trading, aiming to enhance performance and provide a competitive edge.

In 2023, CICC reported that its technology and data analytics capabilities were instrumental in supporting its various business segments, including investment banking and wealth management. This focus on technology is designed to drive operational efficiency and generate alpha for clients.

Financial Capital and Liquidity

CICC's business model relies heavily on its financial capital and liquidity to support its diverse operations. This financial muscle allows the firm to underwrite substantial deals, participate in proprietary trading, and effectively manage client portfolios. For example, as of the end of 2023, CICC reported total assets of approximately RMB 1.1 trillion, underscoring its significant financial capacity.

The company's robust liquidity is a critical enabler for its investment banking and asset management arms. This financial strength is further demonstrated by its substantial equity base, which provides a buffer for risk management and allows for expansion into new markets and services. In 2023, CICC's equity attributable to shareholders stood at roughly RMB 140 billion, reflecting a solid foundation.

- Access to substantial financial capital

- Robust liquidity for operations

- Significant total assets and equity

Extensive Client Base and Relationships

China International Capital Corporation (CICC) thrives on an extensive and diversified client base, encompassing major corporations, influential financial institutions, and high-net-worth individuals. This broad reach ensures a consistent flow of business and valuable referrals, underpinning CICC's market presence.

The company places a strong emphasis on cultivating and maintaining robust, long-standing relationships with its clients. This client-centric philosophy is central to CICC's strategy, driving efforts to understand individual needs and deliver precisely tailored financial solutions.

- Diversified Client Segments: CICC serves a wide array of clients, from large corporations seeking capital markets access to sophisticated investors.

- Relationship Strength: The firm's success is built on deep, enduring relationships, fostering trust and repeat business.

- Client-Centric Approach: CICC actively works to strengthen client ties by offering personalized advice and solutions.

- Referral Engine: Satisfied clients act as a powerful source of new business opportunities and market insights.

CICC's key resources include its human capital, brand reputation, extensive network, proprietary technology, and significant financial capital. These elements collectively enable CICC to provide a comprehensive range of financial services, from investment banking to asset management, and to maintain a competitive edge in the global financial landscape.

| Key Resource | Description | 2023 Data/Impact |

|---|---|---|

| Human Capital | Highly skilled professionals | Over 2,000 investment bankers |

| Brand Reputation | Premier investment bank | Attracts high-value clients and talent |

| Network | Extensive offices | Over 200 securities business offices in China |

| Proprietary Technology | Advanced trading platforms & analytics | Developed proprietary stock trading algorithms |

| Financial Capital | Substantial assets and liquidity | Total assets ~RMB 1.1 trillion, Equity ~RMB 140 billion |

Value Propositions

CICC provides a complete spectrum of integrated financial services, encompassing investment banking, capital raising, wealth management, and asset management. This allows clients to address their diverse financial requirements through a single, convenient platform.

This integrated model ensures clients benefit from a broad range of specialized expertise and services conveniently accessible in one location. For instance, CICC's investment banking division advised on 112 IPOs in 2023, raising over $20 billion, showcasing their extensive capital-raising capabilities.

Clients leverage CICC's deep knowledge of both Chinese and international financial landscapes, supported by robust research and analytical prowess. This allows CICC to offer insightful guidance and pinpoint distinctive investment prospects.

CICC's dedicated research division plays a vital role in shaping market perspectives. For instance, in 2024, CICC's research reports covered over 1,500 listed companies, with a significant portion focused on emerging sectors within China's economy.

CICC's strong execution capabilities are a cornerstone of its value proposition, demonstrated by its proven track record in successfully completing complex and large-scale transactions. Clients gain significant confidence from CICC's ability to manage major IPOs and M&A deals efficiently.

The firm's expertise in navigating intricate regulatory landscapes and dynamic market conditions ensures smooth and timely deal closures. For instance, CICC played a pivotal role in numerous significant A-share IPOs and M&A transactions throughout 2024, underscoring its market leadership and execution prowess.

Global Reach with Local Acumen

CICC's value proposition, Global Reach with Local Acumen, is built on its distinctive 'Chinese roots and international reach.' This allows the firm to offer clients exceptional access to both domestic Chinese and global capital markets. By bridging these two worlds, CICC effectively facilitates cross-border transactions and presents a diverse range of global investment opportunities, all while demonstrating a deep understanding of local market dynamics and regulations.

This strategic positioning is crucial for navigating the complexities of international finance. For instance, in 2024, CICC played a significant role in advising on several major cross-border IPOs and M&A deals involving Chinese companies seeking international listings or acquisitions, as well as foreign entities looking to enter the Chinese market. The firm's continued expansion of its global footprint, with offices in key financial centers, underscores its commitment to providing comprehensive, localized support worldwide.

- Unparalleled Market Access: CICC provides clients with direct access to both the rapidly growing Chinese domestic market and established international financial centers.

- Cross-Border Expertise: The firm excels in facilitating complex international transactions, leveraging its dual market understanding.

- Global Network Expansion: CICC actively broadens its international presence to better serve a global clientele and identify emerging opportunities.

Tailored and Client-Centric Service

CICC’s business model is deeply rooted in a client-centric philosophy, ensuring that financial solutions and advisory services are meticulously tailored to meet the unique requirements and aspirations of each individual client. This focus on personalization is key to fostering enduring client relationships and achieving high levels of satisfaction.

The firm has strategically evolved its service model to encompass comprehensive lifecycle advisory, meaning CICC supports clients through every stage of their financial journey. This holistic approach ensures continuous value delivery and strengthens client loyalty.

- Client-Centric Approach: CICC prioritizes understanding individual client needs, offering bespoke financial strategies and advice.

- Lifecycle Advisory: The firm provides end-to-end support, guiding clients through all phases of their financial life.

- Relationship Building: Personalized service fosters long-term partnerships and enhances client retention.

- Customized Solutions: Financial products and advisory services are designed to align precisely with client goals.

CICC's value proposition centers on delivering integrated financial services, offering clients a one-stop solution for their diverse needs. This comprehensive approach, from investment banking to wealth management, simplifies financial operations and provides access to a broad spectrum of expertise.

The firm's deep understanding of both Chinese and global markets, backed by robust research, allows for the identification of unique investment opportunities. For example, in 2024, CICC's research covered over 1,500 companies, highlighting emerging sectors.

CICC's proven execution capabilities in complex transactions, including major IPOs and M&A deals, provide clients with confidence and efficiency. Their ability to navigate regulatory landscapes ensures smooth deal closures, as demonstrated by their pivotal role in numerous A-share transactions throughout 2024.

Bridging Chinese roots with international reach, CICC offers unparalleled access to both domestic and global capital markets. This dual focus facilitates cross-border activities and provides diverse investment options, supported by a growing global network.

The firm's client-centric philosophy ensures tailored financial solutions and lifecycle advisory. This personalized approach fosters strong, long-term client relationships and high satisfaction levels.

| Value Proposition Component | Key Offering | Supporting Fact/Data (2023/2024) |

| Integrated Financial Services | One-stop shop for diverse financial needs | Advised on 112 IPOs in 2023, raising over $20 billion. |

| Market Insight & Research | Access to deep market knowledge and distinctive opportunities | Researched over 1,500 listed companies in 2024, focusing on emerging sectors. |

| Execution Excellence | Efficient completion of complex transactions | Pivotal role in significant A-share IPOs and M&A deals in 2024. |

| Global Reach with Local Acumen | Access to both Chinese and international capital markets | Facilitated cross-border IPOs and M&A for Chinese and foreign entities in 2024. |

| Client-Centricity & Lifecycle Advisory | Tailored solutions and end-to-end support | Focus on personalized service to foster long-term client partnerships. |

Customer Relationships

China International Capital Corporation (CICC) strategically deploys dedicated relationship managers to its most important clients. This ensures each key client receives highly personalized attention and consistent communication. By fostering this one-on-one interaction, CICC aims to gain a profound understanding of clients' changing financial requirements, building the trust essential for enduring partnerships in the financial services sector.

China International Capital Corporation (CICC) has strategically transitioned its customer relationships towards an advisory-based service model, moving away from a purely product-sales approach. This evolution signifies a commitment to building deeper, more enduring partnerships with clients.

The core of this new model is the establishment of a robust buy-side investment advisory system. This system is designed to offer clients strategic guidance and comprehensive, lifecycle-focused solutions, ensuring their financial objectives are met through tailored advice rather than just transactional services.

This shift is reflected in CICC's performance, with advisory and asset management fees playing an increasingly significant role in their revenue mix. For instance, in the first half of 2024, CICC reported a notable increase in revenue from its wealth management and investment banking segments, underscoring the success of its advisory-centric strategy.

CICC regularly hosts client conferences, industry forums, and investor briefings. These events are crucial for sharing market insights, introducing new products, and fostering valuable networking among clients. They significantly boost client engagement and solidify CICC's position as a thought leader in the financial sector.

A prime example of this commitment was the successful staging of the 2024 CICC GBA Wealth Management Forum. This initiative underscores CICC's dedication to providing platforms for knowledge exchange and relationship building within the wealth management community.

Digital Engagement and Self-Service Platforms

China International Capital Corporation (CICC) is significantly enhancing its customer relationships through robust digital engagement and self-service platforms. Leveraging advanced financial technology, CICC empowers its clients with seamless access to vital information, efficient account management, and swift trade execution via its mobile applications and digital portals. This strategic digital investment complements traditional personal interactions, providing clients with unparalleled flexibility and operational efficiency.

The company's commitment to digital transformation is evident in its ongoing investments in fintech. For instance, in 2024, CICC announced a substantial increase in its technology budget, with a notable portion allocated to upgrading its digital infrastructure and developing new client-facing applications. This focus aims to broaden accessibility and deepen engagement across its diverse client base.

- Digital Accessibility: CICC's mobile app and online platforms offer 24/7 access to market data, research reports, and portfolio management tools.

- Self-Service Capabilities: Clients can independently perform a wide range of transactions, including account opening, fund transfers, and investment product subscriptions.

- Personalized Experience: Digital channels are being optimized to deliver tailored content and recommendations based on individual client preferences and investment profiles.

- Enhanced Efficiency: The integration of digital tools streamlines operational processes, reducing transaction times and improving overall client experience.

Investor Education and Research Dissemination

China International Capital Corporation (CICC) actively engages in investor education, offering comprehensive programs designed to equip clients with the knowledge needed for sound financial decision-making. This dedication to empowering investors fosters deeper trust and cultivates lasting client relationships.

CICC's commitment to transparency extends to the widespread dissemination of its in-depth research reports. By sharing valuable market insights and analysis, the firm helps clients navigate complex financial landscapes, reinforcing loyalty and strengthening partnerships.

- Investor Education Programs: CICC offers a suite of educational resources to enhance financial literacy among its diverse client base.

- Research Dissemination: The firm actively distributes its proprietary research, providing clients with actionable insights.

- Client Trust and Loyalty: This focus on knowledge sharing directly contributes to building robust and enduring client relationships.

- Recognition: CICC received an 'A' grade in the 2023-2024 investor education evaluation, underscoring its effectiveness in this area.

CICC cultivates strong customer relationships through a blend of personalized advisory services and robust digital engagement. This dual approach prioritizes understanding client needs and providing accessible, efficient financial solutions.

The firm's strategic focus on advisory services, evident in its growing fee-based income, highlights a commitment to long-term client partnerships. This is further supported by significant investments in technology to enhance client experience and operational efficiency.

By offering comprehensive investor education and transparent research, CICC empowers its clients, fostering trust and loyalty. These initiatives solidify CICC's role as a trusted financial partner.

| Customer Relationship Aspect | Description | Key Initiatives/Data |

|---|---|---|

| Personalized Advisory | Dedicated relationship managers for key clients | Profound understanding of evolving financial needs |

| Advisory-Centric Model | Shift from product sales to lifecycle solutions | Growing revenue from advisory and asset management fees |

| Digital Engagement | 24/7 access via mobile app and online platforms | Substantial increase in technology budget for digital infrastructure upgrades (2024) |

| Investor Education & Transparency | Comprehensive programs and research dissemination | 'A' grade in 2023-2024 investor education evaluation |

Channels

China International Capital Corporation (CICC) leverages a robust direct sales force and an extensive branch network to connect with clients. This physical infrastructure is crucial for building relationships and offering personalized financial services.

As of recent data, CICC maintains over 200 securities business offices strategically located throughout mainland China. This significant footprint ensures broad market coverage and accessibility for a diverse client base within the country.

Beyond its domestic reach, CICC also operates offices in key international financial centers. This global presence facilitates engagement with international investors and clients, supporting CICC's ambition as a comprehensive financial services provider.

CICC's digital presence, including its official website and mobile applications, acts as a primary gateway for clients. These platforms provide seamless access to trading functionalities, sophisticated wealth management tools, in-depth research reports, and efficient account management services, catering to a digitally adept clientele.

The company is committed to leveraging financial technology to broaden access to its premium financial products. By investing in digital infrastructure, CICC aims to reach a wider audience and offer greater convenience, reflecting the growing demand for online financial services in China.

CICC's institutional sales and trading desks are crucial for serving sophisticated clients such as corporations, banks, and significant asset managers. These specialized teams are designed to handle substantial transaction volumes, offering clients direct access to CICC's deep trading knowledge and robust market liquidity. This direct engagement ensures efficient execution and tailored solutions for complex financial needs.

A key differentiator for CICC in this segment is its established offshore capabilities. This allows the firm to effectively bridge international markets and provide its institutional clients with seamless access to global trading opportunities and capital. For instance, in 2024, CICC reported significant growth in its cross-border trading volumes, underscoring the strength of its international network and its ability to facilitate global capital flows for its institutional partners.

Partnership Networks

CICC's partnership networks are crucial for expanding its market presence and client base. By collaborating with other financial institutions, law firms, and consulting agencies, CICC gains access to a wider pool of potential clients through referrals and joint ventures.

These strategic alliances create significant synergistic opportunities, enabling CICC to enhance its service delivery and client acquisition capabilities. For instance, in 2024, CICC reported a substantial increase in cross-border deal advisory, partly attributed to its strengthened relationships with international financial partners.

- Extended Reach: Partnerships allow CICC to tap into new markets and client segments that might otherwise be inaccessible.

- Synergistic Opportunities: Joint ventures and referrals foster collaborative growth, benefiting all parties involved.

- Enhanced Service Delivery: Collaborations enable CICC to offer more comprehensive solutions by integrating specialized expertise from partners.

- Client Acquisition: Referrals from trusted partners serve as a powerful and cost-effective channel for acquiring new business.

Media and Public Relations

CICC strategically leverages financial media and industry publications to broadcast its comprehensive research and bolster its brand reputation. This proactive approach ensures CICC remains a prominent voice in market discussions, reaching a broad audience of investors and stakeholders.

Public relations activities are essential for reinforcing CICC's image as a leading financial institution. By actively engaging with the media, CICC disseminates key insights and analyses, solidifying its position as a trusted source of financial intelligence.

Participation in major financial forums and conferences serves as a vital channel for CICC's brand promotion and client engagement. These events provide platforms to showcase expertise, network with potential clients, and foster valuable business relationships, contributing to CICC's market presence and growth.

- Media Visibility: CICC's consistent presence in top-tier financial news outlets, such as Bloomberg and The Wall Street Journal, throughout 2024, highlights its commitment to transparency and information dissemination.

- Research Dissemination: The firm's research reports, frequently cited in industry publications, reached an estimated audience of over 5 million professionals in the first half of 2024.

- Brand Reinforcement: CICC's active participation in over 15 major international financial conferences in 2024, including the World Economic Forum, directly contributed to a 10% increase in brand recognition among target investor demographics.

- Client Outreach: These forums facilitated direct engagement with key clients, leading to a measurable uptick in new business inquiries and advisory mandates during the reporting period.

CICC's channels are a multi-faceted approach, blending physical presence with digital innovation and strategic partnerships. Its extensive network of securities business offices, exceeding 200 locations across mainland China as of recent data, ensures deep domestic market penetration. Complementing this is a global footprint in key financial hubs, facilitating international client engagement.

Digital platforms, including its website and mobile apps, serve as primary client gateways, offering seamless access to trading, wealth management, and research. CICC actively invests in fintech to broaden access to its premium offerings, reflecting the growing demand for online financial services.

Institutional clients are served through specialized sales and trading desks, adept at handling high volumes and complex transactions. CICC's offshore capabilities are a significant differentiator, enabling seamless cross-border trading and capital access. In 2024, the firm reported substantial growth in cross-border trading volumes, highlighting the strength of its international network.

Partnerships with other financial institutions, law firms, and consultants expand CICC's market reach and client base through referrals and joint ventures, fostering synergistic growth. In 2024, CICC noted a significant increase in cross-border deal advisory, partly due to these strengthened alliances.

Furthermore, CICC utilizes financial media and industry publications to disseminate research and enhance its brand. Public relations activities reinforce its image as a leading institution, while participation in major financial forums provides platforms for client engagement and business development. CICC's consistent presence in top-tier financial news outlets throughout 2024, and its active participation in over 15 major international financial conferences, underscore its commitment to visibility and client outreach.

Customer Segments

Large corporations, including significant state-owned enterprises (SOEs) in China, represent a crucial customer segment for CICC. These entities frequently require sophisticated investment banking services such as capital raising through equity and debt offerings, as well as mergers and acquisitions (M&A) advisory. CICC's deep understanding of the domestic market and its alignment with national development priorities, particularly in SOE reform, positions it as a key partner for these major players.

For instance, CICC played a vital role in advising on several high-profile SOE restructurings and privatizations throughout 2023 and early 2024, facilitating billions of dollars in transactions. The firm's ability to navigate complex regulatory environments and provide strategic guidance on market access makes it indispensable for corporations looking to expand their operations, optimize their capital structures, or engage in cross-border M&A activities.

Financial institutions, including banks, insurance companies, and various asset managers like mutual funds and hedge funds, represent a crucial customer segment for CICC. These entities leverage CICC's comprehensive suite of services, encompassing equities, fixed income, and asset management. They also engage with CICC for interbank trading and benefit from its in-depth research capabilities. In 2024, the global asset management industry continued its growth trajectory, with assets under management expected to reach $145 trillion by the end of the year, highlighting the significant market opportunity for CICC within this segment.

High-net-worth individuals and ultra-high-net-worth individuals represent a crucial customer segment for CICC. These affluent clients demand highly specialized wealth management, strategic asset allocation, and comprehensive private banking services. By the close of 2024, CICC Wealth Management successfully catered to a substantial base of 47,000 international clients within this demographic.

Sovereign Wealth Funds and Government Agencies

China International Capital Corporation (CICC) actively advises and manages investments for sovereign wealth funds and a range of government-affiliated entities. This engagement is bolstered by CICC's established relationships with state-backed institutions, facilitating access and trust. The DIFC branch, specifically, is strategically positioned to collaborate closely with these significant sovereign wealth funds and other financial institutions, aiming to foster mutually beneficial investment partnerships.

Sovereign wealth funds, such as the China Investment Corporation (CIC), are major global investors. For instance, as of the end of 2023, CIC reported assets under management exceeding $1.3 trillion, highlighting the scale of capital CICC aims to engage with. These entities often seek long-term, stable returns and diversification, areas where CICC's expertise in both domestic Chinese and international markets is valuable.

- Advisory Services: CICC provides tailored investment strategies and market insights to sovereign wealth funds and government agencies, aligning with their long-term objectives.

- Asset Management: The firm manages significant portfolios for these entities, focusing on capital preservation and growth across diverse asset classes.

- Strategic Partnerships: CICC's DIFC presence is designed to enhance its ability to partner with Middle Eastern sovereign wealth funds and financial institutions, leveraging geographical proximity and regulatory frameworks.

- Access to Chinese Markets: For international government entities, CICC offers unparalleled access and guidance for investing in China's rapidly evolving economy.

Emerging Companies and Growth Enterprises

Emerging companies and growth enterprises, especially those in dynamic sectors like technology, healthcare, and renewable energy, represent a key customer segment for CICC. These businesses are actively seeking CICC's specialized knowledge in securing early-stage funding, navigating the complexities of Initial Public Offerings (IPOs), and obtaining strategic guidance to fuel their expansion. CICC is strategically positioned to support these ventures as they mature and scale.

The demand from these burgeoning companies is projected to rise significantly. For instance, China's venture capital market saw substantial activity in 2023, with technology and healthcare consistently being top investment areas. CICC's ability to provide tailored financial solutions and market access is crucial for these enterprises aiming for substantial growth and public market listings.

- Focus on High-Growth Sectors: CICC targets emerging companies in technology, healthcare, and renewable energy, sectors experiencing rapid innovation and market expansion.

- Core Services Offered: Expertise in early-stage financing, IPO advisory, mergers and acquisitions, and strategic corporate finance consulting are provided to support growth.

- Anticipated Demand Growth: CICC foresees an increasing need for its services from these companies as they progress through their growth stages and seek capital for further development.

- Market Context: The Chinese IPO market, while subject to regulatory shifts, remains a vital avenue for growth enterprises, with CICC playing a significant role in facilitating these transitions.

CICC's customer base is diverse, encompassing large corporations, financial institutions, high-net-worth individuals, and emerging companies. This broad reach allows CICC to offer a comprehensive suite of financial services across various market segments. The firm's strategic focus on key economic drivers in China and globally ensures its relevance to a wide array of clients.

| Customer Segment | Key Needs | CICC's Role |

|---|---|---|

| Large Corporations (SOEs) | Capital raising, M&A, SOE reform advisory | Strategic guidance, market access, complex transaction execution |

| Financial Institutions | Equities, fixed income, asset management, trading, research | Comprehensive financial solutions, market insights, trading platform |

| High-Net-Worth Individuals | Wealth management, asset allocation, private banking | Specialized financial planning, personalized investment strategies |

| Emerging Companies | Early-stage funding, IPO advisory, growth capital | Tailored financing, IPO facilitation, strategic corporate finance |

| Sovereign Wealth Funds & Govt. Entities | Long-term investment, diversification, China market access | Advisory, asset management, strategic partnerships |

Cost Structure

Staff costs, encompassing salaries, bonuses, and comprehensive benefits for CICC's extensive team of investment bankers, traders, and analysts, form a substantial component of its operational expenditures. These highly skilled professionals are crucial for delivering CICC's diverse financial services.

For fiscal year 2024, CICC's total employee compensation and benefits expenses were reported at approximately RMB 15.5 billion. Projections for fiscal year 2025 anticipate an increase in these staff costs, reflecting continued investment in talent acquisition and retention within the competitive financial services sector.

China International Capital Corporation (CICC) recognizes that continuous investment in technology and infrastructure is fundamental to its business model. This includes ongoing upgrades to its IT systems, sophisticated trading platforms, robust data centers, and advanced cybersecurity measures. These investments are vital for ensuring operational efficiency and maintaining a competitive edge in the dynamic financial services landscape.

In 2024, CICC made a significant commitment, allocating approximately ¥500 million towards the development of artificial intelligence-driven analytics and trading platforms. This strategic investment underscores CICC's focus on leveraging cutting-edge technology to enhance its service offerings and drive innovation within its operations.

China International Capital Corporation (CICC) incurs significant costs from its extensive network of offices. This includes maintaining over 200 branches across Mainland China, as well as presence in key international financial hubs. These expenses cover essential operational needs like rent, utilities, and general administrative overhead, forming a substantial part of the company's overall cost structure.

Marketing and Business Development Costs

Marketing and business development are crucial for China International Capital Corporation (CICC) to maintain its market position and attract new clients. These expenses cover a range of activities designed to enhance brand visibility and foster client relationships.

In 2024, CICC's investment in marketing and business development would have been substantial, reflecting the competitive landscape of China's financial services sector. These costs are directly tied to client acquisition, brand building initiatives, and active participation in key industry events and forums to ensure a strong market presence and facilitate growth.

- Client Acquisition: Costs associated with sales teams, advertising campaigns, and direct outreach to potential clients.

- Brand Building: Expenses for public relations, corporate communications, and maintaining a strong corporate image.

- Event Sponsorship and Participation: Funds allocated to hosting seminars, conferences, and participating in industry-specific forums to network and showcase expertise.

- Digital Marketing: Investment in online advertising, social media engagement, and content creation to reach a wider audience.

Regulatory and Compliance Costs

China International Capital Corporation (CICC) faces substantial regulatory and compliance costs due to operating in China and internationally. Adhering to the China Securities Regulatory Commission (CSRC) and other global financial watchdogs necessitates significant investment in dedicated compliance personnel, legal counsel, and sophisticated risk management software. These expenditures are crucial for maintaining operational integrity and avoiding penalties.

In 2024, the global financial services industry continued to see increased regulatory scrutiny, impacting firms like CICC. These costs are not merely operational; they are strategic investments in maintaining market access and reputation. For instance, the implementation of new data privacy regulations or anti-money laundering (AML) frameworks requires ongoing updates to systems and training, directly adding to the cost structure.

- Compliance Teams: Hiring and retaining skilled compliance officers and legal experts to navigate complex regulatory landscapes.

- Risk Management Systems: Investing in technology and infrastructure for monitoring, reporting, and mitigating financial and operational risks.

- Legal Services: Engaging external legal counsel for advice on cross-border transactions, regulatory filings, and dispute resolution.

- Training and Audits: Continuous education for staff on evolving regulations and conducting regular internal and external audits to ensure adherence.

CICC's cost structure is heavily influenced by its human capital, with staff costs representing a significant outlay. The firm also invests heavily in technology to maintain its competitive edge and operational efficiency.

Physical infrastructure and extensive marketing efforts are also key cost drivers, essential for client acquisition and brand presence. Furthermore, navigating the complex regulatory environment incurs substantial compliance and risk management expenses.

| Cost Category | 2024 Estimate (RMB billions) | Key Drivers |

| Staff Costs | 15.5 | Salaries, bonuses, benefits for skilled professionals |

| Technology Investment | 0.5 (AI development) | IT systems, trading platforms, data centers, cybersecurity |

| Office Network | Significant | Rent, utilities, administrative overhead for 200+ branches |

| Marketing & Business Development | Substantial | Client acquisition, brand building, industry events |

| Regulatory & Compliance | Significant | Compliance personnel, legal counsel, risk management software |

Revenue Streams

Investment banking fees are a significant revenue driver for CICC, stemming from their expertise in advising and executing capital-raising activities like IPOs and bond issuances, as well as mergers and acquisitions. These fees encompass underwriting, advisory, and placement charges, reflecting the complexity and value CICC provides to its clients in navigating financial markets.

Demonstrating the strength of this segment, CICC's investment banking business experienced robust year-on-year growth in the first half of 2025, underscoring its continued success in facilitating major corporate transactions within China and internationally.

CICC generates substantial revenue from brokerage and trading commissions, earning fees for executing a wide range of securities transactions on behalf of its clients. This includes equity, fixed income, and derivatives trades, reflecting the diverse needs of its investor base.

The firm also benefits from proprietary trading activities, where it trades securities for its own account, aiming to profit from market movements. This dual approach to trading revenue is a key component of its financial model.

The dynamic Hong Kong stock market plays a significant role, with its active daily trading volume directly contributing to CICC's commission-based income. For instance, in 2023, Hong Kong's stock market saw significant activity, providing a robust environment for brokerage services.

CICC Wealth Management generates revenue through fees for managing high-net-worth individual portfolios and offering tailored investment advisory services. These fees are a crucial component of their income. In 2024, CICC Wealth Management saw continued growth in its revenue streams, indicating successful client acquisition and retention.

Asset Management Fees

CICC generates revenue through asset management fees, which are typically a percentage of the total assets they oversee. This applies to a variety of investment vehicles like mutual funds, private equity, and real estate investment trusts.

In 2024, CICC Fund Management saw a notable increase in its assets under management (AUM) for mutual funds. This growth directly translates to higher fee income for the company.

- Fee Structure: Percentage of Assets Under Management (AUM).

- Fund Types: Mutual Funds, Private Equity, REITs.

- 2024 Performance: Significant increase in AUM for CICC Fund Management's mutual funds.

Interest Income

Interest income is a significant revenue driver for CICC, stemming from various financial activities. This includes earnings generated from the company's loan portfolio, margin financing extended to clients, and any other assets that accrue interest.

For the first half of 2024, interest income played a crucial role in CICC's financial performance, representing 31.3% of its total revenue. This highlights the importance of its lending and financing operations.

- Interest on Loans: Revenue earned from extending credit to corporations and individuals.

- Margin Financing: Income generated from clients borrowing funds to trade securities.

- Other Interest-Bearing Assets: Earnings from investments in bonds, deposits, and other financial instruments that yield interest.

CICC's diversified revenue streams are anchored by robust investment banking fees from IPOs, M&A, and debt issuance, alongside significant income from brokerage and trading commissions. The firm also leverages proprietary trading for market gains.

Wealth management fees, derived from managing high-net-worth portfolios, and asset management fees, calculated as a percentage of AUM for various funds, are key contributors. Interest income from loans and margin financing also forms a substantial part of their earnings.

| Revenue Stream | Primary Activities | 2024 Data/Significance |

|---|---|---|

| Investment Banking | IPOs, M&A, Debt Issuance | Robust growth in H1 2025; significant fee generation. |

| Brokerage & Trading | Securities execution, Proprietary Trading | Commissions from active markets like Hong Kong; profitable trading. |

| Wealth Management | Portfolio management, Advisory services | Continued growth in client acquisition and retention. |

| Asset Management | Fund management (Mutual Funds, PE, REITs) | Notable increase in AUM for mutual funds in 2024. |

| Interest Income | Loans, Margin Financing | 31.3% of total revenue in H1 2024; crucial for financial performance. |

Business Model Canvas Data Sources

The China International Capital Corporation Business Model Canvas is informed by comprehensive financial reports, extensive market research, and internal strategic planning documents. These diverse data sources ensure a robust and accurate representation of the company's operations and market position.