Canadian Imperial Bank PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Canadian Imperial Bank Bundle

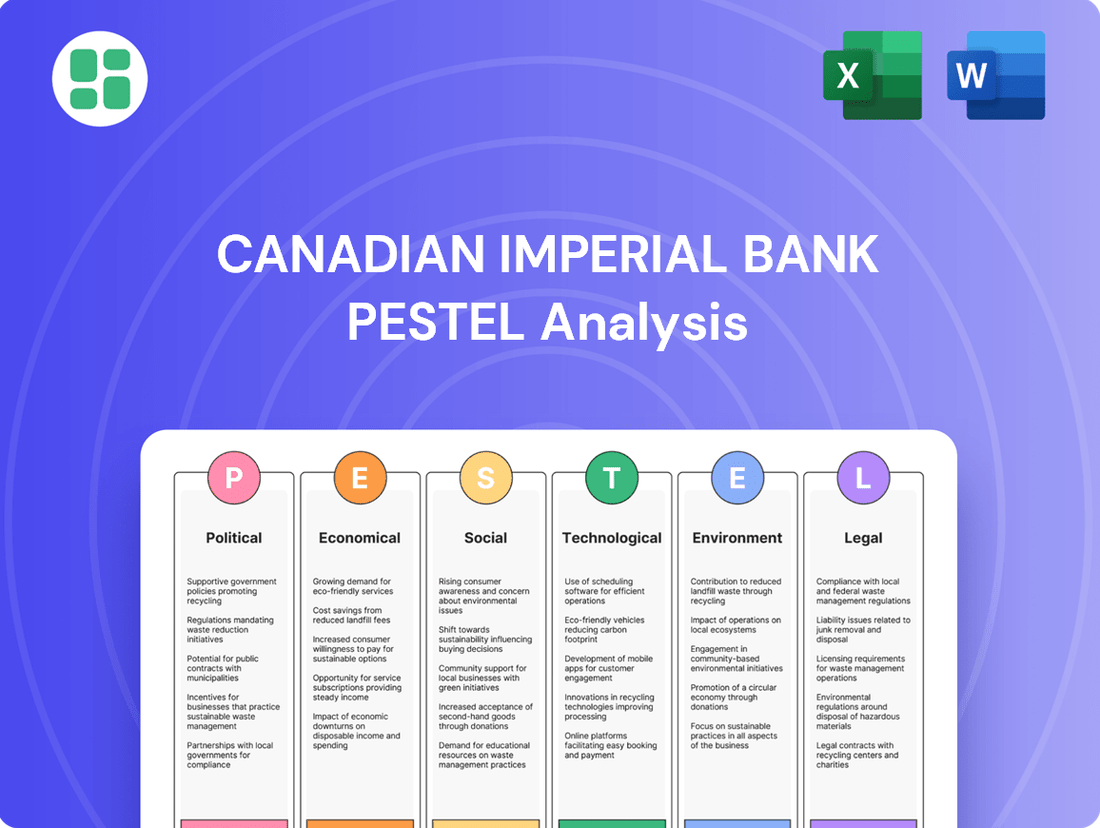

Navigate the complex external forces shaping Canadian Imperial Bank's future with our comprehensive PESTLE analysis. Understand how political stability, economic fluctuations, evolving social trends, technological advancements, environmental regulations, and legal frameworks are impacting the bank's operations and strategic direction. Gain a critical competitive advantage by leveraging these expert-level insights. Download the full PESTLE analysis now for actionable intelligence to inform your investment decisions and market strategies.

Political factors

CIBC navigates a stringent regulatory landscape in both Canada and the U.S., with key oversight from OSFI and various U.S. federal agencies. These regulations, particularly concerning capital and liquidity, significantly shape the bank's operational capacity and risk management approaches.

Recent updates to OSFI's Supervisory Framework and mortgage lending guidelines, implemented in 2024 and continuing into 2025, necessitate ongoing adjustments to CIBC's business practices. For instance, the ongoing implementation of Basel III endgame reforms, impacting capital requirements, directly influences lending strategies and profitability.

Political stability in Canada and the United States significantly shapes economic confidence and the policy direction for financial institutions like CIBC. Changes in government, especially across the border, can trigger shifts in regulatory frameworks, potentially leading to deregulation or a heightened focus on areas such as climate-related financial risks or bank mergers. For instance, a new U.S. administration in 2025 might alter the pace of financial regulatory reform that impacts cross-border banking operations.

Monetary policy decisions by central banks, like the Bank of Canada and the U.S. Federal Reserve, directly impact CIBC's financial health. For instance, the Bank of Canada's decision to maintain its overnight rate at 5.00% as of early 2024 influences borrowing costs for CIBC's clients and the returns on its investments.

These policy rate adjustments are critical for CIBC's net interest margin, which is the difference between the interest income generated and the interest paid out to its lenders. Higher rates generally boost this margin, but also increase the risk of loan defaults, a key consideration for the bank's lending activities.

CIBC's profitability is therefore highly sensitive to these policy shifts. For example, a 0.25% change in the policy rate can have a material impact on the bank's earnings, underscoring the importance of accurately forecasting and adapting to evolving monetary policy landscapes.

Trade Policies and International Relations

Canadian Imperial Bank of Commerce (CIBC) is significantly exposed to the evolving trade policies and international relations between Canada and the United States. For instance, the United States' imposition of tariffs on Canadian steel and aluminum in 2018, though later rescinded, created uncertainty and impacted cross-border investment flows, directly affecting CIBC's capital markets and commercial banking operations. The renegotiation of the North American Free Trade Agreement into the United States-Mexico-Canada Agreement (USMCA) in 2020 also brought about adjustments in trade frameworks that the bank had to navigate.

The bank actively monitors these geopolitical shifts to manage its exposure. For example, in 2024, ongoing discussions around supply chain resilience and potential new trade barriers could influence CIBC's lending and advisory services for businesses heavily reliant on cross-border trade. The stability of the Canada-U.S. economic relationship remains a critical factor for CIBC's performance.

- USMCA Implementation: The USMCA, effective July 1, 2020, continues to shape trade dynamics, with ongoing interpretations and potential disputes impacting sectors where CIBC has significant exposure.

- Cross-Border Investment: Fluctuations in foreign direct investment between Canada and the U.S. directly affect CIBC's investment banking and wealth management divisions.

- Tariff Impact: While major tariffs have been removed, the threat of future trade disputes remains a constant consideration for businesses and, by extension, CIBC's risk assessment.

Government Support and Sector-Specific Initiatives

Government initiatives designed to bolster specific industries, like housing or sustainable finance, can create both avenues for growth and potential hurdles for CIBC. For instance, government-backed mortgage programs for first-time buyers or incentives encouraging environmentally conscious investments can significantly influence lending and capital allocation. CIBC's strategic focus on sustainable finance aligns well with these governmental priorities, potentially allowing the bank to capitalize on favorable policy trends.

Canada's federal government has been actively promoting sustainable finance. In 2023, the government launched the Sustainable Finance Roadmap, aiming to position Canada as a leader in green finance. This roadmap includes initiatives like the development of green bond standards and disclosure requirements, which could create new product opportunities for CIBC in areas like green mortgages and corporate lending for sustainability projects.

- Government Housing Support: Programs like the First-Time Home Buyer Incentive, while subject to review and potential modification, aim to increase homeownership, potentially driving mortgage demand for CIBC.

- Sustainable Finance Initiatives: The Canadian government's commitment to net-zero emissions by 2050 fuels demand for green financing solutions, creating opportunities for CIBC's expanding ESG-focused product offerings.

- Regulatory Environment: CIBC's adaptation to evolving regulatory frameworks, such as those concerning climate-related financial disclosures, is crucial for maintaining stakeholder confidence and accessing government-supported initiatives.

Political stability and government policies significantly influence CIBC's operating environment. Changes in leadership, particularly in Canada and the U.S., can lead to shifts in regulatory focus, impacting areas from capital requirements to climate-related financial risks.

The ongoing implementation of financial regulations, such as the Basel III endgame reforms, directly affects CIBC's capital adequacy and lending strategies. For instance, OSFI's 2024 updates to supervisory frameworks require continuous adaptation of the bank's risk management practices.

Trade policies and international relations, especially between Canada and the U.S., create both opportunities and risks for CIBC. The continued integration under the USMCA, for example, shapes cross-border investment flows, a key area for the bank's capital markets division.

Government initiatives promoting sustainable finance and housing affordability present strategic avenues for CIBC. The bank's alignment with Canada's 2023 Sustainable Finance Roadmap, for instance, positions it to capitalize on growing demand for green financial products.

What is included in the product

This PESTLE analysis delves into the external macro-environmental forces impacting the Canadian Imperial Bank, examining Political, Economic, Social, Technological, Environmental, and Legal factors.

It provides actionable insights for strategic decision-making by highlighting key trends and potential challenges and opportunities within the bank's operating landscape.

A concise PESTLE analysis for CIBC offers a clear overview of external factors, simplifying complex market dynamics for strategic decision-making and reducing the pain of information overload.

Economic factors

Fluctuations in interest rates directly affect Canadian Imperial Bank of Commerce's (CIBC) net interest margin (NIM), a crucial measure of its profitability. When interest rates rise, CIBC can potentially earn more on its loans, expanding its NIM. Conversely, falling rates can put pressure on this margin.

For instance, in the first quarter of fiscal 2024, CIBC reported a net interest margin of 1.72%, a slight decrease from 1.76% in the prior year's quarter, underscoring the sensitivity of this metric to the prevailing interest rate environment.

The bank's performance is heavily reliant on both the net interest margin and the volume of its lending activities to drive overall revenue growth.

Canada's economic growth is a key driver for CIBC's performance. In the first quarter of 2024, Canada's GDP expanded by 1.7% at an annualized rate, indicating a positive economic environment that supports increased lending and transaction volumes for the bank.

Consumer spending closely tracks economic health. As of early 2024, Canadian retail sales showed resilience, contributing to higher demand for credit products and services offered by CIBC. This trend directly boosts the bank's revenue streams in its retail banking operations.

The economic outlook for the United States also significantly impacts CIBC, particularly its cross-border business. The US economy, projected to grow around 2.5% in 2024, provides opportunities for CIBC's business banking segment through increased trade and investment activities.

Rising inflation in Canada presents a significant challenge for CIBC, directly impacting its operating costs. For instance, in the first quarter of 2024, CIBC reported a 3% increase in non-interest expenses year-over-year, partly driven by inflationary pressures on salaries, technology investments, and other operational inputs.

While CIBC has seen revenue growth, notably a 6% increase in total revenue in Q1 2024, effectively offsetting some of these rising expenses, proactive cost management remains a critical strategic imperative. The bank's focus is on achieving operational efficiencies to counter the impact of inflation on its bottom line.

CIBC is actively pursuing initiatives to enhance operational efficiency, aiming to maintain positive operating leverage. This strategy is crucial for ensuring that revenue growth outpaces cost increases, thereby protecting profitability amidst an inflationary environment.

Credit Quality and Loan Loss Provisions

The health of CIBC's loan portfolios and the level of provisions for credit losses are critical economic indicators for the bank. These provisions directly reflect the bank's assessment of potential losses from loans that may not be repaid.

For instance, in CIBC's fiscal second quarter of 2024, reported in May 2024, the bank's provision for credit losses increased to $547 million, up from $479 million in the prior quarter. This rise, driven by a more challenging economic environment and increased provisions in the personal and small business banking segments, significantly impacted net income.

- Provision for Credit Losses (Q2 2024): $547 million.

- Impact on Net Income: Higher provisions directly reduce profitability.

- Monitoring and Stress Testing: CIBC actively manages credit risk across all lending segments through continuous portfolio monitoring and stress testing.

Capital Market Performance and Asset Growth

Capital market performance is a direct driver for CIBC’s wealth management and capital markets divisions. When markets rally, as seen with the S&P/TSX Composite Index reaching new highs in early 2024, it boosts the value of assets held by clients. This appreciation directly translates into higher assets under administration (AUA) and assets under management (AUM), which are crucial for generating fee-based revenue for the bank.

CIBC's strategic imperative to expand its mass affluent and private wealth segments is intrinsically linked to market conditions. For instance, in Q1 2024, CIBC reported a notable increase in its wealth management segment's revenue, partly due to stronger market performance and client acquisition. This growth in AUA/AUM is essential for the bank’s profitability, as it increases the recurring income derived from managing client assets.

- Market Appreciation Impact: Strong capital market performance in 2024 has led to increased asset values, directly benefiting CIBC's AUA/AUM.

- Fee-Based Revenue Growth: Higher AUA/AUM, driven by market appreciation, enhances fee-based income streams for CIBC's wealth management operations.

- Strategic Focus Alignment: CIBC's efforts to grow its mass affluent and private wealth franchises are supported by positive market trends, fostering asset growth.

- Q1 2024 Performance: CIBC's wealth management segment saw revenue growth in early 2024, partly attributed to favorable market conditions and client base expansion.

Economic factors significantly shape CIBC's operational landscape and profitability. Interest rate movements directly influence the bank's net interest margin, a key profit indicator. For example, CIBC's Q1 2024 net interest margin was 1.72%, down slightly from the previous year, highlighting this sensitivity.

Canada's economic growth, with GDP expanding by 1.7% annually in Q1 2024, fuels lending and transaction volumes for CIBC. Consumer spending resilience also boosts demand for credit products. Furthermore, the US economy's projected 2.5% growth in 2024 offers cross-border opportunities for CIBC.

Inflationary pressures, however, increase operating costs, as seen in CIBC's 3% rise in non-interest expenses in Q1 2024. The bank is actively managing costs to maintain profitability amidst these challenges.

Credit risk management is paramount, with provisions for credit losses rising to $547 million in Q2 2024, impacting net income. This increase reflects a more challenging economic environment, particularly in personal and small business banking segments.

| Economic Factor | CIBC Impact | Data Point (Q1/Q2 2024) |

|---|---|---|

| Interest Rates | Net Interest Margin (NIM) | NIM: 1.72% (Q1 2024) |

| Canadian GDP Growth | Lending & Transaction Volumes | GDP: 1.7% annualized (Q1 2024) |

| Inflation | Operating Costs | Non-interest expenses up 3% YoY (Q1 2024) |

| Credit Risk | Provisions for Credit Losses | Provisions: $547 million (Q2 2024) |

| US Economic Growth | Cross-border Business | US GDP projected 2.5% growth (2024) |

Preview Before You Purchase

Canadian Imperial Bank PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis for the Canadian Imperial Bank details the Political, Economic, Social, Technological, Legal, and Environmental factors impacting its operations. You'll gain valuable insights into the strategic landscape of one of Canada's largest financial institutions.

Sociological factors

Customers now expect banking to be as easy and personalized as their favorite apps. This means instant access, tailored advice, and straightforward digital tools. For CIBC, this translates into a significant push towards digital-first solutions.

CIBC is actively investing in technologies like artificial intelligence and machine learning to understand client needs better and offer more personalized services. This is evident in their ongoing enhancements to mobile banking features and online platforms, aiming to boost client satisfaction and engagement.

In 2024, CIBC reported a 10% increase in digital transaction volumes, underscoring the shift in customer behavior. The bank's strategy to prioritize digital capabilities is a direct acknowledgment of these evolving expectations for convenience and tailored experiences.

Canada's demographic landscape is evolving, with an aging population and increasing ethnic diversity shaping consumer needs. By 2024, seniors are projected to represent a significant portion of the population, driving demand for retirement planning and wealth management services. Simultaneously, the growing influx of newcomers presents a key opportunity for banks like CIBC to offer tailored financial solutions.

CIBC is actively responding to these demographic shifts by focusing on the mass affluent and high-net-worth segments, recognizing their growing financial influence. The bank is also developing specialized programs for groups such as recent immigrants, aiming to capture a larger market share by meeting their unique banking requirements. This strategic segmentation allows for more effective product development and targeted marketing campaigns.

Attracting, retaining, and developing talent remains a cornerstone for CIBC's continued success. The bank actively cultivates employee engagement and a connected culture, recognizing these as vital for operational excellence and innovation. This focus is supported by ongoing investments in learning and development programs, aiming to equip employees with the skills needed for evolving market demands.

CIBC places a significant emphasis on diversity, equity, and inclusion (DEI) initiatives, understanding that a diverse workforce drives better decision-making and fosters a more inclusive environment. This commitment is not just aspirational; it's reflected in tangible programs and policies designed to create equitable opportunities for all employees.

The bank's dedication to advancing gender equity and inclusion has been recognized through external accolades, underscoring its efforts to build a workforce where all individuals can thrive and contribute their best. For instance, in 2023, CIBC was named one of Canada's Best Diversity Employers, highlighting its progress in this area.

Community Investment and Social Responsibility

CIBC's dedication to community investment, particularly supporting individuals with disabilities, Indigenous peoples, and the Black community, significantly bolsters its public image and stakeholder trust. This focus on social responsibility is deeply ingrained in the bank's operational ethos, reinforcing its purpose-driven culture.

In 2023, CIBC's community investment efforts included a significant commitment to various social programs. For instance, their partnerships with organizations supporting Indigenous economic development saw tangible growth, with a reported CAD 10 million invested in initiatives aimed at fostering entrepreneurship and skill development within these communities. This aligns with their broader strategy to contribute meaningfully to societal well-being.

- Community Focus: CIBC prioritizes support for persons with disabilities, Indigenous peoples, and the Black community through targeted investment initiatives.

- Reputation Enhancement: This commitment to social responsibility directly improves the bank's reputation and fosters stronger stakeholder relationships.

- Global Contributions: CIBC makes substantial global contributions, underscoring its purpose-driven culture and commitment to broader societal impact.

- 2023 Investment Example: A CAD 10 million investment in 2023 specifically targeted Indigenous economic development programs, showcasing concrete action.

Trust and Ethical Conduct

Maintaining integrity and transparency is crucial for CIBC to safeguard client trust and its brand image. This extends to ethical data handling and strong oversight of emerging technologies such as Artificial Intelligence. For instance, CIBC's 2024 focus on enhancing AI governance and risk management frameworks demonstrates a commitment to responsible technological adoption.

Upholding ethical conduct is fundamental to CIBC's operations, influencing customer loyalty and investor confidence. In 2024, the bank continued to emphasize its commitment to fair practices, particularly in how customer data is managed and utilized. This focus aims to build and maintain a reputation for trustworthiness in an increasingly data-driven financial landscape.

- Ethical Data Practices: CIBC's adherence to stringent data privacy regulations, such as those updated in 2024, is key to maintaining client trust.

- AI Governance: The bank's proactive development of AI governance policies in 2024 reflects a commitment to responsible innovation and mitigating ethical risks.

- Brand Reputation: Trust and ethical conduct directly impact CIBC's brand perception, influencing customer acquisition and retention rates throughout 2024.

- Stakeholder Confidence: Demonstrating robust ethical frameworks and transparency reassures investors and regulators, bolstering overall stakeholder confidence in the bank's long-term viability.

Canada's evolving demographics, marked by an aging population and increasing ethnic diversity, present both challenges and opportunities for CIBC. By 2024, seniors are a growing segment, increasing demand for retirement and wealth management services. Simultaneously, the rise of newcomers offers a significant avenue for CIBC to provide tailored financial solutions, aiming to capture market share by meeting unique banking needs.

Technological factors

CIBC is heavily invested in digital transformation, aiming to enhance its personal banking offerings with a digital-first approach. This strategy directly addresses changing customer expectations for seamless online and mobile interactions.

The bank's mobile banking platform is a cornerstone of this transformation, recognized for its user-friendly design and innovative features. In 2023, CIBC reported that over 70% of its customer interactions occurred through digital channels, highlighting the critical role of mobile in their strategy.

Continued investment in digital channels is crucial for CIBC's competitive edge and customer loyalty. By prioritizing digital innovation, the bank aims to improve client experience and drive engagement in an increasingly digital financial landscape.

CIBC is significantly integrating AI and GenAI across its operations to boost client satisfaction and streamline processes. This strategic move includes establishing an Enterprise AI Governance Office and launching pilot initiatives, such as the CIBC AI platform, to manage and scale these advanced technologies.

AI applications at CIBC are diverse, spanning enhanced fraud detection, improved customer service interactions, and strengthened cybersecurity measures. Furthermore, AI is being leveraged to automate sophisticated tasks, including the intricate process of credit analysis, thereby increasing efficiency and accuracy.

By embracing AI, CIBC aims to unlock new levels of operational efficiency and deliver more personalized client experiences. The bank's commitment to this technological advancement is underscored by its ongoing investment in AI governance and pilot programs, positioning it for future growth and competitive advantage in the financial sector.

Cybersecurity is paramount for CIBC, especially with the escalating digital transactions in Canada. In 2023, Canadian financial institutions reported a significant increase in cyber incidents, underscoring the need for advanced protection. CIBC’s ongoing investments in sophisticated security protocols are designed to shield sensitive client information and maintain operational integrity.

The bank’s commitment to data protection directly impacts its reputation and regulatory standing. For instance, Canada's Digital Charter emphasizes stringent data privacy rules, making robust cybersecurity crucial for compliance. CIBC’s proactive approach ensures the confidentiality and security of financial data, vital for customer trust and business continuity.

Fintech Partnerships and Open Banking

CIBC is actively forging partnerships with fintech firms to accelerate innovation and deliver more tailored financial experiences to its customers. This strategic approach allows the bank to integrate cutting-edge technologies and specialized services more rapidly than developing them in-house. For instance, CIBC's collaboration with Wealthsimple, a leading Canadian robo-advisor, provides clients with accessible and automated investment management solutions.

The evolving landscape of open banking in Canada is a significant technological factor, facilitating secure data exchange between financial institutions and authorized third-party providers. This framework, expected to see further implementation and regulatory clarity throughout 2024 and 2025, empowers consumers to share their financial data, fostering a more competitive and customer-centric banking ecosystem. Such developments are crucial for CIBC to offer integrated financial management tools and personalized insights.

These fintech collaborations are instrumental in the creation of novel products and services. Examples include the development of advanced analytics for personalized financial advice, streamlined payment solutions, and potentially exploring blockchain applications for enhanced security and efficiency in transactions. The bank's investment in these areas reflects a commitment to staying at the forefront of digital financial services.

Key areas of fintech integration and their impact:

- Robo-Advisory Services: Partnerships enhance digital wealth management offerings, making investment advice more accessible.

- Open Banking Integration: Facilitates secure data sharing, enabling personalized financial dashboards and third-party service integration.

- Digital Payments: Collaborations aim to improve the speed, security, and convenience of payment processing.

- Data Analytics: Leveraging fintech expertise to provide deeper customer insights and more personalized product recommendations.

Automation and Operational Efficiency

CIBC is heavily investing in automation to boost operational efficiency and cut costs. For instance, in 2023, CIBC reported a 5% reduction in operating expenses, partly attributed to ongoing automation initiatives. This strategic push allows the bank to streamline processes and reallocate resources effectively.

The bank is leveraging advanced technologies like machine learning and generative AI. These tools are increasingly automating intricate tasks, including software testing and aspects of IT operations. This technological adoption is crucial for maintaining a competitive edge in a rapidly evolving financial landscape.

- Increased Productivity: Automation allows CIBC to handle a larger volume of work with existing resources.

- Cost Reduction: Streamlining operations through technology directly contributes to lower overheads.

- Enhanced Accuracy: Automated systems can reduce human error in complex processes like compliance checks.

- Faster Service Delivery: Efficiency gains translate to quicker turnaround times for both internal operations and client services.

CIBC's technological strategy centers on a robust digital transformation, emphasizing mobile-first banking and AI integration. By 2023, over 70% of customer interactions occurred digitally, showcasing the success of this shift. The bank is actively deploying AI and GenAI for enhanced fraud detection, customer service, and credit analysis, aiming for greater efficiency and personalized client experiences.

Cybersecurity remains a critical focus, with CIBC investing in advanced protocols to protect sensitive data amidst rising cyber threats. Canada's Digital Charter reinforces the need for stringent data privacy, making CIBC's proactive security measures essential for trust and compliance. Furthermore, partnerships with fintech firms, like Wealthsimple for robo-advisory services, are key to delivering innovative solutions and leveraging open banking frameworks to enhance customer-centric offerings.

Automation is a significant driver of operational efficiency, with CIBC reporting a 5% reduction in operating expenses in 2023, partly due to these initiatives. Technologies like machine learning are automating complex tasks, from software testing to IT operations, ensuring CIBC maintains a competitive edge.

| Technology Area | CIBC's Focus | Impact/Benefit | Key Data Point (2023/2024) |

|---|---|---|---|

| Digital Channels | Mobile Banking, Online Platforms | Enhanced customer experience, increased engagement | Over 70% of customer interactions via digital channels |

| Artificial Intelligence (AI/GenAI) | Fraud detection, customer service, credit analysis, automation | Improved efficiency, accuracy, personalized services | Launch of CIBC AI platform, Enterprise AI Governance Office |

| Cybersecurity | Advanced security protocols, data protection | Maintaining trust, regulatory compliance, operational integrity | Increased investment in sophisticated security measures |

| Fintech Partnerships | Robo-advisory, open banking, digital payments | Accelerated innovation, tailored financial experiences | Collaboration with Wealthsimple for robo-advisory |

| Automation | Process streamlining, task automation | Cost reduction, increased productivity, faster service delivery | 5% reduction in operating expenses attributed to automation |

Legal factors

CIBC navigates a complex legal landscape, primarily overseen by Canada's Office of the Superintendent of Financial Institutions (OSFI) and multiple U.S. federal banking regulators. OSFI's 2024 Supervisory Framework, for instance, emphasizes enhanced risk management and governance, directly impacting CIBC's operational strategies.

Further regulatory shifts are evident with OSFI's 2025 updates to capital adequacy requirements, aligning with evolving Basel III standards. These changes necessitate robust capital planning and risk-weighted asset management to ensure CIBC maintains its financial resilience and license to operate.

CIBC faces significant legal obligations regarding data privacy and consumer protection, especially as digital transactions increase. The bank must adhere to strict regulations governing the secure storage and use of customer information, ensuring transparency in all dealings. For instance, in 2023, Canada saw ongoing discussions and potential legislative changes concerning digital privacy, impacting how financial institutions manage customer data.

Evolving consumer protection measures are a key legal consideration for CIBC. This includes compliance with new rules around digital signage on their platforms and potential future regulations that might address the reporting of medical debt on credit reports, a topic gaining traction in consumer advocacy circles in 2024.

Canadian Imperial Bank of Commerce (CIBC) operates under stringent Anti-Money Laundering (AML) and Anti-Terrorist Financing (ATF) regulations, notably the Proceeds of Crime (Money Laundering) and Terrorist Financing Act. These laws are critical for maintaining the integrity of the financial system.

Looking ahead to 2025, regulatory bodies are proposing enhancements to AML/CFT programs for financial institutions. These updates will likely mandate that banks adapt their strategies to new priorities, ensuring robust defenses against financial crime.

Adherence to these evolving compliance standards is paramount for CIBC to mitigate risks, prevent illicit financial activities, and avoid significant penalties. For instance, in 2023, Canadian financial institutions collectively reported thousands of suspicious transactions, highlighting the ongoing challenge and the importance of vigilant compliance.

Mortgage Lending Regulations

Canadian mortgage lending operates under strict regulatory oversight, with the Office of the Superintendent of Financial Institutions (OSFI) continuously updating guidelines. For instance, OSFI's introduction of a loan-to-income (LTI) approach for uninsured mortgages and adjustments to the Minimum Qualifying Rate (MQR) in 2024 are designed to bolster the stability of the real estate secured lending market. These measures directly impact how institutions like CIBC assess and manage credit risk associated with their mortgage portfolios.

CIBC must therefore proactively adjust its mortgage origination and underwriting processes to ensure full compliance with these evolving prudential standards. Failure to adapt could lead to increased capital requirements or penalties. The bank’s ability to navigate these regulatory shifts will be crucial for maintaining its competitive position and financial health in the Canadian mortgage sector.

Key regulatory developments impacting CIBC's mortgage lending include:

- Loan-to-Income (LTI) Ratio Implementation: OSFI's focus on LTI ratios for uninsured mortgages aims to prevent over-leveraging by borrowers.

- Minimum Qualifying Rate (MQR) Adjustments: Changes to the MQR, effective from early 2024, affect the stress test calculations for mortgage affordability.

- Capital Adequacy Requirements: Banks must hold sufficient capital against their mortgage assets, with regulations influencing these calculations.

Corporate Governance and Reporting Standards

CIBC is dedicated to strong corporate governance and meets numerous reporting requirements, including those for environmental, social, and governance (ESG) information. This commitment is crucial for maintaining trust with investors and the public.

The Office of the Superintendent of Financial Institutions (OSFI) Guideline B-15, focusing on Climate Risk Management, sets expectations for disclosures that are in sync with global benchmarks like the ISSB IFRS S2. This means CIBC must provide detailed financial information related to climate change impacts.

- ESG Reporting: CIBC actively reports on its ESG performance, aligning with evolving stakeholder expectations for transparency.

- Climate Risk Disclosure: Compliance with OSFI Guideline B-15 mandates comprehensive reporting on climate-related financial risks, reflecting a growing focus on sustainability.

- International Alignment: Adherence to standards like ISSB IFRS S2 ensures CIBC's disclosures are comparable on a global scale, enhancing investor confidence.

CIBC's legal framework is heavily influenced by OSFI's 2024 Supervisory Framework, demanding enhanced risk management and governance. Furthermore, 2025 updates to capital adequacy, aligning with Basel III, require meticulous capital planning and risk-weighted asset management.

The bank must also navigate evolving consumer protection laws, including those concerning digital privacy and potential changes to medical debt reporting on credit reports, a topic under scrutiny in 2024.

CIBC's adherence to Anti-Money Laundering (AML) and Anti-Terrorist Financing (ATF) regulations, such as the Proceeds of Crime (Money Laundering) and Terrorist Financing Act, is critical, with proposed 2025 enhancements to AML/CFT programs necessitating strategic adaptation.

Mortgage lending is particularly impacted by OSFI's 2024 measures, including the loan-to-income (LTI) approach for uninsured mortgages and Minimum Qualifying Rate (MQR) adjustments, which directly affect credit risk assessment and capital requirements.

Environmental factors

CIBC is stepping up its game in managing and reporting climate-related risks, following guidelines from the Task Force on Climate-related Financial Disclosures (TCFD) and the new International Sustainability Standards Board (ISSB) IFRS S2. This proactive stance is crucial as climate risks are increasingly seen as major emerging threats to financial institutions.

The bank's 2024 Climate Report highlights its commitment to evaluating and handling these risks, even developing a specific framework for Transition Planning Assessment and Engagement. This shows a clear focus on understanding and mitigating the financial impacts of climate change, a trend expected to continue shaping the banking sector.

CIBC is actively pursuing ambitious sustainable finance goals, aiming to mobilize $300 billion by 2030. This initiative is designed to assist clients in meeting their environmental, social, and decarbonization targets.

By the end of 2024, CIBC had already mobilized $42.5 billion, demonstrating significant headway towards its 2030 objective. This progress underscores the bank's dedication to integrating sustainability into its core operations and client services.

The bank's commitment extends to providing financing for crucial areas like emissions-free energy generation and the development of innovative sustainable finance solutions, reflecting a strategic focus on supporting the transition to a greener economy.

CIBC is actively pursuing a 2050 net-zero ambition, a significant undertaking in the financial sector. This commitment is underscored by concrete interim targets, including a 2030 financed emissions reduction goal for critical sectors like oil and gas and automotive manufacturing. These strategic objectives signal a proactive approach to climate change within the bank's operations and lending portfolios.

The bank has already made notable progress in reducing its own environmental footprint, having achieved substantial cumulative reductions in its operational Scope 1 and 2 greenhouse gas emissions. This internal progress, coupled with external portfolio targets, demonstrates a holistic strategy to accelerate climate action and align its business practices with global sustainability goals.

ESG Integration in Investment Processes

CIBC Asset Management is actively integrating environmental, social, and governance (ESG) factors into its investment decisions. This strategic move acknowledges the growing importance of sustainability-related risks and opportunities for long-term financial performance. By equipping investment teams with robust data and analytical tools, CIBC aims to foster more informed decision-making, including a formal framework for assessing macro-level ESG risks across portfolios.

The bank's commitment extends to actively seeking positive change and contributing to a more sustainable future through its investment strategies. This proactive approach reflects a broader industry trend where financial institutions are increasingly recognizing the link between ESG performance and value creation. For instance, CIBC's 2024 ESG report highlights a growing allocation to sustainable investments, demonstrating a tangible commitment to these principles.

- Data-Driven ESG Integration: CIBC Asset Management provides investment teams with specialized data and tools to incorporate ESG considerations.

- Macro ESG Risk Assessment: A formal framework is in place to evaluate top-down, macro-related ESG risks impacting investment portfolios.

- Commitment to Sustainability: The bank's ESG strategy is designed to drive positive societal and environmental change.

- Growing Sustainable Allocations: CIBC's 2024 disclosures indicate an increasing proportion of assets managed with a focus on sustainability.

Physical Climate Risks and Resilience

CIBC acknowledges that physical climate risks, such as severe weather events, pose significant financial risks with the potential for substantial economic disruption. The bank is actively working to build resilience and assist clients in their shift towards a low-carbon economy. This involves comprehending the ways climate risks can affect economies and overall financial stability.

For instance, in 2024, Canada experienced a range of extreme weather events, including widespread flooding in the spring and persistent drought conditions in Western Canada, impacting agricultural output and potentially leading to increased insurance claims and loan defaults for businesses in affected sectors. CIBC's focus on resilience means evaluating the potential impact of such events on its loan portfolio and operational continuity.

- Climate Risk Assessment: CIBC is enhancing its capabilities to identify and quantify the financial impact of physical climate risks on its operations and client base.

- Client Support: The bank is developing strategies to support clients in adapting to climate change and transitioning to more sustainable business models.

- Economic Impact Analysis: CIBC is investing in research to understand how climate change could affect Canadian economic sectors and the broader financial system.

CIBC is actively integrating environmental factors into its strategy, aiming to mobilize $300 billion in sustainable finance by 2030, with $42.5 billion already achieved by the end of 2024.

The bank is committed to net-zero emissions by 2050, setting interim targets for financed emissions reductions in key sectors like oil and gas by 2030.

CIBC Asset Management is incorporating ESG factors into investment decisions, utilizing specialized data and a framework for macro ESG risk assessment, with growing allocations to sustainable investments noted in their 2024 reports.

Recognizing physical climate risks, CIBC is building resilience and supporting clients in their low-carbon transition, assessing the impact of events like the 2024 Canadian floods and droughts on its portfolio.

| Initiative | Target | Progress (as of end 2024) | Focus Area |

|---|---|---|---|

| Sustainable Finance Mobilization | $300 billion by 2030 | $42.5 billion | Client decarbonization and environmental goals |

| Net-Zero Ambition | 2050 | Interim targets set for financed emissions (e.g., Oil & Gas by 2030) | Operational and lending portfolio alignment |

| ESG Integration | Systematic incorporation into investment decisions | Growing allocation to sustainable investments | Risk assessment and value creation |

PESTLE Analysis Data Sources

Our PESTLE analysis for Canadian Imperial Bank draws on official Statistics Canada data, Bank of Canada reports, and federal government policy documents. We also incorporate insights from reputable financial news outlets and industry-specific market research to ensure a comprehensive view.