Canadian Imperial Bank Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Canadian Imperial Bank Bundle

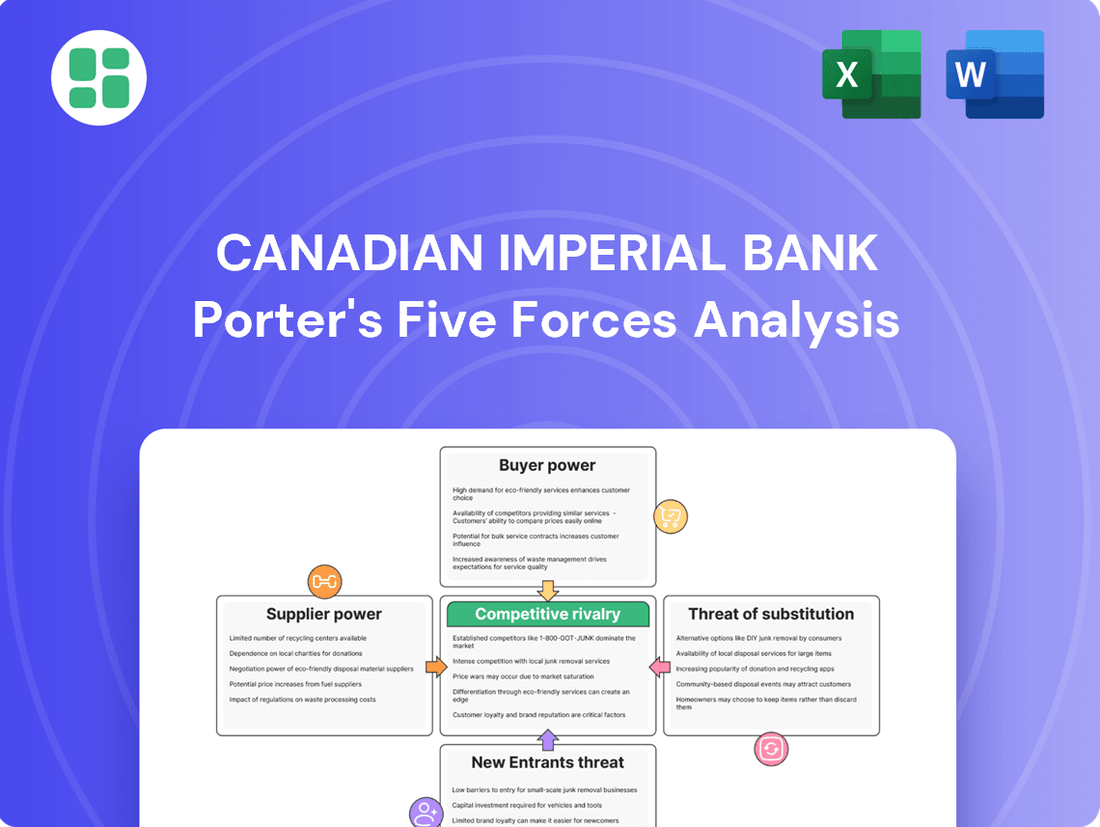

Canadian Imperial Bank of Commerce (CIBC) operates in a dynamic financial landscape where intense rivalry among existing players, the significant bargaining power of customers, and the constant threat of new entrants shape its strategic decisions. Understanding the subtle influence of substitute products and the bargaining power of suppliers is crucial for navigating this competitive environment.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Canadian Imperial Bank’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

The cost of funds for Canadian Imperial Bank of Commerce (CIBC) is directly tied to the interest rates it must offer to attract deposits and secure wholesale funding. In 2024, the Bank of Canada's monetary policy significantly influences these costs. While previous rate hikes increased borrowing expenses, recent adjustments and anticipated rate cuts are expected to ease some of the pressure on CIBC's cost of funds, potentially improving net interest margins.

Canadian Imperial Bank of Commerce (CIBC) depends significantly on advanced IT systems, software, and cybersecurity. Major technology providers offering these essential services can wield considerable influence, particularly when supplying specialized or proprietary solutions. As banks like CIBC accelerate their digital transformation and AI adoption, the reliance on these vendors intensifies, potentially increasing their bargaining power.

The bargaining power of suppliers, particularly concerning skilled labor, presents a significant factor for CIBC. The availability and cost of highly skilled employees in fields critical to modern banking, such as artificial intelligence, data analytics, cybersecurity, and capital markets, directly impact the bank's operational expenses and its ability to innovate. In 2024, the competition for top talent in these specialized areas remained intense, with reports indicating salary increases for AI specialists by as much as 15-20% year-over-year in some Canadian markets, directly influencing CIBC's recruitment and retention strategies.

Regulatory Bodies and Compliance

Regulatory bodies, such as the Financial Consumer Agency of Canada (FCAC), wield considerable influence over Canadian Imperial Bank of Commerce (CIBC) by imposing compliance costs and operational mandates. These agencies dictate the necessary investments in technology, staffing, and processes to adhere to evolving financial regulations, particularly those concerning consumer protection and data privacy. For instance, the FCAC's oversight ensures adherence to consumer-focused legislation, directly impacting CIBC's operational expenses and strategic planning.

The 'power' of these regulators is evident in the substantial financial commitments banks must make to ensure compliance. In 2024, Canadian banks, including CIBC, continued to invest heavily in regulatory compliance, with estimates suggesting billions spent annually across the industry to meet requirements like anti-money laundering (AML) and know your customer (KYC) regulations. These ongoing investments are critical for maintaining operational licenses and avoiding significant penalties.

- Compliance Costs: Regulatory bodies impose significant operational and technological expenses on CIBC to meet legal and ethical standards.

- Consumer Protection Mandates: Requirements related to financial consumer protection, such as those enforced by the FCAC, necessitate investments in customer service infrastructure and complaint resolution systems.

- Industry-Wide Impact: The collective financial impact of regulatory compliance across the Canadian banking sector underscores the substantial bargaining power of these governing bodies.

Payment Network Providers

Payment network providers, such as Visa and Mastercard, hold significant bargaining power over Canadian Imperial Bank of Commerce (CIBC). CIBC's ability to process customer transactions is fundamentally reliant on these networks, which dictate the fees and terms of service. In 2024, the ongoing modernization of Canada's payment infrastructure, including initiatives like the Real-Time Rail, further solidifies the position of these established networks, potentially increasing the costs CIBC must bear or pass on to consumers.

- Network Dependence: CIBC's transaction processing capabilities are directly tied to major payment networks, limiting its leverage.

- Fee Structures: The fees imposed by these networks represent a substantial operational cost for CIBC.

- Infrastructure Modernization: Canada's evolving payment landscape in 2024 enhances the negotiating strength of dominant network providers.

Suppliers of critical technology, like specialized AI software or cybersecurity solutions, have considerable leverage over CIBC. As the bank increasingly relies on these advanced systems for digital transformation, the power of providers offering unique or proprietary services grows. This dependence can lead to higher costs for CIBC, especially as demand for such expertise intensifies.

The bargaining power of suppliers in the labor market is substantial for CIBC, particularly for highly skilled professionals in AI, data analytics, and cybersecurity. In 2024, competition for these roles remained fierce, with reports indicating significant salary increases for AI specialists in Canada, impacting CIBC's recruitment and retention costs. This dynamic directly affects the bank's ability to innovate and maintain its competitive edge.

| Supplier Type | Impact on CIBC | 2024 Trend/Data |

|---|---|---|

| Technology Providers (AI/Cybersecurity) | Increased costs due to reliance on specialized solutions | Intensified demand driving up vendor pricing |

| Skilled Labor (AI Specialists) | Higher recruitment and retention expenses | Reported 15-20% year-over-year salary increases in some Canadian markets |

| Payment Networks (Visa, Mastercard) | Significant transaction fees and reliance on network infrastructure | Ongoing modernization of payment systems solidifies network provider strength |

What is included in the product

Tailored exclusively for Canadian Imperial Bank, analyzing its position within its competitive landscape by examining the intensity of rivalry, threat of new entrants, bargaining power of buyers and suppliers, and the threat of substitutes.

Effortlessly identify and mitigate competitive threats by visualizing the intensity of each force, allowing for targeted strategic adjustments.

Customers Bargaining Power

Customer switching costs in Canadian banking, while historically significant, are seeing a gradual reduction. This shift is largely driven by the rise of digital banking platforms and the ongoing development of open banking initiatives across Canada.

These advancements are making it less effortful and more cost-effective for consumers to transfer their accounts between financial institutions. For instance, improved online account opening processes and data portability features simplify the migration experience.

While Canada's open banking framework is still in its developmental stages, its eventual full implementation is expected to further empower customers by providing them with greater control over their financial data and easier access to competitive offerings from challenger banks and fintech firms. This trend directly increases the bargaining power of customers.

Customers today have an incredible amount of information at their fingertips. Online platforms and comparison tools allow them to easily see what different banks are offering in terms of interest rates, fees, and product features. This makes it much harder for any single bank to stand out solely on price or product simplicity.

This increased transparency directly translates into greater bargaining power for customers. They can readily compare offers from Canadian Imperial Bank (CIBC) against its competitors, leading to higher price sensitivity. For example, a quick online search in 2024 could reveal a 0.50% difference in savings account interest rates between major Canadian banks, prompting customers to switch for better returns.

Consequently, customers are more likely to demand better terms and seek out personalized solutions that meet their specific financial needs. This forces institutions like CIBC to be more competitive and innovative in their product development and pricing strategies to retain and attract clients.

CIBC offers a comprehensive suite of financial products, yet the banking landscape is highly competitive. Customers can easily find comparable services from other large Canadian banks and a growing number of agile fintech companies, which dilutes CIBC's unique product advantage.

The commoditized nature of many core banking services, such as chequing accounts and mortgages, significantly amplifies customer bargaining power. This allows consumers to readily switch providers based on factors like interest rates, fees, or the quality of their digital banking experience. For instance, in 2023, Canadians opened an estimated 2.5 million new investment accounts, demonstrating a willingness to explore options beyond traditional offerings.

Large Institutional Clients

Large institutional clients, including major corporations and high-net-worth individuals, wield considerable bargaining power with Canadian Imperial Bank of Commerce (CIBC). Their substantial transaction volumes in capital markets and wealth management allow them to negotiate favorable terms, including preferential interest rates and customized financial products. This often translates into demanding specialized services and a high caliber of expertise from CIBC.

For instance, in 2023, CIBC's wholesale banking revenue was C$4.7 billion, with a significant portion attributable to these large clients. Their ability to shift business to competitors if demands aren't met puts pressure on CIBC to maintain competitive pricing and service quality across its offerings.

- Significant Transaction Volumes: Large clients drive substantial revenue, giving them leverage in negotiations.

- Negotiation of Preferential Rates: Access to better pricing on loans, deposits, and investment products.

- Demand for Customized Solutions: Requirement for tailored financial strategies and specialized services.

- Potential for Client Attrition: The risk of losing large accounts to competitors if service or pricing is not satisfactory.

Digital Disruption and Fintechs

The proliferation of fintech companies, offering specialized services like low-fee investing or tailored lending, significantly boosts customer bargaining power. These digital alternatives provide Canadians with more choices beyond traditional banking institutions.

For instance, by mid-2024, the Canadian fintech sector saw continued growth, with platforms like Wealthsimple and KOHO attracting millions of users by offering streamlined, cost-effective financial solutions. This increased competition forces established banks to respond with improved digital offerings and competitive pricing.

- Fintech Adoption: By Q2 2024, over 60% of Canadians had used at least one fintech service, demonstrating a clear shift in consumer preference.

- Fee Sensitivity: Research from 2024 indicated that a significant portion of Canadian bank customers would switch providers for a 0.5% reduction in fees or improved digital convenience.

- Niche Service Growth: Specialized payment processors and peer-to-peer lending platforms experienced an average year-over-year user growth of 25% in 2024, indicating a strong demand for alternatives.

Customers today are highly informed and have numerous options, significantly increasing their bargaining power against Canadian Imperial Bank (CIBC). The ease of comparing services online means CIBC must constantly offer competitive rates and features to retain clients.

This trend is amplified by the rise of fintech, which provides specialized, often lower-cost alternatives. For example, by mid-2024, fintech platforms like Wealthsimple had attracted millions of users, forcing traditional banks to enhance their digital offerings and pricing to compete.

Large corporate clients, in particular, possess immense leverage due to their substantial transaction volumes. In 2023, CIBC's wholesale banking revenue of C$4.7 billion highlights how these clients can negotiate favorable terms, potentially shifting business if their demands for preferential rates or customized solutions aren't met.

| Factor | Impact on CIBC | Supporting Data (2023-2024) |

|---|---|---|

| Information Accessibility | Increased customer price sensitivity and demand for better terms. | Customers can easily compare savings account rates, with differences of up to 0.50% noted between major banks in 2024. |

| Fintech Competition | Pressure to improve digital offerings and pricing; potential loss of market share. | Over 60% of Canadians used at least one fintech service by Q2 2024; specialized platforms saw 25% average user growth in 2024. |

| Large Institutional Clients | Ability to negotiate preferential rates and customized services; risk of client attrition. | CIBC's wholesale banking revenue was C$4.7 billion in 2023, with large clients driving significant portions of this. |

| Switching Costs | Gradual reduction due to digital banking and open banking initiatives. | Open banking advancements simplify account transfers, making it easier for customers to switch providers. |

Preview the Actual Deliverable

Canadian Imperial Bank Porter's Five Forces Analysis

This preview showcases the exact Canadian Imperial Bank Porter's Five Forces Analysis document you will receive immediately after purchase, ensuring complete transparency and no hidden surprises. You are looking at the actual, professionally written analysis, fully formatted and ready for your immediate use. Once your purchase is complete, you will gain instant access to this precise file, allowing you to leverage its insights without delay.

Rivalry Among Competitors

Canada's banking landscape is highly concentrated, with the 'Big Six' banks, including CIBC, holding a dominant position. This oligopolistic structure fuels fierce competition for market share across all client segments and core banking services in both Canada and the United States.

In 2024, the six largest Canadian banks collectively managed assets exceeding CAD 4.5 trillion, underscoring their significant market power and the intense rivalry among them for customer acquisition and retention.

Canadian banks face intense competition from rivals who aggressively market new products and services, often with competitive pricing on loans, mortgages, and investments. This constant push for market share means banks are always looking for an edge, especially in the dynamic mortgage sector.

For example, in 2024, major Canadian banks continued to offer attractive promotional rates on mortgages to capture new clients. This aggressive stance is a key driver of competitive rivalry, forcing all players to remain agile and customer-focused.

Major Canadian banks, including CIBC, are locked in intense competition through significant digital transformation investments. In 2024, these investments are focused on artificial intelligence, data analytics, and cloud infrastructure to create seamless customer experiences and boost operational efficiency.

This technology race intensifies rivalry as institutions like CIBC vie to offer the most advanced digital services, from personalized banking apps to AI-driven financial advice. For instance, many Canadian banks have reported substantial year-over-year increases in their technology budgets, with some allocating upwards of 15% of their operating expenses to digital initiatives in 2024.

The drive to automate processes and personalize customer offerings means that banks are constantly innovating, making it challenging for any single player to gain a lasting advantage. This constant pursuit of digital superiority means that competition among Canadian banks remains exceptionally fierce.

Cross-Selling and Bundling Strategies

Canadian banks actively engage in cross-selling, offering a diverse range of products like banking, insurance, and investment services. This approach aims to deepen customer relationships and secure a larger portion of their financial business. For instance, in 2023, Canadian banks continued to leverage bundled offerings, such as mortgage and investment packages, to enhance customer loyalty and reduce churn.

This intensified competition for complete client relationships means banks are striving to be the primary financial provider for their customers. By offering integrated solutions, they make it more convenient for clients to manage all their financial needs under one roof. This strategy is crucial in a market where customer acquisition costs can be high, making retention through comprehensive service a key differentiator.

- Cross-Selling Focus: Banks are increasingly promoting a wider suite of financial products beyond traditional banking.

- Bundled Offerings: Packages combining accounts, loans, insurance, and investments are common.

- Customer Stickiness: These strategies aim to increase customer loyalty and reduce the likelihood of them switching to competitors.

- Share of Wallet: The goal is to capture a greater percentage of a customer's overall financial spending and savings.

Geographic Expansion and Niche Markets

While CIBC's core business is in Canada, it actively competes in the United States and other international markets. This geographic diversification means facing a broader competitive landscape, including established players and emerging fintechs. For instance, CIBC's U.S. operations, particularly through CIBC Bank USA, contend with major American banks for market share.

Beyond broad geographic reach, intense rivalry exists within specific niche markets. CIBC targets segments like small business banking, wealth management, and capital markets, where competition is often driven by specialized offerings and strategic partnerships. In 2023, Canadian banks collectively saw significant growth in wealth management assets, indicating a vibrant and competitive environment for attracting and retaining high-net-worth clients.

- Geographic Reach: CIBC competes in Canada, the U.S. (e.g., CIBC Bank USA), and other international markets.

- Niche Market Focus: Intense rivalry exists in segments like small business banking, wealth management, and capital markets.

- Growth Drivers: Strategic realignments and the pursuit of growth opportunities fuel this competitive rivalry.

- Market Dynamics: The Canadian wealth management sector experienced robust growth in 2023, highlighting the competitive nature of this segment.

The competitive rivalry among Canadian banks, including CIBC, is exceptionally high due to the concentrated market structure dominated by the "Big Six." In 2024, these institutions collectively managed over CAD 4.5 trillion in assets, intensifying their pursuit of market share through aggressive pricing, innovative digital offerings, and cross-selling strategies. This dynamic environment forces continuous investment in technology and customer retention initiatives to maintain a competitive edge.

| Metric | 2023 (CAD billions) | 2024 (Estimated CAD billions) | Key Competitive Driver |

|---|---|---|---|

| Total Assets (Big Six) | ~4,300 | ~4,500+ | Market Share Acquisition |

| Digital Investment % of OpEx | 10-15% | 12-18% | Customer Experience & Efficiency |

| Wealth Management Growth | ~8% | ~7-9% | High-Net-Worth Client Acquisition |

SSubstitutes Threaten

Fintech lending platforms represent a significant threat of substitutes for Canadian Imperial Bank of Commerce (CIBC). Online lenders and peer-to-peer platforms provide alternative avenues for borrowing, often boasting quicker approvals and distinct credit assessment methods compared to traditional banking. This directly challenges CIBC's core lending products, especially in the personal and small business loan segments.

In 2024, the fintech lending market continued its robust growth. For instance, Canadian fintech lenders facilitated billions in new loan originations, capturing market share from incumbent institutions. These platforms frequently offer more flexible terms or cater to borrowers who might not meet the stringent criteria of traditional banks, thereby presenting a compelling substitute.

Robo-advisors and low-cost online brokerages represent a significant threat to CIBC's traditional wealth management. These platforms offer automated investment management, directly competing with CIBC's financial advisory services. For instance, Wealthsimple, a prominent Canadian robo-advisor, had over $20 billion in assets under management as of early 2024, attracting investors prioritizing digital convenience and lower fees.

The appeal of these substitutes lies in their cost-effectiveness and accessibility, particularly for younger or less affluent investors. Many robo-advisors charge management fees significantly lower than traditional human advisors, often in the range of 0.25% to 0.50% annually, compared to the 1% or more typically seen in full-service wealth management. This cost advantage makes them a compelling alternative for Canadians seeking to grow their investments without the higher price tag.

The rise of digital payment solutions like mobile payment apps, digital wallets, and even cryptocurrency platforms presents a significant threat of substitutes for Canadian Imperial Bank. These alternatives offer convenient ways for consumers and businesses to transfer funds, often bypassing traditional banking channels altogether. For instance, in 2023, the Canadian digital payments market saw substantial growth, with mobile payments alone projected to reach over $170 billion by 2025, indicating a clear shift away from traditional methods for many transactions.

Alternative Savings and Investment Vehicles

Customers increasingly have access to alternative savings and investment vehicles beyond traditional bank offerings. This includes direct investments in real estate, private equity, and a growing array of non-bank investment funds, which can offer competitive returns and diversification opportunities. For instance, in 2024, Canadian real estate continued to attract significant capital, with average home prices across the country showing resilience. Similarly, the alternative investment sector, including private equity and venture capital, saw substantial inflows as investors sought to capture growth beyond public markets.

These substitutes present a significant threat to CIBC's traditional deposit and mutual fund business. As investors allocate capital to these alternative avenues, it directly reduces the pool of funds available for traditional banking products. The appeal of these alternatives often lies in their potential for higher yields or unique investment strategies, forcing banks like CIBC to innovate and offer more compelling products to retain market share.

Key substitute categories include:

- Direct Real Estate Investment: Property ownership as an inflation hedge and income generator.

- Private Equity and Venture Capital: Investments in privately held companies, offering high growth potential.

- Hedge Funds and Alternative Funds: Pooled investment vehicles employing diverse strategies, often with lower correlation to traditional markets.

- Peer-to-Peer Lending Platforms: Direct lending to individuals or businesses, bypassing traditional financial intermediaries.

Credit Unions and Non-Bank Financial Institutions

Credit unions and trust companies present a significant threat of substitutes for Canadian Imperial Bank of Commerce (CIBC). These institutions often provide comparable deposit and lending services, attracting customers seeking an alternative to traditional banking models, a more localized approach, or specialized financial products.

While typically smaller in scale than major commercial banks, their presence diversifies the financial landscape and offers customers choice. For instance, as of December 31, 2023, Canada's credit union system held approximately $290 billion in assets, demonstrating a substantial market share and competitive offering against large banks.

The appeal of these substitutes can stem from:

- Customer-centric models: Credit unions, often member-owned, can foster a stronger sense of community and personalized service.

- Niche specialization: Some non-bank institutions cater to specific demographics or industries, offering tailored solutions.

- Competitive rates and fees: These alternatives may offer more attractive interest rates on savings or lower fees on certain banking products.

The threat of substitutes for CIBC extends to non-traditional investment avenues. Canadians are increasingly exploring direct real estate investments, private equity, and venture capital funds as alternatives to traditional bank products. In 2024, the Canadian alternative investment market continued to see significant inflows, with private equity fundraising alone reaching record levels, indicating a strong preference for these potentially higher-return, albeit riskier, substitutes.

| Substitute Category | Key Characteristics | 2024 Market Trend/Data Point |

|---|---|---|

| Fintech Lending | Faster approvals, alternative credit scoring | Billions in new loan originations in Canada, capturing market share. |

| Robo-Advisors | Automated investment management, lower fees | Wealthsimple managing over $20 billion in assets by early 2024. |

| Digital Payments | Convenient fund transfers, bypassing traditional banking | Mobile payments projected to exceed $170 billion by 2025 in Canada. |

| Direct Real Estate | Inflation hedge, income generation | Continued capital attraction with resilient average home prices in Canada. |

| Credit Unions | Member-owned, community focus, niche specialization | Approximately $290 billion in assets held by the Canadian credit union system as of Dec 31, 2023. |

Entrants Threaten

The threat of new entrants into Canada's banking sector is significantly diminished by high regulatory barriers. New players must navigate complex licensing procedures and meet substantial capital reserve requirements, as mandated by bodies like the Office of the Superintendent of Financial Institutions. For instance, in 2023, Canadian banks were required to maintain capital adequacy ratios well above international minimums, making it exceptionally costly for newcomers to establish a competitive footing.

Established Canadian banks, including CIBC, enjoy significant advantages from economies of scale, operating vast branch networks and holding substantial customer deposits. For instance, as of Q1 2024, CIBC reported total assets of CAD 1.04 trillion, reflecting its considerable operational size. This scale allows for lower per-unit costs in service delivery and marketing, a barrier new entrants find difficult to overcome.

Brand recognition and trust are also formidable deterrents. Decades of operation have fostered a deep-seated trust among Canadian consumers in incumbent institutions like CIBC. A 2023 survey indicated that over 70% of Canadians prefer to bank with established institutions, making it challenging for new, less-known entities to attract a significant market share and achieve profitability without substantial investment in building credibility.

Launching a full-service bank in Canada, like Canadian Imperial Bank of Commerce (CIBC), demands staggering upfront capital. This includes building extensive branch networks, investing in sophisticated IT infrastructure, and meeting stringent regulatory reserve requirements mandated by bodies like the Office of the Superintendent of Financial Institutions (OSFI). For instance, in 2024, the Tier 1 capital ratio for major Canadian banks remained robust, with CIBC consistently reporting ratios well above regulatory minimums, demonstrating the substantial capital base necessary to operate.

These immense financial barriers effectively deter most potential new entrants. The sheer scale of capital required to establish operations, acquire technology, and build brand recognition to compete with established players like CIBC is simply prohibitive for many. This high capital threshold significantly limits the threat of new competitors entering the Canadian banking landscape, thereby protecting incumbent institutions.

Customer Loyalty and Switching Costs (for new entrants)

Customer loyalty to established Canadian banks like CIBC remains a significant barrier for new entrants. Despite advancements in digital banking, which have somewhat lowered switching costs, many customers still value the long-standing relationships and trust built over years with incumbent institutions. This loyalty means new players must offer compelling reasons beyond basic functionality to draw customers away.

The existing customer base for major Canadian banks is substantial. For instance, CIBC reported serving over 11 million clients in fiscal year 2023, highlighting the scale of customer relationships new entrants must contend with. While digital platforms make account opening easier, the inertia of established banking relationships, coupled with bundled services and perceived security from larger institutions, creates a formidable challenge.

Switching costs, though reduced, are not entirely eliminated. These can include the effort involved in transferring direct deposits, updating pre-authorized payments, and potentially losing loyalty program benefits. For new entrants, overcoming this inertia requires not just competitive pricing but also superior user experience and innovative product offerings to incentivize customers to make the change.

- Customer Loyalty: Established banks benefit from deep-rooted customer relationships, making it difficult for new entrants to gain market share.

- Switching Costs: While digital channels have lowered some costs, factors like account consolidation and loyalty programs still present hurdles for customers switching banks.

- Incumbent Advantage: Banks like CIBC leverage their extensive branch networks and integrated digital services to retain customers, presenting a significant challenge for newcomers.

- Market Inertia: A substantial portion of the banking public remains with their current provider due to convenience and established trust, requiring new entrants to offer truly disruptive value propositions.

Fintechs Becoming Neobanks/Challenger Banks

Fintech companies are increasingly obtaining banking licenses, transforming into neobanks and directly challenging established institutions like Canadian Imperial Bank. This trend escalates the threat of new entrants, as these digital-native banks often boast lower operating costs and can deliver more agile, customer-centric experiences. For instance, by mid-2024, several prominent fintechs in Canada had secured or were actively pursuing full banking charters, signaling a significant shift in the competitive landscape.

These evolving fintechs, by offering a comprehensive suite of banking services beyond their initial niche offerings, directly compete for customer deposits and lending opportunities. Their digital-first approach allows for streamlined operations and rapid innovation, creating a more dynamic competitive environment. By the end of 2023, challenger banks in Canada had captured a notable percentage of the digital banking market share, indicating their growing influence.

- Fintech Evolution: Many fintechs are moving from specialized services to becoming full-service neobanks.

- Competitive Advantage: Digital-first models enable lower overhead and enhanced customer experiences.

- Market Impact: By 2024, several Canadian fintechs were pursuing or had obtained banking licenses, increasing direct competition.

- Market Share: Challenger banks saw increased market share in Canada by the close of 2023.

The threat of new entrants into Canada's banking sector remains relatively low, primarily due to substantial regulatory hurdles and high capital requirements. Obtaining a banking license involves rigorous oversight from bodies like the Office of the Superintendent of Financial Institutions (OSFI), demanding significant financial and operational commitments. For instance, in 2024, major Canadian banks maintained robust capital adequacy ratios, with CIBC's Common Equity Tier 1 ratio consistently exceeding 11%, a benchmark that new entrants must meet or surpass to operate. This creates a formidable financial barrier to entry.

Established players like CIBC benefit from significant economies of scale, extensive branch networks, and deeply entrenched customer loyalty, all of which are difficult for newcomers to replicate quickly. As of Q1 2024, CIBC's total assets stood at CAD 1.04 trillion, underscoring its vast operational capacity and market presence. Overcoming the brand recognition and trust that incumbent banks have cultivated over decades requires immense investment and time, making it challenging for new entities to attract a substantial customer base and achieve profitability.

While fintech innovation has introduced new competitive dynamics, many are evolving into licensed banks, directly challenging incumbents. These digital-first challengers often operate with lower overheads and can offer more agile, customer-centric services. By mid-2024, several Canadian fintechs were actively pursuing or had secured full banking licenses, indicating a shift towards more direct competition. However, the established infrastructure and trust of institutions like CIBC, which served over 11 million clients in fiscal year 2023, still present a significant challenge for these emerging players.

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Canadian Imperial Bank of Commerce (CIBC) leverages data from annual reports, regulatory filings (like SEDAR), and industry-specific publications from Canadian financial sector analysts. We also incorporate macroeconomic data from Statistics Canada and Bank of Canada reports to understand the broader economic landscape.