Chuy's Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Chuy's Bundle

Chuy's faces moderate bargaining power from buyers, who have many casual dining options. The threat of substitutes is significant, with numerous restaurants offering similar Tex-Mex cuisine. However, Chuy's enjoys a strong brand loyalty and unique atmosphere, which helps mitigate these pressures.

The complete report reveals the real forces shaping Chuy's’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The number of key suppliers for Chuy's fresh ingredients and specialized Tex-Mex components directly impacts supplier bargaining power. If Chuy's depends on a limited number of unique suppliers for its signature scratch-made dishes and distinctive sauces, these suppliers gain leverage over pricing and contract terms. For instance, a supplier providing a proprietary blend of chilies crucial for Chuy's salsa verde could command higher prices due to its essential nature and limited alternatives.

The restaurant sector, including businesses like Chuy's, grapples with fluctuating input costs. Food and commodity prices have seen a notable surge, rising by 28% since 2019, with projections indicating continued upward pressure into 2025.

This volatility, especially concerning essential ingredients such as beef, directly enhances the bargaining power of suppliers. They can effectively transfer their escalating expenses onto restaurants, impacting profitability.

Supply chain disruptions, driven by factors like global conflicts, trade restrictions, and labor shortages in agriculture, significantly impact the bargaining power of suppliers. For instance, in 2024, the ongoing geopolitical tensions and adverse weather patterns continued to create volatility in the availability and pricing of key food commodities, directly affecting restaurant input costs.

These unpredictable events can lead to scarcity of essential ingredients, granting suppliers leverage to dictate terms and prices. Restaurants, including those like Chuy's, must then navigate these challenges by potentially adjusting sourcing strategies or modifying their menus to accommodate the fluctuating availability of certain items, a direct consequence of heightened supplier power.

Impact of Darden Restaurants Acquisition

Chuy's acquisition by Darden Restaurants in October 2024 for $605 million is poised to reshape its supplier relationships. Darden's immense scale, operating numerous brands, allows for consolidated purchasing, potentially granting Chuy's enhanced bargaining power with its suppliers.

This increased leverage could translate into more favorable pricing and terms for Chuy's as it benefits from Darden's larger order volumes. Suppliers may find it more advantageous to negotiate with a consolidated entity like Darden, potentially leading to reduced input costs for Chuy's restaurants.

- Increased Purchasing Power: Darden's overall purchasing volume across its portfolio of brands, which includes popular names like Olive Garden and LongHorn Steakhouse, will likely be leveraged to negotiate better terms for Chuy's.

- Potential for Cost Savings: By consolidating orders for key ingredients and supplies, Chuy's could see a reduction in its cost of goods sold, directly impacting its profitability.

- Supplier Consolidation: Suppliers may face increased pressure to offer competitive pricing to secure business with a larger entity like Darden, potentially leading to a more consolidated supplier base for Chuy's.

- Impact on Small Suppliers: While larger suppliers might benefit from the increased volume, smaller, more specialized suppliers might face challenges in meeting the demands or pricing expectations of a large operator like Darden.

Switching Costs for Chuy's

For Chuy's, the bargaining power of suppliers is influenced by switching costs. While many ingredients like produce and dairy might have low switching costs, allowing Chuy's to easily change suppliers, specialized or proprietary ingredients could present higher switching costs.

This means that for common items, Chuy's can leverage competition among suppliers to negotiate favorable terms. However, for unique components integral to their scratch-made recipes, suppliers may hold more sway.

Consider the impact on Chuy's cost of goods sold. In 2023, Chuy's reported a cost of sales of $245.5 million. If a significant portion of these costs were tied to a few specialized suppliers with high switching costs, their ability to control these expenses would be diminished.

- Low Switching Costs for Standard Ingredients: Chuy's can readily substitute suppliers for common items like vegetables, meats, and basic pantry staples, limiting supplier leverage.

- Higher Switching Costs for Specialized Items: If Chuy's relies on unique spice blends, specific regional produce, or proprietary sauces from particular suppliers, the cost and effort to find and vet new sources increase supplier power.

- Impact on Cost of Goods Sold: The proportion of specialized versus commodity ingredients directly affects how much bargaining power Chuy's has with its supplier base.

The bargaining power of suppliers for Chuy's is a critical factor, especially with the restaurant sector facing significant input cost inflation. For instance, food commodity prices rose by 28% from 2019 to 2024, and this trend is expected to continue, directly empowering suppliers who can pass these increased costs onto restaurants like Chuy's.

The acquisition of Chuy's by Darden Restaurants in October 2024 for $605 million is likely to shift this dynamic. Darden's substantial purchasing volume across its portfolio, which includes brands like Olive Garden, will provide Chuy's with greater leverage to negotiate more favorable terms and potentially lower input costs.

| Factor | Impact on Chuy's Supplier Bargaining Power | Data/Example |

|---|---|---|

| Input Cost Volatility | Increases Supplier Power | Food commodity prices up 28% since 2019; continued upward pressure projected into 2025. |

| Darden Acquisition (Oct 2024) | Decreases Supplier Power for Chuy's | Darden's scale ($605 million acquisition) enables consolidated purchasing, enhancing Chuy's negotiation leverage. |

| Switching Costs (Specialized Ingredients) | Increases Supplier Power | Proprietary spice blends or unique regional produce can lead to higher costs and effort to find new suppliers. |

What is included in the product

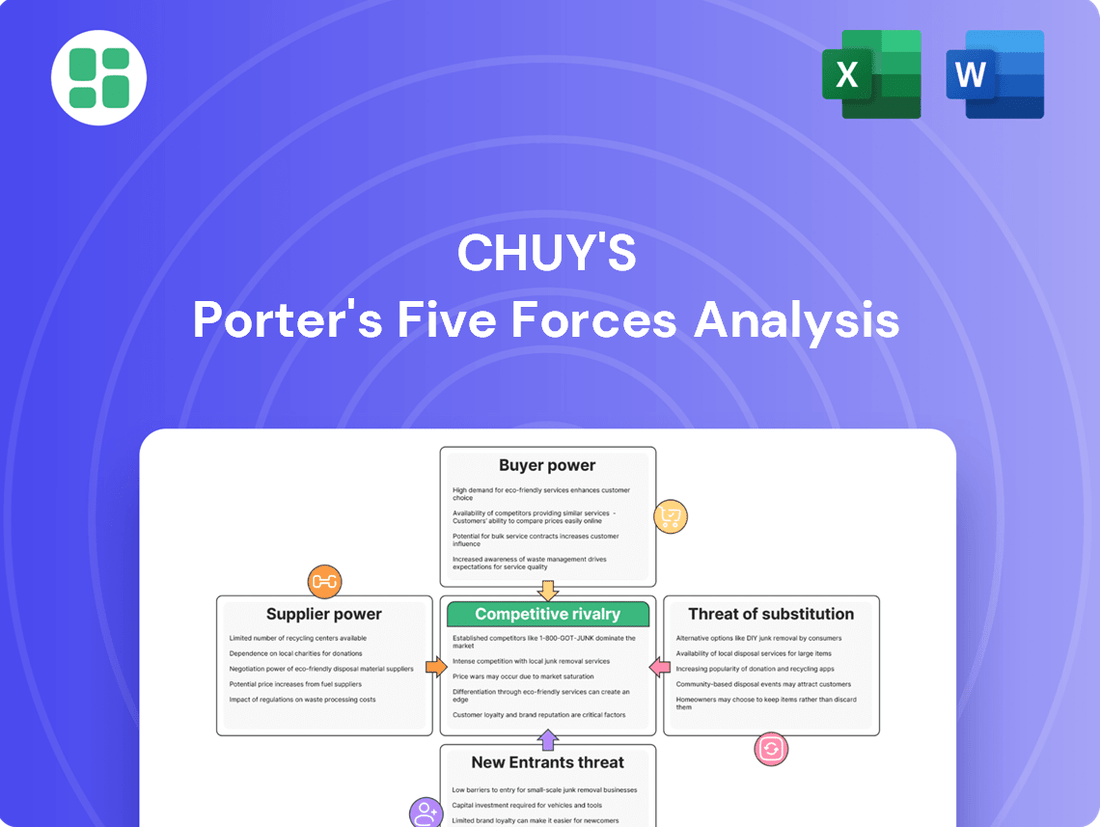

Analyzes the competitive intensity and profitability of the casual dining sector for Chuy's, detailing the power of buyers and suppliers, threat of new entrants and substitutes, and rivalry among existing firms.

Visualize competitive intensity with a dynamic, interactive dashboard that highlights key pressures and opportunities.

Customers Bargaining Power

Consumers are feeling the pinch of inflation, making them more mindful of their spending. In 2024, a significant portion, close to 40%, reported reducing their dining out frequency, often seeking out less expensive alternatives. This shift directly impacts businesses like Chuy's, as customers now have more leverage to select establishments offering better value for their money.

This increased price sensitivity translates into a stronger bargaining position for customers. When guest traffic declines, as it has in the current economic climate, consumers are less compelled to dine out and more likely to compare prices and promotions across different restaurants. This dynamic puts added pressure on Chuy's to maintain competitive pricing strategies to attract and retain its customer base.

The bargaining power of customers is significantly influenced by the availability of substitutes and alternatives. For a restaurant like Chuy's, customers have a vast selection of dining options, ranging from other casual dining chains to fast-casual and quick-service restaurants. This broad competitive environment empowers customers, as they can readily switch to a competitor if Chuy's pricing or menu doesn't align with their preferences or budget. For instance, in 2024, the casual dining sector faced intense competition, with many chains offering similar Tex-Mex or American cuisine.

For the typical diner, the financial and logistical hurdles in selecting an alternative dining establishment are negligible. This low barrier to entry allows patrons to readily shift their spending to competitors if they encounter issues with Chuy's offerings, be it the cuisine, service quality, or price point.

This ease of departure significantly amplifies the bargaining power of customers. In 2024, the casual dining sector saw continued competition, with numerous new entrants and established chains vying for consumer attention, further reinforcing the low switching costs for diners across the industry.

Growth of Off-Premise Dining

The significant growth in off-premise dining, driven by delivery and takeout, has substantially increased customer bargaining power. With 60% of U.S. consumers ordering food at least once a week through these channels, convenience and choice are paramount.

This shift empowers customers to readily compare options and seek the best value, potentially reducing loyalty to single establishments. For Chuy's, this means customers can easily switch to competitors offering more attractive off-premise deals or faster service, directly impacting traffic and sales within the physical restaurants.

- Increased Customer Choice: The proliferation of third-party delivery apps and restaurant-specific online ordering systems provides consumers with an unprecedented array of dining options.

- Value Sensitivity: Customers in the off-premise market are often more price-sensitive and actively seek promotions and discounts, putting pressure on restaurant margins.

- Convenience as a Driver: The ease of ordering from home or work means customers can bypass the traditional dining experience, giving them more leverage in choosing where to spend their money.

Chuy's Unique Brand and Experience

Chuy's distinctive brand, characterized by its vibrant, eclectic atmosphere and dedication to scratch-made Tex-Mex cuisine, cultivates a unique dining experience. This strong brand identity and focus on experiential dining can reduce the bargaining power of customers by fostering loyalty that transcends price sensitivity.

- Brand Loyalty: Chuy's unique atmosphere and food quality encourage repeat visits, making customers less likely to switch based solely on price.

- Experiential Dining: The lively decor and live music contribute to an experience that customers value, giving Chuy's an edge over competitors offering less engaging environments.

- Customer Preference: In 2023, Chuy's reported a 7.9% increase in revenue, reaching $475.1 million, indicating a strong customer preference for its offering despite potential price variations.

Customers wield significant power due to the abundance of dining alternatives, especially with the rise of off-premise ordering. In 2024, many consumers reduced dining out, seeking value, which increases their ability to switch based on price or promotions.

The ease with which customers can switch to competitors, coupled with a wide array of substitute options in the casual dining sector, amplifies their bargaining leverage. This low switching cost means Chuy's must remain competitive in pricing and offerings to retain its customer base.

The growth of delivery and takeout channels has further empowered consumers, allowing them to easily compare prices and convenience. This trend, with 60% of U.S. consumers ordering food weekly via these methods, puts pressure on restaurants to offer compelling off-premise deals.

| Factor | Impact on Bargaining Power | 2024 Data/Observation |

|---|---|---|

| Availability of Substitutes | High | Casual dining sector offers numerous Tex-Mex and American cuisine competitors. |

| Switching Costs | Low | Negligible financial or logistical hurdles for customers to choose alternative dining. |

| Price Sensitivity | Increasing | ~40% of consumers reduced dining out frequency due to inflation. |

| Off-Premise Dining Growth | High | 60% of consumers order food weekly via delivery/takeout, increasing comparison shopping. |

Preview the Actual Deliverable

Chuy's Porter's Five Forces Analysis

This preview showcases the complete Chuy's Porter's Five Forces analysis, offering a thorough examination of the competitive landscape. The document you see here is the exact, professionally formatted report you will receive immediately after purchase. You can confidently expect to download this comprehensive analysis, ready for immediate use and application to your strategic planning needs.

Rivalry Among Competitors

The casual dining and Tex-Mex restaurant sectors are incredibly crowded. This means Chuy's faces intense competition from both large, well-known chains and smaller, local eateries. For instance, in 2024, the U.S. casual dining market alone is valued at over $100 billion, with a vast array of concepts vying for consumer attention.

Major players like Chili's, known for its American fare, and Texas Roadhouse, a popular steakhouse chain, represent significant competitive forces. Their established brand recognition and extensive marketing budgets put pressure on restaurants like Chuy's to continually innovate and attract customers in a saturated market.

The casual dining sector, while part of a growing restaurant industry, is experiencing a more modest expansion. Projections indicate a 2% growth rate for casual dining in 2024. This slower pace, especially within an already crowded market, intensifies the struggle for market share.

Chuy's thrives on its unique brand identity, setting it apart from competitors. Its commitment to scratch-made food, fresh ingredients, and a distinctive, quirky dining atmosphere creates a memorable customer experience.

This strong differentiation is vital in the competitive casual dining landscape, especially against other Tex-Mex restaurants. For instance, in 2023, Chuy's reported total revenue of $425.5 million, indicating its ability to attract and retain customers through its unique offerings.

Acquisition by Darden Restaurants

Chuy's becoming an indirect, wholly-owned subsidiary of Darden Restaurants, a major multi-brand operator, significantly bolsters its competitive standing within the casual dining sector. This strategic move grants Chuy's access to Darden's substantial scale, financial resources, and extensive operational knowledge. For instance, Darden's 2024 fiscal year reported total sales exceeding $10.5 billion, showcasing the immense leverage Chuy's now possesses.

This integration enhances Chuy's competitive edge by providing:

- Access to Darden's robust supply chain and procurement power, potentially lowering ingredient costs.

- Leverage of Darden's advanced marketing and brand-building capabilities.

- Opportunities for operational efficiencies through shared best practices and technology adoption.

Marketing and Promotional Activities

Restaurants frequently engage in promotions and value deals to attract and retain customers, particularly when consumers are price-sensitive. For instance, in 2024, many casual dining chains continued to offer limited-time discounts and loyalty programs to drive traffic. This intense promotional activity among competitors directly impacts Chuy's ability to capture market share without engaging in similar, potentially margin-eroding, tactics.

Chuy's must continually innovate its menu and marketing strategies to stand out in a crowded market. Competitors are also vying for customer attention through various channels, from social media campaigns to local sponsorships. The need to differentiate through unique offerings and effective communication is paramount, especially as consumer preferences evolve.

- Promotional Intensity: Competitors often use discounts and value menus, a trend observed across the casual dining sector in 2024.

- Menu Innovation: Restaurants are constantly updating offerings to attract new customers and re-engage existing ones.

- Marketing Channels: Digital marketing, including social media and targeted advertising, is a key battleground for customer acquisition.

- Customer Loyalty: Programs designed to reward repeat business are crucial for retention in a competitive landscape.

The competitive rivalry in the casual dining sector, including Tex-Mex, is fierce, with numerous players vying for consumer dollars. Chuy's faces pressure from established giants like Chili's and Texas Roadhouse, as well as a multitude of smaller, local establishments. The U.S. casual dining market, valued at over $100 billion in 2024, underscores the intense competition for market share.

The sector's modest 2% growth projected for 2024 further intensifies this rivalry, forcing companies to innovate and attract customers more aggressively. Chuy's differentiation through its unique brand, scratch-made food, and quirky atmosphere, as evidenced by its $425.5 million revenue in 2023, is crucial for standing out. Becoming a subsidiary of Darden Restaurants, with its fiscal year 2024 sales exceeding $10.5 billion, significantly enhances Chuy's competitive arsenal through scale, resources, and expertise.

| Competitor Type | Key Characteristics | Impact on Chuy's |

| Large Casual Dining Chains | Established brand, extensive marketing budgets, broad menus | Forces Chuy's to maintain strong differentiation and marketing efforts |

| Other Tex-Mex Restaurants | Similar cuisine, potential for price competition | Requires Chuy's to emphasize unique offerings and customer experience |

| Local Eateries | Niche appeal, community focus | Can capture local market share, requiring Chuy's to maintain broad appeal |

SSubstitutes Threaten

Home cooking presents a significant threat to restaurants like Chuy's. In 2024, with ongoing economic considerations and fluctuating food costs, many consumers are increasingly turning to preparing meals at home. This trend is amplified by the convenience and perceived value of home-prepared meals compared to dining out, especially when restaurant prices are on the rise.

The burgeoning meal kit industry further strengthens this substitute threat. Services offering pre-portioned ingredients and recipes make home cooking more accessible and appealing, directly competing for consumer dining occasions. This segment saw continued growth, with market reports indicating sustained consumer interest in the convenience and controlled cost of meal kits throughout 2024.

The fast-casual and quick-service restaurant sectors present a significant threat of substitutes for casual dining establishments like Chuy's. These segments are outperforming casual dining in terms of growth, largely due to their emphasis on convenience and often more accessible pricing. For instance, the U.S. quick-service restaurant market was projected to reach $330.5 billion in 2024, indicating strong consumer preference for these faster, more affordable options.

Customers have an incredibly diverse range of dining options beyond Tex-Mex, including Italian, Asian, and farm-to-table experiences. This means a craving for Mexican food can easily be satisfied by Italian or Thai restaurants, presenting a significant threat to Chuy's. For instance, a 2024 report indicated that casual dining restaurants offering diverse ethnic cuisines saw a 7% increase in customer preference over traditional Tex-Mex establishments.

Food Delivery Services

The threat of substitutes for Chuy's is significantly amplified by the proliferation of third-party food delivery services. These platforms offer consumers unparalleled convenience, allowing them to order meals from a vast array of restaurants without leaving their homes. This ease of access means a delivered meal from a competitor, or even a different cuisine entirely, can easily substitute for dining at Chuy's.

The convenience factor is a major driver here. In 2024, the food delivery market continued its robust growth, with platforms like DoorDash, Uber Eats, and Grubhub commanding significant market share. For instance, DoorDash reported over 2.5 billion orders in 2023, a testament to consumer reliance on these services for meal solutions. This widespread availability means customers can readily switch from wanting Tex-Mex to opting for pizza or sushi delivered to their doorstep, directly impacting Chuy's potential customer base.

- Widespread Availability: Third-party apps provide access to numerous restaurants, making it easy for consumers to find alternatives to Chuy's.

- Convenience Factor: The ability to order food from home directly substitutes the need to visit a restaurant like Chuy's.

- Market Growth: The food delivery sector's continued expansion in 2024, evidenced by billions of orders processed by major platforms, highlights the strength of these substitutes.

- Dietary and Cuisine Variety: Delivery platforms offer a broad spectrum of cuisines, allowing consumers to easily substitute Tex-Mex with other popular options.

Groceries and Prepared Foods

Supermarkets and convenience stores are stepping up their game, offering a wider array of high-quality prepared meals and fresh ingredients. This makes them a significant substitute for dining out at restaurants like Chuy's. For instance, many grocery chains now feature extensive deli sections with chef-prepared meals, gourmet sandwiches, and even sushi, directly competing with restaurant offerings for convenient weeknight dinners.

These alternatives often present a more budget-friendly option for consumers. In 2024, the average cost of a meal at a casual dining restaurant like Chuy's could easily be $20-$30 per person, whereas a comparable prepared meal from a supermarket might cost $10-$15. This price difference is a major driver for consumers seeking value, especially when balancing household budgets.

- Cost-Effectiveness: Prepared meals from supermarkets can be 30-50% cheaper than restaurant dining.

- Convenience Factor: Many consumers find it equally, if not more, convenient to pick up a ready-to-eat meal during their regular grocery shopping.

- Quality Improvement: The quality of prepared foods in retail settings has significantly improved, closing the gap with restaurant quality for many consumers.

The threat of substitutes for Chuy's is substantial, encompassing home cooking, meal kits, and a wide array of other dining options. Consumers increasingly opt for convenience and value, with home preparation and readily available meal kits directly challenging casual dining. In 2024, the overall restaurant industry faced pressure from these alternatives, as consumers re-evaluated their spending habits and sought more economical or convenient meal solutions.

The rise of fast-casual and quick-service restaurants further intensifies this threat. These segments offer speed and often lower price points, appealing to a broad consumer base. For instance, the U.S. quick-service restaurant market's projected $330.5 billion value in 2024 underscores its strong consumer appeal. This means customers can easily substitute Chuy's for a quicker, more wallet-friendly meal from a competitor.

Third-party delivery services significantly broaden the substitute landscape. These platforms provide access to a vast culinary spectrum, allowing consumers to easily switch from Tex-Mex to Italian, Asian, or other cuisines without leaving their homes. The continued growth of food delivery, with billions of orders processed annually by major platforms, highlights how easily consumers can substitute Chuy's with a delivered meal from virtually any restaurant.

Supermarkets and convenience stores are also emerging as strong substitutes by offering high-quality prepared meals. These options provide a convenient and often more budget-friendly alternative to dining out. Many grocery chains now feature extensive deli sections with chef-prepared meals, directly competing with restaurant offerings for weeknight dinners, with prepared meals costing significantly less than a restaurant visit.

| Substitute Category | Key Attributes | Impact on Chuy's | 2024 Relevance |

|---|---|---|---|

| Home Cooking | Cost savings, control over ingredients | Reduces frequency of dining out | Growing due to economic factors |

| Meal Kits | Convenience, guided preparation | Competes for weeknight meals | Sustained consumer interest |

| Fast-Casual/QSR | Speed, lower price point | Attracts budget-conscious diners | Strong market growth ($330.5B projected for U.S. QSR market) |

| Diverse Cuisines | Variety, novelty | Offers alternatives to Tex-Mex craving | Increased preference for ethnic variety noted |

| Food Delivery Services | Unparalleled convenience, wide selection | Easy substitution from home | Billions of orders processed annually |

| Supermarket Prepared Meals | Convenience, cost-effectiveness | Direct competitor for quick meals | Improved quality, 30-50% cost savings |

Entrants Threaten

Opening a full-service restaurant, like Chuy's, demands a considerable upfront investment. This includes securing prime real estate, the costs associated with construction or renovation, outfitting a professional kitchen with essential equipment, and covering initial operating expenses such as inventory and staffing. For instance, the average cost to open a full-service restaurant in the US can range from $275,000 to over $1 million, depending on location and scale, as reported by industry analyses in 2024.

Chuy's has successfully built a robust brand and fostered deep customer loyalty, a significant barrier for potential newcomers. Their distinctive Tex-Mex atmosphere and commitment to fresh, scratch-made food, a strategy honed over decades, resonate strongly with patrons.

New restaurants entering the market would need substantial investment and considerable time to replicate Chuy's established brand recognition and cultivate a similarly devoted customer base. For instance, in 2023, Chuy's reported a 5.3% increase in comparable restaurant sales, underscoring the strength of their existing customer engagement.

Navigating the restaurant industry's intricate web of health, safety, and labor regulations presents a substantial hurdle for potential new entrants. For instance, in 2024, the average cost for a new restaurant to obtain all necessary permits and licenses could range from $5,000 to $20,000, depending on the location and scale of operation. These compliance costs, coupled with the sheer complexity, deter many aspiring restaurateurs.

Beyond regulatory burdens, the inherent operational complexities of managing a full-service restaurant chain, from securing reliable supply chains to effectively managing staffing across multiple locations, act as a significant barrier. In 2023, labor costs represented approximately 30-35% of revenue for full-service restaurants, highlighting the critical nature of efficient workforce management, a challenge for newcomers.

Access to Favorable Locations

Newcomers to the casual dining scene face significant hurdles in securing prime real estate. The market for desirable restaurant locations often sees high vacancy rates, but these vacancies may not align with the specific needs of a new establishment, creating a mismatch. For instance, in 2024, reports indicated that while some retail sectors experienced increased availability, prime restaurant-ready spaces in high-traffic areas remained competitive.

Established players like Chuy's, with their existing brand recognition and financial capacity, are better positioned to negotiate and secure these sought-after locations. This advantage makes it considerably more challenging for new entrants to find and acquire sites that offer optimal visibility and accessibility, a crucial factor for success in the restaurant industry.

- High Vacancy Rates: While overall retail vacancies might be elevated, prime restaurant locations are still scarce.

- Mismatched Opportunities: Available properties may not suit the specific requirements of new casual dining concepts.

- Established Chain Advantage: Brands like Chuy's can leverage their resources to secure the best sites.

- Barriers to Entry: Difficulty in acquiring ideal locations acts as a significant deterrent for new competitors.

Darden's Backing and Scale

Chuy's faces a reduced threat from new entrants due to its acquisition by Darden Restaurants. This backing provides significant capital, supply chain advantages, and managerial expertise that independent startups simply cannot match. For instance, Darden's 2024 fiscal year reported revenues exceeding $10 billion, illustrating the immense scale and resources Chuy's now leverages, making it exceptionally difficult for new, smaller competitors to enter the market and compete effectively.

The integration with Darden enhances Chuy's competitive position by:

- Access to Capital: Darden's financial strength allows for greater investment in store expansion, technology, and marketing, which new entrants would struggle to fund.

- Supply Chain Efficiencies: Leveraging Darden's established and powerful supply chain network offers cost savings and consistent quality that are hard for new players to replicate.

- Management Expertise: Darden's deep experience in restaurant operations, brand management, and strategic planning provides Chuy's with invaluable guidance, raising the bar for any potential new competitor.

The threat of new entrants for Chuy's is significantly mitigated by its acquisition by Darden Restaurants. This strategic move provides Chuy's with substantial financial backing, robust supply chain advantages, and extensive operational expertise that independent startups cannot easily replicate. Darden's considerable resources, evidenced by its over $10 billion in reported revenue for fiscal year 2024, create a formidable barrier to entry for smaller, emerging competitors seeking to challenge Chuy's market position.

| Factor | Impact on New Entrants | Chuy's Advantage |

|---|---|---|

| Capital Investment | High (e.g., $275k-$1M+ to open a full-service restaurant in 2024) | Leverages Darden's financial strength for expansion and marketing. |

| Brand Recognition & Loyalty | Difficult and time-consuming to build | Established customer base, evidenced by 5.3% comparable sales growth in 2023. |

| Regulatory Compliance | Costly (e.g., $5k-$20k in permits/licenses in 2024) and complex | Darden's experience streamlines compliance processes. |

| Operational Complexity | Challenging to manage supply chains and labor (labor costs ~30-35% of revenue in 2023) | Benefits from Darden's efficient supply chain and management expertise. |

| Real Estate Acquisition | Competitive market for prime locations | Darden's resources facilitate securing optimal sites. |

Porter's Five Forces Analysis Data Sources

Our Chuy's Porter's Five Forces analysis is built upon a robust foundation of data from Chuy's annual reports, investor presentations, and SEC filings, alongside industry-specific market research from firms like IBISWorld and Technomic.