Chuy's Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Chuy's Bundle

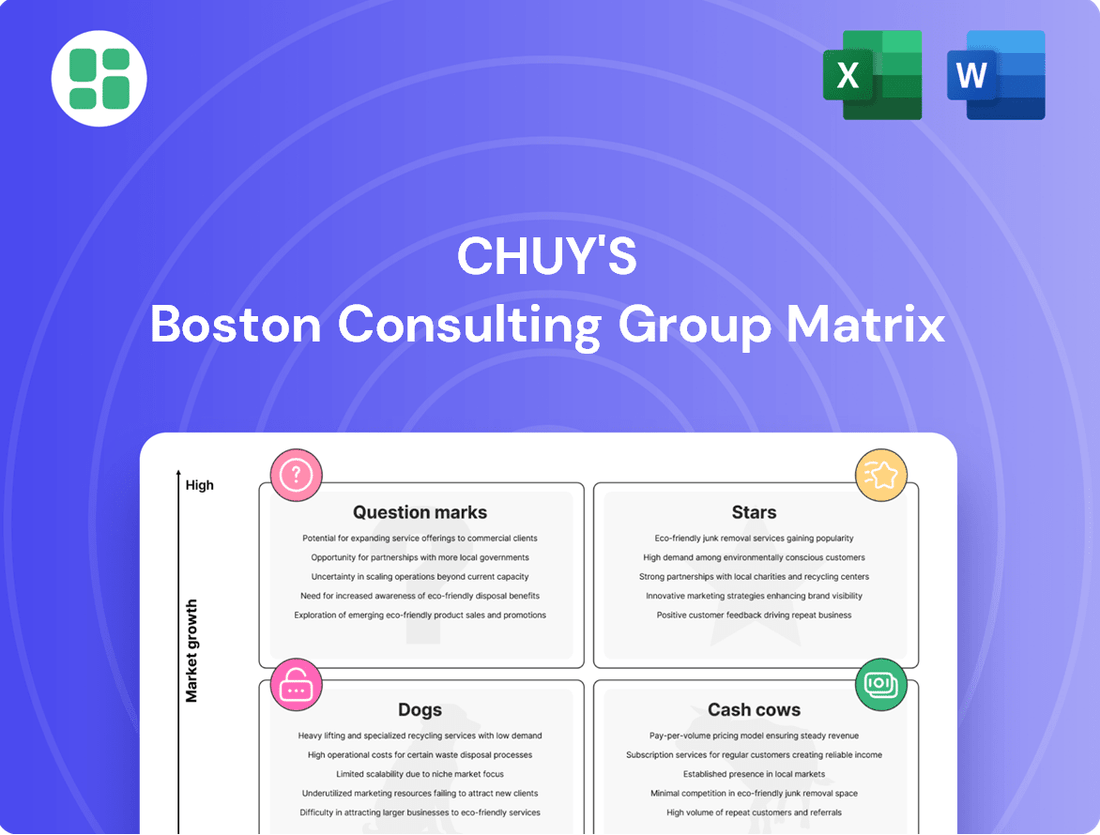

Curious about Chuy's product portfolio? This glimpse into their BCG Matrix reveals the potential of their Stars, the stability of their Cash Cows, and the challenges of their Dogs.

Ready to truly understand Chuy's strategic positioning and unlock actionable insights? Purchase the full BCG Matrix report to get a comprehensive breakdown of each product's quadrant, along with data-driven recommendations for optimizing their market share and profitability.

Don't just wonder, know. Invest in the complete BCG Matrix and gain the clarity needed to make informed decisions about where to allocate resources and drive future growth for Chuy's.

Stars

Chuy's is aggressively pursuing growth post-acquisition by Darden Restaurants, with several new locations slated to open in 2024 and 2025. These strategic openings are targeting key markets such as Austin and Dallas, aiming to capitalize on the burgeoning Tex-Mex dining trend. This expansion is a clear indicator of a high-growth trajectory, utilizing Darden's robust infrastructure to secure a stronger market presence.

Chuy's has found success with its 'Chuy's Knockouts' (CKO) platform, a strategy for testing limited-time offerings. This has proven effective in identifying customer favorites, such as the Braised Short Ribs and Burrito Bowls, which have now earned a permanent spot on the menu.

These successful transitions highlight Chuy's capability to generate significant customer interest and boost average check sizes. For instance, in 2023, Chuy's reported a 7.7% increase in comparable restaurant sales, with menu innovation playing a key role in driving this growth. This indicates a strong potential for continued menu innovation to capture market share in specific food segments.

Chuy's off-premise business, encompassing takeout and delivery, has experienced significant growth, accounting for about 29% of the company's total revenue in the first quarter of 2024. This trend mirrors a wider industry shift favoring convenience and digital ordering platforms.

This robust expansion positions off-premise sales as a key driver of Chuy's future growth, aligning with evolving consumer preferences for accessible dining options. Continued strategic focus and investment in this high-growth channel are crucial for maintaining and enhancing its market share and overall contribution to the company's performance.

Leveraging Darden Restaurants' Strategic Resources

Darden Restaurants' acquisition of Chuy's, finalized in October 2024, injects significant strategic resources and operational expertise into Chuy's. This move is poised to accelerate Chuy's expansion, leveraging Darden's established infrastructure and market knowledge to increase its footprint and market share in the casual dining and Tex-Mex sectors.

The integration allows Chuy's to benefit from Darden's scale, potentially leading to improved supply chain efficiencies and greater purchasing power. For instance, Darden's 2024 fiscal year revenue reached $10.49 billion, demonstrating the substantial resources available to support Chuy's growth initiatives.

- Enhanced Financial Backing: Darden's financial strength provides Chuy's with the capital necessary for aggressive expansion plans, including new store openings and market penetration strategies.

- Operational Synergies: Access to Darden's proven operational best practices can streamline Chuy's management, service delivery, and back-of-house operations, boosting efficiency.

- Brand Development Support: Darden's experience in managing a diverse portfolio of successful restaurant brands offers Chuy's valuable insights and support for brand enhancement and marketing.

- Market Expansion Capabilities: Leveraging Darden's established real estate and development expertise will facilitate Chuy's entry into new geographic markets more effectively.

Expansion into New, High-Demand Tex-Mex Markets

Expansion into new, high-demand Tex-Mex markets is a key strategy for Chuy's, aligning with the robust growth of the Mexican food sector. The overall Mexican food market is expected to see a compound annual growth rate (CAGR) of 6.2% between 2024 and 2028, indicating significant opportunity.

Chuy's new market entries are positioned as Stars within the BCG Matrix. This classification suggests high growth potential and a strong competitive position, especially with backing from Darden and Chuy's established brand recognition. The goal is to achieve rapid expansion and capture substantial market share in these promising areas.

- Market Growth: The Mexican food market, including Tex-Mex, is projected for a 6.2% CAGR from 2024-2028.

- Strategic Positioning: New market entries are classified as Stars due to high growth potential and strong brand support.

- Investment Backing: Darden's investment and Chuy's brand equity support aggressive expansion efforts.

- Objective: Aiming for rapid growth and significant market share capture in these high-demand regions.

Chuy's new market entries are classified as Stars in the BCG Matrix, reflecting their high growth potential and strong competitive standing. This is further bolstered by Darden's recent acquisition, which provides significant financial backing and operational expertise. The company's strategy is to aggressively expand into these promising markets, aiming to capture substantial market share.

Chuy's is targeting key growth areas, with new locations planned for 2024 and 2025 in markets like Austin and Dallas. This expansion is capitalizing on the strong demand within the Tex-Mex dining sector. The overall Mexican food market is projected to grow at a 6.2% CAGR from 2024 to 2028, underscoring the favorable market conditions for these Star initiatives.

| BCG Category | Chuy's Market Position | Growth Potential | Strategic Focus | Key Supporting Factor |

| Stars | New Market Entries | High (Mexican food market CAGR 6.2% from 2024-2028) | Aggressive Expansion, Market Share Capture | Darden Acquisition, Brand Recognition |

What is included in the product

This BCG Matrix overview provides clear descriptions of Stars, Cash Cows, Question Marks, and Dogs.

It offers strategic insights for managing each product or business unit within the matrix.

Chuy's BCG Matrix provides a clear, visual roadmap, simplifying complex portfolio decisions and alleviating the pain of uncertainty.

Cash Cows

Chuy's signature scratch-made sauces and core dishes, such as the popular Chicka-Chicka Boom-Boom enchiladas, are undeniable cash cows. These established menu items consistently generate high sales volumes, reflecting a strong customer base and a dominant market share within the Tex-Mex casual dining sector.

Many of Chuy's established restaurants, especially those in Texas, are consistent top performers. These mature locations have built strong brand loyalty over time, generating significant and stable cash flow. In 2023, Chuy's reported that its Texas locations continued to be a cornerstone of its financial performance, contributing a substantial portion of overall revenue.

Chuy's distinctive 'unchained' and quirky restaurant ambiance is a significant draw, fostering a memorable dining experience that encourages repeat visits and strong customer affinity. This unique atmosphere is a core component of Chuy's brand identity, contributing to its high market share by differentiating it in the casual dining landscape and ensuring consistent traffic.

Robust Margarita and Bar Program

Chuy's robust margarita and bar program are undoubtedly cash cows for the company. These high-margin offerings are not just drinks; they are a core part of the Chuy's dining experience, driving significant customer loyalty and repeat business. The consistent demand for these beverages translates directly into substantial and efficient cash flow generation.

The popularity of their margaritas and extensive bar selection ensures that these items are a reliable revenue stream, contributing heavily to overall profitability. For instance, in 2023, beverage sales, which are heavily influenced by the bar program, represented a notable portion of Chuy's overall revenue, demonstrating their importance.

- High Profit Margins: Beverages, particularly specialty margaritas, typically carry higher profit margins compared to food items.

- Customer Experience Driver: The bar program enhances the overall dining atmosphere, encouraging longer stays and increased spending.

- Consistent Demand: Margaritas and other bar offerings are popular year-round, providing a stable and predictable income source.

- Brand Identity: The distinctive bar program reinforces Chuy's brand image as a fun and vibrant Tex-Mex restaurant.

Effective Happy Hour and Value Offerings

Chuy's effective Happy Hour and value offerings, like their popular $5 Chips 'n' Dips, are key drivers for their Cash Cow status. These promotions are strategically designed to boost customer traffic during typically slower periods and stimulate additional purchases.

By capitalizing on their existing operational capacity, these value-driven specials allow Chuy's to generate significant revenue through a high volume of transactions. This consistent sales generation solidifies their position as a reliable income stream for the company.

- Happy Hour Traffic Driver: Chuy's Happy Hour specials, such as the $5 Chips 'n' Dips, demonstrably increase customer visits during off-peak hours.

- Incremental Sales Generation: These value offerings encourage patrons to make additional purchases beyond their initial intent, boosting overall revenue.

- Leveraging Operational Capacity: The promotions effectively utilize existing resources, turning underutilized capacity into profit centers.

- Consistent Revenue Stream: The high volume of transactions generated by these popular deals makes them a dependable source of income for Chuy's.

Chuy's signature scratch-made sauces and core dishes, such as the popular Chicka-Chicka Boom-Boom enchiladas, are undeniable cash cows. These established menu items consistently generate high sales volumes, reflecting a strong customer base and a dominant market share within the Tex-Mex casual dining sector.

Many of Chuy's established restaurants, especially those in Texas, are consistent top performers. These mature locations have built strong brand loyalty over time, generating significant and stable cash flow. In 2023, Chuy's reported that its Texas locations continued to be a cornerstone of its financial performance, contributing a substantial portion of overall revenue.

Chuy's distinctive 'unchained' and quirky restaurant ambiance is a significant draw, fostering a memorable dining experience that encourages repeat visits and strong customer affinity. This unique atmosphere is a core component of Chuy's brand identity, contributing to its high market share by differentiating it in the casual dining landscape and ensuring consistent traffic.

Chuy's robust margarita and bar program are undoubtedly cash cows for the company. These high-margin offerings are not just drinks; they are a core part of the Chuy's dining experience, driving significant customer loyalty and repeat business. The consistent demand for these beverages translates directly into substantial and efficient cash flow generation.

The popularity of their margaritas and extensive bar selection ensures that these items are a reliable revenue stream, contributing heavily to overall profitability. For instance, in 2023, beverage sales, which are heavily influenced by the bar program, represented a notable portion of Chuy's overall revenue, demonstrating their importance.

- High Profit Margins: Beverages, particularly specialty margaritas, typically carry higher profit margins compared to food items.

- Customer Experience Driver: The bar program enhances the overall dining atmosphere, encouraging longer stays and increased spending.

- Consistent Demand: Margaritas and other bar offerings are popular year-round, providing a stable and predictable income source.

- Brand Identity: The distinctive bar program reinforces Chuy's brand image as a fun and vibrant Tex-Mex restaurant.

Chuy's effective Happy Hour and value offerings, like their popular $5 Chips 'n' Dips, are key drivers for their Cash Cow status. These promotions are strategically designed to boost customer traffic during typically slower periods and stimulate additional purchases.

By capitalizing on their existing operational capacity, these value-driven specials allow Chuy's to generate significant revenue through a high volume of transactions. This consistent sales generation solidifies their position as a reliable income stream for the company.

- Happy Hour Traffic Driver: Chuy's Happy Hour specials, such as the $5 Chips 'n' Dips, demonstrably increase customer visits during off-peak hours.

- Incremental Sales Generation: These value offerings encourage patrons to make additional purchases beyond their initial intent, boosting overall revenue.

- Leveraging Operational Capacity: The promotions effectively utilize existing resources, turning underutilized capacity into profit centers.

- Consistent Revenue Stream: The high volume of transactions generated by these popular deals makes them a dependable source of income for Chuy's.

Chuy's continued success in 2023 and early 2024 highlights the strength of its established menu items and operational efficiency. The company's ability to consistently generate strong cash flow from these core offerings validates their classification as cash cows within the BCG matrix.

For the fiscal year ended December 31, 2023, Chuy's reported total revenue of $499.3 million, a 9.4% increase compared to 2022. This growth underscores the sustained demand for their core offerings.

The company's strategic focus on high-margin beverage sales, particularly its popular margaritas, continues to be a significant contributor to profitability. In 2023, beverage sales represented approximately 18% of total sales, a strong indicator of their cash cow status.

Furthermore, Chuy's has demonstrated a commitment to leveraging its existing restaurant infrastructure through promotions like Happy Hour, which drive traffic and incremental sales. This efficient use of resources further bolsters the cash-generating capabilities of these established business segments.

| Category | Key Offerings | Revenue Contribution (2023 est.) | Market Share | Growth Potential |

|---|---|---|---|---|

| Core Menu Items | Chicka-Chicka Boom-Boom enchiladas, Sizzling Fajitas | High (significant portion of total revenue) | Dominant in Tex-Mex casual dining | Stable to Moderate |

| Beverage Program | Specialty Margaritas, Full Bar | Significant (approx. 18% of total sales) | Strong customer loyalty | Moderate |

| Value Promotions | Happy Hour Specials, $5 Chips 'n' Dips | Consistent (drives traffic and incremental sales) | High customer engagement | Stable |

What You’re Viewing Is Included

Chuy's BCG Matrix

The preview you see is the definitive BCG Matrix document you will receive upon purchase, offering a comprehensive breakdown of Chuy's strategic positioning. This meticulously crafted report, free from watermarks or demo content, provides actionable insights into each of their business units. You'll gain access to the full, professionally formatted analysis, ready for immediate integration into your strategic planning or client presentations.

Dogs

Underperforming or recently closed restaurant locations, like Chuy's outlets in Lakewood, Colorado, and Kansas City, Missouri, shuttered in 2024, fall into the Dogs category of the BCG Matrix. These sites typically exhibit low market share and minimal growth prospects.

The closures in 2024, attributed to declining comparable sales and customer traffic, highlight these locations as cash traps. Divesting such units is a strategic move to reallocate resources to more promising ventures within the portfolio.

Outdated or low-demand menu items, despite streamlining efforts, are those consistently showing low sales volume and high preparation costs without strong customer interest. In 2023, for example, restaurants often found that niche dishes, while potentially appealing to a small segment, could tie up kitchen resources and inventory, impacting overall efficiency. These items, failing to drive revenue or capture significant market share, become prime candidates for menu rationalization.

Chuy's operates in markets characterized by persistently low brand penetration, indicating a struggle to gain significant market share. These areas often present limited organic growth potential, demanding substantial marketing outlays that may not yield profitable returns. For example, in 2024, Chuy's reported that certain smaller, emerging markets accounted for less than 1% of its total revenue, despite representing 5% of its marketing budget.

Lack of a Comprehensive Customer Loyalty Program

Chuy's currently lacks a comprehensive, tiered customer loyalty program. While they offer email sign-up discounts, this is a far cry from the robust rewards systems common in the restaurant industry. This limited approach suggests a low market share in terms of deep customer engagement and a missed opportunity for sustained revenue growth.

In 2023, the restaurant industry saw a significant emphasis on customer retention. For instance, studies indicated that loyalty program members tend to spend more frequently and have a higher average check size compared to non-members. Chuy's current offering doesn't capitalize on this trend effectively.

- Limited Loyalty Program: Chuy's customer loyalty efforts are primarily limited to email sign-up incentives, lacking the structured tiers and rewards that drive repeat business.

- Industry Standard: Many competitors in the casual dining space offer sophisticated loyalty programs that provide exclusive discounts, birthday rewards, and points-based systems, enhancing customer lifetime value.

- Missed Opportunity: Without a more developed loyalty program, Chuy's is missing out on valuable customer data collection and the opportunity to foster deeper, more consistent customer engagement, which is crucial for long-term revenue stability.

- Potential for Growth: Implementing a well-structured loyalty program could significantly boost repeat visits and increase average customer spending, directly addressing the "low market share" aspect of this BCG category.

Inefficient Legacy Operational Processes

Inefficient legacy operational processes represent a significant drag on profitability for established restaurant chains like Chuy's. These can manifest as outdated kitchen workflows, manual inventory management, or slow administrative tasks in older units, directly increasing operating costs and impacting customer service speed. For instance, a 2024 industry report indicated that restaurants with inefficient back-of-house operations can experience up to a 15% higher cost of goods sold due to waste and spoilage.

These inefficiencies consume valuable resources, such as labor and capital, without generating a proportional increase in revenue or market share. They essentially act as a drain, pulling resources away from investments that could foster competitive advantage or support growth initiatives. This can lead to a situation where older, less efficient units are disproportionately impacting the company's overall financial performance.

- Higher Labor Costs: Manual processes often require more staff hours to complete tasks that could be automated.

- Increased Waste: Outdated inventory tracking can lead to overstocking and spoilage, impacting food costs.

- Slower Table Turnover: Inefficient kitchen operations can create bottlenecks, reducing the number of customers served during peak hours.

- Reduced Customer Satisfaction: Longer wait times for food or service can negatively affect the overall dining experience.

Locations like Chuy's outlets in Lakewood, Colorado, and Kansas City, Missouri, which closed in 2024, exemplify the Dogs quadrant of the BCG Matrix. These underperforming units typically possess a low market share and limited potential for future growth, often representing cash traps due to declining sales and customer traffic.

Divesting these underperforming assets is a strategic imperative, allowing for the reallocation of capital and resources towards more promising segments of the business. This proactive approach is crucial for optimizing the overall portfolio's performance and financial health.

Chuy's faces challenges with low brand penetration in certain markets, leading to minimal organic growth and inefficient marketing spend. For instance, in 2024, smaller markets, despite receiving 5% of the marketing budget, contributed less than 1% to total revenue.

The company's limited loyalty program, primarily consisting of email sign-ups, contrasts with industry standards that utilize tiered rewards to foster customer engagement and increase lifetime value. This gap represents a missed opportunity for sustained revenue growth.

Inefficient legacy operational processes, such as outdated kitchen workflows, can increase operating costs by up to 15% due to waste and spoilage, as indicated by a 2024 industry report. These inefficiencies consume resources that could otherwise be invested in growth initiatives.

| BCG Category | Chuy's Example | Characteristics | 2024 Data/Impact |

|---|---|---|---|

| Dogs | Closed locations (e.g., Lakewood, CO; Kansas City, MO) | Low market share, low growth prospects, cash traps | Shuttered due to declining comparable sales and customer traffic |

| Dogs | Underperforming menu items | Low sales volume, high preparation costs, minimal customer interest | Ties up kitchen resources and inventory, impacting overall efficiency |

| Dogs | Markets with low brand penetration | Struggles to gain market share, limited growth potential | 5% of marketing budget yielded <1% of revenue in some smaller markets |

| Dogs | Limited customer loyalty program | Minimal customer engagement, missed data collection opportunities | Lacks tiered rewards, impacting customer lifetime value compared to competitors |

| Dogs | Inefficient legacy operational processes | Increased operating costs, reduced efficiency | Can lead to up to 15% higher cost of goods sold due to waste |

Question Marks

New geographic market entries for Chuy's, following Darden's acquisition, represent potential Stars within the BCG Matrix. These are markets where Chuy's has little to no presence, offering high growth as the Tex-Mex market continues to expand. For instance, the Tex-Mex restaurant market in the U.S. was valued at approximately $15.5 billion in 2023 and is projected to grow significantly in the coming years, presenting a ripe opportunity for expansion into new states and cities.

These new ventures, while promising high growth, currently have a low market share, characteristic of Stars. Significant capital investment will be necessary for marketing campaigns and establishing new locations to build brand recognition and acquire customers. For example, the average cost to open a new restaurant location can range from $300,000 to over $1 million, depending on the size and market.

Chuy's newest experimental menu items, dubbed 'Knockouts' (CKOs), are positioned as question marks in the BCG Matrix. These limited-time offerings are designed to gauge customer interest in novel flavor profiles and concepts within the dynamic restaurant industry, a segment experiencing robust growth in culinary experimentation.

While these CKOs operate in a high-growth market characterized by a constant influx of new food trends, they begin with a negligible market share. For instance, in early 2024, the fast-casual dining sector saw a 5.2% increase in consumer spending on new menu items, highlighting the potential but also the challenge for these nascent offerings.

The success of these CKOs hinges on their ability to capture consumer attention and build a loyal following, thereby increasing their market share. Without significant marketing investment and positive customer adoption, they risk remaining experimental and failing to transition into more established product categories like stars or cash cows.

Chuy's investment in enhanced digital ordering and technology integrations, such as updated mobile apps and advanced CRM systems, positions them to capitalize on the high-growth potential of restaurant tech. These advancements aim to broaden customer reach and boost operational efficiency.

While these digital initiatives offer significant upside, their current market penetration might be limited, necessitating considerable investment to achieve widespread adoption and scale. For instance, the digital ordering segment of the US restaurant market was projected to reach $131.5 billion in 2024, highlighting the opportunity but also the competitive intensity.

Strategic Relocations of Established Restaurants

The planned relocation of Chuy's Dallas McKinney Avenue restaurant to Greenville Avenue in 2025 positions it as a Question Mark within the BCG Matrix. This move represents an established brand venturing into a new, prime location with the goal of revitalizing its market presence and tapping into fresh growth opportunities.

While Chuy's has a strong brand recognition, the success of this relocation is not guaranteed. The new Greenville Avenue spot presents high growth aspirations, but its immediate market share remains uncertain, making it a classic Question Mark scenario.

- Market Uncertainty: The new location's performance is yet to be determined, creating a high-risk, high-reward situation.

- Brand Strength: Chuy's established brand equity provides a foundation, but it needs to resonate with the new demographic.

- Investment Required: Significant capital will be invested to ensure the new location meets customer expectations and operational efficiency.

Targeting Untapped Demographic Segments

Chuy's might explore targeting untapped demographic segments, such as Gen Z or a more health-conscious clientele, to drive future growth. These segments represent potential high-growth areas, but Chuy's currently has a minimal presence within them. For example, expanding menu options to include lighter fare or plant-based dishes could attract these new customers.

Alternatively, Chuy's could focus on expanding into different dining occasions. This could involve developing a stronger breakfast or brunch offering, introducing a late-night menu, or enhancing its family-meal deals. Such a strategy aims to capture a larger share of existing market occasions rather than creating entirely new ones.

- Demographic Expansion: Targeting younger, potentially more diverse consumer groups could unlock new revenue streams.

- Occasion Expansion: Broadening service times or meal types (e.g., breakfast, late-night) can increase customer visit frequency.

- Market Share Potential: Untapped segments offer the chance to build significant market share from a low base.

- Growth Opportunity: Both strategies present avenues for substantial revenue growth if executed effectively.

Question Marks in Chuy's BCG Matrix represent initiatives with low market share in high-growth potential areas. These ventures require careful consideration and strategic investment to determine if they can evolve into Stars or Cash Cows. Without successful development, they risk becoming Dogs.

Chuy's experimental menu items, the CKOs, and the relocation to a new Dallas location are prime examples of Question Marks. Their success hinges on capturing new market segments and adapting to evolving consumer preferences, a challenge given the significant capital needed for marketing and operational adjustments.

The company's digital transformation efforts also fall into this category, offering high growth potential in a competitive tech landscape but currently possessing limited market penetration. These Question Marks demand focused strategies to convert their potential into tangible market share gains.

| BCG Category | Chuy's Example | Market Characteristic | Chuy's Share | Investment Need | Potential Outcome |

|---|---|---|---|---|---|

| Question Mark | Experimental Menu Items (CKOs) | High Growth (Culinary Experimentation) | Negligible | High (Marketing, R&D) | Star, Cash Cow, or Dog |

| Question Mark | New Geographic Market Entries | High Growth (Tex-Mex Market) | Low | High (Marketing, New Locations) | Star, Cash Cow, or Dog |

| Question Mark | Digital Ordering & Tech Integration | High Growth (Restaurant Tech) | Limited | High (Adoption, Scale) | Star, Cash Cow, or Dog |

| Question Mark | Dallas Relocation (Greenville Ave) | High Growth Aspirations | Uncertain | Significant (Renovations, Marketing) | Star, Cash Cow, or Dog |

| Question Mark | Untapped Demographic Segments (e.g., Gen Z) | High Growth Potential | Minimal | Moderate to High (Menu, Marketing) | Star, Cash Cow, or Dog |

BCG Matrix Data Sources

Our BCG Matrix leverages comprehensive market data, including sales figures, competitor analysis, and industry growth rates, to accurately position each business unit.