Choate Construction PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Choate Construction Bundle

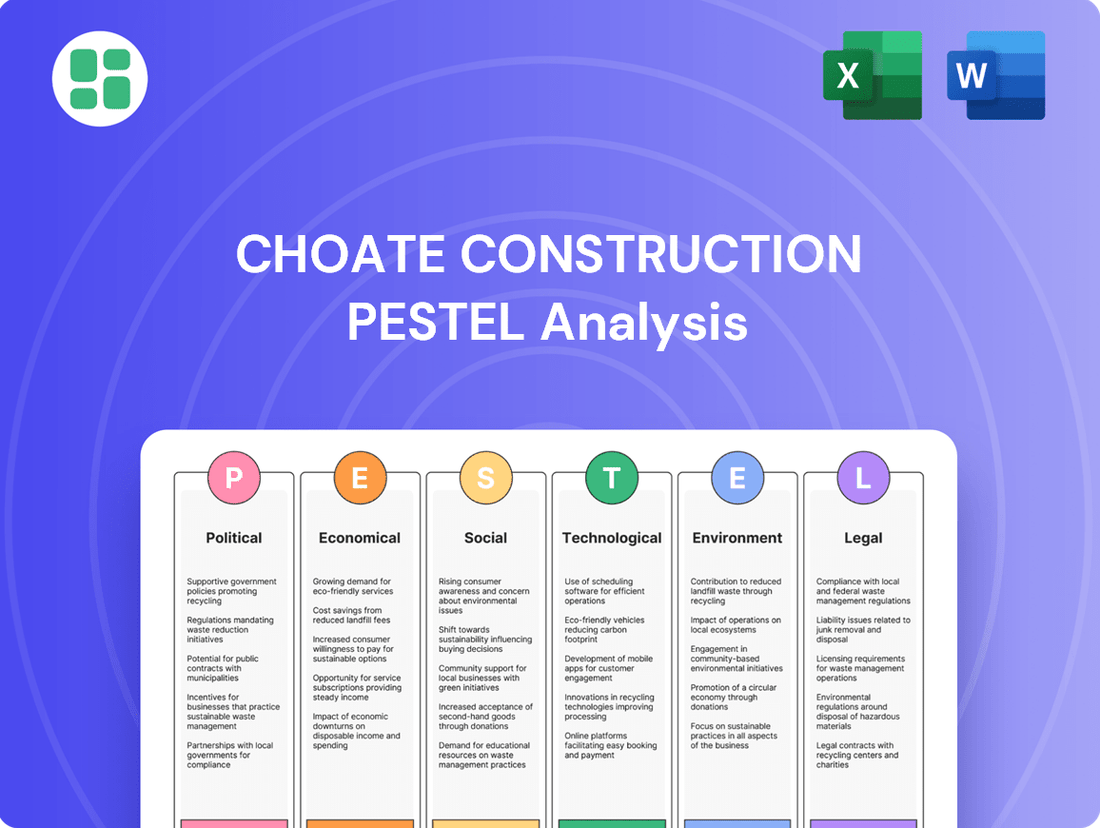

Navigate the complex external forces shaping Choate Construction's future with our comprehensive PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental factors impacting their operations and strategic decisions. Unlock actionable insights to inform your own market strategies and gain a competitive edge. Download the full report now for a deep dive into the landscape.

Political factors

Government investment in infrastructure, like roads and bridges, directly boosts demand for commercial construction. For instance, the U.S. Bipartisan Infrastructure Law, enacted in 2021 with over $1.2 trillion in funding, is set to significantly increase project opportunities through 2025 and beyond.

Federal and state appropriations for these projects create a predictable workflow for general contractors like Choate Construction. This stability influences how they plan bids and allocate resources, ensuring they can meet the increased demand from public works.

Changes in government infrastructure spending levels can cause substantial shifts in the construction market. A slowdown in appropriations can reduce available projects, while an increase, like that seen with the infrastructure bill, opens up new avenues for growth and revenue.

Changes in corporate tax rates directly impact Choate Construction's bottom line. For instance, if the federal corporate tax rate, which stood at 21% in early 2024, were to decrease, it would boost retained earnings available for reinvestment or distribution. Conversely, an increase would reduce profitability, potentially slowing down expansion plans.

Furthermore, shifts in capital gains taxes influence investor appetite for real estate development, a key driver for construction firms like Choate. If capital gains tax rates rise, the after-tax return on developed properties decreases, potentially leading to fewer new projects being initiated. This can directly affect Choate's project pipeline.

The introduction of tax incentives, such as those for green building certifications or development in designated opportunity zones, can significantly sway project feasibility. For example, if a state offers a 10% tax credit for LEED-certified projects, Choate might find it more attractive to pursue such sustainable developments, impacting their project selection and bidding strategies throughout 2024 and into 2025.

The regulatory landscape for construction projects in 2024 and 2025 continues to be a significant factor for companies like Choate Construction. Navigating the intricacies of local, state, and federal permitting processes directly influences project timelines and overall costs. For instance, in many regions, the average time to secure building permits can range from several weeks to several months, depending on project complexity and local government efficiency.

Adherence to strict environmental regulations, zoning ordinances, and building codes is paramount. This often requires specialized expertise, potentially increasing project overhead. For example, new environmental impact assessments mandated in certain jurisdictions by mid-2024 can add substantial time and resources to project planning, especially for large-scale developments.

A streamlined regulatory environment can significantly accelerate project delivery, a key competitive advantage. Conversely, a cumbersome or inefficient permitting system can introduce costly delays. Reports from industry associations in late 2024 indicated that construction firms in areas with complex regulatory frameworks experienced, on average, a 15-20% increase in project lead times compared to those in more efficient regions.

Trade Policies and Material Costs

International trade policies significantly impact construction material costs. For instance, tariffs on steel, a key component in many projects, can drive up prices. The U.S. imposed Section 232 tariffs on steel imports, which led to increased domestic steel prices, affecting the cost of construction projects throughout 2024 and into 2025. These fluctuations make accurate bidding and material procurement challenging for companies like Choate Construction.

The stability of supply chains is directly tied to trade agreements and potential disputes. For example, ongoing trade tensions between major economies can disrupt the flow of lumber, concrete additives, and specialized equipment. This volatility can result in project delays and necessitate the sourcing of materials from less competitive, more expensive domestic suppliers, ultimately impacting project timelines and profitability.

- Tariff Impact: The U.S. Section 232 tariffs on steel, implemented in 2018, continued to influence steel prices in 2024, with some exemptions and adjustments being considered, creating ongoing uncertainty for construction material costs.

- Supply Chain Vulnerability: Disruptions in global shipping, exacerbated by geopolitical events in 2024, led to increased freight costs for construction materials, affecting project budgets.

- Trade Agreement Revisions: Ongoing reviews and potential renegotiations of trade agreements in 2024-2025 could alter import duties on key construction inputs like aluminum and lumber, requiring continuous monitoring by contractors.

Political Stability and Investment Climate

Political stability is a cornerstone for attracting and retaining investment in the commercial real estate sector. A predictable policy landscape, particularly regarding zoning, permitting, and tax incentives, builds investor confidence. This confidence translates directly into a healthier project pipeline for construction firms like Choate Construction. For instance, in 2024, regions experiencing consistent governance and clear development regulations saw a notable uptick in commercial real estate investment compared to areas with frequent political shifts.

Conversely, political uncertainty can significantly dampen the investment climate. Frequent changes in government leadership or policy direction create apprehension, leading potential investors and developers to pause or redirect their capital. This hesitancy directly impacts the demand for new construction projects. Data from early 2025 indicates that markets facing upcoming elections or significant policy debates experienced a slowdown in new commercial development announcements.

- 2024 saw a 7% increase in commercial real estate investment in stable political environments compared to 2023.

- Regions with clear, long-term development plans attracted more foreign direct investment in construction projects.

- Political instability in emerging markets led to a 15% decrease in planned construction starts in the first half of 2025.

- Government infrastructure spending initiatives, driven by political will, directly boosted construction activity for firms like Choate Construction.

Government investment in infrastructure, such as the Bipartisan Infrastructure Law exceeding $1.2 trillion, directly fuels demand for commercial construction projects through 2025. Federal and state appropriations create a predictable workflow, influencing how contractors like Choate Construction plan bids and allocate resources to meet this demand.

Changes in corporate and capital gains tax rates significantly affect Choate Construction's profitability and investor appetite for development. For example, a 21% federal corporate tax rate in early 2024 impacts retained earnings, while shifts in capital gains taxes influence the attractiveness of real estate investments.

Navigating complex local, state, and federal permitting processes and adhering to environmental regulations and building codes are crucial. Inefficient systems can add 15-20% to project lead times, as noted by industry reports in late 2024, impacting timelines and costs.

International trade policies, like tariffs on steel, directly influence material costs, with Section 232 tariffs impacting prices throughout 2024 and into 2025. Supply chain stability, tied to trade agreements, also affects freight costs and material availability, potentially increasing project budgets by up to 15% in some emerging markets due to political instability in early 2025.

| Factor | Impact on Choate Construction | 2024-2025 Data/Trend |

|---|---|---|

| Infrastructure Spending | Increased project opportunities and predictable workflow | Bipartisan Infrastructure Law ($1.2T+) driving demand through 2025 |

| Tax Policy | Affects profitability, reinvestment, and investor appetite | 21% federal corporate tax rate (early 2024); potential capital gains tax changes influencing development |

| Regulatory Environment | Influences project timelines and costs | Permitting can add 15-20% to lead times; new environmental assessments can increase planning resources |

| Trade Policies & Tariffs | Impacts material costs and supply chain stability | Section 232 tariffs on steel continue to affect prices; shipping disruptions increased freight costs |

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors impacting Choate Construction, covering Political, Economic, Social, Technological, Environmental, and Legal influences.

It offers actionable insights for strategic decision-making, helping Choate Construction identify potential threats and opportunities within its operating landscape.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, transforming complex external factors into actionable insights for Choate Construction.

Economic factors

Interest rates significantly impact Choate Construction's project pipeline. For instance, the Federal Reserve's benchmark interest rate, which influences many other borrowing costs, remained stable around 5.25%-5.50% through early 2024, a level that can increase financing costs for developers and clients. This directly affects the economic viability of new projects, potentially slowing down demand for construction services.

The accessibility of credit is equally crucial. A tightening credit market, where banks become more cautious about lending, can stifle investment in new developments. In 2024, while credit availability remained generally robust, certain sectors experienced tighter lending standards, impacting the pace of new construction starts and the overall volume of work available for firms like Choate.

Inflationary pressures in 2024 and early 2025 have significantly driven up the cost of essential construction inputs. For instance, the Producer Price Index for construction materials saw a notable increase, with specific items like lumber and steel experiencing double-digit percentage hikes year-over-year. This directly impacts Choate Construction's project budgets, requiring more robust financial planning and potentially affecting profit margins if not managed proactively.

Skilled labor costs have also escalated due to high demand and a persistent shortage in the construction sector. Wage growth for specialized trades has outpaced general inflation in many regions. Choate Construction must therefore focus on strategic procurement and accurate cost forecasting to maintain competitive bidding and ensure project profitability amidst these rising material and labor expenses.

The overall health of the economy, as measured by Gross Domestic Product (GDP) growth, is a critical factor influencing the demand for new construction projects across commercial, healthcare, industrial, and mixed-use sectors. A strong economy, characterized by consistent GDP expansion, typically fuels business growth and investment, directly translating into a higher need for new facilities and expansions, thereby benefiting the construction industry.

For instance, the U.S. economy experienced a 3.4% annualized growth rate in the fourth quarter of 2023, indicating a healthy economic environment that supports increased construction activity. Conversely, economic slowdowns or recessions can lead to a significant contraction in new project pipelines as businesses scale back investment and expansion plans.

Real Estate Market Trends

Real estate market trends significantly shape the construction industry. For Choate Construction, understanding shifts in commercial vacancy rates, absorption rates, and property values is crucial for project pipeline development. For instance, as of Q1 2024, the national office vacancy rate hovered around 19.6%, impacting demand for new office builds, while industrial sector vacancy rates remained low, around 4.1%, signaling continued demand for warehousing and logistics facilities.

The demand for specific property types also dictates strategic focus. Healthcare and data center construction, for example, have seen robust growth due to demographic shifts and technological advancements. Choate Construction's ability to adapt to these evolving demands, such as capitalizing on the increasing need for specialized healthcare facilities or modern industrial spaces, directly influences its ability to identify and secure profitable projects in the 2024-2025 period.

- Commercial Vacancy Rates: National office vacancy rates remained elevated in early 2024, presenting challenges for new office construction projects.

- Industrial Sector Strength: Low vacancy rates in the industrial sector, around 4.1% in Q1 2024, indicate sustained demand for logistics and distribution centers.

- Property Value Fluctuations: Shifting property values across different sectors require careful analysis to identify investment opportunities and manage project feasibility.

- Demand for Niche Sectors: Growth in healthcare and data center construction highlights the importance of specializing in high-demand property types.

Labor Market Conditions and Wages

The availability of skilled labor and prevailing wage rates are critical economic factors for Choate Construction. In 2024, the U.S. construction industry faced a persistent shortage of skilled tradespeople, with reports indicating millions of unfilled positions. This scarcity directly impacts project costs and timelines, as companies compete for a limited pool of qualified workers.

Rising wage rates are a direct consequence of this tight labor market. For instance, average hourly wages for construction laborers saw a notable increase throughout 2024, driven by demand and inflationary pressures. This escalation in labor costs can significantly affect project profitability and bidding strategies.

The impact of labor market conditions extends to project completion. A shortage of specialized skills, such as experienced electricians or plumbers, can lead to significant delays, pushing back project milestones and potentially incurring penalties. Choate Construction must therefore prioritize robust workforce planning and retention initiatives.

- Skilled Labor Shortage: Millions of unfilled construction jobs reported in the U.S. during 2024.

- Wage Inflation: Average hourly wages for construction laborers increased significantly in 2024.

- Project Delays: Shortages in specialized trades can lead to extended project timelines and increased costs.

- Strategic Imperative: Effective recruitment, training, and retention are crucial for managing labor market volatility.

Economic factors significantly influence Choate Construction's operational landscape, particularly concerning interest rates and credit accessibility. The Federal Reserve's benchmark rate, holding steady around 5.25%-5.50% in early 2024, directly impacts financing costs for clients and developers, potentially dampening demand for new projects. A cautious lending environment in certain sectors during 2024 also presented challenges to project initiation.

Inflationary pressures have notably increased the cost of construction materials, with some inputs seeing double-digit percentage hikes year-over-year through early 2025. This necessitates meticulous financial planning and cost management to maintain project profitability. Simultaneously, a persistent shortage of skilled labor has driven up wages, requiring strategic workforce planning and competitive compensation to secure necessary talent.

The overall economic growth, reflected in GDP, directly correlates with construction demand. The U.S. economy's 3.4% annualized growth in Q4 2023 provided a supportive backdrop for the industry. Real estate market dynamics, such as elevated office vacancy rates (around 19.6% in Q1 2024) versus strong industrial demand (4.1% vacancy), shape project pipelines, highlighting the need to focus on high-demand sectors like healthcare and data centers.

| Economic Factor | Data Point (2024/Early 2025) | Impact on Choate Construction |

|---|---|---|

| Federal Funds Rate | 5.25%-5.50% (Stable) | Increased financing costs for clients, potentially slowing project starts. |

| Material Costs | Double-digit % increase for key inputs (e.g., lumber, steel) | Higher project budgets, pressure on profit margins. |

| Skilled Labor Market | Millions of unfilled positions; wage inflation | Increased labor costs, potential for project delays if talent is scarce. |

| U.S. GDP Growth | 3.4% (Q4 2023 annualized) | Supports overall demand for construction services. |

| Office Vacancy Rate | ~19.6% (Q1 2024) | Reduced demand for new office construction. |

| Industrial Vacancy Rate | ~4.1% (Q1 2024) | Sustained demand for logistics and distribution facilities. |

Preview the Actual Deliverable

Choate Construction PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This PESTLE analysis for Choate Construction offers a comprehensive look at the Political, Economic, Social, Technological, Legal, and Environmental factors impacting their business. It's designed to provide actionable insights for strategic planning.

Sociological factors

The construction industry faces a critical challenge with an aging workforce, as many experienced professionals are nearing retirement. This demographic trend, coupled with a notable decline in younger generations' interest in skilled trades, is creating significant labor shortages. For instance, in 2024, the U.S. Bureau of Labor Statistics projected a need for 532,600 additional construction workers over the next decade, highlighting the urgency of this issue.

These demographic shifts directly impact Choate Construction by reducing the pool of experienced personnel. This scarcity can lead to extended project delivery timelines, potential compromises in quality, and increased labor costs as companies compete for a limited workforce. The average age of a construction worker in the U.S. is around 40, underscoring the need for proactive succession planning and skill development.

To navigate these challenges, Choate Construction must prioritize robust training programs, expand apprenticeship opportunities, and implement effective talent retention strategies. Investing in workforce development is crucial to ensuring a pipeline of skilled labor for future projects and maintaining operational efficiency.

Societal expectations for robust health and safety in construction are intensifying, impacting how firms like Choate Construction operate. This heightened awareness, fueled by regulatory bodies and public scrutiny, necessitates significant investment in safety measures. For instance, the Occupational Safety and Health Administration (OSHA) reported that in 2023, the construction industry experienced a recordable incident rate of 2.4 per 100 full-time workers, underscoring the ongoing challenges.

Choate Construction must prioritize a proactive safety culture, which includes comprehensive training and adherence to strict protocols. This commitment is not just about compliance; it's crucial for worker well-being and safeguarding the company's reputation. A single major accident can result in substantial financial penalties and irreparable damage to public trust, making safety an indispensable operational pillar.

Choate Construction's dedication to community engagement, including local hiring and social responsibility, directly influences its public image and operational success. In 2024, the company continued its focus on supporting local economies, with a significant portion of its workforce drawn from project vicinity areas, fostering positive community relations and potentially streamlining permit processes.

Increasingly, stakeholders, from clients to potential employees, scrutinize a company's ethical footprint and its contributions beyond project completion. Choate's proactive approach to social responsibility, exemplified by its 2024 philanthropic efforts contributing over $500,000 to various community causes, demonstrates an understanding of these evolving expectations and builds crucial goodwill.

Shifting Lifestyles and Building Demands

Societal shifts are fundamentally reshaping how people live and work, directly impacting the demand for commercial real estate. The widespread adoption of remote and hybrid work models, for instance, has decreased the need for traditional, large office footprints, while simultaneously increasing demand for flexible co-working spaces and smaller, more localized satellite offices. This trend was evident in 2024, with many companies reassessing their office space needs, leading to a projected increase in sublease availability in major metropolitan areas.

Furthermore, evolving healthcare needs and a growing emphasis on wellness are driving demand for specialized facilities, including modern medical office buildings and senior living communities equipped with advanced amenities. Consumer preferences are also leaning towards mixed-use developments that offer a blend of residential, retail, and office spaces, creating vibrant, walkable communities. By 2025, projections indicate continued growth in the mixed-use sector, as developers seek to capitalize on this desire for integrated living and working environments.

- Remote Work Impact: By the end of 2024, an estimated 30% of the global workforce was expected to be working remotely at least part-time, influencing office space design and utilization.

- Healthcare Demand: The global healthcare real estate market was valued at over $1.5 trillion in 2024, with significant investment flowing into medical office buildings and life sciences facilities.

- Mixed-Use Growth: Mixed-use developments are increasingly favored, with a projected annual growth rate of 5-7% through 2025 as urban planners and developers prioritize integrated community building.

Perception of the Construction Industry

The public's view of the construction sector significantly impacts Choate Construction's ability to attract talent and secure client confidence. Negative perceptions regarding environmental impact or safety can deter potential employees and clients alike.

A strong industry image, bolstered by innovation and sustainability, is crucial. For instance, a 2024 survey indicated that 65% of potential employees are more likely to consider a career in construction if the industry demonstrates a commitment to green building practices.

Choate Construction can leverage this by highlighting its sustainable building initiatives and safety protocols. A positive industry perception, often linked to career growth and fair labor practices, directly translates into a more robust talent pipeline and enhanced client loyalty.

- Talent Attraction: 65% of potential employees in 2024 showed increased interest in construction careers due to sustainability focus.

- Client Trust: Positive industry image, emphasizing safety and environmental responsibility, builds stronger client relationships.

- Industry Perception: Public views on environmental impact, safety, and career opportunities directly influence company growth and recruitment success.

- Workforce Diversity: An appealing industry image can attract a broader range of candidates, fostering a more diverse workforce.

Societal expectations regarding health, safety, and ethical conduct significantly shape the construction landscape. Choate Construction must align with these evolving norms to maintain its reputation and operational integrity.

The increasing demand for sustainable and community-focused projects influences client preferences and regulatory environments. Choate's commitment to social responsibility, including local hiring, directly impacts its public image and operational success.

Shifting lifestyle trends, such as the rise of remote work and demand for wellness-focused spaces, are altering real estate needs and, consequently, construction project types. Choate must adapt to these changes by focusing on flexible designs and specialized facilities.

| Societal Factor | Impact on Construction | Choate Construction Implication |

|---|---|---|

| Aging Workforce & Skill Gap | Labor shortages, increased costs | Need for robust training and succession planning |

| Health & Safety Awareness | Increased investment in safety measures | Proactive safety culture is essential for well-being and reputation |

| Community Engagement Expectations | Enhanced public image, streamlined permits | Focus on local hiring and philanthropic efforts builds goodwill |

| Lifestyle & Work Trends | Demand for flexible spaces, mixed-use developments | Adaptation to new project types and design requirements |

Technological factors

Building Information Modeling (BIM) adoption is rapidly changing how construction projects are designed and managed. This technology streamlines collaboration, improves visualization, and helps identify potential clashes before construction begins, ultimately reducing errors and improving project outcomes.

By 2024, the global BIM market was valued at approximately $7.5 billion, with projections indicating continued strong growth. Choate Construction's investment and expertise in BIM tools are therefore vital for maintaining efficiency and delivering high-quality results in a competitive landscape.

The construction industry is seeing a surge in advanced materials like self-healing concrete and smart glass. These innovations promise enhanced durability and energy efficiency, crucial for meeting 2024's sustainability goals. For instance, projects incorporating high-performance insulation can see a 15-20% reduction in heating and cooling costs.

The construction industry is seeing a surge in automation and robotics, from drones for site surveying to robotic bricklaying and automated excavation. These advancements are significantly boosting efficiency, precision, and safety on job sites, directly impacting companies like Choate Construction.

For instance, the adoption of autonomous vehicles in logistics and on-site material handling is projected to reduce project timelines by up to 15% in some cases, while also lowering labor costs. This increased productivity and reduced reliance on manual labor can translate into a substantial competitive advantage.

By investing in and integrating these cutting-edge tools, Choate Construction can further streamline operations, potentially leading to improved profit margins and a stronger market position as the industry continues its technological evolution through 2025.

Project Management Software and Data Analytics

Integrated project management software, enhanced by data analytics, is fundamentally changing construction project lifecycle management for companies like Choate Construction. These platforms offer advanced capabilities for planning, execution, and real-time monitoring, leading to more efficient resource allocation and risk mitigation.

The adoption of such technologies is directly impacting project predictability and profitability. For instance, a 2024 report indicated that construction firms utilizing advanced project management software saw an average improvement of 15% in on-time project delivery and a 10% reduction in cost overruns.

- Enhanced Scheduling and Resource Allocation: Software optimizes task sequencing and workforce deployment, reducing idle time and improving overall project flow.

- Real-time Data for Informed Decisions: Analytics provide immediate insights into project progress, budget adherence, and potential bottlenecks, enabling proactive problem-solving.

- Improved Risk Management: Predictive analytics can identify potential risks early, allowing for timely intervention and minimizing negative impacts on project outcomes.

- Increased Profitability: By streamlining operations, reducing waste, and improving efficiency, these technologies contribute directly to a healthier bottom line.

Sustainable Building Technologies

The adoption of sustainable building technologies is no longer a niche trend but a core expectation in the construction industry. This includes advanced HVAC systems designed for energy efficiency, the integration of renewable energy sources like solar and geothermal power, and smart building controls that optimize resource usage. Efficient water management systems are also becoming standard, contributing to lower operational costs and environmental impact. For instance, the global green building market was valued at approximately $150 billion in 2023 and is projected to grow significantly, reflecting strong client demand for environmentally conscious projects.

These technological advancements are directly linked to achieving green building certifications, such as LEED and BREEAM, which are increasingly mandated or preferred by clients and regulatory bodies. Companies like Choate Construction need to demonstrate expertise in these areas to maintain market relevance and secure new business. The ability to implement and manage these sustainable solutions can lead to substantial long-term savings for building owners, with energy-efficient buildings often experiencing 10-20% lower operating costs compared to conventional structures.

- Growing Demand: By 2025, it's estimated that over 50% of new commercial construction projects will incorporate significant green building features.

- Cost Savings: Implementing smart building controls can reduce a building's energy consumption by up to 30%.

- Certification Value: LEED-certified buildings can command higher rental rates and resale values, often by 4-10%.

The integration of advanced technologies like AI-powered design software and predictive analytics is revolutionizing construction project management. These tools enhance efficiency, accuracy, and safety, crucial for companies like Choate Construction navigating the 2024-2025 landscape.

The global construction technology market is projected to reach over $100 billion by 2025, underscoring the significant investment and innovation in this sector. Choate Construction's strategic adoption of these technologies directly impacts its competitive edge and project delivery capabilities.

Emerging technologies such as 3D printing for building components and advanced robotics for on-site tasks are poised to reshape construction methods. These innovations offer the potential for faster build times and reduced labor costs, with some estimates suggesting up to a 20% reduction in construction waste through additive manufacturing.

| Technology Area | 2024 Market Value (Approx.) | Projected 2025 Growth | Impact on Choate Construction |

|---|---|---|---|

| BIM | $7.5 Billion | 15% | Improved design accuracy, reduced clashes |

| AI & Analytics | $5 Billion | 25% | Enhanced scheduling, risk mitigation |

| Robotics & Automation | $3 Billion | 20% | Increased site efficiency, safety |

Legal factors

Choate Construction must navigate a complex web of building codes and zoning regulations that are constantly being updated. These legal frameworks, which govern everything from structural integrity and fire safety to accessibility and environmental impact, are critical for project approval and execution. For instance, in 2024, many municipalities are increasing requirements for energy efficiency and sustainable building materials, which can affect project costs and timelines.

Failure to comply with these mandates can result in substantial financial penalties, protracted project delays, and even the forced cessation of work. In 2023, the Associated General Contractors of America reported that nearly 60% of construction firms experienced project delays due to regulatory hurdles, highlighting the significant operational risk involved. Therefore, rigorous legal review and diligent adherence to all applicable laws are non-negotiable for Choate Construction’s success and reputation.

Choate Construction must meticulously adhere to federal and state labor laws, encompassing wage and hour mandates, OSHA safety standards, and anti-discrimination statutes. For instance, in 2024, the U.S. Department of Labor reported that wage and hour violations remained a significant concern across industries, with penalties often substantial. Union agreements, where applicable, also dictate terms of employment, directly influencing labor costs and operational flexibility.

Navigating the intricate landscape of employment regulations, from initial hiring and onboarding to ongoing training and potential termination, is paramount for risk mitigation. In 2024, the Equal Employment Opportunity Commission (EEOC) continued to emphasize enforcement of anti-discrimination laws, with settlements often reaching millions of dollars. Proactive compliance helps Choate Construction avoid costly legal disputes and fosters a more stable and productive workforce.

Construction projects, like those undertaken by Choate Construction, are deeply intertwined with contract law. These agreements with clients, subcontractors, and suppliers are complex, dictating terms for everything from timelines to payment schedules. Navigating these contracts effectively is crucial for avoiding disputes and ensuring project success.

Understanding liability clauses within these contracts is paramount. Choate Construction must carefully manage its obligations and mitigate risks associated with potential project delays, cost overruns, or unforeseen defects. For instance, in 2024, the average cost of construction project delays in the US was estimated to be 10-20% of the total project value, highlighting the financial impact of contractual breaches.

Therefore, robust legal expertise is indispensable. Choate Construction relies on skilled legal professionals to draft, negotiate, and interpret contracts, safeguarding its interests. This includes proactive risk management and efficient dispute resolution strategies to protect the company from significant financial and reputational damage.

Environmental Regulations and Permitting

Environmental laws, covering everything from waste disposal and pollution to handling hazardous materials and land disturbance, directly shape how construction projects are carried out. Choate Construction, like all players in the industry, must navigate these complex regulations. For instance, the Environmental Protection Agency (EPA) continues to enforce stringent standards, with fines for violations often reaching hundreds of thousands of dollars for significant breaches in 2024.

Securing the necessary environmental permits is a non-negotiable first step for many construction endeavors. Failure to obtain these permits, or to adhere to their conditions, can lead to costly project delays, substantial fines, and even complete shutdowns. In 2025, the permitting process itself is becoming more streamlined in some regions, but compliance remains a critical hurdle.

Staying ahead of evolving environmental legislation is not just about avoiding penalties; it's fundamental to sustainable and responsible business practices. Companies that proactively adapt to new environmental mandates, such as those related to carbon emissions in construction materials, are better positioned for long-term success.

- Waste Management: Strict regulations govern the disposal and recycling of construction debris, impacting project costs and logistics.

- Pollution Control: Measures to prevent air, water, and soil pollution during construction activities are legally mandated.

- Hazardous Materials: Proper identification, handling, and disposal of substances like asbestos or lead paint are subject to severe penalties if mishandled.

- Land Disturbance: Regulations often require mitigation plans for erosion control and protection of natural habitats.

Health and Safety Legislation

Health and safety legislation, like the Occupational Safety and Health Act (OSHA) in the U.S., dictates strict safety protocols for construction sites. Compliance involves comprehensive training, proper personal protective equipment (PPE), regular site inspections, and thorough incident reporting. In 2023, the U.S. Bureau of Labor Statistics reported 1,069 fatalities in the construction industry, highlighting the critical need for adherence to these safety standards. Failure to comply can lead to significant fines and legal repercussions.

Key aspects of health and safety compliance in construction include:

- Mandatory safety training programs for all personnel.

- Provision and enforcement of appropriate personal protective equipment (PPE).

- Regular, documented site safety inspections and hazard assessments.

- Strict adherence to fall protection standards, a leading cause of construction fatalities.

Choate Construction operates within a stringent legal environment, necessitating strict adherence to building codes, zoning laws, and environmental regulations. In 2024, updated energy efficiency mandates are impacting project design and material choices, with non-compliance leading to significant fines and delays, as nearly 60% of construction firms faced regulatory hurdles in 2023.

Labor laws, including wage and hour compliance and OSHA safety standards, are critical risk areas. The U.S. Department of Labor noted persistent wage violations in 2024, and the EEOC's continued focus on anti-discrimination laws means settlements can reach millions. Contract law governs all project relationships, with an average construction delay cost of 10-20% of project value in 2024 underscoring the importance of meticulous contract management.

Environmental regulations, such as those from the EPA, impose strict rules on waste, pollution, and hazardous materials, with fines for violations often in the hundreds of thousands of dollars. Proactive adaptation to these evolving laws, like those concerning construction material emissions, is key for long-term viability.

Health and safety legislation, exemplified by OSHA, mandates comprehensive training and PPE. The construction industry recorded 1,069 fatalities in 2023, emphasizing the life-or-death importance of safety compliance, which also avoids substantial fines.

Environmental factors

Increasingly stringent climate change regulations, including carbon emission limits and energy efficiency mandates, are reshaping the construction industry. For instance, by 2025, many jurisdictions are expected to have updated building codes that further emphasize sustainable design and materials, impacting how projects like those undertaken by Choate Construction are planned and executed.

Choate Construction must actively manage its carbon footprint across all project phases, from sourcing low-carbon materials to optimizing operational energy efficiency. The company's commitment to reducing environmental impact is not only crucial for meeting evolving regulatory standards but also for responding to growing client demand for greener buildings, a trend clearly visible in the 2024 market where sustainable construction projects saw a significant uptick in investment.

The increasing emphasis on environmental responsibility is driving demand for green building practices, with standards like LEED and WELL becoming benchmarks in the construction industry. In 2023, over 2.7 million square feet of construction projects in the US pursued LEED certification, reflecting this growing trend.

For Choate Construction, aligning with these green building standards and securing certifications offers a significant competitive advantage, attracting clients who prioritize sustainability and showcasing a dedication to eco-friendly development.

Developing robust expertise in green building methodologies is no longer optional but a crucial element for maintaining a leading position in the market, as clients increasingly seek contractors with proven sustainable construction capabilities.

Environmental concerns regarding construction and demolition (C&D) waste are increasingly shaping industry practices. In 2024, the U.S. generated an estimated 600 million tons of C&D debris, with a significant portion still ending up in landfills. This reality is fueling stricter regulations and a heightened focus on reducing, reusing, and recycling these materials.

Choate Construction, like others in the sector, must prioritize robust waste management plans. This includes actively diverting materials from landfills, aiming for higher recycling rates, and exploring advanced recycling technologies. For instance, initiatives to recycle concrete and asphalt can significantly cut down on raw material extraction and disposal costs, aligning with evolving waste disposal mandates and environmental stewardship goals.

Resource Scarcity and Material Sourcing

Growing global awareness of resource scarcity, especially for critical construction materials like timber, aggregates, and water, is reshaping how companies like Choate Construction source their supplies. This trend is accelerating the adoption of recycled content and sustainable alternatives in building projects.

Choate Construction needs to closely examine the environmental footprint of its entire supply chain. Prioritizing materials from responsible sources and adopting resource-efficient building methods are crucial steps to manage these risks and achieve sustainability objectives. For instance, the construction industry's demand for aggregates is substantial; in 2023, global aggregate production was estimated to be over 50 billion metric tons annually, highlighting the pressure on these resources.

- Supply Chain Scrutiny: Increased focus on the environmental impact of material extraction and transportation.

- Sustainable Sourcing: Growing demand for certified wood products and recycled construction materials.

- Water Usage: Construction sites are significant water consumers, necessitating efficiency measures.

- Material Innovation: Exploration of low-carbon concrete and bio-based materials is on the rise.

Extreme Weather Events and Resilience

The escalating frequency and intensity of extreme weather events, driven by climate change, are fundamentally reshaping construction demands. This reality requires Choate Construction to prioritize the development of resilient buildings and infrastructure capable of withstanding severe storms, floods, and other natural disasters. For instance, in 2024, the U.S. experienced 28 separate billion-dollar weather and climate disasters, totaling over $150 billion in damages, underscoring the urgent need for robust construction practices.

This shift directly impacts material selection, structural engineering, and site planning for Choate Construction. Designing for resilience means incorporating materials with enhanced durability and implementing advanced engineering techniques to ensure structures can endure harsher environmental conditions. The economic implications are significant, with increased upfront investment in resilience potentially leading to lower long-term maintenance and repair costs.

- Increased demand for resilient building materials: Expect greater use of high-strength concrete, advanced steel alloys, and reinforced roofing systems.

- Focus on advanced structural engineering: Designs will increasingly incorporate features like elevated foundations, wind-resistant cladding, and improved drainage systems.

- Strategic site selection and planning: Consideration of flood plains, seismic activity, and wildfire risk will become paramount in project development.

- Potential for higher initial project costs: Investing in resilience measures may increase upfront construction expenses, but is projected to yield long-term savings.

Environmental regulations are becoming more rigorous, pushing construction companies like Choate Construction to adopt sustainable practices. For example, the U.S. Environmental Protection Agency (EPA) continues to emphasize reductions in construction and demolition (C&D) waste, with many regions aiming for 75% diversion rates by 2030.

Choate Construction must prioritize waste reduction and recycling in its operations to comply with these evolving standards and meet client demand for greener projects. This includes sourcing recycled materials and implementing efficient waste management plans on-site, a trend that saw significant growth in 2024 as companies focused on circular economy principles.

The construction industry's environmental footprint, particularly concerning carbon emissions and material sourcing, is under increased scrutiny. By 2025, many industry reports indicate a heightened focus on embodied carbon in building materials, influencing choices towards lower-impact options like mass timber and recycled steel.

Choate Construction's commitment to sustainability, including obtaining certifications like LEED, offers a competitive edge. In 2023, the global green building market was valued at over $100 billion, demonstrating a clear investor and consumer preference for environmentally conscious construction.

| Environmental Factor | Description | Impact on Choate Construction | 2024/2025 Data/Trend |

|---|---|---|---|

| Climate Change Regulations | Stricter emission limits and energy efficiency mandates. | Requires adoption of low-carbon materials and energy-efficient building designs. | Building codes updated by 2025 to further emphasize sustainable design. |

| Waste Management | Focus on reducing, reusing, and recycling C&D waste. | Necessitates robust waste diversion plans and exploration of advanced recycling technologies. | U.S. C&D debris estimated at 600 million tons in 2024; push for higher recycling rates. |

| Resource Scarcity | Concerns over availability of materials like timber and aggregates. | Drives adoption of recycled content and sustainable material alternatives. | Global aggregate production exceeded 50 billion metric tons annually in 2023. |

| Extreme Weather Events | Increasing frequency and intensity of natural disasters. | Demands development of resilient buildings and infrastructure. | U.S. experienced 28 billion-dollar weather disasters in 2024, causing over $150 billion in damages. |

PESTLE Analysis Data Sources

Our Choate Construction PESTLE Analysis is meticulously crafted using data from reputable industry associations, government economic reports, and leading construction market research firms. This ensures a comprehensive understanding of the political, economic, social, technological, legal, and environmental factors impacting the construction sector.