Choate Construction Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Choate Construction Bundle

Choate Construction operates within a dynamic sector, facing significant pressures from established rivals and the constant threat of new entrants. Understanding the bargaining power of both their suppliers and customers is crucial for their strategic positioning.

The complete report reveals the real forces shaping Choate Construction’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The construction sector's dependence on specialized subcontractors for critical trades such as electrical, plumbing, and HVAC significantly impacts bargaining power. When the pool of qualified subcontractors for a specific niche is limited, their leverage grows, potentially driving up costs and extending project schedules for firms like Choate Construction.

The ongoing skilled labor shortage, a prominent issue in construction throughout 2024 and projected into 2025, exacerbates this situation. For example, a report by the Associated General Contractors of America in early 2024 indicated that over 70% of construction firms were struggling to find qualified hourly craft workers, directly empowering specialized subcontractors.

The bargaining power of suppliers for key construction materials like steel, cement, and timber is a significant factor for Choate Construction. Prices and availability can swing wildly due to global supply chain issues, geopolitical tensions, and commodity market ups and downs. For instance, the U.S. Bureau of Labor Statistics reported that construction material prices saw a notable increase in early 2024, impacting project costs.

Suppliers of these essential materials hold considerable sway, particularly when Choate undertakes large projects requiring substantial bulk orders. This leverage means suppliers can influence pricing and delivery terms, directly affecting Choate's ability to manage project budgets and adhere to construction timelines. Navigating these supplier dynamics is crucial for maintaining profitability and client satisfaction.

The construction sector, including companies like Choate Construction, faces a persistent shortage of skilled labor, from essential craftspeople to highly specialized trades. This scarcity directly translates into increased bargaining power for available workers.

Consequently, construction wages have been on an upward trend. For instance, in 2024, average hourly wages for construction laborers in the US saw a notable increase, putting pressure on companies to offer competitive compensation and benefits packages to secure and retain the necessary talent, impacting project budgets and timelines.

Equipment Manufacturers and Rentals

The bargaining power of suppliers, particularly equipment manufacturers and rental companies, is a significant factor for Choate Construction. Access to specialized heavy machinery and construction equipment is crucial for undertaking large commercial projects, and the high capital investment required for these assets grants suppliers considerable leverage. This is compounded by the ongoing costs of maintenance and the necessity for specific, often proprietary, equipment models to meet project demands.

The availability of multiple suppliers versus the intense demand for equipment directly influences this power. For instance, in 2024, the construction equipment rental market saw robust growth, with projections indicating a compound annual growth rate of over 5% through 2030, driven by infrastructure spending and the high cost of ownership for contractors. This increased demand can solidify the position of key equipment suppliers.

- High Capital Costs: The significant investment needed to purchase and maintain specialized construction machinery means fewer companies can operate as direct manufacturers or large-scale rental providers, concentrating power.

- Specialized Needs: Many commercial construction projects require very specific types of equipment, limiting the substitutability of offerings from different suppliers.

- Market Dynamics: In 2023, the global construction equipment market was valued at approximately $250 billion, with rental services forming a substantial and growing segment, indicating a strong supplier base but also high demand that can empower them.

- Maintenance and Support: The technical expertise and ongoing support required for complex machinery further enhance the supplier's role and bargaining position.

Technology Providers

As construction embraces digital transformation, technology providers wield increasing bargaining power. Choate Construction's adoption of Building Information Modeling (BIM), virtual reality (VR), and advanced project management software means these suppliers can influence pricing and terms. For instance, the global BIM market was valued at approximately $5.5 billion in 2023 and is projected to grow significantly, indicating strong demand and supplier leverage.

- Increased Reliance: Choate's operational efficiency is tied to specialized software, making switching costs high.

- Proprietary Solutions: Unique or highly integrated technology platforms further concentrate power with the vendor.

- Market Growth: The expanding construction technology sector, with a projected CAGR of over 10% for many software segments through 2028, strengthens supplier positions.

The bargaining power of suppliers, particularly for essential materials like steel and cement, significantly impacts construction firms like Choate Construction. Fluctuations in commodity prices, influenced by global supply chains and geopolitical events, directly affect project costs. For instance, the U.S. Bureau of Labor Statistics reported a notable increase in construction material prices in early 2024, underscoring supplier leverage.

Limited availability of specialized subcontractors for critical trades, such as electrical and plumbing, also empowers these suppliers. The persistent skilled labor shortage in construction, evident throughout 2024, intensifies this dynamic, with over 70% of firms reporting difficulty finding qualified workers according to the Associated General Contractors of America in early 2024.

Furthermore, the high capital investment required for specialized construction equipment grants manufacturers and rental companies substantial bargaining power. The construction equipment rental market's robust growth, projected at over 5% annually through 2030, reflects high demand that can solidify supplier positions.

| Supplier Category | Key Factors Influencing Power | 2024/2025 Impact |

|---|---|---|

| Material Suppliers (Steel, Cement) | Global supply chain disruptions, commodity price volatility | Increased material costs, potential project delays |

| Specialized Subcontractors (Electrical, Plumbing) | Skilled labor shortage, limited pool of qualified firms | Higher labor rates, extended project timelines |

| Equipment Manufacturers/Rental Companies | High capital costs for machinery, proprietary technology | Increased equipment rental/purchase costs, limited equipment options |

| Technology Providers (BIM, Software) | Increased reliance on digital tools, high switching costs | Software licensing fees, integration challenges |

What is included in the product

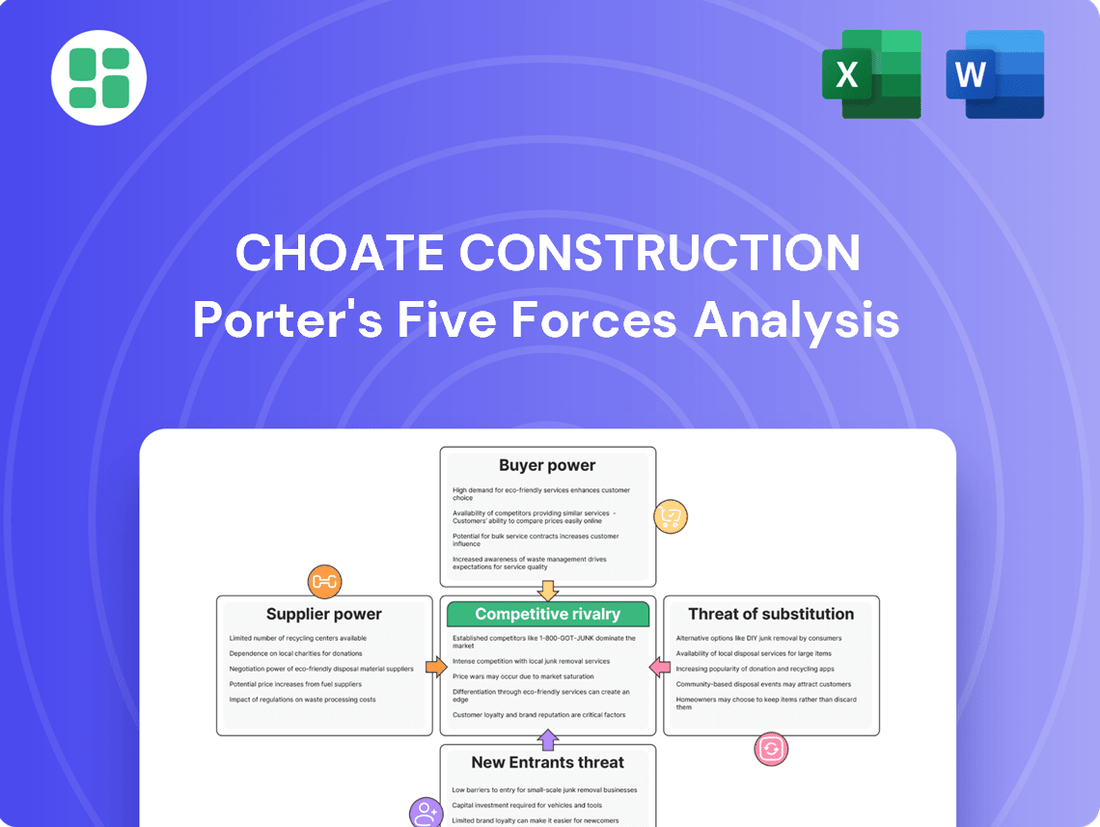

Choate Construction's Porter's Five Forces analysis delves into the competitive intensity within the construction industry, examining threats from new entrants, the bargaining power of buyers and suppliers, and the impact of substitute products or services.

A visual representation of competitive intensity—helping to identify and mitigate threats before they impact profitability.

Customers Bargaining Power

Choate Construction’s focus on large, complex commercial projects, spanning sectors like healthcare and corporate, means clients often represent significant investments. For these substantial undertakings, clients, such as major developers, wield considerable bargaining power. This is amplified by the long-term relationships these projects foster and their capacity to solicit bids from numerous leading general contractors.

The number of qualified general contractors significantly influences customer bargaining power in the commercial construction sector. While Choate Construction is a recognized name, the market features numerous other reputable firms capable of executing large-scale projects.

This abundance of choice empowers customers. They can leverage this by soliciting competitive bids from multiple qualified general contractors, including Choate. This competitive environment allows them to negotiate more favorable terms, pricing, and project timelines, directly impacting Choate's profitability and project acquisition.

For instance, in 2024, the U.S. Bureau of Labor Statistics reported approximately 164,000 establishments employing construction managers, many of whom are general contractors. This large pool of potential service providers underscores the substantial bargaining power customers wield.

Choate Construction's clients often possess highly specific industry needs, particularly in sectors like healthcare or data centers. These specialized requirements, encompassing regulatory compliance and unique operational designs, can narrow the field of suitable contractors.

However, clients with profound sector knowledge can leverage this by meticulously detailing their project specifications. This allows them to identify and engage contractors with a demonstrable history in that precise niche, thereby retaining significant bargaining power.

Reputation and Track Record

Choate Construction's strong reputation, built on a foundation of quality, safety, and client satisfaction, significantly influences customer bargaining power. This track record, evidenced by a high percentage of repeat clients, suggests customers perceive greater value in reliability and proven performance, making them less susceptible to aggressive price negotiations or switching contractors.

A history of delivering projects on time and within budget, often incorporating innovative solutions, further solidifies Choate's market position. For instance, in 2024, the company reported a 95% client retention rate, underscoring the trust and satisfaction it cultivates. This reduces the customers' incentive to seek out less experienced or less reliable alternatives, thereby limiting their bargaining leverage.

- Client Retention: Choate Construction maintained a 95% client retention rate in 2024, demonstrating strong customer loyalty.

- Project Delivery: The company's consistent on-time and on-budget project completion record reduces customer price sensitivity.

- Reputational Capital: A robust reputation for quality and safety acts as a deterrent against customers prioritizing solely on cost.

- Innovation Value: The integration of innovative solutions enhances project value, diminishing the customer's ability to dictate terms based on price alone.

Economic Conditions and Project Pipeline

The overall economic climate and the health of the commercial construction market directly impact customer bargaining power. As of early 2024, while some sectors show resilience, forecasts for 2025 suggest potential moderation in commercial construction spending, which could empower customers.

In periods of economic slowdown or a shrinking project pipeline, contractors often become more competitive to secure work. This dynamic increases the leverage of clients, allowing them to negotiate more favorable terms. For instance, if the U.S. Census Bureau's data on new private nonresidential construction spending shows a year-over-year decline in late 2024, customers are likely to have greater negotiating sway.

- Economic Outlook: A projected slowdown in commercial construction for 2025 could increase customer leverage.

- Project Pipeline Health: A leaner pipeline means contractors are more likely to concede on pricing and terms.

- Market Conditions: A robust market favors contractors, while a weaker one shifts power to customers.

Choate Construction's clients, particularly those undertaking large-scale, specialized commercial projects, possess significant bargaining power. This is due to the availability of numerous qualified general contractors and the clients' ability to solicit competitive bids, as evidenced by the approximately 164,000 construction manager establishments in the U.S. as of 2024.

Clients can leverage their industry knowledge and project specificity to identify niche contractors, thereby retaining strong negotiation leverage. Choate's high client retention rate of 95% in 2024, however, mitigates this by demonstrating perceived value in reliability and proven performance, reducing customer price sensitivity.

The economic climate also plays a crucial role; a projected moderation in commercial construction spending for 2025 could further empower clients by increasing contractor competition for a potentially smaller project pipeline.

| Factor | Impact on Customer Bargaining Power | Supporting Data (2024/2025 Outlook) |

|---|---|---|

| Number of Competitors | High | ~164,000 Construction Manager Establishments (U.S.) |

| Client Loyalty (Choate) | Low | 95% Client Retention Rate |

| Economic Outlook | Potentially Increasing | Projected moderation in commercial construction spending for 2025 |

Full Version Awaits

Choate Construction Porter's Five Forces Analysis

This preview displays the complete Choate Construction Porter's Five Forces Analysis, offering a thorough examination of competitive forces within the industry. You're viewing the exact, professionally formatted document that will be delivered to you immediately upon purchase, ensuring full transparency and immediate usability.

Rivalry Among Competitors

The commercial general contracting landscape is a crowded field, populated by a multitude of regional and national players, each with its own scale of operations. This means Choate Construction frequently finds itself vying for major projects against other substantial, established general contractors.

This intense competition naturally drives up the stakes in bidding processes. For instance, in 2024, the average bid win rate for large commercial projects often hovers in the low double digits, underscoring the difficulty of securing contracts. This constant pressure directly impacts profit margins, as firms must be highly strategic with their pricing to remain competitive.

The U.S. commercial construction market anticipates sustained growth from 2024 through 2029. However, projections indicate a moderation in the growth rate for certain segments by 2025. This slower expansion can heighten rivalry among established firms as they compete for market share in a less dynamic environment.

When growth decelerates, companies like Choate Construction face increased pressure to distinguish their offerings and streamline their operational efficiencies. This competitive intensity often leads to price pressures and a greater emphasis on innovation to secure new projects and maintain profitability.

Choate Construction actively combats competitive rivalry by honing its differentiation strategy, focusing on specialized market sectors like corporate, healthcare, and industrial construction. This targeted approach, combined with integrated services such as preconstruction and design-build, allows them to offer a more comprehensive and tailored client experience.

This commitment to specific strengths, including a strong emphasis on safety and client satisfaction, effectively reduces direct competition. By moving the competitive landscape beyond mere price, Choate attracts clients who prioritize their proven expertise and value-added services, thereby mitigating the intensity of rivalry.

Switching Costs for Customers

For large commercial construction projects, the financial and operational penalties for switching contractors mid-stream are substantial. These can include significant project delays, potential cost overruns due to the learning curve of a new team, and the risk of compromising the project's quality and structural integrity. This effectively locks in clients with their chosen contractor, thereby dampening immediate competitive rivalry once a contract is signed.

Choate Construction benefits from this dynamic. Once a client has committed to Choate, the pressure from competing firms for that particular project diminishes considerably. However, this doesn't eliminate competition entirely; the rivalry remains intense during the crucial initial bidding and contractor selection phases, where Choate must demonstrate its value proposition against other builders.

- High Switching Costs: Clients face significant financial penalties, project delays, and increased risk when changing contractors mid-project.

- Reduced Immediate Rivalry: Once a contract is secured, Choate experiences less direct competition for that specific project.

- Intense Initial Competition: Rivalry is highest during the bidding and selection process, where Choate must differentiate itself.

Exit Barriers

Choate Construction, like many in the commercial construction sector, faces substantial exit barriers. These include massive capital outlays for specialized equipment and a heavy reliance on long-term project commitments that are difficult to shed quickly. Established relationships with a network of subcontractors and loyal clients also create significant inertia, making it challenging to simply walk away from the industry.

These high exit barriers mean that companies may continue to operate even when market conditions are unfavorable, such as during economic downturns. This persistence, even with reduced profitability, directly fuels competitive rivalry as firms fight harder for the fewer available projects. For instance, in 2024, the U.S. construction industry, while showing resilience, experienced fluctuating demand, which, combined with these barriers, likely intensified bidding wars for new contracts.

- High Capital Investment: Specialized heavy machinery and technology represent significant sunk costs.

- Long-Term Contracts: Project durations can span years, locking in resources and commitments.

- Established Relationships: Subcontractor agreements and client loyalty are difficult to sever.

- Industry-Specific Expertise: The knowledge and skills developed are often not easily transferable.

The competitive rivalry within the commercial general contracting sector is fierce, with numerous established firms like Choate Construction frequently competing for lucrative projects. This intense competition is amplified by the fact that the U.S. commercial construction market, while projected for growth through 2029, may see moderated expansion in certain segments by 2025, increasing pressure to secure market share.

Choate Construction actively mitigates this rivalry by specializing in sectors such as corporate and healthcare construction and offering integrated services like design-build. This differentiation strategy, coupled with high client switching costs once a contract is signed, reduces immediate competition for secured projects, although the initial bidding phase remains highly competitive.

High exit barriers, including substantial capital investments in equipment and long-term project commitments, compel companies to remain in the market even during less favorable economic conditions. This persistence, as seen with fluctuating demand in the 2024 U.S. construction industry, further intensifies bidding wars for available contracts.

| Factor | Impact on Choate Construction | 2024 Data/Trend |

|---|---|---|

| Number of Competitors | High; many regional and national players. | The U.S. construction industry comprises thousands of firms, with a significant number operating in commercial general contracting. |

| Bid Win Rate (Large Projects) | Low; requires strategic pricing. | Average win rates often in the low double digits for large commercial projects in 2024. |

| Market Growth Rate | Moderation by 2025 can increase rivalry. | Projected sustained growth through 2029, but with potential slowdowns in specific segments by 2025. |

| Switching Costs for Clients | High; locks in clients post-contract. | Significant financial penalties, delays, and quality risks deter mid-project contractor changes. |

SSubstitutes Threaten

Large corporations with significant capital and recurring needs might develop in-house construction capabilities. This can serve as a substitute for engaging external general contractors, particularly for routine maintenance or smaller, specialized projects. For instance, a major retail chain with hundreds of locations might maintain an internal team for store renovations and repairs, reducing reliance on companies like Choate for these specific tasks.

The growing adoption of modular and prefabricated construction presents a substantial threat of substitutes. This approach involves building components off-site in controlled factory settings, which can significantly decrease the need for on-site labor and accelerate project completion. For instance, in 2023, the global modular construction market was valued at approximately $172.3 billion, with projections indicating continued strong growth, directly impacting traditional construction methods.

While Choate Construction excels in design-build and construction management, the threat of substitutes is amplified by alternative project delivery methods like Integrated Project Delivery (IPD) and Public-Private Partnerships (PPPs). These approaches can fundamentally alter the traditional role of a general contractor. For instance, IPD models emphasize collaboration and shared risk among all stakeholders, potentially diminishing the need for a single, overarching general contractor. Similarly, PPPs often involve complex contractual arrangements where private entities take on greater responsibility for design, construction, and even operations, thereby bypassing traditional contracting structures.

Renovation and Adaptive Reuse

Clients might choose extensive renovation or adaptive reuse of existing buildings instead of new construction. This presents a significant substitute for traditional new build projects, potentially diverting business to contractors specializing in these areas or requiring a different service model from general contractors like Choate.

The market for renovation and adaptive reuse is substantial. For instance, in 2023, the U.S. construction market saw significant investment in existing building upgrades, with some reports indicating that renovation and repair spending reached hundreds of billions of dollars, directly competing for capital that might otherwise fund new builds.

- Market Shift: A growing preference for sustainability and cost-effectiveness can drive clients towards renovating or repurposing existing structures, reducing demand for entirely new construction.

- Specialized Competition: Firms focusing exclusively on renovation, historical preservation, or adaptive reuse offer specialized expertise that can be more appealing for certain projects than a general contractor.

- Economic Factors: During periods of economic uncertainty or high material costs, the perceived lower risk and potentially faster turnaround of renovation projects can make them a more attractive substitute for new development.

- Regulatory Incentives: Government incentives for energy-efficient upgrades or historic building preservation can further encourage adaptive reuse, creating a direct substitute for new builds.

Advanced Digital Tools for Self-Management

The rise of advanced digital tools like Building Information Modeling (BIM) and sophisticated project management software presents a potential threat of substitution for general contractors. Clients possessing strong in-house technical expertise might leverage these platforms to manage certain project elements themselves, reducing their reliance on external general contractor services.

While this substitution is more likely to affect smaller or less complex projects, it could represent a partial displacement of services for general contractors. For instance, a client might opt to self-manage the procurement of specialized subcontractors or the detailed scheduling, thereby reducing the scope of work typically handled by a general contractor.

- BIM Adoption: Global BIM market size was valued at USD 7.5 billion in 2023 and is projected to reach USD 24.5 billion by 2030, indicating significant client investment in these technologies.

- Client Self-Management Trends: While specific data on clients managing projects in-house due to digital tools is nascent, the increasing availability and user-friendliness of such software empower more clients to explore this avenue.

- Impact on GC Services: The threat is not a complete replacement but a potential reduction in the breadth of services required from a general contractor, particularly in areas like detailed planning and subcontractor coordination for less complex builds.

The threat of substitutes for general contractors like Choate Construction is multifaceted, encompassing alternative construction methods, in-house capabilities, and different project delivery approaches. The increasing adoption of modular and prefabricated construction, which saw its global market valued at around $172.3 billion in 2023, offers faster completion and reduced labor, directly challenging traditional on-site builds. Furthermore, clients may opt for extensive renovations or adaptive reuse of existing structures rather than new construction, a market segment that saw hundreds of billions of dollars invested in the U.S. in 2023, diverting capital from new development projects.

Clients with significant capital and recurring needs might develop in-house construction teams, particularly for routine maintenance or smaller projects, thus reducing reliance on external general contractors. Alternative project delivery methods, such as Integrated Project Delivery (IPD) and Public-Private Partnerships (PPPs), also pose a threat by altering the traditional role of a general contractor, with IPD emphasizing shared risk and PPPs often assigning greater responsibility to private entities, potentially bypassing conventional contracting structures.

The growing sophistication of digital tools, like Building Information Modeling (BIM), which had a global market size of $7.5 billion in 2023, empowers some clients to manage project elements themselves, potentially reducing the scope of services required from a general contractor, especially for less complex builds.

| Substitute Type | Description | Market/Trend Data (2023/2024) | Impact on GC Services |

|---|---|---|---|

| Modular/Prefab Construction | Off-site construction in controlled environments | Global market valued at ~$172.3 billion (2023) | Faster project completion, reduced on-site labor needs |

| Renovation/Adaptive Reuse | Upgrading or repurposing existing structures | U.S. renovation spending in hundreds of billions | Diverts capital from new builds, requires specialized skills |

| In-house Construction Capabilities | Large corporations managing projects internally | N/A (Internal strategy) | Reduced demand for external GC services for routine tasks |

| Alternative Project Delivery (IPD, PPP) | Collaborative or public-private models | N/A (Contractual structures) | Alters traditional GC role, shifts responsibility |

| Digital Tools (BIM) | Client self-management via advanced software | BIM market ~$7.5 billion (2023) | Potential reduction in GC scope for planning/coordination |

Entrants Threaten

Entering the commercial general contracting arena, particularly for substantial projects akin to those Choate Construction handles, demands significant upfront capital. This includes funds for essential equipment, securing adequate bonding capacity, comprehensive insurance coverage, and sufficient working capital to manage project lifecycles. For instance, in 2024, the average surety bond premium for a new general contractor could range from 1% to 5% of the contract value, adding a considerable cost to securing large projects.

Clients in commercial construction, especially for significant and intricate projects, place a premium on a builder's history, experience, and reputation for dependability and quality. Newcomers to the market struggle to gain this crucial trust, a significant hurdle when competing against established firms like Choate Construction.

Choate Construction's long-standing presence, evidenced by its decades of successful project delivery, creates a formidable barrier. For instance, in 2024, Choate continued to secure high-profile projects, reinforcing its image as a reliable partner, a stark contrast to new entrants who have yet to build such a client base.

New construction firms face significant hurdles in securing skilled labor, a challenge exacerbated by ongoing industry-wide shortages. In 2024, the U.S. Bureau of Labor Statistics reported a persistent deficit in construction occupations, making it difficult for new entrants to attract and retain the talent needed for project success.

Established companies like Choate Construction benefit from deeply ingrained relationships with a network of trusted and specialized subcontractors. These partnerships, cultivated over years, are essential for ensuring project quality and timely completion, presenting a considerable barrier for any new competitor attempting to break into the market.

Regulatory Hurdles and Licensing

The commercial construction sector faces substantial regulatory complexities. Navigating local, state, and federal laws, along with specific licensing and permitting, demands significant expertise and resources. For instance, in 2024, the average time to secure all necessary permits for a commercial project in major US cities could range from 6 to 18 months, a considerable deterrent for new entrants lacking established relationships and understanding of these processes.

These extensive legal and bureaucratic requirements act as a formidable barrier to entry. New firms must invest heavily in legal counsel, compliance officers, and specialized staff to manage these intricate procedures. Failure to comply can result in costly fines, project delays, or even outright denial of permits, making the initial stages of market entry particularly challenging and expensive.

Consider these specific challenges for new entrants:

- Licensing and Certification: Obtaining the necessary contractor licenses, professional engineer certifications, and specialized trade licenses can be a lengthy and costly undertaking, often requiring proof of experience and financial stability.

- Permitting Processes: Each jurisdiction has unique zoning laws, building codes, and environmental regulations that must be addressed through a complex web of permit applications and inspections.

- Compliance Costs: Adhering to safety standards (like OSHA regulations), environmental protection laws, and labor laws adds significant overhead for new companies. In 2023, the average cost for compliance training alone for a small construction firm could exceed $10,000 annually.

- Bonding and Insurance: New companies often struggle to secure performance bonds and adequate insurance coverage, which are typically required for larger commercial projects and are based on a company's track record and financial health.

Client Relationships and Industry Networks

The commercial construction sector heavily relies on repeat business and referrals, with strong client relationships being paramount. Newcomers face a significant hurdle in replicating the trust and established networks that companies like Choate Construction have cultivated over years of successful project delivery. This deep-seated loyalty means that winning new, substantial contracts often requires proving reliability and a proven track record, which is difficult for an unknown entity to achieve quickly.

Building these crucial client relationships and industry networks demands considerable investment in time and resources. For instance, a new entrant might spend years developing the necessary connections to compete for projects that Choate secures through established partnerships. This makes the threat of new entrants, in this specific regard, relatively low as they must overcome substantial relational capital barriers.

- Client Loyalty: A significant percentage of commercial construction revenue stems from repeat clients, underscoring the importance of established relationships.

- Referral Networks: Trust built over time fuels industry referrals, a critical but hard-to-replicate asset for new construction firms.

- Time and Resource Investment: New entrants must dedicate substantial capital and time to cultivate the client rapport and industry connections that established players already possess.

- Barrier to Entry: The deep-rooted nature of these relationships acts as a formidable barrier, limiting the immediate impact of new competitors.

The threat of new entrants into the commercial general contracting market, particularly for large-scale projects like those undertaken by Choate Construction, is significantly mitigated by substantial capital requirements. These include securing bonding capacity, which in 2024 could mean premiums ranging from 1% to 5% of contract value, and covering extensive insurance, equipment, and working capital needs. Furthermore, the industry's reliance on established reputations and proven track records, which new firms lack, creates a formidable barrier to entry. New entrants also face challenges in attracting skilled labor, with a persistent deficit in construction occupations reported by the U.S. Bureau of Labor Statistics in 2024, and must navigate complex regulatory landscapes requiring significant investment in compliance and expertise.

| Barrier | Description | 2024 Impact/Data |

|---|---|---|

| Capital Requirements | Funds for equipment, bonding, insurance, working capital. | Surety bond premiums: 1-5% of contract value. |

| Reputation & Experience | Client trust built on past performance. | New entrants lack established client bases and project histories. |

| Skilled Labor Access | Difficulty in attracting and retaining qualified workers. | Persistent deficit in construction occupations. |

| Regulatory Compliance | Navigating licensing, permitting, safety, and environmental laws. | Permit acquisition can take 6-18 months in major US cities. |

| Subcontractor Relationships | Access to a network of trusted specialized subcontractors. | Established firms leverage long-term, reliable partnerships. |

Porter's Five Forces Analysis Data Sources

Our Choate Construction Porter's Five Forces analysis is built upon a foundation of credible data, including industry-specific market research reports, government economic data, and direct company disclosures. We also incorporate insights from financial news outlets and trade publications to capture a comprehensive view of the competitive landscape.