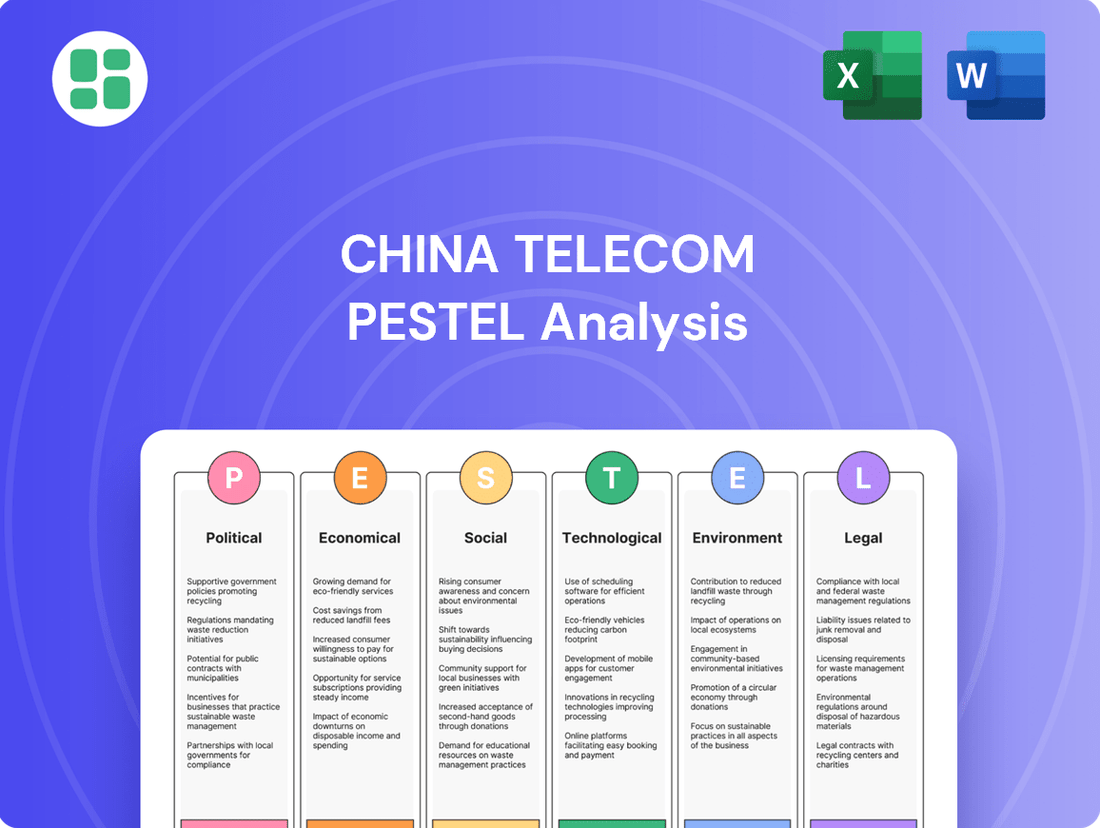

China Telecom PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

China Telecom Bundle

Navigate the complex external landscape impacting China Telecom with our comprehensive PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental factors driving the telecommunications giant's strategy and future growth. Gain a critical advantage by leveraging these expert-level insights to inform your own market approach. Download the full version now for actionable intelligence that empowers smarter business decisions.

Political factors

China Telecom, as a state-owned enterprise, operates under substantial government influence and strategic direction. This close relationship provides stable backing and ensures alignment with national development goals, such as the expansion of 5G infrastructure. For instance, in 2024, the Chinese government continued to prioritize telecommunications as a key sector for economic growth and digital transformation.

However, this state ownership means China Telecom's operations are subject to political priorities and directives from Beijing. Government mandates can significantly shape investment areas, influencing where the company allocates capital, and can also dictate service pricing and the dynamics of market competition within the telecommunications sector, ensuring services align with national strategic objectives.

The Chinese government, through bodies like the Ministry of Industry and Information Technology (MIIT), maintains robust regulatory oversight of the telecommunications sector. These regulations dictate crucial aspects such as licensing, spectrum allocation, and stringent network security protocols, directly shaping China Telecom's operational framework and compliance obligations. For instance, the ongoing push for 5G network expansion, supported by government policy, presents significant growth avenues, while data localization mandates can introduce operational complexities.

Escalating geopolitical tensions, particularly with Western nations, pose a significant risk to China Telecom's international operations and its access to advanced technology. For instance, the ongoing trade disputes and technology restrictions between the US and China, which intensified in 2023 and continue into 2024, could directly impact China Telecom's ability to procure essential network equipment and software. This environment necessitates a robust strategy for supply chain diversification and resilience in its global business dealings to mitigate potential disruptions.

National Cybersecurity Strategy

China's National Cybersecurity Strategy, a cornerstone of its digital governance, significantly shapes China Telecom's operational landscape. This strategy emphasizes data sovereignty and network security, compelling the company to align its infrastructure and services with national directives. For instance, the Cybersecurity Law of 2017 and subsequent regulations mandate strict data localization and cross-border transfer protocols, requiring substantial investment in compliant systems.

China Telecom must navigate these regulations, which often necessitate enhanced data storage and processing capabilities within China. This focus on security, while potentially bolstering domestic user confidence, also introduces considerable compliance overhead. In 2024, the ongoing evolution of these regulations continues to drive technological upgrades and strategic adjustments for telecom providers.

- Data Localization Mandates: China Telecom must ensure critical data, as defined by national regulations, is stored and processed within mainland China, impacting its global data management strategies.

- Increased Security Investments: The company is expected to allocate significant capital towards advanced cybersecurity measures, including encryption, network monitoring, and secure data handling systems to meet evolving compliance standards.

- Compliance Burden: Adherence to China's cybersecurity framework involves complex reporting requirements and regular audits, adding to operational costs and demanding specialized expertise.

Industrial Policy Support

The Chinese government's commitment to fostering strategic industries, particularly telecommunications, translates into substantial industrial policy support for companies like China Telecom. This backing is crucial for their growth and technological advancement.

China Telecom directly benefits from state-backed initiatives aimed at driving technological innovation, expanding infrastructure, and accelerating digital transformation across the nation's economy. This support is a significant enabler for deploying cutting-edge technologies.

This governmental assistance provides China Telecom with a distinct competitive advantage, enabling smoother and faster deployment of advanced technologies such as cloud computing and artificial intelligence. For instance, in 2024, the government continued to emphasize 5G network expansion and the development of data centers, key areas for China Telecom's operations.

- State-backed Funding: China Telecom has received significant state funding for R&D and infrastructure projects, contributing to its robust network capabilities.

- Digital Transformation Initiatives: Government policies promoting digital transformation across industries directly boost demand for China Telecom's services.

- Technological Advancement Support: Subsidies and preferential policies encourage the adoption and development of advanced technologies like AI and cloud services.

- Infrastructure Development: Continued government investment in telecommunications infrastructure, including 5G and fiber optics, supports China Telecom's network build-out.

China Telecom's operations are profoundly shaped by the Chinese government's strategic objectives and regulatory framework. As a state-owned enterprise, its alignment with national development goals, such as the widespread deployment of 5G, is paramount. The government's continued emphasis on telecommunications as a driver of economic growth and digital transformation, evident in 2024 policies, provides a stable operating environment and significant backing.

Government directives influence investment priorities, pricing strategies, and competitive dynamics within the sector, ensuring services support national aims. For instance, the ongoing push for 5G expansion, a key government initiative, continues to shape capital allocation and operational focus for China Telecom through 2024.

The Ministry of Industry and Information Technology (MIIT) oversees crucial regulations covering licensing, spectrum allocation, and network security, directly impacting China Telecom's operational framework and compliance needs. Data localization mandates, a significant aspect of China's cybersecurity strategy, require substantial investment in compliant systems and data management, adding to operational complexities and costs.

| Policy Area | Impact on China Telecom | 2024 Relevance |

|---|---|---|

| 5G Infrastructure Expansion | Government prioritizes and funds 5G rollout, creating growth opportunities. | Continued government investment in 5G networks and related data centers. |

| Cybersecurity & Data Localization | Mandates strict data handling and storage within China, increasing compliance costs. | Evolving regulations require ongoing investment in secure infrastructure and data management. |

| Geopolitical Tensions | Potential restrictions on access to advanced technology and equipment. | Ongoing trade disputes impact supply chain resilience and technology procurement. |

What is included in the product

This PESTLE analysis examines the external macro-environmental influences on China Telecom, dissecting the impact of Political, Economic, Social, Technological, Environmental, and Legal factors.

It provides actionable insights for strategic decision-making by identifying key trends and potential challenges within China's dynamic telecommunications landscape.

A PESTLE analysis of China Telecom provides a clear, summarized version of external factors, acting as a pain point reliever by simplifying complex market dynamics for easier referencing during strategic planning and decision-making.

Economic factors

China's economic growth, while moderating from previous decades, remains a significant driver for China Telecom. In 2024, projections suggest continued expansion, with the IMF forecasting a 4.6% GDP growth for China. This sustained growth fuels demand for telecommunication services as businesses invest in digital infrastructure and consumers upgrade their connectivity.

A healthy economic climate directly boosts China Telecom's revenue streams. For instance, increased consumer disposable income translates to higher spending on mobile data and premium broadband packages. Similarly, businesses expanding operations require more advanced ICT solutions, benefiting China Telecom's enterprise segment.

However, potential economic headwinds, such as global supply chain disruptions or domestic policy shifts, could temper this growth. Should China experience an economic slowdown, demand for telecommunication services might soften, impacting China Telecom's investment capacity and profitability, necessitating agile strategic adjustments.

Rising disposable incomes in China are a significant tailwind for China Telecom. As more Chinese citizens earn higher wages, they are increasingly willing to spend on premium telecommunications services. This includes upgrading to faster broadband, subscribing to higher-tier mobile plans with more data, and adopting smart home technologies that rely on robust connectivity. For example, the average disposable income per capita in China reached approximately ¥52,994 in 2023, a notable increase that fuels this consumer demand for advanced digital services.

Inflationary trends, particularly in energy, raw materials, and labor costs, can significantly impact China Telecom's operational expenses and capital expenditure. For instance, the Producer Price Index (PPI) in China saw a notable increase in early 2024, reflecting rising input costs across various sectors, which could translate to higher expenses for the telecommunications giant.

While China Telecom operates within a regulated environment that can offer some buffer, persistent cost increases can still squeeze profit margins if they cannot be effectively managed or passed on to consumers. Monitoring these inflationary pressures is crucial for the company's financial planning and the development of effective pricing strategies to maintain profitability.

Foreign Exchange Rate Stability

China Telecom's international operations and reliance on global supply chains make foreign exchange rate stability a critical economic factor. Fluctuations in the Renminbi (RMB) against other currencies can directly impact the cost of imported equipment and the value of revenue earned in foreign markets when converted back to RMB. A stable exchange rate environment is therefore beneficial for predictable financial planning and performance.

For instance, during 2024, the RMB experienced periods of depreciation against the US Dollar, which could have increased China Telecom's capital expenditure on imported technology. Conversely, a stronger RMB in certain periods might have reduced the cost of overseas operations but also lowered the RMB equivalent of foreign earnings.

Managing these currency risks is a core component of China Telecom's financial strategy. The company actively employs hedging strategies to mitigate potential losses arising from adverse currency movements. As of the latest available data in early 2025, the global economic outlook suggests continued, albeit potentially moderate, currency volatility, underscoring the ongoing importance of this factor for China Telecom.

- Impact on Costs: A weaker RMB increases the cost of imported network equipment and components.

- Revenue Conversion: Fluctuations affect the RMB value of revenue generated from international services or overseas subsidiaries.

- Financial Predictability: Exchange rate stability aids in forecasting earnings and managing international budgets.

- Hedging Importance: Proactive currency risk management through hedging is essential for mitigating financial performance impacts.

Investment in Digital Infrastructure

China's commitment to digital infrastructure development, particularly the expansion of 5G networks and data centers, significantly bolsters China Telecom's operational landscape. For instance, by the end of 2023, China had built out over 3.38 million 5G base stations nationwide, a figure expected to grow substantially. This robust build-out directly translates into a larger addressable market for China Telecom's services.

These government-led investments in fiber optics and cloud computing infrastructure provide the essential backbone for China Telecom's business. The company is not merely a passive recipient but an active participant, contributing to and benefiting from these national digital initiatives. This synergy fuels growth in areas like the Internet of Things (IoT) and advanced cloud services.

- 5G Network Expansion: China's 5G base station count surpassed 3.38 million by the end of 2023, creating a vast network for China Telecom.

- Data Center Growth: Significant investments in data centers support cloud computing and data storage, key growth areas for the company.

- Fiber Optic Backbone: Continued upgrades to fiber optic networks enhance broadband speeds and capacity, benefiting China Telecom's core services.

China's economic growth trajectory remains a primary driver for China Telecom, with the IMF projecting a 4.6% GDP growth for 2024. This expansion fuels demand for telecommunications services, as businesses invest in digital infrastructure and consumers seek enhanced connectivity, directly boosting China Telecom's revenue streams through increased consumer spending and enterprise ICT solutions.

Inflationary pressures, particularly concerning energy, raw materials, and labor, present a challenge to China Telecom's operational expenses and capital expenditure. For instance, China's Producer Price Index (PPI) saw increases in early 2024, indicating rising input costs that could impact the company's profit margins if not managed effectively through strategic pricing and cost control measures.

Foreign exchange rate stability is crucial for China Telecom, given its international operations and reliance on imported equipment. Fluctuations in the Renminbi (RMB) against currencies like the US Dollar directly affect capital expenditure on technology and the value of foreign earnings. As of early 2025, continued currency volatility underscores the importance of proactive hedging strategies for financial predictability.

| Economic Factor | 2024/2025 Data/Projection | Impact on China Telecom |

|---|---|---|

| China GDP Growth | Projected 4.6% (IMF, 2024) | Drives demand for telecom services, boosts revenue. |

| Disposable Income Per Capita | Approx. ¥52,994 (2023) | Increases consumer spending on premium digital services. |

| Producer Price Index (PPI) | Notable increase in early 2024 | Raises operational and capital expenditure costs. |

| RMB/USD Exchange Rate | Periods of depreciation observed in 2024 | Increases cost of imported equipment, affects foreign revenue conversion. |

Preview Before You Purchase

China Telecom PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This detailed China Telecom PESTLE analysis covers Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. It provides a comprehensive overview for strategic planning and market understanding.

Sociological factors

China's ongoing urbanization, with an estimated 65% of its population expected to live in cities by 2025, concentrates demand for advanced telecom services, benefiting China Telecom. This trend drives higher per-user revenue potential in urban centers.

However, China Telecom must address the digital divide, as rural internet penetration lagged urban areas significantly in 2024, with urban broadband speeds averaging 150 Mbps compared to rural averages of 70 Mbps. Bridging this gap requires substantial investment in infrastructure and tailored service offerings to ensure equitable access and foster adoption across diverse demographics.

The pervasive adoption of mobile internet in China, with smartphone penetration reaching an estimated 88.7% by the end of 2024, is fundamentally reshaping consumer expectations for telecom services. This digital shift means consumers increasingly demand high-speed, reliable connectivity to support activities like streaming high-definition video, engaging in immersive online gaming, and participating in the booming e-commerce sector, which saw online retail sales grow by over 10% in 2024.

China Telecom must therefore continuously adapt its service portfolio to meet these evolving digital habits. The growing preference for integrated digital experiences, where seamless connectivity is a given, necessitates ongoing investment in network infrastructure and the development of value-added services that complement these online behaviors. Failure to innovate risks falling behind competitors and losing market share to more agile digital service providers.

China's demographic shift towards an aging population, with the number of individuals aged 65 and over projected to reach 300 million by 2025, presents a significant societal change. This trend, while potentially moderating overall population growth, simultaneously cultivates a burgeoning market segment with distinct communication needs. China Telecom can capitalize on this by developing accessible and user-friendly services tailored to seniors, such as enhanced telehealth platforms and smart home solutions designed for ease of use.

Increased Demand for Remote Work/Education

The global surge in remote work and online education, amplified by recent events, has dramatically increased the need for dependable, high-speed internet. China Telecom is well-positioned to capitalize on this, as companies and schools increasingly depend on its network for essential connectivity.

This societal shift places a premium on robust network capacity and secure communication channels, directly benefiting China Telecom's core business. The company’s infrastructure is crucial for supporting these evolving demands.

- Broadband Growth: China's fixed broadband penetration reached 54.3 per 100 people by the end of 2023, indicating a strong market for China Telecom's services.

- Digital Learning Adoption: In 2024, online education platforms are projected to see continued user growth, requiring sustained investment in high-capacity networks.

- Remote Work Infrastructure: By early 2025, a significant percentage of Chinese enterprises are expected to maintain hybrid or fully remote work models, necessitating reliable enterprise-grade connectivity solutions.

Privacy Concerns and Data Security Awareness

As digital services become increasingly intertwined with daily life in China, consumers are showing a heightened awareness of and concern for data privacy and security. This trend necessitates that China Telecom actively demonstrate robust commitments to safeguarding user data and fortifying its digital platforms against breaches. Building and maintaining consumer trust through transparent data handling practices is paramount for ensuring sustained customer loyalty and a positive market reputation.

For instance, a 2024 survey indicated that over 70% of Chinese internet users expressed significant concerns about how their personal data is collected and used by service providers. This growing sentiment directly impacts how consumers perceive and interact with telecommunications companies. China Telecom's ability to effectively address these privacy concerns will be a key differentiator in the competitive landscape.

- Growing Consumer Awareness: A significant majority of Chinese internet users, upwards of 70% in 2024 surveys, are increasingly worried about personal data privacy.

- Trust as a Competitive Edge: Demonstrating strong data security and transparent practices is crucial for China Telecom to earn and maintain consumer trust.

- Impact on Loyalty: Proactive measures to protect user data can directly translate into higher customer retention and a stronger brand image for China Telecom.

- Regulatory Scrutiny: Heightened public awareness often leads to increased regulatory oversight, making compliance with data protection laws a critical operational factor.

China's aging demographic, with the elderly population expected to exceed 300 million by 2025, creates a unique market for specialized services. China Telecom can leverage this by offering user-friendly telehealth and smart home solutions tailored for seniors, enhancing their quality of life and creating new revenue streams.

Technological factors

China Telecom is heavily invested in the aggressive rollout and ongoing development of 5G infrastructure throughout China. This commitment translates into substantial capital expenditures, with the company investing billions in base stations, core network upgrades, and related technologies to provide ultra-fast, low-latency connectivity.

By the end of 2023, China Telecom had deployed over 1.3 million 5G base stations, a significant portion of the nation's total. The company's 2024 capital expenditure plan includes continued substantial investment in 5G network expansion and enhancement, aiming to further increase coverage and capacity.

The successful implementation and widespread adoption of 5G are crucial for unlocking new revenue streams by enabling advanced applications such as the Internet of Things (IoT), artificial intelligence (AI), and industrial automation, which are key strategic growth areas for China Telecom.

China Telecom is heavily investing in cloud computing and AI, aiming to embed these technologies across its services. For instance, in 2023, the company announced significant expansion plans for its cloud infrastructure, projecting substantial growth in its cloud segment revenue. This strategic push is designed to boost operational efficiency through AI-driven network management and enhance customer experiences via intelligent support systems.

China Telecom is leveraging big data analytics to refine network operations and understand customer preferences, leading to more tailored service offerings. For instance, by analyzing network traffic patterns, they can proactively address congestion and optimize resource allocation, enhancing service quality for their 400 million mobile subscribers as of Q1 2024.

The company's vast infrastructure is a key enabler for the expanding Internet of Things (IoT) ecosystem. With millions of connected devices already on their network, China Telecom is well-positioned to capitalize on the growth of smart city initiatives and industrial IoT solutions, projecting significant revenue streams from this sector in the coming years.

Research and Development Investment in Emerging Tech

China Telecom's commitment to R&D is crucial for its future. The company is heavily investing in cutting-edge areas like quantum communications and advanced cybersecurity. For instance, in 2023, China Telecom announced plans to significantly increase its R&D spending, with a focus on these emerging technologies, aiming to bolster its competitive edge in the rapidly evolving telecom landscape.

These strategic investments are designed to keep China Telecom at the vanguard of innovation, enabling the introduction of next-generation services. By staying ahead of technological trends, the company can effectively navigate the dynamic telecom sector. This proactive approach ensures China Telecom is well-positioned to capitalize on future market opportunities.

- Quantum Communications: China Telecom is actively exploring quantum communication networks, aiming for enhanced security and data transmission capabilities.

- Blockchain Applications: The company is investigating blockchain for secure data management, supply chain transparency, and digital identity solutions.

- Advanced Cybersecurity: Significant resources are allocated to developing sophisticated cybersecurity measures to protect its vast network infrastructure and customer data.

- R&D Investment Growth: China Telecom's R&D expenditure saw a notable increase in 2023, reflecting its dedication to technological advancement in these key areas.

Cybersecurity Innovations

China Telecom is actively enhancing its cybersecurity defenses against increasingly complex threats. The company is investing in advanced encryption, sophisticated threat detection systems, and secure network protocols to safeguard its infrastructure and user data. This focus is crucial as cybersecurity breaches can severely damage reputation and operational continuity.

By prioritizing robust cybersecurity, China Telecom not only meets stringent regulatory demands but also builds essential trust with its customer base. This commitment is vital for maintaining operational integrity in an environment where cyberattacks are a constant concern.

In 2024, China Telecom's cybersecurity spending is projected to align with global telecom trends, where investments in AI-driven threat intelligence and zero-trust architectures are paramount. For instance, the global cybersecurity market for telecommunications was valued at approximately $20 billion in 2023 and is expected to grow significantly, reflecting the industry's commitment to security.

- Investment in AI-powered threat detection: China Telecom is integrating artificial intelligence to proactively identify and neutralize emerging cyber threats in real-time.

- Implementation of zero-trust security models: The company is moving towards a zero-trust framework, assuming no implicit trust and continuously verifying every access request.

- Enhanced data encryption standards: Adopting next-generation encryption techniques ensures the confidentiality and integrity of sensitive customer and network data.

China Telecom's technological strategy is deeply rooted in its aggressive 5G network expansion, with over 1.3 million 5G base stations deployed by the end of 2023. The company is also heavily investing in cloud computing and AI, aiming to embed these technologies across its services to boost efficiency and customer experience.

Leveraging big data analytics for network optimization and customer understanding is a key focus, supporting its 400 million mobile subscribers as of Q1 2024. Furthermore, China Telecom is exploring advanced technologies like quantum communications and blockchain, alongside a significant increase in R&D spending in 2023 to maintain its competitive edge.

Cybersecurity is paramount, with investments in AI-powered threat detection and zero-trust models to protect its infrastructure and data, aligning with a global telecom cybersecurity market valued at approximately $20 billion in 2023.

Legal factors

China Telecom's operations are deeply intertwined with telecommunications law and licensing. The company must secure and maintain various licenses for its mobile, fixed-line, and internet services, which are critical for its business continuity. For instance, by the end of 2023, China Telecom held licenses covering a vast network of users, underpinning its market position.

Changes in these legal stipulations or licensing terms can significantly reshape China Telecom's operational scope and competitive environment. Staying compliant with evolving regulations, such as those concerning data privacy or network security, is paramount for avoiding penalties and ensuring uninterrupted service delivery.

China's evolving legal landscape, particularly concerning data privacy and security, presents significant operational considerations for China Telecom. Laws like the Cybersecurity Law, Data Security Law, and the Personal Information Protection Law (PIPL) mandate strict adherence to data handling practices.

China Telecom is obligated to ensure its data collection, storage, processing, and any cross-border transfer of user information fully comply with these comprehensive regulations. For instance, PIPL, which came into effect in November 2021, imposes stringent requirements on how personal information can be processed and transferred, impacting how China Telecom manages its vast user data.

Failure to meet these legal obligations can result in substantial penalties, including significant fines and severe reputational damage, underscoring the critical need for robust compliance frameworks within the company's operations.

China Telecom, despite its state-owned status, operates under stringent anti-monopoly and competition laws aimed at curbing market dominance and fostering fair play. Regulatory bodies like the State Administration for Market Regulation (SAMR) actively scrutinize its market activities, pricing, and any potential mergers or acquisitions to ensure a competitive environment.

In 2023, China's anti-monopoly enforcement saw significant activity, with SAMR issuing fines for various violations. While specific figures for China Telecom's direct penalties under these laws aren't always publicly detailed in isolation, the broader regulatory landscape underscores the importance of compliance. Failure to adhere to these regulations can result in substantial fines, impacting profitability and market standing, as seen in other sectors where large enterprises have faced penalties for anti-competitive practices.

Intellectual Property Rights Protection

China Telecom’s ability to protect its vast intellectual property, encompassing patents for network infrastructure, software, and innovative services, is paramount. This includes safeguarding its investments in 5G technology and digital platforms, which are central to its competitive edge in the 2024-2025 period.

The company must also diligently avoid infringing on the intellectual property rights of other entities. This is particularly important as China Telecom expands its global reach and engages in international collaborations, where IP compliance is rigorously scrutinized.

Navigating the intricate web of intellectual property laws, both within China and across its international markets, is crucial for China Telecom's ongoing technological advancement and strategic partnerships. In 2023, China reported over 3.5 million patent applications, highlighting the dynamic IP environment the company operates within.

- IP Protection Strategy: China Telecom actively protects its patents in areas like optical networking and mobile communications.

- Compliance: Ensuring non-infringement is key for international market entry and joint ventures.

- Regulatory Landscape: Adapting to evolving IP regulations in China and abroad is a continuous challenge.

- Innovation Investment: Protecting R&D investments, which saw significant growth in 2024, is vital for future service development.

International Sanctions and Compliance

China Telecom, as a global player, faces significant challenges from international sanctions and trade restrictions, notably those enacted by the United States. Navigating these complex regulations is paramount for its operations, impacting everything from supply chain integrity to its ability to access critical foreign technologies. For instance, in 2023, continued geopolitical tensions and specific US export controls on advanced semiconductor technology directly affect the telecommunications sector's ability to procure cutting-edge equipment, potentially influencing China Telecom's network upgrade strategies and service expansion plans.

Compliance with these evolving international legal frameworks is not merely a procedural requirement but a strategic imperative for China Telecom's continued global engagement. Failure to adhere to sanctions can result in substantial financial penalties, reputational damage, and the severe consequence of market exclusion, directly hindering its international growth ambitions and partnerships.

The company's commitment to compliance is essential for maintaining trust with international partners and investors. For example, in the first half of 2024, telecommunications companies globally have been increasingly scrutinized for their adherence to data privacy and security regulations, which are often intertwined with sanctions compliance, impacting cross-border data flows and service offerings.

- US Export Controls: Ongoing US restrictions on advanced technology can limit China Telecom's access to critical network infrastructure components.

- Geopolitical Tensions: Heightened international political friction directly influences the scope and enforcement of sanctions impacting global telecommunications.

- Compliance Costs: Significant resources are dedicated to ensuring adherence to a multitude of international legal and regulatory requirements.

- Market Access: Non-compliance risks exclusion from key international markets and partnerships, impacting revenue streams and technological development.

China Telecom's operations are governed by a complex legal framework, including licensing requirements for its various services and stringent data protection laws like the Personal Information Protection Law (PIPL). These regulations, which became more comprehensive in 2021, mandate strict data handling and cross-border transfer practices.

The company must also navigate China's anti-monopoly and competition laws, enforced by bodies like the State Administration for Market Regulation (SAMR), to ensure fair market practices. In 2023, SAMR's active enforcement across various sectors highlights the importance of compliance for large enterprises like China Telecom.

Intellectual property protection is critical, especially as China Telecom invests heavily in areas like 5G technology, with China seeing over 3.5 million patent applications in 2023. Safeguarding its innovations and avoiding infringement are key to its competitive edge and international collaborations.

Furthermore, China Telecom faces challenges from international sanctions and export controls, particularly those from the United States, which can affect access to advanced technologies. The first half of 2024 has seen increased scrutiny on global telecom firms regarding data privacy and security, often linked to sanctions compliance.

Environmental factors

China Telecom's vast network, encompassing numerous data centers and base stations, inherently demands substantial energy, directly impacting its carbon footprint. For instance, in 2023, the telecommunications sector globally saw a notable increase in energy demand driven by 5G deployment and data traffic growth, a trend China Telecom is part of.

The company is under growing pressure from regulators and stakeholders to integrate more energy-efficient technologies and transition towards renewable energy sources to mitigate its environmental impact. This aligns with China's national goals for carbon neutrality, pushing all major industries, including telecom, to adopt greener practices.

Key to China Telecom's sustainability strategy is the robust measurement and transparent reporting of its energy consumption. This includes tracking the kilowatt-hours used by its infrastructure and the corresponding carbon emissions, with annual sustainability reports detailing progress in reducing these figures.

The telecommunications industry, including China Telecom, faces increasing pressure regarding electronic waste (e-waste) due to the rapid upgrade cycles of network infrastructure and consumer devices. Estimates suggest that China generates millions of tons of e-waste annually, a figure projected to grow significantly.

Responsible e-waste management is crucial for China Telecom to mitigate environmental pollution and comply with evolving regulations. This involves implementing robust programs for the collection, refurbishment, and recycling of retired network equipment, ensuring hazardous materials are handled safely.

Encouraging customer participation in device recycling programs is also a key strategy. China Telecom can leverage its extensive retail network and digital platforms to promote the return of old mobile phones and other electronics, thereby contributing to a circular economy and reducing landfill burden.

China Telecom is making significant strides in adopting green technologies to boost its environmental sustainability. This commitment is evident in their deployment of energy-efficient network equipment and advanced cooling systems for data centers. For instance, by the end of 2023, China Telecom had already achieved a 10% reduction in energy consumption per unit of traffic compared to 2020, a testament to their green tech investments.

The company is also actively exploring renewable energy sources to power its operations. This strategic shift not only helps lower operational expenses by reducing reliance on traditional energy, but also strongly aligns with China's national environmental protection targets. These initiatives are crucial for long-term cost management and regulatory compliance.

Climate Change Adaptation Strategies

China Telecom must prioritize climate change adaptation to safeguard its operations. The company is focusing on building more resilient infrastructure, with investments in hardening base stations and fiber optic networks against extreme weather. For instance, in 2024, significant capital expenditure was allocated to reinforce coastal network facilities in anticipation of more frequent typhoons.

Developing robust backup and redundancy systems is crucial for service continuity. This includes expanding distributed power solutions and enhancing disaster recovery protocols. By mid-2025, China Telecom aims to have 95% of its critical network nodes equipped with multiple layers of power backup, a substantial increase from 80% in 2023.

Proactive planning for potential disruptions is a key component of their strategy. This involves detailed risk assessments for various climate-related scenarios and establishing clear communication channels for emergencies. Their 2024-2025 roadmap includes simulations of major flood and earthquake events to test response effectiveness and identify areas for improvement.

- Infrastructure Hardening: Upgrading network facilities to withstand increased frequency and intensity of extreme weather events, such as typhoons and heavy rainfall.

- Redundancy and Backup Systems: Enhancing power backup capabilities and implementing diverse network routing to ensure service continuity during disruptions.

- Disaster Preparedness and Response Planning: Conducting regular risk assessments and scenario-based drills to improve emergency response and minimize service interruptions.

Sustainability Reporting Requirements

China Telecom faces increasing demands for detailed sustainability reporting, driven by regulators, investors, and the public. These reports are crucial for showcasing environmental performance, governance, and social impact.

In 2023, China's regulatory landscape continued to emphasize ESG (Environmental, Social, and Governance) disclosures. For instance, the Shanghai Stock Exchange and Shenzhen Stock Exchange have been refining their ESG reporting guidelines, encouraging listed companies to provide more standardized data. This aligns with global trends, as seen in the EU's Corporate Sustainability Reporting Directive (CSRD), which aims to enhance transparency and comparability of sustainability information. Companies are expected to report on key environmental metrics such as carbon emissions, energy consumption, and waste management.

Adherence to these evolving reporting standards not only bolsters China Telecom's corporate transparency but also signals a strong commitment to environmental stewardship and responsible business practices, which are increasingly valued by stakeholders. For example, many global institutional investors, managing trillions in assets, now integrate ESG factors into their investment decisions, making robust sustainability reporting a competitive advantage.

- Regulatory Scrutiny: Increased focus from Chinese stock exchanges on ESG disclosures, mirroring global trends.

- Investor Expectations: Growing demand from institutional investors for transparent reporting on environmental, social, and governance performance.

- Public Awareness: Heightened public interest in corporate environmental responsibility and social impact.

- Data Transparency: Requirement to report on specific environmental metrics like carbon emissions and energy efficiency.

China Telecom's environmental strategy is increasingly focused on energy efficiency and renewable energy adoption. By the close of 2023, the company reported a 10% reduction in energy consumption per unit of traffic compared to 2020, a direct result of investing in energy-efficient equipment and advanced data center cooling. This commitment is further underscored by their exploration of renewable energy sources to power operations, aligning with China's national carbon neutrality goals and offering potential long-term cost savings.

The company is also actively addressing the growing issue of electronic waste. China Telecom is implementing programs for the collection, refurbishment, and recycling of retired network equipment, aiming to mitigate pollution and adhere to stricter environmental regulations. Encouraging customer participation in device recycling through its extensive retail and digital channels is a key component of this strategy, fostering a circular economy.

Climate change adaptation is another critical area of focus for China Telecom. The company is investing in hardening its infrastructure against extreme weather events, with significant capital allocated in 2024 to reinforce coastal network facilities. By mid-2025, China Telecom aims for 95% of its critical network nodes to have multiple layers of power backup, a substantial increase from 80% in 2023, ensuring service continuity.

China Telecom faces heightened demands for transparent sustainability reporting, driven by regulatory bodies and investors. In 2023, Chinese stock exchanges enhanced their ESG disclosure guidelines, mirroring global trends. This push for data transparency on metrics like carbon emissions and energy efficiency is crucial for attracting institutional investors who increasingly integrate ESG factors into their decision-making processes.

PESTLE Analysis Data Sources

Our China Telecom PESTLE Analysis is constructed using a blend of official government publications, reports from international financial institutions, and leading market research firms. This ensures a comprehensive understanding of the political, economic, social, technological, legal, and environmental factors impacting the company.