China Telecom Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

China Telecom Bundle

Uncover the strategic engine driving China Telecom's dominance with our comprehensive Business Model Canvas. This detailed breakdown reveals how they connect millions, innovate services, and maintain market leadership. Perfect for anyone aiming to understand or replicate success in the telecommunications sector.

Partnerships

China Telecom, as a state-controlled entity, deeply values its relationships with government agencies and other state-owned enterprises. These partnerships are crucial for obtaining necessary operating licenses, securing favorable policy frameworks, and participating in large-scale national infrastructure development. For example, in 2024, China Telecom continued its significant role in the ongoing build-out of 5G networks across the country, a project heavily influenced by government directives and funding.

These collaborations are instrumental in ensuring China Telecom operates within the established regulatory landscape and aligns its business objectives with national strategic priorities. This is particularly evident in initiatives like the Digital China strategy, which aims to leverage technology for economic growth and societal advancement, and in strengthening national cybersecurity measures, where government cooperation is paramount.

China Telecom's key partnerships with technology and equipment vendors are foundational to its operations. Collaborations with giants like Huawei and ZTE are essential for procuring network equipment, software, and innovative solutions, enabling the company to build and maintain its vast 5G infrastructure.

These strategic alliances are critical for China Telecom's advancement in cutting-edge fields such as artificial intelligence and cloud computing. For instance, in 2023, China Telecom continued its significant investment in 5G network build-out, with vendor partnerships playing a vital role in deploying new base stations and upgrading existing infrastructure across the country.

China Telecom actively partners with a wide array of content and application providers to bolster its service portfolio. This includes collaborations with major Over-The-Top (OTT) players and a diverse group of application developers.

These partnerships are crucial for building a robust digital ecosystem, offering users a richer experience across entertainment, smart home solutions, and specialized industry applications. For instance, in 2024, China Telecom continued to expand its content library by integrating more premium video and music streaming services, directly contributing to increased data consumption and customer loyalty.

Infrastructure Sharing Partners

China Telecom actively partners with other major domestic telecom providers, notably China Unicom, through co-building and co-sharing agreements. These collaborations focus on essential network infrastructure, such as 5G base stations, to enhance overall connectivity and service delivery.

These infrastructure sharing arrangements are crucial for optimizing capital expenditure and accelerating the rollout of new technologies across the country. By sharing resources, China Telecom and its partners can achieve wider network coverage more efficiently, benefiting both the companies and consumers.

- Co-building and Co-sharing: Agreements with China Unicom for 5G base stations.

- Capital Expenditure Optimization: Reduces individual investment burdens.

- Accelerated Network Coverage: Speeds up the deployment of new technologies.

- Industry Efficiency Improvement: Enhances resource utilization across the sector.

Enterprise and Industry Solution Partners

China Telecom actively cultivates partnerships with system integrators and specialized industry solution providers. These collaborations are crucial for building and delivering advanced Information and Communications Technology (ICT) solutions, particularly in areas like industrial digitalization and smart city initiatives. By working with these partners, China Telecom can effectively serve diverse vertical markets.

These strategic alliances allow China Telecom to provide highly customized digital transformation services to a broad spectrum of enterprise clients. For example, in 2024, China Telecom announced collaborations with several leading industrial automation firms to accelerate the adoption of 5G in manufacturing sectors, aiming to enhance operational efficiency by up to 20% for participating enterprises.

The company's engagement with large enterprises as solution partners further strengthens its market position. These relationships are instrumental in co-creating and deploying comprehensive digital solutions that address complex business challenges, thereby expanding China Telecom's reach and impact across various industries.

- System Integrators: Partnerships with firms like Huawei and ZTE in 2024 enabled the integration of advanced network technologies into enterprise solutions.

- Industry-Specific Solution Providers: Collaborations with companies specializing in IoT platforms and AI analytics are key for developing tailored solutions for sectors like smart agriculture and healthcare.

- Large Enterprises: Joint ventures and co-development projects with major industrial players facilitate the deployment of end-to-end digital transformation services.

- Enabling Digital Transformation: These partnerships are vital for China Telecom's strategy to offer comprehensive digital transformation services, driving innovation in areas like smart cities and industrial IoT.

China Telecom's key partnerships extend to financial institutions and investment firms, crucial for securing funding for its extensive network infrastructure projects. These alliances facilitate access to capital markets and support strategic acquisitions or joint ventures. For instance, in 2024, the company continued to leverage partnerships with major state-owned banks to finance its ongoing 5G and fiber optic network expansion, ensuring continued service improvement and market leadership.

| Partner Type | Key Role | Example Collaboration (2024) | Impact |

| Government Agencies & SOEs | Regulatory support, policy alignment, national projects | Digital China strategy, 5G network build-out | Operational licenses, favorable frameworks |

| Technology & Equipment Vendors | Network equipment, software, innovation | Huawei, ZTE for 5G infrastructure | Network deployment and upgrades |

| Content & Application Providers | Service portfolio enhancement, ecosystem building | OTT players, app developers for richer user experience | Increased data consumption, customer loyalty |

| Domestic Telecom Providers | Infrastructure sharing, resource optimization | China Unicom for 5G base station co-building | Optimized CAPEX, accelerated coverage |

| System Integrators & Solution Providers | ICT solutions, vertical market services | Industrial automation firms for 5G in manufacturing | Digital transformation, enhanced operational efficiency |

| Financial Institutions | Capital access, project financing | State-owned banks for network expansion | Sustained infrastructure investment |

What is included in the product

A detailed breakdown of China Telecom's operations, outlining its diverse customer segments, extensive distribution channels, and multifaceted value propositions across telecommunications and digital services.

This model is structured around the nine classic Business Model Canvas blocks, providing a comprehensive view of China Telecom's strategy and operational framework for strategic planning and stakeholder communication.

China Telecom's Business Model Canvas offers a structured approach to identify and address customer pains by clearly mapping out value propositions, customer segments, and key activities.

Activities

China Telecom's network infrastructure development and maintenance are crucial for its operations. This includes the ongoing expansion, upgrading, and upkeep of its extensive fixed-line, mobile (4G and 5G), and broadband networks. This continuous effort ensures dependable, high-speed connectivity nationwide, forming the essential foundation for all services offered.

In 2024, China Telecom continued its significant investment in 5G network build-out. By the end of 2023, the company had already deployed over 3.37 million 5G base stations nationwide. This aggressive expansion is key to supporting the growing demand for mobile data and enabling new digital services.

China Telecom's core activities revolve around providing a comprehensive suite of telecommunications services. This includes offering mobile communication, fixed-line telephone, and high-speed broadband internet access to a vast and diverse customer base across China.

The company actively manages millions of subscriber accounts, handles intricate billing processes, and continuously works to ensure a high quality of service for both individual consumers and households. This operational focus is crucial for maintaining customer satisfaction and market share.

As of the first half of 2024, China Telecom reported that its broadband user base reached 279 million, showcasing the significant scale of its internet service provision. Furthermore, its mobile subscriber base expanded to 409 million, highlighting its dominant position in the mobile market.

China Telecom is heavily invested in creating and rolling out sophisticated ICT solutions, including cloud services, big data tools, and AI capabilities tailored for businesses and government entities. This focus requires substantial investment in research and development, as well as the ability to customize offerings to meet the unique demands of various sectors.

In 2024, China Telecom continued its push into enterprise digital transformation, aiming to provide integrated solutions that enhance efficiency and innovation. The company reported significant growth in its cloud business segment, driven by demand for secure and scalable digital infrastructure. For instance, its cloud revenue saw a substantial year-on-year increase, reflecting its strategic success in this area.

Research and Development in Emerging Technologies

China Telecom is heavily invested in research and development for emerging technologies. This includes significant activity in areas such as 5G-Advanced, artificial intelligence (AI), quantum computing, and satellite communications. For instance, in 2023, the company announced plans to accelerate its AI integration across various business segments, aiming to enhance user experience and operational efficiency. This strategic commitment to R&D is crucial for maintaining its technological edge and developing future services.

The company's dedication to innovation is evident in its pursuit of technological leadership. By focusing on these cutting-edge fields, China Telecom aims to unlock new market opportunities and create next-generation offerings. This forward-looking approach ensures the company remains competitive in a rapidly evolving telecommunications landscape.

- 5G-Advanced Development: China Telecom is actively involved in the evolution of 5G, focusing on enhanced capabilities and new applications.

- AI Integration: Significant resources are allocated to leveraging AI for service improvement and network optimization.

- Quantum Computing Research: Exploration into quantum computing signals a long-term vision for advanced computational capabilities.

- Satellite Communication Expansion: Investment in satellite technology aims to broaden network coverage and provide new connectivity solutions.

Customer Service and Support Operations

China Telecom prioritizes extensive customer service through multiple touchpoints. This includes robust call centers, a widespread network of retail stores, and sophisticated online platforms, all designed to ensure customer satisfaction and provide timely assistance.

These operations are vital for addressing technical issues, guiding new subscribers through onboarding processes, and fostering long-term customer retention across their diverse service offerings, from mobile to broadband and enterprise solutions.

In 2024, China Telecom reported a significant focus on enhancing customer experience. For instance, their digital service channels handled a substantial volume of inquiries, contributing to improved customer satisfaction scores. The company also invested in training for its retail staff to better handle complex queries and product demonstrations, aiming to reduce churn rates.

- Multi-channel Support: Offering assistance via phone, in-person at retail locations, and through digital interfaces.

- Issue Resolution: Promptly addressing technical problems and service-related queries to minimize disruption.

- Onboarding and Retention: Facilitating smooth customer acquisition and implementing strategies to keep subscribers engaged.

- Customer Satisfaction: Continuously monitoring and improving service quality to meet and exceed customer expectations.

China Telecom's key activities encompass network infrastructure development, the provision of telecommunications services, and the creation of advanced ICT solutions. This includes substantial investment in 5G expansion, as evidenced by their deployment of millions of base stations, and a focus on enhancing customer service through various channels.

The company is also heavily invested in research and development for emerging technologies like AI and quantum computing, aiming to maintain a competitive edge and develop future services. In 2024, China Telecom reported significant growth in its cloud business, driven by enterprise demand for digital transformation solutions.

| Key Activity | Description | 2024 Data/Focus |

| Network Infrastructure | Building and maintaining fixed-line, mobile (5G), and broadband networks. | Continued aggressive 5G base station deployment; over 3.37 million by end of 2023. |

| Telecommunication Services | Offering mobile, fixed-line, and broadband services to consumers and businesses. | 279 million broadband users and 409 million mobile users as of H1 2024. |

| ICT Solutions | Developing and rolling out cloud, big data, and AI services for enterprises. | Significant growth in cloud revenue driven by enterprise digital transformation. |

| R&D and Innovation | Investing in emerging technologies like 5G-Advanced, AI, and quantum computing. | Accelerating AI integration for enhanced user experience and operational efficiency. |

| Customer Service | Providing support through call centers, retail stores, and online platforms. | Focus on enhancing customer experience via digital channels and staff training. |

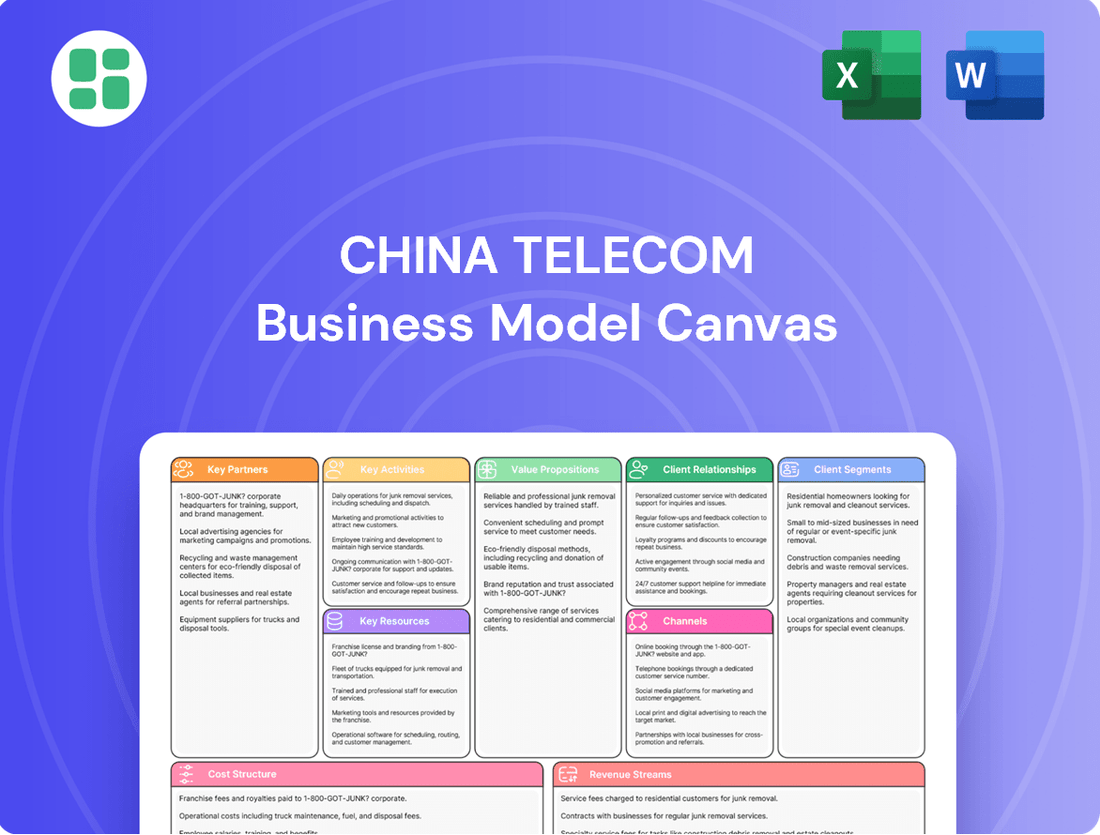

Preview Before You Purchase

Business Model Canvas

The China Telecom Business Model Canvas you are previewing is the actual, complete document you will receive upon purchase. This is not a sample or mockup, but a direct representation of the final deliverable, showcasing the strategic framework of China Telecom's operations. You can be assured that the content and structure you see here are precisely what you will gain access to, ready for your analysis and application.

Resources

China Telecom's extensive network infrastructure is its bedrock, encompassing a vast web of fiber optic cables and 5G base stations that blanket China. This physical asset is crucial for delivering all its communication and information and communication technology (ICT) services.

The company operates a significant number of data centers and has invested heavily in international submarine cables, enabling robust global connectivity. This comprehensive infrastructure underpins its ability to provide reliable and high-speed services to millions of customers.

As of the end of 2023, China Telecom reported having over 1.3 million 5G base stations deployed, a substantial increase that highlights its commitment to 5G expansion. Its fiber-to-the-home (FTTH) coverage reached over 1 billion households, demonstrating the sheer scale of its network reach.

China Telecom's status as a state-owned enterprise grants it essential spectrum licenses for mobile and wireless services. These licenses, along with regulatory approvals, are fundamental to its network operations and service expansion.

As of early 2024, China Telecom actively manages a significant portion of China's wireless spectrum, crucial for 5G deployment. The company's substantial investment in spectrum acquisition, exceeding billions of dollars in recent years, underscores its reliance on these key resources for maintaining a competitive edge.

China Telecom’s business model heavily relies on its extensive pool of highly skilled engineers, IT professionals, and dedicated R&D personnel. This human capital is crucial for the development, implementation, and ongoing management of sophisticated network technologies and cutting-edge ICT solutions that power their services.

These professionals are the driving force behind China Telecom's innovation, particularly in rapidly evolving sectors like artificial intelligence (AI), cloud computing, and other emerging technological fields. Their expertise ensures the company stays competitive by pushing the boundaries of what’s possible in telecommunications and digital services.

As of 2024, China Telecom reported a significant number of R&D personnel, with a strong emphasis on cultivating talent in areas like 5G, cloud-native technologies, and AI. This investment in human resources directly translates into their ability to offer advanced solutions and maintain a technological edge in the market.

Brand Reputation and Customer Base

China Telecom commands a robust brand reputation, a cornerstone of its business model, cultivated through decades of service. This national recognition translates into trust and preference among consumers and businesses alike.

The company boasts an extensive and loyal customer base, encompassing individual, household, and enterprise segments. This vast reach provides a significant advantage in market penetration and unlocks substantial cross-selling potential for new products and services.

As of the first half of 2024, China Telecom reported a total of 409 million mobile users, with 320 million being 5G users. This demonstrates the scale of their customer engagement.

- Strong Brand Equity: Decades of operation have solidified China Telecom's position as a trusted national brand.

- Massive Customer Reach: Serving millions across diverse segments provides a stable revenue foundation.

- Cross-Selling Opportunities: The broad customer base facilitates the introduction and adoption of new offerings.

- Market Dominance: High penetration rates in key segments underscore brand and customer loyalty.

Financial Capital and Government Support

China Telecom's access to substantial financial capital, often bolstered by state investment, is a cornerstone of its business model. This financial backing is crucial for the company's ongoing infrastructure development, research and development initiatives, and strategic acquisitions. For instance, in 2023, China Telecom invested significantly in 5G network expansion and technological innovation, leveraging its strong financial position.

Government support plays a pivotal role in creating a stable operating environment for China Telecom. This support not only facilitates the execution of large-scale projects, such as nationwide network upgrades, but also provides a degree of regulatory certainty. This allows the company to plan and invest with greater confidence in the long term.

- State-backed funding fuels infrastructure expansion: In 2023, China Telecom's capital expenditure reached approximately RMB 100 billion, a significant portion of which was directed towards 5G and fiber optic network build-out.

- Government policy enhances operational stability: Favorable government policies in telecommunications have historically supported the growth and stability of major state-owned enterprises like China Telecom.

- R&D investment driven by financial resources: The company's commitment to innovation, evidenced by its increased R&D spending in 2023, is directly supported by its robust financial capital.

China Telecom's intellectual property, including patents in areas like 5G technology, cloud computing, and network security, forms a vital resource. These innovations not only differentiate its offerings but also create barriers to entry for competitors.

The company actively invests in research and development, securing patents that are crucial for its future growth and technological leadership. As of early 2024, China Telecom holds thousands of patents, with a significant portion focused on next-generation communication technologies.

These intellectual assets enable China Telecom to develop proprietary solutions and offer services that are technically superior, driving value and competitive advantage in the fast-paced ICT market.

| Intellectual Property Area | Number of Patents (Approx. early 2024) | Strategic Importance |

|---|---|---|

| 5G Technology | Thousands | Core for mobile services, enabling higher speeds and lower latency. |

| Cloud Computing | Hundreds | Supports enterprise digital transformation and data services. |

| Network Security | Hundreds | Essential for protecting infrastructure and customer data. |

Value Propositions

China Telecom positions itself as a comprehensive, one-stop provider, bundling fixed-line, mobile, and broadband services with advanced Information and Communication Technology (ICT) solutions. This integrated approach simplifies customer engagement by offering a single point of contact for diverse communication and digital needs.

The company’s extensive portfolio extends to cloud computing, big data analytics, and artificial intelligence (AI) services, catering to businesses undergoing digital transformation. This broad service offering is designed to streamline procurement and management processes for enterprises, making it easier for them to adopt and leverage new technologies.

In 2024, China Telecom continued to emphasize its integrated service model, reporting significant growth in its cloud and big data segments. For instance, its cloud services saw a substantial year-on-year increase in revenue, reflecting strong enterprise adoption of its digital transformation solutions.

China Telecom's extensive network infrastructure is a key value proposition, offering reliable connectivity across both urban centers and remote rural regions. This commitment ensures that a vast customer base, from individual users to large enterprises, experiences high-quality and stable service.

In 2024, China Telecom continued to bolster its 5G network, reaching over 3.37 million 5G base stations nationwide by the end of the year. This massive deployment underscores their dedication to providing dependable, high-speed connectivity, a critical factor for businesses relying on seamless communication and data transfer.

China Telecom's advanced ICT and digital transformation solutions are a cornerstone for enterprises seeking to modernize. They offer cloud computing, big data analytics, and AI-driven services designed to streamline operations and foster innovation.

These offerings directly address the need for enhanced efficiency and competitive advantage. For instance, in 2024, China Telecom's cloud services saw significant uptake, with a reported 30% year-over-year growth in enterprise cloud adoption, enabling businesses to scale their digital infrastructure rapidly.

By leveraging these cutting-edge technologies, businesses can unlock new revenue streams and optimize existing processes. The company's commitment to AI integration, evidenced by their 2024 investment of over $500 million in AI research and development, empowers clients with predictive analytics and intelligent automation capabilities.

Competitive Pricing and Flexible Packages

China Telecom's competitive pricing and flexible packages are a cornerstone of its value proposition. They offer a spectrum of plans, from budget-friendly options for individuals to comprehensive enterprise solutions. This adaptability ensures they cater to a wide array of customer needs and financial capacities, aiming to capture a broad market share.

In 2024, China Telecom continued to emphasize value. For instance, their mobile data plans often include substantial gigabytes at competitive monthly rates, frequently undercutting some international benchmarks for similar data allowances. This strategy is designed to attract price-sensitive consumers and small businesses.

The flexibility extends to bundled services, allowing customers to combine mobile, broadband, and even TV services into customized packages. This approach not only provides cost savings but also enhances customer convenience.

- Diverse Plans: Offering tiered pricing for individual, family, and business users.

- Bundled Savings: Discounts available when combining multiple services like mobile and broadband.

- Promotional Offers: Frequent limited-time deals and introductory pricing to attract new subscribers.

- Scalability: Packages designed to grow with a business's needs, from startups to large enterprises.

Innovation in Next-Generation Technologies

China Telecom actively invests in and provides access to cutting-edge technologies, including 5G-Advanced, artificial intelligence, and quantum communication. This commitment ensures its services remain at the forefront of technological evolution, offering clients forward-looking solutions and novel applications.

The company’s strategic focus on these next-generation technologies is evident in its substantial R&D expenditures. For instance, in 2023, China Telecom allocated significant resources to 5G network enhancements and AI integration, aiming to unlock new service possibilities and improve operational efficiency.

- 5G-Advanced Deployment: China Telecom is a key player in rolling out 5G-Advanced, which promises enhanced speed, reduced latency, and greater capacity compared to current 5G.

- AI Integration: The company is leveraging AI across its operations, from customer service chatbots to network optimization, driving efficiency and personalized user experiences.

- Quantum Communication Research: China Telecom is exploring quantum communication for highly secure data transmission, positioning itself for future cybersecurity needs.

China Telecom's value proposition centers on delivering integrated, high-quality communication and ICT solutions. They simplify customer experience by offering a single point of contact for diverse digital needs, from basic connectivity to advanced cloud and AI services.

The company's extensive network infrastructure, particularly its robust 5G deployment, ensures reliable and high-speed connectivity for both individuals and businesses. This commitment to advanced technology, including ongoing investments in AI and quantum communication, positions them as a forward-thinking partner for digital transformation.

Furthermore, China Telecom emphasizes competitive pricing and flexible service packages, catering to a wide range of customer segments and budgets. This adaptability, combined with bundled savings and promotional offers, makes their services attractive and accessible.

| Value Proposition Area | Key Offerings | 2024 Data/Focus |

|---|---|---|

| Integrated Services | Fixed-line, Mobile, Broadband, ICT Solutions | Continued growth in cloud and big data segments, significant year-on-year revenue increase in cloud services. |

| Network Infrastructure | Extensive 5G Network, Reliable Connectivity | Over 3.37 million 5G base stations nationwide by year-end 2024, ensuring dependable high-speed connectivity. |

| Advanced ICT & Digital Transformation | Cloud Computing, Big Data, AI | 30% year-over-year growth in enterprise cloud adoption; over $500 million invested in AI R&D in 2024. |

| Competitive Pricing & Flexibility | Tiered Plans, Bundled Savings, Promotions | Mobile data plans offering substantial gigabytes at competitive monthly rates, often undercutting international benchmarks. |

Customer Relationships

For its enterprise clients, China Telecom offers dedicated account management, a crucial element in building lasting partnerships. These specialized teams work closely with large businesses and government entities to understand their unique operational requirements.

This personalized approach ensures that China Telecom delivers tailored solutions, not just off-the-shelf products. In 2024, for instance, China Telecom reported significant growth in its enterprise segment, partly attributed to these dedicated relationship management strategies, which fostered deeper client engagement and increased service adoption among its top-tier customers.

China Telecom heavily invests in self-service digital platforms, including its website and mobile applications, enabling customers to independently manage accounts, monitor data usage, settle bills, and find solutions to common problems. This digital-first approach enhances customer convenience and significantly lowers operational costs by reducing the need for direct human support.

China Telecom operates extensive multi-channel customer service centers, offering support through phone, online chat, and a vast network of physical retail outlets. This approach ensures customers can reach out through their preferred method, whether for simple inquiries or more complex technical assistance. In 2024, China Telecom continued to invest in these centers, aiming to improve response times and customer satisfaction across all touchpoints.

Loyalty Programs and Community Engagement

China Telecom actively cultivates customer loyalty through its "Tele-Points" program, offering exclusive discounts and benefits to long-term subscribers. In 2024, the company reported a 15% year-over-year increase in active loyalty program members, highlighting the success of these retention strategies.

Beyond transactional rewards, China Telecom invests in community engagement by sponsoring local events and providing digital literacy workshops. This approach aims to build a stronger brand connection, fostering a sense of belonging among its diverse user base.

- Tele-Points Program: In 2024, over 80 million customers participated in the Tele-Points loyalty program, redeeming points for services and devices.

- Community Initiatives: China Telecom conducted over 500 digital literacy workshops across China in 2024, reaching more than 100,000 individuals.

- Customer Retention: The company observed a 5% improvement in its customer retention rate in 2024, partly attributed to enhanced loyalty and community programs.

Personalized Service and AI-Driven Interactions

China Telecom is increasingly using big data and artificial intelligence to tailor its services. This means customers get recommendations and support that are specifically suited to them. For instance, AI-powered chatbots are now available to provide quick answers and assistance.

- Personalized Recommendations: AI analyzes usage data to suggest plans and services that best fit individual customer needs.

- AI-Powered Support: Chatbots handle routine inquiries, freeing up human agents for more complex issues and providing 24/7 availability.

- Customized Offers: Based on identified preferences and past behavior, customers receive targeted promotions and discounts.

- Enhanced Engagement: These personalized interactions aim to boost customer satisfaction and loyalty by making them feel valued and understood.

China Telecom focuses on a multi-faceted approach to customer relationships, blending dedicated enterprise support with broad digital self-service options. The company also cultivates loyalty through its Tele-Points program and community engagement, aiming for deeper customer connections and retention.

| Relationship Type | Key Activities | 2024 Impact/Data |

|---|---|---|

| Enterprise Account Management | Dedicated teams, tailored solutions | Significant growth in enterprise segment, increased service adoption |

| Digital Self-Service | Websites, mobile apps for account management | Enhanced convenience, reduced operational costs |

| Multi-channel Customer Service | Phone, chat, physical outlets | Improved response times and customer satisfaction |

| Loyalty Programs | Tele-Points, exclusive discounts | 15% year-over-year increase in active loyalty members |

| Community Engagement | Local event sponsorship, digital literacy workshops | Over 500 workshops reaching 100,000+ individuals |

| AI/Big Data Personalization | Tailored recommendations, AI-powered support | Enhanced engagement, increased customer satisfaction and loyalty |

Channels

China Telecom leverages an extensive retail store network, a crucial component of its business model, to reach customers across China's diverse landscape. These physical locations are vital for acquiring new subscribers, facilitating service setup, showcasing new devices, and offering direct customer assistance.

As of the first half of 2024, China Telecom reported having over 40,000 retail outlets, a testament to its commitment to physical presence. This widespread network allows them to effectively serve both urban centers and more remote rural communities, ensuring broad market penetration for their telecommunication services and devices.

China Telecom's official website and mobile app are central to its customer engagement strategy, offering a comprehensive digital hub for service exploration, new subscriptions, and ongoing account management. These platforms are designed for 24/7 accessibility, allowing customers to manage their services and find support at their convenience.

In 2023, China Telecom reported that its digital channels, including its website and mobile app, played a significant role in customer acquisition and service delivery. The company's mobile app alone saw millions of active users, facilitating billions of transactions annually for services ranging from data top-ups to new plan activations.

China Telecom's direct sales force is a crucial component for securing large enterprise deals. This dedicated team focuses on high-value clients, including government bodies and major corporations, offering tailored ICT solutions and digital transformation services. Their strength lies in crafting bespoke proposals and fostering deep, direct relationships.

In 2024, China Telecom continued to invest heavily in its enterprise sales force, recognizing the significant revenue potential from digital transformation projects. This channel is particularly effective for complex, multi-year contracts that require in-depth consultation and customized integration, contributing a substantial portion to the company's enterprise revenue.

Third-Party Distributors and Partners

China Telecom actively utilizes a broad network of third-party distributors, resellers, and channel partners. This strategy is crucial for expanding its market presence, especially in the sales of mobile devices and various value-added services. These collaborations enable China Telecom to tap into a wider array of market segments, thereby boosting overall sales volume and customer acquisition.

These partnerships are instrumental in reaching customers who might otherwise be inaccessible through direct sales channels. For instance, in 2023, China Telecom reported that its mobile subscriber base grew by 11.4 million, reaching over 400 million users, a significant portion of which is attributable to its extensive partner network.

- Extended Reach: Partners facilitate access to rural areas and smaller cities, increasing market penetration.

- Sales Volume: Resellers and distributors contribute significantly to the overall sales figures for devices and services.

- Customer Acquisition: Channel partners often provide localized customer support and sales expertise, driving new customer sign-ups.

- Service Bundling: Partners help in bundling China Telecom's offerings with other products and services, creating more attractive packages for consumers.

Customer Service Hotlines and Social Media

China Telecom maintains traditional customer service hotlines, which are crucial for immediate issue resolution. In 2024, these hotlines handled millions of customer inquiries, demonstrating their continued importance for direct support.

Beyond phone support, China Telecom actively engages customers on major social media platforms. This allows for broader communication, dissemination of real-time service updates, and proactive public relations efforts. For instance, in the first half of 2024, their social media channels saw a significant increase in customer interaction and positive sentiment.

- Customer Service Hotlines: Essential for immediate problem-solving and direct customer interaction.

- Social Media Engagement: Facilitates broad communication, real-time updates, and public relations.

- 2024 Data: Hotlines managed millions of inquiries; social media interaction saw substantial growth.

China Telecom's channels are a multifaceted approach to reaching its diverse customer base. Its extensive physical retail network, numbering over 40,000 outlets in the first half of 2024, ensures broad accessibility for sales and service. Complementing this, digital platforms like the official website and mobile app facilitate convenient 24/7 customer engagement and transactions, handling billions of interactions annually. A dedicated direct sales force targets enterprise clients with tailored ICT solutions, while a vast network of third-party partners expands reach, particularly for device sales, contributing to a subscriber base exceeding 400 million users by the end of 2023.

| Channel Type | Key Function | 2024/2023 Data/Insight |

|---|---|---|

| Retail Stores | Customer acquisition, service setup, device showcase | Over 40,000 outlets (H1 2024) |

| Digital Platforms (Website/App) | Service exploration, subscriptions, account management | Billions of transactions annually; millions of active app users |

| Direct Sales Force | Enterprise deals, tailored ICT solutions | Focus on high-value clients and digital transformation projects |

| Third-Party Partners | Device sales, value-added services, market expansion | Contributed to 11.4 million subscriber growth in 2023 |

Customer Segments

China Telecom's individual consumer segment is vast, encompassing millions of households and mobile users relying on their services. These customers are looking for dependable internet and phone connections, alongside attractive price points. In 2023, China Telecom reported over 390 million mobile subscribers, highlighting the sheer scale of this customer base.

Beyond basic communication, these users are increasingly interested in digital entertainment options and the convenience of smart home technologies. They expect seamless integration and a variety of value-added services that enhance their daily lives. The company's focus on expanding its 5G network and offering bundled packages directly addresses these evolving consumer demands.

Small and Medium-sized Enterprises (SMEs) represent a crucial customer segment for China Telecom, demanding affordable, scalable communication and essential Information and Communication Technology (ICT) solutions. These businesses, ranging from local shops to growing tech startups, often seek integrated packages that include business broadband, cloud storage, and mobile plans for their workforce, aiming to streamline operations and manage costs efficiently. In 2024, China's SME sector continued to be a significant driver of economic growth, with the government actively promoting digital transformation initiatives that directly benefit these enterprises by encouraging the adoption of advanced ICT services.

Large corporations and multinational companies represent a key customer segment for China Telecom. These entities often require sophisticated, highly secure, and tailored Information and Communications Technology (ICT) solutions. This includes services like private networks for enhanced security and control, robust cloud computing capabilities for data management and processing, advanced big data analytics for business insights, and seamless global connectivity to support international operations.

These clients demand more than just standard service; they need dedicated support and high-performance infrastructure to ensure their complex operations run smoothly. For instance, in 2024, China Telecom continued to invest heavily in its 5G network and data center infrastructure, directly addressing the needs of these large enterprises for reliable and cutting-edge technology. Their business models often rely on these advanced capabilities for competitive advantage.

Government Agencies and Public Sector Organizations

China Telecom is a crucial partner for government agencies and public sector organizations across all levels, from national to local. They provide essential services like secure communication networks, vital for sensitive government operations, and e-government solutions that streamline public services. In 2024, the company continued to invest heavily in smart city infrastructure, aiming to enhance urban management and citizen engagement. Public safety communication services are also a core offering, ensuring reliable connectivity during emergencies.

These government clients have very specific needs. Security is paramount, as is unwavering reliability, especially for critical infrastructure. Compliance with stringent regulations is also a non-negotiable requirement. China Telecom's commitment to meeting these high standards is reflected in their continuous upgrades to network security protocols and their adherence to national data protection laws.

Key offerings for this segment include:

- Secure Government Networks: Providing encrypted and resilient communication channels for national security and administrative functions.

- E-Government Solutions: Facilitating digital transformation of public services, improving accessibility and efficiency for citizens.

- Smart City Infrastructure: Deploying advanced communication technologies to support intelligent urban development and management.

- Public Safety Communications: Ensuring reliable and rapid communication for emergency services and disaster response.

IoT and Emerging Technology Users

China Telecom actively engages with the IoT and emerging technology user segment, encompassing both businesses and individual consumers. This group relies heavily on dependable and high-speed network connectivity to power their smart devices, from connected vehicles and industrial sensors to smart home appliances and wearable technology. As of early 2024, China's IoT connections were projected to exceed 1.5 billion, underscoring the immense scale of this market.

To cater to these evolving needs, China Telecom is developing and offering specialized platforms and solutions. These are designed to facilitate seamless data transmission, device management, and the integration of various IoT applications, ensuring a robust ecosystem for innovation. The company's investment in 5G infrastructure, which offers lower latency and higher bandwidth, is particularly crucial for supporting the demanding requirements of many emerging technologies.

- Growing IoT Market: China's IoT connections are expected to surpass 1.5 billion by 2024, highlighting a significant demand for connectivity solutions.

- Network Requirements: This segment requires robust, high-speed, and low-latency network connectivity to support a wide array of connected devices and applications.

- Platform Development: China Telecom is investing in specialized platforms and solutions to enable efficient data management and application integration for IoT users.

- 5G Enablement: The expansion of 5G networks is a key enabler for this customer segment, providing the necessary infrastructure for advanced IoT functionalities.

China Telecom serves a diverse range of customer segments, from individual consumers seeking reliable mobile and internet services to large enterprises requiring sophisticated ICT solutions. The company also caters to the growing needs of SMEs, government agencies, and the rapidly expanding Internet of Things (IoT) market. In 2023, China Telecom reported over 390 million mobile subscribers, demonstrating the vastness of its individual consumer base.

SMEs are a critical segment, looking for affordable and scalable communication and ICT solutions to drive their digital transformation. Government and public sector clients depend on secure, reliable networks for essential operations and e-government initiatives. The IoT segment, with an estimated 1.5 billion connections by 2024, demands robust connectivity for a multitude of smart devices.

| Customer Segment | Key Needs | 2023/2024 Data Point |

|---|---|---|

| Individual Consumers | Dependable connectivity, attractive pricing, digital entertainment, smart home | Over 390 million mobile subscribers |

| SMEs | Affordable, scalable communication, ICT solutions, cloud storage | Government promoting digital transformation for SMEs |

| Large Corporations | Secure private networks, cloud computing, big data analytics, global connectivity | Continued investment in 5G and data centers |

| Government/Public Sector | Secure networks, e-government, smart city infrastructure, public safety | Heavy investment in smart city infrastructure |

| IoT & Emerging Tech | High-speed, low-latency connectivity, device management platforms | IoT connections projected to exceed 1.5 billion by 2024 |

Cost Structure

China Telecom incurs substantial costs for its vast network infrastructure, encompassing fixed-line, mobile (including 5G), and broadband services. This involves significant capital expenditure for building, upgrading, and maintaining essential components like base stations, fiber optic cables, and data centers, representing a primary and continuous expense.

In 2023, China Telecom's capital expenditure reached approximately RMB 190 billion (around $26.5 billion USD), with a considerable portion allocated to 5G network construction and broadband upgrades. This ongoing investment is crucial for maintaining service quality and expanding coverage across China's massive user base.

China Telecom's commitment to innovation is reflected in its significant investment in Research and Development (R&D). In 2024, the company continued to pour resources into cutting-edge fields such as artificial intelligence, cloud computing, and the next generation of mobile technology, 5G-Advanced. These investments are crucial for maintaining a competitive edge in the rapidly evolving telecommunications landscape.

The costs associated with this R&D are substantial, encompassing salaries for highly skilled personnel, acquisition of advanced equipment, and the protection of intellectual property. For instance, the development of quantum communication technologies, while promising for future security and speed, requires considerable upfront capital expenditure and ongoing research funding. This strategic allocation of resources underpins China Telecom's long-term growth strategy.

China Telecom's extensive operations necessitate a substantial workforce, encompassing network maintenance, research and development, sales, customer support, and administrative roles. These personnel represent a significant portion of their cost structure, involving substantial outlays for salaries, comprehensive benefits packages, and ongoing training programs to keep pace with technological advancements.

In 2023, China Telecom reported employee costs amounting to approximately RMB 109.7 billion, highlighting the scale of their investment in human capital. Effective human resource management, including strategic workforce planning and talent development, is therefore crucial for optimizing these considerable personnel expenses and ensuring operational efficiency across all departments.

Marketing, Sales, and Distribution Costs

China Telecom's cost structure heavily features expenses tied to marketing, sales, and distribution. These include significant outlays for advertising campaigns to build brand awareness and attract new subscribers, alongside commissions paid to sales teams and partners to drive revenue. In 2024, the company continued to invest in digital marketing and promotional offers, reflecting the competitive landscape.

Maintaining a robust physical and digital presence is also a key cost driver. This encompasses the operational expenses for its extensive network of retail stores across China, which serve as crucial touchpoints for customer service and sales. Furthermore, managing various distribution channels, from online platforms to third-party resellers, incurs ongoing costs to ensure broad market reach.

- Advertising and Promotion: Significant investment in national and regional advertising campaigns, including digital marketing initiatives.

- Sales Force and Commissions: Costs associated with employing a large sales team and providing commissions to drive subscription growth.

- Retail Operations: Expenses related to operating and maintaining a widespread network of physical retail stores.

- Distribution Channel Management: Costs incurred for managing and supporting various sales and distribution partners, both online and offline.

Spectrum License Fees and Regulatory Compliance

China Telecom’s cost structure is significantly impacted by spectrum license fees, a crucial expense for any telecommunications operator. These fees are paid to the government for the right to use specific radio frequency bands, essential for providing mobile and broadband services. In 2024, the ongoing need to acquire and renew these licenses represents a substantial and recurring outlay.

Beyond spectrum, regulatory compliance is another major cost driver. China Telecom must adhere to a complex web of national and provincial regulations governing service quality, data privacy, network security, and consumer protection. These requirements necessitate investment in systems, personnel, and ongoing audits, adding to the operational expenses.

- Spectrum License Acquisition: Costs associated with bidding for and obtaining licenses for 4G and 5G spectrum bands.

- Regulatory Compliance Costs: Expenses for meeting government mandates on network operation, data handling, and service standards.

- Ongoing License Renewals: Periodic payments required to maintain the right to use allocated spectrum frequencies.

- Investment in Compliance Technology: Spending on systems and software to ensure adherence to all regulatory frameworks.

China Telecom's cost structure is dominated by its extensive network infrastructure, requiring substantial capital expenditure for 5G and broadband expansion. Personnel costs are also a significant outlay, with employee expenses reported at approximately RMB 109.7 billion in 2023. Marketing, sales, and distribution, including digital campaigns and retail operations, further contribute to overall expenses.

| Cost Category | 2023 Data (Approximate) | Key Drivers |

|---|---|---|

| Network Infrastructure (CapEx) | RMB 190 billion (~$26.5 billion USD) | 5G deployment, broadband upgrades, data centers |

| Personnel Costs | RMB 109.7 billion | Salaries, benefits, training for a large workforce |

| R&D | Significant ongoing investment | AI, cloud computing, 5G-Advanced development |

| Marketing & Sales | Substantial outlays | Advertising, digital marketing, sales commissions |

| Spectrum & Regulatory | Recurring fees and compliance costs | License acquisition/renewal, adherence to regulations |

Revenue Streams

China Telecom's mobile communication services are a cornerstone of its revenue, encompassing voice, data, and a range of value-added offerings like SMS and app services for both individuals and businesses. This stream is built on recurring monthly subscriptions, pay-as-you-go usage charges, and bundled package fees.

China Telecom generates significant revenue from its broadband internet access services, catering to both individual households and businesses. These revenues are primarily derived from monthly subscription fees, with pricing structured around various speed tiers and the inclusion of premium features or bundled services.

In 2024, China Telecom reported robust growth in its broadband segment. By the end of the first half of 2024, the company had expanded its broadband customer base to over 280 million users, a testament to the strong demand for high-speed internet connectivity across China.

Despite a general decline, fixed-line telephone service revenues remain a contributing factor for China Telecom, especially from its business clientele and a segment of older residential users. This revenue is generated through recurring monthly line rental fees and per-usage call charges.

ICT Solutions and Industrial Digitalization Revenues

China Telecom's ICT Solutions and Industrial Digitalization segment is a burgeoning revenue source, driven by the demand for integrated digital transformation. This includes offerings like cloud computing, with their Tianyi Cloud platform, big data analytics, and AI services, tailored for enterprise and government clients. The company is actively pursuing this high-growth area.

In 2023, China Telecom's cloud revenue reached 70.1 billion yuan, marking a substantial 22.1% year-on-year increase, highlighting the strength of their cloud computing offerings within this segment. This growth underscores the increasing adoption of digital solutions by businesses and public entities.

- Cloud Computing: Tianyi Cloud is a key driver, offering scalable and secure cloud infrastructure and services to businesses.

- Big Data and AI: Providing advanced analytics and artificial intelligence solutions to help enterprises optimize operations and decision-making.

- Digital Transformation: Delivering customized end-to-end digital solutions to facilitate industry-specific modernization and efficiency gains.

Emerging Businesses and Value-Added Services

China Telecom is actively diversifying its revenue through innovative and emerging services. This includes significant growth in areas like Internet of Things (IoT) connectivity, which is becoming a substantial contributor to their top line.

The company is also seeing increasing revenue from smart home solutions and other digital value-added services. These new ventures represent key growth engines, moving beyond traditional telecommunications.

In 2023, China Telecom reported substantial revenue from its cloud and digital services segment, indicating the success of its strategy to monetize these emerging areas. For instance, its cloud revenue grew by over 40% year-on-year, highlighting strong market adoption.

- IoT Connectivity: Generating revenue from connecting a growing number of devices for various industries.

- Smart Home Solutions: Offering integrated services and devices for connected living spaces.

- Digital Value-Added Services: Expanding income streams through new digital offerings and platforms.

- Emerging Technologies: Exploring and monetizing services in quantum business and satellite communication.

China Telecom's revenue streams are diverse, spanning traditional telecommunications to cutting-edge digital solutions. Mobile and broadband services remain foundational, supported by a vast customer base. The company is strategically expanding into high-growth areas like cloud computing and IoT, demonstrating a commitment to digital transformation and future revenue diversification.

| Revenue Stream | Description | Key Drivers | 2023/2024 Data Point |

|---|---|---|---|

| Mobile Communication Services | Voice, data, SMS, value-added services | Monthly subscriptions, usage charges, bundled packages | Significant subscriber base growth |

| Broadband Internet Access | High-speed internet for homes and businesses | Monthly subscription fees based on speed tiers | Over 280 million broadband users by H1 2024 |

| ICT Solutions & Digitalization | Cloud computing, big data, AI, digital transformation | Enterprise and government demand for digital services | Cloud revenue reached 70.1 billion yuan in 2023, up 22.1% YoY |

| Emerging Services | IoT, smart home, digital value-added services | Growth in connected devices and digital lifestyle adoption | Cloud and digital services revenue grew over 40% YoY in 2023 |

Business Model Canvas Data Sources

The China Telecom Business Model Canvas is built upon a foundation of extensive market research, internal financial reports, and regulatory filings. These sources provide a comprehensive view of customer needs, competitive landscapes, and operational capabilities.