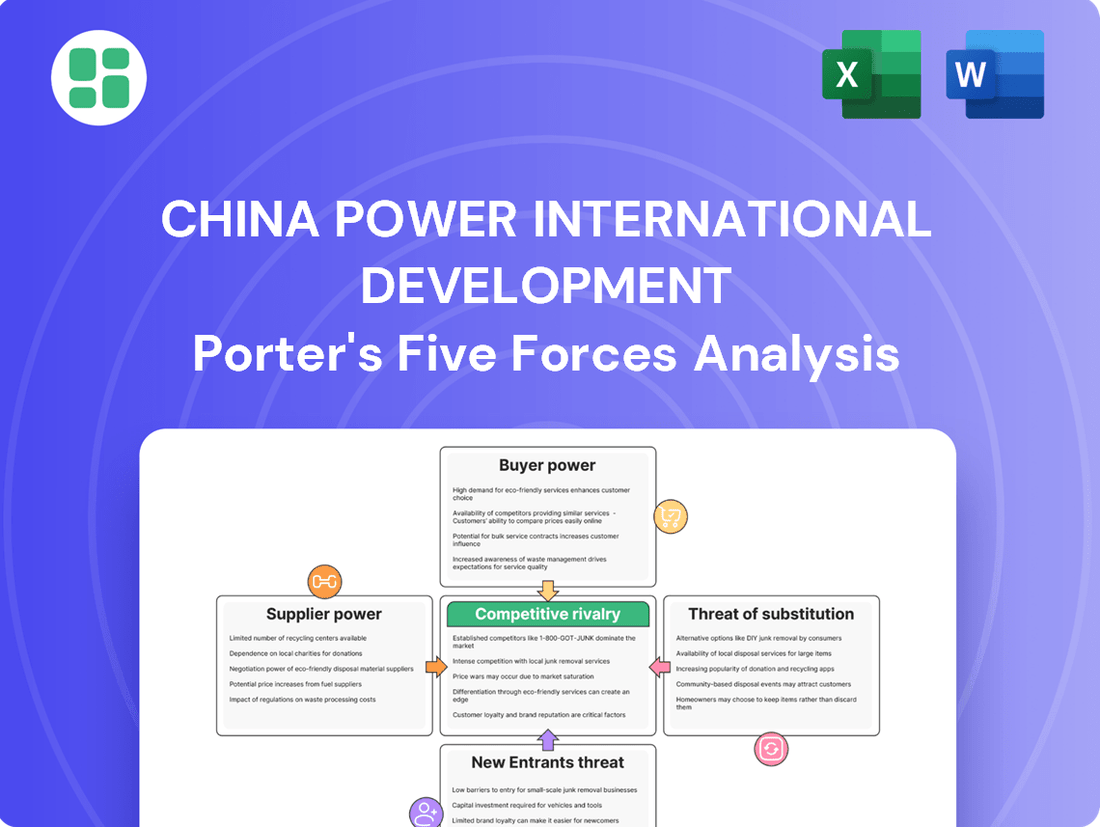

China Power International Development Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

China Power International Development Bundle

China Power International Development navigates a landscape shaped by significant capital requirements and government regulation, impacting the threat of new entrants and the bargaining power of buyers. Understanding these dynamics is crucial for any stakeholder.

The full Porter's Five Forces Analysis reveals the real forces shaping China Power International Development’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The concentration of key fuel suppliers, particularly for coal and natural gas, exerts considerable bargaining power over China Power International Development, especially concerning its thermal power generation. China's ongoing commitment to energy security means coal remains a dominant fuel source, with consumption projected to see a slight uptick in 2025, underscoring the sustained importance of these suppliers.

Despite China Power's strategic moves toward diversification, the sheer scale of its coal-fired power plants necessitates a dependable and consistent supply of fuel. This dependency grants suppliers leverage, even as government initiatives aim to temper their influence through mechanisms like long-term supply contracts that secure demand but also solidify supplier positions.

China's commanding role in manufacturing solar panels, wind turbines, and battery parts significantly curtails the bargaining leverage of overseas equipment providers for Chinese power firms. For instance, in 2023, China accounted for over 80% of global solar panel manufacturing capacity, and its dominance in wind turbine production is similarly substantial.

The abundant domestic production of these clean energy technologies suggests that China Power International Development can secure equipment at favorable prices from a wide array of local manufacturers. This extensive domestic manufacturing base reduces reliance on any single supplier, thereby diminishing their individual bargaining power.

Suppliers offering cutting-edge technologies like advanced grid integration and smart energy management systems wield significant influence. As China's power sector embraces reforms and higher renewable energy adoption, the need for these sophisticated solutions escalates. For instance, in 2023, China's installed renewable energy capacity surpassed 50% of the total, driving demand for specialized equipment and services.

Labor and Construction Services

The bargaining power of suppliers in labor and construction services for China Power International Development is shaped by the availability of skilled workers across various power generation types. Specialized engineering and construction firms, especially for complex projects like large-scale hydropower or offshore wind farms, can exert significant influence due to their unique expertise and limited supply. For instance, in 2024, the demand for skilled technicians in the renewable energy sector, particularly for solar and wind installations, saw a notable increase, potentially driving up labor costs.

Major infrastructure development in China, often aligned with national strategic goals, can also impact labor and construction service providers. The government's emphasis on energy security and the transition to cleaner energy sources means that projects undertaken by companies like China Power International Development are strategically vital. This can create a competitive environment for securing specialized construction services, allowing these suppliers to negotiate more favorable terms. In 2023, China's investment in renewable energy infrastructure reached approximately $141 billion, highlighting the scale and importance of these projects and the associated labor demands.

- Skilled Labor Availability: The pool of qualified engineers and technicians for diverse power plant operations, from hydropower to advanced thermal plants, directly influences supplier power.

- Specialized Expertise: Firms with proven track records in large-scale, complex projects, such as those involving advanced nuclear or offshore wind technologies, can command premium pricing.

- National Development Priorities: The strategic importance of energy infrastructure in China's economic planning can elevate the bargaining position of key construction and labor service providers.

- 2024 Labor Market Trends: Rising demand for renewable energy specialists in 2024 suggests potential upward pressure on wages and service fees for these critical skills.

Financial Institutions and Capital Markets

As a significant state-owned enterprise subsidiary, China Power International Development likely enjoys preferential financing from state-backed financial institutions. This strong backing can significantly diminish the bargaining power of capital suppliers, offering more favorable terms and potentially lower borrowing costs. This is crucial given the company's substantial capital needs for ongoing expansion and its commitment to green initiatives.

Despite its SOE status, the company's significant investments, such as the over RMB 17.8 billion allocated to green and low-carbon transformation in 2024, necessitate access to a broad range of financing options. This includes tapping into global financial markets, particularly for international ventures and the issuance of green bonds, which can diversify funding sources and manage supplier influence.

- State-Owned Financial Support: China Power's SOE affiliation provides leverage with state-owned banks, potentially securing capital at competitive rates.

- Capital Intensity of Green Transition: The substantial investment in green transformation, exceeding RMB 17.8 billion in 2024, underscores the need for consistent and diverse capital access.

- Global Market Influence: International projects and green bond issuances mean China Power must navigate global financial markets, where supplier bargaining power can vary.

The bargaining power of fuel suppliers, particularly for coal, remains a significant factor for China Power International Development due to the ongoing reliance on thermal power. While China's energy security initiatives solidify demand, government efforts to diversify energy sources and manage fuel prices can somewhat mitigate supplier leverage. For instance, in 2023, coal still accounted for over 50% of China's primary energy consumption, highlighting the sustained importance of coal suppliers.

Conversely, China's robust domestic manufacturing of renewable energy components substantially reduces the bargaining power of overseas equipment providers. With China dominating global solar panel production, exceeding 80% capacity in 2023, and holding a strong position in wind turbine manufacturing, China Power can source these technologies competitively. This domestic strength limits the influence of any single foreign supplier.

Suppliers of specialized technology and skilled labor, especially for advanced renewable energy projects, possess notable bargaining power. The rapid expansion of renewables, with China's installed capacity surpassing 50% of the total in 2023, drives demand for niche expertise. In 2024, the need for skilled technicians in this sector saw increased demand, potentially raising labor costs.

| Supplier Type | Bargaining Power Factors | Impact on China Power | Relevant Data/Trends |

| Fuel (Coal, Gas) | Concentration of suppliers, energy security needs | High, especially for thermal generation | Coal >50% of China's primary energy (2023) |

| Renewable Equipment | Domestic manufacturing dominance, competition | Low for China Power | China >80% solar panel capacity (2023) |

| Specialized Technology/Labor | Unique expertise, project complexity, demand | Moderate to High | Renewable labor demand up (2024) |

What is included in the product

This analysis unpacks the competitive forces shaping China Power International Development's market, focusing on supplier and buyer power, the threat of new entrants and substitutes, and the intensity of rivalry within the power generation sector.

Pinpoint the exact competitive pressures impacting China Power International Development, enabling targeted strategies to mitigate threats and capitalize on opportunities.

Customers Bargaining Power

China Power's customers are primarily state-owned grid companies like State Grid Corporation of China and China Southern Power Grid. These entities possess significant bargaining power because they control electricity transmission and distribution, acting as near-monopolies. In 2023, these grid companies were responsible for purchasing the vast majority of China Power's generated electricity, giving them substantial influence over purchase volumes and pricing.

The dominance of these state-owned grid companies limits China Power's options for selling its electricity. Their essential role in the national power infrastructure means that alternative buyers are scarce, further concentrating bargaining power in their hands. This dynamic forces China Power to accept terms that may be less favorable, impacting its revenue and profitability.

Ongoing electricity market reforms in China, notably the 'Basic Rules for Power Market Operation' effective July 2024, are significantly altering how new energy electricity is priced. This shift from fixed tariffs to market-based mechanisms, impacting projects commissioned after June 1, 2025, means renewable energy will be sold at fluctuating market rates.

This transition to market pricing, coupled with the acceleration of spot markets, inherently empowers customers like grid companies and large industrial users. They gain greater leverage as they can negotiate prices based on real-time supply and demand, potentially leading to lower costs for them and increased price volatility for power generators.

Large industrial and commercial consumers in China are gaining more bargaining power. For instance, by 2024, the growth in direct power purchase agreements (PPAs) and participation in electricity spot markets is expected to continue, allowing these entities to bypass traditional intermediaries and negotiate directly with generators. This trend is particularly pronounced for green power, where demand from environmentally conscious corporations is high.

This increased ability to choose suppliers and negotiate terms, especially for renewable energy sources, provides significant leverage for these customers. It means they can often secure more favorable pricing and contract conditions, putting pressure on power generators like China Power International Development to offer competitive terms. For example, a significant portion of industrial electricity consumption in China is now eligible for direct trading, a figure that has seen steady growth over recent years.

However, this customer power is not absolute. Vertically integrated generator retailers, which control both generation and retail distribution, still maintain a dominant position in many segments of the retail electricity market. This integration limits the full extent of customer bargaining power, as these entities can sometimes offer bundled services or leverage their control over the grid to their advantage.

Regulatory and Policy Influence

The bargaining power of customers for China Power International Development is significantly shaped by regulatory and policy influences. Key government bodies like the National Development and Reform Commission (NDRC) and the National Energy Administration (NEA) hold substantial sway over electricity tariffs, market rules, and broader energy policy in China. These entities effectively function as a primary customer by dictating the operational and revenue-generating environment for China Power.

Their policy objectives, such as guaranteeing a stable energy supply and advancing the adoption of cleaner energy sources, directly influence China Power's strategic decisions and financial performance. For instance, in 2024, the NDRC continued to implement policies aimed at reducing coal power generation and increasing renewable energy capacity, which could impact the demand for China Power's existing coal-fired assets while creating opportunities in renewables.

- Regulatory Setting of Tariffs: Government bodies directly control electricity prices, limiting China Power's ability to independently set rates based on market demand.

- Policy-Driven Market Structure: NDRC and NEA directives shape the competitive landscape and market access for different energy sources, influencing China Power's operational choices.

- Influence on Energy Mix: Policies promoting renewable energy can necessitate shifts in China Power's asset portfolio, impacting its revenue streams and capital expenditure plans.

Homogeneity of Electricity as a Product

The electricity sector, particularly in a market like China, is characterized by a high degree of product homogeneity. This means that for most consumers, electricity is a commodity where differences in quality or features are minimal. Consequently, customers often base their purchasing decisions primarily on price and the assurance of a stable supply.

This lack of differentiation significantly amplifies the bargaining power of customers. China Power International Development, like its peers, faces a situation where it cannot easily command premium prices by offering a uniquely superior product. In 2024, with ongoing efforts to liberalize the power market and address overcapacity in certain generation segments, this price sensitivity becomes even more pronounced.

- Homogeneity: Electricity is largely a undifferentiated commodity, driving competition on price and reliability.

- Price Sensitivity: Customers are highly sensitive to price due to the lack of product differentiation.

- Market Dynamics: Increasing competition and potential overcapacity in 2024 further empower customers.

- Limited Differentiation: China Power faces challenges in commanding premium prices, strengthening customer leverage.

China Power's customers, primarily state-owned grid companies like State Grid Corporation of China, wield considerable bargaining power due to their near-monopolistic control over electricity transmission and distribution. These entities purchased the vast majority of China Power's electricity in 2023, granting them significant influence over pricing and volumes.

The essential nature of grid companies in China's power infrastructure limits China Power's options for selling electricity, concentrating power in the hands of these few buyers. This dynamic forces China Power to accept less favorable terms, impacting its profitability.

Ongoing market reforms, like the 'Basic Rules for Power Operation' effective July 2024, are shifting electricity pricing to market-based mechanisms, particularly for new energy projects post-June 2025. This empowers customers, including grid companies and large industrial users, who can negotiate prices based on real-time supply and demand.

| Customer Type | Bargaining Power Drivers | Impact on China Power |

| State-Owned Grid Companies | Monopolistic control over transmission, essential infrastructure | Significant influence on pricing and purchase volumes |

| Large Industrial/Commercial Users | Direct power purchase agreements (PPAs), spot market participation | Ability to negotiate favorable terms, especially for green power |

| Government Bodies (NDRC, NEA) | Tariff setting, market rules, energy policy directives | Dictate operational environment and revenue potential |

Same Document Delivered

China Power International Development Porter's Five Forces Analysis

This preview showcases the comprehensive Porter's Five Forces analysis for China Power International Development, detailing the competitive landscape of the power generation industry. You're looking at the actual document, which includes in-depth insights into buyer and supplier power, threat of new entrants and substitutes, and the intensity of rivalry. Once you complete your purchase, you’ll get instant access to this exact, professionally formatted file, ready for immediate use.

Rivalry Among Competitors

Competitive rivalry in China's power generation sector is intense but shaped by the significant presence of state-owned enterprises (SOEs). China Power International Development operates within an oligopolistic market dominated by a few major players like Huaneng Power, Datang, Huadian, and SPIC.

This structure means competition is largely between these state-backed giants. For instance, in 2023, China's installed power generation capacity reached approximately 2,920 GW, with SOEs accounting for a substantial portion. While these firms compete on efficiency and market share, their strategic decisions are often aligned with national energy policies and coordinated development plans, tempering purely market-driven rivalry.

China's renewable energy sector is experiencing a dramatic surge, with wind and solar capacity exceeding coal for the first time in the first quarter of 2025. This aggressive build-out, while supporting national climate targets, has unfortunately created significant overcapacity in manufacturing and, in certain areas, led to the curtailment of generated renewable power.

This intense expansion fuels a highly competitive environment among energy producers. Companies like China Power International Development must contend with numerous rivals vying for limited grid connection opportunities and market share for their clean energy ventures, intensifying the rivalry within the industry.

China's energy strategy presents a conflicting dynamic for companies like China Power. Despite a strong push for clean energy, the nation continues to approve and build new coal-fired power plants. This is primarily to guarantee grid stability and energy security, a crucial consideration given the rapid growth of its economy.

This dual expansion strategy means China Power operates in a complex competitive environment. Both traditional coal power generation and newer renewable energy sources are vying for generation capacity and market share. For instance, in 2023, China added a record 470 GW of renewable energy capacity, while also approving significant new coal power projects, highlighting this ongoing tension.

Market-Oriented Reforms and Pricing Competition

China's ongoing power market reforms are significantly altering the competitive landscape. The move towards market-based pricing for electricity, especially for new energy sources like solar and wind, is a key driver. This transition away from fixed feed-in tariffs means generators must increasingly compete on price, directly impacting companies like China Power International Development.

This intensified price competition is further fueled by the establishment and expansion of electricity spot markets. These markets allow for real-time trading of electricity, creating a more dynamic pricing environment where supply and demand directly influence costs. For instance, in 2023, several provincial pilot electricity spot markets saw significant price fluctuations, highlighting the growing importance of price competitiveness.

- Shift to Market-Based Pricing: Reforms are transitioning new energy pricing from fixed feed-in tariffs to market-driven rates, increasing direct price competition among power generators.

- Spot Market Intensification: The development of electricity spot markets further amplifies price-based rivalry, as generators must now compete on real-time price discovery.

- Increased Generator Competition: Companies are compelled to optimize their cost structures and operational efficiencies to remain competitive in a market where price is a primary differentiator.

Strategic Diversification and Innovation

Competitive rivalry is intensifying as companies like China Power International Development strategically diversify their energy portfolios. By 2024, China Power had already achieved over 80% of its installed capacity from clean energy sources, a significant shift that reshapes the competitive landscape. This pivot drives intense competition in developing and optimizing a wide range of energy solutions, from traditional hydropower to cutting-edge wind, solar, and energy storage technologies.

The pursuit of innovation in areas such as advanced energy storage systems and smart grid solutions is becoming a critical differentiator. Companies are investing heavily to gain an edge in these rapidly evolving sectors.

- Clean Energy Dominance: China Power's clean energy capacity exceeded 80% by 2024, setting a benchmark for the industry.

- Diversified Portfolio Competition: Rivalry is fierce across hydropower, wind, solar, and energy storage development.

- Innovation as a Differentiator: Advancements in energy storage and smart energy solutions are key to competitive advantage.

Competitive rivalry in China's power sector is fierce, driven by both state-owned giants and the rapid expansion of renewables. China Power International Development faces intense competition from major SOEs like Huaneng and Datang, especially as market-based pricing and electricity spot markets become more prevalent.

The push for clean energy has intensified competition in developing wind, solar, and storage solutions, with China Power aiming for over 80% clean energy capacity by 2024. This dynamic is further complicated by continued investment in coal for grid stability, creating a dual competitive environment.

| Metric | China Power International Development (2023/2024 Estimate) | Key Competitors (Approximate) |

|---|---|---|

| Installed Capacity (GW) | ~50+ (Clean Energy Focus) | Huaneng Power, Datang Power, SPIC (Each 100+ GW) |

| Clean Energy Share | >80% (by 2024) | Varies, but increasing across all major SOEs |

| Market Dynamics | Increasing price competition, spot market participation | Similar trends, driven by national reforms |

SSubstitutes Threaten

Improvements in energy efficiency across industrial, commercial, and residential sectors are a significant substitute threat, directly reducing the demand for electricity. For instance, by 2024, China's industrial sector has seen substantial gains in energy intensity reduction, with many heavy industries implementing advanced manufacturing techniques that consume less power per unit of output. This trend directly impacts the need for grid-supplied electricity from companies like China Power International Development.

Consumers are also increasingly adopting energy-saving appliances and smart home technologies, further diminishing reliance on traditional electricity consumption. Government initiatives, such as subsidies for high-efficiency appliances and stricter building codes for energy performance, actively encourage these substitutions. These policies are designed to foster a culture of energy conservation, effectively offering an alternative to simply consuming more power.

The rapid expansion of distributed generation, especially rooftop solar, presents a significant threat of substitutes for traditional power providers like China Power International Development. Businesses and households can now produce their own electricity, lessening their dependence on the grid.

This shift is fueled by falling solar photovoltaic costs and supportive government policies, such as China's 'whole county solar' initiative. For instance, China's installed solar capacity reached over 600 GW by the end of 2023, a substantial portion of which is distributed. These distributed energy systems directly compete with purchasing power from the utility.

The rapid advancement of energy storage solutions, particularly lithium-ion batteries, presents a significant threat of substitution for traditional grid power. By 2024, China's new-type energy storage capacity hit 78GW, making it the leading storage technology, surpassing even pumped hydro. This growth allows for greater energy independence and lessens reliance on conventional power generation.

Emergence of Alternative Energy Carriers

The emergence of alternative energy carriers presents a notable threat to traditional electricity providers like China Power International Development. While not universally interchangeable, solutions like green hydrogen are increasingly viable for industrial heating and certain transportation needs, directly competing with electricity in these segments. China's ambitious decarbonization goals, targeting peak carbon emissions before 2030 and carbon neutrality by 2060, are accelerating the development and adoption of these alternatives.

This shift could indirectly diminish the overall demand for grid-supplied electricity. For instance, the Chinese government has set targets for hydrogen fuel cell vehicles, aiming for 10,000 such vehicles by 2025, which represents a direct substitution for electric vehicles in some applications. Furthermore, industrial sectors are exploring hydrogen for high-temperature processes, a space traditionally reliant on electricity. By 2030, China aims to have a hydrogen production capacity of 3 million tons per year, much of which is expected to be green hydrogen, indicating a significant potential shift away from electricity in key industrial uses.

- Green Hydrogen as an Industrial Alternative: Green hydrogen offers a clean alternative for industrial heat and chemical processes, directly impacting electricity demand in these sectors.

- Decarbonization Drive: China's national climate targets are a significant catalyst for the adoption of alternative energy carriers, creating a competitive landscape for electricity providers.

- Transportation Sector Shift: The growing adoption of hydrogen fuel cell vehicles, supported by government policy, presents a direct substitute for electric mobility solutions.

- Hydrogen Production Growth: Projected increases in green hydrogen production capacity signal a growing market share for this alternative energy carrier in China.

Technological Progress and Cost Reductions

Technological progress and cost reductions are significantly impacting the threat of substitutes for traditional power generation. For instance, the levelized cost of electricity (LCOE) for utility-scale solar PV dropped by approximately 89% between 2010 and 2022, reaching an average of $30 per megawatt-hour in 2022. Similarly, onshore wind LCOE saw a reduction of around 69% over the same period, averaging $26 per megawatt-hour. These dramatic cost decreases make renewable energy sources increasingly competitive against conventional power plants.

The falling price-performance ratio of renewables and energy storage directly pressures incumbent power generators like China Power International Development. As solar and wind become more affordable and efficient, they present a more viable alternative for electricity consumers and policymakers. This trend encourages greater adoption of these cleaner technologies, forcing traditional players to accelerate their own cost-reduction efforts and explore cleaner generation methods to remain competitive.

- Falling Renewable Costs: Solar PV LCOE decreased by ~89% (2010-2022), reaching $30/MWh in 2022.

- Wind Power Competitiveness: Onshore wind LCOE reduced by ~69% (2010-2022), averaging $26/MWh.

- Increased Adoption Pressure: Lower costs drive demand for renewables, pressuring traditional generators.

- Innovation Imperative: Traditional power companies must innovate and cut costs to compete with substitutes.

Improvements in energy efficiency and the rise of distributed generation, particularly rooftop solar, significantly reduce demand for grid-supplied electricity. By the end of 2023, China's solar capacity exceeded 600 GW, with distributed systems playing a major role. Furthermore, advancements in energy storage, such as lithium-ion batteries, with China's new-type energy storage capacity reaching 78 GW in 2024, enable greater energy independence, directly challenging traditional power providers.

The increasing viability of alternative energy carriers like green hydrogen for industrial and transportation uses also poses a threat. China's commitment to carbon neutrality by 2060 is accelerating the adoption of these alternatives, with targets for 10,000 hydrogen fuel cell vehicles by 2025 and 3 million tons of annual hydrogen production capacity by 2030.

| Substitute | Impact on China Power | Key Data Points (2023-2024) |

|---|---|---|

| Energy Efficiency | Reduces overall electricity demand | Industrial sector gains in energy intensity reduction |

| Distributed Solar | Decreases reliance on grid power | China's solar capacity > 600 GW (end of 2023) |

| Energy Storage | Enhances energy independence | China's new-type storage capacity = 78 GW (2024) |

| Green Hydrogen | Competes in industrial heat & transport | Target: 10,000 FCEVs by 2025; 3M tons/yr H2 capacity by 2030 |

Entrants Threaten

The power generation sector is inherently capital-intensive, demanding enormous upfront investments in constructing and maintaining power plants, transmission lines, and other essential infrastructure. For instance, building a new coal-fired power plant can cost billions of dollars, and renewable energy projects, while increasingly competitive, still require substantial capital for solar farms or wind turbine installations.

These high capital requirements create a significant barrier to entry, effectively deterring most potential new competitors from entering the market. The sheer scale of financial commitment necessary to establish a meaningful presence in China's power generation industry is often beyond the reach of smaller or less established companies.

While China has been opening its energy sector to private investment, the substantial financial hurdles remain a primary deterrent. Even with government encouragement, the prohibitive cost of entry prevents widespread competition from smaller players, reinforcing the dominance of existing large-scale operators like China Power International Development.

The Chinese power sector presents formidable barriers to entry due to its highly regulated nature. New companies face intricate licensing procedures, demanding environmental impact assessments, and strict operational standards mandated by the government. For instance, in 2024, the National Development and Reform Commission (NDRC) continued to emphasize stringent approval processes for new power generation projects, particularly those involving renewable energy, to ensure grid stability and compliance with national energy strategies.

Navigating this bureaucratic landscape is a significant challenge. Entrants must not only secure permits but also adhere to complex policies governing grid connection, market participation, and pricing mechanisms. These regulatory complexities translate into substantial lead times and upfront investment costs, effectively deterring potential new competitors from entering the market and challenging established players like China Power International Development.

Access to China's national power grid, a crucial component for any power generation company, is tightly controlled by state-owned entities. This control acts as a significant hurdle for potential new entrants looking to establish a presence in the market.

Securing the necessary grid connections and negotiating favorable transmission terms is a complex and often lengthy process. This difficulty in bringing generated power to market effectively limits the competitive threat posed by new players.

The integrated control over transmission and distribution by existing state-owned companies provides them with a substantial competitive advantage, making it challenging for newcomers to compete on a level playing field.

Economies of Scale and Incumbent Advantages

Established power generators like China Power International Development benefit from substantial economies of scale. This advantage spans generation, procurement, and operational efficiencies, making it incredibly difficult for newcomers to match their cost structures. For instance, in 2023, China Power International Development reported total assets of RMB 439.2 billion, reflecting the massive capital investment and infrastructure already in place.

New entrants would face immense challenges in achieving comparable cost advantages, directly impacting their ability to compete on price in the highly competitive Chinese power market. The sheer scale of existing operations allows incumbents to negotiate better terms for fuel, equipment, and financing, creating a significant barrier.

Furthermore, the long operating history of state-owned enterprises (SOEs) like China Power International Development has fostered deeply entrenched relationships with suppliers, regulators, and customers. These established networks and the inherent trust they carry are difficult for new companies to replicate quickly.

- Economies of Scale: China Power International Development's substantial asset base (RMB 439.2 billion in total assets as of 2023) allows for significant cost reductions in operations and procurement.

- Procurement Power: Large-scale fuel purchasing and long-term supply contracts provide cost advantages unavailable to smaller, new entrants.

- Operational Efficiency: Mature operational processes and advanced technology, honed over years of experience, lead to lower per-unit production costs.

- Incumbent Relationships: Established SOEs benefit from long-standing ties with government bodies and key industry stakeholders, facilitating smoother operations and market access.

Government Support and Strategic Importance of SOEs

The threat of new entrants for China Power International Development is significantly mitigated by the government's strong support for State-Owned Enterprises (SOEs) in the power sector, which is deemed a strategic industry. This backing translates into preferential treatment and implicit guarantees, creating substantial barriers for independent newcomers. For instance, in 2023, SOEs continued to dominate the energy landscape, with significant government investment directed towards national energy security initiatives, often channeled through these established entities.

New entrants struggle to compete against the deep pockets and established infrastructure of SOEs, which benefit from government-backed financing and regulatory advantages. This uneven playing field means that any new player would face immense challenges in acquiring necessary licenses, land, and capital compared to existing SOEs. The Chinese government's emphasis on energy security and stability further solidifies the position of incumbent players, making market entry exceptionally difficult.

- Strategic Industry Status: The power sector is classified as strategic, granting SOEs like China Power International Development inherent advantages.

- Government Support for SOEs: SOEs receive implicit and explicit government backing, including preferential financing and regulatory treatment.

- Uneven Playing Field: New entrants lack the strategic backing and extensive resources available to established SOEs, hindering their ability to compete effectively.

- Energy Security Focus: Government policies prioritizing energy security and stability favor existing large players, further deterring new market participants.

The threat of new entrants for China Power International Development is low due to immense capital requirements, with new coal power plants costing billions and even renewables needing substantial investment. For example, in 2024, the NDRC maintained strict approval processes for new projects, emphasizing grid stability and national energy strategies.

Regulatory hurdles, including complex licensing and environmental assessments, further deter new players. Securing grid access, controlled by state-owned entities, is a significant challenge, limiting a newcomer's ability to bring power to market.

Economies of scale enjoyed by incumbents, like China Power International Development's RMB 439.2 billion in total assets in 2023, create cost advantages that are difficult for new entrants to match. Additionally, established relationships with suppliers and regulators provide a competitive edge.

| Barrier | Description | Impact on New Entrants |

|---|---|---|

| Capital Requirements | Billions needed for power plant construction and infrastructure. | Deters smaller, less capitalized firms. |

| Regulatory Complexity | Intricate licensing, environmental standards, and grid connection policies. | Increases lead times and upfront costs. |

| Grid Access Control | State-owned entities control national power grid access. | Limits market entry and power delivery for new players. |

| Economies of Scale | Large asset base (RMB 439.2B in 2023) leads to lower per-unit costs. | New entrants struggle to match cost structures. |

| Government Support for SOEs | Power sector is strategic, with preferential treatment for SOEs. | Creates an uneven playing field favoring incumbents. |

Porter's Five Forces Analysis Data Sources

Our analysis of China Power International Development's competitive landscape is built upon a foundation of reliable data, drawing from the company's annual reports, official regulatory filings, and reputable industry research publications.