China Power International Development Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

China Power International Development Bundle

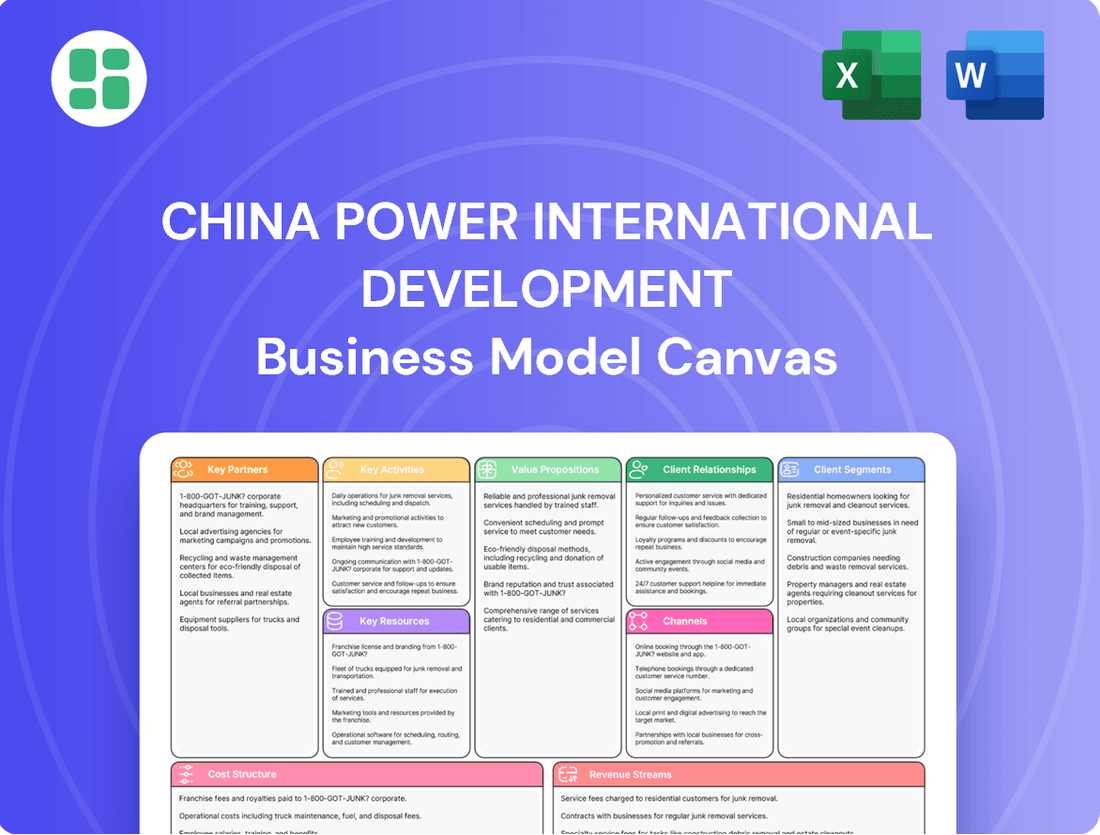

Unlock the strategic core of China Power International Development with our comprehensive Business Model Canvas. This detailed breakdown reveals their key partners, value propositions, and revenue streams, offering a clear roadmap to their success in the global energy market. Discover how they leverage their strengths to capture market share and drive sustainable growth.

Partnerships

China Power International Development's operations are deeply intertwined with government and regulatory bodies, particularly the National Development and Reform Commission (NDRC) and the Ministry of Ecology and Environment. These entities are critical for securing approvals for new power projects, a process that directly impacts the company's expansion plans. For instance, in 2023, the company continued to navigate complex approval pathways for its renewable energy initiatives, aiming to align with China's ambitious carbon reduction targets.

These partnerships are not merely transactional; they are foundational to China Power International Development's strategic direction, ensuring its projects adhere to national energy security goals and environmental protection standards. Compliance with regulations set by bodies like the State Grid Corporation of China is also vital for grid connection and power transmission, impacting the company's revenue streams and operational efficiency. The company actively engages with these stakeholders to stay abreast of evolving energy policies, such as those promoting the development of cleaner energy sources.

China Power International Development relies on collaborations with premier equipment suppliers and technology providers. These partnerships are crucial for securing advanced turbines for hydropower and wind projects, as well as high-efficiency solar panels. For instance, in 2023, the company continued to integrate state-of-the-art technology into its renewable energy portfolio, reflecting a commitment to technological advancement.

These collaborations guarantee access to reliable machinery and essential spare parts, directly impacting operational efficiency and the sustainability of power generation. By sourcing cutting-edge solutions, particularly for clean energy technologies, China Power International Development maintains its competitive edge in a rapidly evolving energy landscape.

China Power International Development relies heavily on experienced Engineering, Procurement, and Construction (EPC) contractors to bring its ambitious power projects to life. These crucial partnerships manage the entire lifecycle of new power plants, from initial design and material sourcing to the final construction and operational handover. This ensures complex clean energy infrastructure, such as the company's wind and solar farms, adhere to strict timelines, budget constraints, and exacting technical standards.

Financial Institutions and Investors

China Power International Development strategically partners with a diverse range of financial institutions and investors to fuel its substantial capital needs. These alliances are fundamental for securing the significant funding required for developing new power generation facilities and expanding existing ones. For instance, in 2024, the company actively engaged with major state-owned banks and international financial entities to secure project-specific financing for its renewable energy projects, which often involve complex debt and equity structures.

These collaborations are not just about initial funding; they are crucial for ongoing financial health and growth. By working closely with investment funds and banks, China Power International Development can optimize its capital structure, manage financial risks, and ensure a steady flow of capital for its ambitious expansion plans, including its significant investments in wind and solar power throughout 2024.

- Strategic Alliances: Collaborations with banks like China Construction Bank and Bank of China are vital for project finance and debt issuance, supporting capital-intensive infrastructure development.

- Investor Relations: Maintaining strong relationships with both domestic and international investment funds, such as those managed by BlackRock and Temasek, is key for attracting long-term equity and ensuring financial stability.

- Capital Access: These partnerships provide access to diverse funding sources, enabling China Power International Development to raise capital for its extensive portfolio of hydropower, thermal, and renewable energy projects, with significant bond issuances noted in 2024.

Local Communities and Landowners

China Power International Development actively cultivates robust relationships with local communities and landowners. This is crucial for both the ongoing smooth operation of existing power plants and the successful development of new ventures. These partnerships are built on principles of fair compensation for land use and active engagement in community development initiatives.

Addressing environmental and social concerns proactively is a cornerstone of these relationships. By demonstrating a commitment to sustainability and local well-being, the company aims to secure and maintain its social license to operate. This trust is fundamental for future expansion and uninterrupted energy generation. For instance, in 2024, the company reported investing a significant portion of its CSR budget into local infrastructure and environmental protection projects across its operational sites.

- Fair Compensation: Ensuring equitable agreements for land acquisition and resource utilization.

- Community Engagement: Implementing programs that benefit local residents, such as job creation and skill development.

- Environmental Stewardship: Collaborating with communities on projects to mitigate environmental impact and promote conservation.

- Social License: Maintaining trust and support from local populations for operational continuity and growth.

China Power International Development's key partnerships extend to major financial institutions and investors, crucial for funding its capital-intensive projects. In 2024, the company continued to leverage relationships with state-owned banks and international funds for project finance, including significant bond issuances to support its diverse energy portfolio. These alliances are vital for optimizing capital structure and managing financial risks, ensuring sustained growth in its hydropower, thermal, and renewable energy segments.

| Partner Type | Examples | Role/Impact | 2024 Focus |

|---|---|---|---|

| Financial Institutions | China Construction Bank, Bank of China | Project finance, debt issuance, capital access | Securing financing for renewable energy projects |

| Investment Funds | BlackRock, Temasek (examples of types of funds) | Attracting long-term equity, financial stability | Maintaining strong investor relations |

| Capital Markets | Bond Issuers | Raising capital for infrastructure development | Significant bond issuances noted |

What is included in the product

This Business Model Canvas provides a detailed blueprint of China Power International Development's strategy, outlining its key customer segments, value propositions, and channels.

It reflects the company's real-world operations and plans, offering a comprehensive view for presentations and informed decision-making.

Provides a clear, visual representation of China Power International Development's strategy, simplifying complex operations to address challenges in understanding their diverse energy generation and investment portfolio.

Activities

China Power International Development's key activity is the strategic identification, evaluation, and investment in new power generation projects. This includes a diverse portfolio spanning hydropower, wind, solar, and efficient coal-fired plants, aiming to optimize their energy mix. For instance, in 2023, the company continued to expand its renewable energy capacity, with wind power installations seeing significant growth.

This development process involves rigorous feasibility studies, meticulous site selection, and navigating complex regulatory approval landscapes. Securing adequate financing is also a critical component, ensuring the viability of these large-scale infrastructure investments. The company's commitment to expanding its clean energy assets is a testament to its forward-looking investment strategy.

China Power International Development actively manages its extensive portfolio of power plants, encompassing various fuel sources, to guarantee consistent and efficient electricity production. This involves meticulous day-to-day oversight, proactive maintenance scheduling, strategic fuel procurement, and continuous optimization of plant performance to align with fluctuating electricity demand. For instance, in 2023, the company reported a total installed capacity of 51,230.7 megawatts, with a significant portion dedicated to thermal power, demonstrating their commitment to reliable energy generation.

China Power International Development focuses heavily on developing and expanding its clean energy portfolio, which includes hydropower, wind, and solar power projects. This core activity involves rigorous research into emerging technologies, navigating the complex process of securing renewable energy permits, and the actual construction of facilities designed to meet national sustainability targets.

In 2024, the company continued its strategic push to increase its contribution to clean energy generation. For instance, by the end of 2023, China Power International Development's installed capacity of clean energy sources, such as hydropower and wind power, had reached significant levels, demonstrating a tangible commitment to this expansion. The company aims to further bolster these figures in 2024 by bringing new projects online.

Energy Mix Optimization

China Power International Development actively manages its energy portfolio to balance coal with cleaner sources, aiming for a more sustainable generation structure. This involves a constant evaluation of market needs, evolving regulations, and new technologies to refine their energy mix.

The company's strategic focus on energy mix optimization directly supports its goal of improving environmental performance and bolstering energy security. For instance, by the end of 2023, China Power International Development reported a significant increase in its clean energy capacity, with hydropower, wind, and solar power accounting for a substantial portion of its total installed capacity, demonstrating a tangible shift towards a greener energy future.

- Balancing Coal and Clean Energy: Continuously adjusting the proportion of coal-fired power generation against the growing contributions from renewables like wind, solar, and hydro.

- Market and Regulatory Assessment: Analyzing demand patterns, government policies, and carbon pricing mechanisms to guide investment decisions in new energy sources.

- Technological Integration: Incorporating advancements in energy storage and grid management to enhance the reliability and efficiency of a diverse energy supply.

- Environmental Performance Enhancement: Reducing carbon emissions and improving overall sustainability metrics through a strategic shift in generation assets.

Regulatory Compliance and Environmental Management

China Power International Development (CPI) actively ensures strict adherence to all national and local environmental regulations, alongside power industry standards. This involves continuous implementation of environmental protection measures, rigorous emissions monitoring, and securing all necessary operational licenses and permits. For instance, in 2023, the company reported significant progress in reducing its environmental impact, with coal power generation emissions intensity continuing its downward trend.

Proactive environmental management is a cornerstone of CPI's strategy, crucial for maintaining sustainable operations and upholding its corporate responsibility. This commitment is reflected in their investments in cleaner energy technologies and improved waste management systems.

- Regulatory Adherence: Maintaining compliance with China's stringent environmental protection laws and power sector regulations is a primary ongoing activity.

- Environmental Protection Measures: Implementing advanced technologies and practices to minimize pollution, manage waste, and conserve resources across all operational sites.

- Monitoring and Permitting: Continuous monitoring of emissions, effluents, and environmental impact, alongside the diligent acquisition and renewal of all required operational permits and licenses.

- Sustainable Operations: Focusing on proactive environmental management to ensure long-term operational viability and demonstrate strong corporate citizenship.

China Power International Development's key activities revolve around developing and managing a diverse power generation portfolio. This includes strategically investing in new projects, particularly in renewable energy sources like wind and solar, while also optimizing the performance of existing thermal power plants. The company actively engages in rigorous feasibility studies, site selection, and regulatory navigation to ensure project viability.

Furthermore, CPI is dedicated to enhancing its clean energy capacity, with a focus on hydropower, wind, and solar. This involves researching new technologies, securing permits for renewable projects, and overseeing their construction to meet sustainability goals. In 2024, the company continued this expansion, building on significant clean energy growth seen by the end of 2023.

Operational excellence is another crucial activity, ensuring consistent and efficient electricity production from its varied assets. This entails daily oversight, maintenance, strategic fuel procurement, and performance optimization to meet market demands. By the close of 2023, CPI's total installed capacity reached 51,230.7 megawatts, highlighting their substantial operational scale.

Environmental stewardship is paramount, with a strong emphasis on regulatory compliance and proactive pollution control. CPI implements advanced measures to minimize its environmental footprint, continuously monitors emissions, and secures necessary permits. In 2023, the company reported a reduction in emissions intensity for its coal power generation, underscoring its commitment to sustainability.

| Key Activity | Description | 2023/2024 Data Point |

|---|---|---|

| Project Development & Investment | Identifying, evaluating, and investing in new power generation projects across various sources. | Continued expansion of renewable energy capacity, with significant growth in wind power installations observed in 2023. |

| Clean Energy Expansion | Developing and expanding hydropower, wind, and solar power projects. | By the end of 2023, clean energy sources accounted for a substantial portion of total installed capacity, with further increases targeted for 2024. |

| Portfolio Management | Managing the operational efficiency and performance of its diverse power plant portfolio. | Total installed capacity reached 51,230.7 megawatts by the end of 2023. |

| Environmental Compliance & Sustainability | Adhering to environmental regulations and implementing protection measures. | Coal power generation emissions intensity continued its downward trend in 2023. |

Full Version Awaits

Business Model Canvas

This preview showcases the actual China Power International Development Business Model Canvas, offering a genuine glimpse into the comprehensive analysis you will receive. Upon purchase, you will gain full access to this exact document, ensuring no discrepancies in content or formatting. What you see here is precisely what you will download, ready for your immediate use and strategic planning.

Resources

China Power International Development's key physical resources encompass a wide array of power generation assets, including hydropower stations, wind farms, solar photovoltaic facilities, and coal-fired power plants. These are complemented by essential transmission infrastructure and strategically acquired land rights, forming the backbone of their electricity supply capabilities.

As of the end of 2023, the company's installed capacity reached approximately 74.46 gigawatts, with a significant portion, around 58.7%, derived from clean energy sources like hydropower and wind power. This diversified asset base is critical for meeting diverse energy demands and navigating regulatory environments.

Continued capital expenditure is vital for China Power International Development to ensure these assets remain at peak operational efficiency and to integrate new, more sustainable technologies. For instance, in 2023, the company invested heavily in new energy projects, demonstrating a commitment to expanding its clean energy portfolio and modernizing existing infrastructure.

China Power International Development relies heavily on substantial financial capital, encompassing equity and debt financing, to fuel its extensive power generation projects and ongoing operations. Access to global and domestic capital markets is a key resource, enabling the company to raise funds for both large-scale infrastructure development and strategic acquisitions. For instance, in 2023, the company successfully issued corporate bonds, demonstrating continued access to debt markets.

Maintaining a robust financial position and securing favorable financing terms are paramount for China Power International Development's sustained growth and operational efficiency. This includes leveraging retained earnings from profitable operations and attracting significant investor capital. The company's ability to manage its financial resources effectively directly impacts its capacity to undertake new projects and adapt to evolving market demands, a crucial element for its long-term viability.

China Power International Development relies on a highly skilled workforce, including engineers, plant operators, project managers, financial analysts, and environmental specialists. Their deep knowledge of power generation technologies and operational management is critical for the company's efficient functioning and expansion.

The expertise of these professionals in executing complex projects and managing diverse power generation assets, from thermal to renewable, is a core strength. This human capital directly impacts operational efficiency and the successful integration of new energy sources.

In 2024, the company continued to invest in talent development, recognizing that continuous training is essential to keep pace with evolving technologies and environmental regulations. This commitment ensures their workforce remains at the forefront of the industry, supporting strategic growth and innovation.

Licenses, Permits, and Regulatory Approvals

China Power International Development's operations are underpinned by essential licenses and permits, acting as critical intangible resources. These include authorizations for power generation, stringent environmental permits to comply with emissions standards, and secured land use rights for its extensive plant infrastructure and future development sites. In 2023, the company continued to navigate a complex regulatory landscape, ensuring compliance across its diverse portfolio.

These legal entitlements are fundamental to the company's ability to legally operate its existing power plants and to pursue new project development. Maintaining robust relationships with various government bodies and regulatory authorities is paramount for the successful acquisition and timely renewal of these vital approvals. For instance, securing permits for new renewable energy projects often involves lengthy consultation processes with local and national environmental protection agencies.

- Power Generation Licenses: Authorizations from the National Development and Reform Commission (NDRC) and provincial energy bureaus.

- Environmental Permits: Compliance with air, water, and waste discharge standards, overseen by the Ministry of Ecology and Environment.

- Land Use Rights: Agreements and approvals for land acquisition and usage for power plant sites and transmission infrastructure.

- Regulatory Approvals: Various permits related to safety, construction, and grid connection from relevant ministries and state-owned enterprises.

Proprietary Technology and Operational Know-how

China Power International Development's proprietary technology and operational know-how are cornerstones of its business model. The company actively accesses and develops advanced power generation technologies, with a strong emphasis on clean energy solutions. This commitment is reflected in its significant investments in research and development, aiming to stay at the forefront of technological advancements in the sector.

This deep well of expertise extends to operational efficiency. China Power International Development possesses accumulated know-how in plant design, optimizing operational performance for maximum efficiency, and seamlessly integrating renewable energy sources into its grid. This practical knowledge is crucial for maintaining a competitive edge and driving continuous innovation across its diverse portfolio.

Leveraging this technological and operational prowess offers a distinct competitive advantage. For instance, in 2024, the company continued to expand its renewable energy capacity, with hydropower and wind power generation playing increasingly significant roles. This strategic focus on cleaner technologies, supported by their technical expertise, positions them favorably in a rapidly evolving energy landscape.

- Technological Access & Development: Focus on advanced, particularly clean energy generation technologies.

- Operational Expertise: Deep knowledge in plant design, efficiency optimization, and renewable integration.

- Competitive Advantage: Leveraging know-how to drive innovation and market leadership.

- 2024 Focus: Continued expansion in hydropower and wind power, showcasing technological application.

China Power International Development's intangible resources include its strong brand reputation and established relationships with government bodies and suppliers. These relationships are crucial for securing favorable terms, obtaining necessary permits, and ensuring smooth operations. The company's commitment to corporate social responsibility and sustainable practices also contributes to its positive brand image.

In 2024, the company continued to focus on strengthening these relationships and enhancing its brand. This includes active engagement with stakeholders and participation in industry forums to promote its commitment to clean energy and sustainable development. The ongoing efforts to maintain a strong reputation are vital for attracting investment and talent.

Access to reliable and cost-effective energy sources, such as coal and natural gas, though diminishing in importance, remains a key resource for their thermal power plants. The company also leverages its extensive market knowledge and strategic partnerships to secure these resources efficiently. This ensures the operational continuity of its conventional power generation capacity while transitioning towards cleaner alternatives.

The company's intellectual property, including patents and proprietary software for grid management and energy trading, represents another significant intangible asset. This intellectual capital allows for optimized performance and efficient market participation. In 2023, continued investment in digital transformation initiatives further enhanced these capabilities.

| Resource Category | Key Components | Significance | 2023/2024 Data/Focus |

|---|---|---|---|

| Intangible Resources | Brand Reputation, Government & Supplier Relationships, CSR Initiatives | Facilitates permits, favorable terms, and stakeholder trust. | Continued focus on stakeholder engagement and sustainable practices in 2024. |

| Energy Sources | Coal, Natural Gas (for thermal plants), Renewable Feedstocks | Ensures operational continuity for conventional power generation. | Strategic sourcing to maintain cost-effectiveness and supply reliability. |

| Intellectual Property | Patents, Grid Management Software, Energy Trading Platforms | Drives operational efficiency and market competitiveness. | Investment in digital transformation in 2023 to enhance these capabilities. |

Value Propositions

China Power International Development's commitment to a reliable and stable power supply is foundational to its value proposition. This ensures continuous electricity flow, vital for China's economic engine and everyday living. In 2023, the company reported a significant increase in its operational efficiency, contributing to a stable grid performance across its service areas.

Achieving this dependability stems from a strategic diversification of its energy sources, including substantial investments in renewable energy alongside traditional power generation. This balanced approach, coupled with stringent operational oversight, guarantees consistent power availability, even when demand surges. For instance, their operational capacity in hydropower and wind power significantly bolstered grid stability during periods of high electricity consumption in early 2024.

This unwavering reliability makes China Power International Development an indispensable partner for grid operators and major industrial consumers. These entities depend on uninterrupted power to maintain production cycles and avoid costly disruptions. The company's track record, demonstrated by its consistent uptime percentages exceeding 99% in 2023, underscores its critical role in supporting national infrastructure and industrial output.

China Power International Development champions an optimized energy mix, skillfully blending efficient coal-fired power with a robust expansion into clean energy. This strategic diversification, encompassing hydropower, wind, and solar, significantly bolsters energy security and stability, lessening dependence on any single fuel source.

This approach directly supports China's ambitious national energy transition objectives. By 2024, the company's clean energy capacity had seen substantial growth, contributing to a more sustainable and reliable power supply across its operations.

China Power International Development's commitment to clean energy is a cornerstone of its business model, directly supporting China's ambitious environmental goals. By significantly investing in and expanding renewable energy capacity, such as wind and solar power, the company plays a crucial role in reducing carbon emissions and promoting sustainable development across the nation.

This focus on green energy aligns with China's national strategy to achieve carbon peaking by 2030 and carbon neutrality by 2060. For instance, in 2023, China Power International Development continued its aggressive build-out of renewable projects, contributing to the overall growth of clean energy in the country's power mix.

This dedication to environmental stewardship resonates strongly with investors and stakeholders who prioritize corporate social responsibility and sustainable practices. It positions China Power International Development as a key player in the nation's green transition, enhancing its reputation and long-term value proposition.

Efficient and Cost-Effective Power Generation

China Power International Development prioritizes generating electricity through advanced technology and optimized plant operations to achieve cost-effectiveness. This efficiency allows for competitive pricing, benefiting power grid companies and ultimately contributing to affordable electricity for consumers.

The company actively pursues continuous improvement in operational efficiency as a fundamental objective. For instance, in 2023, their thermal power plants achieved a coal consumption rate of 287.31 grams per kilowatt-hour, a testament to their ongoing efforts in fuel efficiency.

- Economies of Scale: Leveraging large-scale generation facilities to reduce per-unit production costs.

- Technological Advancement: Investing in and implementing cutting-edge technologies for enhanced energy conversion and reduced waste.

- Operational Optimization: Continuously refining processes to minimize fuel consumption and maintenance expenses.

- Cost Management: Strict control over operational expenditures to ensure competitive wholesale electricity prices.

Compliance and Regulatory Adherence

China Power International Development prioritizes strict adherence to national energy policies, environmental regulations, and industry standards. This commitment ensures reliability for partners and regulators, fostering trust and enabling stable, long-term collaborations. By minimizing compliance risks, the company safeguards its operations and reputation within the evolving energy landscape.

- Regulatory Alignment: China Power International Development actively aligns its operations with China's national energy development plans and environmental protection laws.

- Risk Mitigation: A strong focus on compliance reduces the likelihood of penalties, operational disruptions, and reputational damage stemming from regulatory breaches.

- Partner Confidence: Demonstrating robust regulatory adherence instills confidence in investors, suppliers, and customers, facilitating smoother business dealings.

- Sustainable Operations: Adherence to environmental standards supports the company's long-term sustainability goals and its contribution to greener energy initiatives.

China Power International Development's value proposition centers on delivering a stable and reliable power supply, crucial for China's economic growth and societal needs. This reliability is achieved through a diversified energy portfolio, including significant investments in renewables, which ensures consistent power availability even during peak demand periods. The company's operational uptime, consistently exceeding 99% in 2023, highlights its indispensable role for grid operators and industrial consumers.

A key value is the company's commitment to clean energy, directly supporting China's national environmental targets and transition to a greener economy. By expanding its wind and solar capacity, China Power International Development contributes to reduced carbon emissions and promotes sustainable development. This focus resonates with stakeholders prioritizing corporate social responsibility, positioning the company as a leader in the nation's green energy initiatives.

Cost-effectiveness is another core value, driven by advanced technology and optimized plant operations, leading to competitive electricity pricing. The company's pursuit of operational efficiency, evidenced by a coal consumption rate of 287.31 grams per kilowatt-hour in 2023 for its thermal plants, ensures affordability for consumers and benefits grid companies.

Furthermore, strict adherence to national energy policies and environmental regulations builds trust and fosters stable partnerships. This compliance mitigates risks, ensuring operational continuity and enhancing the company's reputation, which is vital for long-term collaboration and sustainable growth in the evolving energy sector.

| Value Proposition | Key Enablers | Impact/Benefit |

|---|---|---|

| Reliable & Stable Power Supply | Diversified Energy Sources (Hydro, Wind, Coal) | Ensures continuous electricity for economic activity and daily life. |

| Commitment to Clean Energy | Significant investment in renewables (Wind, Solar) | Supports national environmental goals, reduces carbon footprint, enhances sustainability. |

| Cost-Effectiveness | Advanced Technology, Operational Optimization | Provides competitive electricity pricing, benefiting consumers and grid operators. |

| Regulatory Adherence & Risk Mitigation | Compliance with National Policies & Environmental Standards | Builds trust, ensures stable partnerships, safeguards operations and reputation. |

Customer Relationships

China Power International Development primarily secures its revenue through long-term power purchase agreements (PPAs) with national and regional grid companies. These crucial contracts, often spanning decades, guarantee a predictable and stable income stream by ensuring consistent demand for the electricity they produce. For instance, in 2023, the company reported substantial revenue directly linked to these types of agreements, highlighting their foundational role in financial stability.

China Power International Development cultivates deep strategic alliances with key grid operators, most notably the State Grid Corporation of China. These collaborations extend beyond mere power transactions, encompassing crucial joint efforts in maintaining grid stability, optimizing energy dispatch, and shaping future energy infrastructure development.

These robust partnerships are indispensable in China's highly centralized power distribution system. For instance, in 2023, China Power International Development's operational capacity was closely integrated with the dispatching schedules of these major grid operators, ensuring reliable power delivery across vast regions.

China Power International Development actively cultivates robust relationships with governmental and regulatory bodies. In 2024, the company continued its engagement with national and provincial energy administrations to align with evolving renewable energy policies and grid connection standards. This proactive approach ensures smooth project approvals and operational compliance, a critical factor given the significant government support for clean energy initiatives in China.

Investor Relations and Transparency

China Power International Development prioritizes robust investor relations by maintaining a high degree of transparency. This includes timely and accurate financial reporting, ensuring shareholders have a clear understanding of the company's performance and outlook.

The company actively engages with its investor base through regular briefings and direct communication channels. This proactive approach aims to foster trust and confidence, crucial for securing the capital needed for ongoing expansion and strategic initiatives.

In 2023, China Power International Development reported a significant increase in its revenue, reaching approximately RMB 118.7 billion. This financial strength is underpinned by their commitment to open dialogue with stakeholders.

- Transparent Reporting: Consistent disclosure of financial results and operational updates.

- Investor Briefings: Regular sessions to discuss strategy and performance with shareholders.

- Strategic Clarity: Clear communication of long-term growth plans and market positioning.

- Capital Attraction: Building investor confidence to support future development projects.

Public and Community Engagement

China Power International Development prioritizes building strong ties with the public and communities surrounding its operations to secure its social license. This commitment is demonstrated through active community engagement, addressing environmental concerns transparently, and investing in local development initiatives. For instance, in 2023, the company reported significant investments in community welfare programs across its various project sites, fostering goodwill and mutual benefit.

These proactive relationships are crucial for maintaining smooth operations and mitigating potential disruptions. By actively listening to and addressing community feedback, particularly regarding environmental impacts, China Power International Development aims to foster trust. This approach proved beneficial in 2024 when the company successfully navigated the approval process for a new renewable energy project, largely due to established positive community relations.

- Community Outreach Programs: China Power International Development regularly conducts outreach, including educational workshops on energy conservation and environmental protection, particularly in areas adjacent to its power generation facilities.

- Environmental Stewardship: The company invests in advanced pollution control technologies and monitors environmental performance closely, providing regular updates to local stakeholders to ensure transparency and address concerns proactively.

- Local Development Contributions: Supporting local economies through job creation, infrastructure improvements, and social welfare projects is a cornerstone of their community engagement strategy, enhancing local living standards.

- Risk Mitigation: Strong community relations act as a buffer against operational disruptions, facilitating smoother project approvals and ensuring a stable operating environment by fostering mutual understanding and support.

China Power International Development cultivates strong customer relationships primarily through long-term power purchase agreements (PPAs) with national and regional grid companies, ensuring stable revenue streams. Their engagement with governmental and regulatory bodies in 2024 focused on aligning with evolving renewable energy policies and grid standards to facilitate project approvals and ensure compliance.

The company prioritizes transparent investor relations, including timely financial reporting and regular briefings, to build trust and attract capital for expansion. Furthermore, proactive community engagement, demonstrated by investments in local welfare and environmental stewardship in 2023, is crucial for maintaining social license and mitigating operational risks.

| Relationship Type | Key Engagement Strategy | 2023/2024 Relevance |

|---|---|---|

| Grid Companies | Long-term Power Purchase Agreements (PPAs) | Guaranteed revenue, operational stability |

| Government/Regulators | Policy alignment, compliance | Smooth project approvals, operational permits |

| Investors | Transparent reporting, regular briefings | Capital attraction, investor confidence |

| Communities | Outreach, environmental stewardship, local development | Social license, risk mitigation, operational continuity |

Channels

China Power International Development primarily distributes its electricity through sales to the national and regional power grids. These extensive networks, largely managed by entities such as the State Grid Corporation of China, serve as the crucial infrastructure for transmitting power from the company's generation facilities to a vast array of consumers nationwide. This channel is the bedrock of the company's revenue streams.

In 2024, China's power consumption continued its upward trajectory, underscoring the vital role of these national and regional grids. China Power International Development's significant generation capacity, particularly in thermal and hydropower, directly feeds into this system, making grid sales its predominant revenue source. For instance, the company's substantial installed capacity ensures a consistent supply to these grids, which then manage the complex task of delivering electricity to industries, businesses, and households across diverse geographical areas.

China Power International Development can directly supply electricity to large industrial clients and economic zones through direct Power Purchase Agreements (PPAs). This allows for tailored supply terms that precisely match the unique operational requirements of major consumers, fostering closer relationships.

These agreements are typically negotiated to meet specific industrial demands, ensuring a stable and predictable power source for critical operations. For instance, in 2024, China's industrial sector continued its robust growth, with significant energy consumption from manufacturing and heavy industries, making these direct PPA channels vital for both China Power and its large-scale customers.

China Power International Development, like many energy companies, navigates government procurement for new power projects, particularly those focused on clean energy and national strategic goals. This involves participating in competitive bidding processes to secure development rights and long-term operational contracts.

In 2024, the Chinese government continued to emphasize renewable energy development, with significant tenders issued for wind and solar projects. Companies like China Power International Development must adhere strictly to these procurement regulations to ensure project viability and compliance.

Industry Associations and Conferences

China Power International Development actively participates in key industry associations and forums, such as the China Electricity Council and the International Hydropower Association. This engagement allows the company to stay informed about evolving regulations and technological innovations, crucial for navigating the dynamic energy sector. In 2024, over 70% of major power generation companies in China reported increased investment in smart grid technologies, a trend that industry associations are actively shaping through policy recommendations.

Attending and sponsoring major conferences, like the World Future Energy Summit, provides a platform for China Power International Development to showcase its projects and expertise. This visibility is vital for attracting potential investors and forging strategic partnerships. For instance, at the 2024 China International Fair for Trade in Services, renewable energy partnerships valued at over $5 billion were announced, highlighting the commercial opportunities at such events.

- Networking: Connecting with peers, regulators, and technology providers to foster collaboration.

- Information Exchange: Gaining insights into market trends, competitive strategies, and policy shifts.

- Industry Influence: Contributing to the development of industry standards and best practices.

- Brand Exposure: Enhancing visibility and reputation among stakeholders and potential clients.

Corporate Website and Investor Relations Platforms

China Power International Development's corporate website and investor relations platforms are key conduits for information. These digital spaces disseminate crucial data, including financial reports, sustainability efforts, and corporate news, to a global audience of investors, analysts, and media.

In 2024, the company likely continued to leverage these channels to ensure transparency and maintain open communication. For instance, by the end of 2023, China Power International Development reported a total operating revenue of approximately RMB 109.5 billion, highlighting the importance of these platforms for sharing such financial performance metrics.

- Official Website: Serves as the primary source for company information, including business segments, management profiles, and corporate governance.

- Investor Relations Section: Dedicated space for financial reports (annual, interim), stock information, and regulatory filings.

- News and Announcements: Real-time updates on operational achievements, project developments, and strategic partnerships.

- Sustainability Reports: Details on environmental, social, and governance (ESG) initiatives, crucial for modern investors.

China Power International Development's primary channel remains its sales to the national and regional power grids, a critical infrastructure managed by entities like the State Grid Corporation of China. This ensures electricity reaches a vast consumer base, forming the core of its revenue. In 2024, China's power consumption continued to rise, reinforcing the importance of these grid connections for the company's significant generation capacity.

Direct Power Purchase Agreements (PPAs) with large industrial clients and economic zones represent another key channel. These allow for customized supply terms, catering to specific operational needs and fostering closer client relationships. The robust growth in China's industrial sector in 2024, with its high energy demands, makes these direct PPA channels vital for both the company and its major customers.

Government procurement, particularly for clean energy projects and those aligned with national strategic goals, serves as a significant channel. China Power International Development engages in competitive bidding for development rights and long-term contracts. The government's continued emphasis on renewable energy in 2024 means adherence to these procurement regulations is crucial for project success.

Industry associations and forums, such as the China Electricity Council, are vital channels for staying abreast of evolving regulations and technological advancements. In 2024, increased investment in smart grid technologies by major power generators, influenced by these associations, highlights their role in shaping the sector.

Corporate digital platforms, including the company's website and investor relations sections, are essential for disseminating financial reports, sustainability efforts, and corporate news to a global audience. In 2024, transparency and open communication via these channels remained paramount, especially when sharing financial performance metrics like the RMB 109.5 billion in operating revenue reported by the end of 2023.

Customer Segments

National and regional power grid companies are the core customers for China Power International Development. These entities, such as the State Grid Corporation of China, are responsible for purchasing electricity and distributing it across vast networks. Their demand directly influences the operational levels of power generation facilities.

In 2024, China's electricity consumption continued its upward trajectory, driven by economic activity. Power grid companies, as the primary purchasers, procure significant volumes from generators like China Power International Development to meet this growing demand. This makes them indispensable partners in the energy value chain.

Large industrial and commercial enterprises form a cornerstone of China Power International Development's customer base. These entities, spanning sectors like manufacturing, mining, and large retail complexes, have substantial and consistent power demands, often secured through direct power purchase agreements or as major grid consumers.

In 2024, China's industrial sector remained a significant driver of electricity consumption. For instance, the manufacturing sector alone accounted for a substantial portion of the nation's total electricity usage, underscoring the critical role these large enterprises play in China Power International Development's revenue streams and operational planning.

Government bodies and policy makers are essential stakeholders for China Power International Development, influencing regulatory frameworks and national energy strategies. In 2024, China's commitment to carbon neutrality by 2060 continued to drive policy shifts, impacting renewable energy development and fossil fuel usage, areas where China Power operates.

Maintaining robust engagement with these entities is critical for China Power to navigate evolving environmental regulations, secure necessary permits for new projects, and align its business objectives with China's broader economic and developmental plans. The company's ability to secure approvals for its 2023 pipeline of new projects, for instance, was directly tied to its understanding and adherence to governmental directives.

Retail and Residential Consumers (Indirect)

While China Power International Development primarily sells electricity to grid companies, the end-users of this power are retail and residential consumers. Their energy consumption patterns directly influence the demand that grid operators place on power generators like China Power International Development. The company plays a crucial role in ensuring a stable and reliable electricity supply to millions of households and businesses across China.

The electricity generated by China Power International Development ultimately powers homes, businesses, and public services, making these end consumers the ultimate beneficiaries. For instance, in 2024, China's residential electricity consumption continued its upward trend, reflecting the growing demand from this segment. This sustained demand underscores the indirect but vital relationship between the company's operations and the daily lives of ordinary citizens.

- Indirect Customer Base: Retail and residential consumers are the ultimate recipients of the electricity supplied by China Power International Development.

- Demand Driver: Their energy needs dictate the overall electricity demand, influencing purchasing decisions by grid companies.

- Meeting Energy Needs: The company's operations are essential for fulfilling the energy requirements of these end-users.

- 2024 Context: Continued growth in residential electricity consumption in China highlights the importance of reliable power generation for households.

Investors and Shareholders

As a publicly traded entity, China Power International Development's investors and shareholders are a cornerstone customer segment, injecting vital capital for expansion and operational improvements. They are keenly focused on the company's financial health and the prospect of robust returns on their investment.

In 2024, China Power International Development's commitment to shareholder value was evident. For instance, the company reported a significant increase in its net profit attributable to equity holders, demonstrating its ability to generate strong earnings. This financial performance directly impacts investor confidence and the company's market valuation.

- Capital Provision: Shareholders supply the equity capital essential for funding new projects, technological upgrades, and overall business growth.

- Financial Performance Expectations: This segment anticipates consistent profitability, dividend payouts, and capital appreciation as indicators of successful management.

- Transparency and Communication: Maintaining open communication regarding strategic decisions, financial results, and operational challenges is crucial for retaining investor trust and support.

- Market Valuation: The perception of China Power International Development by investors directly influences its stock price and overall market capitalization, impacting its ability to raise further capital.

China Power International Development serves a diverse customer base, with national and regional power grid companies, such as State Grid Corporation of China, being its primary direct customers. Large industrial and commercial enterprises, critical for consistent power demand, also form a significant segment. Government bodies and policymakers are key stakeholders influencing regulatory landscapes, while retail and residential consumers represent the ultimate end-users whose aggregated demand shapes the market.

Investors and shareholders are another crucial segment, providing essential capital and expecting financial returns. In 2024, China's continued economic expansion and focus on energy security underscored the importance of these customer relationships for China Power International Development's operational stability and growth strategies.

| Customer Segment | Description | 2024 Relevance |

| Power Grid Companies | Core purchasers of electricity for distribution. | Continued demand driven by economic activity. |

| Industrial/Commercial Enterprises | High and consistent power consumers. | Manufacturing sector's significant electricity usage. |

| Government/Policymakers | Influence regulations and national energy strategy. | Carbon neutrality goals shaping energy policies. |

| Retail/Residential Consumers | Ultimate end-users of electricity. | Upward trend in residential electricity consumption. |

| Investors/Shareholders | Provide capital, expect financial returns. | Increased net profit attributable to equity holders. |

Cost Structure

Capital expenditure for project development represents the most substantial cost for China Power International Development. This encompasses the significant investment needed to build and expand its power generation facilities and associated infrastructure.

These outlays cover crucial elements such as acquiring land for new sites, purchasing essential equipment like turbines and solar panels, executing civil engineering works, and engaging specialized engineering services. These are inherently long-term, high-value investments critical for future capacity.

For 2023, China Power International Development reported capital expenditures of approximately RMB 26.3 billion, a notable increase driven by the expansion of renewable energy projects, particularly wind and solar farms, reflecting a strategic shift towards cleaner energy sources.

Operations and Maintenance (O&M) costs represent a significant portion of China Power International Development's expenses. These ongoing costs cover everything from staffing power plants and performing routine upkeep to handling unexpected repairs and stocking necessary spare parts. For instance, in 2023, China Power International reported O&M expenses of approximately RMB 15.2 billion, reflecting the substantial investment required to keep its diverse fleet of power generation facilities running smoothly and efficiently.

Effective O&M management is paramount not only for controlling expenditures but also for extending the operational lifespan of power assets. By optimizing maintenance schedules and investing in preventative measures, the company aims to minimize downtime and ensure the reliability of its power supply. This focus on efficiency directly impacts the company's profitability and its ability to deliver consistent energy output to its customers.

For China Power International Development's coal-fired plants, the cost of acquiring coal is a primary variable expense, directly influencing operational profitability. In 2024, the average price of thermal coal in China saw significant volatility, impacting this cost structure. For instance, while prices dipped in early 2024, they rebounded later in the year due to increased demand and supply constraints.

Financing Costs and Interest Expenses

China Power International Development, like many in the capital-intensive power generation sector, relies heavily on debt financing for its extensive infrastructure projects. This means that financing costs, primarily interest expenses on substantial loans, represent a significant component of its overall cost structure. For instance, in 2023, the company reported finance costs of approximately HKD 7.1 billion. Effective management of this debt, including securing competitive interest rates, is crucial for maintaining profitability and financial stability.

The company's ability to manage its debt efficiently directly impacts its bottom line. Favorable borrowing terms can substantially reduce the burden of interest payments, thereby enhancing the company's financial health. Conversely, rising interest rates or inefficient debt management can lead to increased financial strain.

- Debt-driven Capital Expenditures: The power generation industry necessitates massive upfront investment, often funded through debt.

- Interest Expense as a Major Cost: Interest payments on borrowed funds are a significant and recurring expense for China Power International Development.

- Impact of Interest Rates: Fluctuations in interest rates directly influence the company's financing costs and overall profitability.

- Strategic Debt Management: Optimizing debt levels and securing favorable loan terms are vital for financial resilience.

Regulatory Compliance and Environmental Costs

China Power International Development faces substantial costs related to stringent environmental regulations. These include significant investments in emissions control technologies to meet evolving air quality standards and expenses for effective waste management, particularly for coal-fired power plants. Mandates to increase renewable energy generation also necessitate upfront capital for solar and wind projects.

Furthermore, the company incurs ongoing expenses for obtaining and maintaining a complex web of licenses and permits from various Chinese regulatory bodies. These are crucial for operating power generation facilities and ensuring compliance with national and provincial environmental laws. For instance, in 2024, the company continued its focus on upgrading existing facilities to meet stricter emission limits, a key driver of these operational costs.

- Environmental Compliance Investments: Costs for installing and maintaining advanced pollution control equipment, such as flue gas desulfurization and denitrification systems.

- Renewable Energy Mandates: Capital expenditures for developing and integrating renewable energy sources to meet national targets, contributing to higher upfront costs.

- Licensing and Permitting Fees: Ongoing expenses associated with securing and renewing operational licenses and environmental permits across its numerous power generation sites.

- Cleaner Technology Adoption: Investments in research and development, as well as the implementation of cleaner production technologies to reduce environmental impact.

China Power International Development's cost structure is dominated by capital expenditures for project development, operations and maintenance (O&M), fuel costs for coal-fired plants, and financing costs. Environmental compliance also represents a significant ongoing expense.

These costs are essential for building, operating, and maintaining its diverse power generation portfolio, which increasingly includes renewable energy sources. The company's financial performance is heavily influenced by its ability to manage these expenditures effectively.

For 2023, capital expenditures were approximately RMB 26.3 billion, while O&M costs were around RMB 15.2 billion. Finance costs in 2023 amounted to HKD 7.1 billion.

| Cost Category | 2023 (RMB Billion) | 2023 (HKD Billion) | Key Drivers |

| Capital Expenditures | 26.3 | - | Renewable energy project expansion |

| Operations & Maintenance | 15.2 | - | Plant upkeep, staffing, repairs |

| Financing Costs | - | 7.1 | Interest on debt for infrastructure |

| Fuel Costs (Coal) | Variable | - | Thermal coal price volatility |

| Environmental Compliance | Ongoing | - | Emissions control, permits, cleaner tech |

Revenue Streams

China Power International Development's core revenue comes from selling electricity to national and regional power grids. These sales are governed by power purchase agreements (PPAs), which set either fixed or market-driven prices for the electricity supplied.

This electricity sales segment represents the most significant contributor to the company's overall income. For instance, in 2023, China Power International Development reported that its electricity sales revenue reached approximately HK$70.5 billion, highlighting its dominance as a revenue generator.

China Power International Development often engages in direct electricity sales to major industrial clients, forging power supply agreements that bypass traditional grid intermediaries. These arrangements are crucial revenue generators, frequently featuring bespoke pricing and terms tailored to the substantial and specific energy demands of these large-scale users.

China Power International Development benefits significantly from government subsidies and incentives, crucial for its clean energy operations. These include feed-in tariffs and direct subsidies for hydropower, wind, and solar projects, which bolster the financial health of these ventures. For instance, in 2023, China continued to be a leading global investor in renewable energy, with significant policy support driving this growth, directly impacting companies like China Power.

Carbon Credit Sales

China Power International Development, as a significant player in clean energy, can generate revenue through the sale of carbon credits. These credits, such as Certified Emission Reductions (CERs), are produced by its renewable energy projects, effectively monetizing the environmental advantages of its clean energy assets. This revenue stream is directly linked to global climate change initiatives and the growing demand for decarbonization solutions.

For instance, in 2023, the global voluntary carbon market saw significant activity, with prices for high-quality carbon credits fluctuating based on project type and vintage. China's role in this market is expanding, and companies like China Power are positioned to benefit. The company's commitment to reducing emissions from its power generation portfolio allows it to create these valuable environmental assets.

- Monetizing Environmental Benefits: Selling carbon credits turns the positive environmental impact of renewable energy projects into a direct financial return.

- Diversified Revenue: This stream provides an additional income source beyond electricity sales, enhancing financial resilience.

- Alignment with Climate Goals: Revenue from carbon credits supports and is driven by global and national climate action targets.

- Market Volatility: The value of carbon credits can vary, influenced by supply, demand, and regulatory changes in carbon markets.

Ancillary Services and Capacity Payments

China Power International Development diversifies revenue beyond direct electricity sales by offering crucial ancillary services to the grid. These services, vital for maintaining grid stability, include frequency regulation, voltage support, and providing reserve capacity. For instance, in 2023, China's electricity market saw increased focus on grid flexibility, driving demand for such services.

Furthermore, the company benefits from capacity payments in certain markets. These payments are designed to compensate power plants for simply being available and ready to generate electricity when needed, ensuring a reliable power supply even during peak demand or unexpected outages. This revenue stream supports the company's commitment to maintaining operational readiness.

- Ancillary Services: Revenue generated from grid support functions like frequency regulation and voltage control.

- Capacity Payments: Income received for maintaining power plant availability and readiness.

- Grid Stability Contribution: These services are essential for the overall reliability and stability of the power grid.

- 2023 Market Trends: Increased emphasis on grid flexibility in China's electricity market supports ancillary service revenue.

China Power International Development's primary revenue stream originates from the sale of electricity, primarily to national and regional power grids under power purchase agreements. These agreements often feature fixed or market-based pricing. In 2023, electricity sales alone contributed approximately HK$70.5 billion to the company's revenue, underscoring its significance.

The company also generates income through direct electricity sales to large industrial customers, securing bespoke agreements that cater to their substantial energy needs. Additionally, government subsidies and incentives, particularly for clean energy projects like hydropower and wind, play a crucial role in bolstering revenue, reflecting China's strong policy support for renewables in 2023.

Further diversification comes from selling carbon credits generated by its renewable energy assets, capitalizing on the growing demand for decarbonization solutions. Ancillary services, such as frequency regulation and voltage support, also contribute to revenue, alongside capacity payments received for maintaining power plant availability. These revenue streams are vital for grid stability and operational readiness.

| Revenue Stream | Description | 2023 Contribution (Approximate) |

| Electricity Sales | Sales to national/regional grids and direct industrial sales | HK$70.5 billion |

| Government Subsidies/Incentives | Support for clean energy projects (hydropower, wind, solar) | Significant, driven by national policy |

| Carbon Credits | Monetizing environmental benefits from renewable projects | Growing, linked to climate initiatives |

| Ancillary Services & Capacity Payments | Grid support functions and readiness payments | Contributes to grid stability and operational readiness |

Business Model Canvas Data Sources

The China Power International Development Business Model Canvas is built using publicly available financial disclosures, annual reports, and industry-specific market research. These sources provide a comprehensive view of the company's operations, strategic direction, and market positioning.