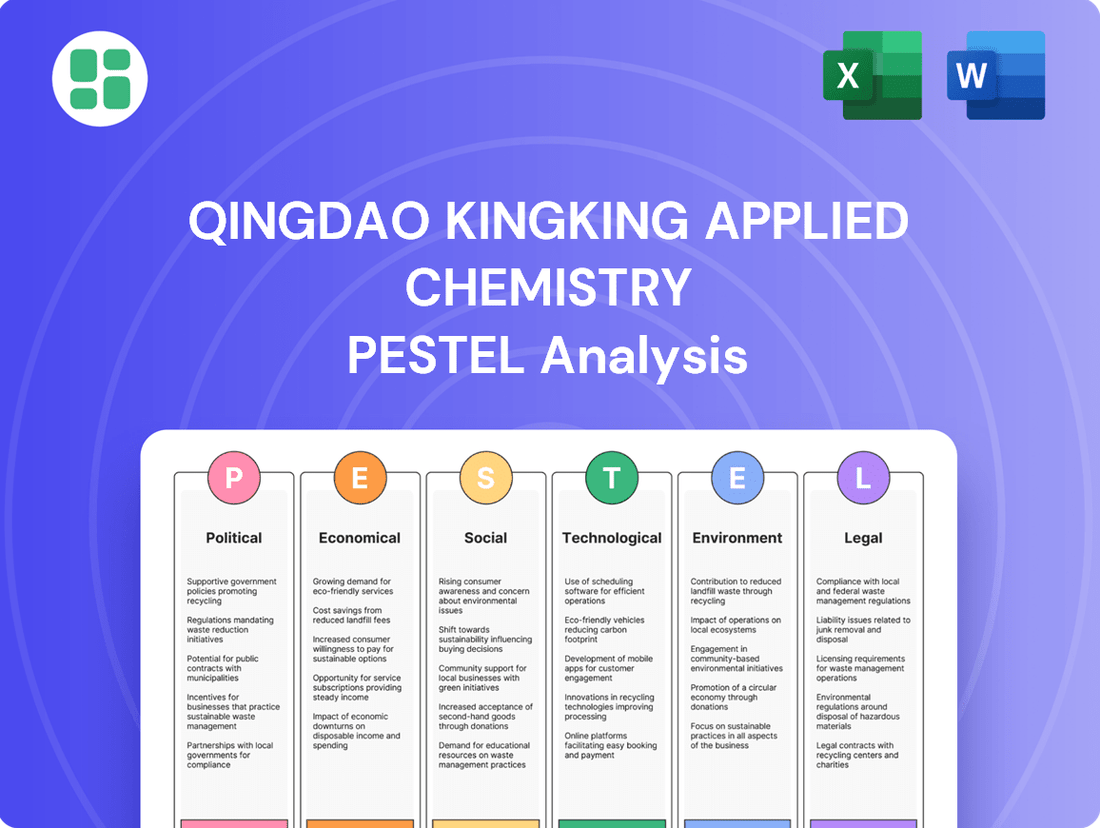

Qingdao Kingking Applied Chemistry PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Qingdao Kingking Applied Chemistry Bundle

Uncover the critical political, economic, social, technological, environmental, and legal factors impacting Qingdao Kingking Applied Chemistry. Our meticulously researched PESTLE analysis provides actionable intelligence to navigate market complexities and identify strategic opportunities. Download the full report to gain a competitive edge and make informed decisions.

Political factors

The Chinese government's ongoing commitment to industrial upgrading and sustainable development translates into tangible support for companies like Qingdao Kingking Applied Chemistry. This support often materializes as subsidies, tax incentives, and favorable policies specifically targeting green chemical production and bio-energy initiatives. For instance, in 2024, China's Ministry of Industry and Information Technology continued to roll out measures aimed at boosting green manufacturing, with a focus on energy efficiency and circular economy principles, directly benefiting Kingking's operational model.

International trade policies, particularly those affecting China's trade with key partners like the United States and the European Union, present a significant factor for Qingdao Kingking Applied Chemistry. Changes in tariffs or trade agreements directly influence the cost of imported raw materials and the competitiveness of Kingking's exported chemical products. For instance, the ongoing trade tensions between China and the US, which saw tariffs imposed on various goods in recent years, could continue to affect supply chain costs and market access.

China's regulatory landscape for chemical production, especially concerning safety and environmental standards, is a critical factor for Qingdao Kingking Applied Chemistry. The consistency and stringency of enforcement directly impact the company's compliance expenses and operational risks. For instance, in 2023, China continued to emphasize stricter environmental protection, with the Ministry of Ecology and Environment reporting a significant increase in penalties for industrial pollution violations.

A stable regulatory framework is crucial for Kingking's long-term strategic planning and capital investments. Conversely, abrupt changes in regulations, such as new mandates on hazardous chemical handling or industrial waste disposal, could force rapid, costly adjustments to manufacturing processes. These potential shifts necessitate ongoing vigilance and adaptability in Kingking's operational strategy to mitigate unforeseen compliance burdens.

Industrial Policy and Sector Prioritization

China's industrial policies are a significant driver of economic growth, with the government actively directing resources and support towards key sectors. For companies like Kingking, this means understanding which areas are being prioritized can unlock substantial advantages. Sectors such as advanced manufacturing, new materials, and renewable energy are consistently highlighted in national development plans, aiming to foster innovation and global competitiveness.

Kingking's core business in oleochemicals and bio-energy directly aligns with these strategic priorities. This alignment positions the company to potentially benefit from government incentives, including research and development grants and preferential tax treatments. For instance, China's 14th Five-Year Plan (2021-2025) explicitly emphasizes the development of green industries and advanced materials, creating a favorable environment for Kingking's operations.

Leveraging these government initiatives requires a keen awareness of the evolving industrial landscape. Key areas of focus for Kingking, supported by policy, include:

- Sustainable oleochemical production: Government support for environmentally friendly manufacturing processes.

- Bio-energy advancements: Investment in renewable energy sources and related technologies.

- New material development: Focus on innovative materials with applications across various industries.

Public Health and Safety Regulations

Governmental emphasis on public health and safety significantly shapes the standards for products like detergents and personal care items, directly impacting Qingdao Kingking Applied Chemistry. For instance, China's tightened regulations on cosmetic ingredients, effective from January 1, 2022, mandated stricter safety assessments and registration processes, potentially requiring Kingking to adapt its formulations for personal care lines. Adherence to these evolving standards is paramount for maintaining market access and consumer confidence, especially as consumer awareness regarding chemical safety continues to rise.

New regulations concerning ingredient safety, product labeling, and overall consumer protection can necessitate significant adjustments for Kingking. This might involve costly reformulation of existing products or substantial upgrades to manufacturing processes to meet updated compliance requirements. For example, the Ministry of Ecology and Environment's continued focus on reducing hazardous substances in consumer goods, as seen in ongoing updates to chemical management policies, presents a continuous challenge and opportunity for innovation in product development.

- Ingredient Scrutiny: Increased governmental oversight on chemical ingredients used in cleaning and personal care products, demanding rigorous safety data and potentially restricting certain compounds.

- Labeling Transparency: Evolving requirements for clear and comprehensive product labeling, including ingredient lists and safety warnings, to enhance consumer protection.

- Manufacturing Standards: Potential for updated Good Manufacturing Practices (GMP) or environmental compliance mandates that could affect production facilities and processes.

- Market Access Barriers: Non-compliance with public health and safety regulations can lead to product recalls, fines, and exclusion from key markets, impacting sales and reputation.

The Chinese government's strategic focus on green development and industrial upgrading directly benefits Qingdao Kingking Applied Chemistry, with policies in 2024 emphasizing energy efficiency and circular economy principles in manufacturing. This governmental support often translates into subsidies and tax incentives for companies aligned with these national priorities, fostering innovation in areas like bio-energy. China's 14th Five-Year Plan (2021-2025) specifically targets green industries and advanced materials, creating a favorable operational environment for Kingking.

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors impacting Qingdao Kingking Applied Chemistry, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers actionable insights by detailing specific threats and opportunities, supported by relevant data and forward-looking trends to inform strategic decision-making.

A clear, actionable PESTLE analysis for Qingdao Kingking Applied Chemistry that highlights external factors impacting their business, serving as a pain point reliever by providing strategic foresight and mitigating potential risks.

Economic factors

Qingdao Kingking Applied Chemistry, as a chemical manufacturer, faces significant exposure to the fluctuating prices of key raw materials. For instance, palm oil, a crucial input for their oleochemical products, experienced considerable price swings in 2024. Global palm oil prices, influenced by factors like weather patterns in Southeast Asia and demand from the food industry, can directly impact Kingking's production costs.

Similarly, petroleum-derived inputs essential for detergents and personal care product manufacturing are subject to global commodity price volatility. The Brent crude oil price, a benchmark for global oil prices, averaged around $83 per barrel in early 2024, but has shown significant upward and downward movements throughout the year due to geopolitical tensions and supply adjustments. These fluctuations directly affect Kingking's cost of goods sold and can compress profit margins if not managed effectively.

Supply chain disruptions, exacerbated by geopolitical events, further amplify raw material price volatility. For example, disruptions in shipping routes or production halts in major supplier regions can lead to sudden price spikes and availability issues for Kingking. To counter these risks, the company relies on robust supply chain management and employs hedging strategies, such as forward contracts, to lock in prices for essential raw materials, thereby stabilizing production costs and protecting profitability.

The health of the Chinese economy is paramount for Qingdao Kingking Applied Chemistry. In 2024, China's GDP growth is projected around 5%, a solid figure, but any slowdown could impact consumer spending on household cleaning and personal care items. A weaker economy might push consumers towards cheaper brands, directly affecting Kingking's sales volumes.

Globally, economic conditions also play a significant role. For instance, if major export markets like the EU or North America experience recessionary pressures in 2024 or 2025, demand for Kingking's products could decrease. Conversely, strong global growth, with a projected IMF global growth rate around 3.2% for 2024, generally translates to increased consumer confidence and a greater willingness to purchase premium or higher-value cleaning and personal care products.

Inflationary pressures in 2024 and early 2025 are a significant concern, potentially reducing the real value of consumer income. This erosion of purchasing power could dampen demand for Kingking's non-essential or premium cleaning and personal care products, forcing a careful balancing act in pricing strategies to maintain competitiveness and profitability.

For instance, if inflation averages 3.5% in key markets throughout 2024, as some projections suggest, consumers might cut back on discretionary spending. Kingking needs to monitor shifts in disposable income closely to effectively position its product portfolio, perhaps by offering value-oriented options alongside premium lines.

Exchange Rate Fluctuations

Kingking's global operations mean its financial performance is directly impacted by exchange rate shifts. The company imports essential raw materials and exports finished chemical products, making it vulnerable to currency volatility. For instance, in 2024, the Yuan experienced fluctuations against major currencies, affecting the cost of imported inputs and the competitiveness of its exports.

A stronger Chinese Yuan, as seen at various points in late 2024, would typically make Kingking's exports pricier for international buyers, potentially dampening demand. Conversely, a weaker Yuan would make imports more expensive, increasing the cost of raw materials.

- Yuan-Dollar Exchange Rate: The USD/CNY rate saw significant movement throughout 2024, impacting the landed cost of imported materials and the dollar-denominated revenue from exports.

- Hedging Strategies: Kingking likely employs financial instruments like forward contracts or options to mitigate currency risks, aiming to lock in exchange rates for future transactions.

- Impact on Profitability: Unfavorable exchange rate movements can directly erode profit margins on both imported and exported goods if not adequately managed.

Competition and Market Saturation

The Chinese market for detergents, personal care, and household cleaning products is intensely competitive. This landscape features a mix of established domestic brands and prominent international companies vying for consumer attention and market share. For instance, in 2024, the Chinese personal care market was valued at over $70 billion, demonstrating its attractiveness but also its crowded nature.

Certain segments within this market are experiencing saturation, which can trigger aggressive price wars. Such conditions often compress profit margins for all participants, making it challenging to achieve substantial growth. Companies like Qingdao Kingking Applied Chemistry must navigate this environment carefully to protect their profitability.

To maintain its competitive edge and market position, Kingking must prioritize continuous product innovation and clear differentiation. Optimizing distribution networks is also crucial. By the end of 2023, e-commerce channels accounted for over 50% of consumer goods sales in China, highlighting the importance of a strong online presence and efficient logistics.

- Intense Competition: Chinese detergent and personal care markets are crowded with both domestic and global brands.

- Market Saturation Risks: Overcrowded segments can lead to price wars and squeezed profit margins.

- Strategic Imperatives: Innovation, product differentiation, and optimized distribution are key for Kingking.

- E-commerce Dominance: Over half of Chinese consumer goods sales occurred online in 2023, emphasizing channel strategy.

Economic factors significantly influence Qingdao Kingking Applied Chemistry's profitability. Global economic growth, projected at 3.2% for 2024 by the IMF, generally supports demand for consumer goods. However, inflationary pressures, with some markets seeing averages around 3.5% in 2024, can erode consumer purchasing power, potentially shifting demand towards lower-priced alternatives. China's GDP growth, around 5% in 2024, remains a key driver for domestic sales.

| Economic Factor | 2024 Projection/Data | Impact on Kingking |

|---|---|---|

| Global GDP Growth | ~3.2% (IMF) | Supports overall demand for consumer products. |

| Chinese GDP Growth | ~5% | Drives domestic sales volume for cleaning and personal care items. |

| Inflation (Key Markets) | ~3.5% | Reduces consumer disposable income, potentially impacting demand for premium products. |

| Brent Crude Oil Price | Averaged ~$83/barrel (early 2024) | Directly affects raw material costs for petrochemical-based products. |

Same Document Delivered

Qingdao Kingking Applied Chemistry PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Qingdao Kingking Applied Chemistry covers Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises. You'll gain a deep understanding of the external forces shaping Qingdao Kingking Applied Chemistry's operations and strategic decisions.

Sociological factors

Consumers worldwide, including in China, are increasingly seeking out products that are good for the planet. This trend is particularly noticeable in everyday items like detergents and personal care products, where there's a growing preference for those made from natural or renewable ingredients. Surveys in 2024 indicated that over 60% of consumers actively look for sustainability labels on their purchases.

Kingking's strategic focus on oleochemicals, which are derived from natural fats and oils, and its ventures into bio-energy directly align with this rising consumer demand. This positioning allows Kingking to tap into a market segment that values eco-friendliness and natural sourcing.

Companies that can clearly articulate their commitment to sustainability and highlight the benefits of their eco-conscious products are poised to capture greater market share. In 2024, brands with strong sustainability narratives saw an average sales increase of 15% compared to those without.

Consumers are increasingly scrutinizing product labels, prioritizing health and wellness. This heightened awareness translates to a demand for personal care and household cleaning items perceived as safer, non-toxic, and health-promoting. For instance, a 2024 survey indicated that 65% of consumers actively seek products with fewer artificial ingredients.

This shift necessitates a move away from certain chemicals, allergens, and synthetic additives. Kingking must proactively adapt its product formulations and marketing strategies to align with these evolving consumer health concerns and preferences, potentially exploring natural or bio-based alternatives.

China's rapid urbanization continues to reshape consumer habits, with a significant portion of its population now residing in cities. This trend fosters smaller household sizes and busier schedules, directly impacting demand for convenience-oriented products. For Kingking, this means an increased need for concentrated chemical formulas and multi-functional items that simplify daily routines.

The evolving urban lifestyle, characterized by time constraints, fuels a growing preference for e-commerce and online purchasing channels. In 2024, online retail sales in China are projected to exceed $3.5 trillion, highlighting the critical importance of robust digital distribution strategies for Kingking to reach these consumers effectively.

Demographic Shifts and Aging Population

China's demographic landscape is undergoing significant transformation, with an aging population becoming a prominent feature. By the end of 2023, China's population aged 60 and above reached 296.97 million, accounting for 20.9% of the total population. This shift directly impacts consumer demand, potentially increasing the market for specialized personal care items catering to elderly consumers and altering household cleaning product needs. Kingking Applied Chemistry can leverage this insight to tailor its product development and marketing strategies for greater market penetration within this growing demographic segment.

The increasing proportion of elderly individuals in China presents specific opportunities for Kingking. For instance, there's a projected rise in demand for products that support independent living and address age-related concerns. This could include gentler cleaning formulations or personal care items designed for ease of use and efficacy in older demographics. Understanding these evolving consumer preferences is crucial for Kingking to maintain its competitive edge and innovate effectively in the coming years.

- Aging Population Growth: China's elderly population (60+) represented 20.9% of the total population in 2023.

- Demand Shifts: Increased demand for specialized personal care and household cleaning products for older consumers.

- Market Opportunities: Potential for Kingking to develop targeted products for the growing senior market.

- Strategic Adaptation: Aligning product innovation and marketing with demographic trends is key for future success.

Social Media and Influencer Culture

Social media and influencer culture deeply shape consumer behavior, directly affecting how products like those from Qingdao Kingking Applied Chemistry are perceived and purchased. In 2024, influencer marketing spending globally is projected to reach $21.1 billion, highlighting its significant economic impact. A misplaced social media post or a viral negative review can quickly damage brand reputation, while strategic partnerships with key influencers can drive substantial sales growth. Kingking must therefore prioritize robust online reputation management and authentic consumer engagement to foster loyalty.

The rapid dissemination of information online means that consumer sentiment can shift dramatically. For instance, by mid-2024, platforms like Douyin (TikTok) and Xiaohongshu are critical for reaching younger demographics in China, where Kingking operates. Companies that actively participate in these digital conversations, address consumer feedback promptly, and leverage user-generated content are better positioned to build trust and enhance brand visibility. Kingking’s strategy should include proactive digital marketing to counter potential misinformation and amplify positive brand narratives.

Key considerations for Kingking include:

- Monitoring online sentiment: Continuously track social media mentions and reviews to identify and address any emerging negative publicity swiftly.

- Influencer collaborations: Strategically partner with credible influencers whose audience aligns with Kingking's target markets to promote products authentically.

- Engaging content creation: Develop shareable and informative content that resonates with online communities, fostering a sense of brand connection and loyalty.

- Digital crisis management: Establish protocols for responding to online crises, ensuring swift and transparent communication to mitigate reputational damage.

Societal shifts towards sustainability and health are paramount. Consumers, with over 60% actively seeking eco-friendly labels in 2024, are driving demand for natural ingredients, directly benefiting Kingking's oleochemical focus. Simultaneously, a growing emphasis on wellness means 65% of consumers in 2024 prefer products with fewer artificial additives, prompting Kingking to consider cleaner formulations.

Technological factors

Continuous innovation in green chemistry and biotechnology presents significant opportunities for Qingdao Kingking Applied Chemistry. These advancements allow for the development of more sustainable and efficient production methods across their product lines, including detergents, personal care items, and oleochemicals. For instance, the global green chemistry market was valued at approximately $10.7 billion in 2023 and is projected to reach $30.8 billion by 2030, indicating a strong growth trajectory for companies embracing these principles.

New techniques in utilizing renewable resources, minimizing waste generation, and formulating biodegradable products are becoming increasingly accessible. Kingking's investment in research and development within these fields could translate into substantial competitive advantages. This includes the potential for entirely new product lines that cater to growing consumer demand for eco-friendly options. For example, the market for biodegradable plastics, a key area within biotechnology and green chemistry, is expected to grow substantially in the coming years, offering new avenues for product development.

Kingking's adoption of automation and smart manufacturing is a key technological driver. By integrating robotics and Industry 4.0 principles, the company can significantly boost production efficiency and product quality. For instance, the global industrial robotics market was valued at approximately $50 billion in 2023 and is projected to grow substantially, indicating a strong industry trend towards automation that Kingking can leverage.

Kingking's technological edge hinges on novel ingredient development. Research into new chemical compounds, enzymes, and natural extracts is crucial for creating products that are not only more effective but also safer and kinder to the environment. This focus allows for the creation of detergents with superior cleaning capabilities and personal care items offering enhanced performance.

By staying ahead in ingredient science, Kingking can carve out unique market positions. For instance, advancements in oleochemical derivatives, a key area for Kingking, can lead to specialized products with distinct advantages. The global oleochemicals market was valued at approximately USD 230 billion in 2023 and is projected to grow steadily, highlighting the opportunity for innovation.

Waste Valorization and Circular Economy Technologies

Technologies that convert industrial waste into valuable resources directly support Qingdao Kingking Applied Chemistry's bio-energy and oleochemical segments, fostering a circular economy. This approach is crucial for reducing disposal expenses and unlocking new revenue streams, enhancing Kingking's environmental performance. For instance, the global waste-to-energy market was projected to reach USD 65.9 billion in 2024, highlighting the economic potential of such technologies.

Exploring waste valorization is a strategic imperative for Kingking, aligning with increasing regulatory pressures and consumer demand for sustainable practices. Companies adopting circular economy principles often see improved resource efficiency and a stronger brand reputation. The European Union's Circular Economy Action Plan aims to boost recycling rates and reduce waste, signaling a global trend that Kingking can leverage.

- Reduced Disposal Costs: Implementing waste valorization can significantly lower expenses associated with landfilling or incineration.

- New Revenue Streams: Converting by-products into marketable materials or energy creates additional income opportunities.

- Enhanced Environmental Footprint: Adopting circular economy technologies improves resource management and reduces pollution.

- Market Competitiveness: Aligning with sustainability trends can strengthen Kingking's position in a market increasingly focused on environmental, social, and governance (ESG) factors.

Digitalization of Supply Chain and E-commerce

Kingking must embrace the digitalization of its supply chain to enhance efficiency and resilience. Leveraging technologies like blockchain for product traceability and advanced analytics for more accurate demand forecasting are crucial. For instance, global supply chain analytics market was valued at USD 5.5 billion in 2023 and is projected to reach USD 11.2 billion by 2028, growing at a CAGR of 15.4% during the forecast period (2023-2028), indicating a strong trend towards digital adoption.

The surging growth of e-commerce demands a robust digital infrastructure for Kingking's operations. This includes optimizing online sales channels, implementing effective digital marketing strategies, and building direct-to-consumer distribution capabilities. In 2024, global e-commerce sales are expected to exceed $7 trillion, highlighting the immense opportunity and necessity for businesses to maintain a strong online presence.

- Supply Chain Digitalization: Adoption of blockchain and AI for improved visibility and predictive analytics.

- E-commerce Growth: Expanding online sales channels and direct-to-consumer models.

- Digital Infrastructure: Investment in platforms for online marketing, sales, and logistics.

- Efficiency Gains: Aiming to reduce operational costs and delivery times through digital transformation.

Technological advancements in green chemistry and automation are pivotal for Qingdao Kingking Applied Chemistry. The company can leverage innovations in renewable resource utilization and waste minimization, aligning with the projected growth of the green chemistry market, which was valued at approximately $10.7 billion in 2023. Embracing Industry 4.0 principles, such as robotics, can enhance production efficiency, mirroring the global industrial robotics market's estimated value of $50 billion in 2023.

Kingking's focus on novel ingredient development, particularly in oleochemical derivatives, offers a competitive edge. The oleochemicals market, valued at around USD 230 billion in 2023, presents ample opportunities for innovation in product performance and sustainability. Furthermore, adopting waste valorization technologies supports a circular economy, tapping into the USD 65.9 billion waste-to-energy market projected for 2024.

Digitalization of the supply chain, including blockchain and advanced analytics, is crucial for efficiency and resilience, with the supply chain analytics market expected to reach USD 11.2 billion by 2028. Simultaneously, capitalizing on e-commerce growth, projected to exceed $7 trillion in global sales for 2024, requires a robust digital infrastructure for online sales and direct-to-consumer models.

| Technology Area | Market Value (2023/2024 Estimate) | Projected Growth/Impact | Kingking Opportunity |

|---|---|---|---|

| Green Chemistry | $10.7 billion (2023) | Projected to reach $30.8 billion by 2030 | Develop sustainable products, improve production methods |

| Industrial Robotics | ~$50 billion (2023) | Significant growth expected | Enhance production efficiency and quality |

| Oleochemicals | ~$230 billion (2023) | Steady growth anticipated | Innovate in specialized derivatives, gain market share |

| Waste-to-Energy | ~$65.9 billion (2024 Projection) | Growing market | Reduce disposal costs, create new revenue streams |

| Supply Chain Analytics | $5.5 billion (2023) | Projected to reach $11.2 billion by 2028 | Improve supply chain visibility and forecasting |

| E-commerce | >$7 trillion (2024 Projection) | Continued rapid expansion | Expand online sales and direct-to-consumer channels |

Legal factors

Qingdao Kingking Applied Chemistry navigates a complex web of product safety and quality regulations, crucial for its detergent, personal care, and household cleaning product lines. These rules apply both within China and in every international market Kingking serves, demanding meticulous adherence to ingredient limitations, rigorous testing protocols, and precise labeling standards. For instance, in 2024, the European Union's REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals) regulation continues to impact chemical formulations, requiring extensive data submission for substances used in consumer goods.

China's chemical sector faces tightening environmental regulations, impacting companies like Kingking. These laws cover wastewater, air emissions, hazardous waste, and carbon emissions, demanding substantial investments in cleaner technologies. For instance, by the end of 2023, China had implemented over 1,500 national environmental standards, with a significant portion targeting industrial pollution.

Kingking's operations must adhere to these evolving standards, which could necessitate upgrades to pollution control systems and the adoption of more sustainable manufacturing processes. Failure to comply can result in hefty penalties and operational limitations, as seen in the 2023 crackdown where numerous chemical plants faced temporary shutdowns for environmental violations.

Protecting Qingdao Kingking Applied Chemistry's proprietary formulations, manufacturing processes, and brand names through patents, trademarks, and trade secrets is crucial for its competitive advantage. In 2024, China's continued emphasis on strengthening intellectual property rights (IPR) enforcement, including increased penalties for infringement, provides a more secure environment for Kingking's innovations.

Robust legal frameworks are vital to prevent unauthorized use of Kingking's intellectual assets and ensure fair market competition. Failure to adequately protect its IPR could lead to significant financial losses and damage to its brand reputation. Conversely, Kingking must diligently ensure its operations and products do not infringe upon the existing IPR of other entities within the global chemical industry.

Labor Laws and Workplace Safety Regulations

Kingking Applied Chemistry must meticulously adhere to China's comprehensive labor laws, encompassing minimum wages, stipulated working hours, and mandatory employee benefits. For instance, the national minimum wage in China saw adjustments in various regions throughout 2024, with provinces like Beijing and Shanghai setting higher benchmarks, impacting operational costs for companies like Kingking. Ensuring compliance is not merely a legal obligation but a fundamental aspect of responsible business operations.

Workplace safety, particularly in the chemical manufacturing sector, is paramount. Kingking must implement and rigorously enforce occupational health and safety standards to prevent accidents and protect its workforce. In 2024, China continued to emphasize stricter enforcement of safety regulations in hazardous industries, with reported increases in workplace inspections and penalties for non-compliance. This focus aims to reduce industrial accidents and safeguard employee well-being.

To maintain robust compliance, Kingking should implement a proactive strategy involving:

- Regular internal audits to assess adherence to labor and safety regulations.

- Continuous training programs for employees on safety protocols and legal requirements.

- Establishing clear grievance mechanisms and ensuring fair labor practices.

- Staying updated on any legislative changes or new directives from Chinese labor authorities.

Anti-Monopoly and Competition Laws

Kingking Applied Chemistry operates under China's stringent anti-monopoly and competition laws. These regulations are designed to prevent market manipulation, price fixing, and other unfair business practices, ensuring a level playing field for all companies. For instance, China's Anti-Monopoly Law (AML) was significantly revised in 2022, increasing penalties and broadening its scope to cover digital economy platforms.

Any strategic moves by Kingking, such as mergers, acquisitions, or substantial increases in market share, will be subject to rigorous review by Chinese regulatory bodies. This scrutiny aims to prevent the formation of monopolies and protect consumer interests. Failure to comply can result in substantial fines; for example, in 2021, Alibaba was fined ¥18.2 billion (approximately $2.8 billion) for abusing its market dominance.

- Regulatory Oversight: Kingking must navigate the Anti-Monopoly Law of the People's Republic of China, with enforcement overseen by the State Administration for Market Regulation (SAMR).

- Merger Control: Significant transactions require pre-merger notification and approval if they meet certain turnover thresholds, ensuring no anti-competitive effects arise.

- Compliance Importance: Adherence to these laws is crucial for avoiding hefty fines and legal disputes, thereby safeguarding the company's operational continuity and reputation.

Kingking Applied Chemistry must navigate China's evolving intellectual property rights (IPR) landscape, with the government strengthening enforcement and penalties for infringement in 2024. This legal framework protects Kingking's proprietary formulations and manufacturing processes, ensuring a more secure environment for its innovations. Diligent adherence to IPR laws is vital to prevent financial losses and brand damage, while also ensuring Kingking does not infringe on others' intellectual assets.

Environmental factors

Qingdao Kingking Applied Chemistry, as a producer of oleochemicals and bio-energy, navigates the complexities of resource scarcity, particularly concerning palm oil. The global palm oil market, a key feedstock, has seen fluctuating prices and supply chain disruptions. For instance, in early 2024, benchmark crude palm oil futures traded around RM 3,800-4,000 per metric ton, influenced by weather patterns and geopolitical events impacting agricultural output.

Ensuring sustainable sourcing is paramount, especially given concerns around deforestation and land use. Initiatives like the Roundtable on Sustainable Palm Oil (RSPO) aim to promote responsible production, with certified sustainable palm oil (CSPO) becoming increasingly important for market access and consumer perception. Kingking's commitment to ethical supply chains directly impacts its brand reputation and ability to meet evolving regulatory and consumer demands for environmentally sound products.

Diversifying raw material inputs and actively promoting sustainable agricultural practices are strategic imperatives for Kingking. Exploring alternative feedstocks and investing in technologies that enhance yield and reduce environmental impact from existing sources can mitigate risks associated with single-source reliance. This proactive approach not only addresses resource scarcity but also strengthens the company's resilience against market volatility and environmental pressures.

The global imperative to address climate change is intensifying, placing significant pressure on the chemical sector to decarbonize. For companies like Qingdao Kingking Applied Chemistry, this translates into a direct need to reduce their carbon footprint, especially given the energy-intensive nature of chemical manufacturing.

Stricter carbon emission targets are becoming the norm, with many nations implementing or considering carbon pricing mechanisms, such as carbon taxes or cap-and-trade systems. For instance, by 2024, many European Union countries have already strengthened their emissions trading systems, impacting industrial energy costs.

Kingking's long-term viability will hinge on strategic investments in energy efficiency improvements and the adoption of renewable energy sources to power its operations. This proactive approach is crucial not only for regulatory compliance but also for operational cost management and enhanced market reputation.

Kingking's operations, particularly in producing detergents, personal care items, and chemicals, inherently create wastewater and solid waste. The company must invest in sophisticated waste treatment systems and adhere to responsible disposal practices to mitigate environmental impact.

For instance, in 2024, China's Ministry of Ecology and Environment reported that industrial wastewater discharge standards were tightened, requiring companies like Kingking to achieve higher levels of pollutant removal. Failure to comply can result in significant fines and operational disruptions.

Effective waste reduction strategies, robust recycling programs, and secure disposal methods are crucial for Kingking to maintain regulatory compliance and demonstrate strong environmental stewardship, which is increasingly a factor in consumer and investor decisions.

Biodegradability and Eco-toxicity of Products

Growing environmental awareness is placing significant pressure on chemical manufacturers like Qingdao Kingking Applied Chemistry to address the biodegradability and eco-toxicity of their products. This is especially true for everyday items such as detergents and personal care products, which are frequently discharged into waterways.

Kingking must prioritize ongoing research and development to create formulations that readily break down in the environment and exhibit low toxicity. This proactive approach is crucial for meeting evolving regulatory standards and consumer expectations. For instance, the European Union's REACH regulation, which came into full effect in 2007, mandates rigorous assessment of chemical substances for their environmental impact, influencing product design and ingredient selection across the industry.

- Focus on readily biodegradable ingredients: Kingking should invest in R&D for surfactants and other key components that degrade quickly and completely.

- Minimize eco-toxicological profiles: Developing products with reduced impact on aquatic life and ecosystems is paramount.

- Promote green chemistry principles: Phasing out persistent organic pollutants and prioritizing safer chemical alternatives aligns with sustainability goals.

- Enhance product lifecycle assessments: Understanding the environmental footprint from raw material sourcing to end-of-life disposal is vital.

Water Scarcity and Water Pollution

Chemical manufacturing, including Kingking Applied Chemistry's operations, is inherently water-intensive. This reliance makes water scarcity a significant operational risk, particularly in regions experiencing water stress. For instance, China, where Qingdao is located, has faced increasing water challenges, with some northern regions experiencing severe scarcity. This necessitates proactive water management strategies.

The chemical industry is also subject to stringent environmental regulations concerning industrial wastewater discharge. Kingking must adhere to these regulations, which often involve sophisticated treatment processes to remove pollutants before release. Failure to comply can result in substantial fines and reputational damage.

To mitigate these environmental factors, Kingking Applied Chemistry should focus on several key areas:

- Water Conservation: Implementing measures to reduce overall water consumption in manufacturing processes.

- Advanced Wastewater Treatment: Investing in and maintaining state-of-the-art systems to ensure discharged water meets or exceeds regulatory standards.

- Closed-Loop Systems: Exploring and adopting technologies that allow for the recycling and reuse of water within the production cycle, minimizing reliance on external water sources and reducing discharge volumes.

Environmental regulations are tightening globally, impacting chemical manufacturers like Qingdao Kingking Applied Chemistry. China's commitment to environmental protection means stricter standards for emissions and waste disposal. For example, in 2023, China's environmental protection tax law continued to incentivize pollution reduction, affecting operational costs.

Kingking must prioritize sustainable sourcing, particularly for palm oil, a key feedstock. Fluctuating prices, as seen with crude palm oil futures trading around RM 3,900 per metric ton in early 2024, highlight the need for supply chain resilience and ethical sourcing practices, such as RSPO certification.

The company faces pressure to reduce its carbon footprint and adopt greener chemistry principles, focusing on biodegradable products and minimizing eco-toxicity. This includes investing in energy efficiency and renewable energy sources to meet evolving climate change imperatives and consumer expectations.

| Environmental Factor | Impact on Kingking | Key Considerations |

|---|---|---|

| Resource Scarcity (Palm Oil) | Price volatility, supply chain risks | Sustainable sourcing, alternative feedstocks |

| Climate Change & Emissions | Increased operational costs, regulatory compliance | Energy efficiency, renewable energy adoption |

| Waste Management | Stricter discharge standards, compliance costs | Advanced treatment systems, waste reduction |

| Product Ecotoxicity | Consumer demand for green products, regulatory scrutiny | Biodegradable ingredients, R&D investment |

PESTLE Analysis Data Sources

Our Qingdao Kingking Applied Chemistry PESTLE Analysis is built on a robust foundation of data from official Chinese government agencies, reputable international economic organizations, and leading industry research firms. This ensures comprehensive coverage of political, economic, social, technological, legal, and environmental factors impacting the company.