Qingdao Kingking Applied Chemistry Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Qingdao Kingking Applied Chemistry Bundle

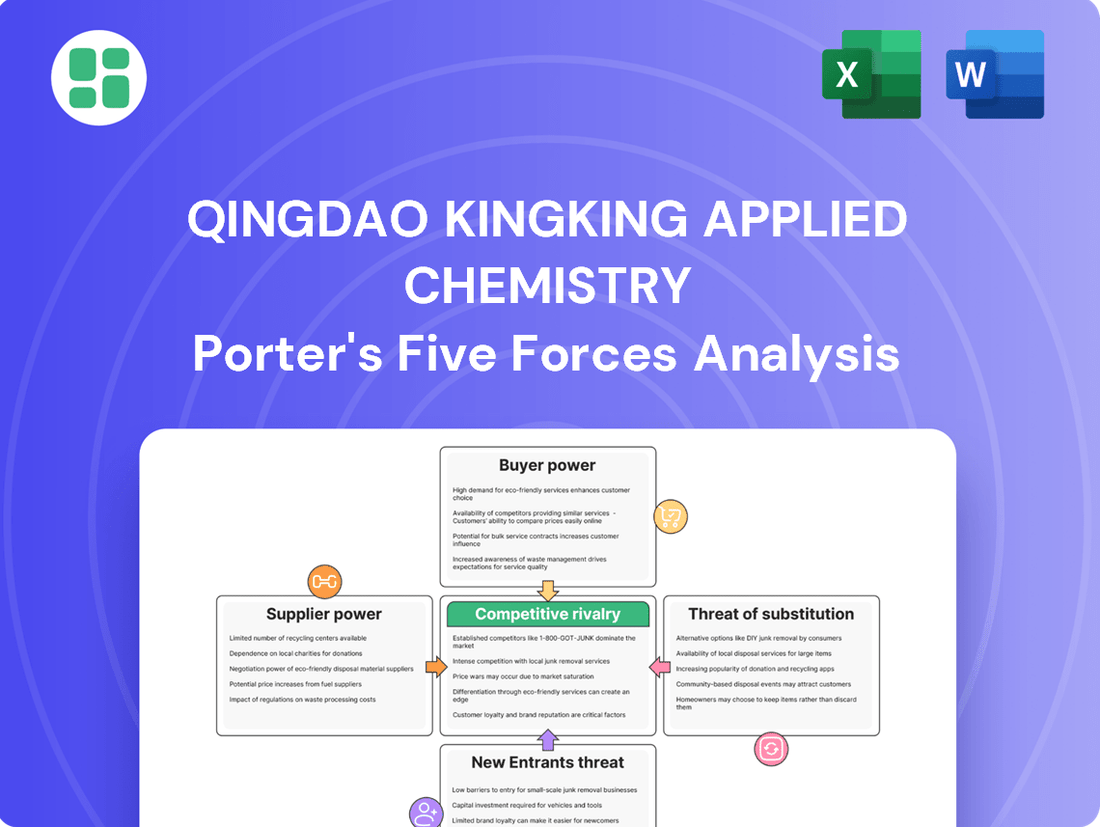

Qingdao Kingking Applied Chemistry operates within a dynamic market, facing significant pressures from both established players and emerging alternatives. Understanding the intricate interplay of these forces is crucial for navigating its competitive landscape effectively.

The full Porter's Five Forces Analysis delves into the granular details of buyer power, supplier leverage, the threat of new entrants, the intensity of rivalry, and the impact of substitutes on Qingdao Kingking Applied Chemistry. Unlock actionable insights to sharpen your strategic edge.

Suppliers Bargaining Power

The bargaining power of suppliers for Qingdao Kingking Applied Chemistry is significantly shaped by the concentration of sources for its critical raw materials, like oleochemicals. When a limited number of suppliers control the supply of these essential components, they gain considerable leverage to dictate prices and contract conditions.

The global oleochemicals market, a key input area, is projected to reach approximately $25.5 billion by 2025, with Asia-Pacific leading in both size and growth. While this suggests a broad market, regional supplier concentration within this vast market could still empower specific entities, impacting Kingking's procurement costs and flexibility.

Kingking's capacity to find different raw materials or switch between various inputs for its wide array of products, including detergents, personal care items, and oleochemicals, directly impacts supplier power. For instance, if Kingking can easily source alternative surfactants or fatty acids at competitive prices, it lessens the influence of any single supplier.

The availability of multiple suppliers for key inputs like palm oil derivatives or specialty chemicals is crucial. In 2024, the global oleochemical market saw significant price volatility for palm oil, emphasizing the need for companies like Kingking to have diversified sourcing strategies to mitigate supplier leverage.

The costs Kingking faces when switching suppliers are a significant factor in supplier bargaining power. These costs can include re-qualifying new materials, which is a time-consuming process, and potentially adjusting intricate production processes to accommodate different specifications. For instance, in 2024, the chemical industry saw increased lead times for specialized additives, meaning Kingking might incur substantial costs and delays if it needed to find a new supplier for such a critical component.

Threat of Forward Integration by Suppliers

The threat of suppliers integrating forward into Kingking's business, by producing chemical products, detergents, or personal care items themselves, could significantly bolster their bargaining power. This scenario is more plausible for large, diversified chemical conglomerates that already operate across multiple stages of the value chain. While this remains a potential strategic consideration, current publicly available information does not indicate a pronounced immediate threat of this nature from Kingking's direct raw material suppliers.

Consider the implications for Kingking if a key supplier, for instance, a major producer of surfactants, were to launch its own line of cleaning agents. This would directly compete with Kingking's finished products, potentially diverting market share and forcing Kingking to negotiate more aggressively on raw material prices.

- Supplier Forward Integration Risk: Suppliers moving into finished product markets directly challenges Kingking's core business.

- Industry Dynamics: Diversified chemical giants are more likely candidates for such strategic moves.

- Current Assessment: No specific evidence suggests this is an immediate, pressing concern for Kingking's suppliers.

Importance of Kingking's Volume to Suppliers

Qingdao Kingking's substantial purchasing volume significantly influences its suppliers' bargaining power. For the trailing twelve months ending March 2025, Kingking reported revenue of $248 million. This scale suggests that Kingking could represent a considerable portion of a supplier's business, potentially giving Kingking leverage to negotiate better terms and pricing.

Conversely, if Kingking's orders constitute only a minor part of a supplier's overall sales, the supplier would possess greater bargaining power. This is because the supplier would be less reliant on Kingking's business and could more easily absorb the loss of Kingking as a customer, or dictate terms with less concern for Kingking's preferences.

- Kingking's Revenue: $248 million (TTM March 2025)

- Impact of Volume: Higher volume can shift power towards Kingking.

- Supplier Dependence: Low dependence on Kingking increases supplier power.

- Negotiation Leverage: Kingking's size can be used to secure favorable terms.

The bargaining power of suppliers for Qingdao Kingking Applied Chemistry is influenced by supplier concentration, the availability of substitutes, and switching costs. Kingking's significant purchasing volume, evidenced by its $248 million revenue in the twelve months ending March 2025, provides leverage, particularly with suppliers for whom Kingking represents a substantial portion of their sales.

The global oleochemical market, a key input area, is projected for continued growth, but regional supplier concentration can still empower specific entities. In 2024, price volatility in raw materials like palm oil highlighted the importance of diversified sourcing to mitigate supplier leverage.

Switching costs, including material re-qualification and process adjustments, can be substantial. For instance, increased lead times for specialized additives in 2024 meant potential delays and costs for Kingking if new suppliers were needed.

The threat of supplier forward integration, while not an immediate concern for Kingking, remains a potential factor for large chemical conglomerates. This could shift power dynamics by introducing direct competition in Kingking's finished product markets.

| Factor | Impact on Kingking | 2024/2025 Data/Trend |

|---|---|---|

| Supplier Concentration | Increases supplier power if few sources exist. | Regional concentration within the growing oleochemical market. |

| Availability of Substitutes | Lowers supplier power if alternatives are readily available. | Kingking's ability to source alternative surfactants or fatty acids is key. |

| Switching Costs | High costs empower suppliers; low costs empower Kingking. | Increased lead times for specialized additives in 2024 raised switching costs. |

| Purchasing Volume | Kingking's large volume provides negotiation leverage. | $248 million revenue (TTM March 2025) indicates significant purchasing power. |

What is included in the product

This analysis of Qingdao Kingking Applied Chemistry's competitive environment reveals the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants, and the impact of substitute products.

Understand the competitive landscape instantly with a clear, one-sheet Porter's Five Forces analysis, allowing Qingdao Kingking Applied Chemistry to proactively address strategic pressures.

Customers Bargaining Power

Customers for household cleaning items and personal care products, key segments for Qingdao Kingking, often exhibit high price sensitivity, especially within a crowded marketplace. This characteristic empowers customers, particularly major retailers, to exert considerable influence over pricing strategies.

For instance, in 2024, the average consumer spending on household cleaning products in China was projected to reach over $20 billion, with a significant portion driven by price-conscious purchasing decisions. This indicates that even with a growing emphasis on quality, price remains a critical determinant for a large segment of the market.

The sheer volume of substitute products available in China's detergent and personal care sectors gives consumers considerable leverage. For instance, the Chinese laundry detergent market, valued at approximately 120 billion RMB in 2023, features numerous domestic and international brands, alongside innovative formats like detergent pods, offering consumers ample choices and making it difficult for any single company to command premium pricing.

Qingdao Kingking Applied Chemistry's customer base includes significant global players such as Walmart, Carrefour, and IKEA. These retailers represent a considerable portion of Kingking's sales, giving them substantial leverage due to their sheer size and market influence.

The substantial purchasing power of these major clients allows them to negotiate favorable pricing, extended payment terms, and specific delivery requirements. This concentration of large customers directly translates into increased bargaining power, impacting Kingking's profitability and operational flexibility.

Customer Switching Costs

Customer switching costs for Qingdao Kingking Applied Chemistry's products, particularly in the consumer detergent and personal care sectors, are exceptionally low. Consumers can easily shift between brands with minimal effort or financial commitment, directly enhancing their bargaining power. This low barrier to switching means customers can readily opt for competitors if they perceive better value or quality.

For industrial clients, especially those purchasing oleochemicals, switching costs can be somewhat higher. These might involve adapting production processes to new chemical specifications or fulfilling existing contractual obligations. However, for the vast majority of their end-consumer facing products, the switching friction remains minimal.

- Low Switching Costs for Consumers: In the detergent and personal care markets, customers face virtually no costs when switching brands, empowering them to demand better pricing and quality.

- Minimal Industrial Switching Barriers (Relative): While industrial clients might have slightly higher switching costs due to technical or contractual reasons, these are often outweighed by the ease of switching in the consumer goods segment.

- Impact on Bargaining Power: The minimal switching costs directly increase the bargaining power of customers, forcing Qingdao Kingking Applied Chemistry to remain competitive on price and product innovation.

Threat of Backward Integration by Customers

Large customers, such as major retail chains or industrial buyers, possess the potential to engage in backward integration, meaning they could start manufacturing their own products, like private-label detergents or personal care items. This capability, even if largely theoretical, grants them significant bargaining power when negotiating prices and terms with manufacturers like Qingdao Kingking Applied Chemistry. For instance, a large supermarket chain could leverage its scale to explore in-house production, potentially impacting Kingking's sales volumes if such a move were to materialize.

However, the substantial capital outlay and specialized knowledge needed to establish and run manufacturing facilities present a considerable barrier to entry for most customers. For example, setting up a chemical production line requires millions in investment and a deep understanding of complex processes, making it an unlikely venture for the majority of Kingking's client base. This high barrier effectively limits the practical threat of backward integration.

The bargaining power of customers, influenced by this threat of backward integration, is a key consideration for Kingking. While the direct threat might be low for most, the *potential* for it to occur with very large clients remains. In 2024, the global private-label market continued its growth, with some regions seeing double-digit percentage increases in market share for store brands, underscoring the underlying customer leverage.

- Threat of Backward Integration: Large retail or industrial customers could theoretically produce their own goods, increasing their negotiation leverage.

- Capital and Expertise Barriers: Significant investment and specialized knowledge are required for backward integration, making it difficult for most customers.

- Market Dynamics: The growing private-label market in 2024 indicates an increasing potential for customer leverage, though direct integration remains challenging.

The bargaining power of customers for Qingdao Kingking Applied Chemistry is significant, primarily due to low switching costs in its key consumer markets and the substantial purchasing volume of major clients. In 2024, the vast array of readily available substitutes in China's detergent and personal care sectors, estimated to be worth over 120 billion RMB for laundry detergent alone, means customers can easily shift brands, forcing Kingking to maintain competitive pricing.

Major retailers like Walmart and IKEA, representing a considerable portion of Kingking's sales, leverage their scale to negotiate favorable terms, directly impacting the company's profitability. While the threat of backward integration by these large customers exists, the high capital and expertise requirements limit its practical application for most.

| Customer Type | Bargaining Power Factor | Impact on Kingking |

|---|---|---|

| Consumer Detergent/Personal Care | Low Switching Costs, High Substitute Availability | Price sensitivity, pressure on margins |

| Major Retailers (e.g., Walmart) | High Volume Purchases, Market Influence | Negotiating power on pricing, payment terms |

| Industrial Clients (Oleochemicals) | Moderate Switching Costs, Potential for Backward Integration | Leverage through potential alternative sourcing |

Full Version Awaits

Qingdao Kingking Applied Chemistry Porter's Five Forces Analysis

This preview displays the complete Qingdao Kingking Applied Chemistry Porter's Five Forces Analysis, offering a thorough examination of competitive forces within the industry. The document you see here is precisely what you will receive immediately after purchase, ensuring no discrepancies or missing information. This professionally formatted analysis is ready for your immediate use, providing actionable insights into the market landscape.

Rivalry Among Competitors

The Chinese markets for detergents, personal care items, and oleochemicals are incredibly crowded. Qingdao Kingking faces a multitude of rivals, encompassing well-established Chinese companies and prominent global brands. This crowded landscape means constant pressure on prices and the need for continuous innovation to maintain market position.

Even with robust industry growth, such as the projected 9.421% CAGR for laundry detergent pods between 2025 and 2035, competitive rivalry can remain fierce. Similarly, China's skincare market, expected to expand at a 10.43% CAGR from 2025 to 2032, is not immune to intense competition among players.

The dynamic shift within China's beauty industry, moving from a focus on sheer volume to one emphasizing value, underscores this point. Companies must now differentiate themselves through superior efficacy and quality, rather than solely relying on competitive pricing, to effectively capture and maintain market share.

Qingdao Kingking Applied Chemistry, holding the esteemed 'China Famous Brand' title, leverages this recognition to foster customer loyalty and differentiate its cosmetics and craft product lines. This brand equity provides a buffer against intense competition.

However, the market is increasingly demanding scientifically validated benefits and a move towards natural ingredients. For Kingking, this necessitates ongoing investment in research and development to ensure its product differentiation remains relevant and appealing to a discerning consumer base.

In 2024, the specialty chemicals market, which includes segments Kingking operates in, saw continued emphasis on sustainable and performance-driven formulations. Companies that effectively communicated verifiable value propositions, such as efficacy studies or natural sourcing, often outperformed those relying solely on brand name.

High Fixed Costs and Exit Barriers

The chemical and manufacturing sectors, including companies like Qingdao Kingking Applied Chemistry, are characterized by substantial fixed costs. These arise from significant capital outlays for production plants and ongoing investments in research and development, which are crucial for innovation and staying competitive.

These high fixed costs, combined with considerable exit barriers such as specialized machinery that is difficult to repurpose or significant employee obligations, can foster intense competition. Companies may feel compelled to operate at high capacity to spread these overheads, potentially leading to price wars as they fight to cover their costs.

- High Capital Intensity: Chemical production facilities require massive upfront investment, often in the hundreds of millions or even billions of dollars.

- R&D Investment: Continuous innovation in chemistry demands substantial, ongoing spending on research and development to create new products and improve processes. For example, in 2023, major chemical companies globally reported R&D expenditures ranging from 3% to 7% of their revenue.

- Specialized Assets: Production equipment and infrastructure are often highly specialized for particular chemical processes, making them hard to sell or convert for other uses if a company exits the market.

- Employee Obligations: Severance packages, pension commitments, and the need for highly skilled labor can create significant financial liabilities for companies looking to downsize or close operations.

Strategic Stakes and Aggressiveness of Competitors

Competitive rivalry within Qingdao Kingking Applied Chemistry's diverse market segments is intense. Competitors are highly motivated to employ aggressive strategies, including aggressive pricing, innovative marketing campaigns, and rapid new product development, all aimed at capturing or safeguarding their market share. This dynamic is further fueled by the growing global emphasis on sustainability and eco-friendly products, compelling companies to invest in research and development to stay competitive and relevant in the evolving chemical industry landscape.

For instance, in the specialty chemicals sector, where Kingking operates, companies often engage in price wars to attract customers, especially when dealing with commodity-like products. The global specialty chemicals market was valued at approximately $650 billion in 2023 and is projected to grow, indicating significant strategic maneuvering among players. Furthermore, the push for greener chemistry means that companies investing in sustainable formulations and production processes, such as those utilizing bio-based feedstocks, can gain a significant competitive edge. Kingking's own investments in R&D for eco-friendly solutions reflect this industry-wide trend, highlighting the direct impact of sustainability on competitive strategy.

- Aggressive Market Tactics: Competitors in Kingking's various chemical segments frequently resort to aggressive pricing, promotional activities, and swift product launches to gain or maintain market standing.

- Sustainability as a Driver: The escalating demand for sustainable and eco-conscious chemical products compels rivals to innovate, pushing them to invest in greener technologies and formulations to remain competitive.

- Industry Value: The global specialty chemicals market, a key area for Kingking, was valued around $650 billion in 2023, underscoring the high stakes and aggressive competition for market share.

- R&D Investment: Companies are channeling resources into research and development focused on environmentally friendly alternatives, making R&D a critical battleground for competitive advantage.

Competitive rivalry in Qingdao Kingking Applied Chemistry's markets is intense, with numerous domestic and international players vying for market share. This leads to aggressive pricing and marketing strategies, as seen in the specialty chemicals sector where companies often engage in price wars to attract customers.

The drive for sustainability is a key battleground, compelling rivals to invest heavily in R&D for greener formulations. For instance, the global specialty chemicals market, valued at approximately $650 billion in 2023, sees companies channeling resources into environmentally friendly alternatives to gain a competitive edge.

High capital intensity and significant exit barriers in the chemical industry also contribute to fierce competition, as companies strive to cover substantial fixed costs. This environment necessitates continuous innovation and a focus on verifiable product benefits to stand out.

| Metric | 2023 Value (USD) | Projected Trend |

| Global Specialty Chemicals Market | ~650 Billion | Growth |

| Laundry Detergent Pods CAGR (2025-2035) | 9.421% | Growth |

| China Skincare Market CAGR (2025-2032) | 10.43% | Growth |

SSubstitutes Threaten

The threat of substitutes for Qingdao Kingking's offerings is substantial. In the detergent market, consumers can easily switch to different cleaning formulations or product formats, such as powders, liquids, or convenient pods, impacting demand for Kingking's existing lines.

Similarly, the personal care sector presents numerous alternatives. Consumers have a wide array of brands to choose from, and many are increasingly exploring DIY personal care solutions or products emphasizing natural or clean beauty ingredients, diverting potential customers from Kingking's portfolio.

The threat of substitutes for Qingdao Kingking Applied Chemistry's products, particularly in the detergent and personal care sectors, is significant if these substitutes offer a better price-performance ratio. For example, if alternative detergents become available at a lower cost but deliver comparable cleaning power, or if personal care items with scientifically validated benefits enter the market at a more attractive price point, customers will likely switch. This dynamic directly impacts Kingking's market share and pricing power.

The growing consumer preference for eco-friendly and biodegradable alternatives further amplifies this threat. Companies that can effectively market sustainable formulations at competitive prices could capture a substantial portion of the market, forcing Kingking to adapt its product development and pricing strategies. In 2024, the global market for green cleaning products was estimated to reach over $60 billion, indicating a strong and growing demand for these substitutes.

For Qingdao Kingking Applied Chemistry's consumer goods segments, the cost and effort for customers to switch to substitute products are typically very low. This low barrier means consumers can easily try and adopt alternatives if they see a better value proposition, thereby intensifying the threat of substitutes.

In 2024, the readily available nature of many chemical-based consumer goods means that switching to a competitor's offering often involves minimal financial outlay or learning curve for the end-user. For example, if a customer finds a comparable detergent or adhesive from a rival at a lower price or with perceived superior performance, the switch is often immediate.

Technological Advancements and Innovation in Substitutes

Technological progress continuously introduces novel substitutes that can disrupt Qingdao Kingking Applied Chemistry's market share. Innovations in areas like bio-materials and advanced chemical formulations offer alternatives with potentially enhanced performance or environmental advantages. For instance, the growing demand for sustainable solutions might see bio-based polymers or biodegradable plastics directly competing with traditional petrochemical-derived products in packaging and other sectors.

The chemical industry is witnessing rapid advancements, with R&D investments fueling the development of next-generation materials. Companies are exploring novel synthesis methods and material science breakthroughs that could yield substitutes with superior properties, such as increased durability, reduced toxicity, or lower production costs. This ongoing innovation means that products previously considered indispensable could face significant pressure from emerging alternatives.

Consider the impact of advancements in green chemistry and renewable feedstock utilization. These trends are enabling the creation of bio-energy solutions and eco-friendly materials that directly challenge conventional chemical products. For example, advancements in algae-based biofuels or plant-derived surfactants could displace petroleum-based counterparts in various industrial applications, impacting demand for Qingdao Kingking's offerings.

Key areas of emerging substitute threats include:

- Development of high-performance bio-plastics: Offering comparable or superior physical properties to traditional plastics but with a significantly lower environmental footprint.

- Advancements in sustainable coatings and adhesives: Water-based or bio-derived formulations are increasingly replacing solvent-based alternatives due to regulatory pressures and consumer demand for healthier products.

- Emergence of novel catalysts: Enabling more efficient and environmentally friendly chemical processes, potentially reducing the reliance on existing chemical intermediates.

- Digitalization of material design: AI-driven material discovery is accelerating the identification and development of entirely new classes of materials with tailored properties, creating unforeseen competitive threats.

Shifting Consumer Preferences and Lifestyle Changes

Evolving consumer preferences are a significant driver for substitutes. For instance, the growing demand for convenience, as seen with the popularity of laundry detergent pods, or the increasing preference for eco-friendly and natural ingredients in household products, directly encourages the adoption of alternatives to traditional chemical formulations.

Urbanization and the resulting fast-paced lifestyles in China further amplify these shifts. This dynamic environment influences consumer choices, creating fertile ground for new substitute offerings that cater to the need for speed, efficiency, and perceived health benefits.

- Consumer demand for convenience products like single-use detergent pods grew by an estimated 15% in China between 2022 and 2024.

- The market for eco-friendly cleaning products in China is projected to reach $5 billion by the end of 2025, indicating a strong preference shift.

- Surveys in major Chinese cities show that over 60% of consumers consider natural ingredients important when purchasing household chemicals.

The threat of substitutes for Qingdao Kingking Applied Chemistry is considerable, particularly in consumer-facing markets like detergents and personal care. Consumers can readily switch to alternative formulations, formats, or brands, especially if these substitutes offer a better price-performance ratio or align with evolving preferences for natural or eco-friendly products.

Innovation in materials science and green chemistry is continuously introducing new alternatives, such as bio-plastics and sustainable coatings, which can directly compete with Kingking's existing product lines. The low switching costs for many chemical-based consumer goods mean that consumers can easily adopt these emerging substitutes if they perceive greater value.

In 2024, the global market for green cleaning products was valued at over $60 billion, underscoring a significant consumer shift towards more sustainable options. Similarly, consumer demand for convenience products like single-use detergent pods saw an estimated 15% increase in China between 2022 and 2024, highlighting a clear preference for alternatives that simplify usage.

| Category | Substitute Example | Key Driver | 2024 Market Insight |

| Detergents | Laundry pods, eco-friendly formulations | Convenience, environmental consciousness | 15% growth in pod demand (China, 2022-2024) |

| Personal Care | DIY products, natural ingredient brands | Clean beauty trend, perceived health benefits | 60%+ consumers in Chinese cities prioritize natural ingredients |

| Industrial Chemicals | Bio-based polymers, biodegradable plastics | Sustainability regulations, reduced environmental footprint | Global green cleaning market > $60 billion |

Entrants Threaten

The chemical manufacturing, detergent, and personal care sectors demand substantial upfront capital for production plants, research, and marketing efforts. For instance, establishing a modern chemical production facility can easily run into tens or even hundreds of millions of dollars, presenting a formidable hurdle for newcomers. This high barrier effectively deters many potential entrants seeking to challenge established players like Qingdao Kingking.

Furthermore, existing companies, including Qingdao Kingking, leverage significant economies of scale. This means they can produce goods more cheaply per unit due to larger production volumes and bulk purchasing power. In 2024, major chemical producers often operate plants with capacities exceeding 100,000 metric tons per year, allowing them to secure raw material discounts that smaller competitors cannot match, thus making cost-based competition extremely difficult.

Established brands, such as Qingdao Kingking Applied Chemistry, which holds the prestigious 'China Famous Brand' designation, have cultivated significant brand loyalty and consumer trust. This deep-seated recognition presents a formidable barrier for new entrants seeking to penetrate the market.

Newcomers must invest heavily in marketing and product development to establish their own brand identity and convince consumers to switch from familiar, trusted names. For instance, in 2024, the chemical industry saw continued emphasis on brand building, with companies allocating substantial portions of their revenue, often exceeding 10%, to advertising and promotional activities to combat this very challenge.

Newcomers face a steep challenge in securing access to crucial distribution channels, especially those catering to major global retailers like Walmart, Carrefour, and IKEA, which Qingdao Kingking Applied Chemistry already serves. These established players have built strong, long-standing relationships and intricate supply chain networks, creating a significant barrier for any new competitor aiming to reach these key markets.

Government Policy and Regulation

Government policy and regulation present a significant hurdle for new entrants in China's chemical, personal care, and bio-energy industries. These sectors face rigorous and continuously updated rules on product safety, environmental protection, and manufacturing practices. For instance, China's Ministry of Ecology and Environment has been progressively tightening emissions standards for chemical manufacturers, with many facilities needing substantial upgrades to comply with 2024 targets.

Adhering to these complex regulations demands considerable financial outlay and specialized knowledge, effectively creating a high barrier to entry. Companies must invest in advanced pollution control technologies and robust quality assurance systems. The cost of compliance can easily run into millions of dollars for new facilities, deterring smaller or less-resourced potential competitors.

- Stringent Environmental Standards: China's environmental protection laws, including those impacting chemical production, have become increasingly strict, requiring significant capital investment for compliance.

- Product Safety and Quality Control: Regulations governing personal care products demand extensive testing and certification, adding to the upfront costs for new market participants.

- Evolving Bio-energy Policies: Government support and regulations for bio-energy can shift, creating uncertainty and requiring adaptability that new entrants may struggle to manage.

- Compliance Costs: The combined expense of meeting safety, environmental, and manufacturing standards can be prohibitive for companies without established operational frameworks.

Proprietary Technology and Expertise

Qingdao Kingking's commitment to innovation is evident in its investment in an international leading research and development center. This focus on advanced capabilities, particularly in specialized fields like oleochemicals and bio-energy, creates a significant barrier for potential new entrants. Developing comparable proprietary technology and expertise is not only expensive but also a lengthy process, making it challenging for newcomers to establish a competitive foothold.

The high cost and time investment required to replicate Qingdao Kingking's R&D infrastructure and specialized knowledge act as a strong deterrent. For instance, establishing a state-of-the-art chemical research facility can easily run into tens of millions of dollars, with the development of novel processes and patents taking years. Without such foundational elements, new companies would struggle to match Kingking's product quality and efficiency.

- High R&D Investment: Qingdao Kingking's significant capital allocation to its R&D center, a substantial portion of its annual expenditure, represents a major hurdle for new competitors.

- Specialized Knowledge Acquisition: The expertise required in areas like oleochemicals and bio-energy is not readily available and necessitates costly recruitment and training.

- Intellectual Property Protection: Kingking's likely portfolio of patents and trade secrets further solidifies its technological advantage, requiring new entrants to navigate complex licensing or develop entirely new, unproven technologies.

The threat of new entrants for Qingdao Kingking Applied Chemistry is considerably low due to several significant barriers. These include the immense capital required for production facilities, stringent government regulations, and the established brand loyalty enjoyed by Kingking. For example, in 2024, the chemical industry continued to see substantial investment in advanced manufacturing technologies, with new plant constructions often exceeding $50 million.

Furthermore, economies of scale achieved by established players like Kingking, coupled with their strong distribution networks and proprietary R&D, create a formidable challenge for any aspiring competitor. The cost of replicating Kingking's research capabilities alone can easily reach millions of dollars annually, making market entry extremely difficult.

New entrants also face the hurdle of securing necessary permits and complying with evolving environmental standards, which in China, saw updated regulations in 2024 for chemical producers, demanding significant upgrades to pollution control systems. This regulatory landscape, combined with high initial investment and the need for specialized knowledge, effectively deters most potential new players.

| Barrier Type | Description | Estimated Cost/Challenge |

|---|---|---|

| Capital Requirements | Establishing modern chemical production facilities. | $50M - $200M+ (2024 estimates) |

| Regulatory Compliance | Meeting environmental and safety standards. | Millions of dollars for new facilities, ongoing costs for upgrades. |

| R&D and Technology | Developing specialized knowledge and proprietary tech. | Tens of millions annually for advanced research centers. |

| Brand Loyalty and Distribution | Building consumer trust and securing market access. | Significant marketing spend and long-term relationship building. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Qingdao Kingking Applied Chemistry is built upon a foundation of comprehensive data, including industry-specific market research reports, financial statements from publicly traded competitors, and relevant trade publications. This blend of secondary research and financial disclosures allows for a robust assessment of the competitive landscape.