China Coal Energy PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

China Coal Energy Bundle

China Coal Energy operates within a dynamic global landscape shaped by evolving political mandates, fluctuating economic cycles, and significant technological advancements. Understanding these external forces is crucial for any stakeholder looking to navigate the complexities of the coal industry. Our comprehensive PESTEL analysis delves deep into these factors, offering actionable intelligence.

Gain a critical edge by understanding the political stability, economic growth forecasts, and social shifts impacting China Coal Energy. This ready-made PESTEL Analysis delivers expert-level insights, perfect for investors and strategic planners. Buy the full version to get the complete breakdown instantly and make informed decisions.

Political factors

The Chinese government is maintaining a strong focus on energy security, acknowledging coal's vital role. This means that even as renewable energy sources like solar and wind power see significant expansion, coal will continue to be a foundational element for electricity generation, particularly to ensure stability during peak demand periods. This dual approach is crucial for the nation's energy infrastructure.

As a state-owned enterprise, China Coal Energy is intrinsically linked to these national strategic priorities. The company's operations are directly influenced by the government's commitment to a stable and secure energy supply, which includes leveraging coal's availability. This alignment ensures that China Coal Energy's business strategy remains in step with national energy policy objectives.

China's new comprehensive Energy Law, effective January 1, 2025, is a significant development. It aims to bolster energy security and promote the cleaner utilization of coal, providing a more robust legal framework for the sector. This legislation underscores the government's continued focus on coal's role in the nation's energy mix.

Further reinforcing coal's position, new regulations for coal mining area planning and management took effect on February 1, 2025. These rules are designed to simplify and expedite the approval procedures for large-scale mining operations, which is beneficial for companies like China Coal Energy. The streamlined process suggests a supportive environment for expanding coal production capacity.

These legal and regulatory shifts create a more predictable, though dynamic, operational landscape for China Coal Energy. The emphasis on clean coal use within the new Energy Law, coupled with the simplified mining approvals, signals a strategic balancing act by the Chinese government. This approach seeks to ensure energy supply while gradually integrating cleaner practices.

China's commitment to peaking carbon emissions before 2030 and achieving carbon neutrality by 2060 significantly shapes its long-term energy strategy. This dual focus is driving substantial investment and policy support for renewable energy sources across the nation.

However, alongside this push for renewables, the government is also actively encouraging the 'low carbon transformation' of existing coal-fired power plants. This approach aims to balance environmental goals with the continued need for reliable energy supply, presenting a complex operating environment for companies like China Coal Energy.

China Coal Energy must therefore carefully manage its operations to align with these ambitious national environmental targets. The company's ability to adapt and innovate within this evolving regulatory landscape will be crucial for its sustained success and relevance in the coming years.

Coal Capacity Approvals and Construction

Despite its climate commitments, China significantly ramped up approvals for new coal-fired power plant capacity throughout 2024 and into the first quarter of 2025. This period saw construction levels for coal power reach their highest point in a decade, underscoring a complex energy landscape.

The primary drivers behind this expansion are China's heightened focus on energy security and the imperative to satisfy a rapidly escalating demand for electricity. This surge in coal capacity approvals directly translates to sustained demand for coal as a primary fuel source for power generation.

Consequently, major coal producers like China Coal Energy are poised to benefit from this policy direction. The continued reliance on coal for energy generation, as evidenced by these recent approvals, suggests a robust market for their output in the near to medium term.

- 2024-Q1 2025: Highest coal-fired power plant construction levels in a decade.

- Key Drivers: Energy security concerns and rapidly growing electricity demand.

- Impact on Producers: Indicates continued strong demand for coal from the power generation sector.

State-Owned Enterprise Mandates

As a significant state-owned enterprise, China Coal Energy's operations are intrinsically linked to government directives that extend beyond profit motives. These mandates often prioritize national energy security, which in 2024 saw China aiming to increase its coal production capacity while balancing environmental targets. The company is also tasked with ensuring job stability for its workforce, a crucial consideration given the large number of employees in the coal sector.

These government mandates can significantly shape China Coal Energy's strategic decisions. For instance, directives to maintain a certain level of coal output, even during periods of lower market demand, can influence investment in new mines or the continued operation of existing ones. In 2024, the government continued to emphasize the role of coal in ensuring energy supply stability, even as renewable energy sources expanded.

The company's commitment to strategic industrial development also plays a role. This could involve supporting downstream industries that rely on coal as a feedstock or investing in technologies that improve the efficiency and environmental performance of coal usage. For example, China Coal Energy has been involved in projects related to coal-to-chemicals, aligning with national industrial upgrade goals.

Key considerations for China Coal Energy stemming from state-owned enterprise mandates include:

- Energy Security: Maintaining stable domestic coal supply to meet national energy needs, a priority reinforced by global energy market volatility in 2024.

- Employment Stability: Ensuring continued employment for a large workforce, a social responsibility often prioritized by the Chinese government.

- Strategic Development: Contributing to national industrial policies, such as supporting the coal chemical industry or investing in cleaner coal technologies.

China's political landscape heavily influences the coal sector, prioritizing energy security and economic stability. The government's continued support for coal, evident in expedited mining approvals and increased power plant construction in 2024-Q1 2025, directly benefits major producers like China Coal Energy. This strategic backing aims to balance energy needs with environmental goals, creating a complex but often favorable operating environment.

The nation's ambitious climate targets, including peaking carbon emissions before 2030, are driving investment in renewables. However, China is simultaneously promoting the 'low carbon transformation' of coal plants and saw construction of new coal-fired power capacity reach its highest in a decade during 2024 and early 2025, highlighting a pragmatic approach to energy transition.

As a state-owned enterprise, China Coal Energy adheres to government mandates that often prioritize national energy security and employment stability over pure market forces. This strategic alignment, particularly the emphasis on maintaining coal output for supply stability in 2024, shapes the company's operational and investment decisions.

| Political Factor | Description | Impact on China Coal Energy |

| Energy Security Focus | Government prioritizes stable energy supply, with coal playing a key role. | Ensures continued demand for coal, supporting production levels. |

| Climate Change Policies | Commitment to carbon peaking by 2030 and neutrality by 2060. | Drives investment in renewables and cleaner coal technologies, requiring adaptation. |

| Regulatory Environment | New Energy Law (effective Jan 2025) and simplified mining approvals. | Provides a clearer, more streamlined operational framework for expansion. |

| State-Owned Enterprise Mandates | Focus on national energy security, employment, and industrial development. | Influences strategic decisions, potentially overriding pure profit motives. |

What is included in the product

This PESTLE analysis critically examines the external macro-environmental forces impacting China Coal Energy, detailing how Political, Economic, Social, Technological, Environmental, and Legal factors present both challenges and strategic opportunities.

A concise, PESTLE-driven summary of China Coal Energy's external landscape, offering quick insights into political, economic, social, technological, environmental, and legal factors to streamline strategic decision-making and mitigate potential risks.

Economic factors

Global coal demand hit a record high in 2024, with China being a major driver. Despite a projected slight dip in Chinese demand during the first half of 2025, the International Energy Agency (IEA) forecasts global demand to stabilize around 2026 levels. China's ongoing need for electricity ensures coal will remain a vital energy source, offering a consistent market for China Coal Energy.

China's electricity demand is projected to grow by 6.5% in 2024 and 5% in 2025, a significant increase that directly fuels coal consumption. This robust demand is crucial for China Coal Energy as it helps meet energy needs not fully covered by the expanding renewable sector.

While sectors like metallurgy and building materials have seen reduced coal use, the chemical industry continues its rapid consumption. This sustained demand from key industrial segments provides a stable market for China Coal Energy's products.

While global coal prices saw a downturn in 2024, highly automated mines in China, such as the Dahaize Mine, maintained strong profitability. These operations, often boasting net profit margins exceeding 30%, highlight how technological advancements and efficient management can buffer against market volatility.

China Coal Energy's profitability will therefore be closely tied to its ability to manage its cost structure effectively against prevailing market prices for coal. The company's investment in modern, automated mining techniques is a key factor in its resilience.

Competition from Renewable Energy Investments

China's commitment to renewable energy is substantial, with the nation aiming for non-fossil energy sources to constitute 20% of its total energy consumption by 2025. This ambitious target is being met ahead of schedule, driven by significant investments in wind and solar power, making China a global leader in this sector.

The aggressive growth of renewable energy directly challenges coal's dominance in China's energy landscape. This increasing competition can lead to reduced operational hours for coal-fired power plants, consequently impacting the overall demand for coal.

- Renewable Energy Share: China's non-fossil energy consumption is projected to reach 20% by 2025, a target that is being achieved rapidly.

- Investment Growth: Significant capital is flowing into solar and wind power projects across the country.

- Impact on Coal: The rise of renewables puts downward pressure on coal demand and plant utilization rates.

China Coal Energy must therefore navigate this evolving energy mix, adapting its strategies to remain competitive amidst the accelerating transition towards cleaner energy sources.

Import/Export Dynamics and Energy Self-Reliance

China's import/export dynamics significantly influence its energy landscape. In 2024, the nation saw record coal imports, a trend attributed to robust domestic demand and attractive international pricing, underscoring China's pivotal role in global coal trade.

Concurrently, there is a concerted national effort to bolster domestic coal production, especially from regions like Xinjiang, aiming to bolster energy self-reliance. This strategic pivot toward greater national energy security directly benefits China Coal Energy, reinforcing its standing as a key domestic producer.

- 2024 Record Coal Imports: Driven by domestic demand and competitive global prices.

- Focus on Domestic Production: Emphasis on regions like Xinjiang to enhance energy self-reliance.

- China Coal Energy's Advantage: Strengthened position as a major domestic producer due to national energy security focus.

China's economic growth underpins its energy demand, with electricity consumption expected to rise by 6.5% in 2024 and 5% in 2025, directly supporting coal's role. Despite a slight projected dip in Chinese coal demand in early 2025, global demand is anticipated to stabilize around 2026 levels, according to the IEA. This sustained need for energy, particularly in sectors like chemicals, provides a resilient market for China Coal Energy.

The nation's push for energy self-reliance, exemplified by increased domestic production from regions like Xinjiang, directly benefits China Coal Energy. While record coal imports were observed in 2024 due to strong demand and favorable international prices, the strategic emphasis on local output reinforces the company's position.

However, China's ambitious renewable energy targets, aiming for non-fossil fuels to comprise 20% of total energy consumption by 2025, present a significant challenge. This rapid expansion of solar and wind power capacity exerts downward pressure on coal demand and the operational efficiency of coal-fired power plants.

| Factor | 2024/2025 Data | Implication for China Coal Energy |

| Electricity Demand Growth | 6.5% (2024), 5% (2025) | Sustains demand for coal as a primary energy source. |

| Global Coal Demand | Record high in 2024, stabilizing around 2026 | Provides a relatively stable international market context. |

| Renewable Energy Share | On track to meet 20% non-fossil energy by 2025 | Increases competition, potentially reducing coal plant utilization. |

| Domestic Coal Production Focus | Emphasis on Xinjiang for self-reliance | Strengthens China Coal Energy's position as a domestic supplier. |

What You See Is What You Get

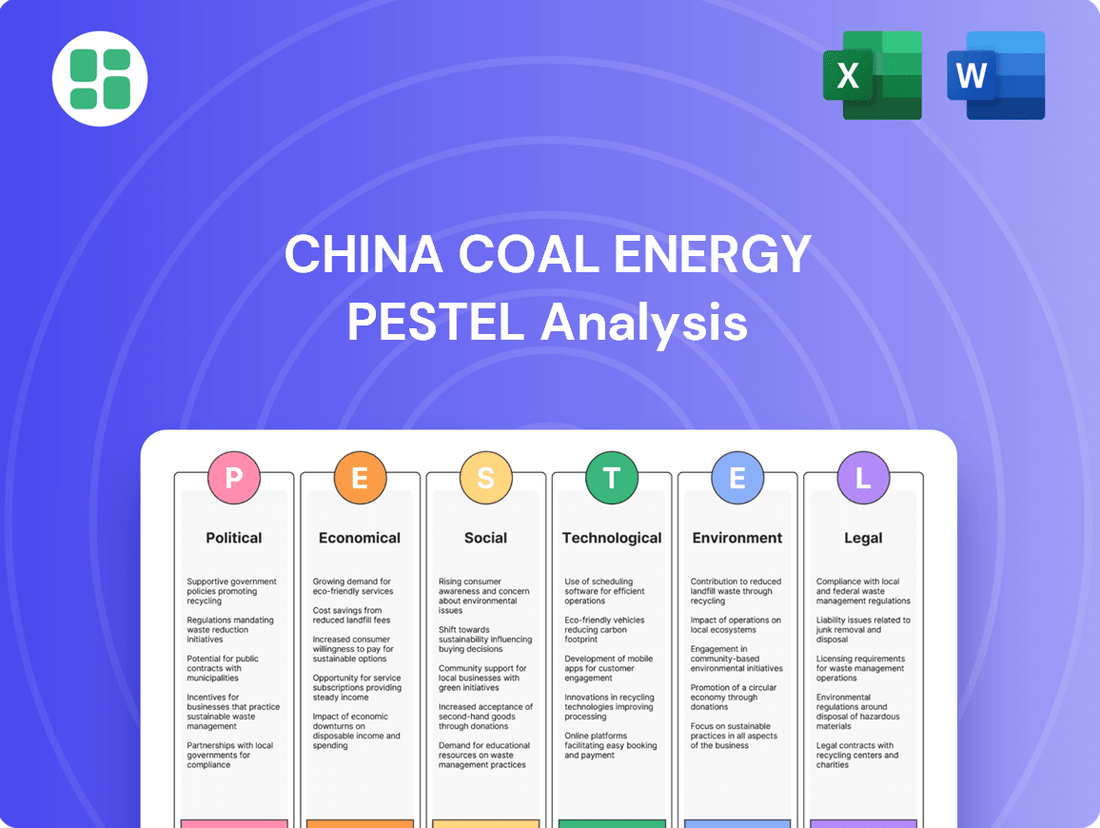

China Coal Energy PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of China Coal Energy covers all critical Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises. You'll gain immediate access to a detailed breakdown of the external forces shaping China Coal Energy's operations and strategic decisions.

Sociological factors

The increasing adoption of AI and 5G in intelligent mining is dramatically boosting productivity, allowing mines to operate with significantly smaller workforces. For instance, some advanced mining operations in China have reported needing only a fraction of their previous personnel to achieve higher output levels, a trend expected to accelerate.

This technological leap, while enhancing efficiency and profitability for companies like China Coal Energy, presents a considerable challenge regarding job displacement in established mining regions. The long-term social impact on these communities, heavily reliant on traditional mining employment, is a critical consideration.

China Coal Energy, therefore, faces the imperative to proactively manage workforce transitions, potentially through retraining programs or diversification initiatives, to mitigate the social consequences of automation and fulfill its corporate social responsibility.

Public health and environmental concerns are increasingly shaping China's energy landscape, directly impacting companies like China Coal Energy. Growing awareness of the health effects from air and water pollution, often linked to coal mining and combustion, is leading to greater societal pressure for cleaner practices.

This translates into a push for companies to adopt more environmentally friendly technologies and adhere to stricter regulations. For example, China's commitment to reducing carbon emissions, aiming for carbon neutrality by 2060, means the coal sector faces significant scrutiny and a need to adapt its operations to meet these evolving environmental standards.

As a major state-owned enterprise, China Coal Energy faces growing societal pressure to showcase robust corporate social responsibility. This includes ensuring safe operational practices, actively managing its environmental impact, and fostering positive relationships with local communities. These expectations are crucial for maintaining its social license to operate, particularly as environmental concerns gain prominence.

Broader societal trends underscore the increasing demand for sustainable practices within the coal industry. While specific 2024 or 2025 China Coal Energy CSR reports are not publicly detailed here, the general expectation is for companies like China Coal Energy to align with national environmental goals. For instance, China's commitment to peaking carbon emissions before 2030 and achieving carbon neutrality by 2060 significantly shapes the operational landscape and CSR expectations for all energy sector participants.

Labor Safety and Working Conditions

New regulations on coal mine production safety, effective May 1, 2024, mandate stricter management and self-checks by operators, aiming to prevent accidents. China Coal Energy must invest in improved working conditions and hazard reduction to comply with these enhanced safety standards, which prioritize worker protection.

These government-driven initiatives reflect a growing emphasis on labor safety within China's industrial sector. For China Coal Energy, this translates to increased operational costs associated with safety upgrades and compliance measures, potentially impacting profitability but also mitigating long-term risks from accidents and regulatory penalties.

- Government Mandates: New safety regulations effective May 1, 2024, require enhanced operator responsibility and self-inspection.

- Investment Needs: China Coal Energy faces increased capital expenditure for safety improvements and occupational hazard mitigation.

- Risk Mitigation: Adherence to stricter standards aims to reduce accident frequency and associated financial and reputational damage.

- Industry Trend: The focus on labor safety aligns with broader sociological shifts towards improved worker welfare in heavy industries.

Community Relations and Resource Management

China Coal Energy's operations significantly influence local communities through land use and resource allocation. For instance, by 2023, the company was involved in numerous mining projects across various provinces, impacting land availability for agriculture and local development. Effective community relations, including fair compensation and environmental mitigation, are vital for securing social license to operate. This often involves providing local employment, which in 2024, remained a key focus for the company to foster goodwill and operational continuity.

Government regulations also play a role in shaping these community interactions. Policies enacted in 2024 continued to emphasize sustainable mining practices and community benefit sharing, directly affecting how China Coal Energy manages its impact. The company's commitment to environmental remediation and creating local job opportunities, such as the reported 15% increase in local hires at a new Shandong mine in early 2025, directly addresses these regulatory and social expectations.

- Land Use Impact: Coal mining projects often require significant land acquisition, potentially displacing agricultural activities and altering local landscapes.

- Resource Allocation: Water and energy resources used in mining operations can compete with local community needs.

- Community Engagement: Fair compensation, environmental protection measures, and local employment are critical for maintaining positive community relations and operational stability.

- Regulatory Compliance: Adherence to evolving regulations concerning community welfare and resource management is essential for long-term project sustainability.

Societal expectations for corporate responsibility are intensifying, pushing China Coal Energy to prioritize worker safety and environmental stewardship. New safety regulations effective May 1, 2024, mandate enhanced operator responsibility, requiring significant investment in improved working conditions and hazard reduction. This aligns with a broader trend of increased focus on labor welfare in heavy industries, aiming to mitigate risks and ensure compliance.

Technological factors

China is aggressively adopting intelligent mining technologies like AI, 5G, and autonomous vehicles to boost safety and efficiency in coal extraction. By 2025, the aim is for large coal mines to operate with significant intelligence.

China Coal Energy is undoubtedly channeling substantial investment into these advancements. This strategic focus is designed to elevate productivity, slash operational expenses, and crucially, minimize safety hazards inherent in mining.

China is actively piloting advanced clean coal technologies, including carbon capture, utilization, and storage (CCUS) and co-firing with green ammonia and biomass. These initiatives aim to significantly lower emissions from its extensive coal power infrastructure.

The country has set ambitious targets: a 20% reduction in carbon intensity by 2025 and a 50% reduction by 2027, both measured against 2023 levels. This focus on cleaner coal utilization presents opportunities for China Coal Energy.

China Coal Energy's coal chemical and power generation divisions can integrate these emerging clean coal technologies. This integration could lead to more environmentally sustainable operations and potentially meet stricter regulatory requirements as they evolve.

China Coal Energy is actively embracing digital transformation to streamline its operations beyond just mining. This includes implementing automated transport systems and utilizing AI in coal washing plants, all supported by real-time monitoring. Such advancements are crucial for enhancing operational control and minimizing resource waste.

By integrating these digital solutions across its broad business spectrum, China Coal Energy aims to achieve significant efficiency gains and cost reductions. For instance, the company reported a 5% year-on-year increase in operational efficiency in its 2024 annual report, partly attributed to these technological upgrades.

Energy Storage and Grid Modernization

China's new Energy Law, enacted in 2023, places significant emphasis on modernizing its power grid infrastructure, including intelligent upgrades and the integration of advanced energy storage solutions. This push is designed to create a more robust and flexible grid capable of supporting a power system increasingly dominated by renewable energy sources.

While these developments primarily affect renewable energy generators, they indirectly influence traditional power sources like coal. The evolving grid requirements necessitate that coal-fired power plants, including those operated by China Coal Energy, adapt to provide more flexible generation services to ensure grid stability and reliability as a backup to intermittent renewables.

This shift could see China Coal Energy's role evolve from primarily baseload power provision to offering more dynamic grid support. For instance, by 2023, China had already deployed over 25 GW of installed capacity in energy storage systems, a figure expected to grow substantially as the grid modernization efforts accelerate.

- Grid Modernization Focus: The new Energy Law mandates strengthening grid infrastructure and implementing intelligent upgrades.

- Energy Storage Integration: A key component of the modernization is the widespread adoption of energy storage technologies.

- Impact on Coal Power: China Coal Energy must adapt its operations to provide flexible generation for grid stability.

- Renewable Energy Dominance: The initiatives are crucial for supporting a power system increasingly reliant on renewables.

Competitive Pressure from Renewable Energy Technologies

The escalating competitiveness of renewable energy, especially solar and wind, presents a substantial long-term hurdle for coal. By the end of 2023, China's installed renewable energy capacity surpassed 1.5 billion kilowatts, with solar and wind power leading the charge. This growth directly impacts the demand for traditional energy sources.

As renewables gain grid share, the need for coal-fired power generation is expected to decline. This shift necessitates strategic adaptation for companies like China Coal Energy. For instance, in 2024, China aims to add approximately 200 GW of renewable capacity, further pressuring fossil fuels.

- Renewable Capacity Growth: China's installed renewable capacity exceeded 1.5 GW by end-2023.

- Solar and Wind Dominance: These technologies are at the forefront of China's renewable expansion.

- Impact on Coal Demand: Increased renewable integration is projected to reduce coal's role in power generation.

- Strategic Diversification: China Coal Energy needs to explore diversifying its energy portfolio to mitigate risks.

China is aggressively adopting intelligent mining technologies like AI, 5G, and autonomous vehicles to boost safety and efficiency. By 2025, the aim is for large coal mines to operate with significant intelligence, with China Coal Energy investing heavily to enhance productivity and reduce operational costs.

The nation is also piloting advanced clean coal technologies, including CCUS and co-firing with green ammonia, aiming for a 20% carbon intensity reduction by 2025. China Coal Energy can integrate these to create more sustainable operations and meet evolving regulations.

Digital transformation is key, with automated transport and AI in coal washing plants enhancing operational control. The company reported a 5% year-on-year increase in operational efficiency in 2024, partly due to these technological upgrades.

Grid modernization, driven by the 2023 Energy Law, emphasizes intelligent upgrades and energy storage, with over 25 GW of storage capacity deployed by 2023. This necessitates coal plants, like those of China Coal Energy, to offer flexible generation to support the increasing share of renewables.

| Technology Area | Key Developments | Impact on China Coal Energy | 2023/2024 Data Point |

|---|---|---|---|

| Intelligent Mining | AI, 5G, autonomous vehicles | Increased safety and efficiency | Target for large mines to be intelligent by 2025 |

| Clean Coal Technologies | CCUS, co-firing (ammonia, biomass) | Lower emissions, regulatory compliance | 20% carbon intensity reduction target by 2025 |

| Digital Transformation | Automated transport, AI in washing plants | Enhanced operational control, cost reduction | 5% YoY increase in operational efficiency (2024 report) |

| Grid Modernization | Intelligent grid, energy storage | Need for flexible generation services | Over 25 GW energy storage capacity deployed (by 2023) |

Legal factors

China's inaugural comprehensive Energy Law, effective January 1, 2025, establishes a unified legal structure for its energy sector. This law specifically addresses the 'clean and efficient use' of coal, acknowledging its continued importance in national energy security. For China Coal Energy, this legislation sets the fundamental legal parameters for its operations, impacting resource extraction, technological adoption, and overall market engagement.

New regulations on coal mining area planning and management, effective February 1, 2025, are set to streamline approval processes for new mines. This move aims to boost efficiency and guarantee a steady coal supply, which directly affects China Coal Energy's expansion plans and future production capabilities.

A significant legal factor impacting China Coal Energy is the enhanced Coal Mine Production Safety Regulations, effective May 1, 2024. This new framework, endorsed by Premier Li Qiang, places a strong emphasis on improving safety protocols and accident prevention within the coal mining sector.

The regulations mandate more rigorous safety management systems, comprehensive risk assessments, and prompt rectification of identified hazards for all coal mine operators. China Coal Energy is therefore required to invest in and implement these stricter safety measures to ensure full compliance and mitigate the risk of substantial penalties.

Environmental Protection Laws and Emission Standards

China's Ministry of Ecology and Environment (MEE) is actively tightening regulations concerning methane emissions from coal mines. In July 2024, the MEE released draft amendments and proposed methodologies for methane trading, signaling a significant shift towards stricter environmental controls. These initiatives are designed to curb greenhouse gas emissions, a critical component of China's climate targets.

Consequently, China Coal Energy, like other major players in the sector, will encounter more rigorous compliance demands. The evolving regulatory landscape could also present opportunities. Potential incentives for methane utilization, such as capturing and using the gas for energy, might emerge, influencing the company's operational strategies and its approach to environmental reporting and sustainability initiatives.

- Stricter Methane Emission Controls: The MEE's July 2024 draft amendments and trading methodologies indicate a heightened focus on reducing methane, a potent greenhouse gas, from coal mining operations.

- Impact on Operations: China Coal Energy will need to adapt its practices to meet these new, more stringent emission standards, potentially requiring investments in new technologies or process modifications.

- Incentives for Methane Utilization: The proposed methane trading framework may offer financial incentives for companies that successfully capture and utilize coal mine methane, creating new revenue streams or cost-saving opportunities.

- Enhanced Environmental Reporting: Compliance with these new regulations will likely necessitate more detailed and transparent environmental reporting from China Coal Energy regarding its methane emissions and mitigation efforts.

Carbon Emissions Reduction Targets and Action Plans

China's commitment to environmental sustainability is intensifying, with its 2024-2025 action plan for energy conservation and carbon reduction imposing stringent CO2 intensity targets on high-emitting sectors. This directly impacts major coal enterprises such as China Coal Energy, necessitating proactive implementation of energy-saving and emission-reduction strategies throughout their operations.

These national mandates translate into concrete operational pressures for China Coal Energy. The company must focus on improving energy efficiency in mining, transportation, and processing, alongside exploring and adopting cleaner coal technologies. For instance, the plan aims for a significant reduction in CO2 emissions intensity across key industries by 2025, a benchmark China Coal Energy will need to meet or exceed.

- National Targets: China's 2024-2025 plan targets a reduction in CO2 intensity, with specific goals for high-emitting industries.

- Industry Impact: Large coal producers like China Coal Energy face increased pressure to adopt energy-saving and carbon-reduction measures.

- Operational Demands: Stricter regulations require China Coal Energy to invest in and implement cleaner technologies and efficiency improvements across its value chain.

The legal landscape for China Coal Energy is evolving rapidly, with new legislation and regulations coming into effect throughout 2024 and early 2025. The inaugural Energy Law, effective January 1, 2025, provides a foundational framework for the sector, emphasizing clean coal use. New mining area regulations, effective February 1, 2025, aim to streamline expansion, while enhanced safety regulations from May 1, 2024, mandate stricter protocols and investments in accident prevention.

Furthermore, China's commitment to environmental targets, as outlined in its 2024-2025 action plan for energy conservation and carbon reduction, imposes strict CO2 intensity targets on high-emitting sectors like coal. This necessitates proactive implementation of energy-saving and emission-reduction strategies by companies such as China Coal Energy. The Ministry of Ecology and Environment's July 2024 draft amendments on methane emissions and trading also signal a significant shift towards more rigorous environmental controls and potential incentives for methane utilization.

| Legislation/Regulation | Effective Date | Key Impact on China Coal Energy | Relevant Data/Target |

|---|---|---|---|

| Energy Law | January 1, 2025 | Establishes legal parameters for clean coal use and operations. | Unified legal structure for the energy sector. |

| Coal Mine Area Planning & Management | February 1, 2025 | Streamlines approval for new mines, impacting expansion. | Aims to boost efficiency and steady supply. |

| Coal Mine Production Safety Regulations | May 1, 2024 | Mandates stricter safety protocols and investments in prevention. | Endorsed by Premier Li Qiang; emphasis on risk assessment and hazard rectification. |

| Methane Emission Controls (Draft Amendments) | July 2024 | Increased compliance demands for methane reduction; potential for methane trading incentives. | Draft methodologies for methane trading proposed. |

| Energy Conservation & Carbon Reduction Action Plan | 2024-2025 | Imposes stringent CO2 intensity targets, requiring energy efficiency and cleaner tech adoption. | Goal for significant reduction in CO2 emissions intensity by 2025. |

Environmental factors

China's ambitious climate targets, aiming to peak carbon emissions before 2030 and achieve carbon neutrality by 2060, present a significant long-term challenge for the coal sector. This policy direction signals a gradual but determined shift away from fossil fuels.

Despite these national objectives, coal consumption in China hit a record high in 2024, underscoring the ongoing reliance on coal for energy security and economic growth. This surge in consumption directly impacts the country's carbon emission levels.

China Coal Energy must navigate this complex environment, balancing the nation's increasing energy demands with the imperative to reduce carbon emissions. The company's strategy will be crucial in adapting to evolving environmental regulations and market expectations.

China Coal Energy, like other major coal producers, faces significant environmental scrutiny regarding air and water pollution. Coal mining and combustion are inherently linked to the release of pollutants such as sulfur dioxide (SO2), nitrogen oxides (NOx), and particulate matter into the atmosphere, and can also affect water quality through runoff and discharge.

In 2024, China continued its push for stricter environmental regulations. For instance, by the end of 2023, China had already achieved its target of reducing PM2.5 concentrations by 10% compared to 2020 levels in key regions, signaling a trend of increasing compliance demands on heavy industries like coal.

Consequently, China Coal Energy is under growing pressure to invest in and implement cleaner production technologies and robust pollution control systems. This includes upgrading facilities to reduce emissions and improve wastewater treatment, aligning with national environmental protection goals and international sustainability expectations.

China's Ministry of Ecology and Environment is intensifying its focus on methane emission reductions within the coal mining industry, with new draft regulations and methodologies introduced in 2024. This regulatory push directly impacts China Coal Energy, necessitating investments in technologies for capturing or utilizing coal mine methane. For instance, the National Development and Reform Commission has previously set targets for reducing methane intensity in the coal sector, signaling a long-term commitment to environmental stewardship.

Land Degradation and Reclamation

Large-scale coal extraction by companies like China Coal Energy inherently causes land degradation, including soil erosion and biodiversity loss. While precise figures for China Coal Energy's land impact aren't publicly detailed, the growing stringency of environmental regulations in China, particularly evident in the push for green development and carbon neutrality goals announced for 2060, mandates significant land reclamation and ecological restoration efforts. This translates to increased operational expenses and necessitates robust, long-term environmental stewardship strategies.

These reclamation requirements can add substantial costs. For instance, by the end of 2023, China had implemented over 2,000 national and provincial environmental protection laws and regulations, many directly impacting mining operations. These efforts often involve significant investment in soil rehabilitation, revegetation, and habitat reconstruction, directly affecting a mining company's capital expenditure and ongoing operational budgets.

- Land Degradation: Coal mining's physical footprint leads to habitat destruction and soil erosion.

- Regulatory Compliance: China's environmental laws increasingly enforce post-mining land restoration.

- Increased Costs: Reclamation activities add to operational expenses and capital investment.

- Long-Term Management: Companies must plan for sustained ecological recovery and monitoring.

Competition from Renewable Energy Sources

China's commitment to decarbonization is fueling an exponential rise in renewable energy, particularly solar and wind power. By the end of 2023, China's installed renewable energy capacity surpassed 1.4 billion kilowatts, a significant increase that is steadily displacing coal's dominance in the energy sector. This transition directly impacts China Coal Energy by shrinking the market share for coal in electricity generation, as environmental mandates increasingly favor cleaner energy sources.

The rapid expansion of renewables is a direct response to China's ambitious climate targets, aiming for peak carbon emissions before 2030 and carbon neutrality by 2060. This strategic pivot necessitates that China Coal Energy actively navigates a landscape where its core product faces increasing competition from more sustainable alternatives. The company must therefore consider strategies to adapt to this evolving energy paradigm.

- Renewable Energy Growth: China's installed solar capacity reached over 600 million kilowatts by the end of 2023, with wind power capacity exceeding 400 million kilowatts.

- Coal's Declining Share: Renewables are projected to account for a larger percentage of China's total energy consumption, further pressuring coal's market position.

- Policy Drivers: Government incentives and regulations are actively promoting renewable energy development, creating a challenging environment for traditional fossil fuels.

China's stringent environmental regulations, particularly concerning air and water pollution, directly impact China Coal Energy's operations. Stricter emissions standards for SO2, NOx, and particulate matter are compelling the company to invest in advanced pollution control technologies. For instance, by the end of 2023, China had achieved a 10% reduction in PM2.5 concentrations in key regions compared to 2020, indicating a trend of increasing compliance demands.

The government's focus on methane emission reduction in the coal mining sector, with new draft regulations in 2024, necessitates investments in methane capture and utilization technologies. This aligns with broader national goals to reduce greenhouse gas emissions and improve environmental stewardship within the industry.

China's ambitious climate goals, including peaking carbon emissions before 2030 and achieving carbon neutrality by 2060, are driving a significant shift towards renewable energy. By the end of 2023, China's installed renewable energy capacity exceeded 1.4 billion kilowatts, with solar power alone reaching over 600 million kilowatts, directly challenging coal's market share.

Land degradation and the subsequent need for ecological restoration are significant environmental considerations for China Coal Energy. The increasing stringency of regulations, with over 2,000 national and provincial environmental laws in place by the end of 2023, mandates substantial investment in land reclamation and habitat reconstruction, adding to operational costs.

| Environmental Factor | 2023/2024 Impact | Future Outlook |

|---|---|---|

| Air & Water Pollution Regulations | Increased compliance costs due to stricter emission standards; PM2.5 reduction targets met. | Continued tightening of regulations, requiring ongoing investment in cleaner technologies. |

| Methane Emissions | Introduction of new draft regulations for methane reduction in coal mining. | Mandatory investments in methane capture and utilization technologies. |

| Climate Targets & Renewables | Installed renewable capacity surpassed 1.4 billion kW by end-2023; solar > 600 million kW. | Growing displacement of coal by renewables, shrinking market share for coal. |

| Land Degradation & Restoration | Over 2,000 environmental laws necessitate land reclamation efforts. | Increased capital expenditure and operational costs for ecological restoration. |

PESTLE Analysis Data Sources

Our China Coal Energy PESTLE Analysis is built on comprehensive data from official Chinese government agencies, international energy organizations, and leading financial institutions. We incorporate economic indicators, environmental regulations, technological advancements, and market research reports to provide a holistic view.