China Coal Energy Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

China Coal Energy Bundle

Unlock the full strategic blueprint behind China Coal Energy's business model. This in-depth Business Model Canvas reveals how the company drives value, captures market share, and stays ahead in a competitive landscape. Ideal for entrepreneurs, consultants, and investors looking for actionable insights.

Partnerships

China Coal Energy, as a significant state-owned enterprise, cultivates essential partnerships with numerous government agencies and fellow state-owned corporations. These alliances are vital for obtaining mining concessions, securing permits, and ensuring operations align with national energy strategies, such as those focused on energy security and environmental stewardship.

These collaborations are instrumental in accessing national infrastructure development projects and securing crucial financial backing. For instance, in 2023, China Coal Energy reported significant investment in infrastructure, often facilitated through state-backed initiatives and joint ventures with other SOEs, underscoring the symbiotic relationship.

China Coal Energy actively collaborates with leading universities and research institutes, fostering innovation in areas like advanced mining techniques and clean coal technologies. For instance, in 2024, the company continued its partnerships with institutions focused on developing more efficient and environmentally friendly coal utilization methods, aiming to reduce carbon footprints.

These strategic alliances extend to technology firms, driving progress in areas such as carbon capture, utilization, and storage (CCUS) and integrated energy systems. In 2024, significant R&D investments were channeled into pilot projects exploring novel energy storage solutions to complement coal-based power generation, enhancing grid stability.

China Coal Energy relies heavily on logistics and transportation partners, including major railway operators and port authorities, to move its vast coal output. In 2024, the company's ability to leverage China's extensive rail network and key port facilities was crucial for both domestic distribution and export volumes. These partnerships directly impact the cost and speed of delivery, influencing overall profitability.

Equipment and Technology Providers

China Coal Energy heavily relies on partnerships with leading equipment and technology providers to maintain its edge. These collaborations are crucial for sourcing advanced coal mining machinery, automation systems, and specialized equipment for their chemical production facilities. For instance, in 2024, the company continued to invest in state-of-the-art automated mining equipment, aiming to boost efficiency by up to 15% in key operational areas.

These strategic alliances ensure access to cutting-edge technology that directly impacts operational efficiency and worker safety. By integrating the latest innovations from manufacturers and suppliers, China Coal Energy can optimize its coal extraction and processing capabilities. This focus on technological advancement is a cornerstone of their strategy to remain competitive in the global energy market.

- Key Partnerships: Equipment and Technology Providers

- Focus Areas: Advanced coal mining machinery, automation systems, industrial equipment for coal processing and chemical production.

- Impact: Enhanced operational efficiency, improved safety standards, and support for the manufacturing segment.

- 2024 Data Point: Continued investment in automated mining equipment to achieve an estimated 15% efficiency boost in select operations.

Financial Institutions

China Coal Energy actively cultivates relationships with a diverse array of financial institutions, including major banks, investment funds, and other capital providers. These partnerships are fundamental to securing the substantial capital required for its extensive capital expenditure plans, such as developing new mining operations and building critical infrastructure like railways and ports. For instance, in 2024, the company continued to leverage its strong financial standing to secure favorable loan terms for its expansion projects.

These financial collaborations are not just about funding; they are also instrumental in managing the inherent financial risks associated with the cyclical nature of the coal industry and the significant investments needed for diversification. By working with these entities, China Coal Energy can access sophisticated financial instruments and expertise to hedge against market volatility and interest rate fluctuations. This strategic engagement ensures the company’s financial stability and supports its long-term growth trajectory.

Furthermore, robust ties with financial institutions grant China Coal Energy vital access to capital markets. This allows the company to efficiently raise funds through various avenues, including bond issuances and equity offerings, which are critical for financing its strategic investments and diversification efforts into areas like new energy. As of early 2025, the company was exploring new avenues for green financing to support its sustainability initiatives.

- Bank Financing: Securing credit lines and project-specific loans for large-scale mining and infrastructure development.

- Investment Funds: Attracting capital from private equity and institutional investors for strategic growth and diversification.

- Capital Markets Access: Issuing bonds and other securities to fund expansion, acquisitions, and new energy ventures.

- Risk Management: Utilizing financial instruments and partnerships to mitigate market and operational risks.

China Coal Energy's key partnerships extend to international mining companies and technology providers, facilitating access to global best practices and advanced extraction technologies. These collaborations are crucial for enhancing operational efficiency and adhering to international environmental standards. For example, in 2024, the company engaged in joint ventures to explore new coal reserves with improved extraction methods.

The company also collaborates with downstream customers, including power generation companies and chemical manufacturers, to ensure stable demand for its products and to develop tailored solutions. These relationships are vital for market stability and for understanding evolving customer needs in the energy sector. By fostering these partnerships, China Coal Energy can better align its production with market requirements.

Strategic alliances with logistics and transportation firms are paramount for efficiently moving vast quantities of coal. These partnerships ensure that China Coal Energy can leverage extensive rail networks and port facilities for both domestic supply and international exports. In 2024, the company's logistical efficiency was a key factor in its ability to meet export targets, with significant volumes moved via rail and sea.

| Partnership Type | Focus | 2024 Impact/Activity |

|---|---|---|

| International Mining Companies | Technology sharing, joint ventures for resource exploration | Exploration of new reserves with advanced extraction techniques. |

| Downstream Customers (Power/Chemical) | Stable demand, product customization | Ensured market stability and tailored product development. |

| Logistics & Transportation Providers | Efficient movement of coal (rail, sea) | Facilitated meeting export targets through optimized supply chains. |

What is included in the product

This Business Model Canvas provides a comprehensive overview of China Coal Energy's strategy, detailing its customer segments, key resources, and revenue streams within the context of the global energy market.

It reflects the company's operational realities and strategic plans, offering insights into its competitive advantages and potential challenges for informed decision-making.

The China Coal Energy Business Model Canvas offers a structured approach to pinpointing and addressing inefficiencies in their complex operations, acting as a powerful pain point reliver by visualizing and organizing key business elements.

Activities

China Coal Energy's primary activity is the extraction of coal, covering exploration, mine development, and extensive mining operations. This includes both underground and open-pit methods to tap into their vast coal reserves.

In 2024, China Coal Energy continued to be a significant player in coal production. The company's output is crucial for meeting China's energy demands, with a strong emphasis on operational efficiency and safety protocols across its mining sites.

China Coal Energy processes extracted coal through washing, sorting, and blending to meet precise customer specifications regarding quality and calorific value. This crucial step ensures the coal is ready for its intended use, whether for power generation or industrial processes.

The processed coal is then distributed and sold through an extensive network, reaching both domestic Chinese markets and international buyers. In 2023, China Coal Energy reported that its sales volume of coal products reached 470 million tonnes, demonstrating the scale of its distribution and sales operations.

China Coal Energy's key activity in coal chemical production involves transforming raw coal into valuable chemical products like polyolefin, methanol, urea, and ammonium nitrate. This sophisticated process leverages advanced manufacturing facilities, reflecting substantial capital investment in specialized technology.

This diversification strategy is crucial for China Coal Energy, as it moves beyond simple coal extraction to create higher-value products. For instance, in 2023, the company reported significant output from its chemical segments, contributing substantially to its overall revenue diversification and maximizing the economic potential of its coal reserves.

Coal Mining Machinery Manufacturing

China Coal Energy actively designs, researches, develops, manufactures, and sells a comprehensive range of coal mining machinery and equipment. This core activity is crucial for providing the advanced solutions necessary for efficient and safe mining operations.

The company's product portfolio includes essential mining equipment such as hydraulic supports, robust conveyor systems, and high-performance shearers. These offerings are designed to enhance productivity and operational reliability in diverse mining environments.

Beyond manufacturing, China Coal Energy provides vital after-sales services, ensuring the entire lifecycle of their equipment is supported. This commitment extends to maintenance, repair, and technical assistance, solidifying customer relationships and equipment longevity.

- Product Development: Focus on innovation in hydraulic supports, conveyors, and shearers.

- Manufacturing Excellence: High-volume production of specialized mining machinery.

- After-Sales Support: Comprehensive services including maintenance and technical assistance.

Engineering and Technical Services

China Coal Energy offers specialized engineering and technical services, crucial for the coal industry's lifecycle. This encompasses everything from initial mine design and construction to ongoing operational support, demonstrating a deep understanding of the sector's complexities.

These services are not confined to internal operations; China Coal Energy also extends its expertise to external clients. This includes vital consulting, efficient project management, and dedicated technical support, leveraging decades of accumulated knowledge.

- Expertise in Coal Mine Lifecycle: China Coal Energy provides comprehensive engineering and technical services covering the entire lifespan of a coal mine, from initial design and construction to ongoing operational optimization and maintenance.

- Consulting and Project Management: The company offers specialized consulting services and robust project management capabilities, ensuring efficiency and adherence to best practices in coal extraction and processing.

- Technical Support and Innovation: Providing crucial technical support to both internal divisions and external clients, China Coal Energy leverages its deep industry knowledge to drive innovation and improve operational performance.

- Leveraging Extensive Industry Experience: These services are built upon the company's vast experience and deep-seated expertise within the global coal industry, positioning them as a trusted provider of specialized solutions.

China Coal Energy's key activities revolve around the comprehensive lifecycle of coal, from its extraction and processing to its transformation into chemical products and the manufacturing of essential mining equipment. They also provide critical engineering and technical services to the industry.

In 2023, the company's coal sales volume reached 470 million tonnes, underscoring its significant role in the global energy market. This extensive operation is supported by their advanced coal chemical production, which adds value by creating products like methanol and urea.

Furthermore, China Coal Energy designs and manufactures specialized mining machinery, ensuring operational efficiency and safety. Their commitment to innovation is evident in their product development and the robust after-sales support they offer for their equipment.

The company's engineering and technical services extend their expertise beyond internal operations, providing consulting and project management to external clients, leveraging their deep industry experience.

| Key Activity | Description | 2023/2024 Data/Context |

| Coal Extraction & Processing | Mining, washing, sorting, and blending coal. | 470 million tonnes coal sales volume (2023). Focus on operational efficiency and safety. |

| Coal Chemical Production | Transforming coal into chemical products. | Significant output from chemical segments contributing to revenue diversification. |

| Mining Equipment Manufacturing | Designing, manufacturing, and selling mining machinery. | Portfolio includes hydraulic supports, conveyor systems, and shearers. |

| Engineering & Technical Services | Mine design, construction, operational support, consulting. | Leveraging extensive industry experience for internal and external clients. |

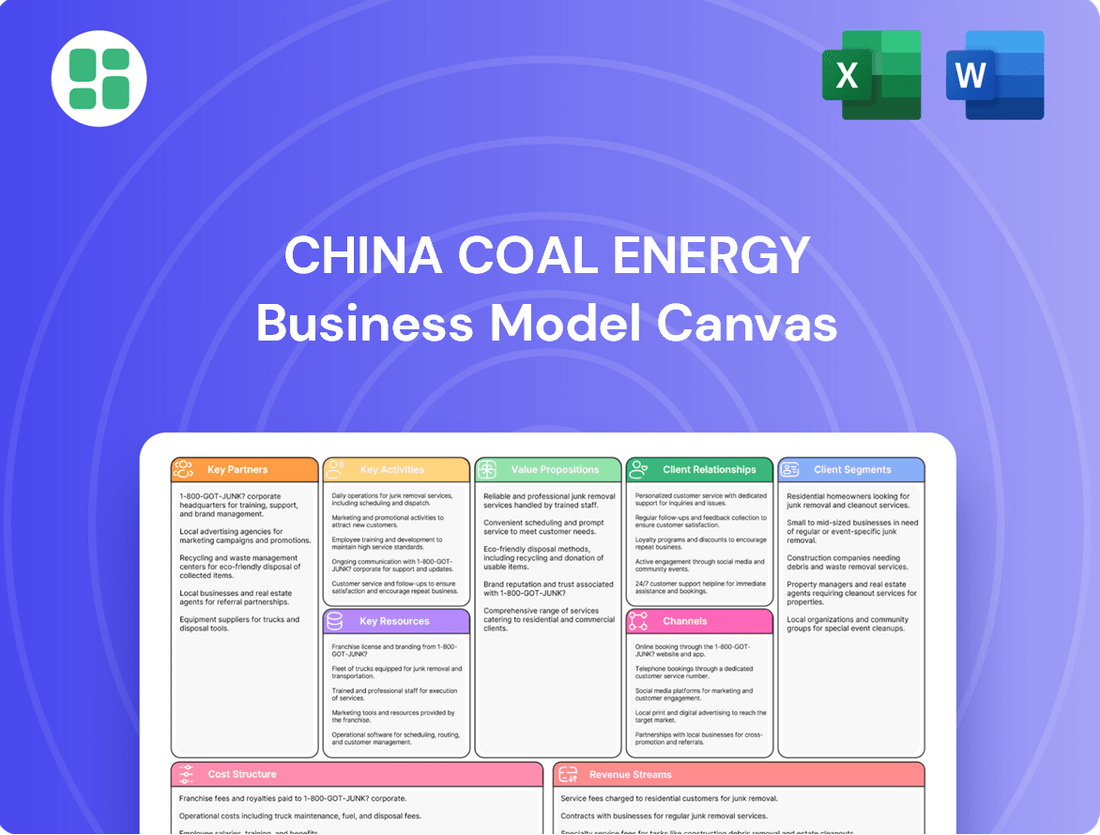

Preview Before You Purchase

Business Model Canvas

The China Coal Energy Business Model Canvas you are previewing is the exact document you will receive upon purchase. This is not a sample or mockup, but a direct snapshot of the complete, ready-to-use file. You'll gain full access to this professionally structured and formatted Business Model Canvas, allowing you to immediately leverage its insights for strategic planning and decision-making.

Resources

China Coal Energy's extensive coal reserves and operational mines are its bedrock, representing vast, high-quality assets that fuel its core business. As of the end of 2023, the company reported total proven and probable coal reserves of approximately 16.1 billion tonnes, a staggering figure that guarantees a long-term, stable supply. This sheer scale of resources is a critical differentiator, solidifying its dominant market position and ability to meet diverse industrial and energy demands.

China Coal Energy's extensive network of modern mining equipment and advanced processing plants forms the backbone of its operations. This infrastructure is designed for high-volume extraction and preparation of coal and its derivatives, ensuring efficiency and cost control.

The company's commitment to scale is evident in its significant investment in logistics, including dedicated railway lines and sophisticated loading facilities. For instance, in 2024, China Coal Energy continued to expand its transportation capacity, a critical factor in delivering millions of tons of product to market reliably and affordably.

China Coal Energy's advanced technology and intellectual property are foundational. This includes proprietary technologies in coal mining, clean coal utilization, and coal chemical processes. These are protected by a significant portfolio of patents, underscoring their commitment to innovation.

Their research and development capabilities are a key resource, driving operational efficiency and environmental impact reduction. In 2023, the company invested heavily in R&D, focusing on areas like intelligent mining and carbon capture technologies, which are crucial for maintaining a competitive edge in the evolving energy landscape.

Skilled Human Capital

China Coal Energy's business model heavily relies on its skilled human capital, a vast workforce of experienced miners, engineers, chemists, researchers, and management professionals. This extensive talent pool is crucial for the company's operational efficiency and innovation across its diverse activities.

The expertise of these professionals is fundamental to the success of China Coal Energy's mining operations, chemical production processes, and machinery manufacturing. Their deep understanding of these sectors directly impacts the company's performance and its ability to develop new technologies and strategies.

Investing in the continuous development and training of this human capital is therefore a vital strategy for China Coal Energy. This commitment to talent development ensures the company maintains its competitive edge and fosters sustained growth in the long term.

- Workforce Composition: China Coal Energy employs a significant number of skilled individuals, including thousands of engineers and technicians essential for its complex operations.

- Expertise Areas: The company's human capital possesses specialized knowledge in areas such as coal extraction techniques, chemical processing for coal-to-chemicals, advanced machinery operation, and strategic business management.

- Talent Development Investment: In 2023, China Coal Energy continued to allocate resources towards employee training programs, focusing on safety protocols, technological advancements, and leadership development to enhance overall workforce capability.

Strong Brand and Government Support

China Coal Energy, as a significant state-owned enterprise, leverages a powerful national brand and implicit government backing. This governmental support translates into enhanced stability, making it easier to secure financing and gain preferential treatment in policy execution. For instance, in 2023, China Coal Energy reported total assets of approximately RMB 1.05 trillion, a testament to its financial strength often bolstered by state backing.

This strong relationship with the government is crucial for securing advantageous terms in policy implementation and participation in major national infrastructure projects. Such backing solidifies its dominant market position, allowing it to navigate regulatory landscapes more effectively than private competitors. In 2024, the Chinese government continued to emphasize energy security, which directly benefits state-owned energy giants like China Coal Energy through favorable policies and project allocations.

- State-Owned Enterprise Advantage: Implicit government backing provides financial stability and easier access to capital.

- Brand Reputation: A strong national brand enhances trust and market recognition.

- Policy Facilitation: Preferential treatment in policy implementation and regulatory approvals.

- Project Allocation: Priority access to major national projects and infrastructure development.

China Coal Energy's extensive coal reserves and operational mines are its bedrock, representing vast, high-quality assets that fuel its core business. As of the end of 2023, the company reported total proven and probable coal reserves of approximately 16.1 billion tonnes, a staggering figure that guarantees a long-term, stable supply.

Its modern mining equipment, advanced processing plants, and significant investment in logistics, including dedicated railway lines, ensure efficient, high-volume extraction and reliable delivery. In 2024, China Coal Energy continued to expand its transportation capacity, a critical factor in market competitiveness.

The company's advanced technology, intellectual property protected by patents, and strong research and development capabilities, particularly in intelligent mining and carbon capture, are crucial for innovation and operational efficiency.

China Coal Energy's skilled human capital, comprising thousands of experienced miners, engineers, and researchers, is fundamental to its operational success and technological advancement. The company's commitment to continuous talent development in 2023 further solidified this critical resource.

As a state-owned enterprise, China Coal Energy benefits from implicit government backing, a strong national brand, and preferential policy treatment, enhancing its financial stability and market position. In 2024, continued emphasis on energy security by the government further reinforced these advantages.

| Key Resource | Description | 2023/2024 Data/Impact |

|---|---|---|

| Coal Reserves | Vast, high-quality coal assets | 16.1 billion tonnes (end of 2023) |

| Infrastructure & Logistics | Modern mining equipment, processing plants, dedicated railways | Continued expansion of transportation capacity in 2024 |

| Technology & R&D | Proprietary technologies, patents, focus on intelligent mining & carbon capture | Heavy R&D investment in 2023 |

| Human Capital | Skilled workforce of miners, engineers, researchers | Thousands of skilled individuals; continued training investment in 2023 |

| Government Support | State-owned enterprise status, brand, policy advantages | Total assets ~RMB 1.05 trillion (2023); favorable policies in 2024 |

Value Propositions

China Coal Energy's value proposition centers on delivering a dependable and substantial volume of coal. This is absolutely vital for maintaining national energy security and supporting key industries such as power generation and steel production.

With its immense production capacity, the company effectively acts as a stabilizer and a solid foundation for the nation's energy infrastructure. For instance, in 2023, China Coal Energy reported a significant increase in coal production, contributing to the country's efforts to ensure stable energy supplies amidst global market fluctuations.

China Coal Energy's value proposition extends far beyond just raw coal. They offer a diverse array of commercial coal products tailored to different industrial needs, demonstrating a commitment to meeting varied customer demands.

The company also actively engages in the coal chemical sector, producing key materials such as polyolefin, methanol, and urea. This strategic move into downstream products adds significant value and opens up new revenue streams.

Furthermore, China Coal Energy manufactures and supplies coal mining machinery, showcasing an integrated approach to the industry. This diversification not only broadens their market reach but also strengthens their resilience against fluctuations in the raw coal market.

China Coal Energy champions technological leadership through its adoption of advanced mining techniques, aiming for peak operational efficiency. This focus extends to clean coal technologies and innovative processes in its coal chemical production and machinery manufacturing divisions.

This dedication to cutting-edge technology directly translates into tangible benefits for the company and its customers. By integrating these advancements, China Coal Energy achieves higher operational efficiency, significantly enhances safety protocols within its facilities, and champions more environmentally responsible practices across its value chain.

In 2023, China Coal Energy reported significant investments in technological upgrades. For instance, the company's research and development expenditure increased by 15% year-on-year, with a substantial portion allocated to smart mining solutions and carbon capture technologies, underscoring its commitment to innovation.

Integrated Value Chain Solutions

China Coal Energy's integrated value chain solutions provide a significant competitive advantage by managing every step from raw material extraction to finished product. This comprehensive approach allows for enhanced quality control throughout the entire process, ensuring that industrial clients receive consistently high-standard materials and products. For example, in 2023, China Coal Energy reported that its integrated operations contributed to a significant portion of its revenue, highlighting the efficiency and profitability of this model.

By controlling the entire coal value chain, China Coal Energy achieves remarkable supply chain efficiency. This vertical integration minimizes disruptions and optimizes logistics, leading to more reliable delivery schedules for their customers. The company's focus on processing, chemical production, and machinery manufacturing alongside mining means they can offer customized solutions tailored to specific industrial needs.

- End-to-End Control: Manages mining, processing, chemical production, and machinery manufacturing.

- Quality Assurance: Ensures consistent product quality through direct oversight of all stages.

- Supply Chain Efficiency: Optimizes logistics and minimizes disruptions for reliable delivery.

- Tailored Offerings: Provides customized solutions to meet diverse industrial client requirements.

Commitment to Sustainability and Compliance

China Coal Energy is deeply committed to sustainability, striving to harmonize energy provision with a transition towards greener, lower-carbon operations. This commitment is firmly rooted in adherence to China's national environmental regulations and a proactive approach to fostering sustainable development across its business. For instance, in 2024, the company continued to invest in advanced emission control technologies, aiming to reduce its environmental footprint.

The company's dedication to robust environmental management and the responsible use of natural resources provides a strong foundation of trust for its investors and the wider community. This focus assures stakeholders of China Coal Energy's long-term resilience and its commitment to corporate social responsibility. In 2023, China Coal Energy reported significant progress in its water conservation efforts, reducing water consumption per ton of coal produced by 5% compared to the previous year.

- Balancing Energy Supply and Green Transformation: China Coal Energy aims to meet energy demands while actively pursuing low-carbon development strategies.

- Adherence to National Environmental Policies: The company operates in strict accordance with China's environmental protection laws and regulations.

- Promoting Sustainable Development: Efforts are concentrated on initiatives that support long-term ecological and economic balance.

- Stakeholder Assurance: Strong environmental management and responsible resource use build confidence in the company's viability and social commitment.

China Coal Energy's value proposition is built on providing reliable, high-volume coal essential for national energy security and industrial needs like power generation and steelmaking. The company also offers a diverse range of commercial coal products and has expanded into coal chemicals, producing methanol and urea, alongside manufacturing coal mining machinery, creating an integrated and resilient business model.

Technological leadership drives operational efficiency and safety, with significant investments in smart mining and carbon capture. This commitment to innovation enhances performance and environmental responsibility. For example, in 2023, R&D expenditure increased by 15% year-on-year.

Their integrated value chain ensures quality control and supply chain efficiency, minimizing disruptions and offering customized solutions. This end-to-end control, from extraction to finished products, is a key competitive advantage. In 2023, integrated operations contributed significantly to revenue.

Sustainability is a core tenet, balancing energy provision with green initiatives and adhering to national environmental regulations. This focus on responsible resource management builds stakeholder trust and long-term viability, with efforts in 2024 continuing to target advanced emission control technologies.

| Value Proposition Aspect | Description | Key Data/Example (2023/2024) |

|---|---|---|

| Reliable Energy Supply | High-volume coal production for national energy security and industry support. | Contributed to stable energy supplies amidst global market fluctuations. |

| Product Diversification | Offers varied commercial coal products and expands into coal chemicals and machinery. | Produces polyolefin, methanol, urea; manufactures coal mining machinery. |

| Technological Advancement | Focus on smart mining, clean coal tech, and carbon capture for efficiency and safety. | R&D expenditure increased 15% YoY in 2023, with focus on smart mining. |

| Integrated Value Chain | Manages mining, processing, chemicals, and machinery for quality and efficiency. | Integrated operations contributed significantly to revenue in 2023. |

| Sustainability Commitment | Balances energy provision with low-carbon operations and environmental compliance. | Continued investment in advanced emission control technologies in 2024; 5% reduction in water consumption per ton of coal in 2023. |

Customer Relationships

China Coal Energy secures its revenue by forging long-term strategic contracts, primarily with major power generation companies and steel producers. These agreements are crucial for guaranteeing consistent demand for its coal products, thereby creating predictable income streams for the company.

These vital supply agreements are typically established through direct, personalized negotiations. This allows China Coal Energy to tailor contract specifics, including volume commitments and precise quality standards, to align with the unique operational needs of its industrial clientele.

In 2023, China Coal Energy reported that a significant portion of its sales volume was underpinned by these long-term contracts, contributing to its financial stability amidst fluctuating market conditions. This strategic approach provides a solid foundation for sustained business operations and revenue generation.

China Coal Energy assigns dedicated account managers to its key industrial clients and government partners. This personalized approach is crucial for building trust and ensuring consistent support. For instance, in 2024, these dedicated teams managed relationships with over 500 major industrial consumers across various sectors, facilitating seamless transactions and problem-solving.

These account managers act as a direct liaison, providing responsive service and tailored solutions to meet specific client needs. They are instrumental in communicating updates on supply chain logistics, pricing adjustments, and offering vital technical assistance, thereby strengthening long-term partnerships and ensuring client satisfaction.

China Coal Energy offers extensive technical support for its diverse product range, encompassing coal, coal chemicals, and machinery. This includes expert troubleshooting, routine maintenance, and practical operational guidance to ensure customers maximize the value of their purchases.

For its critical coal mining equipment, the company provides comprehensive full lifecycle services. This commitment aims to guarantee optimal equipment performance throughout its operational life, fostering customer loyalty and satisfaction.

In 2023, China Coal Energy reported a significant increase in its service revenue, driven by enhanced technical support offerings, contributing to its overall financial performance and reinforcing its customer-centric approach.

Government and Policy Engagement

China Coal Energy's state-owned status necessitates strong ties with government entities. This includes actively contributing to policy discussions, complying with national energy strategies, and partnering on key infrastructure projects to foster alignment and secure backing.

In 2024, China Coal Energy continued its engagement with policymakers, focusing on national energy security and the transition to cleaner fuels. The company actively participated in discussions surrounding the 14th Five-Year Plan's energy targets, aiming to align its operational strategies with government priorities.

- Policy Alignment: Ensuring operations and future investments are in sync with China's evolving energy policies, including those related to carbon emissions reduction and coal-fired power plant upgrades.

- Strategic Partnerships: Collaborating with government bodies on large-scale energy projects, such as advancements in clean coal technologies and the development of integrated energy bases.

- Regulatory Compliance: Strictly adhering to all national regulations concerning environmental protection, safety standards, and resource management, which are critical for maintaining its license to operate.

Investor Relations and Transparency

China Coal Energy prioritizes investor relations and transparency to foster trust and manage expectations. The company actively communicates its performance and strategic direction through various channels.

- Regular Financial Reporting: The company consistently publishes its financial results, adhering to strict reporting standards to provide investors with timely and accurate information. For instance, in 2024, China Coal Energy maintained its commitment to quarterly and annual disclosures, ensuring stakeholders had up-to-date insights into its financial health.

- Analyst Briefings and Shareholder Meetings: China Coal Energy conducts regular analyst briefings and shareholder meetings. These forums allow for direct engagement, enabling management to address investor queries, discuss market trends, and elaborate on the company's operational performance and future outlook.

- Commitment to Transparency: This dedication to open communication helps build credibility and confidence in the company's corporate governance and operational strategies. By proactively addressing concerns and providing clear information, China Coal Energy aims to strengthen its relationships with its investor base.

China Coal Energy cultivates deep relationships with its industrial customers through dedicated account management and comprehensive technical support. This personalized approach ensures client needs are met, fostering loyalty and repeat business.

The company's state-owned nature also necessitates strong ties with government entities, involving active participation in policy discussions and alignment with national energy strategies. Furthermore, robust investor relations, characterized by transparency and regular communication, build trust and manage expectations.

In 2024, China Coal Energy continued to emphasize these relationships, with dedicated teams managing over 500 major industrial consumers and actively engaging with policymakers on energy targets.

Channels

China Coal Energy's primary sales channel is direct distribution to major industrial clients. This includes large power generation companies, key players in the chemical manufacturing sector, and other significant industrial users of coal and its derivatives. This direct approach ensures consistent demand and allows for tailored supply agreements.

The company leverages a robust, proprietary distribution infrastructure to facilitate these direct sales. This network is comprised of dedicated railway lines and strategically located port facilities, enabling efficient and cost-effective delivery of products across China. In 2024, China Coal Energy continued to invest in optimizing this infrastructure to enhance logistical capabilities and reduce transit times.

Long-term supply agreements are a cornerstone of China Coal Energy's business model, with a substantial portion of their sales directly negotiated with major clients. These contracts are crucial for securing large, consistent volumes of both coal and chemical products, providing a stable revenue stream and simplifying supply chain management.

In 2024, China Coal Energy continued to leverage these direct sales channels. For instance, their financial reports often highlight the stability provided by these long-term commitments, which are essential for planning production and managing inventory effectively amidst fluctuating market prices.

China Coal Energy utilizes industry-specific sales teams to cater to distinct client needs across sectors like power generation, metallurgy, and chemicals. These specialized teams bring in-depth knowledge of each industry, enabling them to offer tailored solutions and crucial technical support. For instance, in 2023, China Coal Energy's sales to the power generation sector, a key consumer of thermal coal, remained robust, reflecting the ongoing demand for energy.

Online Platforms and Tenders

China Coal Energy leverages online platforms and tender processes to expand its market reach and secure competitive pricing, particularly for spot sales or when dealing with specific procurement requirements. This channel is crucial for accessing a wider base of potential buyers and suppliers beyond traditional long-term contracts.

In 2024, the global e-commerce in the commodities sector saw significant growth, with online platforms facilitating billions in transactions. China Coal Energy's participation in these digital marketplaces allows for agile responses to market fluctuations and the efficient disposal of smaller or specialized product batches. The company actively monitors and engages with public and private tender opportunities, which often involve substantial volumes and stringent qualification criteria, ensuring transparency and competitive engagement.

- Broader Market Access: Online platforms connect China Coal Energy with a diverse range of domestic and international buyers, increasing sales opportunities.

- Competitive Pricing: Tenders and online auctions foster a competitive environment, potentially leading to more favorable pricing for the company's products.

- Spot Market Agility: These channels enable quick transactions for surplus or specific grades of coal, optimizing inventory management.

- Procurement Efficiency: For specific needs, online tenders provide a structured and efficient method for sourcing materials and services.

International Trade Desks

China Coal Energy leverages specialized international trade desks to manage its global sales. These desks are crucial for navigating the complexities of exporting coal, handling everything from sales contracts to ensuring compliance with international regulations.

These operations are vital for reaching overseas markets. In 2024, China Coal Energy continued to focus on expanding its international footprint, with international trade desks playing a pivotal role in facilitating these efforts. They manage the intricate process of customs clearance and coordinate the vast logistics required to deliver coal to customers across different continents.

- Global Reach: Dedicated desks manage export sales and customer relationships in key international markets.

- Logistics & Customs: Expertise in international shipping, port operations, and customs procedures ensures smooth transactions.

- Market Access: Facilitates entry into new overseas markets and strengthens presence in existing ones.

China Coal Energy's sales strategy heavily relies on direct distribution to major industrial consumers, ensuring consistent demand and tailored supply. This direct approach is supported by a proprietary logistics network, including dedicated railways and ports, which China Coal Energy continued to optimize in 2024 for enhanced efficiency.

The company also utilizes online platforms and tender processes to broaden its market reach and secure competitive pricing, especially for spot sales. These digital channels allow for agile responses to market shifts and efficient management of diverse product batches, a strategy that gained prominence in 2024 with the growth of commodity e-commerce.

Specialized international trade desks are crucial for managing global sales, handling export contracts, regulatory compliance, and complex logistics. These desks are instrumental in expanding China Coal Energy's international footprint, a key focus area in 2024.

| Channel | Key Characteristics | 2024 Focus/Data Point |

|---|---|---|

| Direct Distribution | Major industrial clients (power, chemicals), long-term agreements | Continued investment in logistics infrastructure optimization |

| Online Platforms & Tenders | Broader market access, competitive pricing, spot sales | Leveraging growth in global commodity e-commerce |

| International Trade Desks | Global sales, export compliance, logistics management | Expanding international footprint and market access |

Customer Segments

Large-scale power generators, primarily major thermal power plants, represent a critical customer segment for China Coal Energy. These entities depend on a steady, high-volume supply of coal to fuel their operations and meet China's substantial electricity demands. In 2024, China's thermal power sector continued to be a dominant force, with coal-fired power plants accounting for a significant portion of its installed capacity.

These are often large, state-owned enterprises that are integral to the nation's energy security and infrastructure. Their consistent demand ensures stable revenue streams for coal suppliers like China Coal Energy. For instance, in the first half of 2024, China's coal consumption for power generation saw an increase, reflecting the ongoing reliance on thermal power.

Steel manufacturers and other metallurgical firms are crucial clients for China Coal Energy, relying on coking coal and thermal coal as fundamental inputs for their operations. In 2024, China's steel production was projected to remain robust, with demand from sectors like construction and automotive driving the need for these essential raw materials.

The demand from these heavy industries is intrinsically linked to broader economic indicators. For instance, China's fixed-asset investment growth in infrastructure projects throughout 2024 directly influences the consumption of steel, and consequently, the demand for coal from metallurgical customers.

China Coal Energy's coal chemical segment serves both internal and external chemical producers. These companies rely on coal as a fundamental feedstock to manufacture a wide array of products, including essential plastics like polyethylene and polypropylene, vital fertilizers such as urea, and versatile solvents like methanol. This customer base is absolutely critical for the expansion and diversification of China Coal Energy's chemical business operations.

Industrial and Commercial Users

Industrial and commercial users represent a diverse group that relies on coal for essential operations. This segment includes sectors like cement production, brick manufacturing, and various other industrial processes requiring heat or coal as a feedstock. While not the largest consumers, their consistent demand is a crucial part of China Coal Energy's customer base.

In 2024, China's industrial sector continued to be a significant driver of coal consumption. For instance, the cement industry alone accounted for a substantial portion of industrial coal use, with production levels remaining robust to support ongoing infrastructure development. This segment’s purchasing patterns are often tied to specific production cycles and regional industrial activity.

- Diverse Industrial Needs: Caters to sectors like cement, brick, and general manufacturing.

- Consistent Demand: Provides a steady revenue stream, albeit smaller than primary segments.

- Regional Reliance: Purchasing behavior is often influenced by local industrial output and infrastructure projects.

- Feedstock and Fuel: Utilizes coal both for energy generation and as a raw material in certain processes.

International Buyers

International buyers represent a crucial customer segment for China Coal Energy, particularly those in Asian nations experiencing robust energy demand. This group actively seeks both coal and coal chemical products, driving significant export revenues and contributing to the company's global market diversification efforts.

In 2024, China Coal Energy's international sales played a vital role in its overall financial performance. For instance, the company reported substantial export volumes, with key markets in East and Southeast Asia showing strong purchasing power. This international demand not only bolsters revenue streams but also provides a hedge against domestic market fluctuations.

- Export Revenue Contribution: International sales are a significant driver of China Coal Energy's top line, diversifying income beyond the domestic market.

- Geographic Focus: Key markets include South Korea, Japan, and various Southeast Asian countries, all characterized by high energy consumption and a need for reliable coal supply.

- Product Demand: Both thermal coal for power generation and coking coal for steel production are in demand internationally, alongside growing interest in their coal chemical derivatives.

- Market Diversification: Engaging with international buyers reduces reliance on any single market, enhancing the company's resilience and long-term stability.

China Coal Energy’s customer segments are primarily large-scale power generators and steel manufacturers, both heavily reliant on consistent coal supply for their operations. In 2024, these sectors remained the backbone of demand, with thermal power plants accounting for a significant portion of China's energy mix and steel production continuing to be robust.

The company also serves the coal chemical industry, providing feedstock for plastics and fertilizers, and caters to a diverse range of industrial and commercial users for various manufacturing processes. International buyers, particularly in Asia, represent another key segment, contributing significantly to export revenues and market diversification.

| Customer Segment | Key Demand Drivers (2024 Context) | China Coal Energy's Role |

|---|---|---|

| Power Generators | Electricity demand, thermal power reliance | Primary supplier of thermal coal |

| Steel Manufacturers | Infrastructure, automotive production | Supplier of coking and thermal coal |

| Coal Chemical Industry | Demand for plastics, fertilizers, solvents | Provider of feedstock |

| Industrial/Commercial Users | Cement, brick manufacturing, general industry | Supplier for heat and feedstock |

| International Buyers | Energy needs in Asian markets | Key exporter of coal and chemical products |

Cost Structure

Mining and production costs represent the core expenses for China Coal Energy, encompassing labor wages for its extensive workforce of miners, the substantial energy required to power heavy machinery, and ongoing maintenance for essential equipment. These expenditures are intrinsically linked to the sheer volume of coal extracted, making efficiency paramount.

In 2024, China Coal Energy reported significant operational costs directly related to its mining activities. For instance, the company's cost of sales, which heavily reflects these mining and production expenses, stood at approximately 250 billion RMB for the first three quarters of 2024. This figure underscores the substantial investment in labor, energy, and upkeep necessary to maintain production levels.

China Coal Energy's capital expenditure is a significant cost driver, heavily influenced by substantial investments in developing new mines and expanding existing operations. These outlays are crucial for maintaining and growing their production capacity.

Upgrading mining and processing equipment also forms a major part of their CAPEX. For instance, in 2023, China Coal Energy reported capital expenditures of approximately 39.4 billion RMB, a notable increase from previous years, reflecting their commitment to modernization and efficiency improvements.

Beyond core mining, CAPEX extends to investments in coal chemical plants and machinery manufacturing facilities. These strategic investments aim to enhance overall capacity and operational efficiency across their integrated business model.

Logistics and transportation costs are a substantial component of China Coal Energy's operating expenses, encompassing the movement of coal from extraction sites to processing facilities and finally to end-users. These costs include significant outlays for railway freight, port handling fees, and ocean shipping, all vital for delivering products to domestic and international markets.

In 2024, China's railway freight volume saw a notable increase, with coal transport being a primary driver. For instance, by the end of the first quarter of 2024, railway freight volume across the nation reached approximately 1.3 billion tons, underscoring the scale of these logistical operations. Efficiently managing these expenditures is paramount for maintaining profitability and competitiveness in the global coal market.

Environmental Compliance and Remediation Costs

China Coal Energy faces significant environmental compliance and remediation costs. These include substantial investments in advanced pollution control technologies to meet increasingly stringent air and water quality standards, as mandated by the Chinese government. For instance, in 2024, the company allocated a considerable portion of its capital expenditure towards upgrading its facilities to reduce sulfur dioxide and nitrogen oxide emissions.

Furthermore, land reclamation and ecological restoration are critical components of their cost structure, particularly in areas where mining operations have concluded. These efforts are essential for environmental rehabilitation and regulatory approval. The company is also actively investing in carbon emission reduction initiatives, aligning with China's national goals for peak carbon emissions and carbon neutrality, which adds to operational expenses.

- Pollution Control Technology Upgrades: Significant capital outlay for scrubbers, dust collectors, and wastewater treatment plants.

- Land Reclamation and Restoration: Costs associated with rehabilitating mined-out areas to their natural state.

- Carbon Emission Reduction: Investments in energy efficiency, cleaner energy sources, and carbon capture technologies.

- Environmental Impact Assessments: Ongoing expenses for monitoring, reporting, and assessing environmental performance.

Research and Development (R&D) Costs

China Coal Energy dedicates significant resources to Research and Development, focusing on technological innovation. These investments are vital for developing cleaner coal technologies and more efficient coal chemical processes, ensuring the company remains competitive in a changing energy landscape.

The company's R&D efforts also extend to acquiring advanced mining machinery, which directly impacts operational efficiency and safety. This commitment to innovation is crucial for long-term competitiveness, driving improvements across its operations and paving the way for diversification into new energy sectors.

- Technological Innovation: Investments are channeled into cleaner coal technologies and advanced coal chemical processes.

- Operational Efficiency: R&D supports the adoption of advanced mining machinery to boost productivity and safety.

- Long-Term Competitiveness: Innovation is key to maintaining a competitive edge and adapting to market shifts.

- Diversification: R&D efforts also aim to explore and develop capabilities in new energy areas.

China Coal Energy's cost structure is dominated by mining and production expenses, including labor and energy, which are directly tied to output volume. Significant capital expenditures are also allocated to mine development, equipment upgrades, and coal chemical facilities, as seen with their 2023 CAPEX of approximately 39.4 billion RMB. Furthermore, logistics, environmental compliance, and R&D for cleaner technologies represent substantial ongoing costs critical for maintaining competitiveness and sustainability.

| Cost Category | Key Components | 2024 Relevance/Data Point |

|---|---|---|

| Mining & Production | Labor, Energy, Equipment Maintenance | Cost of Sales ~250 billion RMB (first 3 quarters 2024) |

| Capital Expenditures (CAPEX) | Mine Development, Equipment Upgrades, Coal Chemical Plants | ~39.4 billion RMB (2023 CAPEX) |

| Logistics & Transportation | Rail Freight, Port Handling, Ocean Shipping | Coal transport a primary driver of national railway freight volume (~1.3 billion tons by Q1 2024) |

| Environmental Compliance & R&D | Pollution Control, Land Reclamation, Cleaner Tech, New Energy | Ongoing investments in emission reduction and technological innovation |

Revenue Streams

China Coal Energy's primary revenue stream is generated from the sale of thermal and coking coal. This segment is the backbone of their income, serving power plants, steel mills, and various industrial consumers. The company's financial performance is heavily influenced by the volume of coal produced and sold, alongside prevailing market prices for these commodities.

In 2024, China Coal Energy reported significant revenue from its coal sales operations. For instance, during the first quarter of 2024, the company's revenue from coal production and sales reached approximately RMB 45.8 billion, showcasing the substantial contribution of this segment to its overall financial results.

China Coal Energy generates revenue from selling a variety of coal-derived chemical products. This includes key items like polyolefin, methanol, urea, and ammonium nitrate, showcasing a diversified product portfolio beyond raw coal.

This strategic diversification into coal chemicals not only adds significant value to their operations but also helps to lessen the company's reliance solely on the fluctuating prices of raw coal. For instance, in 2023, China Coal Energy reported that its chemical segment contributed substantially to its overall revenue, demonstrating the growing importance of these downstream products.

China Coal Energy generates income by manufacturing and selling specialized coal mining machinery. This includes selling equipment to its own mining operations as well as to external customers. In 2024, the company's machinery manufacturing segment contributed significantly to its overall revenue, reflecting strong demand for its specialized products in the domestic and international markets.

Related Engineering and Technical Service Fees

China Coal Energy generates revenue by offering specialized engineering and technical services. These services encompass expert consultation for coal mine design, construction, and ongoing operational efficiency.

This segment leverages the company's extensive experience and technical acumen within the coal industry, providing a valuable, diversified income stream. For instance, in 2023, China Coal Energy reported significant contributions from its engineering and technical services, reflecting the demand for its specialized expertise.

- Revenue from Coal Mine Design: Fees charged for planning and developing new coal mining projects.

- Revenue from Construction Services: Income derived from the physical construction and infrastructure development of mines.

- Revenue from Operational Consulting: Earnings from providing advice and solutions to optimize existing mine operations.

Pithead Power Generation Sales

China Coal Energy generates revenue by selling electricity produced at its pithead power plants. These facilities are strategically located at the mine sites, allowing them to directly utilize low-calorific value coal that might otherwise be less economical to transport and sell. This integration of coal mining with power generation creates a valuable additional revenue stream.

This approach not only captures value from lower-grade coal but also significantly improves operational efficiency. By minimizing transportation costs and leveraging onsite resources, China Coal Energy enhances its profitability in the power generation sector.

- Electricity Sales: Revenue derived from selling power generated at pithead plants.

- Resource Utilization: Monetizing low-calorific value coal directly from mines.

- Efficiency Gains: Reduced transportation costs and integrated operations boost profitability.

- Diversified Income: Creates an additional revenue stream beyond traditional coal sales.

Beyond its core coal sales, China Coal Energy diversifies its income through several key channels. The company profits from selling a range of coal-derived chemical products, including polyolefin and methanol, adding value to its raw materials and mitigating reliance on coal price volatility.

Furthermore, revenue is generated from the manufacturing and sale of specialized coal mining machinery, catering to both internal needs and external markets. The company also capitalizes on its deep industry expertise by offering engineering and technical services for mine design, construction, and operational optimization.

Finally, China Coal Energy generates income by selling electricity produced at its pithead power plants, effectively monetizing lower-grade coal and enhancing overall operational efficiency.

| Revenue Stream | Description | 2024 Data (Illustrative/Partial) |

|---|---|---|

| Coal Sales | Thermal and coking coal for industrial use. | Q1 2024 Revenue: Approx. RMB 45.8 billion |

| Coal Chemicals | Products like polyolefin, methanol, urea. | Significant contribution reported in 2023. |

| Machinery Manufacturing | Specialized coal mining equipment. | Strong domestic and international demand in 2024. |

| Engineering & Technical Services | Mine design, construction, and operational consulting. | Significant contributions reported in 2023. |

| Electricity Sales | Power generated at pithead plants. | Monetizing low-calorific value coal. |

Business Model Canvas Data Sources

The China Coal Energy Business Model Canvas is built upon comprehensive financial reports, extensive market research on the energy sector, and strategic analyses of the company's operational landscape. These data sources ensure each block is informed by accurate and relevant information.