CHC Group Ltd SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CHC Group Ltd Bundle

CHC Group Ltd. possesses notable strengths in its established market presence and diverse service offerings, but also faces challenges from evolving industry regulations and competitive pressures. Understanding these dynamics is crucial for any stakeholder looking to navigate its landscape.

Want the full story behind CHC Group Ltd.'s strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

CHC Helicopter boasts a truly global operational footprint, with a presence in over 30 countries across North America, Europe, Africa, Asia, and Australia. This extensive network allows the company to serve a diverse international client base, from oil and gas majors to emergency medical services and government agencies. Its market leadership in specialized helicopter services is underpinned by this widespread reach, enabling it to tap into various regional demands and mitigate country-specific economic risks.

CHC Group Ltd's diversified service portfolio is a significant strength, extending beyond its core offshore oil and gas transport. The company provides crucial Search and Rescue (SAR) and Emergency Medical Services (EMS), which are vital public services. This diversification helps CHC Group mitigate risks associated with the cyclical nature of the oil and gas industry.

Furthermore, its Heli-One segment offers comprehensive Maintenance, Repair, and Overhaul (MRO) services. This segment not only ensures the reliability of its own fleet but also generates external revenue by servicing aircraft for other operators. For instance, in 2024, Heli-One secured new MRO contracts, underscoring the growing demand for its specialized aviation maintenance capabilities.

CHC Helicopter consistently demonstrates a strong safety record, a crucial advantage in the demanding helicopter services sector. This commitment to operational reliability is a key factor in securing and retaining client confidence, especially in industries like offshore oil and gas where safety is paramount.

In 2023, CHC reported a significant achievement with a 99.9% dispatch reliability rate across its global fleet, underscoring its operational excellence. This focus on safety and dependability is not just about compliance; it directly translates into sustained client relationships and the ability to secure long-term contracts, vital for financial stability.

Comprehensive MRO and Training Capabilities

CHC Group Ltd.'s Heli-One segment offers robust maintenance, repair, and overhaul (MRO) services, extending beyond its own fleet to a global external customer base. This comprehensive MRO capability is a significant strength, directly contributing to fleet readiness and operational efficiency by minimizing reliance on external vendors. For instance, in 2023, Heli-One reported strong performance, servicing a diverse range of helicopter types and generating substantial revenue from third-party contracts, underscoring its market penetration.

Beyond MRO, CHC's dedication to training and support is a key differentiator. This ensures a highly skilled workforce, critical for maintaining the complex machinery in the aviation sector and upholding stringent operational standards. The company's investment in training programs directly translates to enhanced safety and reliability for its own operations and its clients, a crucial factor in the competitive helicopter services market.

The dual benefit of in-house MRO and training creates a powerful synergy for CHC. It not only optimizes the performance and longevity of its own significant helicopter fleet but also establishes Heli-One as a significant revenue generator through its services to other operators. This integrated approach positions CHC favorably in the market, offering a complete solution for helicopter lifecycle management.

Key aspects of CHC's MRO and Training strengths include:

- Global MRO Reach: Heli-One provides maintenance services to a worldwide customer base, servicing a variety of helicopter platforms.

- Fleet Readiness: In-house MRO capabilities ensure high availability and operational readiness for CHC's own fleet.

- Revenue Diversification: MRO services for external clients represent a significant and growing revenue stream.

- Skilled Workforce Development: Comprehensive training programs ensure adherence to high operational and safety standards for both internal staff and external clients.

Established Customer Relationships and Long-Term Contracts

CHC Group Ltd benefits significantly from its established customer relationships and a strong track record of securing long-term contracts. This is particularly evident in its partnerships within the oil and gas industry, where major clients such as Equinor and Harbour Energy rely on CHC's services. These enduring agreements are crucial for financial stability, offering predictable revenue streams and underscoring client trust in CHC's operational excellence. For instance, CHC's continued success in renewing existing contracts and acquiring new ones, even amidst challenging market conditions, speaks volumes about its competitive edge and the perceived value it delivers.

The company's ability to maintain these strong ties is further evidenced by its contract wins and renewals. In 2023, CHC secured a multi-year contract extension with a key North Sea operator, demonstrating the ongoing demand for its specialized aviation services. This strategic advantage translates into enhanced financial predictability, a key factor for investors and stakeholders assessing the group's resilience and future growth prospects.

These long-term commitments provide a solid foundation for CHC's business model, mitigating the impact of market volatility. The consistent revenue generated from these contracts allows for more effective financial planning and investment in fleet modernization and service innovation, further solidifying its market position.

CHC Group Ltd's extensive global operational footprint, spanning over 30 countries, is a core strength, enabling it to serve diverse markets and mitigate regional economic risks. This widespread presence is complemented by a diversified service portfolio that includes essential Search and Rescue (SAR) and Emergency Medical Services (EMS), reducing reliance on the cyclical oil and gas sector. The company's Heli-One segment offers robust Maintenance, Repair, and Overhaul (MRO) services, not only ensuring fleet readiness but also generating significant external revenue.

CHC's unwavering commitment to safety and operational excellence is a critical differentiator, evidenced by a 99.9% dispatch reliability rate in 2023. This focus on dependability fosters strong client trust and secures long-term contracts, providing financial stability. The synergy between in-house MRO and comprehensive training programs further enhances fleet performance and positions Heli-One as a key revenue generator through third-party services.

Established customer relationships and a proven track record of securing long-term contracts, such as those with Equinor and Harbour Energy, provide CHC with predictable revenue streams and market resilience. The multi-year contract extension secured with a North Sea operator in 2023 highlights this enduring client confidence and the ongoing demand for CHC's specialized aviation solutions.

| Strength | Description | Supporting Data/Example |

| Global Operational Footprint | Presence in over 30 countries across multiple continents. | Enables service to diverse international clients and mitigation of country-specific risks. |

| Diversified Service Portfolio | Includes offshore transport, SAR, EMS, and MRO services. | Reduces dependency on the oil and gas sector; SAR/EMS provides essential public services. |

| Heli-One MRO Capabilities | Comprehensive maintenance, repair, and overhaul services. | Ensures fleet readiness and generates substantial revenue from third-party contracts. |

| Strong Safety Record & Reliability | Commitment to operational excellence and safety. | Achieved a 99.9% dispatch reliability rate in 2023. |

| Long-Term Customer Relationships | Established partnerships and contract renewals. | Secured multi-year contract extension with a key North Sea operator in 2023. |

What is included in the product

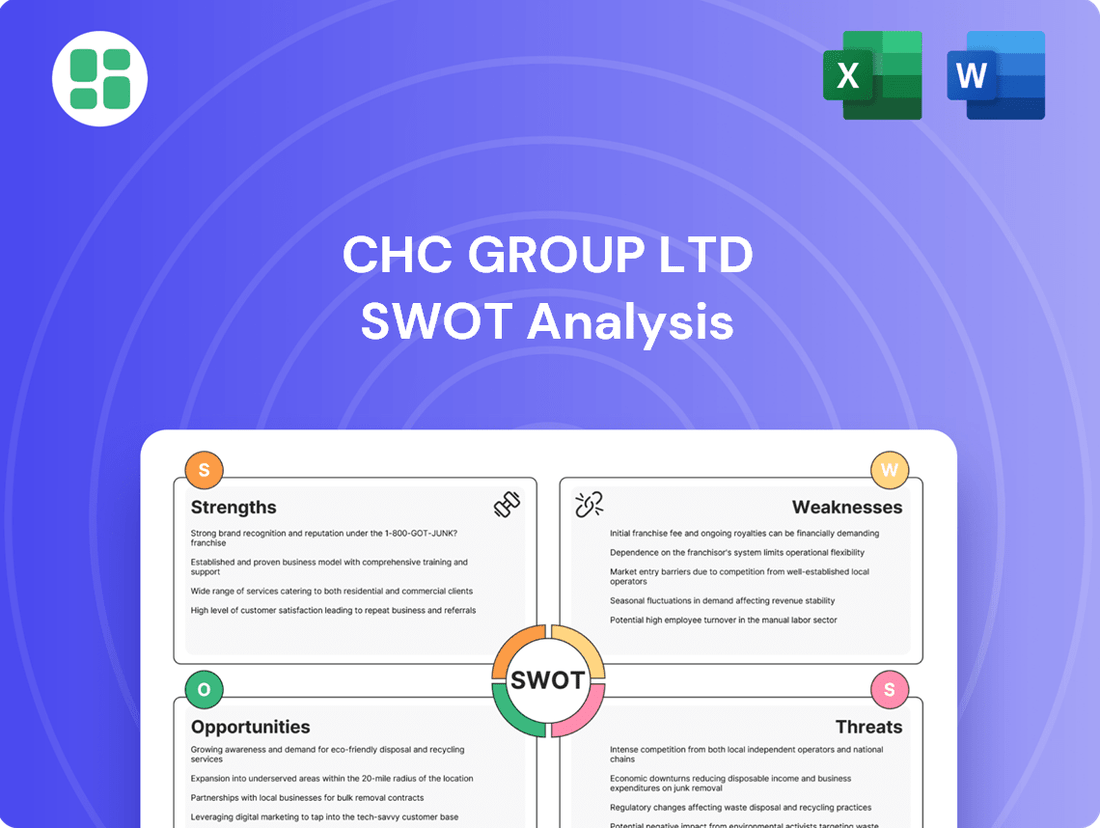

Delivers a strategic overview of CHC Group Ltd’s internal and external business factors, identifying key strengths, weaknesses, opportunities, and threats.

Offers a clear, actionable SWOT analysis that helps CHC Group Ltd identify and address its key challenges and leverage its strengths for improved strategic decision-making.

Weaknesses

The helicopter services sector demands substantial upfront investment in aircraft acquisition and ongoing maintenance, making it inherently capital-intensive. CHC Group is consistently challenged to allocate significant capital towards fleet modernization and the procurement of new helicopters to maintain a competitive edge and adapt to changing operational requirements.

This continuous need for high capital expenditure can place a strain on CHC's financial resources, potentially reducing its financial flexibility, particularly during periods of economic downturn or shifting market dynamics. For instance, in fiscal year 2024, CHC reported capital expenditures of $215 million, primarily for fleet upgrades and new aircraft deliveries.

CHC Group Ltd's significant reliance on the offshore oil and gas sector for a substantial portion of its revenue remains a key weakness. This dependence directly links the company's financial performance to the inherent volatility of global oil and gas prices and exploration activity levels.

For instance, during periods of low oil prices, such as the downturns experienced in 2020, exploration budgets are often slashed, directly reducing the demand for essential helicopter transport services. This can lead to decreased contract volumes and significant revenue fluctuations for CHC, as seen in the sector's historical performance.

CHC Group Ltd operates in a highly competitive helicopter services market, facing pressure from numerous global and regional operators. This intense rivalry often translates into significant pricing pressure, directly impacting profit margins and compelling CHC to relentlessly focus on cost optimization and operational efficiency. For instance, in the offshore oil and gas sector, a key market for CHC, competitive bidding is standard practice, meaning CHC must consistently prove its value proposition to secure contracts and maintain its market share.

Regulatory Compliance Burden and Safety Risks

CHC Group Ltd faces a significant weakness in the aviation sector due to the substantial regulatory compliance burden. The industry is characterized by complex and constantly evolving safety standards and certifications, requiring continuous investment and adaptation. For instance, in 2024, the European Union Aviation Safety Agency (EASA) introduced new regulations for drone operations, impacting various aviation service providers.

This adherence to stringent rules is not only costly but also time-consuming, diverting resources that could otherwise be used for growth or innovation. Beyond compliance, the inherent nature of aviation operations presents ongoing safety risks. While CHC maintains a strong safety record, the possibility of accidents, however infrequent, carries the potential for severe financial repercussions and significant damage to its reputation.

- Regulatory Burden: CHC must continually invest in meeting evolving safety standards and certifications, such as those updated by EASA in 2024 for drone operations.

- Cost of Compliance: Ensuring adherence to these complex regulations requires substantial financial outlay and diverts internal resources.

- Inherent Safety Risks: Despite a strong track record, aviation operations carry inherent risks, where even rare accidents can lead to severe financial and reputational damage.

Skilled Personnel Shortages

CHC Group Ltd, like many in the aviation sector, grapples with skilled personnel shortages. The highly specialized nature of helicopter operations, especially for demanding offshore, search and rescue (SAR), and emergency medical services (EMS), necessitates experienced pilots, engineers, and maintenance technicians. This talent pool is finite, making attraction and retention a persistent challenge, which can drive up labor expenses or impose limitations on operational capacity.

The maintenance, repair, and overhaul (MRO) sector specifically faces a critical shortage of skilled technicians. This deficit directly impacts CHC Group's ability to scale its operations to meet increasing demand, potentially leading to longer turnaround times for aircraft maintenance and affecting fleet availability. For instance, the global shortage of aviation mechanics was projected to reach over 200,000 by 2025, a trend that significantly affects companies like CHC.

- Specialized Skills Gap: Complex missions require highly trained pilots, engineers, and mechanics.

- Talent Attraction & Retention: The industry struggles to secure and keep specialized aviation personnel.

- MRO Technician Shortage: A critical lack of skilled technicians in MRO hinders expansion and efficiency.

CHC Group Ltd's significant reliance on the offshore oil and gas sector exposes it to the volatility of commodity prices and exploration activity. This dependence can lead to revenue fluctuations, as seen when oil prices dropped significantly in 2020, impacting exploration budgets and, consequently, demand for helicopter services.

The company operates in a highly competitive market, facing pressure from numerous global and regional operators, which often results in pricing pressure and impacts profit margins. Intense rivalry necessitates a constant focus on cost optimization and operational efficiency to secure contracts.

CHC faces a substantial regulatory burden in the aviation sector, requiring continuous investment to meet evolving safety standards and certifications. This compliance is costly and time-consuming, diverting resources from potential growth initiatives.

A persistent weakness is the shortage of skilled personnel, particularly experienced pilots, engineers, and maintenance technicians. This talent gap can increase labor expenses and limit operational capacity, especially given the critical need for MRO technicians, a sector projected to face a deficit of over 200,000 mechanics globally by 2025.

Same Document Delivered

CHC Group Ltd SWOT Analysis

This is the actual CHC Group Ltd SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. It provides a comprehensive overview of the company's Strengths, Weaknesses, Opportunities, and Threats, meticulously researched and presented. You can be confident that the detailed insights contained within will be directly applicable to your strategic planning.

Opportunities

The offshore renewable energy sector, particularly offshore wind, is experiencing robust growth, creating a substantial new market for helicopter services. CHC can capitalize on this by providing essential transport and logistics for wind farm construction and maintenance, diversifying revenue streams away from traditional oil and gas.

Global investment in offshore wind is surging; for instance, the Global Wind Energy Council reported that 10.8 GW of new offshore wind capacity was installed globally in 2023, a record year. This expansion directly translates to an increased demand for the specialized helicopter operations CHC excels at, such as transporting technicians and vital equipment to often remote offshore locations.

CHC's existing expertise in operating in challenging offshore environments positions it advantageously to serve this burgeoning sector. The company can leverage its established safety protocols and operational experience to secure contracts supporting the ongoing development and operational needs of offshore wind farms worldwide.

The growing global need for search and rescue (SAR) and emergency medical services (EMS), driven by more frequent natural disasters and increased humanitarian efforts, presents a significant opportunity for CHC Group Ltd. This trend is particularly evident in coastal regions experiencing population booms and a heightened focus on public safety.

CHC's established expertise in providing these critical life-saving services positions it favorably to win additional government and public sector contracts. Securing these contracts would translate into predictable and enduring revenue streams for the company.

The SAR market itself is projected for robust expansion. For instance, reports from 2024 indicate a substantial uptick in demand for specialized aviation services in disaster response, a sector where CHC operates.

CHC Group can leverage technological advancements like AI and IoT to boost efficiency and safety in its operations. For instance, predictive maintenance, powered by AI, can anticipate equipment failures, reducing costly downtime. This is crucial as the aviation MRO market, valued at over $70 billion globally in 2024, increasingly relies on such technologies for competitive advantage.

Investing in enhanced avionics and digital transformation can streamline CHC's MRO services, making them more cost-effective and attractive. Digital tools improve data analysis, leading to better decision-making and operational optimization. This focus on innovation is vital in a sector where technological upgrades directly translate to improved flight safety and service delivery.

Geographic Expansion and Emerging Markets

CHC Group Ltd has a significant opportunity to tap into the burgeoning demand for helicopter services in emerging markets across Asia, Africa, and Latin America. These regions are witnessing robust growth in sectors like resource extraction and emergency medical services, driving the need for modern helicopter fleets. By strategically pursuing new contracts and forging partnerships in these developing economies, CHC can capitalize on increasing operational demands and fleet modernization trends.

For example, the Asia-Pacific region is projected to be a key growth driver, with helicopter fleet growth expected to be around 4.5% annually through 2028, according to industry forecasts. Africa’s demand is also on the rise, particularly for oil and gas support operations. CHC's expansion could be bolstered by:

- Securing long-term contracts with resource companies in regions like Southeast Asia.

- Establishing partnerships with local governments or NGOs for emergency medical and disaster relief services in Africa and Latin America.

- Investing in local infrastructure and training to support operations in these new territories.

Strategic Partnerships and Acquisitions

Strategic partnerships and acquisitions present a significant avenue for CHC Group Ltd to broaden its service portfolio and penetrate new geographical markets. For instance, collaborations in the burgeoning Battery Energy Storage Systems (BESS) sector, a market projected to reach over $150 billion globally by 2030, could unlock substantial revenue diversification. By aligning with specialized technology firms or established regional players, CHC can accelerate its entry into high-growth areas and bolster its competitive edge.

These alliances are crucial for enhancing technological capabilities and ensuring supply chain robustness. In 2024, many companies across various sectors are actively seeking partnerships to mitigate supply chain disruptions, which have been a persistent challenge. For CHC, acquiring smaller, innovative companies could provide immediate access to advanced technologies or niche market expertise, thereby accelerating organic growth and innovation cycles.

CHC's strategic approach to partnerships and acquisitions can be further exemplified by:

- Expanding service offerings: Partnering with firms specializing in renewable energy integration or digital infrastructure solutions to offer comprehensive project management.

- Market entry: Acquiring a regional competitor in a target expansion market to gain immediate market share and operational presence.

- Technological advancement: Collaborating with AI or IoT providers to embed advanced analytics and smart technologies into existing service delivery.

- Supply chain resilience: Forming alliances with key material suppliers or logistics providers to secure critical resources and improve delivery timelines.

The expansion of the offshore renewable energy sector, particularly offshore wind, presents a significant growth opportunity for CHC. Global investment in offshore wind is substantial, with 10.8 GW of new capacity installed in 2023 alone, creating a direct demand for helicopter services for construction and maintenance.

CHC's established expertise in operating in challenging offshore environments, coupled with its strong safety record, positions it well to secure contracts in this burgeoning market. The company can leverage its existing capabilities to provide essential transport and logistics for wind farm development and operations.

The increasing global demand for search and rescue (SAR) and emergency medical services (EMS), driven by factors like natural disasters and humanitarian efforts, offers another key opportunity. CHC's proven track record in these critical life-saving services makes it a strong candidate for securing additional government and public sector contracts, ensuring predictable revenue streams.

Technological advancements, including AI and IoT, offer CHC the chance to enhance operational efficiency and safety. Predictive maintenance, for example, can reduce downtime, which is crucial in the aviation MRO market, valued at over $70 billion globally in 2024 and increasingly reliant on these technologies.

Emerging markets in Asia, Africa, and Latin America are experiencing robust growth in sectors requiring helicopter services, such as resource extraction and emergency medical services. CHC can capitalize on this by expanding its operations and forging strategic partnerships in these developing economies, where helicopter fleet growth is projected to be around 4.5% annually through 2028 in the Asia-Pacific region.

Strategic partnerships and acquisitions are vital for CHC to broaden its service portfolio and enter new markets. Collaborations in high-growth areas like Battery Energy Storage Systems (BESS), a market projected to exceed $150 billion by 2030, can drive revenue diversification and enhance competitive positioning.

| Opportunity Area | Key Driver | CHC's Advantage | Market Data Point (2023/2024) |

| Offshore Renewable Energy | Global investment in offshore wind | Existing offshore operational expertise | 10.8 GW new offshore wind capacity installed globally in 2023 |

| SAR & EMS | Increased demand for life-saving services | Proven track record in critical services | Significant uptick in demand for specialized aviation in disaster response (2024 reports) |

| Technological Integration | Efficiency and safety improvements | Potential for AI-driven predictive maintenance | Global Aviation MRO market > $70 billion (2024) |

| Emerging Markets | Growth in resource extraction & EMS | Expansion into new geographical territories | Asia-Pacific helicopter fleet growth ~4.5% annually through 2028 |

| Strategic Alliances | Market penetration & service expansion | Access to new technologies and markets | BESS market projected > $150 billion by 2030 |

Threats

Significant fluctuations in global oil and gas prices directly impact CHC's offshore energy clients, influencing their spending on helicopter support. For instance, Brent crude oil prices, a global benchmark, saw considerable volatility in 2024, trading between $75 and $90 per barrel for much of the year, which directly affects the operational budgets of CHC's customers.

Prolonged periods of low oil prices, such as those experienced in earlier years, can lead to reduced demand for helicopter services, contract cancellations, or renegotiations at lower rates. This directly impacts CHC's revenue streams and its ability to invest in fleet modernization and expansion, as seen in the sector's cautious capital expenditure trends in 2024.

The offshore helicopter services sector, though niche, is experiencing a rise in competition from both seasoned operators and emerging companies. This dynamic can lead to market saturation in specific geographical areas, consequently pressuring prices downwards and complicating efforts to win new contracts or retain current ones.

For instance, in 2024, the global offshore helicopter market, valued at approximately USD 6.5 billion, saw a notable increase in fleet utilization by key players, indicating a tighter supply-demand balance in some regions, which intensifies competition for contracts.

This heightened competition is a significant factor driving strategic shifts, as companies like CHC Group Ltd must continually innovate and optimize their operations to maintain a competitive edge and secure lucrative, long-term agreements in a crowded marketplace.

CHC Group Ltd operates within an aviation sector governed by rigorous and ever-changing safety and operational regulations from bodies like the EASA and FAA. Non-compliance with these strict mandates can lead to significant financial penalties, operational limitations, or even the suspension of essential certifications, impacting service delivery and revenue streams.

The need to adapt to new regulatory frameworks, such as upcoming environmental standards for emissions or advancements in air traffic management systems, necessitates ongoing capital expenditure and can escalate operational expenses. For example, the increasing focus on sustainability might require significant investment in newer, more fuel-efficient aircraft or operational modifications, impacting profitability in the short to medium term.

Economic Downturns and Geopolitical Instability

Global economic downturns and escalating geopolitical tensions present significant threats to CHC Group Ltd. A widespread recession, for instance, could drastically curb demand for commercial helicopter services across key sectors like offshore energy and general aviation. This directly impacts CHC's revenue streams.

Supply chain disruptions, a common consequence of geopolitical instability, can lead to increased operating costs, particularly through fuel price volatility. For example, the International Air Transport Association (IATA) has highlighted that fuel costs represent a substantial portion of airline operating expenses, and spikes directly affect profitability. Furthermore, reduced investment in energy projects during periods of uncertainty can further dampen demand for CHC's specialized services.

- Reduced Demand: Economic recessions can decrease the need for offshore oil and gas transport and other commercial helicopter operations.

- Increased Operating Costs: Geopolitical events can cause sharp increases in fuel prices, impacting CHC's bottom line.

- Investment Slowdown: Instability often leads to reduced capital expenditure in sectors that rely on helicopter services, like energy.

Reputational Risk from Accidents or Safety Incidents

Despite CHC Group's commitment to safety, helicopter operations inherently involve risks. A significant accident, irrespective of the cause, could severely tarnish CHC's reputation, undermining client confidence. This could translate into higher insurance costs and stricter operational regulations, impacting profitability and market access.

The potential for reputational damage from safety incidents is a critical threat for CHC. For instance, in 2023, the aviation industry saw a slight increase in accident rates compared to 2022, highlighting the persistent challenges. CHC's ability to maintain its stellar safety record is directly tied to its long-term viability and competitive advantage.

- Reputational Damage: A single major incident can quickly erode years of built trust.

- Client Trust Erosion: Clients may seek alternative providers if safety concerns arise.

- Increased Operational Costs: Higher insurance premiums and stricter regulatory oversight can impact financial performance.

- Market Standing: A compromised safety record can lead to a loss of market share and competitive positioning.

CHC faces significant threats from volatile oil prices, which directly influence client spending on helicopter services. For example, Brent crude oil fluctuated between $75 and $90 per barrel in 2024, impacting offshore energy companies' budgets. Increased competition in the niche offshore helicopter market, with a global market value around USD 6.5 billion in 2024, also pressures pricing and contract acquisition.

Stringent and evolving aviation regulations, such as those from EASA and FAA, pose a constant challenge, requiring ongoing investment in compliance and potentially increasing operational costs. Furthermore, global economic downturns and geopolitical instability can reduce demand for services and lead to supply chain disruptions, driving up operating expenses like fuel costs.

The inherent risks of helicopter operations present a critical threat; a major accident could severely damage CHC's reputation, erode client trust, and lead to higher insurance premiums and stricter regulatory oversight. For instance, the aviation industry experienced a slight uptick in accident rates in 2023, underscoring the persistent safety challenges.

SWOT Analysis Data Sources

This SWOT analysis for CHC Group Ltd is built upon a robust foundation of data, including their official financial statements, comprehensive market research reports, and expert industry analyses to provide a well-rounded strategic overview.