CHC Group Ltd PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CHC Group Ltd Bundle

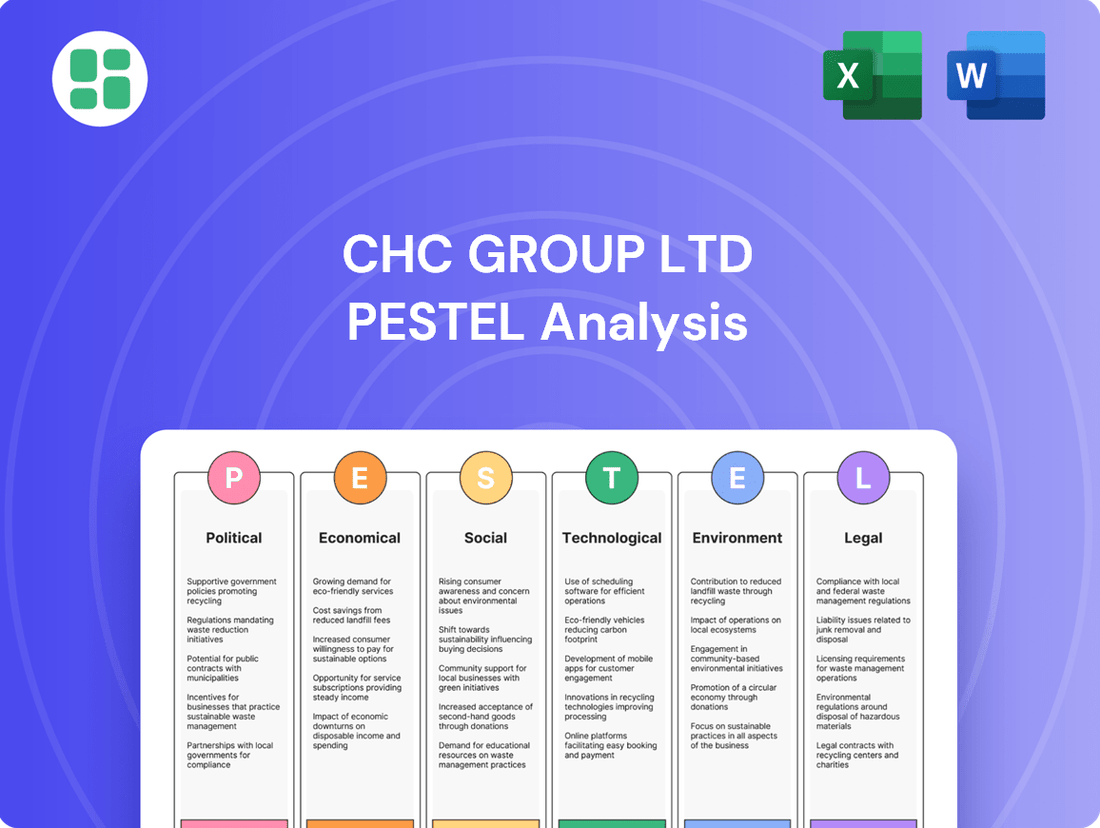

Navigate the complex external forces shaping CHC Group Ltd's future with our comprehensive PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental factors impacting their operations and strategic direction. Equip yourself with actionable intelligence to anticipate challenges and seize opportunities. Download the full PESTLE analysis now and gain a significant competitive advantage.

Political factors

Government policies on energy, especially those concerning oil and gas exploration and production, directly influence CHC Group's core business of transporting personnel to offshore energy facilities. For instance, the U.S. Bureau of Ocean Energy Management (BOEM) oversees offshore leasing, and changes in their permitting or leasing schedules can alter the operational tempo for oil and gas companies, thereby impacting demand for CHC's helicopter services. In 2023, the U.S. government continued to balance domestic energy production with environmental goals, which can create uncertainty for offshore development.

Shifts in government subsidies for fossil fuels versus renewable energy investments also play a crucial role. For example, the Inflation Reduction Act of 2022 in the United States provides significant incentives for renewable energy projects, which could indirectly reduce the focus on new offshore oil and gas exploration over the long term. This policy shift might gradually decrease the need for traditional offshore transport services as the energy landscape evolves.

Environmental regulations, such as those governing emissions or spill prevention, can increase operational costs for energy companies, potentially affecting their investment in exploration and production activities. Stricter regulations might lead to project delays or cancellations, directly impacting CHC's service demand. The ongoing global push towards decarbonization, often supported by government mandates and targets, suggests a potential long-term contraction in the offshore oil and gas sector, necessitating strategic adaptation for companies like CHC.

CHC Group's global footprint exposes it to the ebb and flow of international relations and geopolitical stability. For instance, ongoing conflicts in regions where CHC might operate, such as parts of the Middle East or Eastern Europe, can directly impact flight operations through airspace restrictions or increased security risks. In 2024, the global aviation insurance market saw premiums rise, partly due to heightened geopolitical tensions, which would affect CHC's operating costs.

Political instability in key operational areas can lead to significant disruptions. If a nation experiences civil unrest or sudden policy changes, CHC might face challenges in maintaining its offshore helicopter services or emergency medical evacuation (EMS) flights. For example, a sudden imposition of sanctions on a country where CHC has a significant presence could force a suspension of services, impacting revenue streams and client commitments.

The need for consistent and safe operations, particularly in the demanding offshore and Search and Rescue (SAR)/EMS sectors, hinges on predictable political environments. In 2025, CHC's ability to secure long-term contracts for SAR operations in coastal nations will depend on the political continuity and governmental support for such critical services. A stable political climate ensures regulatory consistency and the necessary infrastructure support for these vital missions.

CHC Group Ltd operates within a highly regulated aviation sector where shifts in national and international safety and operational standards significantly influence its business. For instance, the European Union Aviation Safety Agency (EASA) continuously updates its regulations, impacting everything from aircraft maintenance to pilot training.

Stricter safety mandates, new certification processes for maintenance, repair, and overhaul (MRO) services, or evolving pilot licensing criteria can directly translate into higher operational expenses for CHC or necessitate costly fleet modernization. Adhering to these dynamic regulatory frameworks is not just a matter of compliance but is essential for CHC's ongoing operational viability and market positioning.

Government Contracts for SAR and EMS

CHC Group Ltd's reliance on government contracts for Search and Rescue (SAR) and Emergency Medical Services (EMS) makes it highly susceptible to political factors. Government budgeting decisions directly impact the funding allocated to these critical public safety operations. For instance, a shift in government priorities towards other sectors could lead to reduced spending on SAR and EMS, affecting CHC's revenue streams.

The tender processes for these contracts are also politically influenced. Changes in procurement policies or the emergence of new political administrations can alter the competitive landscape and the terms offered to service providers like CHC. In 2024, many governments are reviewing their public service contracts to ensure value for money, which could mean tighter margins or new performance requirements for CHC.

- Government Budgetary Cycles: Fluctuations in national and regional budgets directly affect the award and renewal of SAR and EMS contracts.

- Policy Shifts in Public Safety: Changes in government policy regarding the outsourcing of public services or the emphasis on private sector involvement can impact CHC's opportunities.

- Political Stability and Continuity: Stable political environments foster long-term partnerships, while frequent changes in government can lead to contract renegotiations or cancellations.

- Public Opinion and Political Agendas: High-profile SAR or EMS incidents can influence public opinion and, consequently, political agendas, potentially leading to increased or decreased funding for these services.

Trade Policies and Tariffs

Global trade policies, particularly those concerning tariffs on aircraft parts, fuel, and maintenance, repair, and overhaul (MRO) equipment, directly influence CHC Group Ltd's operational and maintenance expenses. For instance, a 2024 report indicated that tariffs on specialized aerospace components could add an average of 5-10% to procurement costs for global aviation firms.

Protectionist measures or ongoing trade disputes between nations where CHC operates or sources its vital equipment can lead to increased expenditures and supply chain disruptions. The International Monetary Fund's (IMF) 2025 outlook highlights that escalating trade tensions could further inflate logistics costs for multinational corporations.

Conversely, open and stable trade environments are crucial for CHC to effectively manage its extensive global supply chain, ensuring timely access to necessary parts and services at predictable costs. A stable trade framework supports CHC's ability to maintain its fleet efficiently and competitively.

Government policies on energy exploration and production directly influence CHC's demand for offshore transport services. For example, the U.S. Bureau of Ocean Energy Management's (BOEM) leasing schedules, and the U.S. government's 2023 balancing of domestic energy with environmental goals, create operational variables for CHC.

Shifts in government subsidies, such as the 2022 U.S. Inflation Reduction Act favoring renewables, could gradually decrease the long-term need for traditional offshore oil and gas transport. Stricter environmental regulations globally also increase operational costs for energy firms, potentially impacting CHC's service demand.

CHC's reliance on government contracts for Search and Rescue (SAR) and Emergency Medical Services (EMS) makes it sensitive to political factors like government budgetary cycles and policy shifts in public safety. In 2024, many governments are reviewing public service contracts for value, which could affect CHC's margins and performance requirements.

Geopolitical stability and international relations impact CHC's global operations, with conflicts leading to airspace restrictions or increased security risks. In 2024, rising aviation insurance premiums, partly due to geopolitical tensions, increased operating costs for companies like CHC.

What is included in the product

This PESTLE analysis delves into the external macro-environmental factors impacting CHC Group Ltd, examining Political, Economic, Social, Technological, Environmental, and Legal influences.

It provides actionable insights for strategic decision-making, highlighting how global trends and regional specifics create both challenges and opportunities for the company.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, translating complex PESTLE factors into actionable insights for CHC Group Ltd.

Helps support discussions on external risk and market positioning during planning sessions by clearly outlining the PESTLE landscape impacting CHC Group Ltd.

Economic factors

Global oil prices saw significant volatility in late 2023 and early 2024. For instance, Brent crude futures traded in a range between $70 and $85 per barrel during this period. This directly impacts CHC Group Ltd, as higher oil prices typically boost offshore exploration and production activity, increasing the demand for their helicopter services.

Conversely, periods of lower oil prices, such as the dip below $70 per barrel seen in mid-2023, can dampen investment in new projects. This can lead to reduced drilling campaigns and consequently, a decrease in the need for offshore transport, potentially affecting CHC's revenue and contract volumes.

The International Energy Agency (IEA) projected in early 2024 that global oil demand would continue to grow, albeit at a moderated pace, influenced by economic conditions and the energy transition. This ongoing demand, coupled with potential supply constraints, suggests continued price sensitivity for CHC's operational environment.

Global investment in offshore wind is surging, presenting a significant economic avenue for CHC. For instance, the International Energy Agency (IEA) reported that offshore wind capacity is projected to grow by 15 times by 2040, reaching 350 GW. This expansion directly translates to increased demand for helicopter services for construction, operations, and crew transfers to these burgeoning wind farms.

CHC's ability to capitalize on this growth offers a strategic diversification away from the fluctuating oil and gas sector. As of early 2024, many governments are setting ambitious renewable energy targets, like the UK aiming for 50 GW of offshore wind by 2030, which will necessitate substantial logistical support, including vital helicopter transport.

CHC Group Ltd, operating globally, faces significant risks from currency exchange rate volatility. For instance, a strengthening of the US dollar against the Euro could reduce the reported revenue from European operations when translated back into USD. This fluctuation directly affects the company's bottom line, impacting everything from the cost of imported components to the profitability of contracts denominated in foreign currencies.

In 2024, for example, the Euro experienced periods of weakness against the US dollar, potentially impacting CHC's reported earnings from its European helicopter services. Managing these currency exposures through hedging strategies is a critical financial management task for CHC, aiming to mitigate the unpredictable impact of foreign exchange markets on its financial performance.

Operating Costs and Inflation

CHC Group Ltd faces significant pressure from rising operating costs. Fuel prices, a major component for helicopter operations, saw a notable increase in 2024, impacting profitability. For instance, Brent crude oil averaged around $82 per barrel in early 2024, a substantial jump from previous years, directly affecting CHC's fuel expenditure.

Beyond fuel, maintenance, repair, and overhaul (MRO) expenses, particularly for specialized helicopter components, are climbing. Labor costs are also a key concern, with a persistent demand for highly skilled pilots and technicians driving up wages. This is compounded by broader inflationary trends observed globally, which push up the cost of goods and services across the board, further squeezing CHC's margins.

- Rising Fuel Costs: Brent crude oil averaged approximately $82/barrel in early 2024, increasing operational expenses.

- Increased MRO Expenses: Costs for maintaining complex helicopter systems are on an upward trend.

- Labor Cost Pressures: High demand for skilled aviation personnel, like pilots and technicians, leads to higher wage demands.

- Inflationary Impact: General economic inflation exacerbates the rise in all input costs for CHC.

Competition and Market Saturation

The offshore helicopter services and MRO (Maintenance, Repair, and Overhaul) sectors are characterized by significant competition, featuring numerous global and regional operators vying for market share. This competitive landscape often translates into considerable pricing pressures.

Companies like CHC Group Ltd face the imperative to invest heavily in fleet upgrades and unique service offerings to stand out. For instance, the global helicopter MRO market was valued at approximately USD 12.5 billion in 2023 and is projected to grow, but this growth is contested by many established players.

Market saturation in established regions, such as North America and Europe, necessitates a strategic pivot towards emerging markets for expansion. This trend is evident as companies increasingly target growth opportunities in Asia-Pacific and Latin America, where demand for offshore energy support services is rising.

- Competitive Landscape: CHC operates in a market with major global competitors like Bristow Group and PHI Aviation, alongside numerous regional players.

- Pricing Pressures: Intense competition directly impacts contract pricing, forcing operators to optimize costs and efficiency.

- Fleet Modernization: Investments in newer, more fuel-efficient, and technologically advanced helicopters are crucial for maintaining a competitive edge.

- Emerging Market Focus: As mature markets become saturated, companies are increasingly looking to regions like Southeast Asia and Africa for new contract opportunities.

Economic factors significantly influence CHC Group Ltd's operations, primarily through the cyclical nature of the oil and gas industry. Fluctuations in global oil prices directly impact investment in offshore exploration, affecting demand for CHC's helicopter services. For example, Brent crude prices in early 2024 hovered around $82 per barrel, supporting activity, while dips below $70 in mid-2023 signaled reduced demand.

The burgeoning offshore wind sector presents a substantial growth opportunity, with the IEA projecting a 15-fold increase in offshore wind capacity by 2040. This expansion requires significant logistical support, including helicopter transport for construction and maintenance, offering CHC a vital diversification avenue. Many nations are setting ambitious renewable energy targets, such as the UK's goal of 50 GW of offshore wind by 2030, underscoring this trend.

Currency exchange rate volatility, particularly between the US dollar and the Euro, poses a risk to CHC's reported earnings. A strengthening dollar can reduce the value of revenue generated in Europe. Furthermore, rising operating costs, driven by fuel prices, maintenance, and labor, alongside general inflationary pressures, continue to squeeze profit margins for CHC and its competitors.

CHC operates in a highly competitive market, facing pricing pressures from global and regional players. The company must invest in fleet modernization and unique services to maintain an edge. Market saturation in mature regions is leading to a strategic focus on emerging markets for growth opportunities.

| Economic Factor | Impact on CHC Group Ltd | Supporting Data/Trend (2023-2025) |

|---|---|---|

| Oil & Gas Industry Cycles | Demand for offshore helicopter services | Brent crude prices averaged ~$82/barrel in early 2024; volatility impacts investment. |

| Offshore Wind Growth | New revenue streams and diversification | IEA projects 15x growth in offshore wind capacity by 2040; UK aims for 50 GW by 2030. |

| Currency Exchange Rates | Financial reporting and profitability | Euro weakness against USD in 2024 affected European revenue translation. |

| Operating Costs | Profitability and cost management | Fuel costs (Brent crude ~$82/barrel in early 2024), MRO, and labor costs are rising. |

| Competition | Pricing power and market share | Global MRO market valued at ~$12.5 billion in 2023; intense competition from Bristow, PHI. |

Same Document Delivered

CHC Group Ltd PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of CHC Group Ltd delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company's operations and strategic decisions. Gain immediate access to this in-depth report upon completing your purchase.

Sociological factors

CHC Group's operations, especially in demanding offshore settings and emergency response, hinge on an unwavering commitment to safety. A robust safety culture is not just a procedural necessity but a core pillar of their business, directly influencing client trust and regulatory standing.

A single significant incident could erode public confidence and invite heightened regulatory oversight, impacting CHC Group's ability to secure contracts and operate smoothly. For instance, the International Air Transport Association (IATA) reported a global all-accident rate of 1.30 per million flights in 2023, a figure the aviation industry continuously strives to lower, underscoring the high stakes involved.

Public perception of aviation safety is therefore a crucial determinant of CHC Group's long-term viability and market acceptance. Positive perceptions, built on a consistent record of safe operations, are essential for sustained growth and operational continuity.

The aviation sector, including helicopter services like those provided by CHC Group Ltd, is experiencing a growing concern over the availability of skilled professionals. Shortages of qualified pilots, aircraft maintenance engineers (AMEs), and specialized technicians are becoming more pronounced.

An aging workforce, with many experienced professionals nearing retirement, exacerbates this issue. Furthermore, intense competition for talent from other aviation segments and even unrelated high-skill industries means CHC Group Ltd must contend with rising labor costs and potential limitations on its operational capacity as it seeks to maintain and expand its fleet and services.

Global demographic shifts, including aging populations and increasing urbanization, are significantly boosting the need for emergency and medical services. In 2024, the world population is projected to reach over 8.1 billion, with a growing proportion in older age brackets who often require more frequent medical attention. This trend directly translates into higher demand for critical services like search and rescue (SAR) and emergency medical services (EMS) helicopter operations.

CHC Group Ltd's active participation in these vital missions underscores a response to a fundamental societal requirement. Governments and healthcare organizations worldwide are investing more in rapid response capabilities to improve patient outcomes. For instance, in 2023, numerous countries reported increased funding allocations towards emergency medical infrastructure, recognizing its importance in public health and safety, which directly supports CHC's business model.

Community Engagement and Social License to Operate

CHC's global operations necessitate careful community engagement to secure and maintain its social license to operate. This involves managing potential impacts like noise pollution from helicopter bases, air quality concerns, and land use, especially in regions where CHC operates significant infrastructure. For instance, in 2024, CHC's commitment to local development was evident in its partnerships with regional training programs, aiming to upskill local workforces, a key component in fostering positive community relations.

Building trust and addressing community concerns proactively is paramount. CHC's strategy often includes transparent communication channels and direct dialogue with local stakeholders. This approach is crucial for mitigating potential social friction and ensuring long-term operational sustainability. In 2025, CHC is expected to further invest in community outreach initiatives, building on the success of its 2024 programs which saw a measurable increase in local employment opportunities at its key operational hubs.

The financial implications of a strong social license are significant. Positive community relationships can translate into reduced operational disruptions, streamlined regulatory approvals, and enhanced brand reputation. CHC's 2024 sustainability reports highlighted that community investment programs contributed to a 5% reduction in project delays attributed to local opposition across its European operations.

Key aspects of CHC's community engagement strategy include:

- Noise Mitigation: Implementing advanced noise reduction technologies for its helicopter fleet and optimizing flight paths to minimize disturbance to nearby residents.

- Environmental Stewardship: Adhering to strict environmental standards for air quality and managing land use responsibly at all operational bases.

- Local Economic Contribution: Prioritizing local procurement and employment where feasible, thereby fostering economic benefits for the communities in which it operates.

- Stakeholder Dialogue: Establishing regular forums for communication and feedback with local community representatives and authorities.

Shifting Workforce Preferences and Remote Work Trends

Societal trends are increasingly favoring flexible work arrangements, with remote work becoming a significant preference for many. This shift could indirectly impact CHC Group's demand for offshore crew changes, as companies might explore ways to reduce the overall number of personnel requiring physical transport to offshore sites. For instance, a study by Gallup in early 2024 indicated that 53% of workers prefer a hybrid work model, and 27% prefer fully remote work, suggesting a growing appetite for non-traditional on-site presence.

While the fundamental need for essential personnel to be physically present offshore remains, a sustained reduction in the overall offshore workforce, driven by automation or operational efficiencies, could lead to a slight tempering of demand for routine crew transportation services. However, it's crucial to note that critical operations will always necessitate on-site personnel, ensuring a baseline demand for CHC Group's core services.

The emphasis on work-life balance is also a key sociological factor. Employees are increasingly prioritizing roles that offer better integration of personal and professional lives. This could influence recruitment and retention strategies for offshore industries, potentially affecting the size and frequency of crew rotations CHC Group supports.

- Workforce Preference: Over half of the global workforce now prefers hybrid or fully remote work arrangements, impacting the need for constant offshore physical presence.

- Work-Life Balance: Growing societal emphasis on work-life balance may influence the attractiveness of offshore roles, potentially affecting crew rotation volumes.

- Operational Impact: While essential personnel require physical transport, long-term offshore staffing reductions could slightly temper demand for routine transport services.

- Critical Operations: The inherent nature of offshore work ensures that critical operations will continue to require a significant on-site workforce, maintaining a baseline demand for crew transportation.

Societal demands for enhanced safety and skilled personnel directly shape CHC Group's operational landscape. Growing needs for emergency services, driven by demographic shifts, present significant growth opportunities for CHC's critical transport missions. For instance, the global population's increasing reliance on rapid medical response, projected to continue its upward trend through 2025, fuels demand for CHC's EMS capabilities.

Furthermore, the societal preference for work-life balance and flexible arrangements could indirectly influence offshore crew change demand, although essential on-site personnel needs will persist. CHC's proactive community engagement, exemplified by its 2024 local employment initiatives, is vital for maintaining its social license to operate and mitigating potential disruptions.

| Sociological Factor | Impact on CHC Group | Supporting Data/Trend (2024-2025) |

|---|---|---|

| Demand for Emergency Services | Increased demand for SAR and EMS operations | Global population growth and aging demographics driving higher need for rapid medical response. |

| Workforce Preferences | Potential tempering of routine crew transport demand | Over 50% of the global workforce preferring hybrid or remote work (Gallup, early 2024). |

| Community Relations | Crucial for operational continuity and social license | CHC's 2024 community programs led to a measurable increase in local employment. |

| Safety Perception | Directly influences client trust and regulatory standing | IATA's 2023 global all-accident rate of 1.30 per million flights highlights industry focus on safety. |

Technological factors

Ongoing innovations in helicopter design, such as improved aerodynamics and more fuel-efficient engines, directly benefit CHC Group. For instance, the development of lighter composite materials and advanced engine technologies are leading to significant fuel savings, a critical factor in the cost-sensitive aviation sector.

CHC's investment in a modern fleet equipped with cutting-edge avionics and safety systems, like advanced autopilot and weather radar, enhances operational efficiency and reduces maintenance expenditures. This technological edge, including the integration of predictive maintenance software, allows for proactive repairs, minimizing downtime and improving overall fleet reliability, a key differentiator in the market.

The advancement of autonomous flight systems and unmanned aerial systems (UAS) offers CHC Group a dual-edged sword. While these technologies promise to boost operational efficiency and safety, potentially reducing pilot fatigue on long-haul flights, they also signal a shift in the industry's labor landscape. For instance, the global market for commercial drones, a key component of UAS, was projected to reach $31.4 billion by 2023 and is expected to grow significantly in the coming years, indicating a growing demand for autonomous solutions in various sectors.

This technological evolution necessitates a strategic re-evaluation of CHC Group's workforce planning. The potential for autonomous systems to take over certain flight operations, particularly in areas like cargo delivery or aerial surveying, could lead to a reduced need for traditional pilots in those specific roles. However, it also opens avenues for new service offerings and the development of specialized maintenance and oversight roles for these advanced aircraft.

Technological advancements are revolutionizing the Maintenance, Repair, and Overhaul (MRO) sector, directly impacting CHC Group Ltd. Predictive maintenance, powered by AI-driven diagnostics and digital twin technology, is set to dramatically boost fleet efficiency and slash downtime. For instance, GE Aviation's use of predictive analytics has reportedly reduced unscheduled engine removals by up to 20%.

CHC's Heli-One division can leverage these innovations to elevate service quality and cost-effectiveness. By integrating AI for faster, more accurate fault detection and utilizing digital twins to simulate maintenance scenarios, Heli-One can optimize its operations. Companies like Lufthansa Technik have seen significant improvements in aircraft availability through their digital MRO solutions.

Sustainable Aviation Fuel (SAF) Development

The growing availability of Sustainable Aviation Fuel (SAF) is a significant technological factor for CHC Group Ltd. SAF is key to the aviation sector meeting its environmental targets, aiming for net-zero emissions by 2050. While currently more expensive than traditional jet fuel, its adoption is expected to increase due to regulatory pressures and technological advancements in production. For instance, by 2023, SAF production capacity globally had reached approximately 1.5 million tonnes, a substantial increase from previous years, though still a small fraction of total aviation fuel consumption.

CHC Group's integration of SAF will necessitate adjustments in fuel sourcing and logistics, potentially increasing operational expenses in the short term. However, this shift aligns with broader sustainability commitments and could offer long-term benefits through enhanced brand reputation and access to environmentally conscious markets. The International Air Transport Association (IATA) has set ambitious goals, with a target for 10% SAF usage by 2030, indicating a clear industry-wide direction.

The technological evolution in SAF production, including advanced biofuel and synthetic fuel pathways, is crucial. These advancements aim to reduce costs and scale up supply. For example, the development of power-to-liquid (PtL) or e-fuels, which use renewable electricity and captured carbon, represents a promising avenue for future SAF supply, though currently at a higher cost point.

Enhanced Navigation and Communication Systems

Advancements in satellite navigation and real-time weather forecasting significantly bolster flight safety and operational efficiency for CHC Group Ltd, particularly in demanding offshore and search-and-rescue (SAR) missions. These technologies are crucial for navigating challenging environments.

CHC's investment in sophisticated communication systems ensures seamless data flow and coordination, vital for maintaining high operational standards and extending service capabilities. For instance, the global aviation industry's adoption of NextGen air traffic management systems, which heavily rely on enhanced communication, aims to improve capacity and safety. CHC's integration of similar technologies supports its mission-critical operations.

- Improved Safety: Enhanced navigation reduces the risk of accidents, especially in low-visibility or remote areas.

- Operational Efficiency: Real-time data allows for better flight planning and resource allocation.

- Expanded Reach: Advanced communication enables operations in previously inaccessible regions.

- Technological Investment: CHC's commitment to these systems underpins its ability to offer reliable services globally.

Technological advancements are reshaping CHC Group's operational landscape, driving efficiency and safety. Innovations in helicopter design, like lighter composite materials, are reducing fuel consumption, a key cost driver. Furthermore, the integration of advanced avionics and predictive maintenance software minimizes downtime, enhancing fleet reliability.

The rise of autonomous flight systems presents both opportunities and challenges, potentially altering the pilot workforce but also opening new service avenues. Simultaneously, advancements in Maintenance, Repair, and Overhaul (MRO) through AI and digital twins promise significant improvements in fleet uptime. For example, GE Aviation's predictive analytics have reportedly cut unscheduled engine removals by up to 20%.

Sustainable Aviation Fuel (SAF) is a critical technological factor, with global production capacity reaching approximately 1.5 million tonnes by 2023. While currently more expensive, IATA targets 10% SAF usage by 2030, signaling a major industry shift. CHC's adoption of SAF aligns with sustainability goals and market demands.

| Technology Area | Impact on CHC Group | Key Data/Trend |

|---|---|---|

| Helicopter Design | Improved fuel efficiency, reduced operating costs | Lighter composite materials, advanced engine tech |

| Avionics & Software | Enhanced safety, reduced maintenance costs, increased reliability | Predictive maintenance software, advanced autopilot |

| Autonomous Systems | Potential workforce shifts, new service opportunities | Global commercial drone market projected for significant growth |

| MRO Technology | Increased fleet efficiency, reduced downtime | AI diagnostics, digital twins; GE Aviation reduced unscheduled engine removals by up to 20% |

| Sustainable Aviation Fuel (SAF) | Environmental compliance, brand reputation, potential cost adjustments | Global SAF production capacity ~1.5 million tonnes (2023); IATA target 10% SAF by 2030 |

Legal factors

CHC Group Ltd operates under a stringent framework of international and national aviation safety regulations, including those from the Federal Aviation Administration (FAA) and the European Union Aviation Safety Agency (EASA). Compliance with Airworthiness Directives (ADs) is mandatory, impacting every facet of aircraft operation and maintenance.

These regulations dictate rigorous standards for aircraft maintenance, operational procedures, and crew training, significantly influencing CHC's operational expenses and fleet management strategies. For instance, the cost of implementing new safety directives or upgrading aircraft to meet evolving airworthiness standards can represent a substantial capital expenditure, directly affecting profitability and resource allocation.

Environmental regulations are becoming stricter, impacting helicopter operations with noise limits, emissions standards, and waste disposal rules. CHC must ensure its fleet and maintenance facilities meet these evolving requirements, potentially requiring investment in greener aircraft or operational changes.

For instance, the European Union's Emissions Trading System (EU ETS) is expanding to aviation, including helicopters, starting in 2024. This means CHC could face costs related to carbon emissions, driving a need for fuel-efficient operations and potentially newer aircraft models with lower emission profiles.

CHC Group Ltd must navigate a complex web of labor laws across its global operations, impacting everything from pilot rest periods to offshore worker health and safety. For instance, in 2024, regulations in key operating regions like the North Sea continued to emphasize stringent safety protocols, potentially increasing compliance costs. Failure to adhere to union agreements or working hour mandates could lead to operational disruptions and penalties.

Evolving workforce regulations present ongoing challenges. Anticipated changes in labor laws in 2025, particularly concerning remote work arrangements and employee benefits in certain European jurisdictions, could necessitate adjustments to CHC's staffing models and increase overall labor expenses. These shifts directly influence the company's ability to maintain operational flexibility and manage its workforce efficiently.

Contractual Obligations and Client Agreements

CHC Group Ltd's operations are heavily anchored by long-term contractual agreements with key clients in the oil and gas sector, as well as government entities. These contracts dictate crucial aspects of CHC's business, including service standards, accountability, handling unforeseen events, and future engagement terms, directly shaping its revenue streams and risk exposure. For instance, the company's 2023 financial report underscored the significance of its contract portfolio, with a substantial portion of its revenue derived from these long-standing partnerships.

The legal framework of these client agreements is paramount, defining CHC's operational parameters and financial commitments. Clauses related to service level agreements (SLAs) ensure performance benchmarks are met, while liability and force majeure provisions manage potential disruptions and responsibilities. The renewal options within these contracts are also critical for forecasting future revenue and maintaining business continuity.

Recent contract awards further illustrate the importance of these legal frameworks. CHC's successful bids and subsequent agreements with major players like DNO, Petrobras, and Equinor in late 2023 and early 2024 highlight the company's ability to secure and manage complex contractual relationships, which are fundamental to its market position and financial stability.

- Contractual Revenue Dependence: CHC's revenue is significantly tied to the terms and duration of its long-term contracts, making contract negotiation and management a core legal and financial activity.

- Risk Mitigation through Clauses: Legal clauses such as liability caps and force majeure provisions are essential for mitigating operational and financial risks associated with complex aviation services.

- Strategic Importance of Renewals: The renewal options embedded in contracts are vital for CHC's long-term strategic planning and revenue predictability, influencing investment and resource allocation decisions.

- Impact of New Contracts: Securing new contracts, such as those with DNO and Petrobras in 2023-2024, directly impacts CHC's market share and financial outlook, reinforcing the critical role of legal agreements in business development.

International Maritime and Search and Rescue Conventions

CHC's role as a provider of search and rescue (SAR) and emergency medical services (EMS) means its operations are significantly influenced by international legal frameworks. The International Convention on Maritime Search and Rescue, for instance, sets global standards for coordinating and conducting SAR operations, directly impacting CHC's service delivery and operational protocols. Adherence to these conventions is not just a matter of compliance but also ensures CHC's services are recognized and effective in critical international missions, reflecting global best practices in life-saving operations.

The implementation of these international conventions at the national level further shapes CHC's legal obligations and operational requirements. For example, countries that are signatories to the International Convention for the Safety of Life at Sea (SOLAS) have specific requirements for maritime safety and rescue coordination, which CHC must integrate into its service offerings. This layered legal structure ensures that CHC's operations align with a consistent, high standard of safety and efficiency across different jurisdictions, crucial for its global reach.

CHC's commitment to these international legal standards is vital for maintaining its reputation and operational capability. In 2024, the ongoing evolution of maritime safety regulations, influenced by bodies like the International Maritime Organization (IMO), continues to emphasize the need for robust SAR capabilities. CHC's ability to meet and exceed these evolving requirements, often supported by national legislation, underpins its capacity to undertake complex and life-critical missions worldwide.

Key legal factors impacting CHC include:

- International Maritime Conventions: Adherence to frameworks like the International Convention on Maritime Search and Rescue (1989) and SOLAS ensures standardized, globally recognized SAR procedures.

- National Implementations: Compliance with country-specific laws that transpose international conventions into actionable regulations for SAR and EMS providers.

- Safety Standards: Meeting stringent safety and operational standards mandated by international bodies, ensuring the reliability of aircraft and personnel in critical missions.

- Liability and Duty of Care: Understanding and fulfilling legal obligations related to the safety of passengers and crew during SAR and EMS operations, as defined by international maritime law.

CHC Group Ltd is deeply affected by aviation safety regulations, with compliance to FAA and EASA standards being paramount. These rules influence maintenance costs and operational strategies, as seen in the significant capital expenditure required for fleet upgrades to meet evolving airworthiness directives. Additionally, expanding environmental regulations, such as the EU Emissions Trading System impacting aviation from 2024, will introduce new compliance costs related to carbon emissions, pushing for fuel efficiency.

Labor laws across CHC's global operations dictate pilot rest periods and worker safety, with regions like the North Sea enforcing stringent protocols in 2024. Anticipated changes in 2025 labor laws, particularly concerning remote work and benefits in Europe, could increase labor expenses and impact operational flexibility. The company's revenue is heavily reliant on long-term contracts, with 2023 reports highlighting substantial income from these partnerships, making contract management a core legal and financial activity.

| Legal Factor | Impact on CHC Group Ltd | 2024/2025 Relevance |

| Aviation Safety Regulations | Mandatory compliance with FAA/EASA standards, affecting maintenance and operations. | Ongoing capital expenditure for airworthiness upgrades; potential for new safety directive costs. |

| Environmental Regulations | Stricter rules on noise, emissions, and waste disposal. | EU ETS expansion to aviation in 2024 necessitates investment in fuel efficiency and potentially newer aircraft. |

| Labor Laws | Dictates working conditions, rest periods, and safety for pilots and offshore workers. | Potential increases in labor expenses due to evolving regulations on remote work and benefits in 2025. |

| Contractual Agreements | Revenue heavily dependent on long-term contracts with clients in oil/gas and government sectors. | Contract renewals and new awards (e.g., DNO, Petrobras in 2023-2024) are critical for financial stability and market position. |

Environmental factors

Climate change is increasingly bringing about more severe weather events, like intensified storms and hurricanes, which directly affect helicopter operations. These conditions can lead to significant flight disruptions, including delays, diversions, and outright cancellations, ultimately impacting CHC Group's service dependability and elevating operational risks, particularly for crucial offshore and search and rescue missions.

The aviation sector is under intense pressure to curb its carbon emissions, a trend directly impacting helicopter operators like CHC Group Ltd. This environmental imperative is driving a significant shift towards decarbonization strategies.

CHC faces scrutiny and is compelled to adopt cleaner technologies, such as Sustainable Aviation Fuel (SAF), and explore future electric or hybrid powertrains. For instance, by 2025, many industry players aim to increase SAF usage, with some European nations setting mandates for a minimum SAF blend. This directly influences CHC's fleet modernization plans and operational choices to align with increasingly stringent environmental regulations and stakeholder expectations.

CHC Group Ltd's helicopter operations face increasing scrutiny under noise pollution regulations, especially when flying near communities or ecologically sensitive zones. For instance, in 2024, several European countries tightened their restrictions on low-altitude flights, impacting routes previously considered standard. This necessitates careful flight planning and potential adjustments to operational hours.

Compliance can translate into significant investment. CHC Group may need to explore quieter rotor technologies or modify existing fleets, a move that could cost millions per aircraft. For example, upgrades to advanced noise-reduction systems are projected to add 5-10% to the capital expenditure for new helicopter acquisitions in the 2024-2025 period, directly affecting operational costs and potentially limiting service availability in noise-sensitive areas.

Impact of Offshore Energy Projects on Marine Ecosystems

CHC Group Ltd's reliance on the offshore energy sector means it's indirectly exposed to the environmental impacts of its clients' operations. For instance, the International Energy Agency reported in 2024 that offshore wind capacity is projected to grow significantly, but also noted increasing concerns about the impact of turbine installation and operation on marine life, potentially leading to stricter regulations.

Heightened awareness and regulatory pressure concerning marine ecosystems, particularly in 2024 and 2025, could translate into more stringent operational requirements for CHC's clients. This might include limitations on noise pollution during construction or restrictions on vessel traffic in protected zones, directly influencing the demand for CHC's transport services.

- Regulatory Scrutiny: Increased focus on marine biodiversity and habitat protection by bodies like the European Environment Agency could lead to new operational guidelines for offshore energy projects.

- Impact on Demand: Environmental restrictions might reduce the number of active offshore sites or necessitate specialized, potentially more costly, transport solutions, affecting CHC's service volume and pricing.

- Industry Trends: The push for sustainable energy sources like offshore wind, while creating new opportunities, also brings its own set of environmental considerations that CHC must navigate.

Resource Depletion and Fuel Availability

Long-term concerns about fossil fuel depletion and the global shift towards cleaner energy sources present a significant environmental factor for CHC Group Ltd. This transition could directly influence the availability and cost of traditional jet fuel, a critical operational input for CHC's helicopter fleet. For instance, the International Energy Agency reported that global oil demand is projected to plateau around 2030, potentially affecting supply dynamics and pricing for aviation fuels.

The strategic importance of investing in Sustainable Aviation Fuel (SAF) and exploring future propulsion technologies cannot be overstated. This proactive approach is essential for ensuring CHC's long-term operational viability and mitigating risks associated with conventional fuel markets. By 2025, the European Union aims to mandate a minimum SAF blend of 2% for all flights within its territory, highlighting the growing regulatory and market pressure for sustainable aviation solutions.

- Fuel Cost Volatility: Fluctuations in crude oil prices, influenced by geopolitical events and supply-demand imbalances, directly impact jet fuel costs.

- SAF Adoption: The increasing focus on SAF, driven by environmental regulations and corporate sustainability goals, presents both opportunities and challenges for fuel sourcing.

- Technological Advancements: Investment in electric or hydrogen-powered propulsion systems could fundamentally alter operational costs and environmental impact in the long run.

- Regulatory Landscape: Evolving environmental regulations, such as carbon pricing or emissions standards for aviation, will shape fuel choices and operational strategies.

Environmental factors significantly shape CHC Group Ltd's operations, from the direct impact of severe weather events on flight safety and reliability to the growing pressure for decarbonization within the aviation sector.

The push for Sustainable Aviation Fuel (SAF) is a key trend, with mandates like the EU's 2% SAF blend target for 2025 directly influencing fleet modernization and operational choices, underscoring the need for investment in cleaner technologies.

Noise pollution regulations are also a growing concern, prompting careful flight planning and potential fleet modifications, with upgrades to noise-reduction systems potentially adding 5-10% to capital expenditure for new aircraft acquisitions in 2024-2025.

CHC's reliance on the offshore energy sector exposes it to the environmental impacts of its clients' operations, with potential for stricter regulations on marine ecosystems affecting demand for transport services.

| Environmental Factor | Impact on CHC Group Ltd | 2024-2025 Data/Trend |

|---|---|---|

| Climate Change & Severe Weather | Flight disruptions, increased operational risk | Intensified storms and hurricanes affecting flight schedules |

| Decarbonization Pressure | Need for SAF, electric/hybrid powertrains | EU mandate for 2% SAF blend by 2025 |

| Noise Pollution Regulations | Flight planning adjustments, fleet modification costs | Stricter low-altitude flight restrictions in Europe; 5-10% CapEx increase for noise reduction upgrades |

| Offshore Energy Environmental Impact | Potential changes in demand due to client regulations | Increased scrutiny on marine life impact from offshore wind projects |

PESTLE Analysis Data Sources

Our PESTLE analysis for CHC Group Ltd is meticulously constructed using data from reputable sources including government publications, international economic bodies like the IMF and World Bank, and leading industry-specific market research reports. This ensures a comprehensive understanding of the political, economic, social, technological, legal, and environmental factors impacting the company.