Charter Communications Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Charter Communications Bundle

Charter Communications faces intense competition, with bargaining power of buyers and suppliers significantly impacting its market. The threat of new entrants is moderate, while the threat of substitutes, particularly from streaming services, is a growing concern.

The complete report reveals the real forces shaping Charter Communications’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The bargaining power of content providers for Charter Communications is substantial. Media companies like Disney, Warner Bros. Discovery, and Paramount Global hold sway because their exclusive and popular programming is essential for Charter's video offerings. In 2024, these content providers continue to leverage their desirability, often commanding high carriage fees that directly impact Charter's operational costs and the prices consumers pay for cable packages. This dynamic was evident as negotiations for major sports and entertainment channels frequently involved significant fee increases, underscoring the suppliers' leverage.

Network equipment manufacturers, particularly those producing specialized components like DOCSIS 4.0 modems and advanced fiber optic infrastructure, exert moderate to high bargaining power over Charter Communications. The highly technical and proprietary nature of this equipment, coupled with a concentrated supplier base, grants these vendors significant leverage. For instance, the development and deployment of DOCSIS 4.0, a key technology for Charter's network upgrades, rely on a few key chip manufacturers and equipment providers.

Charter's immense scale as a buyer does provide some counter-leverage, but the specialized demand for cutting-edge networking technology limits its ability to switch suppliers easily. This dependence on a limited number of vendors for critical infrastructure means suppliers can dictate terms to some extent. Charter's strategic approach involves long-term contracts and collaborative development with key partners to temper this supplier power.

Infrastructure access providers, such as those controlling utility poles and conduits, hold significant bargaining power over Charter Communications. Their assets are indispensable for deploying and expanding Charter's network, meaning Charter must secure favorable access agreements. These providers can directly impact the speed and expense of network build-outs, especially in less populated areas where broadband expansion is a priority. For instance, in 2024, the cost of pole attachment fees, a key negotiation point, continued to be a factor in the economics of rural broadband deployment for many cable operators.

Skilled Labor and Technology Talent

The bargaining power of skilled labor and technology talent for Charter Communications is moderate. The demand for specialized technicians, engineers, and cybersecurity professionals in the telecommunications industry means these groups can command higher wages and better benefits. A scarcity of this expertise can indeed lead to increased labor costs and potentially slow down crucial network enhancements or the rollout of new services.

- Skilled Labor Demand: The telecommunications sector, including Charter, relies heavily on technicians for installation and maintenance, and engineers for network design and operation.

- Technology Talent Gap: There's a persistent need for cybersecurity experts to protect infrastructure and customer data, as well as software developers for advanced service platforms.

- Impact on Costs: In 2024, the average salary for a telecommunications engineer in the US was around $95,000, with specialized roles like network security engineers potentially earning significantly more, reflecting this talent demand.

- Operational Efficiency: Delays in deploying new technologies or maintaining existing networks due to a lack of qualified personnel can directly impact Charter's service quality and competitive edge.

Mobile Virtual Network Operators (MVNO) Hosts

The bargaining power of mobile network operators (MNOs) acting as hosts for Mobile Virtual Network Operators (MVNOs) like Charter's Spectrum Mobile is significant. These MNOs, such as T-Mobile, control the essential infrastructure, giving them leverage over wholesale pricing and service level agreements. For instance, in 2024, T-Mobile continued to be a primary partner for many MVNOs, and the terms of these wholesale agreements directly impact the profitability and pricing strategies of MVNOs.

These MVNO hosting relationships are critical for Charter's Spectrum Mobile, as they provide the underlying cellular network coverage and capacity. Without these agreements, Spectrum Mobile could not offer its wireless services. This dependency grants the MNOs considerable influence in negotiations, as they are the sole providers of the core network services required for the MVNO to operate and compete in the mobile market.

- MVNO Reliance: Spectrum Mobile, like other MVNOs, depends entirely on MNOs for network access.

- Infrastructure Control: MNOs own and maintain the cellular towers and spectrum licenses.

- Wholesale Rate Influence: MNOs set the wholesale rates, directly impacting MVNO profitability.

- Service Term Negotiation: MNOs dictate service terms, affecting MVNO customer experience and offerings.

The bargaining power of suppliers for Charter Communications is multifaceted, with content providers and network equipment manufacturers wielding significant influence. Content providers, like major media conglomerates, command high fees for popular programming, directly impacting Charter's costs. Similarly, specialized network equipment manufacturers hold leverage due to the technical nature and limited supplier base for critical infrastructure components, such as those for DOCSIS 4.0 upgrades.

| Supplier Type | Bargaining Power Level | Key Factors | 2024 Relevance |

|---|---|---|---|

| Content Providers | Substantial | Exclusive & popular programming, high carriage fees | Negotiations for sports and entertainment channels drove significant fee increases. |

| Network Equipment Manufacturers | Moderate to High | Technical specialization, concentrated supplier base, proprietary technology | Reliance on key chip manufacturers for DOCSIS 4.0 deployment. |

| Infrastructure Access Providers | Significant | Control of essential assets (utility poles, conduits), indispensable for network expansion | Pole attachment fees impacted rural broadband deployment economics. |

| Skilled Labor & Technology Talent | Moderate | Demand for specialized technicians, engineers, cybersecurity professionals | Average US telecom engineer salary around $95,000 in 2024, higher for specialized roles. |

| Mobile Network Operators (MNOs) | Significant | Control of essential cellular infrastructure, wholesale pricing power | T-Mobile remained a primary partner for MVNOs like Spectrum Mobile, influencing wholesale rates. |

What is included in the product

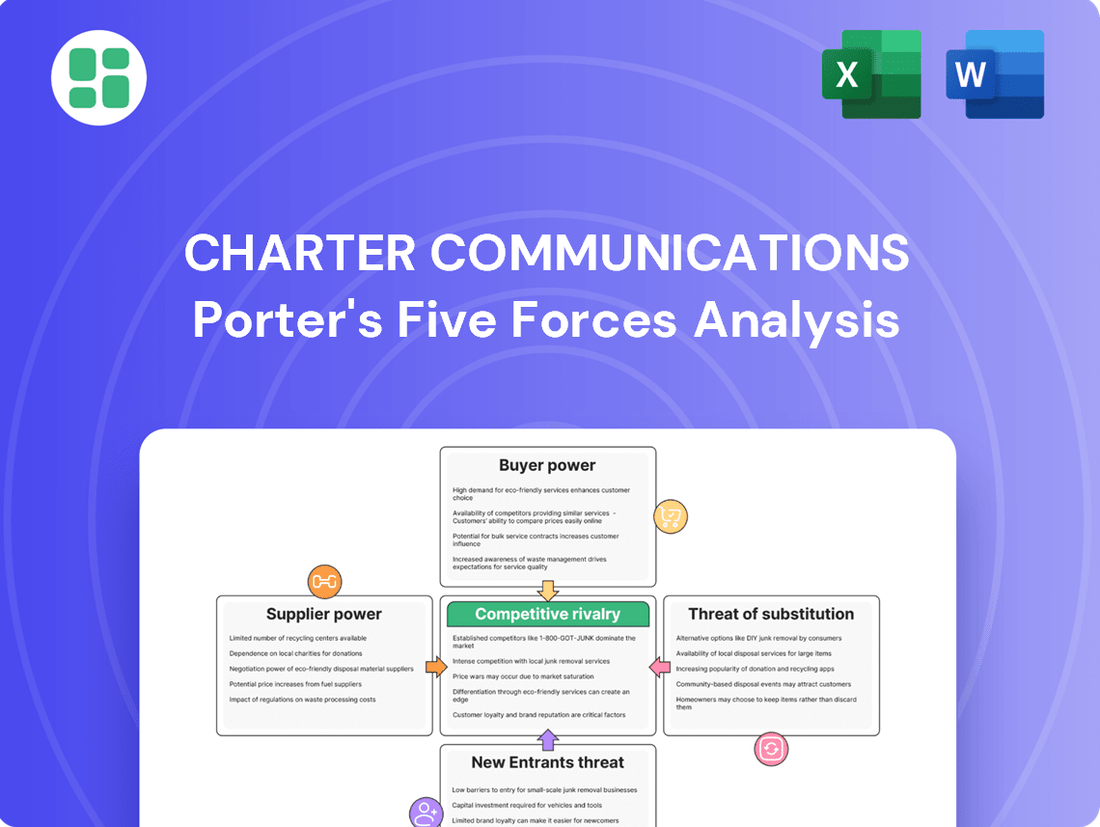

Analyzes Charter Communications' competitive environment by examining the threat of new entrants, the bargaining power of buyers and suppliers, the threat of substitutes, and the intensity of rivalry within the broadband and cable industry.

Instantly visualize Charter Communications' competitive landscape with a dynamic Porter's Five Forces analysis, highlighting key pressure points for improved strategic clarity.

Customers Bargaining Power

Residential customers at Charter Communications are seeing their bargaining power grow. This is largely because there are more choices available for broadband and video services than ever before. For instance, the expansion of fiber-to-the-home networks and the increasing adoption of fixed wireless access (FWA) offer consumers viable alternatives to traditional cable internet.

The proliferation of streaming services also plays a significant role. Consumers can now access a vast array of content through various platforms, reducing their reliance on bundled cable packages. This increased competition gives customers more leverage to demand better pricing and service quality from providers like Charter. If Charter's offerings aren't competitive, customers can more readily switch to a different provider or a combination of alternative services.

Customers of Charter Communications are indeed quite sensitive to price, a trend amplified by the current economic climate. With the cost of living increasing, consumers are scrutinizing their monthly bills more closely. For instance, in 2023, inflation remained a significant concern for households, forcing many to re-evaluate discretionary spending, which often includes entertainment and communication services.

This price sensitivity is a major driver behind the ongoing shift away from traditional cable packages. Many consumers are finding the bundled offerings too expensive and are opting for streaming services or other more budget-friendly options. The decline in traditional pay-TV subscriptions is a clear indicator of this, with reports showing millions of households cutting the cord annually.

The ongoing cord-cutting trend significantly amplifies customer bargaining power within Charter's video services. Consumers are actively choosing to ditch traditional cable bundles in favor of more flexible and often cheaper standalone internet and streaming options. This shift forces Charter to re-evaluate its video product strategy and pricing to remain competitive.

In 2023, approximately 6.5 million households in the U.S. cut the cord, a figure that continues to grow, directly impacting revenue streams for companies like Charter. This widespread adoption of over-the-top (OTT) streaming services means customers have more choices than ever, giving them considerable leverage to demand better value or switch providers if dissatisfied.

Availability of Alternatives

The bargaining power of customers for Charter Communications is significantly influenced by the increasing availability of alternative high-speed internet options. The expansion of fiber optic networks and the rollout of 5G Fixed Wireless Access (FWA) provide consumers with more choices for broadband connectivity in many regions.

This proliferation of alternatives directly lowers customer switching costs. For instance, in 2024, the competitive landscape for broadband saw continued growth, with reports indicating that a substantial percentage of US households had access to at least three different broadband providers, including cable, fiber, and increasingly, 5G FWA.

- Increased Competition: More providers mean customers can easily switch if dissatisfied with Charter's pricing or service.

- Price Sensitivity: Customers can leverage competitor pricing to negotiate better deals with Charter.

- Technology Diversification: The availability of fiber and 5G FWA offers performance parity or superiority in some cases, reducing reliance on cable providers.

Bundling and Promotions

Charter Communications' bundling and promotion strategies aim to lock in customers, but this power is waning. Competitors are increasingly offering similar converged services or compelling standalone deals, giving customers more leverage. For instance, in 2024, the market saw aggressive pricing from mobile virtual network operators (MVNOs) and streaming services, directly impacting the perceived value of traditional cable bundles.

Customers can effectively use these competitive offers to negotiate better terms with Charter or simply switch providers. This dynamic means Charter must continually innovate its bundled packages and promotional offers to maintain customer loyalty and pricing power. The ability for consumers to easily compare and switch between services like internet, mobile, and streaming platforms in 2024 highlights this shifting balance of power.

- Increasing Competition: Rivals like T-Mobile and Verizon are aggressively bundling mobile with home internet, directly challenging Charter's converged offerings.

- Standalone Value: The rise of attractive standalone streaming services and specialized internet providers means customers are less compelled to accept a full bundle for perceived value.

- Price Sensitivity: In 2024, economic factors made consumers more sensitive to pricing, increasing their willingness to switch for even marginal savings, amplified by readily available comparison tools.

- Negotiation Leverage: The ease of switching and the availability of competitive promotions empower customers to negotiate better rates or seek alternative providers.

Charter's customers possess significant bargaining power due to the expanding array of broadband and video alternatives. The increasing availability of fiber-to-the-home and fixed wireless access (FWA) options, coupled with the vast selection of streaming services, allows consumers to easily switch or opt for more cost-effective solutions, thereby pressuring Charter on pricing and service quality.

Price sensitivity among Charter's customer base is a key factor amplifying their bargaining power. With economic pressures in 2023 and 2024, consumers are actively scrutinizing their expenses, leading to a greater willingness to cut the cord and seek out more affordable service bundles or standalone options. This trend is evidenced by millions of households annually discontinuing traditional pay-TV services.

The ease with which customers can switch providers or services, often facilitated by readily available comparison tools, further bolsters their leverage. Competitors are actively bundling mobile with home internet, directly challenging Charter's converged offerings and compelling customers to demand better value, especially given the economic climate of 2024.

| Factor | Impact on Charter | Supporting Data/Trend (2023-2024) |

|---|---|---|

| Availability of Alternatives | Increased customer choice, reduced reliance on Charter | Growth in fiber deployment and FWA availability; 5G FWA expansion in 2024 |

| Price Sensitivity | Higher demand for competitive pricing, lower tolerance for premium bundles | Inflationary pressures in 2023 impacting household budgets; consumer focus on monthly bill scrutiny |

| Cord-Cutting Trend | Erosion of traditional video revenue, pressure on bundle value | Millions of U.S. households cutting the cord annually; rise of OTT streaming services |

| Competitive Bundling | Need to match or exceed competitor offers to retain customers | Aggressive pricing from MVNOs and streaming services; mobile-internet bundles gaining traction |

Full Version Awaits

Charter Communications Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase—no surprises, no placeholders. It provides a comprehensive Porter's Five Forces analysis of Charter Communications, detailing the competitive landscape, bargaining power of buyers and suppliers, threat of new entrants and substitutes, and the intensity of rivalry within the telecommunications and media sectors. This in-depth analysis is crucial for understanding Charter's strategic positioning and potential challenges.

Rivalry Among Competitors

Charter Communications faces significant competitive rivalry from other large cable providers such as Comcast and Cox Communications. This rivalry is particularly fierce in areas where their service territories overlap or are geographically close. For instance, Charter and Comcast often compete directly for customers in various metropolitan areas across the United States, leading to aggressive pricing and service promotions.

The competition among these direct cable competitors primarily centers on offering superior network speeds, attractive service bundles that combine internet, TV, and phone services, and competitive pricing. This dynamic forces companies like Charter to consistently invest in upgrading their network infrastructure to maintain or enhance service quality and speed, a trend that continued strongly into 2024 as providers rolled out faster broadband tiers.

The competitive rivalry among fiber optic providers is intense, directly impacting Charter Communications. Companies like AT&T and Verizon are aggressively expanding their fiber-to-the-home (FTTH) networks, offering customers significantly faster and more reliable internet service. This push for fiber necessitates Charter to continually invest in and upgrade its own infrastructure, such as its DOCSIS 4.0 deployment, to avoid losing market share.

Competitive rivalry in the Fixed Wireless Access (FWA) market is intensifying, with major mobile network operators like T-Mobile and Verizon actively pushing their 5G FWA offerings. These providers are positioning FWA as a direct competitor to traditional cable broadband, particularly in densely populated urban and suburban regions where infrastructure deployment is more efficient.

The appeal of FWA often lies in its more attractive price points and simplified installation process compared to wired alternatives. This has directly impacted established players like Charter Communications, with reports indicating that cable providers have experienced customer losses due to the growing adoption of FWA services. For instance, T-Mobile reported adding 507,000 FWA customers in the fourth quarter of 2023, bringing their total to over 2.7 million FWA customers by the end of the year.

Mobile Service Providers

The competitive rivalry among mobile service providers is intensifying due to the convergence of services. Traditional mobile carriers are now directly challenging incumbents like Charter in the home internet market, particularly with Fixed Wireless Access (FWA) technology. For instance, T-Mobile's Home Internet service has seen significant growth, reaching over 4 million customers by the end of 2023, directly competing with cable providers for broadband subscribers.

Simultaneously, Charter Communications, through its Spectrum Mobile brand, is actively expanding its mobile offerings, becoming a more direct competitor to established mobile network operators. This creates a complex, multi-faceted rivalry where companies battle not just within their traditional segments but across broadband, video, and mobile services simultaneously. In 2023, Charter reported adding 331,000 mobile lines, demonstrating its commitment to growing its mobile subscriber base.

- Convergence: Mobile carriers are entering the home internet market via FWA, while cable companies like Charter are expanding mobile services.

- Multi-Segment Competition: Companies now compete across broadband, video, and mobile, blurring traditional market lines.

- Growth in FWA: T-Mobile reported over 4 million Home Internet customers by late 2023, highlighting the threat to traditional broadband providers.

- Cable's Mobile Push: Charter added 331,000 mobile lines in 2023, indicating a strategic focus on the mobile sector.

Market Saturation and Growth Dynamics

The U.S. broadband market is indeed maturing, which naturally intensifies competition for Charter Communications. This means companies are fighting harder for every new subscriber, making growth more challenging than in the past. For instance, in 2024, the overall broadband subscriber growth rate across the industry has slowed considerably compared to previous years.

While opportunities exist in expanding services to rural areas, the more established urban and suburban markets are where the real battles for market share are happening. Charter, like its competitors, faces this intense rivalry, making customer acquisition and, crucially, customer retention, top priorities. This dynamic means significant investment in marketing and service improvements is often necessary to maintain or grow subscriber numbers.

- Slowing Subscriber Growth: The U.S. broadband market, as of 2024, is experiencing a noticeable slowdown in overall subscriber growth, forcing providers to compete more aggressively for market share.

- Intensified Urban Competition: Established urban markets are characterized by fierce competition, with providers like Charter vying for customers through pricing, service bundles, and network upgrades.

- Focus on Retention and Acquisition: The maturing market necessitates a strong emphasis on retaining existing customers and developing cost-effective strategies for acquiring new ones.

- Rural Expansion as a Growth Avenue: While urban areas are saturated, the expansion into underserved rural regions presents a key growth opportunity, though it often requires substantial infrastructure investment.

Charter Communications faces intense competitive rivalry from both traditional cable providers and emerging technologies. The market is characterized by aggressive pricing, bundling strategies, and continuous network upgrades to attract and retain customers. This pressure necessitates significant capital investment to maintain competitiveness.

The rise of Fixed Wireless Access (FWA) and fiber-to-the-home (FTTH) services presents a direct challenge. Mobile carriers like T-Mobile and Verizon are expanding their FWA offerings, while companies like AT&T are aggressively deploying fiber, providing consumers with faster and often more affordable alternatives. This trend is particularly pronounced in 2024, as these technologies gain traction.

Furthermore, the convergence of services means companies like Charter are competing not only in broadband but also in the mobile sector. Charter's own expansion into mobile services, adding 331,000 lines in 2023, highlights this multi-faceted competitive landscape. The overall broadband market's maturation in 2024 means growth is harder-won, with a stronger focus on customer retention and acquisition.

| Competitor Type | Key Competitors | Competitive Tactics | Impact on Charter | 2023/2024 Data Point |

| Traditional Cable | Comcast, Cox Communications | Bundling, pricing, network upgrades | Direct competition for broadband and video subscribers | Charter added 331,000 mobile lines in 2023 |

| Fiber Providers | AT&T, Verizon | FTTH deployment, higher speeds | Threatens market share with superior internet performance | AT&T continued significant fiber buildout in 2023-2024 |

| Fixed Wireless Access (FWA) | T-Mobile, Verizon | Attractive pricing, simpler installation | Captures broadband subscribers, particularly in urban/suburban areas | T-Mobile had over 4 million FWA customers by late 2023 |

| Mobile Carriers (Convergence) | T-Mobile, Verizon | Bundled mobile and home internet offers | Cross-competition across broadband and mobile segments | Overall broadband subscriber growth slowed in 2024 |

SSubstitutes Threaten

The most significant threat of substitutes for Charter Communications comes from the proliferation of Over-the-Top (OTT) streaming services. These platforms, like Netflix, Disney+, and YouTube TV, offer a vast library of content on-demand, often at a lower monthly cost than traditional cable packages.

This flexibility and affordability have driven significant cord-cutting, directly impacting Charter's video subscriber numbers. In 2023, Charter reported a net loss of 1.4 million video subscribers, highlighting the substantial impact of these substitutes.

Mobile hotspots and public Wi-Fi pose a threat of substitution for Charter Communications, especially for customers with less demanding internet usage or those frequently on the move. These alternatives can diminish the perceived necessity of a dedicated wired broadband connection, particularly for casual browsing or email.

While not a complete substitute for high-speed home internet, the increasing availability and speed of public Wi-Fi, coupled with expanding mobile data plans, offer a viable, albeit often less consistent, option for connectivity. For instance, in 2024, the global public Wi-Fi market is projected to reach over $10 billion, indicating a significant user base seeking these alternatives.

Voice over Internet Protocol (VoIP) apps present a significant threat to Charter's traditional voice services. Services like WhatsApp, Zoom, and FaceTime offer robust communication features, often at no cost, directly competing with Charter's landline offerings.

This shift has led to a noticeable decline in Charter's wireline voice customer base. For instance, the overall U.S. residential landline subscriber count has been steadily decreasing, with VoIP services capturing a substantial portion of this market, impacting revenue streams for traditional providers.

Satellite Internet Services

Satellite internet services present a growing threat of substitution for Charter Communications, particularly in areas where traditional broadband is less accessible. While historically slower and pricier, advancements by providers like Starlink are making satellite a more competitive option, especially in rural and underserved markets. As of early 2024, Starlink has expanded its service to numerous countries, demonstrating a significant global push to capture market share in these less connected regions.

The increasing capabilities of satellite internet directly challenge Charter's dominance in areas where deploying wired infrastructure is cost-prohibitive. This technological evolution means that customers in these locations have a tangible alternative to Charter's cable or fiber offerings. For instance, satellite providers are continuously improving download and upload speeds, narrowing the performance gap with terrestrial broadband services.

- Growing Rural Adoption: Satellite internet is increasingly viable for rural households, a segment where Charter may face higher customer acquisition costs.

- Technological Advancements: Ongoing improvements in satellite technology are enhancing speeds and reducing latency, making it a more attractive substitute.

- Global Expansion: Companies like Starlink are actively expanding their global reach, increasing the competitive landscape for internet services worldwide.

Bundled Streaming and Mobile Services from Competitors

The threat of substitutes is amplified by competitors bundling streaming and mobile services. Major mobile carriers, for instance, are increasingly packaging their wireless plans with popular streaming platforms and even fixed wireless internet. This convergence offers consumers a single, often cost-effective, solution that can directly rival Charter's bundled internet, TV, and mobile services.

These bundled offerings from telecommunication rivals present a significant challenge. For example, in 2024, T-Mobile continued to expand its "TVision" streaming options alongside its mobile plans, aiming to capture customers seeking an all-in-one entertainment and connectivity package. Similarly, Verizon has been aggressive in bundling content deals with its 5G Home Internet and mobile services. This trend directly targets consumers looking for simplified billing and integrated entertainment, potentially drawing them away from Charter's traditional triple-play or quad-play offerings.

- Bundled Offerings: Mobile carriers are combining streaming services with wireless and internet plans.

- Cost-Conscious Consumers: These bundles appeal to customers seeking integrated, value-driven solutions.

- Competitive Landscape: Companies like T-Mobile and Verizon are actively pushing converged offerings.

- Direct Substitution: These packages can serve as direct substitutes for Charter's internet, TV, and mobile bundles.

The threat of substitutes for Charter Communications is substantial, primarily driven by Over-the-Top (OTT) streaming services like Netflix and YouTube TV, which offer content flexibility and affordability, leading to a significant decline in video subscribers. Mobile hotspots and public Wi-Fi also present an alternative for less data-intensive users, with the public Wi-Fi market projected to exceed $10 billion globally in 2024. Furthermore, VoIP services directly challenge Charter's traditional voice offerings, contributing to a steady decrease in landline subscribers.

| Substitute Category | Key Players/Examples | Impact on Charter | 2024 Market Trend/Data |

|---|---|---|---|

| OTT Streaming Services | Netflix, Disney+, YouTube TV | Decreased video subscriber base | Continued growth in streaming subscriptions, impacting traditional pay-TV |

| Wireless & Wi-Fi Alternatives | Mobile Hotspots, Public Wi-Fi | Reduced demand for fixed broadband for casual use | Public Wi-Fi market > $10 billion (2024 projection) |

| Voice Communication Apps | WhatsApp, Zoom, FaceTime | Decline in wireline voice customers | Increasing adoption of app-based calling over landlines |

| Satellite Internet | Starlink | Competition in underserved/rural areas | Active global expansion of satellite internet services |

Entrants Threaten

The telecommunications sector, especially for wireline services like those Charter Communications offers, demands enormous upfront investment. Building out extensive networks, including laying fiber optic cables and upgrading existing DOCSIS infrastructure, requires billions of dollars. For instance, Charter's capital expenditures in 2023 alone were approximately $7.5 billion, highlighting the scale of investment needed to maintain and expand its network.

This substantial capital requirement acts as a significant barrier to entry for potential new competitors. Establishing a competitive network from scratch is incredibly costly and time-consuming, making it extremely challenging for newcomers to gain a foothold against established players like Charter who already possess vast, depreciated infrastructure.

New entrants in the cable and broadband industry, like Charter Communications operates within, encounter substantial regulatory complexities. These include securing federal, state, and local licenses, which can be a lengthy and expensive process. For instance, obtaining franchise agreements from thousands of local municipalities is a significant barrier, often requiring extensive negotiation and compliance with specific local mandates.

Charter Communications, operating primarily under the Spectrum brand, enjoys significant brand loyalty and market dominance, making it a formidable barrier for new entrants. This established recognition means potential competitors must invest heavily in marketing to even approach Charter's visibility and customer trust. For instance, as of the first quarter of 2024, Charter reported serving over 32 million customer relationships, a testament to its deep market penetration.

Access to Content and Spectrum

For video services, new entrants face a significant hurdle in securing favorable content deals with major media companies. These content creators often prioritize established distributors with proven track records and large subscriber bases, making it difficult for newcomers to access the programming necessary to compete. For instance, in 2024, major streaming rights for popular sports leagues and premium content remained concentrated among a few dominant players.

In the mobile services sector, acquiring or leasing sufficient spectrum presents a substantial barrier to entry. Spectrum is a finite and highly regulated resource, with licenses often held by incumbent operators for extended periods. The cost of acquiring new spectrum, as demonstrated in recent FCC auctions, can run into billions of dollars, effectively pricing out many potential new entrants.

- New entrants struggle to secure favorable content deals for video services, as major media companies prefer established distributors.

- Acquiring or leasing sufficient spectrum is a major barrier for new mobile service providers due to its finite and regulated nature.

- The high cost of spectrum licenses, exemplified by billions spent in 2024 FCC auctions, deters potential new entrants in the mobile market.

Technological Advancements and Overbuilding

While emerging technologies like 5G Fixed Wireless Access (FWA) could theoretically lower barriers to entry for new broadband providers, incumbent players like Charter are actively defending their turf. Charter, for instance, is heavily investing in network upgrades, including the rollout of DOCSIS 4.0 and expanding its fiber optic footprint. This creates a significant capital hurdle for newcomers, as matching the performance and reach of established networks requires substantial upfront investment.

The ongoing technological evolution in the telecommunications sector presents a dual threat. New entrants might leverage cutting-edge technologies to offer competitive services, but existing companies are simultaneously upgrading their infrastructure to maintain or enhance their market position. This technological arms race, coupled with the potential for redundant infrastructure development or overbuilding, increases the financial risk for any new company attempting to enter the market.

- Network Investment: Charter Communications projected capital expenditures of $7.0 billion to $7.5 billion in 2024, a significant portion of which is allocated to network enhancements and expansion.

- DOCSIS 4.0 Deployment: Charter is actively deploying DOCSIS 4.0, which promises to increase symmetrical upload and download speeds, directly competing with fiber-based offerings.

- 5G FWA Competition: Major wireless carriers like T-Mobile have been aggressively marketing their 5G FWA services, presenting a direct competitive challenge to traditional cable providers.

The threat of new entrants for Charter Communications is relatively low, primarily due to the immense capital requirements and established infrastructure. Building a comparable network requires billions in investment, a hurdle few can overcome. For example, Charter's 2024 projected capital expenditures were between $7.0 billion and $7.5 billion, largely for network upgrades.

Regulatory hurdles, including securing numerous local franchise agreements, also present significant barriers. Furthermore, securing content rights for video services and acquiring valuable spectrum for mobile operations are substantial challenges for potential newcomers. This complex landscape, combined with Charter's existing market penetration, which saw over 32 million customer relationships in Q1 2024, makes market entry exceedingly difficult.

| Barrier Type | Description | Impact on New Entrants | Example Data (Charter) |

| Capital Requirements | Massive upfront investment for network build-out. | Very High | Projected 2024 CapEx: $7.0-$7.5 billion |

| Regulatory Hurdles | Securing federal, state, and local licenses/franchises. | High | Thousands of municipal franchise agreements required. |

| Content Acquisition | Obtaining favorable deals with media companies for video. | High | Concentrated rights for premium content in 2024. |

| Spectrum Access | Acquiring or leasing mobile spectrum licenses. | Very High | Billions spent in 2024 FCC spectrum auctions. |

| Brand Loyalty/Scale | Established customer base and market recognition. | High | Over 32 million customer relationships (Q1 2024). |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Charter Communications is built upon a foundation of publicly available financial reports, including annual filings (10-K) and quarterly reports (10-Q) from the SEC. We also incorporate insights from industry-specific market research reports and data from financial news outlets to provide a comprehensive view of the competitive landscape.