Charter Communications Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Charter Communications Bundle

Understanding Charter Communications' product portfolio is key to navigating the competitive telecom landscape. Our preview hints at how their services might be categorized within the BCG Matrix, but the full picture is essential for strategic decision-making.

Dive deeper into Charter Communications' BCG Matrix and gain a clear view of where its products stand—Stars, Cash Cows, Dogs, or Question Marks. Purchase the full version for a complete breakdown and strategic insights you can act on.

Stars

Charter's next-generation broadband services, powered by DOCSIS 4.0 and fiber expansions, are poised to capitalize on soaring demand for high-speed internet. These investments solidify their leadership in connectivity, a core strength for the company. In 2024, Charter continued its robust network build-out, aiming to pass millions of new homes with its advanced fiber network, underscoring its commitment to future-proofing its services and maintaining a competitive edge in a rapidly evolving digital landscape.

Enterprise Fiber Solutions, operating under Charter Communications, likely falls into the Stars category of the BCG Matrix. The market for high-capacity fiber and managed networking for large businesses and government entities is booming. Charter's Spectrum Enterprise is investing heavily in expanding its fiber network to capture a larger share of this lucrative market.

Charter Communications is actively expanding its managed business services, targeting the growing market for IT, cybersecurity, and cloud solutions for small and medium-sized businesses. This strategic move leverages Charter's established network and customer relationships to tap into these higher-margin adjacent segments.

By offering these value-added services, Charter aims to deepen its engagement with existing clients and foster greater customer loyalty. This strategy is crucial for driving growth within its business segments, as it moves beyond basic connectivity to provide comprehensive solutions.

In 2024, the SMB managed services market is projected to reach over $100 billion globally, with cybersecurity and cloud solutions being key drivers. Charter's investment in these areas positions it to capture a significant share of this expanding opportunity, enhancing its overall business portfolio.

Advanced Advertising Platforms

Advanced Advertising Platforms are a key growth area for Charter Communications. The company is leveraging its vast subscriber data and extensive video delivery network to offer sophisticated, data-driven advertising solutions. This strategic focus aims to capture a larger portion of the advertising market that is increasingly shifting towards targeted and measurable campaigns, particularly in the video space.

Charter's advanced advertising capabilities enable businesses to reach specific consumer segments with greater precision across both linear and digital video. This is crucial as advertising spend continues to migrate from traditional, less targeted methods to more efficient, audience-centric approaches. For instance, in 2024, the U.S. programmatic TV advertising market was projected to reach significant figures, highlighting the demand for such solutions.

- Growing Market: The demand for data-driven, targeted advertising across linear and digital video platforms is expanding significantly.

- Charter's Advantage: Charter's extensive subscriber data and video network provide a strong foundation for its advanced advertising solutions.

- Targeted Reach: Businesses can utilize Charter's platforms to reach specific audiences more effectively, increasing campaign ROI.

- Market Share Capture: These advanced solutions are designed to attract advertising spend migrating to more measurable and targeted campaigns.

Bundled Connectivity & Entertainment Packages

Charter Communications' bundled connectivity and entertainment packages are strategically positioned to leverage a maturing market by offering integrated solutions. These bundles, combining high-speed internet with streaming, mobile, and smart home services, aim to boost customer lifetime value and capture greater market share in the comprehensive home connectivity space.

The appeal of these integrated offerings lies in their ability to simplify consumer choices and deliver enhanced value. By catering to the growing demand for seamless digital experiences, Charter is driving adoption and improving customer retention. For instance, in Q1 2024, Charter reported a 1.5% increase in total revenue to $13.7 billion, partly driven by its focus on these bundled services.

- Bundled Offerings: High-speed internet, streaming services, mobile connectivity, smart home solutions.

- Strategic Goal: Increase customer lifetime value and market share.

- Consumer Appeal: Simplicity and value in a competitive landscape.

- Financial Impact: Contributes to revenue growth and customer retention.

Charter's Advanced Advertising Platforms represent a significant Star in its BCG Matrix. The market for data-driven advertising is experiencing robust growth, with businesses increasingly seeking targeted and measurable campaigns. Charter's extensive subscriber data and advanced video delivery network position it to capture a substantial share of this expanding market, particularly as advertising spend shifts towards more efficient, audience-centric approaches. In 2024, the U.S. programmatic TV advertising market was projected for significant expansion, underscoring the demand for Charter's sophisticated solutions.

| Category | Market Growth | Charter's Position | Key Drivers | 2024 Data Point |

|---|---|---|---|---|

| Advanced Advertising Platforms | High | Strong/Leader | Subscriber data, video network, targeted campaigns | U.S. programmatic TV market projected for significant growth |

What is included in the product

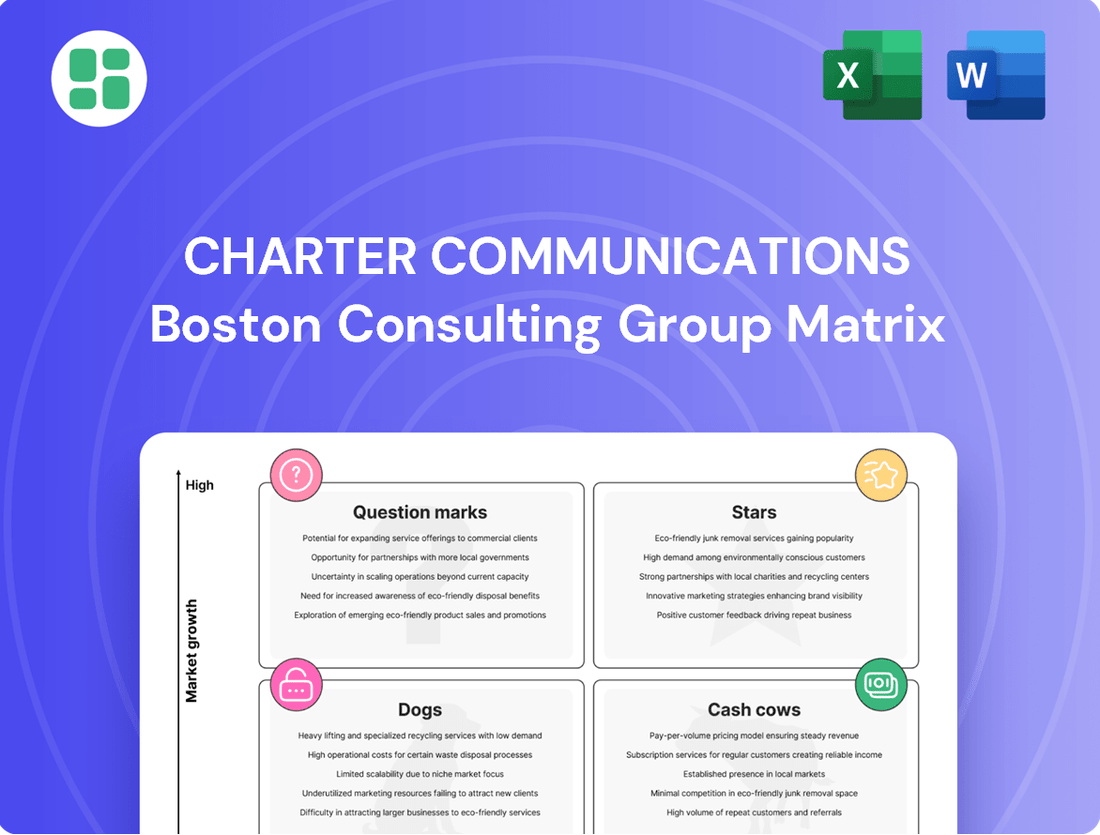

This BCG Matrix analysis highlights Charter's product portfolio, categorizing services into Stars, Cash Cows, Question Marks, and Dogs.

It provides strategic guidance on investment, divestment, and resource allocation for each category.

A clear Charter Communications BCG Matrix provides a one-page overview placing each business unit in a quadrant, relieving the pain of scattered strategic data.

Cash Cows

Charter's residential high-speed internet, primarily under the Spectrum brand, stands as its quintessential cash cow. This service commands a substantial market share across its service areas, reliably delivering broadband to millions of households.

The broadband market is mature, yet this segment consistently generates significant and stable cash flow. Crucially, it requires minimal ongoing investment in promotions or customer acquisition, underscoring its role as the company's financial bedrock.

For the first quarter of 2024, Charter reported approximately 32.4 million total residential customer relationships, with high-speed internet being the cornerstone of this base. The average revenue per user (ARPU) for residential services in Q1 2024 was $135.45, demonstrating the strong monetization of this offering.

Charter's Residential Video Services, often referred to as legacy cable TV, remains a significant cash generator despite the ongoing trend of cord-cutting. As of the first quarter of 2024, Charter reported approximately 14.3 million video subscribers, demonstrating the enduring strength of this segment's subscriber base. This large, established market share allows Charter to extract substantial recurring revenue with relatively low incremental investment, effectively acting as a cash cow.

While the overall video market is experiencing a secular decline, Charter's strong position within it enables them to harvest cash. This robust cash flow from legacy cable is crucial, providing the financial fuel that can be strategically redeployed into higher-growth areas of the business, such as broadband internet services.

Charter's residential voice services, often bundled with internet and video, maintain a significant customer base. Despite the declining landline market, this segment generates consistent, predictable cash flow due to low capital expenditure needs.

Business Internet Services (SMB)

Charter's Business Internet Services for Small and Medium-sized Businesses (SMBs) are a prime example of a Cash Cow within its portfolio. This segment benefits from a mature market position and consistent demand for essential connectivity, leading to predictable and substantial cash generation.

The SMB internet services market, while not experiencing hyper-growth, offers stability. Charter's significant market share in its service areas means this segment requires less aggressive investment in customer acquisition compared to newer ventures. This allows for a strong return on investment and consistent cash flow generation.

- Stable Revenue Stream: Charter's SMB internet services are a reliable source of income, reflecting the ongoing need for business connectivity.

- High Market Share: Within its operating territories, Charter holds a dominant position in providing internet services to small and medium-sized businesses.

- Lower Investment Needs: Compared to high-growth areas, the established nature of this segment means less capital is needed for marketing and expansion, boosting cash flow.

- Essential Service: Internet access is a fundamental requirement for modern businesses, ensuring sustained demand for Charter's offerings.

Existing Network Infrastructure

Charter Communications' extensive network infrastructure, a blend of hybrid fiber-coaxial (HFC) and fiber optic lines, is a prime example of a cash cow. This established network, having benefited from significant prior investment, now efficiently supports a wide array of services, leading to robust profit margins on its operations.

The mature nature of this infrastructure means that ongoing capital expenditures for fundamental service delivery are relatively low. This efficiency translates directly into strong, consistent cash flow generation for the company.

- Network Reach: Charter's network passed approximately 168 million homes in 2023, a testament to its established presence.

- Service Delivery Efficiency: The existing infrastructure allows for high-margin delivery of broadband, video, and voice services.

- Reduced Capital Intensity: Lower ongoing investment requirements for core network functions bolster free cash flow.

Charter's Residential Voice Services, despite the industry-wide shift away from landlines, continues to be a reliable cash cow. This segment benefits from a stable, albeit declining, subscriber base and minimal reinvestment needs.

The bundling of voice with internet and video services helps maintain subscriber loyalty and predictable revenue. For Q1 2024, Charter reported approximately 8.3 million residential voice subscribers, contributing to its overall stable cash flow generation.

This segment's low capital expenditure requirements ensure that the revenue generated translates efficiently into free cash flow, supporting other strategic initiatives within the company.

| Service Segment | Q1 2024 Subscribers (Millions) | Q1 2024 ARPU (Residential) | Cash Cow Characteristics |

|---|---|---|---|

| High-Speed Internet | 32.4 (Total Residential Relationships) | $135.45 (Overall Residential ARPU) | Dominant market share, stable demand, low acquisition costs. |

| Video Services | 14.3 | $135.45 (Overall Residential ARPU) | Large, established base, strong recurring revenue despite cord-cutting. |

| Voice Services | 8.3 | $135.45 (Overall Residential ARPU) | Predictable revenue, low capital expenditure needs. |

| Business Internet (SMB) | Not explicitly broken out, but significant | N/A | Mature market, essential service, high market share in operating areas. |

Full Transparency, Always

Charter Communications BCG Matrix

The Charter Communications BCG Matrix you are previewing is the exact, fully formatted document you will receive upon purchase. This comprehensive analysis, designed for strategic clarity, contains no watermarks or demo content, ensuring you get a professional and ready-to-use report for immediate business planning and competitive analysis.

Dogs

Stand-alone legacy video packages, essentially traditional cable TV without streaming options, are a clear example of a company's "dog" in the BCG matrix. These offerings, often featuring large channel selections, are experiencing a steady decline in popularity.

The primary reason for this downturn is the overwhelming competition from streaming services, which offer more flexibility and often lower prices. Charter Communications, like other cable providers, is seeing a shrinking subscriber base for these legacy products, with very little hope for future growth. In 2024, the trend of cord-cutting continues to impact these segments significantly, as consumers increasingly opt for on-demand digital content.

Charter Communications' older set-top boxes and network equipment are prime examples of dogs in their BCG matrix. These legacy devices, unable to support advanced features like 4K streaming or faster internet speeds, represent a declining market segment with low growth potential.

These outdated assets incur ongoing maintenance and operational costs without generating new revenue or significantly improving customer satisfaction. For instance, in 2024, Charter continued its strategic device refresh programs, aiming to replace millions of older boxes to reduce these costs and improve service quality.

The capital and resources tied up in supporting this older infrastructure could be more effectively deployed in developing and rolling out next-generation technologies. This strategic reallocation is crucial for Charter to remain competitive in the rapidly evolving telecommunications landscape.

Charter Communications' retail locations in areas with consistently low foot traffic and minimal new customer acquisition, often characterized by high operating costs relative to revenue, can be classified as dogs in a BCG matrix analysis. For instance, if a store activation rate falls below 5% in a given quarter, and its operating expenses exceed 20% of its generated revenue, it signals underperformance.

These underperforming retail stores consume valuable resources, including staff time and inventory, without yielding sufficient returns or contributing significantly to Charter's strategic growth objectives, such as expanding its subscriber base. Their continued operation can dilute overall profitability and hinder resource allocation to more promising business segments.

As such, these locations might be prime candidates for strategic review, potentially leading to consolidation with nearby, better-performing stores or outright closure. In 2024, Charter has been actively optimizing its retail footprint, closing approximately 100 underperforming locations to streamline operations and reduce overhead, a move that aligns with managing its 'dog' assets.

Niche, Low-Adoption Ancillary Services

Niche, older ancillary services with consistently low customer adoption rates, like certain legacy digital phone features or premium channel add-ons with declining interest, fall into the Dogs category for Charter Communications. These offerings often demand significant support in relation to their minimal revenue contribution, marking them for potential discontinuation.

In 2024, Charter Communications continued to streamline its product portfolio. While specific revenue figures for individual niche ancillary services are not publicly disclosed, the company's focus on high-growth areas like gigabit internet and mobile services suggests a strategic divestment from underperforming legacy products. For instance, Charter's broadband subscriber growth, which saw a net addition of 178,000 customers in Q1 2024, highlights where investment and focus are directed, implicitly de-prioritizing low-adoption services.

- Low Adoption Rates: Legacy services with minimal uptake represent a drain on resources.

- Minimal Revenue Contribution: These offerings contribute negligibly to overall financial performance.

- High Support Costs: Maintaining outdated services can be disproportionately expensive compared to their returns.

- Strategic Discontinuation: Charter's focus on modern, high-demand services like gigabit internet implies a review of its ancillary service catalog.

Legacy Copper-Based Infrastructure (where still present)

Charter Communications' remaining legacy copper-based infrastructure, primarily for voice services in niche, isolated areas, clearly falls into the dog category of the BCG matrix. These aging networks are costly to maintain and offer little to no room for future upgrades, making them economically unviable.

The customer base relying on these copper lines is shrinking, leading to diminishing returns. For instance, while Charter has heavily invested in its fiber and HFC networks, the operational costs for maintaining copper can be disproportionately high. In 2023, Charter continued its focus on network modernization, aiming to phase out older technologies where feasible.

- High Maintenance Costs: Copper networks require ongoing, expensive upkeep compared to newer technologies.

- Limited Upgrade Potential: Copper infrastructure cannot support the high bandwidth demands of modern services.

- Declining Customer Base: The shift to digital and fiber services leaves fewer customers on copper.

- Strategic Decommissioning: These assets are candidates for retirement and migration to more advanced Charter networks.

Charter Communications' legacy video packages, essentially traditional cable TV without streaming options, are a clear example of a "dog" in the BCG matrix. These offerings are experiencing a steady decline in popularity due to competition from flexible and often cheaper streaming services. In 2024, cord-cutting continues to significantly impact these segments as consumers increasingly opt for on-demand digital content.

Outdated set-top boxes and network equipment also fall into the dog category. These legacy devices, unable to support advanced features like 4K streaming, incur ongoing maintenance costs without generating new revenue. Charter's 2024 device refresh programs aim to replace millions of older boxes to reduce these costs and improve service quality.

Underperforming retail locations with low foot traffic and minimal new customer acquisition, characterized by high operating costs relative to revenue, are also dogs. Charter's optimization efforts in 2024 included closing approximately 100 underperforming locations to streamline operations and reduce overhead.

Niche ancillary services with low customer adoption rates, such as certain legacy digital phone features, represent dogs. These services demand significant support for minimal revenue contribution, prompting strategic streamlining. Charter's focus on high-growth areas like gigabit internet, which saw 178,000 net additions in Q1 2024, implicitly de-prioritizes low-adoption services.

| BCG Category | Charter Communications Example | Market Growth | Relative Market Share | Rationale |

|---|---|---|---|---|

| Dogs | Legacy Video Packages | Low | Low | Declining subscriber base due to streaming competition; minimal future growth potential. |

| Dogs | Older Set-Top Boxes/Network Equipment | Low | Low | Unable to support modern features, incur high maintenance costs, and offer limited revenue generation. |

| Dogs | Underperforming Retail Locations | Low | Low | High operating costs relative to revenue, low customer acquisition, leading to strategic closures. |

| Dogs | Niche Ancillary Services (Low Adoption) | Low | Low | Minimal revenue contribution, high support costs, and de-prioritized in favor of high-growth services. |

Question Marks

Spectrum Mobile, while experiencing robust growth within Charter Communications' existing broadband customer base, holds a modest position in the broader national mobile market. As of early 2024, its overall market share remains significantly smaller than major carriers like Verizon, AT&T, and T-Mobile, reflecting the intense competition.

The company invests heavily in its Mobile Virtual Network Operator (MVNO) agreements and aggressive marketing campaigns to acquire new customers, leading to substantial cash consumption. This investment is crucial for its expansion efforts.

Spectrum Mobile's trajectory towards becoming a 'Star' in the BCG matrix hinges on its ability to sustain its impressive subscriber growth rates and successfully leverage bundling strategies with its core broadband services. Continued innovation in service offerings will also be key to capturing a larger market share.

Charter Communications might be strategically deploying Fixed Wireless Access (FWA) in select locations, likely to address gaps in its wired network or counter competitive pressures. While FWA shows strong growth for some providers, Charter's core strategy remains centered on its established cable infrastructure.

These FWA efforts, though representing a small fraction of Charter's total market presence, could exhibit substantial growth within those niche areas. Such targeted deployments would necessitate considerable capital expenditure to achieve broader scalability and impact.

Emerging Smart Home & IoT Services represent a potential growth area for Charter Communications. While currently holding a low market share, this sector is experiencing significant expansion, positioning it as a high-growth market. For instance, the global smart home market was valued at approximately $138.3 billion in 2023 and is projected to reach $317.0 billion by 2030, demonstrating substantial upward momentum.

Charter could leverage its existing broadband infrastructure to offer more integrated smart home solutions or develop specialized IoT services. This would necessitate considerable investment in technology, strategic alliances, and promotional efforts to capture a meaningful share. Success in this nascent category could eventually elevate these services to Star status within Charter's portfolio.

New Geographic Market Expansions (Greenfield Builds)

Charter's greenfield builds into new geographic markets are essentially investments in potential Stars. These initiatives involve building out their network infrastructure in areas previously lacking high-speed internet or cable services, presenting a significant growth opportunity. For example, in 2024, Charter continued its rural broadband expansion efforts, a key area for greenfield development.

These ventures require substantial upfront capital investment. This includes the cost of laying fiber optic cable, setting up local service centers, and marketing to acquire new customers in these virgin territories. The success hinges on Charter's ability to rapidly gain market share and establish a strong customer base, thereby transforming these initial investments into profitable Stars.

- Greenfield Builds as Potential Stars: Charter's expansion into unserved or underserved markets represents high-growth potential where the company starts with no existing market share.

- Capital Intensive Nature: These projects demand significant upfront capital for infrastructure deployment and customer acquisition efforts.

- Strategic Goal: The objective is to quickly achieve a dominant market position in these new territories, transitioning them from new ventures to established, high-performing Stars within the BCG Matrix.

Advanced Business Applications & Cloud Integrations

Charter Communications is expanding beyond traditional managed services into advanced business applications and cloud integration. This strategic move targets a growing market for complex solutions tailored to specific industries. For instance, in 2024, the global cloud integration market was valued at approximately $14.5 billion, with projections indicating substantial compound annual growth rates, suggesting a fertile ground for Charter's future endeavors.

These advanced offerings, while currently representing a nascent market share for Charter, possess significant growth potential. This positions them as potential stars in the BCG matrix, demanding substantial investment in developing specialized expertise and robust technology platforms. The company's focus here is on building a strong foundation to capture future market demand.

- Targeting High-Growth Segments: Charter is likely focusing on sectors like healthcare, finance, and manufacturing, where complex cloud and application integration are crucial for operational efficiency.

- Investment in Expertise: Significant capital is being allocated to acquire or develop talent in areas such as cybersecurity, data analytics, and specific enterprise software solutions.

- Platform Development: Charter is investing in building or acquiring the necessary technological infrastructure to support these sophisticated service offerings.

- Low Current Market Share, High Potential: These advanced services are in the early stages of adoption for Charter, but the market's rapid expansion suggests a high potential for future market leadership.

Spectrum Mobile, while growing within Charter's existing customer base, still holds a small share of the overall national mobile market as of early 2024, facing stiff competition from established carriers. Significant investment is being poured into its MVNO agreements and marketing to fuel this growth, consuming substantial cash in the process.

The company's success in transitioning Spectrum Mobile to a 'Star' in the BCG matrix depends on maintaining its impressive subscriber growth and effectively leveraging bundled broadband services, with continued service innovation being a key factor.

Charter's greenfield builds and expansion into advanced business applications and cloud integration represent significant investments in potential 'Stars' within the BCG matrix. These initiatives require substantial upfront capital for infrastructure and talent development, aiming to capture high-growth market segments.

BCG Matrix Data Sources

Our Charter Communications BCG Matrix is informed by a blend of financial disclosures, market research reports, and industry growth forecasts, ensuring a robust and accurate strategic overview.