CFO PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CFO Bundle

Unlock critical insights into the external forces shaping CFO's strategic landscape. Our PESTLE analysis delves into political stability, economic fluctuations, and technological advancements, providing you with the foresight needed to navigate complex market dynamics. Equip yourself with actionable intelligence to drive informed financial decisions and secure your company's future. Download the full PESTLE analysis now for a competitive edge.

Political factors

Government funding and subsidies are critical for CFOs, directly influencing their capacity to provide vocational training. For instance, the European Social Fund Plus (ESF+) continues to be a significant source of funding for skills development and employment initiatives across the EU in 2024-2025, with member states allocating substantial portions to lifelong learning programs.

Changes in these funding streams, whether at national or EU levels, can dramatically affect a training center's financial stability and its potential for growth. A reduction in available grants for professional development, for example, could necessitate adjustments to program pricing or a scaling back of expansion plans.

Political priorities regarding employment and skills development are key drivers in resource allocation. In 2024, many governments are focusing on green skills and digital transformation, meaning training institutions aligned with these areas are likely to see increased support, impacting the financial landscape for CFOs in the sector.

Government initiatives aimed at reducing unemployment or tackling skill shortages directly influence the demand for specific training programs. For instance, in 2024, many countries are focusing on reskilling and upskilling initiatives, particularly in digital and green economy sectors, which could see increased uptake of vocational training and certifications.

Policies that champion particular industries or emerging technologies present significant opportunities for CFOs to align their company's offerings with broader national strategic objectives. This alignment can unlock access to government grants, tax incentives, and public-private partnerships, potentially boosting revenue and market share in favored sectors.

Regulations surrounding apprenticeships and internships play a crucial role in shaping the practical training components that companies can offer. As of late 2024 and into 2025, there's a growing emphasis on structured, paid apprenticeship programs designed to bridge the gap between education and employment, impacting how CFOs budget for talent development and workforce integration.

Educational reforms, such as the push for greater STEM (Science, Technology, Engineering, and Mathematics) education in many countries, directly impact the curriculum development for CFO certifications. For instance, the UK's Skills for Jobs White Paper, released in 2021, emphasizes the need for technical education aligned with employer needs, suggesting a greater focus on digital finance skills for future CFOs.

Changes in qualification frameworks, like the ongoing review of the European Qualifications Framework, necessitate that CFO bodies update their course accreditation to ensure continued recognition. This means adapting teaching methodologies to incorporate new pedagogical approaches, ensuring certifications remain relevant in a rapidly evolving professional landscape.

The global trend towards lifelong learning and micro-credentialing, evidenced by the growth in online professional development platforms, also influences how CFOs deliver and update their training. For example, platforms like Coursera reported a significant increase in business and finance course enrollments in 2024, highlighting a demand for flexible, skill-specific learning.

Political Stability and Governance

Political stability in Portugal, a key consideration for CFOs, fosters a predictable environment conducive to long-term strategic planning and investment. For instance, Portugal's government has maintained a relatively stable coalition structure leading into 2024, which generally translates to consistent policy frameworks. This stability reduces the risk associated with unforeseen policy shifts that could impact financial operations or capital allocation.

Conversely, any significant political upheaval or abrupt changes in government objectives can introduce considerable uncertainty. Such instability might affect the availability of public funding for certain sectors or lead to a re-evaluation of existing regulatory landscapes, directly impacting a CFO's financial forecasting and risk management strategies. For example, upcoming elections in 2024, while not necessarily indicative of instability, will require close monitoring by financial leaders.

Effective governance is crucial for ensuring a level playing field and transparent operations within the training sector. This translates to clear, consistently applied regulations that allow training providers to plan and invest with confidence. Portugal's commitment to EU standards, reinforced by ongoing regulatory reviews, aims to uphold these principles.

- Portugal's projected GDP growth for 2024, estimated by the Bank of Portugal at 1.2%, provides a baseline economic outlook influenced by political stability.

- The nation's public debt as a percentage of GDP, around 107.7% in Q4 2023, underscores the importance of stable fiscal policies driven by political continuity.

- EU funding mechanisms, which are often tied to member state governance and stability, represent a significant financial stream for various Portuguese industries.

International Relations and EU Policies

As a Portuguese entity, CFOS is significantly shaped by European Union policies. These policies directly impact areas like education, training, and the movement of workers across borders. For instance, the EU's commitment to lifelong learning, as seen in initiatives like the European Skills Agenda, can create pathways for CFOS to access funding and adopt advanced training methodologies. In 2024, the EU continued its focus on skills development, with significant budget allocations towards programs designed to bridge skill gaps and foster digital competencies among the workforce.

EU programs such as Erasmus+ are crucial for CFOS, offering opportunities for international collaboration and student/staff mobility. These exchanges not only enrich the learning experience but also promote the adoption of best practices in educational delivery and curriculum development. The continued investment in Erasmus+ for the 2024-2027 period, with a budget of €26.2 billion, underscores the EU's dedication to fostering a more interconnected and skilled European population.

Alignment with EU standards is paramount for CFOS, as it ensures the recognition and portability of its qualifications throughout the member states. This harmonization facilitates easier entry into the European labor market for its graduates and strengthens its position as a reputable educational institution within the EU framework. By adhering to EU quality assurance frameworks, CFOS enhances its international appeal and contributes to the broader goal of a unified European Higher Education Area.

Key EU policy impacts on CFOS include:

- Funding Opportunities: Access to EU grants and funding streams for educational innovation and research projects, particularly those aligned with the European Skills Agenda.

- Best Practice Promotion: Adoption of EU-endorsed pedagogical approaches and quality assurance standards to enhance educational outcomes.

- International Partnerships: Facilitation of cross-border collaborations and student/staff exchange programs through initiatives like Erasmus+.

- Qualification Recognition: Ensuring that CFOS qualifications are recognized across EU member states, improving graduate employability.

Political factors significantly shape the operational landscape for CFOs, influencing everything from government funding to regulatory compliance. Government support, such as the €26.2 billion allocated to Erasmus+ for 2024-2027, directly impacts educational institutions' ability to fund international collaborations and staff mobility, enhancing global best practices.

Shifts in political priorities, like the EU's focus on digital transformation and green skills in 2024, can redirect funding and create demand for specialized vocational training, influencing curriculum development and resource allocation for CFOs in the education sector.

Political stability, exemplified by Portugal's consistent policy frameworks into 2024, reduces financial risk and allows for more predictable long-term strategic planning and investment for CFOs.

Regulatory frameworks, including those governing apprenticeships and qualifications, directly affect how CFOs budget for talent development and ensure their organization's offerings remain relevant and recognized, as seen with the UK's Skills for Jobs White Paper emphasizing employer-aligned technical education.

What is included in the product

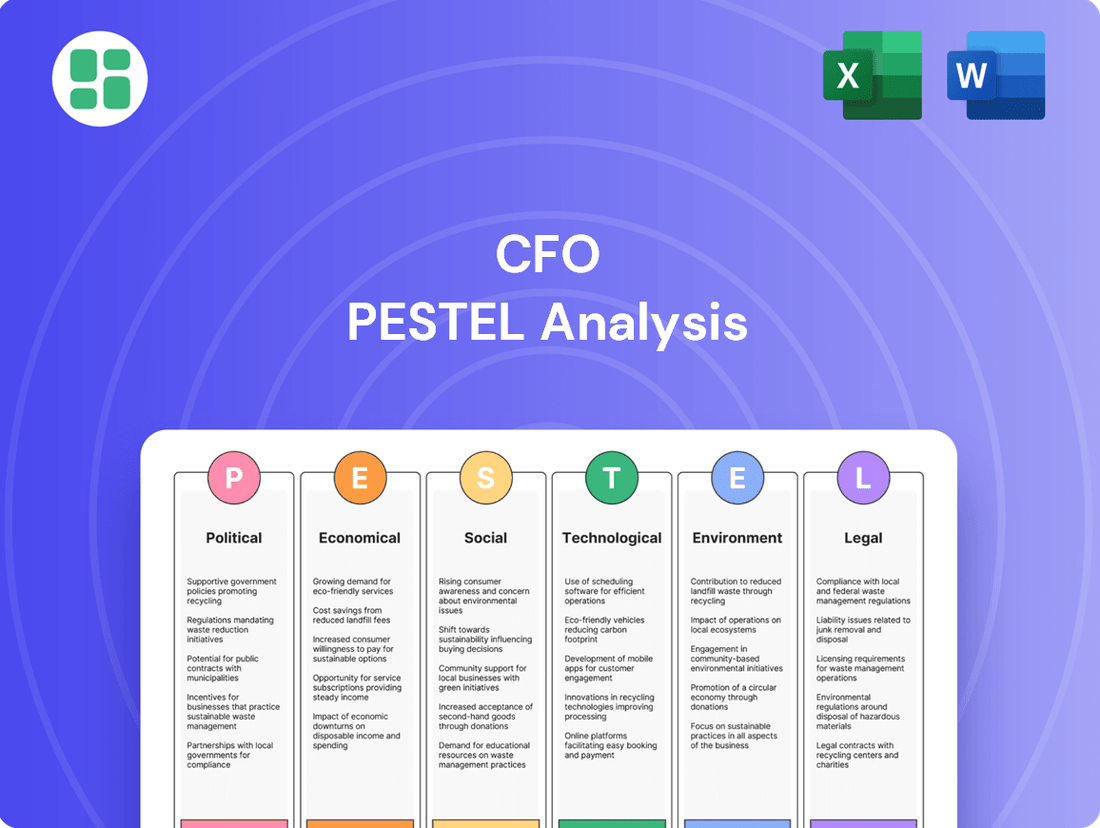

This comprehensive PESTLE analysis examines how political, economic, social, technological, environmental, and legal factors impact the strategic decisions and responsibilities of Chief Financial Officers.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, transforming complex external factors into actionable insights for strategic decision-making.

Economic factors

Portugal's economic growth trajectory significantly influences the demand for CFO services. In 2023, the Portuguese economy expanded by an estimated 2.3%, a solid performance that suggests businesses are more likely to invest in strategic financial planning and potentially new CFO hires.

Employment rates are also a key indicator. Portugal's unemployment rate stood at 6.5% in early 2024, down from higher figures in previous years. This improving employment landscape can mean more companies are stable enough to consider specialized financial leadership, while individuals seeking employment may be more inclined to pursue financial certifications and roles.

A healthy economy generally correlates with increased private and public investment in training and development. As businesses thrive, they often allocate more resources to enhancing their financial management capabilities, which directly benefits the CFO profession and the services they provide.

The availability of public and private sector funding for vocational training is a critical economic factor for CFOs. Government grants, European structural funds, and corporate training budgets directly influence a company's ability to invest in upskilling its workforce. For instance, in 2024, many governments are increasing funding for green skills training to support the transition to a sustainable economy, with the EU's Just Transition Fund allocating billions to retraining workers in affected regions.

Economic downturns often trigger cuts in these vital funding streams. This reduction in available capital can significantly impact a CFO's capacity to offer diverse and high-quality training programs or expand their reach. For example, during periods of economic contraction, corporate training budgets are frequently among the first to be reduced, potentially limiting a CFO's strategic options for talent development.

Disposable income is a key driver for enrollment in professional development courses, directly impacting affordability. For instance, in Q1 2024, the U.S. Bureau of Economic Analysis reported that personal disposable income rose at an annual rate of 3.2%, indicating a potential increase in consumer spending on education. However, economic downturns or rising inflation can shrink this discretionary spending, making training programs a luxury rather than a necessity for many, thereby affecting enrollment figures for fee-based offerings.

Industry Demand and Skill Gaps

Portugal's economic landscape is increasingly shaped by demand for digital and green skills. For instance, a 2024 report indicated a significant shortage of IT professionals, with demand outstripping supply by an estimated 15%. This creates a clear imperative for CFOs to align educational offerings with these burgeoning sectors, ensuring graduates possess in-demand competencies.

Identifying and addressing skill gaps is crucial for economic competitiveness. In 2025, projections suggest the renewable energy sector alone will require an additional 20,000 skilled workers. CFOs can leverage this by developing targeted training programs, potentially partnering with industry leaders to create apprenticeships and specialized courses that directly address these identified needs.

- Digital Skills Demand: Portugal faces a growing need for professionals in areas like cybersecurity, data analytics, and artificial intelligence.

- Green Transition Needs: The shift towards sustainability is driving demand for expertise in renewable energy installation, energy efficiency, and environmental management.

- Bridging the Gap: Educational institutions must adapt curricula to meet these evolving industry requirements, fostering employability.

- Economic Opportunity: Proactive adaptation to skill demands can unlock significant economic growth and innovation within Portugal.

Inflation and Operational Costs

Inflationary pressures directly impact operational costs for educational institutions. For instance, rising wages for instructors, increased utility bills, and higher costs for training materials can significantly squeeze budgets. In 2024, the U.S. experienced an average inflation rate of around 3.4%, impacting these very expenses.

CFOs face the delicate balancing act of absorbing these escalating costs while maintaining competitive program fees to attract students. This requires careful financial management and strategic pricing models.

Economic stability and predictable, controlled inflation are crucial for effective financial planning and long-term sustainability. For example, a stable economic environment allows for more accurate forecasting of future expenses and revenue streams.

- Rising Instructor Salaries: In 2024, average teacher salaries saw an increase, contributing to higher personnel costs.

- Increased Utility Expenses: Energy costs, a significant operational factor, have seen fluctuations, with some regions experiencing higher utility rates.

- Material Costs: The price of specialized equipment and consumables for practical training also reflects broader inflationary trends.

- Competitive Fee Structures: Balancing these rising costs against student affordability remains a key challenge for financial decision-makers.

Portugal's economic growth, projected to be around 2.1% in 2024 and 2.3% in 2025, underpins the demand for financial services, including those provided by CFOs. A stable economic environment encourages business investment and expansion, directly correlating with the need for strategic financial leadership and advice.

Inflationary pressures, with the European Central Bank targeting a 2% inflation rate but experiencing fluctuations, directly impact operational costs for businesses and educational institutions. CFOs must navigate these rising costs, such as increased utility expenses and material costs, while maintaining competitive pricing for services and training programs.

The job market, with Portugal's unemployment rate hovering around 6.4% in early 2024, indicates a relatively stable labor force. This stability, coupled with a growing demand for digital and green skills, presents opportunities for CFOs to focus on talent development and strategic workforce planning to meet evolving industry needs.

| Economic Factor | 2024 Estimate/Projection | Impact on CFO Services |

|---|---|---|

| GDP Growth | 2.1% | Increased demand for strategic financial planning and advisory. |

| Inflation Rate (Target) | 2% (ECB Target) | Pressure on operational costs, requiring careful budget management and pricing strategies. |

| Unemployment Rate | ~6.4% | Availability of skilled talent, enabling focus on strategic development and retention. |

| Key Skill Demands | Digital & Green Skills | Opportunity for CFOs to align training and development with market needs. |

What You See Is What You Get

CFO PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use, offering a comprehensive PESTLE analysis tailored for CFOs.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises, providing actionable insights for financial strategic planning.

The content and structure shown in the preview is the same document you’ll download after payment, empowering you with a robust framework for understanding external business influences.

Sociological factors

Portugal's demographic landscape is marked by an aging population and declining birth rates, a trend projected to continue. This directly impacts the workforce's composition, with a growing proportion of older workers and fewer young entrants. For instance, by 2023, the percentage of the population aged 65 and over reached approximately 22.9%, a significant increase. This necessitates a strategic shift in training and development programs to accommodate both the foundational needs of new, younger talent and the crucial upskilling or reskilling requirements for experienced employees seeking career longevity.

Societal views heavily influence the appeal of vocational training. In 2024, a significant portion of the population still prioritizes university degrees, viewing them as the primary path to success. This can impact the talent pool available for vocational programs, as individuals may bypass them in favor of traditional academic routes, potentially limiting enrollment numbers for institutions like CFO.

However, there's a growing recognition of the value and necessity of skilled trades. As of early 2025, data suggests a shift in perception, with more individuals and employers acknowledging the direct career pathways and earning potential offered by vocational training. CFO can leverage this trend by highlighting successful alumni and the high demand for its graduates in the current job market, effectively countering any lingering negative stereotypes.

The modern workplace is transforming rapidly, with automation and AI increasingly impacting job roles, making adaptability crucial. This shift underscores the societal need for continuous skill development, a concept that financially savvy leaders like CFOs must embrace to ensure their workforce remains competitive and their organizations resilient. For instance, a 2024 LinkedIn report indicated that 70% of professionals believe upskilling is essential for career advancement in the next five years.

CFOs can leverage this societal emphasis on lifelong learning by championing internal training programs and external professional development opportunities. This not only equips employees with in-demand skills, such as data analytics or cybersecurity, but also fosters a culture of innovation and engagement. By investing in their people's growth, companies can mitigate the risks of job displacement and enhance overall productivity, contributing positively to the bottom line.

Skill Gaps and Employability Needs

The widening chasm between the skills the workforce possesses and those demanded by modern industries is a critical concern for Chief Financial Officers. In 2024, reports highlighted that over 60% of businesses struggled to find candidates with the necessary digital and technical proficiencies, impacting productivity and innovation.

Bridging these skill gaps directly enhances individual employability and bolsters a nation's overall economic competitiveness. For instance, government initiatives focused on reskilling programs in areas like artificial intelligence and data analytics are projected to create millions of new jobs by 2025, demonstrating a clear link between skill development and economic growth.

CFOs play a pivotal role in this landscape by collaborating closely with industry leaders. This partnership allows for the proactive identification of emerging skill requirements and the strategic allocation of resources towards training and development programs.

- Industry-Academia Partnerships: Facilitating collaborations to align educational curricula with real-world job demands, reducing the time it takes for graduates to become productive.

- Investment in Upskilling/Reskilling: Allocating budget for continuous learning programs to equip existing employees with future-ready skills, particularly in areas like AI, cybersecurity, and green technologies.

- Data-Driven Workforce Planning: Utilizing labor market analytics to forecast future skill needs and proactively address potential shortages, ensuring a pipeline of qualified talent.

- Measuring ROI of Training: Implementing metrics to track the effectiveness of training investments in terms of improved productivity, reduced turnover, and enhanced innovation.

Cultural Diversity and Inclusion

Portugal's increasing cultural diversity presents a significant consideration for CFOs, particularly in educational or corporate training contexts. Ensuring programs are inclusive means adapting content and delivery methods to accommodate varied cultural backgrounds and learning styles. For instance, by July 2025, a Portuguese university might see its international student enrollment surpass 20% of its total student body, necessitating multilingual support and culturally sensitive teaching materials.

This shift requires a proactive approach to accessibility, including offering language support services and flexible pedagogical strategies. A business aiming to upskill its workforce might invest in training modules that acknowledge different communication norms and prior experiences. For example, a 2024 internal survey could reveal that 30% of employees identify with minority ethnic groups, prompting a review of leadership development programs to ensure equitable access and representation.

- Cultural Adaptation: CFOS must oversee the adaptation of training materials and program content to resonate with a diverse workforce, potentially increasing employee engagement by up to 15% according to recent HR studies.

- Language Support: Implementing robust language support, such as translation services or bilingual instructors, can improve comprehension and participation rates among non-native speakers, a crucial factor as Portugal's foreign-born population reached approximately 7.5% in 2024.

- Inclusive Pedagogy: Adopting teaching methods that respect diverse learning preferences and cultural communication styles can foster a more equitable and effective learning environment.

- Enriching Learning: Promoting diversity within student or employee cohorts demonstrably enriches the learning experience, leading to enhanced problem-solving capabilities and innovation, with companies reporting a 10-20% increase in innovative output from diverse teams.

Societal attitudes towards education and career paths are shifting, with a growing appreciation for vocational training alongside traditional degrees. This evolving perception, evident in early 2025 data, suggests a potential increase in enrollment for skilled trades. CFOs can capitalize on this by highlighting successful alumni and the strong job market demand for their graduates, effectively addressing any remaining outdated stigmas.

The increasing prevalence of automation and AI in the workplace underscores the societal demand for continuous skill development. By 2025, professionals widely acknowledge upskilling as vital for career progression, a trend CFOs can leverage by investing in internal training programs. This fosters a culture of innovation and ensures workforce competitiveness, ultimately boosting productivity and financial performance.

Portugal's growing cultural diversity necessitates inclusive educational and corporate training strategies. By mid-2025, universities may see a significant rise in international students, requiring multilingual support and culturally sensitive materials. This inclusive approach can enhance employee engagement and learning outcomes.

| Sociological Factor | 2024/2025 Data Point | Impact on CFO Strategy |

|---|---|---|

| Perception of Vocational Training | Growing recognition of direct career paths and earning potential (early 2025) | Highlight successful alumni; emphasize job market demand. |

| Demand for Lifelong Learning | 70% of professionals see upskilling as essential for career advancement (2024) | Invest in internal training; promote professional development. |

| Cultural Diversity in Workforce | Foreign-born population approx. 7.5% (2024); potential 20%+ international students by July 2025 | Adapt training for diverse backgrounds; offer language support. |

Technological factors

The surge in digital learning platforms, like Coursera and edX, is reshaping how finance departments upskill their teams. In 2024, the global e-learning market was projected to reach over $400 billion, showcasing a significant shift towards accessible, online professional development. This trend allows CFOs to offer cost-effective, flexible training, potentially reducing traditional classroom expenses by up to 50%.

However, embracing e-learning necessitates strategic financial planning. Companies must allocate capital for robust IT infrastructure, cybersecurity to protect sensitive training data, and high-quality digital content creation. For instance, developing specialized financial modeling courses online can incur significant upfront costs, but offers scalability and broader employee reach compared to in-person sessions.

The pervasive integration of automation and AI across sectors is fundamentally reshaping workforce demands, requiring CFOs to invest in reskilling initiatives. For instance, a 2024 McKinsey report indicated that up to 30% of current work activities could be automated by 2030, highlighting the urgency for adaptation.

Consequently, CFOs must prioritize updating educational curricula to equip individuals with competencies in operating, maintaining, and developing these advanced technologies. This includes robust training in data analytics, cybersecurity, and advanced manufacturing processes, crucial for navigating the evolving industrial landscape.

Industry 4.0, with its focus on interconnected systems, the Internet of Things (IoT), and sophisticated analytics, is fundamentally reshaping manufacturing and various other industries. This technological evolution means businesses must adapt quickly to remain competitive.

For Chief Financial Officers (CFOs), this necessitates a strategic approach to workforce development, including integrating training on smart technologies, digital twins, and advanced production methodologies into educational programs. This proactive measure is crucial for equipping future professionals with the skills demanded by evolving job markets.

Collaboration with industry partners is paramount in this transition. For instance, many manufacturing firms are investing heavily in IoT solutions; a 2024 report indicated that IoT spending in manufacturing was projected to reach over $150 billion globally, highlighting the tangible financial implications of adopting these smart technologies.

Emerging Technologies and Skill Demand

The rapid evolution of technologies like artificial intelligence, quantum computing, and advanced materials is fundamentally reshaping the job market. For CFOs, this means understanding how these advancements create demand for new skill sets. For example, the global AI market was projected to reach $200 billion in 2023 and is expected to surge past $1.8 trillion by 2030, highlighting a significant need for AI specialists and data scientists.

CFOs need to anticipate these shifts and invest in upskilling and reskilling programs. Companies that fail to adapt risk a talent gap, hindering innovation and competitiveness. By identifying emerging technological trends and their associated skill requirements, organizations can ensure their workforce remains relevant and capable of leveraging new opportunities.

- AI and Machine Learning: Demand for AI engineers and data scientists is soaring, with projected annual growth rates exceeding 30% in some sectors.

- Renewable Energy Technologies: The renewable energy sector, valued at over $1 trillion globally in 2023, requires skilled technicians for installation, maintenance, and innovation in areas like battery storage and solar panel efficiency.

- Biotechnology Advancements: The biotech industry, with significant investment in areas like gene editing and personalized medicine, necessitates expertise in bioinformatics and molecular biology.

- Sustainable Construction: As green building practices gain traction, there's an increasing need for professionals skilled in sustainable materials, energy-efficient design, and circular economy principles in construction.

Cybersecurity and Data Privacy

Cybersecurity and data privacy are increasingly critical concerns for CFOs as educational institutions expand their digital footprints. With a significant portion of training now conducted online, safeguarding sensitive student data and maintaining secure learning platforms are paramount for preserving trust and ensuring regulatory compliance. For instance, a 2024 report indicated a 30% rise in cyberattacks targeting educational institutions, highlighting the urgency of robust security measures.

The financial implications of data breaches can be substantial, encompassing remediation costs, potential fines, and reputational damage. Therefore, CFOs must prioritize investments in advanced cybersecurity infrastructure and employee training. Furthermore, the growing demand for cybersecurity expertise presents an opportunity; educational providers can develop and offer specialized cybersecurity training programs, tapping into a lucrative and expanding market. This dual focus addresses immediate risks while creating new revenue streams.

- Data Breach Costs: The average cost of a data breach in the education sector in 2024 was estimated at $4.5 million, according to industry analysis.

- Online Learning Growth: By the end of 2025, it's projected that over 70% of all higher education courses will incorporate some form of online or blended learning delivery.

- Cybersecurity Skills Gap: The global cybersecurity workforce shortage is expected to reach 3.5 million professionals by 2025, indicating strong demand for relevant training.

The rapid advancement of AI and automation is fundamentally altering the business landscape, necessitating strategic financial planning for CFOs. By 2025, it's projected that AI will contribute trillions to the global economy, underscoring the need for investment in AI-driven tools and talent. This shift demands a proactive approach to workforce development, focusing on reskilling employees for roles that complement, rather than compete with, automated processes.

CFOs must also consider the financial implications of adopting new technologies, such as cloud computing and advanced analytics platforms, which are crucial for data-driven decision-making. For example, the global cloud computing market is expected to exceed $1 trillion by 2025, presenting both opportunities for cost savings and significant capital expenditure requirements.

Furthermore, the increasing reliance on digital infrastructure elevates the importance of robust cybersecurity measures. With cybercrime costs projected to reach $10.5 trillion annually by 2025, CFOs need to allocate substantial budgets towards protecting sensitive financial data and ensuring business continuity. This includes investing in advanced threat detection systems and ongoing employee training.

| Technological Factor | 2024/2025 Projection/Data | Financial Implication for CFOs |

| AI & Automation Adoption | AI market projected to exceed $1.8 trillion by 2030; Automation to impact 30% of work activities by 2030. | Investment in AI tools, reskilling workforce, potential cost savings through efficiency. |

| Cloud Computing Growth | Global cloud market expected to surpass $1 trillion by 2025. | Capital expenditure for migration and ongoing subscription fees, potential for scalability and reduced IT overhead. |

| Cybersecurity Threats | Cybercrime costs projected to reach $10.5 trillion annually by 2025. | Increased budget allocation for security infrastructure, insurance, and employee training; risk of significant financial loss from breaches. |

| Digital Learning Investment | Global e-learning market projected over $400 billion in 2024. | Budgeting for online training platforms, content development, and IT infrastructure to support remote learning. |

Legal factors

CFOS must adhere to Portuguese national education and training legislation, which dictates vocational training standards, professional certification requirements, and the operational framework for educational institutions. Failure to comply jeopardizes accreditation and the legal validity of its courses.

For instance, the Portuguese government, through the Ministry of Labour, Solidarity and Social Security, regularly updates regulations concerning adult education and lifelong learning. These updates, often released annually, can affect curriculum design and quality assurance processes, necessitating swift adaptation by CFOS to maintain its operational legality and course relevance.

Labor laws and employment regulations significantly shape how CFOS designs its practical training programs. For instance, adherence to apprenticeship laws, like those governing minimum wage for interns, directly impacts the cost structure of these partnerships. In 2024, the U.S. Department of Labor continued to emphasize fair labor practices, influencing how companies structure paid versus unpaid internships to remain compliant.

Understanding worker rights, including those related to working hours and safety, is crucial for CFOS when establishing business partnerships for student placements. Non-compliance can lead to penalties, affecting the financial viability of such collaborations. As of early 2025, there's a growing focus on gig economy worker protections, which could indirectly influence how CFOS structures its external training opportunities.

Changes in employment legislation can directly affect graduate job placement rates. For example, new regulations mandating specific training hours or certifications could create more opportunities for students completing CFOS programs, thereby boosting placement success. The ongoing evolution of labor markets, particularly with the rise of remote work, necessitates continuous monitoring of these legal frameworks to ensure optimal career outcomes for graduates.

Chief Financial Officers (CFOs) and financial education providers like the Chartered Financial Analyst (CFA) Institute must navigate a complex web of legal and regulatory frameworks. For instance, the CFA Program itself undergoes rigorous review by accreditation bodies to ensure its curriculum meets global standards, impacting its recognition for roles requiring specific financial expertise. Failure to maintain these accreditations can significantly hinder a professional's career progression and the perceived value of their qualifications in the job market.

In 2024, the landscape of financial regulation continues to evolve, with ongoing discussions around data privacy (like GDPR) and anti-money laundering (AML) compliance directly affecting how financial professionals operate and how institutions like CFOs must structure their training and certification processes. Ensuring that all course materials and certification examinations align with these evolving legal mandates is paramount to maintaining credibility and avoiding potential penalties that could impact both the institution and its graduates.

Data Protection and Privacy Laws (GDPR)

CFOs must ensure strict adherence to data protection laws like the General Data Protection Regulation (GDPR) for any personal data handled, particularly concerning students and staff. This necessitates secure data storage, clear policies on data usage, and strong cybersecurity protocols to prevent breaches.

Failure to comply with regulations such as GDPR can result in substantial financial penalties; for instance, in 2023, fines under GDPR exceeded €1.5 billion across the EU. Beyond financial repercussions, non-compliance severely damages an organization's reputation and erodes trust among students, staff, and stakeholders.

- GDPR Fines: In 2023, GDPR fines totaled over €1.5 billion across the EU.

- Data Security: Robust cybersecurity measures are essential to protect sensitive student and staff information.

- Transparency: Clear and accessible data usage policies build trust and ensure accountability.

- Reputational Risk: Data breaches can lead to significant and lasting damage to an organization's public image.

Health and Safety Regulations

Health and safety regulations are paramount, particularly for vocational training programs involving hands-on work with machinery and equipment. CFOs must guarantee that all facilities and training practices meet stringent safety standards, as evidenced by the 2024 Occupational Safety and Health Administration (OSHA) record-keeping requirements, which mandate detailed incident reporting. Non-compliance can lead to significant fines, operational disruptions, and reputational damage, impacting the organization's financial stability.

Ensuring compliance involves a proactive approach to risk management. For instance, in 2024, the construction industry, a sector heavily reliant on vocational training, saw a 5% increase in workplace injuries related to improper equipment handling, underscoring the need for rigorous safety protocols. CFOs are responsible for allocating resources towards up-to-date safety equipment, regular equipment maintenance, and comprehensive safety training for both instructors and students.

Regular safety audits are crucial for identifying and mitigating potential hazards. In 2025, organizations that conduct annual third-party safety audits reported a 15% reduction in workplace accidents compared to those that did not. These audits help ensure that training methodologies align with evolving safety best practices and regulatory updates, protecting the organization's most valuable assets: its people.

- Compliance with OSHA standards: Adherence to regulations like the Hazard Communication Standard is vital.

- Investment in safety equipment: Allocating budget for personal protective equipment (PPE) and machine guarding is essential.

- Regular safety training: Implementing ongoing training programs for staff and students reduces incident rates.

- Incident reporting and analysis: Establishing clear procedures for reporting and investigating accidents helps prevent recurrence.

Legal factors significantly influence financial operations and compliance. Adherence to evolving labor laws, such as minimum wage adjustments and internship regulations, directly impacts cost structures and partnership viability. For example, in 2024, the U.S. Department of Labor continued to focus on fair labor practices, affecting how companies structure internships.

Data protection laws, like GDPR, necessitate robust cybersecurity measures and transparent data usage policies, with significant financial penalties for non-compliance; in 2023, GDPR fines exceeded €1.5 billion across the EU. Maintaining accreditations and aligning certifications with global standards are also critical for professional recognition and career progression.

| Legal Factor | Impact on CFOs | 2023/2024/2025 Data Point |

|---|---|---|

| Labor Laws | Affects employment costs, internship structures, and worker rights. | U.S. Dept. of Labor emphasized fair labor practices in 2024. |

| Data Protection (GDPR) | Requires secure data handling, clear policies, and cybersecurity investment. | GDPR fines exceeded €1.5 billion across the EU in 2023. |

| Accreditation & Certification | Ensures curriculum relevance and professional recognition. | Ongoing reviews by accreditation bodies impact global recognition. |

Environmental factors

Growing environmental concerns are fueling a significant rise in demand for green skills. This surge is driven by the global shift towards a more sustainable economy, creating a need for expertise in areas like renewable energy, circular economy principles, and carbon footprint reduction. For instance, reports from 2024 indicate a substantial increase in job postings requiring sustainability-related qualifications across various sectors.

Chief Financial Officers have a strategic opportunity to capitalize on this trend by developing and offering specialized training programs in these in-demand green skills. This proactive approach not only addresses emerging market needs but also positions companies as leaders in sustainability. Such initiatives directly support national and EU environmental objectives, potentially unlocking access to green financing and government incentives.

CFOs must ensure their organizations, including their own operational footprint, meet environmental regulations concerning waste, energy use, and building codes. For instance, a company might face fines for improper hazardous waste disposal, impacting its bottom line directly. Staying compliant is crucial for maintaining operational licenses and avoiding penalties.

Adherence to these environmental standards, such as those set by the EPA, can unlock financial benefits. By optimizing energy consumption, a company could see a reduction in utility costs, potentially saving millions annually. In 2023, companies investing in energy efficiency measures reported an average of 10% decrease in operational expenses.

Demonstrating corporate responsibility through environmental compliance can also enhance brand reputation and investor confidence. Many institutional investors now screen companies based on their Environmental, Social, and Governance (ESG) performance, with sustainable practices becoming a key factor in capital allocation. This focus is expected to grow significantly by 2025.

Climate change presents significant environmental challenges that directly impact various industries, necessitating strategic adaptation for financial decision-makers. For instance, sectors heavily dependent on natural resources, such as agriculture and forestry, face altered production cycles and increased operational risks due to extreme weather events. The World Economic Forum's 2024 Global Risks Report highlights extreme weather as the top global risk, with significant economic implications.

These environmental shifts can lead to substantial changes in demand for specific skill sets within the workforce, potentially creating new job roles focused on sustainability and climate resilience. Industries may require a workforce retrained in areas like renewable energy installation, sustainable agriculture practices, or carbon accounting. For example, the renewable energy sector experienced a significant surge in investment, with global renewable capacity additions reaching an estimated 510 gigawatts in 2023, according to the International Energy Agency (IEA), indicating a growing demand for specialized skills.

Chief Financial Officers (CFOs) must proactively anticipate these industry transformations and adapt their organizational strategies, including workforce development and curriculum planning, to align with emerging economic landscapes. This foresight ensures that educational institutions and businesses remain relevant and competitive in a climate-conscious economy, preparing individuals for the evolving job market.

Resource Scarcity and Sustainable Operations

Awareness of resource scarcity is increasingly shaping CFOs' operational strategies, pushing for more sustainable material and energy usage. For instance, the global demand for critical minerals like lithium, essential for electric vehicle batteries, is projected to surge by 2030, highlighting the need for efficient resource management. This focus on sustainability can also serve as a valuable learning model for students, demonstrating the practical application of environmental responsibility in business.

Implementing environmentally friendly practices, such as adopting energy-efficient technologies, is becoming a strategic imperative. In 2024, the International Energy Agency reported that energy efficiency improvements are critical to meeting climate goals, with investments in this area expected to grow. Promoting responsible consumption within facilities, like reducing water usage or waste generation, further reinforces a company's commitment to sustainability and can lead to significant cost savings.

- Resource Efficiency: Companies are increasingly investing in technologies that reduce material waste and energy consumption.

- Supply Chain Resilience: CFOs are evaluating supply chains for dependencies on scarce resources, seeking diversification and alternative sourcing.

- Circular Economy Principles: Adoption of circular economy models, focusing on reuse, repair, and recycling, is gaining traction to mitigate scarcity.

- ESG Reporting: Growing pressure from investors and regulators means CFOs must accurately report on resource management and environmental impact.

Corporate Social Responsibility and Brand Image

CFO's commitment to environmental sustainability directly bolsters its corporate social responsibility (CSR) standing. This focus is increasingly vital as stakeholders, including students and business partners, prioritize organizations with strong environmental ethics. For instance, a 2024 survey by Edelman revealed that 60% of consumers globally are more likely to buy from brands that align with their values, including environmental protection.

By actively demonstrating a dedication to eco-friendly practices, CFO can significantly enhance its brand image. This can translate into a tangible competitive advantage, attracting environmentally conscious students who seek out institutions that reflect their own values. Furthermore, businesses increasingly seek partnerships with training providers that exhibit a clear commitment to sustainability, potentially opening doors for new collaborations and revenue streams.

The financial implications are also noteworthy. A robust CSR profile, driven by environmental stewardship, can lead to:

- Improved Brand Reputation: Studies from 2024 indicate that companies with strong CSR initiatives often experience higher brand loyalty and positive public perception.

- Attraction of Talent and Students: Millennials and Gen Z, who represent a significant portion of the student and workforce demographic, actively seek employers and educational institutions with a clear social and environmental purpose.

- Enhanced Investor Relations: Environmental, Social, and Governance (ESG) factors are becoming critical for investors, with sustainable investments seeing substantial growth, reaching trillions of dollars globally by early 2025.

- Risk Mitigation: Proactive environmental management can reduce the risk of regulatory fines and negative publicity associated with environmental non-compliance.

Environmental regulations are becoming increasingly stringent, impacting operational costs and requiring proactive compliance strategies. CFOs must navigate evolving standards related to carbon emissions, waste management, and pollution control, as seen in the EU's Green Deal initiatives. Failure to comply can result in significant fines, potentially impacting profitability and investor confidence.

The shift towards a circular economy is reshaping business models, emphasizing resource efficiency and waste reduction. Companies are exploring innovative approaches like product-as-a-service and advanced recycling technologies to minimize their environmental footprint. For example, the global market for circular economy solutions was valued at over $2 trillion in 2024 and is projected to grow substantially.

Climate change poses direct financial risks and opportunities, influencing investment decisions and supply chain management. CFOs are increasingly assessing climate-related risks, such as extreme weather events impacting operations or the transition risk associated with shifting to a low-carbon economy. The 2024 Global Risks Report by the World Economic Forum identified climate action failure as a top long-term risk.

| Environmental Factor | Impact on CFO Strategy | Data Point/Example |

|---|---|---|

| Regulatory Compliance | Ensuring adherence to environmental laws, managing compliance costs, and avoiding penalties. | EU's Fit for 55 package aims to reduce greenhouse gas emissions by at least 55% by 2030. |

| Resource Scarcity | Optimizing resource usage, exploring alternative materials, and securing supply chains. | Global demand for critical minerals like cobalt and lithium is projected to increase significantly by 2030 due to EV growth. |

| Climate Change Adaptation | Assessing and mitigating physical and transition risks associated with climate change. | Extreme weather events are projected to cost the global economy trillions of dollars by 2050 if not addressed. |

| Sustainable Finance | Accessing green bonds and ESG-linked financing, and meeting investor expectations for sustainability. | The global sustainable investment market reached over $35 trillion in assets under management by early 2025. |

PESTLE Analysis Data Sources

Our CFO PESTLE Analysis is built on a robust foundation of data from leading financial institutions, economic forecasting agencies, and reputable industry publications. We meticulously gather information on political stability, economic indicators, technological advancements, and social trends to provide actionable insights.