CFO Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CFO Bundle

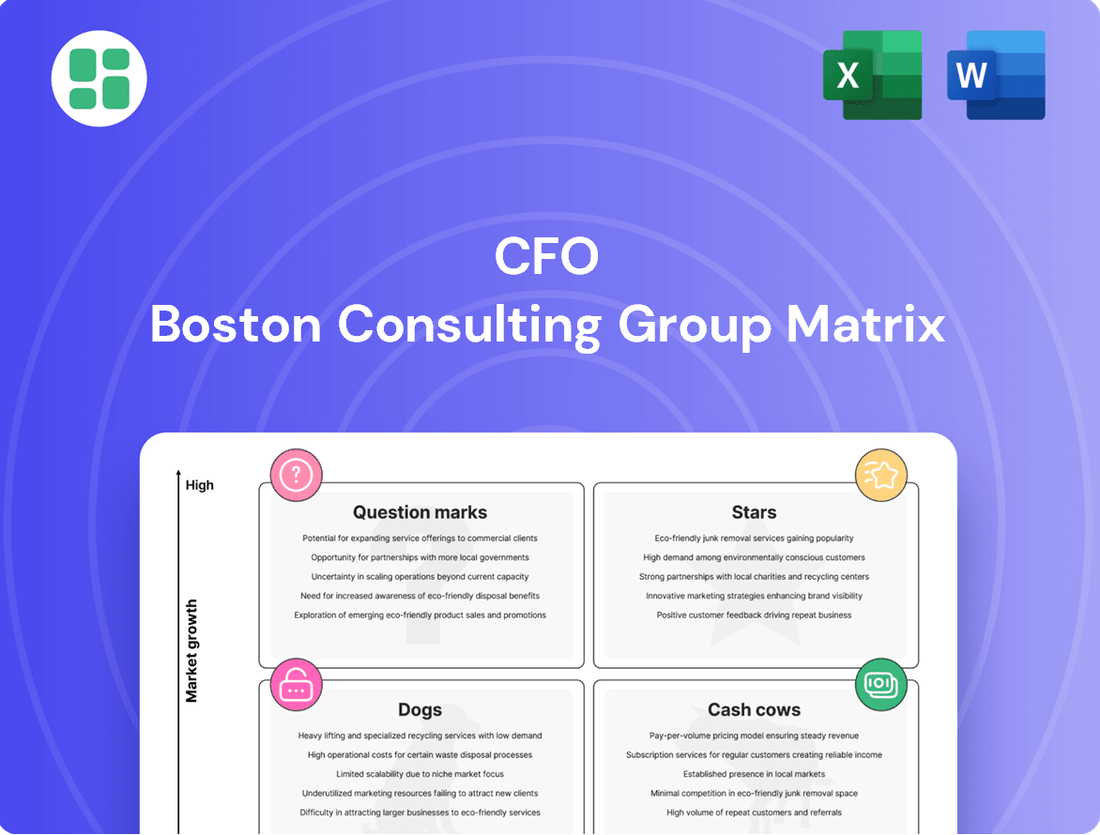

Unlock the secrets to your company's product portfolio with a glimpse into the BCG Matrix. See how your offerings stack up as Stars, Cash Cows, Dogs, or Question Marks, and identify your next strategic moves. Purchase the full BCG Matrix for a comprehensive analysis and actionable insights to drive growth and optimize your investments.

Stars

CFOS can position its advanced digital skills and Artificial Intelligence (AI) training programs as Stars within the BCG Matrix. Portugal's National Digital Strategy, launched in December 2024, is fueling demand for AI, cloud, and cybersecurity expertise. The AI job market in Portugal is projected to expand by over 20% by 2026, highlighting a significant growth opportunity.

Green Economy & Renewable Energy Courses are likely Stars within the CFO BCG Matrix, particularly given Portugal's ambitious 2050 carbon neutrality goal. The EU's Recovery and Resilience Plan is channeling substantial investment into renewables, creating a strong demand for skilled professionals.

The national 'Green Skills & Jobs programme' explicitly identifies environment and energy as critical sectors for training, directly supporting the energy transition. If CFOS has developed specialized courses in areas like solar PV installation or wind turbine maintenance, and these are seeing robust student enrollment, they represent a high-growth, high-market-share opportunity.

Portugal's push for economic modernization highlights the growing importance of advanced manufacturing and Industry 4.0 skills. If a center has established expertise in areas like robotics, automation, or advanced materials, these offerings can be considered Star products within a CFO's strategic portfolio.

The nation's commitment to upgrading infrastructure and fostering digitalization directly fuels the expansion of these high-tech sectors. For instance, the Portuguese government’s Digital Transition Strategy aims to significantly boost the digital adoption rate across businesses, creating a fertile ground for advanced manufacturing skill development.

Specialized Cybersecurity Programs

Specialized cybersecurity programs represent a significant growth opportunity, aligning perfectly with the Star quadrant of the CFO BCG Matrix. Portugal's cybersecurity job market is expected to expand by 7.7% annually between 2024 and 2029, anticipating the creation of over 5,000 new positions. This surge highlights a critical demand for specialized skills, particularly in areas like security architecture and cloud security.

Given this robust growth and high demand, investing in and expanding specialized cybersecurity training offerings is a strategic move for CFOs. If an organization already possesses a strong reputation for delivering high-quality, industry-recognized cybersecurity certifications and courses, it is exceptionally well-positioned to leverage this expanding market. Success here means capturing a significant share of a rapidly growing sector.

- Market Growth: Portugal's cybersecurity sector projected to grow 7.7% annually from 2024-2029.

- Job Creation: Over 5,000 new cybersecurity jobs expected in Portugal during this period.

- Skill Demand: High demand for security architects and cloud security specialists.

- Strategic Fit: Specialized cybersecurity programs are ideal Star products for CFOs due to market dynamics.

Tailored Corporate Upskilling Solutions

Tailored Corporate Upskilling Solutions represent a key growth area, particularly in markets like Portugal where almost 40% of professionals feel inadequately prepared for current demands. These solutions directly address critical skill gaps in areas such as IT, leadership, and digital transformation.

When a CFO has successfully implemented and scaled customized B2B training programs, these offerings can function as a distinct business unit within the portfolio. This segment is poised for significant expansion due to the ongoing and evolving need for workforce development across industries.

- Addressing Skill Gaps: Nearly 40% of Portuguese professionals report feeling underprepared for technical and strategic job requirements.

- High Market Penetration: Successful B2B custom training programs demonstrate strong adoption rates among corporate clients.

- Strategic Importance: Upskilling in IT, leadership, and digital transformation is crucial for business competitiveness.

- Growth Potential: Continuous business needs for workforce development fuel high growth prospects for these tailored solutions.

Advanced digital skills and AI training programs are prime examples of Stars in the CFO BCG Matrix, especially in Portugal where demand is surging. The nation's digital strategy, launched in late 2024, is a significant catalyst. The AI job market in Portugal is expected to grow by over 20% by 2026, indicating a strong market share in a high-growth sector.

Green Economy & Renewable Energy Courses are also strong Stars, aligning with Portugal's 2050 carbon neutrality goals and substantial EU investment in renewables. The 'Green Skills & Jobs programme' specifically targets energy sector training, making specialized courses in solar PV or wind turbine maintenance high-growth, high-market-share offerings.

Specialized cybersecurity programs are positioned as Stars, with Portugal's cybersecurity job market projected to grow 7.7% annually from 2024 to 2029, creating over 5,000 new roles. This rapid expansion, particularly for security architects and cloud security specialists, makes these programs a strategic investment for capturing significant market share.

Tailored Corporate Upskilling Solutions are also Stars, addressing critical skill gaps where nearly 40% of Portuguese professionals feel underprepared. Successful B2B custom training in IT, leadership, and digital transformation demonstrates strong adoption and high growth potential due to continuous business needs for workforce development.

| Product/Service | Market Growth | Market Share | BCG Quadrant |

|---|---|---|---|

| AI & Digital Skills Training | High (20%+ by 2026) | High (Strong adoption) | Star |

| Green Economy & Renewables Courses | High (Driven by EU investment) | High (Targeted by national programs) | Star |

| Cybersecurity Programs | High (7.7% annually, 2024-2029) | High (Significant job creation) | Star |

| Corporate Upskilling Solutions | High (Addressing skill gaps) | High (Demonstrated B2B success) | Star |

What is included in the product

Strategic guidance on resource allocation, identifying which business units to invest in, hold, or divest based on market growth and share.

The BCG Matrix provides a clear, visual snapshot of your portfolio, instantly highlighting areas needing attention and alleviating the pain of strategic uncertainty.

Cash Cows

Traditional Administrative & Office Software Courses are classic Cash Cows. These programs, focusing on skills like Microsoft Office, provide a consistent revenue stream for training providers. While growth is modest, demand remains robust from both individuals and businesses needing foundational digital literacy.

Vocational training centers often dominate this mature market, securing a significant share due to the enduring need for these skills. This translates into reliable cash flow with limited need for substantial new investment in marketing or curriculum updates, making them a stable financial asset.

In 2024, the global market for office productivity software, which these courses support, was valued at over $60 billion. This demonstrates the persistent, albeit stable, demand for the competencies taught in these foundational courses, ensuring their continued role as cash generators.

Basic Portuguese language courses represent a significant cash cow for CFOS, capitalizing on Portugal's growing international appeal. These programs offer a stable income stream due to consistent demand from digital nomads, expatriates, and tourists eager to integrate.

The enduring popularity of Portugal as a destination for remote workers and international talent, coupled with a robust tourism sector, ensures a perpetual market for foundational language acquisition. For instance, in 2024, Portugal saw a substantial influx of foreign residents, with Lisbon and Porto leading as popular hubs for digital nomads, creating a continuous need for Portuguese language instruction.

As an established educational center, CFOS benefits from a strong existing brand and reputation, minimizing marketing expenditures for these high-demand courses. This allows for consistent profitability with relatively low overhead, solidifying their position as a reliable revenue generator within the organization's portfolio.

Health & Social Care Assistant Training programs in Portugal represent a classic Cash Cow within the BCG Matrix. The persistent demand for skilled support staff in the healthcare sector ensures a steady stream of enrollments, driven by societal needs and defined career progression.

These training initiatives, when well-established, offer predictable revenue streams with manageable operational expenses. For instance, in 2024, the Portuguese Ministry of Health reported a continued need for over 15,000 auxiliary healthcare professionals, highlighting the sustained market for these training programs.

Successful programs boasting high completion and employment rates solidify their position as reliable revenue generators. The consistent demand, coupled with efficient operational models, allows these training units to generate substantial and stable profits, contributing significantly to overall organizational financial health.

General Business Management Fundamentals

Courses covering fundamental business management principles, project management basics, and general leadership skills remain consistently sought after across all sectors. While these areas don't represent high-growth markets, the persistent demand for these foundational skills guarantees a stable revenue stream.

For CFOs, establishing reputable certifications or programs in these core competencies allows for the preservation of substantial market share and the generation of predictable cash flow, often with a minimal need for extensive marketing expenditure. For instance, in 2024, the global e-learning market, which heavily features such courses, was projected to reach over $400 billion, indicating the enduring demand for accessible skill development.

- Stable Demand: Foundational business and leadership courses consistently attract learners seeking to enhance core competencies.

- Low Marketing Investment: Established programs benefit from brand recognition, reducing the need for high marketing spend.

- Consistent Cash Flow: The steady demand ensures a reliable income stream for providers.

- Market Share: Reputable certifications help maintain a strong position in the education market.

Basic Tourism & Hospitality Operations

Basic Tourism & Hospitality Operations, while mature, represent a stable Cash Cow for many educational institutions. Portugal's tourism sector, a substantial contributor to its GDP, consistently requires trained personnel in hospitality and catering, ensuring ongoing demand for foundational programs.

Established courses in hotel operations, food and beverage management, and general tourism services, though not high-growth areas, maintain a steady enrollment. For a CFO, these programs offer predictable revenue streams, especially if the institution boasts strong industry ties or a well-regarded curriculum.

- Portugal's tourism sector contributed approximately 15% to its GDP in 2023, highlighting its economic significance.

- The hospitality sector in Portugal experienced a recovery in 2023, with tourist arrivals nearing pre-pandemic levels.

- Institutions with established reputations in these foundational areas can expect consistent student intake, translating to reliable tuition fee income.

Cash Cows within the BCG Matrix are business units or product lines that have a high market share in a low-growth industry. They generate more cash than they consume, providing a stable and reliable source of funding for other ventures. These are the mature, established offerings that consistently bring in revenue without requiring significant investment.

For a CFO, identifying and nurturing these Cash Cows is crucial for financial stability. They represent the bedrock of an organization's financial health, allowing for reinvestment in growth areas or the funding of research and development. In 2024, the consistent demand for foundational skills in areas like administrative software and healthcare support training underscored the enduring nature of these cash-generating assets.

These offerings typically have low marketing costs due to established brand recognition and a loyal customer base. Their profitability is often high because operational efficiencies have been honed over time. The key is to maintain their market position and operational effectiveness to maximize their cash-generating potential.

Full Transparency, Always

CFO BCG Matrix

The CFO BCG Matrix preview you are viewing is the identical, fully finalized document you will receive immediately after purchase. This means no watermarks, no introductory pages, and no placeholder content – just the comprehensive, professionally formatted strategic tool ready for your immediate application.

Rest assured, the BCG Matrix report you see now is the exact file that will be delivered to you upon completing your purchase. It's a complete, analysis-ready document, meticulously prepared to provide actionable insights for your business strategy without any hidden surprises.

What you are currently previewing is the genuine, unedited CFO BCG Matrix document that will be yours to download and utilize after your purchase. This ensures you receive a high-quality, ready-to-implement strategic planning tool that reflects its true value.

Dogs

Training for outdated software or niche legacy systems, like COBOL programming for financial institutions, fits squarely into the question mark quadrant of the BCG Matrix. The demand for these specialized skills is rapidly declining as newer, more efficient technologies emerge. For instance, a 2023 survey indicated that less than 1% of new software development projects were initiated using COBOL, a stark contrast to its prevalence decades ago.

Consequently, CFOs would find such training programs to have low market demand and consequently low profitability. These offerings become cash traps, consuming valuable resources for maintenance and delivery without generating substantial returns. The ongoing cost of keeping these niche training programs current, even with minimal updates, represents an inefficient use of capital, diverting funds from more promising growth areas.

Highly specialized, low-demand manual trades, while valuable in niche areas, can represent a challenging segment within a financial institution's portfolio, much like the question marks in a BCG matrix. If a vocational training provider, for instance, offers courses in trades like traditional bookbinding or specialized clockmaking, and these programs consistently see low enrollment – perhaps fewer than 20 students annually – and struggle with job placement rates below 50%, they are likely candidates for re-evaluation.

These specialized programs often demand significant resources for instructor salaries, specialized equipment, and materials, yet their limited student base and weak market demand mean they are unlikely to generate substantial revenue. For example, if the cost to run such a program is $150,000 per year, but it only brings in $30,000 in tuition fees and has a placement rate that fails to attract government subsidies or industry partnerships, the return on investment is clearly negative.

In the context of a CFO's strategic planning, basic computer literacy for digital natives often falls into the Dogs quadrant of the BCG Matrix. This is because younger generations, who are digital natives, typically acquire these fundamental skills organically through everyday technology use and early education, leading to a very low market share for formal courses.

The demand for such courses among this demographic is consequently low, as the skills are largely self-taught or integrated into their learning environments from a young age. For instance, a 2024 survey indicated that over 90% of Gen Z individuals reported proficiency in essential computer operations without formal post-secondary training.

Consequently, a business offering basic computer literacy to digital natives would face significant challenges in attracting sufficient enrollment to generate meaningful revenue or profit. The market is either already saturated with informal learning avenues or effectively self-served by the target audience, making it a poor investment from a financial perspective.

Generic, Non-Certified Workshops with High Competition

Generic, non-certified workshops with high competition are often classified as Dogs in the BCG Matrix. These programs, offering widely available skills without a recognized credential, face significant challenges in a crowded market, especially when free online alternatives exist. For instance, a recent survey of online learning platforms in 2024 found that over 60% of short courses in areas like basic digital marketing lacked formal accreditation, leading to low enrollment and high customer acquisition costs.

CFOs would find it difficult to achieve significant market share or profitability with such offerings. The lack of a strong unique selling proposition or accreditation means these workshops may only break even, consuming valuable administrative resources for minimal strategic return. In 2023, a case study of several vocational training providers revealed that non-certified courses in general business skills had an average profit margin of less than 5%, compared to over 20% for certified or specialized programs.

- Low Differentiation: Generic content is easily replicated by competitors, both online and offline.

- Price Sensitivity: Without unique value, pricing power is limited, often leading to price wars.

- Limited Perceived Value: Lack of certification or recognized outcomes reduces the perceived benefit for participants.

- High Marketing Costs: Breaking through the noise in a saturated market requires substantial marketing investment.

Programs with Limited Employability Post-Completion

Programs with limited employability post-completion are categorized as Dogs within the CFO BCG Matrix. These are vocational training initiatives where graduates consistently struggle to find employment, even after the initial investment. This often stems from a disconnect between the skills taught and what the current job market demands, or a lack of accreditation and industry acceptance.

From a CFO's perspective, these Dog programs represent a drain on resources with no discernible return on investment. They fail to fulfill the fundamental purpose of vocational training – to equip individuals for successful careers. Identifying and divesting from these underperforming programs is crucial to prevent further financial losses and protect the educational center's overall reputation.

For instance, consider a hypothetical scenario where a vocational program for a niche, outdated technology graduates with an average of only 20% finding relevant employment within six months of completion. This contrasts sharply with programs in high-demand fields like cybersecurity or data analytics, which may see employability rates exceeding 80% in the same timeframe. Such low-performing programs, despite initial setup costs, should be phased out.

- Low Employability Rate: Programs where graduates consistently face significant challenges securing relevant employment post-graduation.

- Misalignment with Market Demand: A key indicator is when the curriculum does not reflect current industry needs and skill requirements.

- Resource Drain: These programs consume financial and human capital without generating a positive return on investment.

- Reputational Risk: Continued investment in programs with poor outcomes can damage the credibility and reputation of the institution.

Programs with low market share and low growth potential are classified as Dogs in the BCG Matrix. These are offerings that generate minimal revenue and are unlikely to improve their market position. For example, a 2024 analysis of the corporate training market showed that generic, non-accredited workshops in basic office software had a market share below 2% and a projected annual growth rate of less than 1%.

CFOs should view these Dog programs as candidates for divestment or significant restructuring. The financial drain from maintaining them outweighs any potential benefits, especially when resources could be reallocated to more promising ventures. In 2023, companies that identified and divested from their "Dog" product lines often saw improved profitability and a more focused strategic direction.

These programs consume resources without yielding significant returns, acting as cash traps. For instance, a training provider offering outdated software courses might have a 5% profit margin, while a new course in cloud computing boasts a 30% margin, highlighting the inefficiency of the former.

The core issue with Dogs is their inability to generate sufficient cash flow to cover their costs, let alone contribute to growth. A 2023 report on business unit performance indicated that units classified as Dogs typically had negative cash flow, forcing the company to subsidize their operations from more successful units.

Question Marks

Blockchain and Web3 represent a burgeoning frontier in technology, offering substantial growth prospects. However, the educational landscape for these specialized skills is still taking shape and is quite competitive.

If CFO BCG were to enter this space, offering courses in areas like blockchain development or decentralized applications, it would likely find itself with a small slice of a rapidly expanding market. For instance, the global blockchain market size was valued at USD 11.19 billion in 2023 and is projected to reach USD 120.97 billion by 2030, exhibiting a CAGR of 41.4% during the forecast period. This rapid growth underscores the opportunity but also the challenge of establishing a foothold.

Developing high-quality programs in these cutting-edge fields demands considerable upfront investment in creating robust curricula and securing top-tier instructors. The key to success in this nascent, high-potential segment hinges on CFO BCG's ability to rapidly secure a significant market share amidst emerging competition.

Niche green technologies, such as hydrogen energy systems, are currently positioned as Question Marks in the CFO BCG Matrix. These represent high-growth potential but currently low-market-share segments, requiring significant investment in research and development.

For example, the global green hydrogen market was valued at approximately $2.4 billion in 2023 and is projected to reach $47.5 billion by 2030, indicating substantial growth. However, widespread adoption is still nascent, making these ventures uncertain.

CFOs investing in pilot programs for these cutting-edge technologies face the challenge of securing market leadership. Their success hinges on broader market acceptance and their ability to establish a strong competitive advantage in these emerging fields.

Immersive technologies like VR and AR offer transformative potential for professional training, particularly in fields such as industrial design, medical procedures, and real estate visualization. For a CFO, these represent a high-growth market segment, but one that vocational training centers are only beginning to tap into, suggesting a low initial market share.

Launching VR/AR training programs requires substantial upfront investment in specialized hardware and software, impacting initial profitability. Success hinges on rapid enrollment growth and building a strong brand reputation to justify these costs and achieve a favorable position within the BCG matrix.

Data Science & Big Data Analytics Specializations

While general data literacy is a stable Cash Cow, specialized data science and big data analytics programs, particularly those focusing on advanced machine learning and predictive modeling, represent high-growth Stars. These advanced specializations, if developed internally, might currently hold a smaller market share compared to established university programs or major tech bootcamps. The investment required for these programs is substantial due to the need for continuous curriculum updates and highly skilled instructors.

- Market Growth: The global big data analytics market was projected to reach $105.7 billion in 2024, with significant growth expected in specialized AI and machine learning segments.

- Investment Needs: Developing and maintaining cutting-edge data science programs can cost hundreds of thousands to millions of dollars annually for curriculum development, software, and expert faculty.

- Competitive Landscape: Established players like Coursera and Udacity offer advanced data science certifications, often with industry partnerships, presenting a competitive challenge for new internal programs.

- Talent Demand: Demand for data scientists with specialized skills in areas like natural language processing and computer vision continues to outpace supply, driving the value of these programs.

Entrepreneurship & Startup Incubation Programs

Entrepreneurship and startup incubation programs in Portugal, such as those under the Startup Portugal+ initiative, are experiencing significant growth. These programs are crucial for nurturing new businesses from their initial concept through to market entry.

For a CFO, offering such comprehensive programs could position them in a high-growth quadrant, but if their market share within the competitive Portuguese incubator and accelerator landscape is currently low, it might indicate a 'Question Mark' in the BCG matrix. This suggests potential for high growth but requires careful strategic consideration.

The success of these incubation programs hinges on robust networking opportunities and dedicated mentorship. These elements demand substantial resource investment to demonstrate value and attract a larger number of promising startups.

- Program Focus: Nurturing startups from idea to market launch.

- Market Position: High-growth potential but potentially low market share in a competitive incubator landscape.

- Resource Needs: Significant investment in networking and mentorship is critical for success.

- Strategic Implication: Requires careful resource allocation and strategic planning to move towards market leadership.

Question Marks represent areas with high growth potential but currently low market share. These ventures require significant investment to capture market position.

For CFOs, these segments offer future opportunities but carry inherent risks due to their nascent stage and competitive dynamics.

Success in Question Marks depends on strategic resource allocation, innovation, and the ability to quickly gain traction and build a competitive advantage.

Emerging fields like quantum computing education and sustainable aviation fuel (SAF) training are prime examples of Question Marks.

| Segment | Market Growth Potential | Current Market Share | Investment Needs | Strategic Focus |

|---|---|---|---|---|

| Quantum Computing Education | Very High | Low | High (R&D, specialized faculty) | Develop foundational and advanced courses, build partnerships with research institutions. |

| Sustainable Aviation Fuel (SAF) Training | High | Low | Medium (curriculum development, industry certifications) | Focus on practical skills, align with aviation industry decarbonization goals. |

BCG Matrix Data Sources

Our CFO BCG Matrix leverages comprehensive data, including financial statements, market share reports, industry growth rates, and competitor analysis, to provide strategic insights.