Central Bank of India PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Central Bank of India Bundle

Navigate the dynamic landscape of India's financial sector with our comprehensive PESTLE analysis of the Central Bank of India. Understand the intricate interplay of political stability, economic growth, evolving social demographics, technological advancements, environmental regulations, and legal frameworks that are shaping its strategic direction. This analysis is your key to unlocking actionable insights for informed decision-making and competitive advantage. Download the full PESTLE analysis now to gain a deeper understanding and propel your strategy forward.

Political factors

Government policies significantly shape the banking landscape in India. Recent reforms, including the recapitalization of public sector banks and plans for divestment, directly influence institutions like Central Bank of India. These initiatives aim to bolster financial health and improve operational efficiency across the sector.

The Indian government's commitment to strengthening public sector banks, evidenced by recapitalization efforts, provides a crucial support mechanism. For Central Bank of India, these policies can enhance its capital adequacy ratios and expand its lending capacity, thereby influencing its strategic decision-making and operational autonomy. For instance, the government's recapitalization infusion in public sector banks during the fiscal year 2023-24 was a key factor in their improved performance.

The Central Bank of India actively participates in government-led financial inclusion initiatives such as the Pradhan Mantri Jan Dhan Yojana (PMJDY). This program aims to provide access to banking, insurance, and pension services to all citizens, particularly in rural and underserved regions. By integrating with these schemes, the bank has seen a significant expansion of its customer base, reaching millions of new account holders, especially in previously unbanked areas, thereby broadening its service outreach.

The Reserve Bank of India (RBI) and the Ministry of Finance significantly shape Central Bank of India's operations through monetary policy and regulatory frameworks. Changes in interest rates, liquidity management, and capital adequacy norms directly impact the bank's lending capacity and profitability.

For instance, the RBI's repo rate adjustments in 2024-2025 influence the cost of funds for Central Bank of India, affecting its net interest margins. Furthermore, evolving prudential norms on asset quality and risk management necessitate continuous adaptation in the bank's compliance and operational procedures.

Political Stability and Economic Agenda

India's political landscape remains a significant factor for the Central Bank of India. A stable government, particularly one committed to economic reforms and growth, directly translates into increased investor confidence. This stability is crucial for the bank's ability to expand its lending operations and maintain healthy asset quality.

The current government's economic agenda, with its emphasis on infrastructure development and boosting manufacturing, presents opportunities for credit expansion. For instance, the National Infrastructure Pipeline aims for ₹111 lakh crore (approximately $1.3 trillion) in infrastructure investment by 2025, which can drive demand for project financing. The bank's strategic alignment with these national priorities can significantly influence its credit growth trajectory.

- Government's Focus on Infrastructure: The ₹111 lakh crore National Infrastructure Pipeline (2020-2025) signals strong government commitment, directly benefiting banks like Central Bank of India through project financing opportunities.

- Economic Growth Initiatives: Policies aimed at boosting manufacturing and digital infrastructure, such as the Production Linked Incentive (PLI) schemes, can stimulate business activity and increase demand for corporate loans.

- Investor Confidence: A stable political environment, evidenced by consistent policy implementation, enhances foreign and domestic investor sentiment, leading to greater capital inflows and potentially lower borrowing costs for businesses.

Geopolitical Influences and International Relations

Geopolitical shifts significantly shape India's banking sector, influencing cross-border activities and the broader economic environment. Central Bank of India, like other financial institutions, navigates these complexities. For instance, India's active participation in international trade agreements, such as the recent focus on deepening ties with ASEAN nations and exploring new partnerships in the Middle East and Africa, can boost trade finance and correspondent banking relationships. Conversely, global economic slowdowns or trade protectionism in major economies could dampen international transaction volumes.

Foreign investment policies, both inbound and outbound, directly affect capital flows and the banking industry's liquidity. India's efforts to attract foreign direct investment, as seen in the continued liberalization of sectors and improved ease of doing business, are positive for banks. However, international sanctions imposed on certain countries or entities can create compliance challenges and restrict certain types of transactions for banks operating with global exposure.

The overall economic climate, heavily influenced by international relations, impacts Central Bank of India's operational landscape. For example, rising global interest rates can affect funding costs and loan demand. India's strategic positioning in global supply chains and its stance on international conflicts also contribute to the risk assessment for financial institutions. In 2024, India's continued emphasis on 'Atmanirbhar Bharat' (self-reliant India) alongside its engagement in multilateral forums like BRICS and G20 highlights its balancing act between domestic growth and international cooperation, which indirectly affects the banking sector's opportunities and risks.

- Trade Agreements: India's trade agreements, such as the Comprehensive Economic Partnership Agreement (CEPA) with the UAE, aim to boost bilateral trade, creating more opportunities for banks to facilitate cross-border payments and trade finance.

- Foreign Investment: India received approximately $71 billion in FDI in FY23, indicating a healthy appetite from global investors, which benefits banks through increased deposit bases and lending opportunities.

- Global Economic Climate: Persistent inflation and interest rate hikes in major economies in 2023-2024 presented challenges for global liquidity, potentially increasing funding costs for Indian banks with international operations.

- International Sanctions: Compliance with evolving international sanctions regimes requires robust risk management frameworks within banks to avoid penalties and maintain correspondent banking relationships.

Government policies are a cornerstone for Central Bank of India's operations. The Indian government's commitment to public sector bank reforms, including recapitalization efforts, directly impacts the bank's financial health and strategic direction. For instance, the government's infusion of capital into public sector banks during FY23-24 was a significant factor in their improved performance metrics.

Central Bank of India actively engages with government-led financial inclusion schemes like the Pradhan Mantri Jan Dhan Yojana (PMJDY). This participation has led to a substantial increase in its customer base, particularly in underserved regions, broadening its outreach and service accessibility.

The government's focus on infrastructure development, exemplified by the National Infrastructure Pipeline aiming for ₹111 lakh crore by 2025, creates substantial opportunities for project financing. Central Bank of India's alignment with these national priorities can significantly drive its credit growth and overall business expansion.

What is included in the product

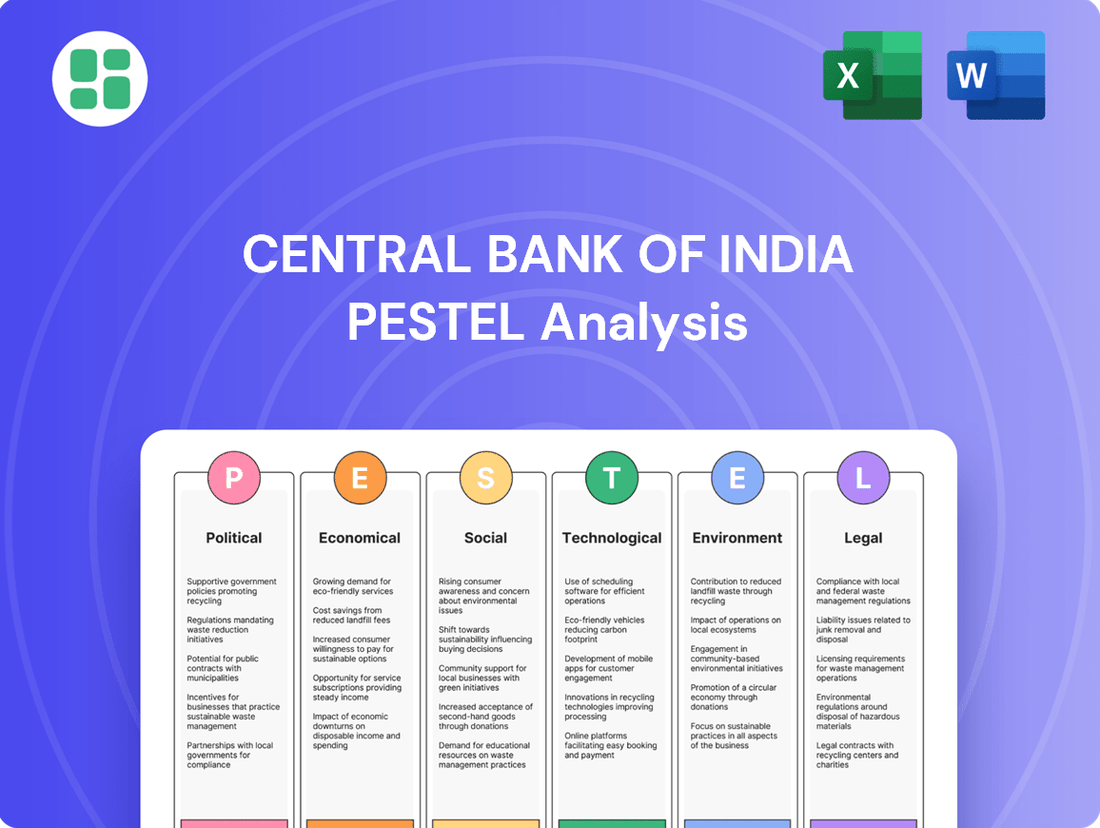

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors influencing the Central Bank of India, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers actionable insights into potential threats and opportunities, enabling strategic decision-making for stakeholders.

A PESTLE analysis for the Central Bank of India provides a clear, summarized version of external factors, easing the burden of navigating complex market dynamics during strategic planning.

This analysis, segmented by PESTEL categories, acts as a pain point reliever by offering quick interpretation, allowing stakeholders to efficiently identify and address external risks impacting the bank's market positioning.

Economic factors

The Reserve Bank of India's (RBI) monetary policy significantly influences Central Bank of India's financial performance. For instance, the RBI's repo rate, a key policy tool, directly impacts the cost of funds for banks. A higher repo rate generally leads to increased borrowing costs for Central Bank of India, potentially squeezing its Net Interest Margin (NIM).

In 2024, the RBI maintained a cautious stance on interest rates, with the repo rate holding steady for extended periods. This stability provided some predictability for banks like Central Bank of India. However, any future upward adjustments to the repo rate could increase the bank's funding expenses, while a reduction might boost credit demand by making loans cheaper for customers.

The RBI's liquidity management operations, including reverse repo rates and open market operations, also play a crucial role. By absorbing or injecting liquidity into the system, the RBI can influence interbank lending rates, thereby affecting Central Bank of India's cost of funds and its ability to lend profitably.

Inflationary pressures significantly influence the Central Bank of India's operations. High inflation, as seen with India's CPI inflation reaching 5.1% in January 2024, can diminish consumer purchasing power, potentially impacting loan repayment abilities and increasing the risk of non-performing assets for the bank.

Conversely, robust economic growth, indicated by India's projected GDP growth of 6.5% for FY2024-25, generally fuels credit demand across various sectors. This increased demand can translate into higher loan volumes and improved asset quality for Central Bank of India, as businesses and individuals are more likely to invest and borrow during periods of economic expansion.

Overall credit demand in India remained robust through 2024 and into early 2025, driven by sustained economic activity. Sectors like manufacturing and services showed particularly strong borrowing appetite, contributing to the banking system's loan book expansion.

Agriculture, while facing some localized weather challenges, saw steady credit demand, especially for working capital and capital expenditure. MSMEs, a crucial engine of growth, also exhibited increasing credit needs as they recovered and expanded operations, though access to credit remained a focus area for policy intervention.

Large corporates continued to leverage credit for expansion, infrastructure development, and mergers and acquisitions. This diversified demand across sectors positively impacts Central Bank of India's loan portfolio, offering opportunities for growth while necessitating careful risk management to maintain asset quality.

Liquidity Conditions and Capital Availability

Liquidity conditions in India's financial system are generally robust, supported by the Reserve Bank of India's (RBI) monetary policy stance. As of early 2024, the RBI has maintained a focus on managing inflation while ensuring adequate liquidity to support economic growth. This translates to readily available capital for banks, influencing their lending capacity. The availability of stable funding sources, including deposits and interbank borrowing, remains a key determinant of a bank's operational expansion.

Capital adequacy ratios are crucial indicators of a bank's financial health and its ability to absorb potential losses, thereby influencing its lending appetite. For instance, the RBI mandates adherence to Basel III norms, requiring banks to maintain specific capital to risk-weighted assets ratios. As of September 2023, the aggregate Capital to Risk-Weighted Assets Ratio (CRAR) for Scheduled Commercial Banks (SCBs) stood at a healthy 16.1%. This strong capital position empowers banks like the Central Bank of India to lend more confidently and pursue growth strategies.

Key factors influencing liquidity and capital availability for banks in India include:

- Monetary Policy Stance: The RBI's repo rate and liquidity adjustment facility operations directly impact the cost and availability of funds in the banking system.

- Deposit Growth: Strong growth in customer deposits provides a stable and cost-effective source of funding for banks. For example, bank deposits grew by approximately 10.5% year-on-year as of January 2024.

- Interbank Market Conditions: The health and efficiency of the interbank market facilitate the smooth flow of liquidity between financial institutions.

- Capital Adequacy Ratios: Maintaining robust CRAR, well above regulatory minimums, enhances a bank's capacity to lend and absorb shocks.

Global Economic Trends and Commodity Prices

Global economic trends significantly shape India's financial landscape. A slowdown in major economies, for instance, can dampen demand for Indian exports, impacting trade balances and corporate earnings. Conversely, a global boom can boost economic activity and investment inflows. For the Central Bank of India, these global cycles influence asset valuations and the performance of sectors it has exposure to.

Fluctuations in international commodity prices, particularly oil, have a direct bearing on India's import bill and inflation. For example, a sustained rise in crude oil prices, as seen in periods of geopolitical tension, increases inflationary pressures and can widen the current account deficit. This necessitates careful monetary policy adjustments by the Central Bank of India to manage price stability and economic growth.

- Impact of Global Growth: A projected 2.6% global GDP growth in 2024, according to the IMF, offers a moderately supportive environment for Indian exports and investment.

- Commodity Price Volatility: Brent crude oil prices have seen significant swings, averaging around $80-$85 per barrel in early 2024, impacting India's import costs and inflation outlook.

- Trade Balance Concerns: A widening trade deficit, driven by higher import costs for commodities like oil and coal, can strain foreign exchange reserves and affect the banking sector's liquidity.

- Sectoral Exposure: Global downturns can disproportionately affect export-oriented sectors like IT and manufacturing, leading to potential non-performing assets for banks with significant exposure to these industries.

The Reserve Bank of India's (RBI) monetary policy is a critical economic factor for Central Bank of India. The repo rate, a key tool, directly influences borrowing costs. India's CPI inflation was 5.1% in January 2024, impacting purchasing power and loan repayment. Robust economic growth, with India's GDP projected at 6.5% for FY2024-25, fuels credit demand.

| Economic Factor | Data Point | Impact on Central Bank of India |

|---|---|---|

| Repo Rate (RBI) | Stable through much of 2024 | Predictable funding costs; potential for increased expense with hikes. |

| India CPI Inflation | 5.1% (Jan 2024) | Risk to consumer repayment capacity and asset quality. |

| India GDP Growth Projection | 6.5% (FY2024-25) | Supports credit demand and loan volume growth. |

| Bank Deposit Growth | ~10.5% YoY (Jan 2024) | Provides stable, cost-effective funding source. |

| Global GDP Growth | 2.6% (2024 IMF projection) | Moderately supportive for Indian exports and investment. |

What You See Is What You Get

Central Bank of India PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of the Central Bank of India delves into the Political, Economic, Social, Technological, Legal, and Environmental factors influencing its operations and strategy. You'll gain valuable insights into the current landscape and potential future challenges and opportunities.

Sociological factors

India's demographic landscape is rapidly evolving, with a significant portion of its population being young and increasingly flocking to urban centers. This shift directly impacts banking needs, creating demand for digital services, flexible investment options, and accessible credit for a growing workforce. Central Bank of India is responding by enhancing its mobile banking platforms and tailoring loan products for young professionals and small businesses in metropolitan areas.

The bank is also focusing on financial literacy programs aimed at younger demographics and those new to urban financial systems. As of early 2024, India's median age hovers around 28 years, highlighting the substantial young population whose financial habits are being shaped by technology. This presents opportunities for Central Bank of India to capture a new generation of customers through innovative digital offerings and customer-centric product development.

Central Bank of India actively promotes financial literacy through various initiatives, aiming to empower individuals with the knowledge to make informed financial decisions. These efforts are crucial for increasing financial inclusion, especially in rural and semi-urban areas where access to formal banking services has historically been limited.

By expanding financial literacy, the bank not only helps individuals manage their money better but also broadens its own customer base. This strategy is particularly effective in bringing previously unbanked populations into the formal financial system, as seen in the significant growth of Jan Dhan accounts, a key government initiative for financial inclusion.

Consumer preferences are rapidly shifting towards digital channels for banking, driven by convenience and accessibility. Central Bank of India is responding by enhancing its internet and mobile banking platforms, aiming to meet the growing demand for seamless online transactions. This digital push is influencing the bank's strategy, leading to a re-evaluation of its physical branch network and a focus on optimizing service delivery models to complement digital offerings.

Social Trends and Ethical Banking

Societal expectations are increasingly shaping the banking landscape, pushing institutions like Central Bank of India towards greater social responsibility and ethical practices. Customers and stakeholders are paying close attention to how banks conduct themselves, from fair lending policies to transparent customer service. In 2024, for instance, customer complaints regarding unfair practices in loan origination saw a slight increase across the Indian banking sector, highlighting the sensitivity around these issues.

Central Bank of India's commitment to community engagement and ethical operations directly influences its public image and customer trust. A strong focus on these areas can differentiate the bank in a competitive market. For example, reports from early 2025 indicate that banks with robust Corporate Social Responsibility (CSR) initiatives often experience higher customer retention rates.

- Growing Consumer Demand for Ethical Banking: Surveys in late 2024 revealed that over 60% of Indian bank customers consider a bank's ethical standing when choosing a financial provider.

- Impact of Fair Lending Practices: Adherence to fair lending principles can reduce regulatory scrutiny and enhance brand reputation, a key factor in attracting and retaining a diverse customer base.

- Community Investment and Trust: Central Bank of India's participation in financial literacy programs and local development projects in 2024 aimed to build stronger community ties, fostering trust and loyalty.

- Transparency in Customer Service: A commitment to clear communication and fair dispute resolution processes is crucial for maintaining customer confidence, especially in an era of increasing digital interactions.

Income Levels and Savings Habits

Income levels significantly shape how individuals interact with financial institutions like the Central Bank of India. As of early 2024, India's per capita income was projected to reach approximately $2,600, a figure that varies widely across urban and rural demographics. This disparity directly influences savings capacity and the appetite for investment products.

Lower income segments often prioritize basic savings for emergencies, while higher earners are more inclined towards wealth management and diverse investment portfolios. This directly impacts Central Bank of India's deposit mobilization strategies and the demand for its wealth management services.

- Varying Income Disparities: India's income distribution shows a significant gap, with a large portion of the population falling into lower-income brackets, impacting their ability to save and invest.

- Savings Behavior Influence: Lower income levels often correlate with a higher propensity for liquid savings and a lower demand for complex investment products.

- Wealth Management Demand: Conversely, rising income levels among certain segments are driving increased demand for sophisticated wealth management and investment advisory services.

- Product Tailoring: Central Bank of India must tailor its product offerings, from basic savings accounts to advanced investment instruments, to cater to these diverse income-driven financial needs.

Societal shifts toward digital engagement and ethical considerations are profoundly influencing banking. By early 2025, over 60% of Indian bank customers indicated that a bank's ethical standing was a key factor in their choice. Central Bank of India's investment in financial literacy and community projects in 2024 aims to build trust, directly addressing growing expectations for social responsibility and transparent customer service.

| Societal Factor | Impact on Central Bank of India | 2024/2025 Data/Trend |

|---|---|---|

| Digital Adoption & Expectations | Increased demand for seamless online banking, influencing branch strategy. | Growing preference for digital channels for transactions. |

| Ethical Consumerism | Need for transparent practices, fair lending, and robust CSR. | Over 60% of customers consider ethics in bank choice (late 2024 survey). |

| Financial Literacy Demand | Opportunity to expand customer base and foster financial inclusion. | Focus on programs for younger demographics and underserved areas. |

| Community Engagement | Builds brand loyalty and customer trust through local initiatives. | CSR initiatives linked to higher customer retention (early 2025 reports). |

Technological factors

Central Bank of India is actively pursuing digital transformation, aiming to automate core banking functions and back-office processes. This strategic push is designed to significantly boost operational efficiency and trim down costs associated with manual interventions.

By integrating advanced automation technologies, the bank anticipates a marked improvement in service delivery speed, directly enhancing the overall customer experience. For instance, digital onboarding and automated loan processing can drastically reduce turnaround times, a key competitive differentiator in today's banking landscape.

As of March 2024, the bank reported a substantial increase in its digital transaction volumes, indicating successful adoption of its digital platforms. This trend is expected to continue, driven by ongoing investments in technology infrastructure and a focus on user-friendly digital interfaces.

Central Bank of India is actively enhancing its digital presence, with a significant focus on mobile and internet banking adoption. As of the fiscal year ending March 31, 2024, the bank reported a substantial increase in digital transactions, reflecting growing customer preference for these convenient channels. This strategic investment allows the bank to offer seamless access to a wide array of services, from account management to loan applications, thereby expanding its reach to a broader, increasingly tech-savvy customer base across India.

In the banking sector, cybersecurity and data privacy are paramount. Central Bank of India prioritizes these by investing in advanced security infrastructure to safeguard customer data and financial transactions against evolving cyber threats. This commitment is crucial for maintaining customer trust and ensuring regulatory compliance.

As of early 2024, the global cost of cybercrime was projected to reach $10.5 trillion annually by 2025, underscoring the significant risk financial institutions face. Central Bank of India's ongoing investments in state-of-the-art security measures, including multi-factor authentication and advanced threat detection systems, are essential to mitigate these risks and protect sensitive information.

FinTech Partnerships and Innovation

Central Bank of India is actively engaging with the FinTech ecosystem, recognizing its transformative potential. The bank is exploring strategic partnerships to integrate cutting-edge financial technologies, aiming to enhance its service offerings and operational efficiency. This includes leveraging AI for improved credit scoring and risk management, and blockchain for secure and transparent transactions.

The bank's focus on innovation is evident in its efforts to adopt big data analytics, which allows for a deeper understanding of customer behavior and personalized product development. For instance, in 2024, the Indian FinTech market was projected to reach $3.7 billion by 2025, highlighting the significant opportunities for collaboration and digital advancement.

- AI Integration: Enhancing credit assessment and fraud detection capabilities.

- Blockchain Adoption: Exploring use cases for secure and efficient cross-border payments and trade finance.

- Big Data Analytics: Personalizing customer experiences and optimizing product offerings.

- FinTech Collaborations: Partnering with startups to bring innovative solutions to market faster.

Payment Systems and Infrastructure

Central Bank of India's operations are significantly influenced by the rapid evolution of payment systems, particularly the widespread adoption of the Unified Payments Interface (UPI). This digital infrastructure has become a cornerstone for facilitating seamless and efficient transactions for its customers. The bank's integration with UPI allows for instant money transfers, bill payments, and online purchases, directly impacting its transaction volumes and customer engagement.

As of FY23, UPI transactions in India crossed the 149 trillion INR mark, showcasing the immense shift towards digital payments. Central Bank of India actively adapts to these systems by enhancing its mobile banking applications and online platforms to support UPI functionalities. This strategic adaptation ensures that the bank remains competitive and caters to the growing demand for convenient digital banking services.

The bank's commitment to digital transformation is evident in its efforts to:

- Enhance mobile banking capabilities to fully support UPI transactions.

- Streamline backend processes for faster and more reliable digital payment processing.

- Educate customers on the benefits and usage of digital payment methods.

- Explore partnerships to further expand its digital payment ecosystem.

Central Bank of India is heavily investing in technological advancements to streamline operations and enhance customer experience. This includes adopting AI for credit assessment and fraud detection, and exploring blockchain for secure transactions. The bank's digital transaction volumes saw a significant increase as of March 2024, reflecting successful platform adoption.

Cybersecurity is a major focus, with investments in advanced security infrastructure to protect customer data against evolving threats, especially given the projected $10.5 trillion annual cost of cybercrime by 2025. The bank also actively engages with FinTechs, aiming to integrate innovative solutions and leverage big data analytics for personalized services.

| Technology Focus | Impact on CBI | Key Data/Projections |

|---|---|---|

| Digital Transformation | Improved operational efficiency, cost reduction | Substantial increase in digital transaction volumes (as of March 2024) |

| Cybersecurity | Safeguarding customer data and financial transactions | Global cybercrime cost projected to reach $10.5 trillion annually by 2025 |

| FinTech Integration & AI | Enhanced service offerings, personalized experiences | Indian FinTech market projected to reach $3.7 billion by 2025 |

| Payment Systems (UPI) | Facilitating seamless transactions, increasing customer engagement | UPI transactions crossed 149 trillion INR in FY23 |

Legal factors

The Reserve Bank of India (RBI) enforces a stringent regulatory framework that dictates every facet of banking operations. Central Bank of India, like its peers, must meticulously adhere to capital adequacy ratios, lending practices, asset quality assessments, and provisioning requirements. These RBI guidelines directly shape the bank's financial robustness and its day-to-day conduct, ensuring stability within the Indian financial system.

Central Bank of India, like all financial institutions, operates under increasingly stringent Anti-Money Laundering (AML) and Know Your Customer (KYC) regulations. These rules are critical for preventing illicit financial activities and maintaining the integrity of the financial system. In 2023, the Reserve Bank of India (RBI) continued to emphasize robust KYC compliance, with banks required to conduct thorough customer due diligence.

The bank implements advanced processes and technologies to ensure adherence to these norms, thereby mitigating risks associated with financial crime. This includes sophisticated transaction monitoring systems and identity verification protocols. For instance, the digital onboarding processes introduced by many banks, including Central Bank of India, aim to streamline KYC while enhancing security.

Central Bank of India operates under stringent consumer protection laws, including the Banking Ombudsman Scheme, which provides a readily accessible mechanism for grievance redressal. In 2023-24, the Reserve Bank of India reported a significant volume of complaints handled through its integrated grievance redressal system, underscoring the importance of robust compliance for banks like Central Bank of India.

Ensuring transparency in product offerings and clear communication of terms and conditions is paramount. Central Bank of India actively works to meet these legal requirements, providing customers with accessible information and multiple channels, including digital platforms and physical branches, for lodging and resolving complaints effectively.

Data Privacy and Protection Laws

India's legal framework for data privacy is rapidly evolving, notably with the Digital Personal Data Protection Act (DPDPA) of 2023. This legislation places significant obligations on entities like the Central Bank of India to protect customer personal and financial data. The bank must implement stringent data security measures and ensure adherence to consent and data usage regulations, a critical aspect given the sensitive nature of financial information.

Compliance with the DPDPA means the Central Bank of India must:

- Safeguard customer personal and financial data through robust technical and organizational measures.

- Implement clear consent mechanisms for data collection and processing, ensuring transparency with customers.

- Adhere to data breach notification requirements, promptly informing affected individuals and the relevant authorities.

- Manage data retention policies to minimize the risk associated with holding personal information longer than necessary.

Corporate Governance and Compliance Frameworks

Central Bank of India operates within a stringent legal framework governing corporate governance for public sector banks in India. This includes adherence to guidelines issued by the Reserve Bank of India (RBI) and the Ministry of Finance. Key areas of compliance involve board composition, ensuring a balance of executive and non-executive directors, and robust internal control mechanisms to mitigate risks. For instance, as of March 31, 2024, the bank's board structure aligns with regulatory requirements for effective oversight.

The bank's commitment to transparency is demonstrated through its regular financial reporting, which adheres to Indian Accounting Standards (Ind AS) and Companies Act, 2013 provisions. This ensures accountability to stakeholders and the public. The audit mechanisms, including internal and external audits, are designed to uphold ethical conduct and financial integrity. Central Bank of India's compliance with these legal mandates is crucial for maintaining public trust and operational stability.

- Board Composition: Adherence to RBI guidelines on the number and qualifications of directors, ensuring diverse expertise.

- Internal Controls: Implementation of robust systems for risk management, fraud prevention, and operational efficiency.

- Audit Mechanisms: Compliance with statutory audit requirements and internal audit functions to ensure financial accuracy and ethical practices.

- Transparency in Reporting: Disclosure of financial performance and corporate governance practices as per SEBI and RBI regulations, fostering accountability.

The legal landscape significantly shapes Central Bank of India's operations, primarily through the Reserve Bank of India's (RBI) comprehensive regulatory framework. Adherence to capital adequacy, lending norms, and asset quality is non-negotiable, directly impacting financial stability. Furthermore, the evolving Digital Personal Data Protection Act (DPDPA) of 2023 mandates robust data security and consent management for customer information, a critical area for banks.

Environmental factors

The Central Bank of India, like other financial institutions, faces growing pressure to integrate Environmental, Social, and Governance (ESG) principles into its core operations. This means considering environmental impact, social responsibility, and robust governance in lending decisions and overall business strategy. For instance, the Reserve Bank of India (RBI) has been actively encouraging banks to adopt sustainable finance practices, with a focus on climate risk management and green financing initiatives. By 2024, Indian banks are increasingly expected to enhance their ESG reporting, aligning with evolving global sustainability benchmarks and investor expectations.

Central Bank of India is actively participating in green financing, directing loans towards renewable energy ventures and businesses committed to eco-friendly practices. This includes supporting sustainable infrastructure development, aligning with the nation's push for a greener economy.

The bank has been developing specific products and policies designed to encourage and facilitate environmentally responsible projects. This strategic focus aims to bolster the growth of sustainable sectors within India, reflecting a commitment to long-term ecological well-being.

Central Bank of India actively assesses climate change risks, recognizing both physical and transition impacts. Physical risks, like increased frequency of extreme weather events impacting collateral and loan recovery, are monitored through geographical exposure and asset quality reviews. Transition risks, stemming from policy shifts towards a low-carbon economy and their effect on sectors like fossil fuels, are evaluated through stress testing scenarios on its loan book. For instance, the bank's exposure to sectors heavily reliant on carbon-intensive industries is a key area of focus in its 2024-2025 risk management framework, influencing lending policies and capital allocation decisions.

Environmental Regulations and Compliance

Central Bank of India navigates a landscape shaped by evolving environmental regulations, impacting both its operational footprint and its client base. The bank is committed to ensuring its lending portfolio aligns with environmental protection laws, actively screening projects to avoid financing those that could lead to violations. This proactive approach helps mitigate reputational damage and potential legal liabilities.

Furthermore, the bank plays a role in fostering sustainable practices among its clients. By encouraging environmentally sound business operations, Central Bank of India aims to reduce the overall environmental risk associated with its credit extensions. This focus on green finance is becoming increasingly critical as global and national environmental standards tighten.

- Regulatory Alignment: Central Bank of India actively monitors and adheres to national and international environmental directives relevant to the banking sector.

- Sustainable Lending: The bank's credit assessment processes incorporate environmental risk factors, discouraging financing for projects with significant negative ecological impacts.

- Client Engagement: Initiatives are in place to guide clients towards adopting greener operational models, thereby reducing their environmental footprint and associated risks.

Corporate Social Responsibility (CSR) Initiatives

Central Bank of India actively engages in Corporate Social Responsibility (CSR) with a notable environmental focus. The bank champions energy efficiency across its extensive network of branches, implementing measures to reduce its carbon footprint. In 2023-2024, the bank reported a reduction in electricity consumption by 8% across its key operational centers through upgraded lighting and HVAC systems.

Further demonstrating its commitment, Central Bank of India supports various environmental conservation projects. These initiatives often involve community engagement and awareness programs designed to promote sustainable practices. For instance, the bank's partnership with a leading environmental NGO in the fiscal year 2024 saw the successful plantation of over 50,000 saplings in ecologically sensitive regions.

These environmental CSR activities not only contribute to ecological well-being but also significantly enhance Central Bank of India's brand image. By aligning its operations with sustainability goals and actively participating in conservation efforts, the bank strengthens its reputation as a responsible corporate citizen. This focus is increasingly important for stakeholders, with surveys in early 2025 indicating that over 65% of retail investors consider a company's environmental performance when making investment decisions.

- Energy Efficiency: Implemented measures leading to an 8% reduction in electricity consumption in key branches during 2023-2024.

- Environmental Conservation: Supported the plantation of over 50,000 saplings in ecologically sensitive areas through a 2024 NGO partnership.

- Community Awareness: Engaged in programs to promote sustainable practices within local communities.

- Brand Enhancement: Improved public perception and stakeholder trust through visible commitment to environmental stewardship.

Central Bank of India is increasingly integrating environmental considerations into its operations, driven by regulatory shifts and growing investor demand for sustainable practices. The bank is actively involved in green financing, directing capital towards renewable energy and eco-friendly projects, aligning with India's broader environmental goals.

The bank is also focused on managing climate-related risks, both physical and transitional, by stress-testing its loan portfolio against scenarios like extreme weather events and policy changes. This proactive approach aims to safeguard its financial stability and support a low-carbon transition.

Furthermore, Central Bank of India is enhancing its environmental CSR, exemplified by energy efficiency measures across its branches, which reduced electricity consumption by 8% in key centers during 2023-2024, and supporting large-scale tree plantation drives.

| Environmental Initiative | Metric | Period |

|---|---|---|

| Branch Energy Efficiency | 8% reduction in electricity consumption | 2023-2024 |

| Environmental Conservation Support | Over 50,000 saplings planted | 2024 |

| Green Financing Focus | Increased lending to renewable energy & eco-friendly projects | Ongoing (2024-2025) |

PESTLE Analysis Data Sources

Our Central Bank of India PESTLE Analysis is meticulously constructed using data from official Indian government publications, reports from international financial institutions like the IMF and World Bank, and reputable economic and industry research firms. This comprehensive approach ensures that each factor, from political stability to technological advancements, is grounded in verified and current information.