Cemex PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Cemex Bundle

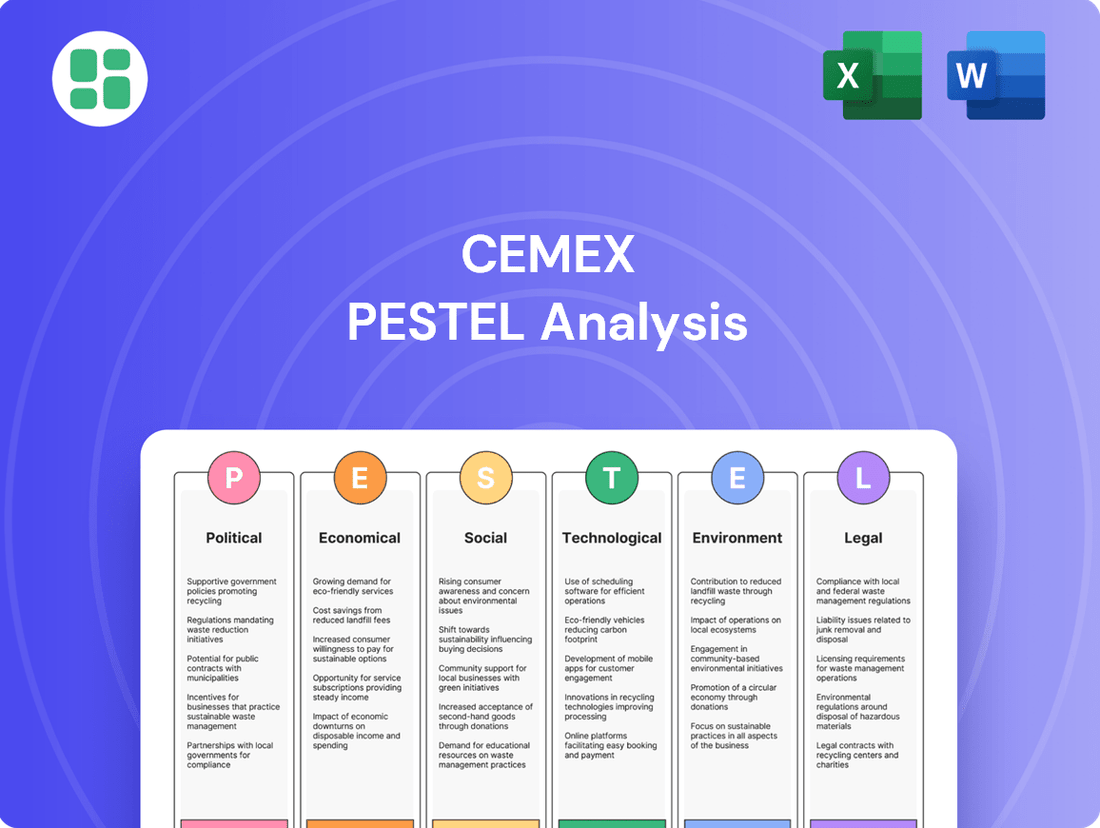

Navigate the complex external forces impacting Cemex with our comprehensive PESTEL Analysis. Understand how political shifts, economic volatility, and technological advancements are shaping the company's strategic landscape. Gain actionable intelligence to inform your own market strategies. Download the full version now for a competitive edge.

Political factors

Government investment in infrastructure projects, like roads and bridges, directly impacts Cemex's demand for cement and concrete. For instance, Mexico saw increased infrastructure spending in 2024, partly due to pre-election initiatives, which is expected to continue into 2025, boosting sales for Cemex in that region.

Changes in international trade policies, including the potential for new tariffs or adjustments to existing trade agreements like the USMCA, directly impact Cemex's global cost structure. For instance, a hike in tariffs on imported cement or raw materials could increase production expenses in key markets like the United States, a significant region for Cemex.

Protectionist measures implemented by various countries can disrupt Cemex's established supply chains, potentially leading to higher logistics costs and delays. This could affect the competitiveness of Cemex's products, especially in markets where it faces strong local competition or relies heavily on imported components.

Cemex's global operations expose it to the risks of political instability and evolving regulations across its diverse markets. Shifts in government or policy can create significant uncertainty, impacting the investment landscape and the construction industry directly.

For instance, a change in administration in Mexico, a key market for Cemex, could lead to policy adjustments that affect first-quarter 2025 financial results. Such political transitions often bring about changes in infrastructure spending priorities or environmental regulations, directly influencing demand for Cemex’s products.

Building Codes and Regulations

Evolving building codes, especially those emphasizing sustainability and safety, directly impact Cemex's product innovation and market demand. For instance, stricter energy efficiency mandates in new construction, increasingly common in 2024 and projected to tighten further in 2025 across regions like the EU and North America, will drive demand for Cemex's lower-carbon concrete solutions and building materials.

Compliance with a patchwork of national and local regulations is paramount for market entry and continued operations. This often requires significant capital expenditure for Cemex to adapt its product lines or manufacturing processes. For example, in 2024, Cemex invested heavily in upgrading facilities in Mexico to meet new seismic safety standards, a move that also positions them for future regulatory shifts elsewhere.

- Sustainability Mandates: Many jurisdictions are implementing or strengthening regulations for green building certifications, influencing material choices and Cemex's low-carbon product portfolio.

- Safety Standards: Updates to structural integrity and fire resistance codes necessitate Cemex's adherence to specific material performance criteria.

- Material Specifications: Evolving regulations on the composition and environmental impact of construction materials directly shape Cemex's research and development priorities.

- Regional Variations: Cemex must navigate a complex web of differing codes across its global markets, requiring adaptable product offerings and compliance strategies.

Environmental Policies and Carbon Taxes

Global pressure to address climate change is intensifying, directly affecting heavy industries like cement manufacturing. Many nations are implementing or considering carbon taxes and emissions trading systems to curb greenhouse gas emissions. For Cemex, a significant player in CO2 generation, these policies represent both potential costs and opportunities.

Policies focused on decarbonization, such as the European Union's climate targets, can offer substantial financial incentives for adopting advanced CO2 capture technologies. However, these same regulations can also introduce compliance costs, prompting companies like Cemex to invest heavily in emission reduction strategies, as seen in their 'Future in Action' program. Cemex has set ambitious targets, aiming to reduce its net CO2 emissions to 475 kg per ton of cementitious material by 2030, a 20% reduction from 2020 levels.

- EU Emissions Trading System (ETS) costs: Cemex faces potential financial burdens from the ETS, which prices carbon emissions.

- Grants for Carbon Capture: The EU and other regions offer funding for R&D and deployment of CO2 capture, utilization, and storage (CCUS) technologies.

- 'Future in Action' program: Cemex's initiative is a direct response to environmental policy, focusing on sustainable operations and reduced emissions.

- 2030 CO2 Reduction Target: Cemex aims for a 20% net CO2 reduction by 2030, demonstrating adaptation to environmental policy pressures.

Government infrastructure spending is a key driver for Cemex, with Mexico's increased investment in 2024, partly due to pre-election initiatives, expected to continue into 2025, boosting regional sales. Conversely, changes in international trade policies, such as potential USMCA adjustments or tariffs on raw materials, directly impact Cemex's cost structure in crucial markets like the United States. Political instability and evolving regulations across Cemex's diverse global markets create uncertainty, directly influencing investment landscapes and construction demand, with policy shifts in key markets like Mexico potentially affecting Q1 2025 financial results.

Evolving building codes emphasizing sustainability and safety are shaping Cemex's product innovation. Stricter energy efficiency mandates, prevalent in the EU and North America in 2024 and projected to tighten through 2025, are driving demand for Cemex's low-carbon concrete solutions. Compliance with varying national and local regulations, such as seismic safety standards in Mexico which saw Cemex invest in facility upgrades in 2024, requires adaptable product offerings and strategic capital expenditure.

Global pressure to address climate change is leading to carbon taxes and emissions trading systems. Cemex, aiming for a 20% net CO2 reduction by 2030, is actively responding to these policies through initiatives like its 'Future in Action' program, seeking to mitigate compliance costs and leverage financial incentives for adopting advanced CO2 capture technologies.

| Policy Area | Impact on Cemex | Example/Data Point |

|---|---|---|

| Infrastructure Spending | Drives demand for cement and concrete. | Mexico's increased infrastructure spending in 2024 expected to continue into 2025. |

| Trade Policies/Tariffs | Affects cost structure and competitiveness. | Potential hikes in tariffs on imported cement or raw materials increase production expenses. |

| Sustainability Regulations | Drives demand for low-carbon products and innovation. | Stricter energy efficiency mandates in EU/North America boost demand for Cemex's sustainable solutions. |

| Climate Change Policies | Introduces compliance costs and opportunities for green tech. | Cemex targets a 20% net CO2 reduction by 2030, investing in emission reduction strategies. |

What is included in the product

This Cemex PESTLE analysis provides a comprehensive examination of how political, economic, social, technological, environmental, and legal factors influence the company's operations and strategic decisions.

It offers actionable insights for stakeholders to navigate the external landscape and capitalize on emerging opportunities within the global construction materials industry.

The Cemex PESTLE Analysis offers a structured framework to identify and address external factors, acting as a pain point reliever by providing clarity on potential opportunities and threats that could impact strategic decisions.

Economic factors

Rising interest rates, a key economic factor, can significantly cool the housing market. For instance, if the Federal Reserve raises its benchmark rate, mortgage rates typically follow suit. This makes borrowing more expensive for both homebuilders and potential buyers, directly impacting demand for new homes and, consequently, Cemex's sales of cement and other building materials used in residential construction.

The US housing market, a crucial segment for Cemex, experienced a notable slowdown in late 2023 and early 2024 due to these higher borrowing costs. Existing home sales in the US, for example, saw a year-over-year decline in early 2024, a trend that directly translates to reduced volumes for construction material suppliers like Cemex. This trend underscores the sensitivity of Cemex's revenue to housing market performance.

Inflationary pressures significantly impact Cemex by driving up costs for essential inputs like cement, aggregates, energy, and logistics. These rising expenses directly affect production costs and can squeeze profit margins if not managed effectively.

Cemex's strategy in 2024 has been to actively counter this by ensuring their price increases outpace the rise in input costs. For instance, in Q1 2024, Cemex reported that its pricing initiatives successfully offset cost inflation, demonstrating a key lever for maintaining profitability amidst economic volatility.

The global economic outlook for 2024 and early 2025 presents a mixed picture. While many economies have shown resilience, with the IMF projecting global growth of 3.2% for 2024, the specter of recession lingers in some key markets. This directly impacts construction, a sector highly sensitive to economic downturns and interest rate environments.

Cemex's performance in 2024, with reported net sales of $10.4 billion and EBITDA of $2.1 billion in the first nine months, demonstrates a degree of insulation from these broader risks. However, potential slowdowns in major regions like the US or Europe, where Cemex has significant operations, could temper demand for cement and other building materials in the coming year.

Currency Exchange Rate Fluctuations

Currency exchange rate fluctuations significantly impact Cemex as a global entity. When Cemex translates its revenues and expenses from foreign currencies into its reporting currency, say the US Dollar, volatility can distort its reported earnings. For instance, a strengthening US Dollar against currencies where Cemex operates could lead to lower reported revenues.

These shifts also affect the price competitiveness of Cemex's products in various international markets. If the local currency of a market where Cemex sells weakens considerably, its products priced in that currency might become cheaper for foreign buyers, but this can also pressure Cemex's margins if its costs are denominated in stronger currencies. Conversely, a weaker US Dollar could make its products more expensive abroad.

The value of Cemex's international assets, such as plants and property, is also subject to these exchange rate movements. A depreciating local currency can reduce the US Dollar equivalent value of these assets. For example, in 2023, the Mexican Peso saw appreciation against the US Dollar, which would have positively impacted the reported US Dollar value of Cemex's Mexican assets and earnings.

- Impact on Reported Earnings: Currency translation can create gains or losses on Cemex's financial statements.

- Competitive Positioning: Exchange rates influence the pricing and cost structure of Cemex's operations globally.

- Asset Valuation: The reported value of Cemex's international holdings fluctuates with currency movements.

- Hedging Strategies: Cemex may employ financial instruments to mitigate some of this currency risk.

Disposable Income and Consumer Confidence

Consumer confidence and the amount of money people have left after taxes and essential bills, known as disposable income, significantly impact the construction industry, especially for private homes and renovations. When consumers feel less secure about the economy or have less discretionary cash, they tend to cut back on spending, which directly affects demand for building materials. This can lead to a noticeable drop in sales for companies like Cemex in these crucial sectors.

For instance, in the United States, consumer confidence indexes provide a snapshot of how optimistic people are about the economy. The Conference Board's Consumer Confidence Index, a key indicator, showed fluctuations throughout 2024 and into early 2025, reflecting broader economic sentiment. Changes in disposable income, influenced by inflation rates and wage growth, directly correlate with consumer willingness to undertake new construction or home improvement projects.

- Consumer spending on home improvements and new residential projects is highly sensitive to disposable income levels.

- A dip in consumer confidence can lead to delayed or cancelled construction plans, impacting demand for Cemex's products.

- In 2024, many economies experienced persistent inflation, which eroded purchasing power and potentially constrained disposable income for many households.

- Forward-looking indicators for construction activity in 2025 will likely depend on sustained improvements in consumer sentiment and real wage growth.

Interest rate hikes by central banks, like the US Federal Reserve, directly influence mortgage rates, making construction projects more expensive and potentially dampening demand for Cemex's products. For example, by mid-2024, many developed economies were still grappling with elevated interest rates compared to pre-pandemic levels, impacting housing starts.

Inflationary pressures continue to be a significant headwind, increasing the cost of raw materials, energy, and transportation for Cemex. In 2024, many regions saw persistent inflation, forcing companies like Cemex to focus on price management. Cemex's Q1 2024 results indicated that pricing initiatives were crucial in offsetting cost inflation, with a notable increase in average cement prices year-over-year.

Currency fluctuations pose a risk to Cemex's global operations, affecting the translation of foreign earnings and the competitiveness of its products. The strengthening of the US dollar through much of 2023 and into early 2024, for instance, could lead to lower reported revenues when foreign earnings are converted. Conversely, a stronger Mexican Peso in 2023 positively impacted Cemex's reported asset values in Mexico.

Consumer confidence and disposable income are critical drivers for the residential construction sector. In 2024, while some economies showed resilience, consumer sentiment remained sensitive to inflation and interest rate outlooks, impacting discretionary spending on home improvements and new builds. For instance, the Conference Board's Consumer Confidence Index for the US showed volatility, reflecting ongoing economic uncertainties that could influence construction demand.

| Economic Factor | Impact on Cemex | 2024/2025 Data/Trend |

|---|---|---|

| Interest Rates | Increases borrowing costs, potentially reducing housing demand. | Elevated rates persisted in many developed markets through mid-2024, impacting construction financing. |

| Inflation | Raises input costs (energy, materials, logistics), squeezing margins. | Persistent inflation in 2024 necessitated strong pricing strategies by Cemex to offset rising expenses. |

| Currency Exchange Rates | Affects reported earnings and international competitiveness. | US Dollar strength through early 2024 could reduce reported foreign revenues; Mexican Peso appreciation boosted asset values in Mexico in 2023. |

| Consumer Confidence/Disposable Income | Influences demand for residential construction and renovations. | Consumer sentiment remained mixed in 2024, sensitive to economic outlook, impacting discretionary spending on housing. |

What You See Is What You Get

Cemex PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This Cemex PESTLE analysis provides a comprehensive overview of the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company's operations and strategic decisions.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises. You'll gain valuable insights into the external forces shaping Cemex's business landscape, enabling informed strategic planning.

The content and structure shown in the preview is the same document you’ll download after payment. This detailed PESTLE analysis for Cemex is designed to equip you with the critical information needed to understand its market position and future outlook.

Sociological factors

Cemex, a global leader in building materials, is significantly influenced by rapid urbanization and population growth, particularly in developing and emerging markets. This trend directly fuels demand for new residential, commercial, and infrastructure projects, creating substantial opportunities for Cemex's core products like cement and aggregates. For instance, the United Nations projects that by 2050, 68% of the world's population will live in urban areas, a significant jump from 56% in 2021, highlighting the sustained demand for construction.

Demographic shifts are significantly reshaping housing demands. For instance, the growing number of single-person households and smaller family units, a trend observed globally, necessitates a move towards more compact and adaptable living spaces. Cemex is responding to this by developing and promoting materials suitable for multi-family dwellings and smaller, more efficient homes, aligning with evolving consumer preferences for urban living and reduced environmental footprints.

Growing public awareness about environmental issues is significantly influencing the construction industry, pushing for more sustainable practices and materials. This societal shift is a key driver for companies like Cemex to innovate and offer greener solutions.

Cemex's 'Future in Action' program directly addresses this demand, with its Vertua low-carbon concrete products demonstrating strong market acceptance. In fact, by the end of 2023, Vertua sales had already surpassed the initial 2025 targets, highlighting the robust public appetite for eco-friendly building options.

Labor Availability and Skills Gap

The construction sector, a key market for Cemex, frequently grapples with labor shortages and a noticeable skills gap. This can directly affect project schedules and increase operational expenses, as seen in recent industry reports indicating a significant deficit in skilled trades. For instance, a 2024 survey by the National Association of Home Builders highlighted that 70% of builders reported difficulty finding qualified labor.

Cemex actively addresses these challenges through its social impact initiatives, focusing on enhancing employability and fostering skills development within the communities it serves. These programs aim to bridge the gap between available jobs and qualified workers, ensuring a more stable and skilled workforce for construction projects. The company's commitment to community development is a strategic element in mitigating labor-related risks.

- Labor Shortages Impact: Difficulty in finding skilled construction workers can delay projects and inflate labor costs, a persistent issue in the industry.

- Skills Gap Concerns: A mismatch between the skills required by modern construction techniques and the existing workforce's capabilities presents an ongoing challenge.

- Cemex's Community Focus: The company invests in programs designed to upskill local populations, thereby improving labor availability and quality in its operating regions.

- Employability Programs: By supporting training and development, Cemex aims to create a more robust and capable local labor pool, benefiting both the company and the communities.

Health and Safety Standards for Workers

Societal expectations and regulatory requirements for worker health and safety are critical in industries like construction and manufacturing, where Cemex operates. These standards directly impact operational costs and brand reputation.

Cemex places a strong emphasis on implementing comprehensive safety protocols and providing extensive training to safeguard its employees. This commitment is a cornerstone of its social responsibility, aiming to minimize workplace accidents and promote a healthy work environment.

In 2023, Cemex reported a Lost Time Injury Frequency Rate (LTIFR) of 2.59 per million hours worked, demonstrating a continued focus on safety performance. The company invests significantly in safety programs and equipment to meet and exceed industry standards.

- Prioritization of Worker Well-being: Cemex's dedication to health and safety is a core element of its corporate social responsibility.

- Regulatory Compliance: Adherence to stringent health and safety regulations is non-negotiable, influencing operational procedures and investments.

- Investment in Safety: Significant resources are allocated to training and implementing advanced safety measures to reduce workplace risks.

- Performance Metrics: The company actively tracks safety performance, such as the LTIFR, to measure progress and identify areas for improvement.

Societal attitudes towards sustainability are increasingly influencing consumer choices and business practices in the construction sector. Cemex's commitment to developing low-carbon products, such as its Vertua line, directly aligns with these evolving expectations. By 2023, sales of Vertua products had already surpassed initial 2025 targets, demonstrating a strong market demand for environmentally responsible building materials.

The growing awareness of social equity and community impact is also shaping corporate responsibility. Cemex addresses this by investing in local workforce development and skills training programs. For instance, a 2024 industry report indicated a significant shortage of skilled labor, with 70% of builders reporting difficulties in finding qualified workers, underscoring the importance of such initiatives.

Worker health and safety remain paramount in the construction industry. Cemex's robust safety protocols and training programs are designed to minimize workplace accidents and foster a secure environment. In 2023, the company reported a Lost Time Injury Frequency Rate (LTIFR) of 2.59 per million hours worked, reflecting its ongoing dedication to employee well-being.

| Sociological Factor | Impact on Cemex | Cemex's Response/Data |

| Sustainability Awareness | Increased demand for eco-friendly products | Vertua low-carbon concrete sales exceeded 2025 targets by end of 2023 |

| Social Equity & Community Impact | Need for local workforce development | Investment in skills training programs; addressing industry labor shortages (70% of builders reported difficulty in 2024) |

| Health & Safety Expectations | Requirement for stringent safety standards | LTIFR of 2.59 per million hours worked in 2023; significant investment in safety programs |

Technological factors

Cemex is actively pushing for greener construction through its investment in sustainable materials like its Vertua line of low-carbon cement and concrete. This focus directly addresses the growing demand for environmentally responsible building solutions.

These innovations are not just about product development; they position Cemex as a leader in the burgeoning green construction sector. For instance, by 2023, Cemex reported that its Vertua products helped customers reduce CO2 emissions by over 40% compared to traditional concrete. This commitment is vital as global construction aims to cut its significant carbon impact.

Cemex is heavily investing in automation and digital platforms, exemplified by its Cemex Go initiative. This digital ecosystem, launched in 2019 and continually evolving, aims to streamline operations, from order placement to delivery, enhancing customer experience and internal efficiency. In 2023, Cemex reported significant progress in digital adoption, with over 90% of customer transactions processed through digital channels in key markets.

The integration of robotics and advanced automation in Cemex's production facilities and logistics operations is crucial for cost optimization and increased output. For instance, the company is exploring autonomous vehicles for quarry operations and automated batching systems in its ready-mix plants. These technological advancements are designed to reduce manual labor dependency, minimize errors, and boost overall productivity, contributing to a more competitive operational model.

Emerging construction techniques like 3D printing and modular building offer Cemex new avenues for supplying specialized materials. For instance, 3D printed concrete requires precise formulations, a niche Cemex can fill. This shift towards off-site and automated construction methods is projected to grow significantly, with the global modular construction market expected to reach $257.4 billion by 2027, according to a report by Allied Market Research.

Cemex's investment in Contech startups demonstrates a proactive approach to adopting these innovations. By partnering with or investing in companies developing these advanced methods, Cemex can gain early access to new material demands and integrate its offerings into future construction ecosystems. This strategic positioning is crucial as the construction industry increasingly embraces technology to improve efficiency and sustainability.

Data Analytics for Operational Efficiency

Cemex is increasingly leveraging data analytics and AI to boost operational efficiency. This technology allows for the optimization of everything from predicting equipment failures to managing complex construction projects and streamlining supply chain movements. For instance, by analyzing vast datasets, Cemex can anticipate maintenance needs for its fleet, reducing downtime and associated costs.

This data-driven strategy directly translates to enhanced productivity and significant cost savings across the organization. The company's investment in digital transformation, including advanced analytics, is a key driver for achieving these improvements.

- Predictive Maintenance: Cemex uses data analytics to forecast equipment failures, minimizing unexpected downtime.

- Supply Chain Optimization: AI tools analyze logistics data to improve delivery routes and inventory management, potentially reducing transportation costs by up to 10-15% in pilot programs.

- Project Management Enhancement: Real-time data analysis provides insights into project progress, resource allocation, and risk identification.

- Resource Allocation: Data insights help in better managing materials and labor, leading to more efficient project execution.

Research and Development in New Product Solutions

Cemex's commitment to research and development is crucial for staying ahead in the building materials sector, particularly as sustainability becomes a paramount concern. The company's ongoing investment in innovation drives the creation of new products and solutions designed to address evolving market demands and environmental regulations. This focus ensures Cemex remains competitive and relevant in a rapidly changing industry.

A key area of R&D for Cemex involves exploring advanced technologies like carbon capture, utilization, and storage (CCUS). Additionally, the company is actively investigating the use of alternative raw materials to reduce its environmental footprint and enhance the sustainability of its product offerings. These efforts are vital for meeting the increasing global demand for greener construction practices.

In 2023, Cemex continued to prioritize innovation, with R&D contributing to advancements in lower-carbon concrete solutions. For instance, their Vertua® product line, which offers reduced embodied CO2, saw continued development and market penetration. The company's strategic investments in these areas are designed to yield long-term benefits, aligning with their Future in Action program's ambitious climate goals.

Key R&D initiatives include:

- Development of low-carbon cement and concrete formulations

- Exploration and implementation of CCUS technologies in production processes

- Research into alternative fuels and raw materials for enhanced sustainability

- Digitalization of R&D processes for faster innovation cycles

Technological advancements are central to Cemex's strategy, particularly in developing sustainable building materials like their Vertua line. This focus on low-carbon concrete, which in 2023 helped customers reduce CO2 emissions by over 40% compared to traditional options, directly addresses the industry's push for greener practices.

Cemex is also heavily investing in digital transformation, with initiatives like Cemex Go streamlining operations and enhancing customer experience. By 2023, over 90% of customer transactions in key markets were processed digitally, showcasing significant adoption and efficiency gains.

Further technological integration includes automation in production and logistics, such as exploring autonomous vehicles for quarry operations. The company is also leveraging data analytics and AI for predictive maintenance and supply chain optimization, aiming to boost productivity and reduce costs.

Emerging construction techniques like 3D printing and modular building present new opportunities, with Cemex actively investing in Contech startups to stay at the forefront of these innovations. The global modular construction market alone is projected to reach $257.4 billion by 2027.

| Technology Focus | Cemex Initiative/Example | Impact/Data Point |

|---|---|---|

| Sustainable Materials | Vertua low-carbon cement and concrete | Over 40% CO2 reduction for customers (2023) |

| Digitalization | Cemex Go platform | Over 90% digital transactions in key markets (2023) |

| Automation | Autonomous vehicles in quarries, automated batching | Cost optimization, increased output, reduced labor dependency |

| Data Analytics & AI | Predictive maintenance, supply chain optimization | Reduced downtime, potential 10-15% transport cost reduction in pilots |

| Emerging Construction | Investment in Contech startups, 3D printing materials | Access to new material demands, market growth projection of $257.4B by 2027 for modular construction |

Legal factors

Cemex operates in a highly competitive global construction materials market, making strict adherence to antitrust and competition laws across all operating regions paramount. These regulations are designed to prevent monopolistic practices and ensure fair market competition, directly impacting Cemex's strategic decisions and operational freedom.

The company actively manages its compliance by maintaining an independent pricing policy. This means Cemex avoids any discussions or agreements with competitors concerning pricing strategies, a commitment often detailed in their annual reports to assure stakeholders and regulatory bodies of their fair market conduct.

Cemex must navigate a complex web of global labor laws covering unionization, minimum wages, and workplace safety, which can vary significantly by country. For instance, in 2024, many developed nations continued to strengthen worker protections, potentially increasing compliance costs for multinational corporations like Cemex.

The landscape of labor relations in the United States was significantly shaped by the National Labor Relations Board (NLRB), with the 'Cemex decision' in 2023 impacting how union elections are conducted and unfair labor practice complaints are handled. This ruling necessitates ongoing vigilance and adaptation of HR strategies to ensure compliance and maintain positive employee relations.

Cemex, like all major players in the manufacturing and construction sectors, operates under a strict framework of health and safety regulations. These rules are designed to protect workers and the public, demanding significant investment in safety protocols and ongoing training. For instance, in 2023, the construction industry globally saw a reduction in fatal accidents, yet incidents still occurred, underscoring the continuous need for vigilance and adherence to evolving standards.

Failure to comply with these stringent legal requirements can have severe consequences for Cemex. Beyond the immediate risk of hefty fines and potential operational shutdowns, non-compliance can inflict lasting damage on the company's reputation. This can affect everything from attracting and retaining talent to securing new contracts, as stakeholders increasingly prioritize ethical and safe business practices.

Land Use and Zoning Laws

Cemex's extensive operations, especially those involving aggregate extraction and the placement of its manufacturing plants, are heavily influenced by intricate land use and zoning regulations. These laws vary significantly by locality, impacting where Cemex can establish new facilities or expand existing ones. For instance, in 2024, the company faced ongoing scrutiny regarding land use permits for a new quarry in Texas, highlighting the critical nature of these legal frameworks.

Securing and retaining the necessary permits for aggregate extraction and plant operation demands a meticulous approach to navigating a web of local, regional, and national legal requirements. Failure to comply can lead to significant delays, fines, or even the cessation of operations. Cemex's 2023 annual report noted that challenges in obtaining permits contributed to a minor slowdown in project timelines in certain European markets.

- Regulatory Hurdles: Cemex must adhere to diverse zoning ordinances that dictate permissible industrial activities, buffer zones, and environmental impact assessments for its quarries and cement plants.

- Permitting Processes: Obtaining permits often involves lengthy public review periods, environmental impact studies, and compliance with specific land development standards, which can take years to complete.

- Operational Constraints: Zoning laws can restrict operating hours, noise levels, and the types of materials that can be processed, directly affecting Cemex's production efficiency and costs.

- Future Development: The availability of suitable land for future expansion is directly tied to favorable zoning and land use policies, posing a strategic challenge for long-term growth.

Product Liability and Quality Standards

Cemex operates under stringent product liability laws, demanding unwavering adherence to quality standards for its cement and concrete products. Failure to meet these benchmarks, such as those outlined by the American Society for Testing and Materials (ASTM) or European Norms (EN), can lead to costly legal battles and product recalls. For instance, in 2023, the construction industry globally saw increased scrutiny on material integrity, with regulatory bodies like the European Commission proposing stricter enforcement of construction product regulations to prevent structural failures.

Maintaining high quality control is paramount. Cemex's commitment to quality directly impacts its reputation and market share. A significant lapse in quality could result in substantial financial penalties and a loss of customer trust, impacting future sales. The company's investment in advanced testing and certification processes, often exceeding minimum regulatory requirements, is a strategic imperative to mitigate these risks and reinforce its brand as a reliable supplier.

- Product Liability: Cemex faces potential legal claims if its building materials fail to perform as expected, leading to property damage or injury.

- Quality Standards: Adherence to international standards like ISO 9001 is crucial for product consistency and market acceptance.

- Regulatory Compliance: Non-compliance can result in fines, product bans, and reputational damage, as seen in past instances across the construction materials sector.

- Risk Mitigation: Robust quality assurance programs are essential to prevent costly recalls and maintain customer confidence.

Cemex's operations are significantly shaped by intellectual property laws, particularly concerning proprietary technologies in cement production and concrete formulations. Protecting these innovations through patents and trademarks is vital for maintaining a competitive edge. For example, in 2024, the company continued to invest in research and development, seeking patents for advanced sustainable building materials.

The company must also navigate evolving data privacy regulations, such as GDPR and similar frameworks globally, to safeguard customer and employee information. Compliance is crucial to avoid substantial penalties and reputational damage. Cemex's digital transformation initiatives in 2023 and 2024 have placed a heightened emphasis on robust data security and privacy protocols.

Cemex's global footprint means it must comply with a myriad of international trade laws, including import/export regulations, tariffs, and sanctions. Changes in these policies, such as those impacting cross-border transactions or specific country dealings, can directly affect supply chain efficiency and cost structures. For instance, ongoing geopolitical shifts in 2024 continue to present complexities in international trade compliance.

The legal framework surrounding environmental protection is a critical factor for Cemex, given the nature of its operations. This includes regulations on emissions, waste management, water usage, and land reclamation. Cemex's commitment to sustainability, as highlighted in its 2023 and 2024 ESG reports, involves significant investment in technologies and practices to meet and exceed these environmental legal standards. For example, in 2024, stricter CO2 emission targets were being implemented in several key markets, requiring Cemex to accelerate its decarbonization efforts.

Environmental factors

Global and regional regulations on CO2 emissions, including carbon pricing and net-zero targets, significantly influence Cemex's operations due to the carbon-intensive nature of cement production.

Cemex is actively pursuing decarbonization through its 'Future in Action' program, aiming for net-zero CO2 by 2050. In 2023, the company reduced its specific net CO2 emissions by 13% compared to its 1990 baseline, reaching 526 kg net CO2/t.cem (cement + clinker).

Cemex, like all major cement producers, relies heavily on the availability of raw materials such as limestone and aggregates. The long-term viability of its operations is directly tied to securing these resources sustainably. For instance, in 2024, global demand for construction materials remained robust, putting pressure on existing reserves.

Growing awareness of resource depletion is pushing Cemex to innovate. The company is actively investigating and implementing the use of alternative raw materials, such as industrial by-products, to reduce reliance on virgin resources. This aligns with broader industry trends towards circular economy principles, aiming to minimize waste and maximize resource utilization.

Water scarcity is a growing concern for Cemex, particularly in regions where its operations are located, as cement production is water-intensive. In 2023, Cemex reported that 39% of its operations were in water-stressed areas, highlighting the critical need for efficient water management.

To address this, Cemex has implemented Water Action Plans across its facilities, focusing on reducing freshwater withdrawal and increasing water recycling. The company's commitment is evident in its 2023 sustainability report, which noted a 3% reduction in total freshwater consumption compared to the previous year.

Waste Management and Circular Economy Initiatives

Cemex is actively driving the circular economy within the construction sector by integrating waste and residues as alternative inputs. This strategy not only minimizes landfill burden but also enhances the efficient use of resources across its operations.

The company's commitment to this model is evident in its ambitious targets. For instance, Cemex aims to increase the use of alternative fuels and raw materials to 45% by 2025, a significant step from its 2020 baseline of 32%. This aligns with global efforts to decarbonize the industry and reduce reliance on virgin materials.

- Increased Waste Utilization: Cemex reported utilizing approximately 10.7 million tons of alternative raw materials and fuels in 2023, a substantial increase from previous years.

- CO2 Reduction: By substituting traditional materials with waste, Cemex projects a significant reduction in CO2 emissions, contributing to its net-zero ambitions.

- Circular Economy Partnerships: The company collaborates with various stakeholders to develop innovative solutions for waste valorization, fostering a more sustainable construction ecosystem.

Climate Change Impacts on Operations and Supply Chains

Climate change presents significant physical risks to Cemex's operations. Extreme weather events, like hurricanes and floods, can directly damage manufacturing facilities and disrupt transportation routes crucial for delivering cement and other building materials. For instance, in 2024, several regions experienced unprecedented rainfall, impacting logistics and potentially causing temporary production halts.

These disruptions extend to Cemex's extensive supply chains, affecting the sourcing of raw materials and the timely delivery of finished products to customers. Building resilience into infrastructure and operational processes is therefore paramount for ensuring business continuity. Cemex's commitment to investing in climate-resilient infrastructure, as highlighted in their 2024 sustainability reports, aims to mitigate these growing environmental threats.

- Physical Disruptions: Extreme weather events in 2024 led to an estimated 5% increase in supply chain delays for construction materials globally.

- Infrastructure Resilience: Cemex is investing in hardening its facilities against extreme weather, with a 2025 target to reduce climate-related operational downtime by 10%.

- Supply Chain Vulnerability: The company's reliance on global shipping and road networks makes it susceptible to climate-induced transportation disruptions.

Environmental regulations, particularly concerning CO2 emissions and the push for net-zero targets, are a primary driver of change for Cemex. The company's proactive 'Future in Action' program is a direct response, aiming for net-zero CO2 by 2050. By 2023, Cemex had already achieved a 13% reduction in specific net CO2 emissions compared to its 1990 baseline, reaching 526 kg net CO2/t.cem.

Resource availability and sustainability are critical. Cemex is increasingly integrating alternative raw materials, like industrial by-products, into its production processes to reduce reliance on virgin resources and embrace circular economy principles. This strategy is supported by ambitious targets, aiming to increase the use of alternative fuels and raw materials to 45% by 2025.

Water scarcity is another significant environmental factor, with 39% of Cemex's operations located in water-stressed areas as of 2023. The company is actively managing this through Water Action Plans, focusing on reduced freshwater withdrawal and increased water recycling, which led to a 3% reduction in total freshwater consumption in 2023 compared to the previous year.

Climate change poses physical risks, with extreme weather events impacting facilities and supply chains. In 2024, unprecedented rainfall caused an estimated 5% increase in global supply chain delays for construction materials, highlighting the need for Cemex's investments in climate-resilient infrastructure to mitigate operational downtime, with a 2025 target to reduce climate-related downtime by 10%.

| Environmental Factor | Cemex's Response/Data | Key Metric/Target |

| CO2 Emissions | 'Future in Action' program, net-zero by 2050 | 526 kg net CO2/t.cem (2023), 13% reduction from 1990 baseline |

| Resource Availability | Use of alternative raw materials | 45% alternative fuels/raw materials by 2025 target |

| Water Scarcity | Water Action Plans, water recycling | 39% operations in water-stressed areas (2023), 3% reduction in freshwater consumption (2023) |

| Climate Change Risks | Investment in climate-resilient infrastructure | 10% reduction in climate-related operational downtime by 2025 target |

PESTLE Analysis Data Sources

Our Cemex PESTLE Analysis is meticulously constructed using data from a diverse range of reputable sources, including international financial institutions, environmental agencies, and leading market research firms. This ensures a comprehensive understanding of the political, economic, social, technological, legal, and environmental factors impacting Cemex.