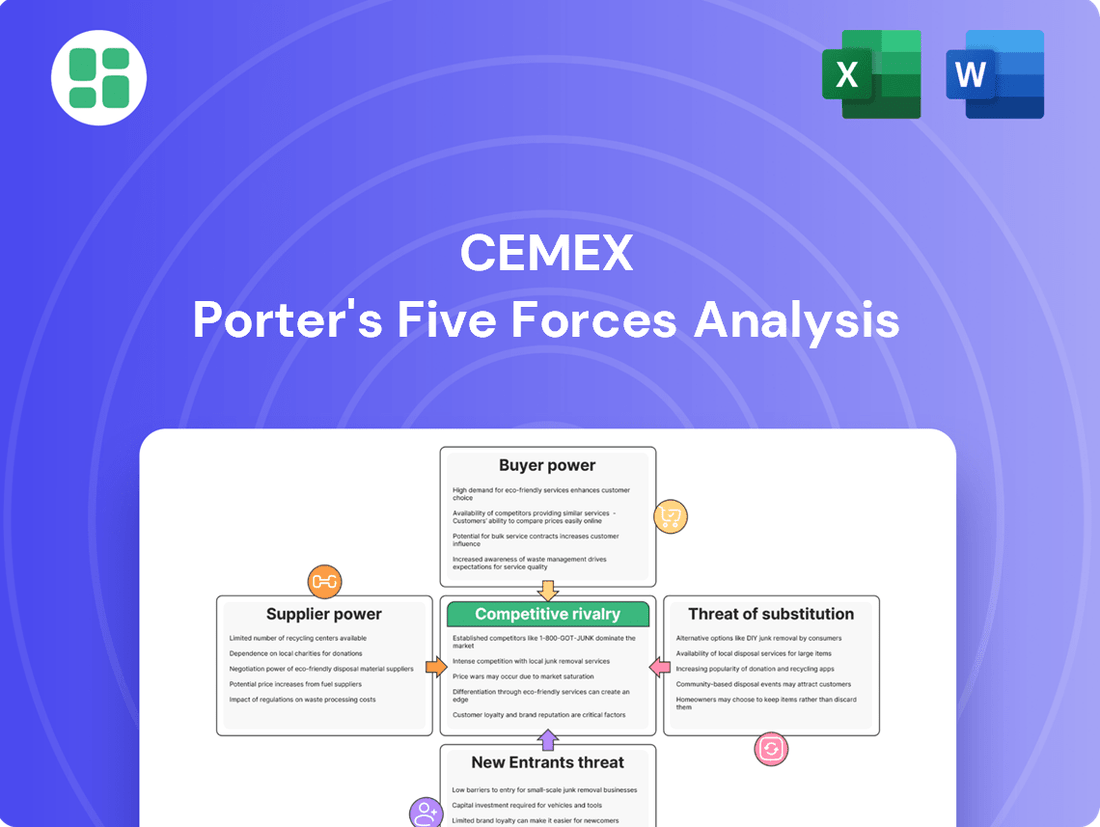

Cemex Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Cemex Bundle

Cemex faces significant competitive pressures, with a moderate threat from new entrants and a strong bargaining power of buyers in the construction materials industry. Understanding these dynamics is crucial for any stakeholder.

The full Porter's Five Forces Analysis reveals the real forces shaping Cemex’s industry—from supplier influence to the threat of substitutes. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The cement industry, and by extension Cemex, depends on specialized industrial by-products such as fly ash and slag. The limited number of companies that can reliably supply these crucial materials grants those suppliers considerable leverage.

This scarcity means Cemex has fewer options when sourcing these inputs, potentially leading to increased costs or less favorable contract terms. For instance, in 2023, the availability of high-quality fly ash, a key pozzolanic material, saw regional fluctuations, impacting production costs for cement manufacturers in certain areas.

Cement production is a major energy consumer, requiring significant electricity and various fuels. This inherent reliance makes Cemex susceptible to the pricing power of energy providers. In 2024, global energy markets experienced considerable volatility, with oil prices fluctuating and natural gas costs remaining a key concern for industrial operations.

The potential for regional energy monopolies further amplifies supplier bargaining power. When few energy suppliers operate in a specific region, they can dictate terms, impacting Cemex's production costs. This can lead to increased operational expenses if Cemex cannot negotiate favorable long-term energy agreements.

Cemex actively works to mitigate this supplier power through strategic initiatives. Securing long-term energy contracts at fixed prices provides cost stability. Furthermore, investing in and utilizing alternative fuels, such as waste-derived fuels, diversifies energy sources and reduces dependence on traditional, volatile energy markets.

The availability and cost of primary raw materials are a key factor in supplier bargaining power. While materials like limestone, clay, and silica sand are generally abundant worldwide, their extraction and transportation expenses can significantly impact this power dynamic. In 2023, global commodity prices for construction materials saw fluctuations, with energy costs directly affecting transportation expenses.

Cemex's strategic advantage lies in its extensive quarry network and vertical integration, which help in managing these raw material costs. However, even with these measures, regional variations in availability and logistical hurdles can still grant a degree of leverage to local suppliers of these essential inputs.

Importance of specialized equipment and technology providers

The building materials sector, including companies like Cemex, relies heavily on specialized equipment and technology providers for its operations. These suppliers offer critical machinery such as kilns, grinders, and sophisticated automation systems essential for efficient production. Their significant bargaining power stems from the substantial capital investment required for this equipment, the necessity for specialized maintenance and technical support, and the proprietary intellectual property embedded in their innovations.

Cemex's strategic focus on technological advancement, exemplified by initiatives like 'Project Cutting Edge,' underscores the vital role these suppliers play. This project aims to integrate advanced digital technologies and automation to optimize production processes, reduce costs, and enhance product quality. The dependence on these specialized providers means that fluctuations in their pricing or availability can directly impact Cemex's operational efficiency and profitability.

- High Capital Costs: Specialized machinery for cement production can represent millions of dollars in upfront investment, limiting the number of potential suppliers.

- Technical Expertise & Maintenance: Providers of advanced kilns and grinding technologies often offer exclusive maintenance and service contracts, creating a captive customer base.

- Intellectual Property: Innovations in areas like energy efficiency for kilns or advanced process control systems are protected by patents, further strengthening supplier leverage.

- Industry Concentration: In certain niches of specialized equipment, the market may be dominated by a few key players, increasing their bargaining power.

Increasing focus on sustainable inputs and circularity

Cemex's growing emphasis on sustainability and circular economy principles directly impacts the bargaining power of its suppliers. By actively seeking to incorporate waste and residues as alternative raw materials and fuels, Cemex aims to diversify its input sources.

This strategic shift can diminish the leverage held by traditional suppliers of virgin materials. For instance, Cemex reported in its 2023 Integrated Report that it increased the use of alternative fuels and raw materials to 34% of its total energy consumption, up from 31% in 2022. This demonstrates a tangible move towards reducing reliance on conventional suppliers.

The development of new supply chains for recycled or alternative materials creates a more balanced supplier landscape. This allows Cemex to negotiate terms from a stronger position, potentially lowering input costs and improving supply chain resilience.

- Diversification of Inputs: Cemex's strategy to use waste and residues reduces dependence on traditional raw material suppliers.

- Increased Alternative Fuel Use: In 2023, alternative fuels and raw materials accounted for 34% of Cemex's energy consumption, up from 31% in 2022.

- New Supply Chain Development: Fostering new chains for recycled materials empowers Cemex in negotiations with existing suppliers.

- Reduced Supplier Leverage: A broader and more diversified supplier base inherently weakens the bargaining power of individual suppliers.

Suppliers of specialized industrial by-products like fly ash and slag hold significant bargaining power due to their limited availability and the critical role these materials play in cement production. Furthermore, the energy sector, a major input for Cemex, exhibits strong supplier leverage, particularly in regions with limited energy providers, as seen with 2024's energy market volatility. Even for abundant raw materials, extraction and transportation costs can empower local suppliers, though Cemex's vertical integration helps mitigate this. Suppliers of specialized machinery and technology also wield considerable influence due to high capital costs, proprietary intellectual property, and the need for exclusive technical support.

| Supplier Type | Key Factors Influencing Bargaining Power | Impact on Cemex | Relevant Data/Trends |

|---|---|---|---|

| Specialized By-products (Fly Ash, Slag) | Scarcity, Criticality for production | Potential for increased costs, less favorable terms | Regional fluctuations in high-quality fly ash availability impacting production costs (2023) |

| Energy Providers | Market concentration (regional monopolies), Price volatility | Susceptibility to pricing power, increased operational expenses | Global energy market volatility in 2024; natural gas costs remain a concern |

| Raw Materials (Limestone, Clay) | Extraction & Transportation Costs | Leverage for local suppliers despite global abundance | Fluctuations in construction material commodity prices and transportation expenses (2023) |

| Specialized Equipment & Technology | High Capital Costs, Technical Expertise, Intellectual Property, Industry Concentration | Impact on operational efficiency and profitability | Dependence on providers for advanced kilns, grinders, and automation systems |

What is included in the product

Uncovers key drivers of competition, customer influence, and market entry risks tailored to Cemex's position in the global cement industry.

Effortlessly identify and mitigate competitive threats by visualizing Cemex's Porter's Five Forces with an intuitive, interactive dashboard.

Customers Bargaining Power

Large-scale construction companies and major infrastructure projects represent a significant chunk of Cemex's clientele. Their substantial order volumes give them considerable leverage.

These major buyers can directly negotiate with manufacturers, using the sheer size of their purchases to secure better pricing, more flexible payment terms, and preferred delivery timelines. This directly increases their bargaining power.

For instance, in 2024, global infrastructure spending was projected to reach trillions of dollars, with large construction firms securing a majority of these contracts, highlighting their importance as Cemex customers.

Cemex's individual customer base is highly fragmented, meaning there are many small buyers rather than a few large ones. This fragmentation significantly reduces the bargaining power of any single customer. For instance, a homeowner undertaking a small renovation or a small contractor buying materials for a single project purchases in quantities that are insignificant to Cemex's overall sales volume.

Consequently, these individual customers typically have little leverage to negotiate prices or terms. They are generally bound by the standard pricing and conditions offered by Cemex or its extensive network of distributors. This contrasts sharply with large institutional buyers or government projects that might purchase vast quantities and thus possess greater negotiating clout.

Customers are increasingly seeking out sustainable building options, which strengthens their bargaining power. This growing demand is driven by both market preference and a push from regulators for eco-friendly construction materials.

Products like Cemex's Vertua line, which offers low-carbon concrete and cement, directly cater to this trend. For instance, Cemex reported that its Vertua products contributed to a significant portion of its sales in 2023, reflecting substantial customer adoption.

This shift empowers customers who prioritize environmental impact, as they now have more leverage to select suppliers aligning with their sustainability goals, potentially influencing pricing and product development.

Impact of regional market dynamics and project pipelines

The bargaining power of Cemex's customers is heavily influenced by regional market dynamics. In areas with robust economic growth and a high volume of construction projects, like certain Latin American markets experiencing infrastructure investment, customers may have less sway due to strong demand for cement and building materials. For instance, in 2024, Mexico's construction sector saw continued expansion, driven by public works and private investment, which could temper customer price negotiation power.

Conversely, in more mature or saturated markets, or those with a higher concentration of cement suppliers, customers can exert greater pressure. The density of competitors directly impacts a customer's ability to switch suppliers, thereby increasing their bargaining power. Cemex's presence in diverse markets means this dynamic is constantly shifting, with some regions offering more favorable conditions for customers than others.

- Regional Demand Fluctuations: Customer power is lower in regions with high project pipelines and strong economic growth, such as parts of Latin America in 2024, where demand outstrips immediate supply.

- Competitive Landscape: In markets with numerous cement producers, customers gain leverage due to the ease of switching suppliers, increasing their bargaining power.

- Project Type Impact: Large-scale infrastructure projects often involve significant volumes, giving these customers more negotiation clout compared to smaller residential builders.

- Economic Sensitivity: Economic downturns can amplify customer bargaining power as demand softens, forcing suppliers like Cemex to compete more aggressively on price.

Low switching costs for standardized products

For undifferentiated products like standard cement, switching costs for customers are generally low because the product is largely a commodity. This ease of switching between suppliers based on price or availability significantly amplifies customer bargaining power.

Cemex actively mitigates this by moving beyond basic product offerings. They focus on providing comprehensive solutions and highlighting superior service, aiming to build loyalty beyond just price points. In 2024, Cemex continued to invest in customer relationship management and digital platforms to enhance service delivery.

- Low Switching Costs: Customers can easily shift between cement suppliers for standardized products.

- Commodity Nature: Cement's undifferentiated status makes price and availability primary decision factors.

- Increased Bargaining Power: This ease of switching empowers customers to demand better terms.

- Cemex's Counter-Strategy: Focus on value-added solutions and exceptional customer service to retain clients.

The bargaining power of Cemex's customers is a key factor, particularly for large construction firms and infrastructure projects that account for substantial order volumes. These major buyers can negotiate favorable pricing, payment terms, and delivery schedules, directly impacting Cemex's profitability. For instance, in 2024, the global infrastructure spending, projected to be in the trillions, saw large construction companies securing a significant portion of these contracts, underscoring their considerable leverage.

Conversely, Cemex's fragmented individual customer base, composed of numerous small buyers like homeowners or small contractors, significantly limits the bargaining power of any single customer. These smaller entities typically purchase insignificant volumes, leaving them with little ability to negotiate terms and largely bound by standard pricing. This contrasts sharply with the clout held by institutional buyers or government projects that procure materials in much larger quantities.

The growing demand for sustainable building options, exemplified by Cemex's Vertua product line which saw substantial customer adoption in 2023, further empowers customers. This trend allows environmentally conscious buyers to leverage their preferences to influence supplier selection, potentially impacting pricing and product development strategies.

Regional market dynamics also play a crucial role. In high-growth areas with robust construction activity, such as parts of Latin America in 2024 experiencing infrastructure investment, customer bargaining power tends to be lower due to strong demand. However, in more mature markets with a higher concentration of cement suppliers, customers gain leverage due to the ease of switching, increasing their negotiation power.

| Customer Segment | Bargaining Power Driver | Impact on Cemex | Example (2024 Data) |

| Large Construction Firms | High Order Volumes | Strong Price Negotiation, Favorable Terms | Securing large infrastructure contracts |

| Individual Homeowners | Low Order Volumes | Minimal Negotiation Power | Purchasing for small renovations |

| Sustainability-Focused Buyers | Demand for Eco-Friendly Products | Influence on Product Development, Potential Price Premiums | Adoption of Cemex's Vertua line |

| Customers in High-Demand Regions | Limited Supplier Choice (due to demand) | Reduced Negotiation Leverage | Construction boom in certain Latin American markets |

Same Document Delivered

Cemex Porter's Five Forces Analysis

This preview showcases the comprehensive Cemex Porter's Five Forces analysis you will receive instantly upon purchase. The document displayed here is the exact, professionally formatted report, providing an in-depth examination of competitive forces within the cement industry. You're looking at the final version—precisely the same document that will be available to you instantly after buying, offering immediate insights into Cemex's strategic landscape.

Rivalry Among Competitors

The building materials sector is dominated by a handful of powerful multinational corporations, creating a highly competitive landscape. Cemex finds itself directly challenged by industry titans like Holcim and Heidelberg Materials, both of which operate extensively in the same product categories and geographical regions. This intense competition frequently drives down prices and necessitates constant strategic adaptation from all players involved.

The cement industry, including players like Cemex, experienced moderate capacity utilization in 2024, with some regions facing slower volume growth. This environment naturally fuels more intense competition as companies strive to secure sales and maintain production levels.

When demand falters or excess capacity exists, the pressure to gain market share can lead to price wars or heightened promotional activities. For instance, reports from early 2024 indicated that certain European markets saw capacity utilization rates hovering around 70-75%, prompting some producers to offer discounts to move inventory.

The building materials sector is witnessing significant consolidation, driven by high-value mergers and acquisitions. Companies are actively pursuing these strategies to achieve geographic expansion and integrate sustainability innovations into their operations. This trend is a clear indicator of intense competition and a strategic imperative to gain market share.

Competitors to Cemex have been particularly active in this M&A space. For instance, in 2024, Holcim announced its acquisition of Firestone Building Products for $3.4 billion, a move aimed at strengthening its roofing solutions segment and expanding its North American presence. Such substantial deals reshape the competitive landscape, intensifying the rivalry for market dominance.

Product differentiation through sustainable solutions

While basic construction materials like cement can be seen as commodities, Cemex and its competitors are actively differentiating through sustainable and advanced product offerings. This shift means that the ability to provide lower-carbon concrete and innovative building materials is becoming a crucial area of competition, moving the focus beyond just cost. For instance, Cemex's Vertua line of low-carbon concrete products exemplifies this trend, allowing them to capture market share by addressing growing environmental concerns among customers.

The competitive rivalry in the cement industry is intensifying as companies leverage product differentiation, particularly through sustainability. Cemex, for example, has invested heavily in developing and marketing its Vertua range, which offers significantly reduced carbon footprints compared to traditional cement. This strategy allows them to command a premium and appeal to a segment of the market prioritizing eco-friendly construction, thereby creating a distinct advantage.

- Product Differentiation: Cemex's Vertua line offers low-carbon concrete solutions, distinguishing its offerings in a traditionally commoditized market.

- Sustainability as a Competitive Edge: The ability to provide environmentally friendly building materials is becoming a key battleground, influencing customer choice and brand perception.

- Market Trend: Growing demand for sustainable construction practices is driving innovation and creating opportunities for companies that can deliver on these requirements.

- Impact on Rivalry: This focus on differentiated, sustainable products elevates the competitive intensity, pushing rivals to invest in similar innovations to remain competitive.

High exit barriers for incumbents

The cement industry's capital-intensive nature presents substantial exit barriers for established players. Specialized facilities are challenging to redeploy or sell without incurring significant financial losses, compelling companies to remain operational even during economic slowdowns. This commitment to existing infrastructure fuels intense competition, often manifesting as sustained price wars as firms strive to cover fixed costs.

For instance, the global cement industry requires massive upfront investment in plants and equipment. In 2024, the average cost to build a new cement plant can range from $200 million to over $1 billion, depending on capacity and technology. This immense capital outlay makes exiting the market a financially punitive decision, locking companies into ongoing operations and intensifying rivalry.

- High Capital Investment: Building a new cement plant in 2024 can cost upwards of $1 billion, creating a significant barrier to exit.

- Specialized Assets: Cement production facilities are highly specialized, limiting resale value and making repurposing difficult.

- Sustained Rivalry: Incumbents are incentivized to stay in the market, leading to persistent competition and potential price pressures.

- Operational Continuity: Companies are compelled to continue operations to avoid substantial asset write-downs, even in unfavorable market conditions.

Competitive rivalry within the building materials sector, particularly for companies like Cemex, is characterized by the presence of large, established multinational corporations. Major players such as Holcim and Heidelberg Materials actively compete across similar product lines and geographic markets, leading to consistent pressure on pricing and the need for continuous strategic adjustments.

The intensity of this rivalry is further amplified by market conditions. In 2024, moderate capacity utilization in the cement industry meant that companies like Cemex faced increased competition to secure sales and maintain production volumes. For example, certain European markets saw capacity utilization around 70-75% in early 2024, prompting some competitors to offer discounts.

Companies are actively pursuing mergers and acquisitions to gain market share and expand their reach. A notable instance in 2024 was Holcim's $3.4 billion acquisition of Firestone Building Products, aimed at bolstering its roofing solutions and North American presence, thereby reshaping the competitive landscape.

The competitive landscape is also shaped by product differentiation, especially in sustainable offerings. Cemex's Vertua line of low-carbon concrete products exemplifies this trend, allowing it to capture market share by appealing to environmentally conscious customers and setting a new standard in the industry.

| Competitor | Key 2024 Strategic Move | Impact on Rivalry |

|---|---|---|

| Holcim | Acquisition of Firestone Building Products ($3.4B) | Strengthened position in roofing solutions and North America, increasing competitive pressure. |

| Heidelberg Materials | Continued investment in decarbonization technologies | Raises the bar for sustainability performance, forcing rivals to innovate or risk losing market share. |

| CRH plc | Divestment of European cement assets to focus on Americas | Creates opportunities for competitors in divested regions while sharpening CRH's competitive focus elsewhere. |

SSubstitutes Threaten

The construction sector's increasing focus on sustainability is driving the adoption of alternative materials. Recycled concrete and steel, alongside wood and bio-based options like hempcrete and mycelium, are gaining prominence. These alternatives offer reduced carbon footprints, presenting a long-term challenge to traditional cement and concrete products.

The rise of modular and offsite construction presents a growing threat of substitutes for traditional concrete products. These methods, increasingly adopted in 2024, streamline building processes by prefabricating components away from the construction site, thereby enhancing efficiency and potentially lowering costs.

While these innovative approaches still necessitate foundational materials, they can significantly reduce the overall volume of conventional concrete and aggregates required for many building applications. This shift represents a partial substitution, as the pre-manufactured elements often incorporate alternative materials or optimized designs that lessen the demand for traditional on-site concrete work.

The development of advanced composite and smart materials presents a significant threat of substitution for Cemex. Research and development in these areas are yielding innovative building solutions with superior performance characteristics. For instance, advanced composites can offer greater strength-to-weight ratios than traditional concrete, potentially impacting specialized construction segments.

These new materials are designed to adapt to changing environmental conditions, offering benefits like improved insulation or self-healing properties. This adaptability could lead to their adoption in high-value projects where enhanced durability and reduced maintenance are prioritized, thereby displacing conventional materials.

Cost-effectiveness and performance of substitute materials

The threat of substitutes for cement is significantly influenced by the cost-effectiveness and performance of alternative building materials. As new technologies emerge and production costs for substitutes decline, they present increasingly attractive options for construction. For instance, advancements in engineered wood products and advanced composites offer comparable or even superior strength-to-weight ratios, often at competitive price points.

The relative cost-effectiveness of substitutes directly impacts cement demand. In 2024, the global average price of Portland cement hovered around $150-$200 per ton, depending on region and grade. However, the increasing efficiency and scale of production for materials like cross-laminated timber (CLT) have seen its price become more competitive, especially for mid-rise structures. For example, while traditional concrete might have a lower upfront material cost, the faster construction times and reduced labor associated with pre-fabricated or modular building systems using substitutes can lead to lower overall project costs.

- Cost-Competitiveness: Fluctuations in energy prices, a key component of cement production, can widen the cost gap between cement and substitutes like recycled steel or advanced polymers.

- Performance Attributes: Substitutes are increasingly offering enhanced features such as lighter weight, better insulation properties, and faster installation, directly challenging cement's traditional advantages.

- Technological Advancements: Innovations in material science are continuously improving the performance and reducing the production costs of alternatives, making them more viable for a wider range of construction applications.

Regulatory pressures and consumer preferences for sustainability

Regulatory pressures and a growing consumer preference for sustainability are increasingly making substitute materials a more attractive option for construction projects. Stricter building codes, such as those mandating lower embodied carbon, and evolving environmental regulations directly push the industry towards alternatives. For instance, by 2024, the European Union's Construction Products Regulation (CPR) is expected to further tighten requirements on the environmental performance of building materials, potentially increasing the appeal of lower-impact substitutes.

These external forces compel companies like Cemex to actively explore and adopt alternative materials that can help reduce carbon emissions and minimize overall environmental impact. The demand from clients and consumers for greener building solutions is a significant driver, influencing material choices and pushing innovation in the sector. In 2023, global demand for green building materials saw a notable uptick, with market research indicating continued growth through 2024 and beyond.

- Increased regulatory scrutiny on carbon emissions and waste management in construction.

- Shifting consumer and client demand for sustainable and eco-friendly building solutions.

- Potential for higher adoption rates of alternative materials that meet stricter environmental standards.

- Growing market share for substitutes that offer lower embodied carbon compared to traditional cement.

The threat of substitutes for Cemex's traditional cement and concrete products is intensifying due to the rise of sustainable and innovative building materials. Alternatives like recycled concrete, steel, and advanced composites offer reduced carbon footprints and enhanced performance, directly challenging cement's market position. For example, by 2024, the increasing adoption of modular construction methods, which often utilize pre-fabricated components, can decrease the overall volume of conventional concrete needed on-site.

Cost-effectiveness and performance attributes are key drivers for substitute adoption. While cement prices averaged $150-$200 per ton in 2024, engineered wood products like CLT are becoming more competitive, especially for mid-rise structures. Furthermore, regulatory pressures, such as the EU's Construction Products Regulation, are pushing for lower embodied carbon, making eco-friendly substitutes more appealing. Global demand for green building materials saw a notable increase in 2023 and is projected to continue growing through 2024.

| Substitute Material | Key Advantages | 2024 Market Relevance |

|---|---|---|

| Recycled Concrete/Steel | Reduced waste, lower embodied energy | Growing adoption in infrastructure projects |

| Engineered Wood (e.g., CLT) | Lighter weight, faster construction, carbon sequestration | Increasingly competitive with concrete for mid-rise buildings |

| Advanced Composites | High strength-to-weight ratio, enhanced durability | Targeting specialized and high-performance construction segments |

| Bio-based Materials (e.g., Hempcrete) | Low embodied carbon, excellent insulation | Emerging in sustainable residential and commercial construction |

Entrants Threaten

The cement and heavy building materials sector demands substantial upfront capital, creating a significant hurdle for newcomers. Constructing state-of-the-art production facilities and developing robust distribution channels requires immense financial commitment.

For instance, establishing a new, modern cement plant can easily cost hundreds of millions of dollars, effectively deterring many potential entrants due to the sheer financial barrier to entry.

Established players like Cemex leverage significant economies of scale in production, procurement, and logistics, leading to lower unit costs. For instance, Cemex's extensive global network and high production volumes in 2024 allow them to negotiate better raw material prices and optimize transportation, creating a substantial cost advantage.

This cost advantage makes it exceptionally difficult for new entrants to compete on price. A new company would need to invest heavily to achieve a similar scale of operations, a considerable hurdle that deters many potential competitors from entering the market.

New entrants into the cement industry, like Cemex, often confront intricate and protracted regulatory approval pathways. Securing environmental permits and acquiring land for quarries and manufacturing facilities are particularly challenging, demanding substantial time and financial investment. This complexity acts as a significant barrier, effectively delaying or deterring potential new competitors from entering the market.

Established distribution networks and customer relationships

Established players like Cemex benefit from deeply entrenched distribution networks and strong, long-standing relationships with major construction firms and distributors. For instance, Cemex's extensive logistics infrastructure, including its own fleet and strategically located depots, ensures efficient delivery across diverse markets.

New entrants face significant hurdles in replicating these established channels and fostering comparable customer loyalty. Building trust and securing reliable distribution takes considerable time and substantial capital investment, making it difficult for newcomers to compete effectively on delivery and service.

In 2024, the global construction market, valued at trillions, highlights the scale of these established networks. Companies with existing supply chain efficiencies and trusted relationships can leverage these advantages to maintain pricing power and market share, presenting a formidable barrier to entry.

Key aspects of this barrier include:

- Extensive Logistics Infrastructure: Incumbents possess robust transportation and warehousing capabilities built over decades.

- Customer Loyalty and Trust: Long-term partnerships with major clients are difficult for new firms to disrupt.

- High Capital Requirements: Establishing comparable distribution and sales networks requires significant upfront investment.

- Brand Reputation: Established brands carry a weight of reliability that new entrants must earn over time.

Potential for aggressive retaliation from existing players

The concentrated nature of the cement industry, with established players like Cemex, means new entrants face a significant threat of aggressive retaliation. Existing competitors are likely to respond forcefully through price wars or by strategically increasing their own capacity, making it difficult for newcomers to gain market share.

This potential for severe backlash deters many potential entrants. The risk of substantial financial losses for an unestablished company facing established giants is exceptionally high, effectively acting as a barrier to entry.

- High Concentration: The global cement market, while vast, is dominated by a few major players, increasing the likelihood of coordinated defensive actions.

- Price Wars: Historically, price wars have been a common tactic in the cement industry to drive out weaker competitors.

- Capacity Additions: Existing firms can quickly add capacity, flooding the market and depressing prices for new entrants.

- Retaliation Risk: The potential for significant financial losses discourages new companies from entering markets where established players are likely to fight back aggressively.

The threat of new entrants in the cement industry, including for Cemex, is generally considered moderate to low. This is primarily due to the extremely high capital requirements for establishing new production facilities, which can run into hundreds of millions of dollars. Furthermore, established players benefit from significant economies of scale, robust distribution networks, and strong customer relationships that are difficult and costly for newcomers to replicate.

In 2024, the global cement market, valued at over $300 billion, still presents these formidable barriers. New entrants must not only overcome the initial investment but also contend with established players' pricing power and aggressive defense strategies, such as price wars, which can quickly erode the profitability of new ventures.

Regulatory hurdles, including obtaining environmental permits and land rights, add further complexity and cost, acting as a significant deterrent. The industry's concentrated nature also means that established companies are well-positioned to retaliate against any new competition, making market entry a high-risk proposition.

| Barrier Category | Description | Impact on New Entrants | Example for Cemex (2024) |

|---|---|---|---|

| Capital Requirements | High cost to build new cement plants and acquire raw materials. | Very High - Significant financial hurdle. | New plant costs can exceed $500 million. |

| Economies of Scale | Lower production costs due to high volume operations. | High - New entrants struggle to match cost efficiency. | Cemex's global production capacity allows for bulk purchasing discounts. |

| Distribution Networks | Established logistics and customer relationships. | High - Replicating reach and trust is challenging. | Cemex's extensive fleet and long-term contracts with developers. |

| Brand Loyalty & Reputation | Trust built over years of reliable supply. | Moderate to High - New brands need time to gain acceptance. | Cemex's established brand recognition in key markets. |

| Regulatory Hurdles | Complex permits for operations and environmental compliance. | High - Time-consuming and costly approval processes. | Securing permits for quarrying and emissions control. |

Porter's Five Forces Analysis Data Sources

Our Cemex Porter's Five Forces analysis is built upon a robust foundation of data, including publicly available financial statements, annual reports from Cemex and its key competitors, and industry-specific market research reports from reputable sources like IBISWorld and Statista.