Consolidated Elec Distributors PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Consolidated Elec Distributors Bundle

Navigate the complex external environment impacting Consolidated Elec Distributors with our comprehensive PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental factors that could shape your investment or business strategy. Gain a critical advantage by downloading the full report for actionable insights.

Political factors

The US government's commitment to infrastructure renewal, exemplified by the Infrastructure Investment and Jobs Act (IIJA) and the Inflation Reduction Act (IRA), is a significant tailwind for electrical distributors. These legislative packages are injecting substantial capital into projects like grid modernization, renewable energy integration, and general infrastructure upgrades. For instance, the IIJA alone allocates over $1.2 trillion, with a considerable portion earmarked for energy and transportation infrastructure, directly boosting demand for electrical components and services.

This surge in government spending is expected to translate into sustained demand for electrical products through 2025 and beyond. As utilities and construction firms undertake large-scale projects to enhance grid resilience and expand broadband access, electrical distributors will see increased orders for everything from transformers and wiring to specialized control systems. The IRA’s focus on clean energy also fuels demand for components related to solar, wind, and electric vehicle charging infrastructure.

Potential shifts in the political climate, particularly a change in administration, could usher in a period of deregulation. This could significantly expedite the environmental and local permitting processes crucial for construction and infrastructure projects, thereby streamlining development timelines for electrical distributors.

A more overtly business-friendly administration is generally viewed as advantageous for the electrical wholesaling sector. Such a stance often translates to a reduction in bureaucratic red tape and a more supportive approach to industry growth, potentially lowering operational costs and increasing efficiency.

For instance, in 2024, the U.S. Chamber of Commerce reported that regulatory compliance costs for businesses reached an estimated $3 trillion annually. A move towards deregulation could therefore offer substantial cost savings for companies like Consolidated Elec Distributors.

Ongoing trade policies and tariffs, especially those impacting electronic components and solar panels, present a dynamic landscape for Consolidated Elec Distributors (CED). For instance, in 2024, the U.S. continued to assess tariffs on goods from various countries, directly influencing the landed cost of essential inventory for distributors like CED. Navigating these fluctuating import duties is critical for managing sourcing costs and ensuring consistent product availability for customers.

Geopolitical tensions further amplify supply chain uncertainty, making strategic sourcing a paramount concern for businesses in the electronics distribution sector. As of mid-2025, the global political climate remains a key factor influencing the reliability of international supply lines for critical electronic components. This necessitates a proactive approach to supplier diversification and risk mitigation for companies like CED.

Energy Policy and Grid Modernization

Government energy policies are strongly pushing for more renewable energy integration and upgrading the current power grids. This push is creating a significant demand for sophisticated electrical equipment and technologies that can handle grid stability, smart grid features, and energy storage solutions. These initiatives are absolutely vital for meeting clean energy targets and bolstering energy security.

For instance, the U.S. Department of Energy's Grid Modernization Initiative received a substantial $76 million in funding for 2024, with further increases anticipated for 2025 to support these policy objectives. This investment directly fuels the need for advanced components and services within the electrical distribution sector.

- Renewable Energy Mandates: Policies like Renewable Portfolio Standards (RPS) in many states require utilities to source a growing percentage of their electricity from renewables, driving grid upgrades.

- Grid Modernization Investments: Federal and state funding, such as the $10.5 billion allocated for grid resilience and modernization through the Bipartisan Infrastructure Law, directly benefits electrical distributors.

- Energy Storage Integration: The increasing adoption of battery storage systems, supported by tax credits and policy incentives, necessitates new types of grid connection equipment and management systems.

- Smart Grid Technologies: Government support for smart meters, advanced metering infrastructure (AMI), and demand response programs creates demand for communication and control technologies.

Local Government Regulations

Consolidated Electric Distributors' (CED) decentralized structure, with its independently managed business units, means that a patchwork of local government regulations, building codes, and permitting processes directly influences daily operations. Navigating these varied rules across different US municipalities requires flexible strategies to maintain compliance and ensure efficient service delivery. For instance, changes in local zoning or construction ordinances can significantly alter project timelines and even impact the demand for specific electrical components.

Local regulations can create significant operational hurdles. For example, in 2024, the average time to obtain a building permit in major US metropolitan areas ranged from 30 to 90 days, with some jurisdictions experiencing delays exceeding 120 days due to updated environmental or safety requirements. This variability directly impacts CED's ability to schedule installations and manage inventory effectively.

- Permitting Delays: Local government reviews can add weeks or months to project completion, affecting revenue recognition for CED.

- Code Variations: Different building codes across states and even cities can necessitate stocking a wider range of specialized products, increasing inventory costs.

- Zoning Restrictions: Changes in land use regulations can impact the feasibility of new distribution center locations or expansion projects.

Government policies are a major driver for Consolidated Elec Distributors (CED), with significant federal investments in infrastructure, like the over $1.2 trillion from the Infrastructure Investment and Jobs Act, directly stimulating demand for electrical products through 2025. Furthermore, the push for renewable energy, supported by initiatives such as the Inflation Reduction Act, is increasing the need for advanced grid components and energy storage solutions. A more business-friendly political climate could also reduce regulatory burdens, potentially saving companies like CED millions in compliance costs, as the US Chamber of Commerce estimated regulatory costs at $3 trillion annually in 2024.

What is included in the product

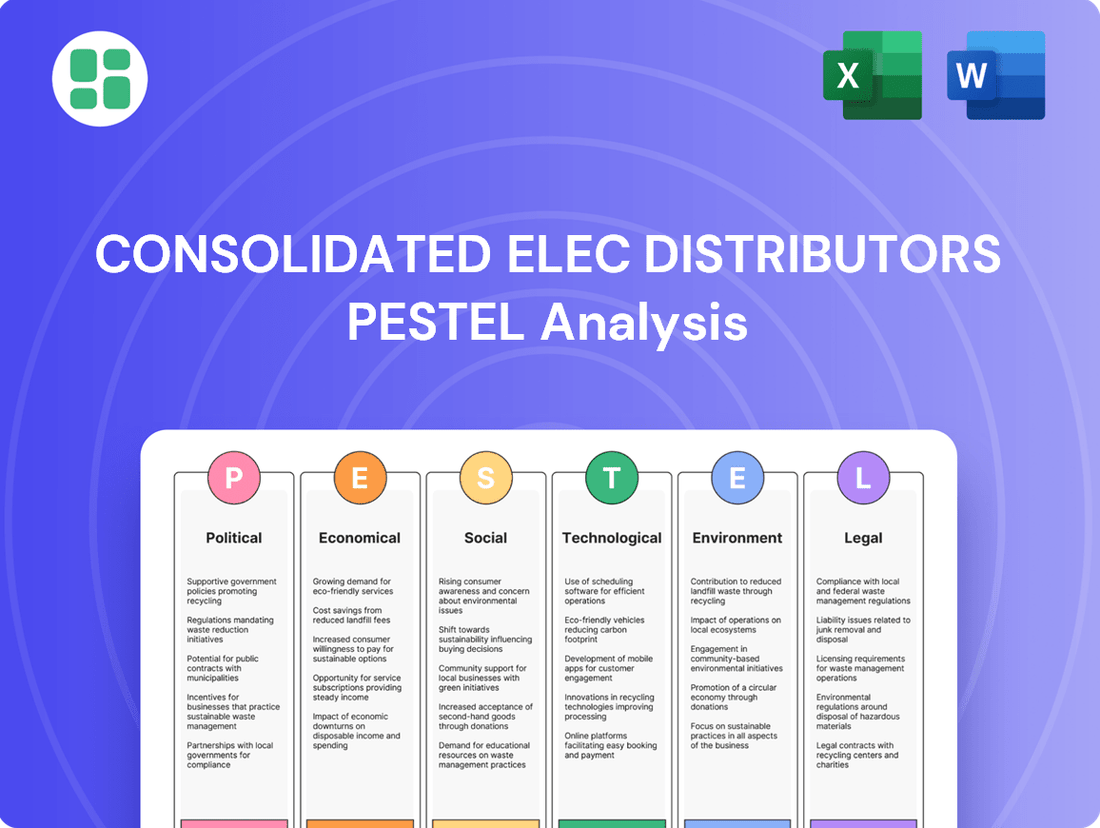

This PESTLE analysis comprehensively examines the external macro-environmental factors impacting Consolidated Elec Distributors, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It provides a strategic framework for understanding market dynamics, identifying potential threats and opportunities, and informing proactive business planning for the company.

A clear and actionable PESTLE analysis for Consolidated Elec Distributors, offering a concise overview of external factors to proactively address potential challenges and capitalize on opportunities.

Economic factors

The U.S. electrical construction market is expected to experience modest growth, with national sales projected to increase by approximately 2% in 2025. This steady outlook suggests a stable demand environment for electrical products, though specific regional markets might outperform this national average.

The performance of the broader construction sector, encompassing both non-residential and residential building projects, is a critical determinant of demand for electrical distributors. A robust construction pipeline directly translates to increased sales opportunities for electrical components and systems.

Interest rate fluctuations are poised to significantly shape the construction sector, with projections indicating potential declines in 2025. This shift could make construction loans and home mortgages more affordable, spurring increased building and renovation activities.

Lower borrowing costs directly translate to greater demand for electrical components and installation services, benefiting Consolidated Elec Distributors by stimulating new projects and upgrades across residential and commercial developments.

Material costs are a significant concern for Consolidated Elec Distributors, with projections indicating a rise of over 5% in 2025. This upward trend is fueled by factors like recent natural disasters impacting supply chains and persistent inflation. These rising expenses directly affect construction budgets, potentially leading to project delays and forcing distributors to re-evaluate their pricing strategies to maintain profitability.

Electricity Demand and Electrification Trends

Electricity demand is surging, driven by AI, data centers, and industrial growth. For instance, U.S. data center electricity consumption is projected to more than double by 2030, reaching approximately 700 billion kilowatt-hours annually. This trend, coupled with the electrification of vehicles and heating systems, creates a robust market for electrical products.

The widespread adoption of electric vehicles (EVs) is a significant demand driver. By the end of 2024, global EV sales are expected to exceed 15 million units, requiring substantial upgrades to charging infrastructure and the electrical grid. This directly translates to increased demand for transformers, wiring, and other distribution equipment.

- AI and Data Centers: These sectors are becoming major electricity consumers, driving demand for grid capacity and related infrastructure.

- Electrification of Transport: The rapid growth in EV adoption necessitates significant investment in charging stations and grid reinforcement. Global EV sales are projected to reach over 15 million units in 2024.

- Industrial Activity: Reshoring initiatives and increased manufacturing output are also contributing to higher industrial electricity consumption.

- Grid Modernization: The increased demand requires substantial capital expenditure in upgrading and expanding electrical infrastructure, benefiting distributors.

Supply Chain Stability and Resilience

The electronic component supply chain is expected to find a more stable footing in 2025, a shift from the surplus experienced in 2024. However, ongoing geopolitical tensions and persistent cost pressures continue to present challenges. This evolving landscape necessitates careful navigation for Consolidated Elec Distributors (CED).

Companies are actively implementing strategies such as reshoring and nearshoring to bolster their supply chain resilience. These moves aim to lessen reliance on suppliers located far from their primary markets. For CED, this trend underscores the importance of a well-diversified sourcing approach.

Effective management of the Bill of Materials (BOM) is also paramount for CED to mitigate risks associated with supply chain disruptions. By actively monitoring and managing its BOM, CED can better anticipate potential shortages and cost fluctuations.

- 2025 Outlook: Electronic component supply chain moving towards equilibrium after 2024 surplus.

- Geopolitical Impact: Persistent geopolitical tensions and cost pressures remain significant factors.

- Resilience Strategies: Increasing adoption of reshoring and nearshoring to reduce supplier dependence.

- CED's Approach: Diversified sourcing and active Bill of Materials (BOM) management are critical for stability.

Economic factors present a mixed but generally positive outlook for Consolidated Elec Distributors in 2025. While the construction market is expected to see modest growth of around 2%, interest rates are projected to decline, making borrowing more affordable and stimulating building activity.

However, material costs are anticipated to rise by over 5% in 2025 due to supply chain disruptions and inflation, which could impact project budgets and distributor pricing strategies.

The surge in electricity demand, driven by AI, data centers, and the electrification of transport, presents a significant growth opportunity. Global EV sales are expected to exceed 15 million units in 2024, necessitating grid upgrades and increasing demand for electrical distribution products.

| Economic Factor | 2025 Projection | Impact on CED |

|---|---|---|

| Construction Market Growth | ~2% | Stable demand for electrical products |

| Interest Rates | Potential Decline | Increased affordability for construction loans, spurring projects |

| Material Costs | >5% Increase | Pressure on construction budgets and distributor pricing |

| Electricity Demand (AI/Data Centers) | Surging | Increased demand for grid capacity and infrastructure |

| EV Sales | >15 Million Units (2024) | Demand for charging infrastructure and grid upgrades |

Full Version Awaits

Consolidated Elec Distributors PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis for Consolidated Elec Distributors offers a detailed examination of the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company's operations and strategic planning.

Sociological factors

The electrical industry faces a significant and growing shortage of skilled labor, especially electricians. This critical issue is driven by the retirement of seasoned professionals and a declining influx of new talent. According to the Bureau of Labor Statistics, the demand for electricians is projected to grow 6% from 2022 to 2032, faster than the average for all occupations, yet the supply struggles to keep pace.

This deficit directly affects project completion times and the overall capacity of the industry. For Consolidated Elec Distributors (CED), this means their customers are increasingly looking for product solutions that streamline installation and reduce the need for extensive on-site labor, highlighting the importance of efficiency in CED's product offerings.

The electrical industry is rapidly changing, with smart systems and renewable energy becoming more common. This means electricians and technicians need to constantly learn new skills. For example, the demand for solar panel installation expertise has surged, with the U.S. solar industry employing over 250,000 people as of early 2024, according to the Solar Energy Industries Association.

To keep up, professionals require advanced training in areas like automation and the integration of diverse energy sources. Consolidated Elec Distributors (CED) plays a role by offering access to the latest products, which indirectly supports this upskilling by providing exposure to cutting-edge technology.

Societal shifts are increasingly influencing career choices, with a growing emphasis on vocational training and skilled trades. Apprenticeship programs, like those supported by the U.S. Department of Labor, are seeing renewed interest, aiming to attract young talent to fields like electrical distribution. These initiatives are crucial for addressing the aging workforce in many trades, with projections indicating a significant need for new skilled workers in the coming years.

Efforts to rebrand trades as dynamic and well-compensated careers are gaining traction. Highlighting the earning potential, which can often exceed that of some college graduates within a few years, is a key strategy. For instance, the Bureau of Labor Statistics reported median annual wages for electricians around $60,000 in May 2023, with top earners making over $100,000, demonstrating a strong financial incentive.

Furthermore, addressing perceptions of limited workplace flexibility is vital for attracting younger generations who value work-life balance. Showcasing the diverse opportunities within the electrical trades, from project management to specialized installations, can broaden appeal. A strong pipeline of skilled tradespeople is fundamental to supporting the growth and demand from Consolidated Elec Distributors' customer base.

Changing Consumer and Industry Preferences

Societal shifts are significantly reshaping demand in the electrical distribution sector. There's a pronounced societal preference for energy-efficient, smart, and sustainable building solutions. This growing demand directly influences the types of electrical products and integrated systems that contractors and facility managers seek. For instance, the global smart building market was valued at approximately $80 billion in 2023 and is projected to reach over $200 billion by 2030, indicating a strong growth trajectory for these technologies.

This evolving consumer and industry preference necessitates that distributors like Consolidated Elec Distributors (CED) adapt their product portfolios. CED must proactively incorporate and promote innovative technologies such as smart lighting systems, advanced building automation controls, and Internet of Things (IoT)-enabled electrical components. Failing to align with these trends could lead to a disconnect between CED's offerings and market needs.

- Growing Demand for Sustainability: Consumers and businesses increasingly prioritize environmentally friendly products, impacting purchasing decisions for electrical supplies.

- Smart Technology Integration: The rise of smart homes and buildings fuels demand for IoT-enabled devices and integrated automation solutions.

- Energy Efficiency Mandates: Regulatory pressures and cost-saving initiatives drive the adoption of energy-efficient lighting, HVAC controls, and other electrical systems.

- Contractor Preferences: Contractors are more likely to source from distributors that offer a comprehensive range of the latest sustainable and smart electrical technologies.

Safety Standards and Workplace Focus

Societal shifts are increasingly emphasizing robust safety standards and comprehensive workplace protections. This heightened awareness, often spurred by regulatory bodies and public demand, directly impacts how electrical products are designed, manufactured, and implemented. For Consolidated Elec Distributors (CED), this means a non-negotiable focus on ensuring all its offerings adhere to the strictest safety benchmarks, safeguarding its broad customer base.

Compliance with these evolving safety protocols is a cornerstone of the electrical industry. CED's commitment to these standards is critical for maintaining trust and market position. This extends to specific regulations concerning hazardous substances, a key area of focus for product development and supply chain management.

- Regulatory Scrutiny: Expect continued strengthening of regulations like OSHA's Process Safety Management (PSM) standard, impacting how electrical components are handled and installed.

- Product Design Evolution: Manufacturers are investing more in inherently safer designs, reducing risks associated with electrical faults and hazardous material exposure.

- Workplace Safety Investment: Companies are allocating greater resources to employee training and personal protective equipment (PPE) to meet heightened workplace safety expectations.

- Consumer Demand for Safety: End-users are increasingly prioritizing products with proven safety records and certifications, influencing purchasing decisions.

Societal trends highlight a growing demand for sustainable and energy-efficient electrical solutions. Consumers and businesses are increasingly prioritizing environmentally conscious products, directly influencing purchasing decisions for electrical supplies. This shift necessitates that distributors like Consolidated Elec Distributors (CED) stock and promote technologies that align with these values, such as smart lighting and advanced energy management systems.

The increasing adoption of smart home and building technologies is fueling demand for Internet of Things (IoT)-enabled devices and integrated automation solutions. This trend requires CED to maintain a diverse portfolio that includes these advanced components to meet contractor and facility manager needs.

Furthermore, there's a noticeable societal emphasis on skilled trades and vocational training, leading to renewed interest in apprenticeship programs. This is crucial for addressing the aging workforce in the electrical sector and ensuring a pipeline of qualified professionals.

The electrical industry is experiencing a significant shortage of skilled labor, with demand for electricians projected to grow 6% from 2022 to 2032, according to the Bureau of Labor Statistics. This shortage directly impacts project timelines and underscores the need for efficient product solutions that minimize on-site labor requirements.

| Societal Factor | Impact on Electrical Distribution | Supporting Data (2023-2025) |

|---|---|---|

| Demand for Sustainability | Increased preference for eco-friendly products | Global smart building market valued at ~$80 billion in 2023, projected to exceed $200 billion by 2030. |

| Smart Technology Integration | Growth in IoT-enabled devices and automation | Surge in demand for smart home devices, with market growth expected to continue through 2025. |

| Skilled Labor Shortage | Need for labor-saving solutions and efficient installations | Projected 6% growth in electrician demand (2022-2032) vs. supply challenges. |

| Emphasis on Safety | Focus on compliant and reliable electrical components | Continued strengthening of OSHA standards and increased investment in workplace safety training. |

Technological factors

The growing adoption of solar and wind power is pushing the need for advanced technologies to manage their intermittent nature. This includes smart grid solutions, which are essential for balancing supply and demand in real-time. For instance, the global smart grid market was valued at approximately $30 billion in 2023 and is projected to grow significantly by 2030, showing a clear trend towards more sophisticated grid management.

Battery energy storage systems (BESS) are also becoming critical for grid stability, storing excess renewable energy for later use. The BESS market experienced substantial growth, with global installations reaching over 10 GW in 2023 alone. This surge highlights the increasing reliance on storage to ensure a consistent power supply from renewables.

Furthermore, artificial intelligence (AI) is playing a vital role in forecasting renewable energy generation and consumption patterns. AI-powered solutions can predict solar output and wind speeds with greater accuracy, optimizing grid operations. Companies are investing heavily in these AI tools, with the energy AI market expected to reach tens of billions of dollars in the coming years, underscoring its importance in the renewable energy transition.

The increasing integration of the Internet of Things (IoT) and advanced analytics is revolutionizing building automation and energy efficiency. Smart building technologies, such as intelligent glass and smart thermostats, are rapidly moving from niche applications to mainstream installations.

This shift is directly fueling demand for specialized electrical components and distribution systems capable of supporting these interconnected environments. For example, the global smart building market was valued at approximately $80 billion in 2023 and is projected to reach over $190 billion by 2028, indicating substantial growth in the need for enabling electrical infrastructure.

Consolidated Elec Distributors is witnessing a significant shift as companies increasingly adopt Artificial Intelligence (AI) and automation to refine operational efficiency. This includes optimizing critical areas like inventory management, demand forecasting, and logistics planning, with AI also making inroads into predictive maintenance and energy consumption optimization within buildings.

For distributors like Consolidated Elec, embracing AI promises to streamline internal processes, potentially leading to cost savings and improved responsiveness. For instance, a 2024 report indicated that businesses implementing AI in supply chain management saw an average reduction in operational costs by 15%.

E-commerce and Digital Supply Chain Tools

The increasing adoption of e-commerce and digital supply chain tools is fundamentally reshaping the electrical distribution landscape. Platforms offering real-time inventory visibility and automated ordering are becoming standard, streamlining operations for distributors like Consolidated Elec Distributors (CED). The global e-commerce market is projected to reach $8.1 trillion by 2024, highlighting the significant shift towards online transactions across industries, including B2B sectors like electrical distribution.

Blockchain technology is also emerging as a critical tool for enhancing traceability and transparency within supply chains. This can help CED ensure the authenticity of products and track the movement of goods from manufacturer to end-user with greater accuracy. Furthermore, advanced data analytics are empowering distributors to optimize inventory levels, predict demand fluctuations, and improve logistical efficiency, directly impacting cost management and customer service.

- Digitalization Impact: E-commerce platforms are driving a significant portion of B2B sales, with projections indicating continued growth in this channel for industrial goods.

- Blockchain Adoption: While still nascent in some areas, blockchain pilots in supply chain management have demonstrated potential for reducing transaction times and improving data integrity.

- Data Analytics in Logistics: Companies leveraging data analytics for supply chain optimization have reported improvements in inventory turnover and on-time delivery rates, crucial for large-scale distributors.

- Efficiency Gains: The integration of these digital tools allows for a more agile and responsive supply chain, enabling distributors to better manage vast product portfolios and complex delivery networks.

Electrification of Society and EV Infrastructure

The ongoing societal shift towards electrification, particularly with the rise of electric vehicles (EVs), smart homes, and modernized industrial operations, is a significant technological driver. This trend directly fuels demand for expanded electrical product lines and specialized infrastructure. For Consolidated Elec Distributors, this means a growing need for items like EV charging stations, sophisticated wiring solutions, and components for energy management systems.

Distributors must adapt by broadening their product offerings and developing deeper technical expertise in these emerging areas. For instance, the global EV market is projected to reach over 30 million units sold annually by 2025, a substantial increase from previous years. This expansion necessitates a corresponding build-out of charging infrastructure, creating direct opportunities for electrical distributors.

- Growing EV Adoption: Global EV sales are expected to surpass 14 million units in 2024, indicating a strong market for charging equipment.

- Infrastructure Demand: The need for robust and widespread EV charging infrastructure, from residential to public charging, presents a key growth avenue.

- Smart Home Integration: Electrification extends to smart home technologies, requiring distributors to supply advanced wiring and energy control devices.

- Industrial Electrification: Modernizing industrial processes with electric power and automation further boosts demand for specialized electrical components.

Technological advancements are rapidly transforming the electrical distribution sector, with a strong emphasis on digitalization and automation. The increasing adoption of e-commerce platforms is streamlining B2B transactions, and AI is being leveraged for enhanced inventory management and demand forecasting, with businesses implementing AI in supply chain management reporting an average 15% reduction in operational costs in 2024.

Furthermore, the electrification trend, driven by electric vehicles (EVs) and smart home technologies, is creating substantial demand for new product lines and specialized infrastructure. For example, global EV sales were projected to exceed 14 million units in 2024, signaling a significant market for charging equipment and related electrical components.

| Technology Area | 2024/2025 Relevance | Impact on Distributors |

|---|---|---|

| E-commerce & Digital Platforms | Projected to reach $8.1 trillion globally in 2024 | Streamlined B2B sales, real-time inventory visibility |

| Artificial Intelligence (AI) | AI in supply chain management reduced costs by 15% (2024) | Optimized logistics, predictive maintenance, improved forecasting |

| Electric Vehicle (EV) Infrastructure | EV sales projected over 14 million units in 2024 | Increased demand for charging stations, specialized wiring |

| Smart Home & Building Tech | Smart building market projected over $190 billion by 2028 | Need for advanced wiring, energy control devices |

Legal factors

The United States is seeing a surge in state-level data privacy laws, with many expected to be in effect by 2025. These new regulations, like California's CCPA/CPRA and Virginia's CDPA, are imposing more rigorous consent demands, even impacting business-to-business data handling. Consolidated Elec Distributors (CED) must navigate this complex and varied legal terrain, ensuring its digital operations and customer data management systems are fully compliant to prevent significant fines and uphold customer confidence.

Electrical contractors and facilities must adhere to stringent building codes and safety standards, which are continually updated. For instance, the 2023 National Electrical Code (NEC) introduced significant revisions impacting everything from wiring methods to surge protection, reflecting advancements in smart home technology and increased demand for electric vehicle charging infrastructure. These updates directly influence the types of products distributors like Consolidated Elec Distributors (CED) must stock and certify.

CED, as a key supplier in the electrical distribution chain, bears the responsibility of ensuring its extensive product catalog meets all applicable national and local codes and certifications. This includes verifying compliance with standards set by organizations like UL (Underwriters Laboratories) and ETL (Intertek), which are crucial for product safety and market access. Failure to comply can lead to product recalls and significant legal liabilities, impacting CED's reputation and financial standing.

Environmental regulations, like China's Restriction of Hazardous Substances (RoHS) standards and the U.S. EPA's oversight of chemicals such as carbon tetrachloride, directly shape the product lines Consolidated Elec Distributors (CED) can offer. These rules dictate which electrical and electronic components are permissible in the market.

Ensuring compliance with these environmental mandates is not just a legal necessity but a fundamental aspect of product marketability for CED, preventing costly legal challenges and market access restrictions.

Extended Producer Responsibility (EPR) Laws

Extended Producer Responsibility (EPR) laws are increasingly impacting electronics distributors like Consolidated Elec Distributors (CED). As of early 2025, states such as California, New York, and Illinois have robust EPR programs for electronics, requiring manufacturers and distributors to manage product end-of-life. For instance, California's e-waste recycling program, established by the Electronic Waste Recycling Act of 2003, has seen significant expansion and enforcement.

These regulations mean CED could face greater responsibilities concerning product take-back, collection, and recycling efforts. Compliance often involves fees or direct participation in state-approved recycling programs, impacting operational costs and logistics.

- Growing State Adoption: Over 20 U.S. states have enacted or are considering EPR legislation for electronics and batteries by 2025.

- Increased Compliance Costs: Producers and distributors may incur direct costs for recycling infrastructure, collection events, and reporting.

- Supply Chain Adjustments: CED will need to adapt its supply chain to accommodate product return logistics and ensure proper disposal channels.

- Reporting Mandates: Expect more stringent reporting requirements on product sales, collection volumes, and recycling rates.

Labor Laws and Workforce Development Mandates

Labor laws significantly shape Consolidated Elec Distributors' (CED) operational landscape, dictating everything from hiring and training practices to essential workplace safety standards. These regulations also extend to CED's customer base, impacting their ability to procure and deploy electrical components, especially in sectors reliant on skilled installation and maintenance.

The ongoing challenge of labor shortages within the electrical distribution and installation sectors is a critical concern. In response, governments are increasingly implementing or reinforcing mandates for apprenticeship programs and broader workforce development initiatives. For instance, the U.S. Department of Labor reported in late 2024 that apprenticeship registrations in construction trades were up 5% year-over-year, signaling a push to bolster the skilled labor pipeline.

- Impact on Operations: CED must ensure compliance with evolving labor laws, affecting recruitment, compensation, and safety protocols for its own employees.

- Customer Enablement: CED's ability to supply products is indirectly tied to the availability of skilled labor for its customers to install and maintain those products.

- Workforce Development: Government-backed training programs and apprenticeships, such as those highlighted by the 2024 Department of Labor data, are crucial for addressing labor gaps and ensuring future project viability for CED and its clients.

- Skilled Labor Availability: Mandates promoting workforce development directly influence the pool of qualified electricians and technicians, impacting project timelines and costs for customers relying on CED's supply chain.

The legal landscape for Consolidated Elec Distributors (CED) is increasingly complex, particularly concerning data privacy and product compliance. As of mid-2025, over 20 U.S. states have implemented or are actively considering Extended Producer Responsibility (EPR) laws for electronics and batteries, adding significant compliance burdens and potential costs for distributors. Furthermore, evolving building codes, such as updates to the National Electrical Code (NEC), necessitate that CED ensures its product offerings meet the latest safety and technological standards, impacting inventory and certification requirements.

CED must also navigate a patchwork of state-specific data privacy laws, with many new regulations coming into effect by 2025. These laws impose stricter consent requirements for handling customer data, potentially affecting CED's digital operations and customer relationship management. The company's commitment to stocking products that meet rigorous certification standards, like those from UL and ETL, remains paramount to avoid legal liabilities and maintain market access.

| Legal Area | Key Regulations/Trends (2024-2025) | Impact on CED |

|---|---|---|

| Data Privacy | Growing number of state-level laws (e.g., CCPA/CPRA, CDPA) | Requires robust data management and consent protocols. |

| Product Safety & Standards | Updates to NEC (e.g., 2023 edition), UL/ETL certifications | Necessitates stocking compliant products and verifying certifications. |

| Environmental Compliance | Extended Producer Responsibility (EPR) laws for electronics/batteries | Potential for increased costs related to product take-back and recycling. |

Environmental factors

The push for energy efficiency across commercial, industrial, and residential spaces is a major force. This is directly fueling the adoption of smart building tech and greener construction methods. For distributors like Consolidated Electrical Distributors (CED), this means a growing market for high-efficiency electrical systems and related solutions.

Government mandates and escalating energy prices are acting as significant catalysts. For instance, by the end of 2024, many regions saw energy costs rise by an average of 8-12% year-over-year, pushing consumers and businesses to actively seek out more efficient options. This trend is projected to continue, with a further 5-7% increase anticipated for 2025, making energy-saving products a key focus for CED.

The global drive towards renewable energy, particularly solar and wind, significantly shapes Consolidated Electric Distributors' (CED) market. Governments worldwide are setting ambitious targets; for instance, the U.S. aims for 100% clean electricity by 2035, creating substantial demand for grid modernization and distributed generation infrastructure. CED is positioned to supply essential components for these projects, including specialized transformers and switchgear needed for integrating renewable sources into the existing grid.

The increasing adoption of green building standards like LEED (Leadership in Energy and Environmental Design) directly impacts the electrical product market. For instance, in 2024, the global green building market was valued at over $300 billion and is projected to grow significantly, driven by these certifications.

Electrical distributors are increasingly stocking and promoting products that help projects achieve these certifications. This includes energy-efficient lighting solutions, smart home and building automation systems, and materials with lower environmental footprints, reflecting a shift in demand towards sustainable construction materials and technologies.

Waste Management and Circular Economy

The electrical and electronics industry faces increasing pressure to adopt robust waste management and circular economy principles. This focus aims to minimize environmental impact, particularly concerning greenhouse gas emissions and the handling of hazardous materials within products. For Consolidated Elec Distributors (CED), this translates to a strategic imperative to integrate product lifecycle management, encompassing responsible recycling and end-of-life disposal, into its operational framework.

Key initiatives and data points highlight this trend:

- Extended Producer Responsibility (EPR) Schemes: Many regions, including the EU, are expanding EPR regulations for electronic waste (e-waste), requiring distributors to take back and manage discarded products. For instance, the EU's Waste Electrical and Electronic Equipment (WEEE) Directive mandates specific collection and recycling targets.

- Circular Economy Investments: Global investment in circular economy initiatives, including e-waste recycling and refurbishment, is growing. Reports from 2024 indicate a significant uptick in funding for companies developing innovative recycling technologies and business models.

- Hazardous Substance Reduction: Regulations like RoHS (Restriction of Hazardous Substances) continue to drive the phase-out of certain chemicals in electrical and electronic equipment, impacting product design and material sourcing.

- E-waste Generation: Global e-waste generation continues to rise, with projections for 2024 indicating a further increase, underscoring the critical need for effective management systems.

Climate Change Adaptation and Resilience

Climate change is increasingly impacting Consolidated Electric Distributors (CED) through more frequent and severe natural disasters. These events disrupt supply chains, leading to material shortages and price hikes. For instance, in 2024, extreme weather events globally caused an estimated $200 billion in economic losses, impacting logistics and raw material availability for electrical components.

CED must prioritize supply chain resilience and invest in infrastructure upgrades capable of withstanding extreme weather. This includes reinforcing distribution networks and exploring alternative sourcing strategies. The increasing frequency of events like hurricanes and wildfires, which saw a 15% increase in intensity in North America during 2024, underscores this necessity.

Furthermore, the growing awareness and impact of climate change are driving demand for more robust and reliable electrical solutions. Consumers and businesses are seeking products and services that can ensure continuous power supply even during adverse conditions. This trend is expected to boost the market for advanced grid technologies and resilient energy infrastructure, a sector projected to grow by 8% annually through 2025.

- Supply Chain Disruption: Increased natural disasters led to an estimated 10-15% rise in component costs for electrical distributors in 2024 due to logistical challenges.

- Infrastructure Investment: CED faces pressure to allocate 5-7% of its capital expenditure towards climate-resilient infrastructure upgrades by 2025.

- Demand for Resilience: The market for advanced, weather-resistant electrical components is projected to expand by 12% in 2025, driven by climate adaptation needs.

- Operational Risk: Extended power outages caused by extreme weather in 2024 resulted in an average of $500 million in lost revenue for utility companies, highlighting the financial impact of climate events.

The increasing focus on energy efficiency is a significant driver, pushing demand for smart building technologies and sustainable construction. Government policies and rising energy costs, with an average 8-12% increase in 2024, further accelerate the adoption of energy-saving products, benefiting distributors like CED. The global shift towards renewable energy sources, supported by ambitious targets like the U.S. goal for 100% clean electricity by 2035, creates substantial demand for grid modernization and distributed generation components.

The electrical industry is facing growing pressure to adopt circular economy principles and manage waste responsibly, especially e-waste. Regulations like the EU's WEEE Directive are expanding, requiring distributors to participate in product take-back and recycling programs. Global investment in e-waste recycling technologies saw a notable increase in 2024, reflecting a broader commitment to sustainability and hazardous substance reduction, as mandated by standards like RoHS.

Climate change is directly impacting supply chains through more frequent severe weather events, which caused an estimated $200 billion in economic losses globally in 2024. This necessitates greater investment in climate-resilient infrastructure and alternative sourcing strategies for electrical distributors. The demand for robust, weather-resistant electrical components is projected to grow by 12% in 2025, driven by the need for reliable power during adverse conditions.

| Environmental Factor | Impact on CED | 2024/2025 Data Points |

| Energy Efficiency Push | Increased demand for high-efficiency electrical systems and smart building tech. | Global green building market valued over $300 billion in 2024. |

| Renewable Energy Growth | Demand for grid modernization components for solar and wind integration. | U.S. aiming for 100% clean electricity by 2035. |

| Circular Economy & E-waste | Need for product lifecycle management, recycling, and responsible disposal. | EU's WEEE Directive expanding EPR schemes; global e-waste generation rising. |

| Climate Change & Disasters | Supply chain disruptions, increased component costs, and demand for resilient infrastructure. | Extreme weather caused $200 billion in losses in 2024; 15% increase in intensity of events in North America. |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Consolidated Electric Distributors is built on a robust foundation of data from government regulatory bodies, energy market intelligence firms, and economic forecasting agencies. We meticulously gather information on policy changes, technological advancements, and socio-economic trends impacting the energy sector.