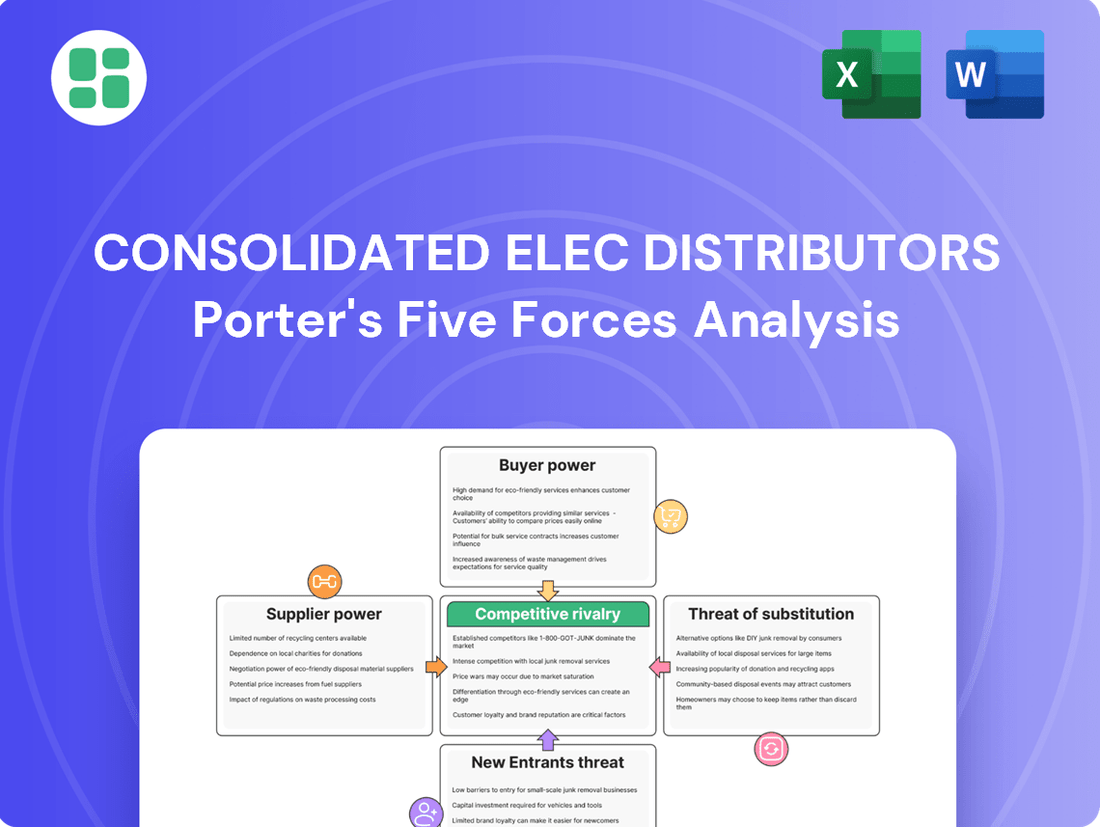

Consolidated Elec Distributors Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Consolidated Elec Distributors Bundle

Consolidated Elec Distributors faces moderate bargaining power from suppliers due to specialized components, while buyer power is significant, especially from large retail chains. The threat of new entrants is moderate, hindered by capital requirements and established distribution networks. Rivalry among existing competitors is intense, driven by price sensitivity and product differentiation efforts. The threat of substitutes is relatively low, as electrical distribution is essential.

The complete report reveals the real forces shaping Consolidated Elec Distributors’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The electrical distribution sector, including Consolidated Elec Distributors (CED), depends on manufacturers for everything from basic wiring to complex industrial automation. When a crucial, specialized component is sourced from only a handful of manufacturers, those suppliers gain substantial leverage.

CED's broad product catalog means it engages with a multitude of suppliers, but the sourcing of certain specialized equipment often involves a limited pool of manufacturers, potentially increasing their bargaining power.

Switching suppliers presents tangible costs for Consolidated Elec Distributors (CED). These include the expenses associated with qualifying new products, reconfiguring inventory management systems, and the potential for operational disruptions as new supply chains are integrated. For instance, in 2024, many distributors reported increased IT integration costs averaging 3-5% of the total procurement value when onboarding new suppliers.

Furthermore, CED benefits from established relationships with its current key manufacturers. These long-standing partnerships often translate into favorable volume discounts and specific contractual terms that make transitioning to alternative suppliers economically unappealing. In 2023, the average discount for high-volume electrical component purchases was around 7-10%, a significant factor in supplier retention.

However, CED's decentralized operational structure offers a degree of flexibility. Individual branch locations may possess greater autonomy to select alternative suppliers for specific product categories, especially for less critical or commoditized items. This localized decision-making can mitigate some of the broader organizational switching costs, allowing for more agile procurement strategies at the branch level.

While it's generally improbable for major electrical equipment manufacturers to replicate the extensive product range and localized service of distributors like Consolidated Elec Distributors (CED), a strategic shift towards direct sales is a potential threat. Some manufacturers might opt to bypass intermediaries for high-volume, standardized items, targeting very large clients or establishing their own e-commerce platforms. This could directly impact distributors by siphoning off profitable sales segments.

Importance of Supplier's Input to CED's Business

The bargaining power of suppliers for Consolidated Elec Distributors (CED) is significant because electrical products form the very foundation of its operations. Without a consistent and reliable supply of these core items, CED cannot effectively serve its customer base.

Recent industry reports from 2024 highlight how distributors, including those like CED, have faced challenges with product availability. For instance, lead times for critical components like switchgear have extended, directly impacting CED's capacity to meet project deadlines and fulfill customer orders promptly. This dependency underscores the leverage suppliers hold.

Furthermore, the financial health of CED is directly tied to supplier pricing and supply chain stability. Fluctuations in raw material costs, a common occurrence in the electrical manufacturing sector, can immediately affect CED's cost of goods sold. Supply chain disruptions, whether due to geopolitical events or manufacturing issues, can further exacerbate these cost pressures and limit inventory availability.

- Essential Inputs: Electrical products are the lifeblood of CED's business model.

- Delivery Reliability: Delays in receiving crucial items like switchgear, a recurring issue in 2024, directly impede CED's ability to complete projects.

- Cost Sensitivity: Price volatility of raw materials and supply chain interruptions directly impact CED's profitability.

Availability of Substitute Inputs

The availability of substitute inputs significantly influences the bargaining power of suppliers for Consolidated Elec Distributors (CED). For standard, commoditized electrical products, CED can often source from numerous manufacturers, which dilutes the power of any single supplier.

However, when dealing with specialized, proprietary, or patented components, the limited availability of substitutes grants those particular suppliers considerable leverage. For instance, in 2024, tariffs imposed on imported electrical components, such as solar panels and transformers, have demonstrably increased the cost and constrained the availability of certain inputs, thereby amplifying the bargaining power of domestic or alternative suppliers.

- Limited Substitutes for Proprietary Components: Suppliers of unique or patented electrical parts hold greater power due to the lack of readily available alternatives for CED.

- Impact of Tariffs on Input Costs: Tariffs on imported goods like solar panels in 2024 have raised prices and reduced supply options, strengthening the position of remaining suppliers.

- Commoditized Products Offer More Choice: For standard electrical items, CED benefits from a wider array of suppliers, reducing the leverage of any individual supplier.

Suppliers hold significant sway over Consolidated Elec Distributors (CED) due to the essential nature of electrical components. When specialized items are sourced from a limited number of manufacturers, their bargaining power increases substantially.

CED faces substantial switching costs, averaging 3-5% of procurement value in 2024 for IT integration alone when onboarding new suppliers. Furthermore, established relationships often provide discounts of 7-10% on high-volume purchases in 2023, making supplier changes economically unattractive.

The availability of substitutes is critical; while commoditized items have many suppliers, proprietary components grant significant leverage to their manufacturers. For example, 2024 tariffs on imported electrical goods have boosted the power of domestic suppliers.

| Factor | Impact on CED | Supplier Leverage |

|---|---|---|

| Specialized Components | High dependency | Strong |

| Switching Costs (2024 Avg.) | 3-5% of procurement value | Moderate |

| Volume Discounts (2023 Avg.) | 7-10% | Moderate |

| Tariffs on Imports (2024) | Increased costs, reduced options | Strong (for domestic/alternative suppliers) |

What is included in the product

This analysis of Consolidated Elec Distributors reveals the intensity of rivalry, buyer and supplier power, the threat of new entrants and substitutes, providing a strategic roadmap for navigating its competitive environment.

Consolidated Elec Distributors' Porter's Five Forces analysis provides a clear, one-sheet summary of all five forces, perfect for quick decision-making and understanding strategic pressure.

Customers Bargaining Power

Consolidated Elec Distributors (CED) faces significant customer price sensitivity across its varied clientele. Electrical contractors, industrial and commercial facilities, and utility companies often operate under tight budget constraints and competitive bidding processes, making them highly attuned to price. For instance, in the competitive electrical supply market, a 2024 industry report indicated that over 70% of purchasing decisions were heavily influenced by price, with availability being a close second.

The digital age has amplified this price sensitivity. With the proliferation of online platforms and easy access to competitor pricing, customers can readily compare offerings, further pressuring distributors like CED to maintain competitive price points. This transparency means customers are more empowered than ever to seek out the best deals, directly impacting CED's pricing strategies and margins.

Consolidated Elec Distributors (CED) caters to a broad customer base, from numerous small electrical contractors to significant industrial, commercial, and utility clients. These larger clients, by virtue of their substantial purchase volumes, often wield considerable bargaining power.

This power can translate into demands for preferential pricing, more favorable payment terms, and bespoke product or service offerings. For instance, a major utility company might negotiate bulk discounts that significantly impact CED's margins on those specific sales.

However, CED's decentralized operational structure, emphasizing localized service and relationship management, can serve as a countermeasure to this customer power. By fostering strong, personalized connections with these high-volume buyers, CED can potentially mitigate the pressure for concessions and maintain a more balanced negotiating position.

Customers possess significant leverage due to the abundance of alternative suppliers for electrical distribution products. Beyond traditional distributors like Consolidated Elec Distributors (CED), buyers can procure goods directly from manufacturers, through large retail chains, or via online platforms such as Amazon Business. This accessibility to substitutes means customers can readily shift their business if CED’s pricing or product selection isn't appealing.

The proliferation of e-commerce has further amplified this customer bargaining power. For instance, in 2024, online B2B marketplaces continued to gain traction, offering competitive pricing and convenience that challenges established distributors. This easy switching capability forces distributors to remain highly competitive on price and service to retain their customer base.

Customer Switching Costs

Customer switching costs for Consolidated Elec Distributors (CED) vary significantly. For standard, easily replaceable electrical goods, switching to a competitor might involve minimal cost. However, for specialized components or integrated electrical systems, customers often incur higher switching costs. These can include the expense of re-qualifying suppliers, re-establishing credit lines, and the learning curve associated with new product specifications and support services.

The convenience and competitive pricing from alternative suppliers, including online retailers and direct-to-consumer channels, frequently offset these potential switching costs for a broad segment of CED's customer base. This is particularly true for smaller projects or routine purchases where the value of established relationships is less pronounced.

- Low Switching Costs for Commoditized Products: Basic electrical supplies often have readily available substitutes, making it easy for customers to switch suppliers without significant financial or operational disruption.

- Higher Switching Costs for Complex Solutions: For integrated systems, specialized equipment, or large-scale projects, customers face increased costs related to supplier integration, credit terms, and familiarity with CED's specific offerings.

- Competitive Alternatives Impact Switching: The availability of convenient and competitively priced alternatives from other distributors or online platforms can diminish the perceived value of staying with CED, especially for less complex needs.

Threat of Backward Integration by Customers

The threat of backward integration by customers for Consolidated Elec Distributors (CED) is generally low. For typical customers like electrical contractors, the immense capital outlay and specialized manufacturing knowledge needed to produce their own electrical products makes this an impractical strategy.

However, a segment of very large industrial or utility clients could potentially bypass distributors for specific high-volume or niche electrical components.

By engaging in direct procurement from manufacturers, these powerful customers can reduce their dependence on intermediaries like CED. For instance, in 2024, major utility companies have been observed to negotiate directly with cable manufacturers for significant portions of their infrastructure needs, impacting distributor margins on these specific product categories.

This direct sourcing capability, though not widespread across CED's entire customer base, represents a tangible pressure point that can influence pricing and service demands.

Customers wield considerable power over Consolidated Elec Distributors (CED) due to intense price sensitivity and the wide availability of alternative suppliers, including manufacturers and online marketplaces. This leverage is amplified by the increasing transparency of pricing in the digital age, forcing CED to remain highly competitive to retain its customer base, especially for commoditized products.

While switching costs can be higher for specialized systems, the convenience and competitive pricing from alternatives often negate these for many customers, particularly for routine purchases. The potential for large clients to engage in direct sourcing from manufacturers, as seen with utility companies in 2024, further pressures distributors like CED on pricing and service demands.

| Customer Segment | Price Sensitivity (2024 Data Estimate) | Switching Cost (General) | Backward Integration Potential |

|---|---|---|---|

| Electrical Contractors | High | Low to Moderate | Very Low |

| Industrial/Commercial Facilities | Moderate to High | Moderate | Low to Moderate |

| Utility Companies | Moderate | Moderate to High | Moderate |

Preview the Actual Deliverable

Consolidated Elec Distributors Porter's Five Forces Analysis

This preview displays the complete Porter's Five Forces Analysis for Consolidated Elec Distributors, offering a thorough examination of industry competition and profitability. You're looking at the actual document; once you complete your purchase, you’ll get instant access to this exact, professionally formatted file, ready for your strategic planning needs.

Rivalry Among Competitors

The electrical wholesale distribution sector is experiencing a significant wave of consolidation. Major players like Consolidated Electrical Distributors (CED) are actively acquiring smaller, regional businesses, leading to a more concentrated market. This trend means fewer, larger entities are controlling a greater portion of the industry.

Evidence of this shift is clear: the top ten distributors now command more than 50% of the total industry revenue. For instance, in 2023, the largest distributors saw their market share increase, demonstrating the ongoing impact of mergers and acquisitions on the competitive landscape.

This consolidation intensifies rivalry among the remaining large distributors. As the market becomes more concentrated, these dominant firms engage in aggressive strategies to capture and maintain market share, often through competitive pricing and expanded service offerings.

The electrical wholesalers market is projected to see a moderate compound annual growth rate of around 2.6% between 2025 and 2033. This pace, while steady, means that companies are actively vying for a larger slice of the market pie.

While specific segments such as data centers, electric vehicle charging infrastructure, and renewable energy projects are showing strong demand and driving growth, the broader market expansion for 2025 is anticipated to be relatively subdued. This environment naturally heightens the competitive rivalry among established electrical distributors.

While many electrical components are seen as commodities, distributors like Consolidated Elec Distributors (CED) stand out by offering more than just products. They focus on value-added services, deep local knowledge, and maintaining a broad stock of items. This approach helps them build strong connections with their customers, setting them apart from competitors who might just compete on price.

CED's structure, which emphasizes local operations and tailored expertise, is a significant advantage. This allows them to cater to the specific needs of different regions and customer bases. By providing specialized solutions for complex projects, such as those in solar energy or industrial automation, CED can lessen the pressure of direct price competition.

Exit Barriers

High fixed costs are a major hurdle for electrical distributors looking to exit the market. Think about the massive investments in extensive warehousing, sophisticated distribution networks, and the specialized inventory required to serve diverse customer needs. These aren't small, easily shed assets.

These substantial capital outlays create significant exit barriers, meaning companies might stick around even when profits are thin. This can lead to prolonged competitive pressure as struggling firms remain in the game rather than liquidating their assets. For instance, a distributor with a nationwide network of warehouses, each representing millions in investment, cannot simply shut down overnight without incurring massive losses on the sale or disposal of these facilities.

- High Fixed Costs: Significant investments in warehousing, distribution, and specialized inventory.

- Asset Specificity: Infrastructure is often specialized and difficult to repurpose or sell quickly.

- Persistence of Competitors: Companies may continue operating at low profitability due to the difficulty of exiting.

- Capital Intensity: The industry's capital-intensive nature makes exiting a costly and complex process.

Diversity of Competitors

Consolidated Electrical Distributors (CED) faces a broad spectrum of competitors, extending beyond major national players like WESCO, Sonepar, Graybar, and Rexel. This includes a multitude of smaller regional distributors, specialized niche suppliers catering to specific industries, and even generalist big-box retailers. The competitive arena is further broadened by the rise of online-only electrical suppliers, intensifying pressure on price, service, and product accessibility.

This multifaceted competitive environment compels CED to differentiate itself across various strategic dimensions. Key areas of focus include maintaining competitive pricing, ensuring high levels of customer service, guaranteeing product availability, and enhancing digital engagement capabilities to meet evolving customer expectations.

- National Distributors: WESCO, Sonepar, Graybar, and Rexel represent significant competitors with extensive reach and resources.

- Regional and Niche Players: Smaller, localized distributors and those specializing in particular product categories or markets also exert competitive pressure.

- Alternative Channels: Big-box retailers and online-only electrical suppliers are increasingly capturing market share, forcing CED to adapt its sales and distribution strategies.

- Competitive Factors: Success hinges on competing effectively on price, the quality of customer service, the breadth and depth of product inventory, and the sophistication of digital platforms.

Competitive rivalry within the electrical distribution sector is intense, fueled by a fragmented market despite ongoing consolidation. While major players like CED, WESCO, and Sonepar vie for dominance, a significant number of regional and niche distributors, alongside emerging online channels, maintain a strong presence. This diverse competitive landscape necessitates constant strategic adaptation.

The industry's growth, projected at a modest 2.6% CAGR from 2025-2033, intensifies competition as firms fight for market share. Companies like CED differentiate through value-added services, local expertise, and comprehensive inventory, rather than solely on price, to navigate this challenging environment.

High fixed costs and specialized assets create substantial exit barriers, keeping even less profitable competitors in the market and thus prolonging competitive pressure. This dynamic means that firms must continually innovate and optimize operations to maintain their edge.

Key competitors for Consolidated Electrical Distributors (CED) include national giants like WESCO, Sonepar, Graybar, and Rexel, alongside numerous regional players, specialized suppliers, and increasingly, online retailers. Success hinges on a multi-faceted approach balancing price, service, product availability, and digital engagement.

| Competitor Type | Key Players/Examples | Competitive Factors |

|---|---|---|

| National Distributors | WESCO, Sonepar, Graybar, Rexel | Extensive reach, resources, broad product lines |

| Regional Distributors | Various local entities | Local market knowledge, personalized service |

| Niche Suppliers | Specialized product focus (e.g., automation, renewables) | Deep technical expertise, tailored solutions |

| Online-Only Retailers | Amazon Business, specialized e-commerce sites | Price competitiveness, convenience, broad accessibility |

SSubstitutes Threaten

Large industrial and utility customers, representing a significant portion of the electrical distribution market, have the potential to bypass distributors and source directly from manufacturers. This threat is amplified for high-volume, commoditized items where price is the primary driver. For instance, in 2024, major construction projects often negotiate bulk pricing directly with manufacturers for essential components like transformers and switchgear, reducing their reliance on intermediary distributors.

The rapid advancement of smart electrical systems, IoT devices, and distributed energy resources (DERs) poses a significant threat of substitution for Consolidated Elec Distributors (CED). These emerging technologies, including microgrids and sophisticated energy storage solutions, are fundamentally altering electricity management and consumption patterns. For instance, the global microgrid market was valued at approximately $27.5 billion in 2023 and is projected to reach $62.7 billion by 2030, indicating a substantial shift towards alternative energy infrastructure. This evolution could diminish reliance on traditional distribution components and methods, compelling CED to integrate these innovative solutions into its portfolio to remain competitive.

Digital-first and online retailers, including giants like Amazon Business and niche electrical supply websites, present a potent threat of substitution for Consolidated Electrical Distributors (CED). These platforms offer unparalleled convenience and often aggressive pricing, directly challenging CED's traditional model.

The shift towards online purchasing is undeniable, with a significant portion of electrical buyers now opting for digital channels. In 2024, e-commerce sales in the electrical wholesale sector continued their upward trajectory, with many buyers prioritizing speed and cost-effectiveness, factors where online competitors frequently excel.

Energy Efficiency and Sustainable Alternatives

The increasing focus on energy efficiency presents a significant threat of substitutes for Consolidated Elec Distributors. As consumers and businesses prioritize reducing energy consumption, they increasingly adopt solutions like LED lighting and smart home devices. For instance, the global LED lighting market was valued at approximately $80 billion in 2023 and is projected to grow substantially, indicating a direct shift away from less efficient lighting technologies that Consolidated Elec Distributors might supply.

Furthermore, the proliferation of renewable energy sources, such as rooftop solar panels, directly substitutes the need for grid-supplied electricity and the components associated with it. In 2024, residential solar installations continued to see robust growth, with the U.S. market alone expected to add over 30 gigawatts of solar capacity. This trend means fewer traditional electrical distribution components may be required for new installations or upgrades.

- Energy Efficiency Mandates: Government regulations and corporate sustainability goals are driving demand for energy-saving products, impacting the market for conventional electrical supplies.

- Technological Advancements: Innovations in areas like smart grid technology and advanced power management systems offer alternatives that optimize energy usage, potentially reducing reliance on basic distribution infrastructure.

- Customer Preference Shift: A growing consumer awareness and preference for environmentally friendly and cost-saving solutions encourage the adoption of substitutes that lower overall electricity bills and carbon footprints.

DIY and Self-Installation Trends

The rise of DIY and self-installation trends presents a moderate threat to Consolidated Electrical Distributors (CED). For simpler electrical products and routine maintenance, consumers and even some small businesses might opt for direct purchases from general hardware stores or online retailers, bypassing specialized distributors. This trend is fueled by readily available online tutorials and accessible product designs, allowing individuals to undertake basic electrical tasks themselves.

While CED's core business remains serving professional contractors, the availability of products in channels outside traditional electrical distribution can siphon off demand for certain lower-complexity items. For instance, the home improvement sector saw significant growth, with consumers increasingly tackling projects themselves. In 2024, the global DIY home improvement market was valued at over $150 billion, indicating a substantial consumer base willing to engage in such activities.

- DIY Market Growth: The global DIY home improvement market is projected to continue its upward trajectory, potentially impacting sales of basic electrical components.

- Online Availability: Many electrical products, from basic wiring to simple fixtures, are widely available through online marketplaces, offering convenience and competitive pricing.

- Impact on Basic Items: While professional contractors remain CED's primary customer base, the threat of substitutes is more pronounced for less specialized, easily installable electrical goods.

The threat of substitutes for Consolidated Elec Distributors (CED) is significant, driven by direct sourcing, emerging technologies, and online retail. Large industrial clients increasingly bypass distributors for bulk commodity items, a trend amplified in 2024 by major construction projects negotiating directly with manufacturers for components like transformers. This bypass strategy directly reduces CED's market share for high-volume, price-sensitive goods.

Emerging technologies like smart grids, IoT devices, and distributed energy resources (DERs) offer fundamental alternatives to traditional electrical distribution. The microgrid market, valued at approximately $27.5 billion in 2023 and projected to reach $62.7 billion by 2030, exemplifies this shift, potentially diminishing the need for CED's conventional offerings.

Digital platforms, including Amazon Business and specialized online electrical suppliers, pose a potent substitution threat due to their convenience and aggressive pricing. In 2024, e-commerce sales in electrical wholesale continued to climb, with buyers prioritizing speed and cost-effectiveness, areas where these online competitors often excel.

| Threat Category | Key Substitutes | 2024 Market Relevance |

| Direct Sourcing | Manufacturers (for bulk/commodity items) | High for large industrial/utility customers; price-driven. |

| Technological Advancements | Microgrids, DERs, Smart Grids | Growing rapidly; microgrid market ~$27.5B (2023). |

| Online Retail | Amazon Business, Niche Electrical E-tailers | Increasingly dominant; e-commerce sales in wholesale rising. |

| Energy Efficiency | LED Lighting, Smart Home Devices | Significant; LED market ~$80B (2023). |

| Renewable Energy | Rooftop Solar | Robust growth; US solar capacity additions over 30GW expected in 2024. |

Entrants Threaten

Entering the electrical wholesale distribution market demands substantial upfront capital. Think about the costs for stocking a wide range of products, securing and maintaining warehouse space, running a fleet of delivery vehicles, and implementing robust IT systems. These significant financial hurdles naturally deter many potential new competitors from even trying to enter the field.

For established companies like Consolidated Electrical Distributors (CED), these high capital requirements translate into a considerable advantage. They've already made these investments, allowing them to leverage economies of scale and benefit from existing infrastructure, making it much harder for newcomers to compete on price or efficiency.

Consolidated Electrical Distributors (CED) benefits from established distribution networks and relationships, a significant barrier to new entrants. Existing distributors have cultivated deep, long-standing ties with both electrical product manufacturers and a broad spectrum of customers, from large industrial clients to smaller contractors. These relationships, forged over years of reliable service and mutual trust, represent a substantial competitive advantage that new players find challenging to penetrate.

CED's network of over 700 independently operated locations across North America provides localized expertise and responsive customer service. This decentralized model allows for tailored solutions and quick access to inventory, a level of personalized support that is time-consuming and costly for new entrants to build from scratch. The sheer scale and established presence of CED's network make it difficult for newcomers to achieve comparable reach and efficiency.

Customer loyalty is another critical factor. Many customers have relied on established distributors like CED for decades, valuing their consistent product quality, technical support, and dependable delivery. This ingrained trust, coupled with the convenience of existing relationships, creates a strong inertia that new entrants must overcome with compelling value propositions and significant investment to gain market share.

Consolidated electrical distributors leverage significant economies of scale, meaning their per-unit costs decrease as their volume of business increases. This allows them to negotiate better prices from manufacturers and optimize their logistics, making it difficult for smaller, newer companies to compete on price. For instance, in 2024, the top five electrical distributors in North America accounted for an estimated 60% of the market share, a testament to their scale advantages.

The experience curve also plays a crucial role; as established players have refined their processes over years of operation, they've become more efficient in areas like inventory management and customer service. This accumulated operational expertise translates into cost savings and a smoother customer experience that new entrants would find challenging to replicate quickly, especially in a market characterized by moderate growth projections for 2025.

Regulatory Requirements and Industry Standards

The electrical distribution sector faces significant barriers to entry due to stringent regulatory requirements and industry standards. New companies must invest heavily in understanding and complying with a complex web of safety regulations, building codes, and environmental standards. For instance, in 2024, compliance costs for new electrical product manufacturers can easily reach hundreds of thousands of dollars, covering certifications like UL listing and adherence to National Electrical Code (NEC) standards.

Navigating this intricate regulatory landscape demands specialized expertise and can significantly increase the capital and operational costs for potential entrants. Failure to meet these often rigorous guidelines can result in product recalls, fines, and reputational damage, making compliance a critical, albeit costly, prerequisite for market participation.

- High Compliance Costs: Significant investment required for certifications and adherence to safety standards.

- Specialized Knowledge: Need for expertise in navigating complex electrical codes and regulations.

- Stringent Guidelines: Often demanding specifications for product safety, performance, and environmental impact.

- Market Entry Hurdles: Regulatory compliance acts as a substantial deterrent for new players.

Emergence of Niche or Technologically Advanced Entrants

While the established electrical distribution sector presents significant capital and scale barriers for traditional full-line entrants, a more nuanced threat emerges from specialized, technologically adept players. These new entrants can bypass some of the established hurdles by focusing on rapidly expanding niches or by leveraging advanced technologies.

For instance, the burgeoning solar energy market, projected to see global installations reach over 400 GW in 2024, presents an opportunity for specialized distributors. Similarly, the electric vehicle (EV) charging infrastructure segment, which saw a significant increase in charging points globally in 2023, is attracting new distributors focused on this specific demand. These niche players might utilize AI-driven logistics for efficient inventory management or develop specialized e-commerce platforms tailored to the unique needs of these growing sectors, thereby posing a targeted, rather than a broad, competitive pressure.

- Niche Market Focus: New entrants are targeting high-growth areas like solar and EV charging, which are expanding rapidly.

- Technological Advantage: Advanced technologies such as AI in logistics and specialized e-commerce platforms can lower entry barriers.

- Circumventing Traditional Barriers: Specialization allows new players to avoid the high capital and scale requirements of full-line distributors.

- Targeted Competitive Pressure: The threat is more focused on specific segments rather than challenging established players across the board.

The threat of new entrants for Consolidated Electrical Distributors (CED) is moderate, primarily due to substantial capital requirements and established networks. However, specialized players targeting high-growth niches like solar and EV charging present a more focused challenge. These new entrants can leverage technology to bypass traditional barriers, making them a targeted competitive pressure rather than a broad one.

| Barrier Type | Description | Impact on New Entrants | CED Advantage |

|---|---|---|---|

| Capital Requirements | High costs for inventory, warehousing, fleet, and IT systems. | Significant deterrent for new players. | Leverages existing infrastructure and economies of scale. |

| Distribution Networks & Relationships | Established ties with manufacturers and customers. | Difficult for newcomers to penetrate existing loyalties. | Deep, long-standing relationships built on trust and service. |

| Regulatory Compliance | Costs associated with safety standards, building codes, and environmental regulations. | Requires specialized expertise and substantial investment. | Existing compliance infrastructure and knowledge base. |

| Economies of Scale | Lower per-unit costs due to high volume. | Makes it hard for smaller, new companies to compete on price. | Negotiates better prices from manufacturers and optimizes logistics. |

| Niche Market Specialization | Focus on high-growth areas like solar and EV charging. | Can circumvent traditional barriers using technology. | Requires adaptation to serve these specialized segments effectively. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Consolidated Elec Distributors leverages data from industry-specific market research reports, competitor financial disclosures, and regulatory filings to assess competitive intensity.