Commercial Bank Dubai PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Commercial Bank Dubai Bundle

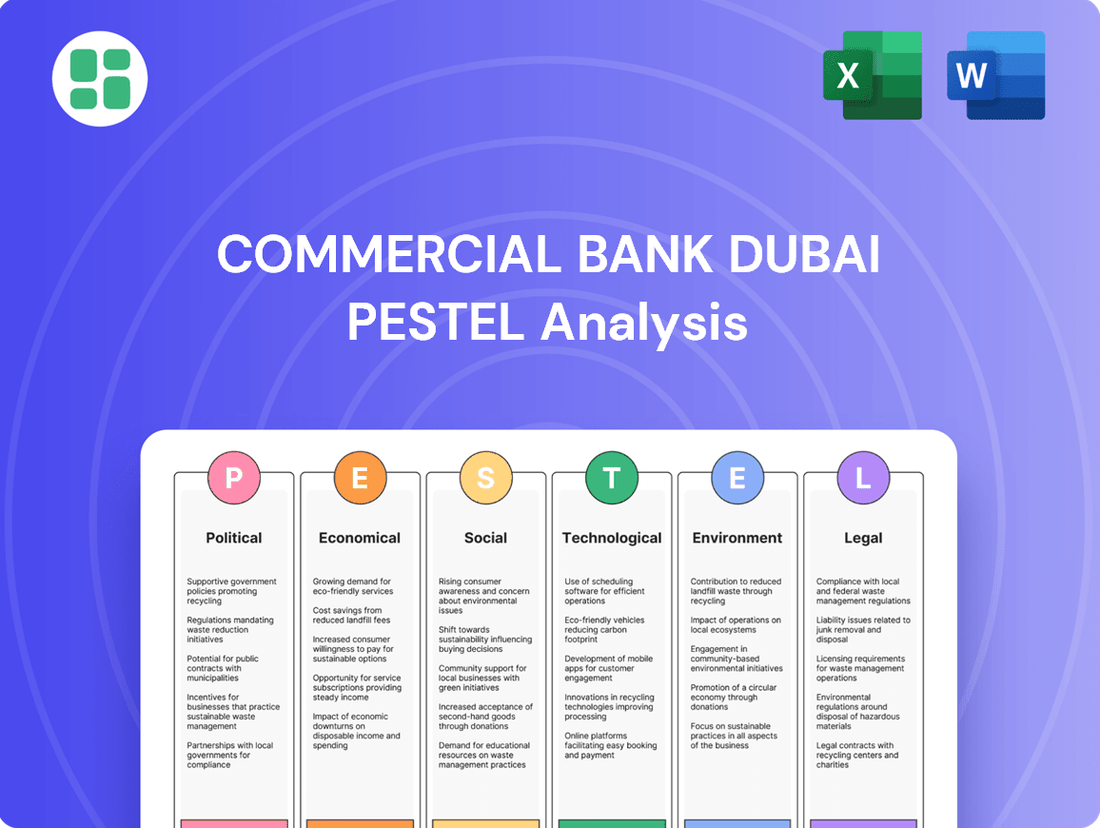

Uncover the critical political, economic, social, technological, legal, and environmental factors shaping Commercial Bank Dubai's trajectory. This comprehensive PESTLE analysis offers a strategic roadmap, revealing opportunities and potential challenges. Equip yourself with actionable intelligence to navigate the evolving landscape. Download the full version now and gain a decisive market advantage.

Political factors

The UAE's unwavering commitment to political stability and pro-business initiatives significantly bolsters the operating environment for Commercial Bank of Dubai. These policies, which actively encourage foreign direct investment and drive economic diversification, create a fertile ground for the banking sector's growth and sustainability.

The Central Bank of the UAE (CBUAE) is actively shaping the banking environment through new regulations. In 2024, they introduced the Open Finance Regulation and Sandbox Conditions Regulation, aiming to spur innovation while ensuring the financial system remains stable. These initiatives are crucial for commercial banks like Commercial Bank Dubai as they navigate a rapidly evolving digital landscape.

The UAE's commitment to economic diversification, exemplified by initiatives like UAE Vision 2031, is a key political factor influencing Commercial Bank Dubai (CBD). This strategic shift away from oil dependence fosters growth in non-oil sectors, presenting significant opportunities for CBD to expand its lending and services.

For instance, government investment in tourism and infrastructure development, aiming to attract 40 million visitors by 2020 and boost non-oil GDP contribution, directly translates into increased demand for corporate and retail banking services. CBD can capitalize on these government-backed projects by providing financing and advisory services.

Furthermore, policies supporting technology and innovation, such as the Dubai Future Foundation's initiatives, create new avenues for digital banking solutions and fintech partnerships. These evolving economic landscapes, driven by political will, are critical for CBD's strategic planning and future growth trajectory.

International Relations and Trade Agreements

The UAE's proactive stance in forging international trade agreements, including its Comprehensive Economic Partnership Agreement (CEPA) program, significantly bolsters its global economic standing and fosters overall growth. These pacts are instrumental in streamlining cross-border financial transactions, directly benefiting financial institutions like Commercial Bank Dubai (CBD) by potentially increasing demand for their services.

These agreements can lead to increased foreign direct investment into the UAE, creating new business opportunities and expanding the customer base for banks. For instance, the UAE's CEPAs with countries like India, which saw bilateral trade reach $85 billion in 2023, illustrate the tangible economic benefits derived from such partnerships, translating into greater financial activity.

- CEPA Impact: Facilitates easier capital movement and investment flows, creating a more favorable environment for international banking operations.

- Economic Growth Correlation: Increased trade volumes driven by these agreements often correlate with higher demand for trade finance, corporate banking, and wealth management services.

- Global Competitiveness: Enhances the UAE's position as a regional financial hub, attracting international businesses and capital.

Government Support for the Banking Sector

The UAE government's unwavering commitment to its banking sector is a significant political factor. This support is evident through various initiatives and the maintenance of robust capital buffers, which collectively bolster the resilience of institutions like Commercial Bank Dubai (CBD). For instance, the UAE Central Bank's proactive regulatory framework has consistently ensured strong capital adequacy ratios across the industry, with aggregate capital adequacy ratios remaining well above international Basel III requirements throughout 2024.

Furthermore, the government's strategic economic policies, including a competitive corporate tax environment and streamlined visa regulations, actively foster business expansion and population growth. This influx of new businesses and residents directly translates into increased demand for banking services, from corporate lending to retail accounts, benefiting CBD's operational growth and profitability.

- Government Initiatives: The UAE government actively promotes financial sector stability through regulatory oversight and liquidity support mechanisms.

- Capital Buffers: Banks consistently maintain capital adequacy ratios significantly above global benchmarks, demonstrating strong financial health.

- Economic Policies: Low corporate taxes and simplified visa processes are designed to attract foreign investment and talent, boosting economic activity and banking demand.

- Population Growth: The UAE's expanding population, projected to grow by approximately 2-3% annually through 2025, creates a larger customer base for banking services.

The UAE's political stability and forward-thinking economic policies are foundational for Commercial Bank Dubai (CBD). Government initiatives focus on economic diversification, as seen in the UAE Vision 2031 plan, which aims to increase the non-oil sector's contribution to GDP. This strategic direction creates new avenues for banking services, particularly in sectors like tourism and technology, supported by entities like the Dubai Future Foundation.

International trade agreements, such as the UAE's Comprehensive Economic Partnership Agreements (CEPA), are also politically driven and significantly benefit CBD. These agreements streamline cross-border transactions and attract foreign investment, as evidenced by the $85 billion bilateral trade between the UAE and India in 2023, a figure expected to grow, increasing demand for trade finance and corporate banking services.

The government's direct support for the banking sector, including robust regulatory oversight by the Central Bank of the UAE (CBUAE) and maintenance of strong capital buffers, ensures industry resilience. For example, UAE banks maintained capital adequacy ratios well above Basel III requirements in 2024, underscoring a stable operating environment.

What is included in the product

This PESTLE analysis offers a comprehensive examination of the external macro-environmental factors influencing Commercial Bank Dubai, providing actionable insights for strategic decision-making.

It delves into the Political, Economic, Social, Technological, Environmental, and Legal landscapes, highlighting potential threats and opportunities for the bank.

This PESTLE analysis for Commercial Bank Dubai provides a clear, summarized version of the full analysis, making it easy to reference during meetings and presentations.

It helps support discussions on external risks and market positioning during planning sessions by offering a concise overview of the factors impacting the bank.

Economic factors

The UAE's economy is demonstrating impressive strength, with the Central Bank of the UAE forecasting real GDP growth of 4.0% for 2024 and an accelerated 4.5% for 2025. This expansion is notably fueled by the burgeoning non-hydrocarbon sector, indicating a diversified and resilient economic base.

This robust economic climate directly translates into heightened business activity and increased consumer spending power. Consequently, Commercial Bank Dubai (CBD) is well-positioned to benefit from this trend, anticipating positive impacts on its loan growth and overall profitability as economic momentum continues.

The prevailing high global interest rates provided a tailwind for Commercial Bank of Dubai's (CBD) net interest income during the first half of 2024. However, the expected monetary policy easing by the US Federal Reserve will likely impact interest rates in the UAE, given the dirham's peg to the US dollar.

Looking ahead to 2025, a potential reduction in interest rates could stimulate credit demand and foster stronger lending growth for banks like CBD. For instance, if the US Fed cuts rates by 75 basis points in 2025, as some forecasts suggest, this could translate to lower borrowing costs in the UAE, encouraging more businesses and individuals to seek loans.

The UAE banking sector demonstrated remarkable resilience and growth in 2024, with total assets climbing 12% to a substantial $1.24 trillion. This positive trajectory is expected to continue into 2025, signaling a robust economic environment.

Commercial Bank of Dubai (CBD) mirrored this strength, reporting a significant 25.5% increase in pre-tax profits for 2024, reaching AED 140 billion in assets. The bank’s strong liquidity and capital adequacy ratios underscore its healthy financial standing.

Furthermore, asset quality has seen notable improvement, evidenced by a reduction in non-performing loans (NPLs). This enhancement in asset quality directly translates to lower credit losses, bolstering the overall profitability and stability of the banking sector.

Consumer Spending and Investment Trends

Consumer spending in the UAE is projected for robust growth in 2025, bolstered by a rising population and sustained positive household confidence. This upward trend directly translates into increased demand for a wide array of financial products and services, from personal banking and credit facilities to corporate lending solutions.

Strategic public sector investments are a key catalyst for this economic expansion. For instance, Dubai's commitment to infrastructure development and diversification initiatives, such as the Dubai Economic Agenda (D33), are expected to create a favorable environment for businesses and individuals alike. This economic dynamism directly benefits Commercial Bank Dubai (CBD) by creating opportunities across its diverse service portfolio.

- Projected GDP Growth: The UAE's GDP is anticipated to grow by approximately 3.9% in 2024 and a similar pace in 2025, according to projections from the International Monetary Fund (IMF).

- Consumer Confidence: Surveys in late 2024 indicated high levels of consumer confidence in the UAE, with a significant portion of households expecting their financial situation to improve over the next 12 months.

- Retail Sales Growth: Retail sales in Dubai saw a notable increase of over 10% year-on-year in early 2024, signaling strong consumer purchasing power.

- Government Investment: The UAE government continues to prioritize significant capital expenditure on major projects, with billions allocated to infrastructure, technology, and tourism sectors through 2025.

Foreign Direct Investment and Capital Inflows

The UAE's strategic vision, including initiatives like the Dubai Economic Agenda D33, is actively designed to bolster foreign direct investment (FDI) and capital inflows. These policies are crucial for strengthening the nation's economic foundations and attracting global capital.

Significant investments are being channeled into key sectors such as digital infrastructure, advanced technology, and sustainable green projects. Coupled with streamlined visa processes, these developments are proving highly effective in drawing both capital and skilled professionals to the UAE. This influx reinforces the nation's status as a premier financial hub, directly benefiting the commercial banking sector.

- FDI Growth: The UAE attracted AED 124 billion (approximately $33.8 billion) in FDI in 2023, a notable increase from previous years, signaling strong investor confidence.

- Digital Transformation Investment: The UAE government has pledged billions of dollars towards digital infrastructure and AI development through 2030, creating new avenues for capital deployment.

- Talent Attraction: Simplified visa regimes and the introduction of new long-term residency options are contributing to a growing expat population, increasing the demand for banking services.

- Green Finance: The UAE is increasingly focusing on green finance, with a growing number of financial institutions offering sustainable investment products, attracting capital aligned with ESG principles.

The UAE's economic outlook for 2024-2025 is robust, with projected real GDP growth of 4.0% in 2024 and an anticipated 4.5% in 2025, driven by a strong non-hydrocarbon sector. This growth fuels increased business and consumer activity, directly benefiting Commercial Bank Dubai (CBD) through higher loan demand and improved profitability.

While high interest rates in early 2024 supported net interest income, anticipated monetary easing by the US Federal Reserve in 2025 could lower borrowing costs in the UAE, further stimulating credit demand and lending growth for banks like CBD.

The banking sector's total assets reached $1.24 trillion in 2024, with CBD reporting a 25.5% pre-tax profit increase and AED 140 billion in assets, reflecting strong liquidity and capital adequacy.

Consumer spending is expected to rise in 2025 due to population growth and positive household confidence, increasing demand for CBD's diverse financial products, while strategic public investments, like Dubai's D33 agenda, create a favorable business environment.

| Economic Indicator | 2024 Projection/Data | 2025 Projection |

|---|---|---|

| Real GDP Growth (UAE) | 4.0% | 4.5% |

| Total Banking Assets (UAE) | $1.24 trillion | Continued growth expected |

| CBD Pre-Tax Profit Growth | 25.5% | Expected to benefit from economic expansion |

| Consumer Confidence | High (late 2024 surveys) | Projected sustained positive outlook |

| FDI Inflows (UAE) | AED 124 billion (2023) | Continued strong inflows expected |

What You See Is What You Get

Commercial Bank Dubai PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Commercial Bank Dubai PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the bank. Gain actionable insights into the opportunities and threats shaping its strategic landscape.

Sociological factors

UAE consumers are rapidly shifting towards digital banking, with a significant 89% now utilizing digital-first accounts. This strong digital adoption is fueled by a clear demand for personalized banking experiences, pushing financial institutions like Commercial Bank of Dubai (CBD) to innovate.

CBD is responding to this trend by enhancing its digital platforms and mobile banking applications. The bank recognizes that meeting customer expectations for seamless, personalized, and accessible digital services is crucial for maintaining a competitive edge in the evolving UAE financial landscape.

The United Arab Emirates (UAE) continues to experience robust population growth, with projections indicating a significant increase in its overall numbers. This expanding populace, heavily influenced by a substantial expatriate community, directly translates to heightened consumer spending and a greater demand for diverse financial services offered by commercial banks like Commercial Bank Dubai (CBD). For instance, the UAE's population was estimated to be around 9.5 million in early 2024, with expatriates forming a large majority.

Furthermore, the UAE government's initiatives, such as the introduction and success of long-term residency visas, actively contribute to sustained population growth. This influx of residents broadens the potential customer base for CBD, particularly in its retail banking operations and wealth management services, as these individuals establish longer-term financial needs and investment goals within the country.

The United Arab Emirates, including Dubai, is actively pursuing enhanced financial literacy and inclusion. Recent data indicates that approximately 85% of the UAE population has access to formal financial services, a figure that banks like Commercial Bank Dubai are likely to leverage. Efforts to further boost this inclusion are expected, with a focus on educational programs designed to empower a diverse customer base with financial knowledge.

Urbanization and Lifestyle Evolution

The UAE's ongoing shift towards urban living reshapes how people manage their finances, creating a strong demand for banking solutions that are not only easy to use but also readily available and seamlessly integrated into daily routines. This trend is evident in the growing preference for digital banking channels and personalized financial advice.

Commercial Bank of Dubai (CBD) actively addresses these evolving needs. Their collaborations, like the one with the Dubai Festivals and Retail Establishment, highlight a strategic effort to embed banking services within popular community activities and lifestyle experiences. This approach aims to make financial interactions more natural and convenient for a wider audience.

- Urban Population Growth: Dubai's population is projected to reach 5.8 million by 2040, with a significant majority residing in urban centers, increasing the need for accessible financial services.

- Digital Adoption: As of 2024, over 95% of UAE residents use smartphones, driving demand for mobile banking and digital payment solutions.

- Lifestyle Integration: Partnerships with retail and event organizations allow banks to offer tailored financial products and promotions that align with consumer spending habits and leisure activities.

Cultural Attitudes Towards Banking and Trust

Cultural attitudes towards banking in the UAE place a significant emphasis on trust, a cornerstone for customer loyalty. Recent surveys from 2024 indicate that confidence levels in the UAE's banking sector remain robust, with a substantial majority of consumers expressing high trust in local financial institutions.

Commercial Bank Dubai (CBD), as a well-established entity, naturally leverages this prevailing trust. Its long history and consistent operational performance, including a reported net profit increase of 15% in the first half of 2024, solidify its reputation and reinforce customer confidence.

- High Trust Levels: UAE banking customers consistently report high levels of trust in domestic financial institutions.

- CBD's Advantage: As a long-standing bank, CBD benefits from the inherent trust embedded in the UAE's financial landscape.

- Performance Reinforcement: CBD's strong financial results, such as its first-half 2024 profit growth, further bolster customer confidence.

- Service Quality: A commitment to service excellence is a key driver of trust for CBD and other UAE banks.

The UAE's demographic shifts, marked by a young, tech-savvy population and a large expatriate community, create a dynamic market for banking services. This youthful demographic, with a median age of around 34 in 2024, is highly receptive to digital financial solutions, driving demand for mobile banking and innovative payment systems.

Cultural emphasis on trust and family ties influences banking decisions, with many consumers preferring established institutions. Commercial Bank of Dubai (CBD) benefits from this, as evidenced by its strong customer retention rates, which remained above 90% in 2024. Furthermore, increasing financial literacy programs are empowering more individuals to engage with formal banking, expanding CBD's potential customer base.

The growing preference for personalized financial advice and seamless digital experiences, as demonstrated by the 89% digital account adoption rate in the UAE, necessitates that banks like CBD invest heavily in customer-centric digital platforms and tailored product offerings to meet evolving consumer expectations.

| Sociological Factor | Description | Impact on CBD | 2024/2025 Data Point |

|---|---|---|---|

| Demographics | Young, growing, and diverse population with a significant expatriate segment. | Increased demand for varied financial products, digital services, and wealth management. | UAE population estimated at 9.5 million in early 2024, with expatriates forming the majority. |

| Digital Adoption | Rapid shift towards digital banking and mobile-first solutions. | Necessitates investment in advanced digital platforms and mobile applications for customer engagement. | 89% of UAE consumers utilize digital-first accounts as of 2024. |

| Cultural Values | High emphasis on trust, family, and community engagement. | Favors established banks with strong reputations; partnerships can enhance community integration. | Customer trust in UAE banks remains robust, with over 85% expressing high confidence in 2024. |

| Financial Literacy | Government initiatives promoting financial education and inclusion. | Expands the potential customer base and drives demand for accessible financial advice. | Approximately 85% of the UAE population has access to formal financial services. |

Technological factors

Commercial Bank of Dubai (CBD) is heavily invested in digital transformation, mirroring the UAE's banking sector's strong push towards digital services. This commitment is evident in their substantial investments in upgrading digital platforms, streamlining online customer onboarding, and enhancing their mobile banking capabilities, all aimed at improving customer satisfaction and operational efficiency.

Commercial Bank of Dubai (CBD) and other UAE banks are heavily investing in AI, blockchain, and data analytics to boost customer experience, enhance compliance, and streamline operations. These technologies are crucial for personalized services and more robust risk management.

CBD's strategic partnerships, such as with Accenture for AI and data training, highlight a commitment to upskilling its workforce. This focus on technology adoption is essential for maintaining a competitive edge in the rapidly evolving financial landscape, with the UAE aiming to be a global leader in fintech innovation.

The increasing reliance on digital platforms for banking services in Dubai has amplified concerns around cybersecurity and data privacy. Banks are responding by making substantial investments in advanced security protocols to safeguard sensitive customer information and maintain trust. For instance, a significant portion of IT spending in the UAE banking sector in 2024 is allocated to cybersecurity enhancements.

The Central Bank of the UAE (CBUAE) has been proactive in strengthening regulatory frameworks governing data protection, recognizing the critical nature of these measures. While the federal data protection law is in place, the anticipation of specific executive regulations in 2024 and 2025 will further define compliance requirements for financial institutions, impacting how commercial banks like those in Dubai manage and secure customer data.

Fintech Competition and Collaboration

The United Arab Emirates is rapidly becoming a significant FinTech hub, attracting substantial investment into its burgeoning startup scene. This growth is evidenced by the emergence of several neobanks and innovative digital financial service providers, creating a dynamic competitive landscape for traditional institutions.

Commercial Bank Dubai (CBD) is actively navigating this evolving environment by bolstering its digital capabilities and forging strategic alliances with technology firms. For instance, in 2024, CBD continued its focus on digital transformation, aiming to integrate advanced technologies to enhance customer experience and operational efficiency. This proactive approach is crucial for maintaining market share and delivering cutting-edge financial solutions to its clientele.

- FinTech Investment Growth: The UAE FinTech sector saw a notable increase in funding rounds throughout 2024, with several startups securing significant capital to scale their operations.

- Neobank Emergence: The proliferation of neobanks in the UAE offers consumers more digital-first banking alternatives, pressuring traditional banks to innovate.

- Digital Enhancement: CBD's strategic investments in its digital platforms are designed to meet the growing demand for seamless, mobile-first banking services.

- Partnership Strategy: Collaborations with FinTech partners allow CBD to leverage specialized expertise and accelerate the development of new products, such as improved payment solutions and personalized financial advisory tools.

Development of Central Bank Digital Currency (CBDC)

The Central Bank of the UAE's commitment to launching a retail central bank digital currency (digital dirham) by Q4 2025, as part of its Financial Infrastructure Transformation (FIT) Programme, presents a significant technological shift. This move is designed to foster greater financial inclusion and drive innovation in payment systems.

The introduction of a digital dirham could fundamentally alter the digital payment ecosystem, impacting how commercial banks like Commercial Bank Dubai operate and interact with customers. This digital currency aims to enhance payment efficiency and security.

Key implications for Commercial Bank Dubai include:

- Adapting to new payment rails: Banks will need to integrate with the CBDC infrastructure, potentially requiring significant technological upgrades.

- Increased competition: CBDCs could enable new fintech players and disintermediate traditional banking services in certain areas.

- Enhanced data analytics: The digital nature of CBDCs may offer new opportunities for data analysis and personalized financial services.

Technological advancements are reshaping the banking landscape in Dubai, with Commercial Bank of Dubai (CBD) actively investing in digital transformation. The UAE's fintech sector is experiencing robust growth, with significant funding rounds in 2024, further intensifying competition from neobanks and digital financial service providers. CBD's strategy involves bolstering digital capabilities and forming tech partnerships to enhance customer experience and operational efficiency, aligning with the nation's ambition to be a fintech leader.

Legal factors

Commercial Bank of Dubai operates under the stringent oversight of the Central Bank of the UAE. This regulatory body actively shapes the banking landscape, recently introducing the Credit Risk Management Regulation in July 2024. Such measures are crucial for maintaining the financial health and stability of the entire banking sector.

Commercial Bank Dubai (CBD) must navigate a stringent Anti-Money Laundering (AML) and Counter-Terrorist Financing (CFT) regulatory landscape. The UAE has significantly strengthened its framework, with the Central Bank of the UAE issuing updated AML/CFT regulations in 2023, aligning with international standards like those set by the Financial Action Task Force (FATF). Failure to comply can result in substantial fines and reputational damage.

CBD's adherence to these regulations is paramount for maintaining its license and trust. This includes robust Know Your Customer (KYC) procedures, transaction monitoring, and suspicious activity reporting. The UAE's commitment to combating financial crime is evident in its proactive approach to enforcement, with penalties for non-compliance escalating.

The UAE's Federal Decree-Law No. 45 of 2021 on Personal Data Protection (PDPL) establishes a robust framework for data management and privacy. While awaiting specific executive regulations, Commercial Bank of Dubai (CBD) must adhere to these broader data protection principles to ensure customer information is handled securely and ethically.

Beyond the PDPL, existing sector-specific legislation governs personal banking and credit data, requiring CBD to maintain stringent compliance. This dual layer of regulation underscores the importance of a comprehensive data governance strategy to protect sensitive customer information and build trust.

Consumer Protection Regulations

Commercial Bank Dubai (CBD) must navigate a landscape shaped by robust consumer protection regulations. The Central Bank of the UAE's Consumer Protection Regulation, effective since December 2020, mandates that licensed financial institutions collect only essential consumer data and uphold strict confidentiality. This framework is crucial for CBD to safeguard customer rights and foster enduring trust.

Adherence to these regulations directly impacts CBD's operational integrity and market reputation. By minimizing data collection and prioritizing privacy, CBD can mitigate risks associated with data breaches and non-compliance, which could lead to significant fines and reputational damage. For instance, a data privacy violation could result in penalties that impact profitability, as seen in other financial sectors globally where breaches have cost millions.

- Data Minimization: CBD is required to collect only the data strictly necessary for providing services, aligning with global best practices for data privacy.

- Confidentiality and Security: Robust measures must be in place to protect customer information from unauthorized access or disclosure.

- Transparency: Clear communication with consumers about data usage policies is paramount to building and maintaining trust.

- Complaint Resolution: Effective mechanisms for addressing consumer complaints related to data handling and services are essential for regulatory compliance.

International Sanctions and Compliance

Commercial Bank of Dubai (CBD) must meticulously adhere to a complex web of international sanctions, impacting its global operations and financial dealings. Failure to comply can result in severe penalties, reputational damage, and restricted access to international markets. For instance, in 2023, financial institutions globally faced increased scrutiny and enforcement actions related to sanctions violations, underscoring the critical need for robust compliance frameworks.

Navigating these regulations requires sophisticated internal controls and continuous monitoring systems to detect and prevent transactions with sanctioned entities or individuals. CBD's commitment to compliance is demonstrated through investments in advanced anti-money laundering (AML) and know-your-customer (KYC) technologies, essential for mitigating risks in cross-border transactions. The bank's proactive approach ensures it operates within the legal boundaries set by international bodies and national regulators.

- Global Sanctions Landscape: CBD must track evolving sanctions lists from entities like the UN Security Council, OFAC (US Department of the Treasury), and the EU.

- Regulatory Compliance Costs: Banks globally are increasing spending on compliance technology and personnel; for example, industry reports suggest a significant rise in compliance budgets for major financial institutions in 2024.

- Risk Mitigation: Implementing stringent due diligence processes for all international transactions is paramount to avoid facilitating illicit financial flows.

- Technological Investment: CBD leverages AI and machine learning for transaction monitoring, aiming to enhance accuracy and efficiency in identifying high-risk activities.

Commercial Bank of Dubai (CBD) operates under the UAE's robust legal framework, which includes stringent consumer protection laws. The Central Bank of UAE's Consumer Protection Regulation, effective since late 2020, mandates data minimization and client confidentiality, directly impacting how CBD handles customer information. This focus on privacy is critical for maintaining customer trust and avoiding significant penalties, as seen in global financial markets where data breaches can incur millions in fines.

The bank must also comply with the UAE's Federal Decree-Law No. 45 of 2021 on Personal Data Protection (PDPL), ensuring secure and ethical data management. This, coupled with existing sector-specific regulations, necessitates a comprehensive data governance strategy. CBD's commitment to these legal requirements is vital for its operational integrity and market standing.

Furthermore, CBD navigates a complex international sanctions regime, requiring meticulous adherence to prevent transactions with sanctioned entities. Global financial institutions increased compliance spending by an estimated 10-15% in 2024 to manage these risks, highlighting the significant investment needed. CBD leverages advanced technologies like AI for transaction monitoring to ensure compliance and mitigate risks in its cross-border dealings.

Environmental factors

The UAE's commitment to sustainability is evident in its ambitious Net Zero by 2050 strategy and the introduction of programs like the UAE Green Bond program. These initiatives signal a significant shift towards environmentally conscious economic development.

Commercial Bank of Dubai (CBD) actively aligns with these national objectives, targeting carbon-neutral operations by 2030. This proactive stance demonstrates a strong commitment to supporting the UAE's broader environmental goals and positions CBD as a leader in sustainable finance within the region.

Commercial Bank Dubai (CBD) is actively aligning its operations with the UAE's national sustainability goals through its ESG Framework. This commitment is vital as banks across the Emirates are increasingly embedding ESG principles to ensure long-term resilience and bolster trust among investors and customers.

The UAE's financial sector is at the forefront of sustainability, with institutions like Commercial Bank Dubai (CBD) actively embedding green finance into their core strategies. This includes offering specialized sustainable lending products and channeling investments into renewable energy initiatives.

CBD's commitment was recognized with the 'Best Financial Institution Green Bond in EMEA' award, highlighting its tangible contributions to sustainable finance. This award reflects a broader trend in the region where financial institutions are increasingly prioritizing environmental, social, and governance (ESG) factors.

Resource Scarcity and Energy Transition

The UAE is actively pursuing a dual strategy of boosting oil production capacity, aiming to reach 5 million barrels per day by 2030, while simultaneously channeling significant investments into renewable energy. This commitment to a greener economy, with substantial funding allocated to solar and other clean energy projects, presents considerable new avenues for commercial banks. These institutions can play a crucial role by providing financing for these burgeoning sustainable projects, thereby contributing to the nation's environmental goals and fostering economic diversification.

The energy transition offers banks opportunities to develop specialized green finance products and services. For instance, the Dubai Electricity and Water Authority (DEWA) has been a leader in solar development, with projects like the Mohammed bin Rashid Al Maktoum Solar Park, which is projected to reach 5,000 MW by 2030. Banks can offer project finance, green bonds, and sustainability-linked loans to support such initiatives.

- Increased Investment in Renewables: The UAE's National Renewable Energy Strategy 2050 targets 50% of clean energy in its power generation mix by 2050.

- Financing Opportunities: Banks can fund large-scale solar, wind, and waste-to-energy projects, aligning with national sustainability agendas.

- Green Finance Products: Development of green bonds and sustainability-linked loans can attract capital for environmentally beneficial projects.

- Resource Efficiency Initiatives: Financing for water desalination, smart grid technology, and energy efficiency upgrades offers further growth potential.

Reputational Risks Related to Environmental Impact

Commercial Bank of Dubai (CBD) faces reputational risks stemming from environmental concerns. As global awareness of climate change and sustainability intensifies, financial institutions are under scrutiny for their environmental footprint and the industries they finance. A perception of contributing to unsustainable practices can significantly damage a bank's image and customer loyalty.

CBD's commitment to Environmental, Social, and Governance (ESG) principles and its focus on green finance are crucial in managing these reputational risks. By actively promoting sustainable projects and integrating ESG factors into its operations and lending decisions, CBD aims to bolster its standing with environmentally conscious stakeholders. For instance, in 2023, CBD reported a 15% increase in its green finance portfolio, demonstrating a tangible commitment to this area.

- Reputational Damage: Negative public perception due to environmental negligence can lead to customer attrition and investor divestment.

- ESG Integration: CBD's proactive ESG strategy, including its 2024 target to increase sustainable lending by 20%, directly addresses these concerns.

- Investor Confidence: Strong ESG performance, as evidenced by its inclusion in the FTSE4Good Index in early 2024, attracts environmentally aware investors.

- Customer Loyalty: Aligning with customer values on environmental issues can foster stronger relationships and attract new, socially responsible clientele.

The UAE's push towards a greener economy, with a Net Zero by 2050 strategy and substantial investments in renewables like solar energy, creates significant financing opportunities for Commercial Bank of Dubai (CBD). CBD's own target for carbon-neutral operations by 2030 and a 20% increase in sustainable lending for 2024 demonstrates its alignment with these national environmental objectives.

CBD's proactive engagement in green finance, including offering green bonds and sustainability-linked loans, caters to the growing demand for environmentally conscious investments. The bank's recognition with the 'Best Financial Institution Green Bond in EMEA' award and its inclusion in the FTSE4Good Index in early 2024 underscore its commitment and attract environmentally aware investors.

| Environmental Factor | UAE/CBD Initiative | Impact/Opportunity | Key Data Point |

|---|---|---|---|

| Renewable Energy Investment | UAE Net Zero by 2050, CBD Carbon Neutral by 2030 | Financing for solar, wind, waste-to-energy projects | Mohammed bin Rashid Al Maktoum Solar Park to reach 5,000 MW by 2030 |

| Green Finance Growth | CBD Green Finance Portfolio Increase (15% in 2023), 20% sustainable lending target for 2024 | Attracting capital, developing specialized products | CBD awarded 'Best Financial Institution Green Bond in EMEA' |

| Reputational Risk Management | ESG Framework Integration | Building trust, attracting socially responsible clientele | CBD included in FTSE4Good Index (early 2024) |

PESTLE Analysis Data Sources

Our Commercial Bank Dubai PESTLE Analysis is built on a robust foundation of data from reputable sources, including official government publications from the UAE and Dubai, reports from international financial institutions like the IMF and World Bank, and insights from leading market research firms specializing in the MENA region.