Commercial Bank Dubai Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Commercial Bank Dubai Bundle

Discover the core of Commercial Bank Dubai's success with our comprehensive Business Model Canvas. This detailed breakdown illuminates their customer relationships, revenue streams, and key resources, offering a powerful framework for understanding their market dominance.

Unlock the strategic blueprint behind Commercial Bank Dubai's operational excellence. Our full Business Model Canvas provides a clear, actionable view of their value proposition, cost structure, and competitive advantages, perfect for strategic analysis.

See exactly how Commercial Bank Dubai thrives by downloading our complete Business Model Canvas. This professionally crafted document details their channels, key activities, and revenue model, empowering your own business insights.

Partnerships

Commercial Bank of Dubai (CBD) actively collaborates with technology and fintech providers to bolster its digital banking infrastructure. These partnerships are instrumental in integrating advanced AI capabilities and optimizing operational workflows. For instance, in 2024, CBD continued its focus on enhancing customer experience through digital channels, a strategy supported by its tech partnerships.

These collaborations are vital for delivering a modern, efficient, and secure banking environment, directly supporting CBD's ambition to be a 'default digital' bank. By leveraging cutting-edge solutions from these external partners, CBD aims to significantly improve its service delivery and overall operational effectiveness, staying competitive in the rapidly evolving financial landscape.

Commercial Bank of Dubai (now part of Dubai Islamic Bank) actively collaborates with government and regulatory bodies, including the Central Bank of the UAE. This ensures adherence to all financial regulations, a crucial aspect for stability and trust. In 2023, the UAE's financial sector saw significant growth, with total assets of UAE banks reaching AED 3.77 trillion, highlighting the importance of regulatory alignment.

These partnerships are fundamental to supporting national economic initiatives and fostering the UAE's financial development. By aligning with government policies, such as those aimed at attracting foreign investment and promoting economic diversification, CBD strengthens its role in the nation's growth trajectory.

Commercial Bank Dubai (CBD) actively partners with other financial institutions, both within the UAE and globally. These collaborations are crucial for facilitating essential banking operations such as interbank transactions and syndicated lending, broadening CBD's service offerings and market reach.

These strategic alliances enable CBD to provide more robust trade finance solutions and access a wider network of correspondent banks. This strengthens its ability to serve a diverse clientele with complex financial needs, enhancing its competitive position in the market.

A key example of such integration is CBD's participation in national payment systems like Aani payments. This involvement ensures seamless and efficient transaction processing for its customers, reflecting a commitment to leveraging collaborative infrastructure for improved service delivery.

Business and Corporate Clients (as strategic partners)

Commercial Bank Dubai (CBD) cultivates strategic alliances with significant business and corporate clients, recognizing them as pivotal partners. For instance, CBD provides substantial credit facilities to major entities, exemplified by its support for Siemens Energy. These relationships transcend basic banking services, aiming for enhanced collaboration and shared prosperity.

By actively backing the expansion strategies of prominent corporations, CBD solidifies its reputation as a dependable financial ally. This approach ensures that CBD remains at the forefront of corporate banking, offering tailored solutions that drive mutual success and economic development within the region.

- Strategic Credit Facilities: Extended credit facilities to large corporations, such as Siemens Energy, demonstrating a commitment to supporting significant economic players.

- Deepened Engagement: Fostering relationships that go beyond simple transactions, focusing on mutual growth and long-term value creation.

- Reinforcing Trust: By enabling the growth of leading companies, CBD enhances its standing as a trusted and integral banking partner in the corporate sector.

Community and Industry Organizations

Commercial Bank of Dubai (CBD) actively engages with a variety of community and industry organizations, underscoring its dedication to corporate social responsibility and local development. This strategic approach not only strengthens its brand image but also aligns the bank with crucial societal objectives.

CBD's commitment is evident through its support for key initiatives. For instance, the bank has participated in and supported events like the Future Sustainability Forum, highlighting its focus on environmental and social governance. Such partnerships are vital for fostering a positive reputation and demonstrating a commitment to the broader community's well-being.

Furthermore, collaborations with entities such as the Dubai Festivals and Retail Establishment (DFRE) showcase CBD's role in supporting the economic vibrancy of Dubai. These partnerships contribute to the city's growth and reinforce CBD's position as a key player in the local financial landscape.

- Community Engagement: CBD partners with organizations focused on sustainability and local development, demonstrating corporate social responsibility.

- Initiative Support: The bank backs important events, such as the Future Sustainability Forum, reinforcing its commitment to societal progress.

- Brand Reputation: These engagements enhance CBD's brand image and align its operations with broader societal and economic goals.

- Economic Contribution: Partnerships with entities like Dubai Festivals and Retail Establishment (DFRE) contribute to Dubai's economic vitality.

Commercial Bank of Dubai, now part of Dubai Islamic Bank, emphasizes strategic partnerships with technology and fintech firms to enhance its digital banking capabilities. These collaborations are crucial for integrating advanced AI and streamlining operations, as seen in CBD's 2024 focus on digital customer experience improvements. Such alliances are fundamental to achieving its goal of becoming a 'default digital' bank by leveraging external expertise for better service delivery and competitiveness.

CBD also actively collaborates with government and regulatory bodies, including the Central Bank of the UAE, to ensure compliance and foster financial development. In 2023, the UAE's banking sector saw total assets reach AED 3.77 trillion, underscoring the importance of regulatory alignment for stability and growth, and aligning with national economic diversification initiatives.

Furthermore, CBD partners with other financial institutions globally for interbank transactions and syndicated lending, expanding its service offerings and market reach. Participation in national payment systems like Aani payments exemplifies this, ensuring efficient transaction processing and leveraging collaborative infrastructure.

CBD cultivates strong relationships with major corporate clients, providing significant credit facilities, such as to Siemens Energy, to support their expansion and foster mutual success. These deep engagements reinforce CBD's position as a reliable financial ally in driving corporate growth and regional economic development.

What is included in the product

This Business Model Canvas for Commercial Bank Dubai outlines its core strategy, focusing on delivering diverse financial products and services to retail and corporate clients through a multi-channel approach, supported by robust partnerships and efficient operations.

Commercial Bank Dubai's Business Model Canvas acts as a pain point reliever by offering a clear, one-page snapshot that quickly identifies core components, simplifying complex banking operations for better strategic understanding.

Activities

Core banking operations are the lifeblood of Commercial Bank Dubai (CBD), encompassing the essential functions of accepting customer deposits and providing credit facilities. These activities are foundational to the bank's revenue streams and its role in facilitating economic activity.

CBD's core offerings include a wide array of products designed for individuals and businesses, such as savings accounts, current accounts, personal loans, mortgages, credit cards, and various corporate lending solutions. This comprehensive suite caters to diverse financial needs, underpinning the bank's customer relationships.

In 2024, the banking sector, including institutions like CBD, continued to navigate a dynamic economic landscape. For instance, the UAE's banking sector saw robust growth, with total assets reaching approximately AED 3.77 trillion by the end of Q1 2024, indicating a healthy demand for banking services, including deposits and loans. This environment highlights the critical importance of efficient core banking operations for sustained performance.

Commercial Bank Dubai (CBD) is heavily invested in its digital transformation, pouring resources into advanced platforms, artificial intelligence, and user-friendly digital offerings. This strategic push aims to create a more seamless and efficient banking experience for its customers.

Key initiatives include a complete overhaul of their mobile and internet banking services, ensuring they are intuitive and feature-rich. CBD is also integrating instant payment systems, aligning with the growing demand for immediate financial transactions.

Furthermore, the bank is developing AI-powered services designed to personalize customer interactions and streamline operations. For instance, in 2024, CBD reported a significant increase in digital transactions, highlighting the success of these investments in enhancing customer engagement and operational agility.

Commercial Bank Dubai's wealth management and investment solutions are a cornerstone activity, offering comprehensive services to both individuals and corporations. This includes expert advice on investment strategies, meticulous asset management, and the provision of bespoke financial products designed to meet diverse client needs.

The bank actively manages assets for high-net-worth individuals and corporate clients, aiming to optimize their financial portfolios and achieve long-term wealth growth. This focus on tailored solutions is crucial for retaining and expanding its client base in a competitive market.

In 2024, the global wealth management sector saw significant activity, with assets under management projected to reach over $100 trillion. Commercial Bank Dubai, by offering sophisticated investment and treasury solutions, positions itself to capture a share of this expanding market, catering to clients seeking robust financial planning and growth opportunities.

Trade Finance and Corporate Lending

Commercial Bank of Dubai (CBD) actively facilitates international trade by offering a comprehensive suite of trade finance products. These solutions are designed to support businesses with their import and export operations, mitigating risks and ensuring smooth transactions. For instance, in 2023, CBD reported a significant increase in its trade finance portfolio, reflecting the growing demand from corporate clients engaged in global commerce.

Beyond trade finance, CBD's corporate lending arm is a cornerstone of its business model, providing essential capital for the growth and operational needs of its clients. This lending activity is critical for enabling businesses to expand, invest in new projects, and manage their day-to-day expenses. The bank's commitment to supporting businesses was evident in its 2023 financial results, which highlighted robust growth in its corporate loan book.

- Trade Finance Facilitation: CBD's redesigned Trade Finance platform enhances automation and streamlines workflows, making it easier for businesses to manage international transactions.

- Corporate Lending Support: The bank provides vital capital for corporate clients, fueling their expansion and operational requirements.

- 2023 Performance: CBD experienced strong growth in both its trade finance and corporate lending segments in 2023, underscoring the importance of these key activities.

Risk Management and Regulatory Compliance

Commercial Bank Dubai actively manages credit, market, and operational risks to ensure financial stability. This involves rigorous stress testing and scenario analysis, crucial for navigating economic volatility. For instance, adhering to the UAE Central Bank's guidelines on capital adequacy, such as maintaining a Capital Adequacy Ratio (CAR) well above the regulatory minimum of 13% as of early 2024, is a cornerstone of their strategy.

Regulatory compliance is a non-negotiable daily activity, encompassing adherence to Anti-Money Laundering (AML) and Know Your Customer (KYC) regulations. In 2023, UAE banks collectively reported significant investments in technology to bolster compliance frameworks, a trend expected to continue. This commitment safeguards the bank's reputation and operational integrity.

- Credit Risk Mitigation: Strengthening loan loss provisions and diversifying the loan portfolio to absorb potential defaults.

- Capital Adequacy: Consistently maintaining capital ratios above UAE Central Bank requirements, ensuring a strong buffer against unforeseen losses.

- Regulatory Adherence: Implementing and updating policies to align with evolving AML, KYC, and other financial regulations.

- Operational Resilience: Developing robust business continuity plans and cybersecurity measures to protect against operational disruptions.

Key activities for Commercial Bank Dubai (CBD) revolve around its core banking functions, digital innovation, wealth management, and robust risk management. These pillars ensure operational efficiency, customer satisfaction, and financial stability. The bank's commitment to these areas is reflected in its ongoing investments and strategic initiatives, aiming to maintain its competitive edge in the evolving financial landscape.

| Key Activity | Description | 2023/2024 Data Highlight |

|---|---|---|

| Core Banking Operations | Accepting deposits and providing credit facilities to individuals and businesses. | UAE banking sector assets reached ~AED 3.77 trillion by Q1 2024, indicating strong demand for banking services. |

| Digital Transformation | Enhancing digital platforms, AI services, and mobile/internet banking for a seamless customer experience. | CBD reported a significant increase in digital transactions in 2024, showcasing successful investment in digital offerings. |

| Wealth Management & Investment | Offering expert financial advice, asset management, and bespoke financial products. | Global wealth management assets under management projected to exceed $100 trillion, highlighting market opportunity. |

| Trade Finance & Corporate Lending | Facilitating international trade and providing capital for business growth. | CBD saw robust growth in its trade finance and corporate lending segments in 2023. |

| Risk Management & Compliance | Managing credit, market, and operational risks, adhering to regulatory standards (AML, KYC). | CBD maintained its Capital Adequacy Ratio well above the UAE Central Bank's minimum of 13% in early 2024. |

Preview Before You Purchase

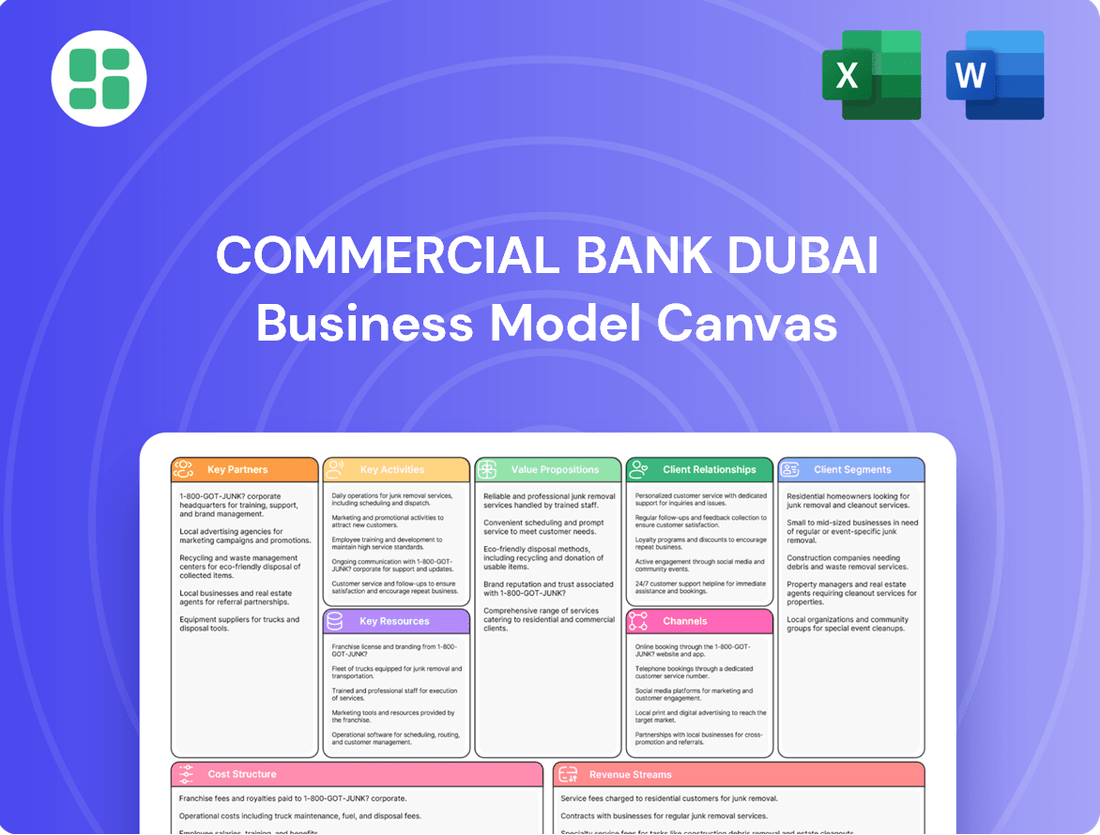

Business Model Canvas

The Commercial Bank Dubai Business Model Canvas preview you are viewing is an authentic representation of the final document you will receive upon purchase. This means you are seeing the exact structure, content, and formatting that will be delivered, ensuring no discrepancies or surprises. Upon completing your transaction, you will gain full access to this same, professionally prepared Business Model Canvas, ready for immediate use.

Resources

Commercial Bank Dubai (CBD) relies on adequate financial capital, encompassing shareholder equity and a diverse deposit base, to fuel its operations and lending. This capital is the bedrock of its stability and capacity to extend credit.

CBD's strong capital adequacy ratios, which stood at a robust 19.2% as of December 31, 2023, exceeding regulatory requirements, are a critical resource. This financial strength empowers the bank to absorb potential losses and maintain confidence in its solvency.

Furthermore, CBD's robust liquidity position, evidenced by a liquidity coverage ratio of 155.7% at the end of 2023, is a vital asset. This ensures the bank can meet its short-term financial obligations, supporting consistent loan growth and operational continuity.

Commercial Bank Dubai (CBD) recognizes that its skilled employees are a cornerstone of its success. This includes a diverse team of financial professionals adept at navigating complex markets, technology specialists who ensure seamless digital operations, and customer service representatives dedicated to client satisfaction.

CBD actively invests in its human capital, with a strong emphasis on Emiratisation to foster local talent. In 2024, the bank continued to expand its training and leadership development programs, aiming to cultivate a high-performance culture. These initiatives are crucial for driving innovation and maintaining high levels of customer engagement.

Commercial Bank Dubai (CBD) relies on advanced technology infrastructure, including robust data centers and core banking systems, to power its operations. These foundational elements are essential for efficient and secure transaction processing, a cornerstone of modern banking.

CBD's digital platforms, such as its mobile banking app and online portals, are crucial key resources, enabling customers to access a wide range of services conveniently. These platforms are the primary interface for customer interaction and service delivery in today's digital-first environment.

The bank's commitment to significant investments in modernizing these digital platforms and integrating AI-driven solutions underscores its strategic focus. For instance, CBD has been actively enhancing its digital capabilities, aiming to provide a seamless and personalized customer experience, which is vital for attracting and retaining clients in a competitive market.

Brand Reputation and Customer Trust

A robust brand reputation, synonymous with trust, reliability, and security, stands as a vital intangible asset for Commercial Bank Dubai (CBD). This deeply ingrained trust is fundamental to attracting and retaining a diverse customer base, from individual depositors to large corporate clients.

CBD's extensive history within the UAE, coupled with a consistent dedication to customer-focused services, significantly bolsters its brand equity. For instance, in 2023, CBD reported a net profit of AED 3.1 billion, reflecting strong operational performance that underpins customer confidence.

- Brand Reputation: CBD's established presence and commitment to security foster customer loyalty.

- Customer Trust: Reliability in services and transparent dealings are key drivers of trust.

- Customer-Centricity: Focus on customer needs enhances brand perception and retention.

- Financial Performance: Strong financial results, like the AED 3.1 billion net profit in 2023, reinforce market confidence.

Customer Data and Analytics

Customer data and advanced analytics are vital for Commercial Bank Dubai (CBD). By understanding customer behavior and financial needs, CBD can tailor product offerings and enhance service delivery. This data-driven approach allows for more effective decision-making and stronger customer relationships.

Leveraging customer data allows CBD to identify trends and predict future needs. For instance, in 2024, banks globally saw a significant increase in digital transaction data, which provides granular insights into spending habits and preferences. CBD can utilize this to proactively offer relevant financial solutions.

- Personalized Product Development: Data analytics helps CBD identify specific customer segments and their unmet needs, leading to the creation of highly targeted financial products and services.

- Enhanced Service Delivery: By analyzing customer interactions and feedback, CBD can optimize its service channels, ensuring a more seamless and satisfactory customer experience.

- Data-Driven Strategic Decisions: Insights derived from customer data inform strategic planning, from marketing campaigns to new market entry, ensuring resources are allocated effectively.

- Improved Customer Retention: Understanding customer behavior allows CBD to anticipate potential churn and implement proactive measures to retain valuable clients.

Commercial Bank Dubai (CBD) leverages a robust financial foundation, including substantial capital adequacy and strong liquidity, as critical resources. Its commitment to skilled human capital, particularly through Emiratisation and continuous development, drives innovation and customer engagement.

Advanced technology infrastructure and user-friendly digital platforms are paramount for efficient operations and customer interaction. Furthermore, CBD's strong brand reputation, built on trust and reliability, and its strategic use of customer data for personalized services are vital intangible assets that foster loyalty and inform strategic decisions.

| Key Resource | Description | Supporting Data/Fact |

|---|---|---|

| Financial Capital | Shareholder equity and diverse deposit base for operations and lending. | Capital Adequacy Ratio: 19.2% (Dec 31, 2023) |

| Liquidity | Ability to meet short-term obligations. | Liquidity Coverage Ratio: 155.7% (Dec 31, 2023) |

| Human Capital | Skilled employees, including financial professionals and tech specialists. | Focus on Emiratisation and leadership development programs in 2024. |

| Technology Infrastructure | Data centers, core banking systems, and digital platforms. | Investments in modernizing digital platforms and AI integration. |

| Brand Reputation & Trust | Inherent trust, reliability, and security in services. | Net Profit: AED 3.1 billion (2023) |

| Customer Data & Analytics | Understanding customer behavior for tailored offerings. | Global trend of increased digital transaction data in 2024 providing granular insights. |

Value Propositions

Commercial Bank Dubai (CBD) provides a complete spectrum of banking products and services. This includes personal accounts, various loan types, credit cards, and sophisticated wealth management solutions. For businesses, CBD offers crucial trade finance and extensive corporate lending capabilities, effectively meeting a wide range of financial requirements.

This all-encompassing approach positions CBD as a single point of contact for individuals, small businesses, and large corporations. By consolidating diverse financial needs into one provider, CBD simplifies financial management for its clientele, making operations more streamlined and efficient.

In 2024, CBD continued to expand its digital offerings, with mobile banking transactions growing significantly. Their retail loan portfolio saw a healthy increase, reflecting strong customer demand for personal financing solutions.

Commercial Bank Dubai (CBD) prioritizes digital convenience, offering customers seamless and secure banking through intuitive mobile apps and online platforms. This commitment to innovation, including AI-powered tools, ensures efficient financial management anytime, anywhere. For instance, CBD reported a 20% increase in digital transactions in 2024, highlighting customer adoption of these enhanced services.

Commercial Bank Dubai (CBD) excels in providing personalized customer service and robust relationship management, a key value proposition. This involves offering tailored financial advice and dedicated support, particularly for their high-net-worth and corporate clientele.

CBD actively works to strengthen and deepen customer relationships, aiming for increased product penetration by ensuring financial solutions precisely match individual client needs. This client-centric approach fosters significant long-term loyalty and satisfaction.

In 2024, CBD reported a notable increase in customer engagement metrics, with a 15% rise in personalized advisory sessions for its priority banking segment. This focus on relationship management directly contributed to a 10% growth in wallet share among these key customer groups.

Financial Stability and Security

Commercial Bank Dubai (CBD) provides unparalleled financial stability and security, offering customers immense peace of mind. As a prudently managed institution, CBD ensures the safety of deposits and transactions through a strong capital base and rigorous risk management. This reliability is paramount for individuals and businesses entrusting their wealth to the bank.

CBD's commitment to financial security is backed by robust performance metrics. For instance, as of the first quarter of 2024, CBD reported a capital adequacy ratio of 19.3%, significantly exceeding regulatory requirements. This strong capital position, coupled with a non-performing loan ratio of 2.7% in the same period, highlights the bank's resilience and prudent lending practices.

- Deposit Security: Customers can be confident in the safety of their funds due to CBD's sound financial management.

- Robust Risk Management: The bank employs stringent risk mitigation strategies to protect against financial downturns.

- Strong Capital Position: CBD maintains a healthy capital adequacy ratio, ensuring its ability to absorb potential losses.

- Reliability and Trust: These factors collectively build trust, making CBD a dependable partner for financial needs.

Support for Economic Growth and Sustainability

Commercial Bank of Dubai (CBD) actively champions the UAE's economic expansion and sustainability objectives. This is achieved through dedicated green financing solutions and robust support for national development agendas, aligning with the nation's vision for a prosperous and environmentally conscious future.

This commitment resonates strongly with clients who seek responsible banking partners, reinforcing CBD's role in achieving broader national economic and ecological targets. For instance, in 2023, CBD reported a significant increase in its sustainable finance portfolio, demonstrating tangible progress in this area.

- Green Financing Initiatives: CBD offers a range of financial products designed to support environmentally friendly projects and businesses, contributing to a lower carbon footprint.

- National Agenda Alignment: The bank's strategies are closely linked to the UAE's national sustainability goals, such as those outlined in the UAE Vision 2030 and the Net Zero by 2050 strategic initiative.

- Client Prioritization: CBD attracts and retains clients who value ethical and sustainable business practices, fostering a community of like-minded stakeholders.

- Reported Impact: CBD's sustainability reports detail its progress and impact on economic growth and environmental preservation, showcasing its dedication to transparency and measurable outcomes.

CBD's value proposition centers on offering a comprehensive suite of banking services, from personal accounts to corporate finance, acting as a single financial hub for diverse client needs. They prioritize digital innovation, enhancing customer experience with user-friendly mobile and online platforms, evidenced by a 20% rise in digital transactions in 2024. Furthermore, CBD fosters deep client relationships through personalized advice and dedicated support, particularly for high-net-worth and corporate clients, which led to a 10% growth in wallet share for these segments in 2024. This is underpinned by a commitment to financial stability and security, demonstrated by a capital adequacy ratio of 19.3% in Q1 2024, exceeding regulatory standards.

| Value Proposition | Description | 2024 Data/Impact |

|---|---|---|

| Comprehensive Financial Solutions | One-stop shop for personal, business, and corporate banking needs. | Significant growth in retail loan portfolio; expanded digital offerings. |

| Digital Convenience & Innovation | Seamless and secure banking via mobile and online platforms, including AI tools. | 20% increase in digital transactions; enhanced customer adoption. |

| Personalized Relationship Management | Tailored financial advice and dedicated support for key client segments. | 15% rise in advisory sessions for priority banking; 10% growth in wallet share. |

| Financial Stability & Security | Prudent management, strong capital base, and rigorous risk mitigation. | Capital Adequacy Ratio of 19.3% (Q1 2024); Non-Performing Loan Ratio of 2.7%. |

Customer Relationships

Commercial Bank Dubai (CBD) cultivates personalized relationships, especially for its corporate and high-net-worth clientele. Dedicated relationship managers act as single points of contact, offering bespoke financial advice and solutions designed to meet intricate needs.

This high-touch strategy ensures that complex financial requirements are addressed with expert guidance and individualized attention. By prioritizing these deep connections, CBD aims to foster significant customer loyalty and long-term partnerships.

In 2024, CBD reported a substantial increase in its focus on relationship banking, with a significant portion of its new business originating from these dedicated client interactions. This highlights the effectiveness of their personalized approach in driving growth and client retention.

Commercial Bank of Dubai (CBD) prioritizes digital self-service for its retail and SME customers through advanced mobile and online banking platforms. These channels empower users to manage accounts, execute payments, and access a wide array of banking services instantly and conveniently. This focus on digital accessibility is a cornerstone of their customer relationship strategy.

CBD's commitment to an enhanced customer experience is underscored by substantial investments in its digital infrastructure. For instance, in 2024, the bank continued to roll out new features and streamline existing functionalities on its digital channels, aiming to reduce reliance on traditional branch interactions and provide a seamless, always-on banking environment.

Commercial Bank of Dubai (CBD) is enhancing customer relationships through automated and efficient interactions. They've launched a next-generation chatbot, leveraging AI to handle routine inquiries and transactions. This initiative aims to significantly improve response times and manage a high volume of customer queries effectively.

Community Engagement and Loyalty Programs

Commercial Bank of Dubai (CBD) actively engages the community through sponsorships and financial literacy programs, fostering goodwill and customer loyalty. In 2024, CBD continued its commitment to financial education, reaching thousands of individuals with workshops aimed at improving financial understanding. These efforts are designed to build lasting relationships beyond basic transactional banking.

Partnerships are a key strategy for enhancing customer relationships. For example, collaborations with entities like the Dubai Festivals and Retail Establishment (DFRE) provide exclusive benefits and offers to CBD customers during major events. This strategy directly rewards loyalty and reinforces the value proposition of banking with CBD.

- Community Sponsorships: CBD's involvement in local events and initiatives in 2024 aimed to strengthen community ties and brand visibility.

- Financial Literacy: The bank's commitment to financial education programs in 2024 provided valuable resources to residents, enhancing trust and engagement.

- Exclusive Partnerships: Collaborations with organizations like DFRE in 2024 offered tangible benefits, rewarding CBD's customer base and encouraging continued patronage.

Proactive Communication and Financial Education

Commercial Bank Dubai prioritizes proactive communication and financial education to foster robust customer relationships. Regularly sharing updates on new products, market trends, and personalized financial advice empowers customers to make informed decisions.

By offering accessible educational resources, the bank helps clients navigate complex financial landscapes and better utilize digital banking channels. This commitment to transparency and knowledge sharing builds trust and enhances customer loyalty.

- Regular Updates: Customers receive timely information on account activity, new service offerings, and relevant market insights, ensuring they are always in the loop.

- Financial Guidance: Access to personalized financial advice and planning tools helps customers achieve their financial goals, from saving to investment.

- Digital Channel Support: The bank actively guides customers in leveraging its digital platforms for seamless banking experiences, enhancing convenience and engagement.

- Educational Resources: A suite of workshops, webinars, and online content is available to boost financial literacy, enabling customers to manage their finances more effectively.

Commercial Bank Dubai (CBD) employs a multi-faceted approach to customer relationships, blending personalized high-touch service for key segments with efficient digital solutions for broader reach. This strategy is supported by significant investments in technology and community engagement initiatives, aiming to build lasting loyalty and drive business growth.

| Customer Segment | Relationship Approach | 2024 Focus/Data Point |

|---|---|---|

| Corporate & High-Net-Worth | Dedicated Relationship Managers, Bespoke Advice | Significant portion of new business originated from these interactions. |

| Retail & SME | Digital Self-Service (Mobile & Online Banking) | Continued rollout of new features to enhance user experience and reduce branch reliance. |

| All Customers | AI-powered Chatbot, Community Engagement, Partnerships | AI chatbot launched for faster query resolution; financial literacy programs reached thousands. |

Channels

Commercial Bank Dubai's branch network is a cornerstone for customers who value traditional banking. These physical locations offer essential services like face-to-face consultations and cash handling, catering to those who prefer or require in-person interactions for more complex financial needs.

As of June 2025, CBD's commitment to a physical presence is evident with its operation of 11 branches strategically located across the UAE. This network ensures accessibility for a broad customer base, reinforcing the bank's role as a trusted financial partner.

Commercial Bank Dubai's (CBD) digital banking platforms, encompassing its online portal and mobile app, are central to its operations. These channels facilitate a comprehensive suite of services, from basic account management and transfers to more complex transactions like loan applications. This digital-first approach is a cornerstone of CBD's strategy, with a significant majority of its customer base actively utilizing these digital avenues.

In 2023, CBD reported a substantial increase in digital transactions, with over 70% of customer interactions occurring through its digital channels. This reflects the success of their 'default digital' strategy, aiming to make online and mobile banking the primary method of engagement for customers. The bank's award-winning mobile application, in particular, continues to see high adoption rates, reinforcing its role as a key customer touchpoint.

Automated Teller Machines (ATMs) and Cash Deposit Machines (CDMs) form a crucial part of Commercial Bank Dubai's (CBD) customer access strategy. With a network of 147 ATMs and CDMs across the UAE, CBD ensures customers can perform essential transactions like cash withdrawals and deposits conveniently, anytime.

These machines are vital for meeting daily transactional demands, acting as extensions of the bank's physical presence. They significantly enhance customer accessibility and operational efficiency by providing 24/7 service without the need for full branch staffing for every interaction.

Contact Centers and Chatbots

Contact centers provide essential telephonic support, acting as a crucial human touchpoint for customers needing assistance with more complex issues or personalized guidance. In 2024, many banks saw a significant portion of customer inquiries still routed through these centers, especially for sensitive transactions or relationship management.

AI-powered chatbots have become indispensable for instant, 24/7 support, efficiently handling common queries and routine transactions. By the end of 2024, it's estimated that chatbots across the banking sector were resolving over 60% of initial customer contact volume, freeing up human agents for higher-value interactions.

These channels collectively ensure continuous customer support and drive efficient problem resolution, improving overall customer satisfaction. The ongoing development and integration of next-generation chatbots are further elevating the digital customer service experience, offering more sophisticated conversational capabilities and personalized assistance.

- Customer Support Channels: Telephonic contact centers for complex needs and AI-powered chatbots for instant, common queries.

- Efficiency Gains: Chatbots resolve a majority of initial inquiries, allowing human agents to focus on intricate issues.

- 24/7 Availability: Both channels provide round-the-clock assistance, enhancing customer convenience.

- Digital Enhancement: Next-generation chatbots are improving the sophistication and personalization of digital customer service.

Social Media and Digital Marketing

Social media and digital marketing are crucial for Commercial Bank Dubai (CBD) to connect with a broad audience, build its brand, and engage customers directly. By leveraging platforms like Instagram, LinkedIn, YouTube, and X (formerly Twitter), CBD can share updates, promote services, and foster a sense of community.

CBD's digital strategy aims to enhance customer interaction and brand visibility. In 2024, the bank continued to invest in content creation and targeted campaigns across these channels to reach both existing and potential customers. For instance, their LinkedIn presence focuses on corporate news and professional networking, while Instagram highlights lifestyle banking and customer success stories.

- Customer Engagement: Social media allows for real-time interaction, addressing queries and gathering feedback, which is vital for service improvement.

- Brand Building: Consistent and engaging content across platforms reinforces CBD's brand identity and values, making it more relatable.

- Wider Reach: Digital marketing campaigns extend the bank's message beyond traditional channels, attracting a diverse customer base.

- Information Dissemination: Platforms are used to announce new products, services, and important financial news efficiently.

Commercial Bank Dubai (CBD) utilizes a multi-channel approach to reach its customers, blending physical and digital touchpoints. This strategy ensures accessibility and caters to diverse customer preferences, from traditional branch interactions to seamless online and mobile experiences.

The bank's channel mix includes 11 physical branches, a robust network of 147 ATMs and Cash Deposit Machines, along with advanced digital platforms like its online portal and award-winning mobile app. Customer support is further bolstered by contact centers and AI-powered chatbots, with chatbots handling over 60% of initial customer inquiries by the end of 2024.

Social media and digital marketing also play a significant role in CBD's engagement strategy, with targeted campaigns on platforms like LinkedIn and Instagram to enhance brand visibility and customer interaction.

Customer Segments

Retail customers, encompassing individuals from all income brackets, form a cornerstone of Commercial Bank Dubai's (CBD) business model. This segment ranges from those needing everyday banking services like current accounts and debit cards to individuals seeking significant financial products such as home loans and car financing.

In 2024, CBD experienced remarkable growth within its retail banking operations. The bank reported a substantial increase in its retail customer base, driven by new account openings and a surge in demand for digital banking solutions. This segment's performance was a key contributor to CBD's overall financial success for the year.

Small and Medium-sized Enterprises (SMEs) represent a vital customer segment for Commercial Bank Dubai (CBD). These businesses require a range of financial services, including working capital financing to manage day-to-day operations, trade finance to facilitate international transactions, and specialized business accounts. CBD is committed to providing tailored lending solutions that directly address the growth and operational necessities of SMEs, acknowledging their significant contribution to the UAE's economic landscape.

CBD's dedication to serving SMEs is evident in its customer satisfaction metrics. For the first half of 2025, the bank achieved its highest SME Net Promoter Score in more than three years. This strong performance highlights CBD's success in meeting the evolving needs of this crucial business segment and fostering loyalty through effective financial support and service delivery.

Commercial Bank Dubai (CBD) serves large corporations and institutions, including significant government entities, by offering sophisticated financial services. These clients rely on CBD for complex needs such as substantial corporate lending, intricate trade finance operations, comprehensive treasury management, and advanced e-commerce solutions tailored for large-scale business.

CBD positions itself as a vital banking partner for these major players, facilitating their extensive operations and crucial strategic initiatives. For instance, in 2024, CBD continued to be a key financier for infrastructure projects within Dubai, contributing significantly to the emirate's growth.

High-Net-Worth Individuals (HNWIs)

High-Net-Worth Individuals (HNWIs) represent a crucial customer segment for Commercial Bank Dubai (CBD), primarily seeking sophisticated wealth management and tailored investment advisory services. CBD caters to these clients by offering specialized financial products designed to preserve and grow substantial assets, often facilitated by dedicated relationship managers who provide exclusive, personalized attention.

This segment is particularly vital for driving CBD's investment solutions business. For instance, in 2024, the global wealth management market saw significant growth, with HNWIs increasingly looking for expert guidance to navigate complex financial landscapes and capitalize on emerging opportunities.

- Wealth Management Focus: HNWIs prioritize comprehensive strategies for managing, preserving, and growing their significant financial portfolios.

- Investment Advisory Needs: This segment actively seeks expert advice on investment opportunities, risk management, and asset allocation to achieve their financial goals.

- Specialized Financial Products: CBD provides access to exclusive and bespoke financial products, including alternative investments and structured products, catering to the unique demands of HNWIs.

- Relationship-Driven Services: Dedicated relationship managers are key, offering personalized service and building long-term partnerships to address the evolving financial needs of HNWIs.

Government and Public Sector Entities

Commercial Bank of Dubai (CBD) actively engages with government and public sector entities, offering a comprehensive suite of banking solutions tailored to their unique needs. This includes managing public finances, facilitating transactions for government departments, and providing financial support for national development initiatives.

CBD's commitment to this segment is underscored by its understanding of the stringent compliance and reporting requirements inherent in public sector operations. The bank ensures its services align with government regulations and actively supports national economic agendas and development projects, contributing to the UAE's growth trajectory. For instance, in 2024, Dubai's government continued to drive significant infrastructure investment, with CBD playing a role in financing key projects.

- Facilitating Public Finance: CBD provides treasury management and payment processing services crucial for efficient government operations.

- Supporting National Development: The bank offers financing solutions for large-scale public infrastructure and development projects, aligning with national strategic goals.

- Compliance and Reporting: CBD adheres to all regulatory frameworks, ensuring transparency and accountability in its dealings with public sector clients.

- Strategic Alignment: CBD's services are designed to support government initiatives, contributing to economic diversification and public service delivery.

Commercial Bank Dubai (CBD) serves a diverse customer base, including retail individuals, SMEs, large corporations, HNWIs, and government entities. Each segment has distinct financial needs, from basic banking to complex corporate finance and wealth management.

In 2024, CBD saw significant growth in its retail segment, driven by digital adoption, and maintained strong relationships with SMEs, evidenced by high satisfaction scores in early 2025. The bank also continued its role in financing major corporate and government infrastructure projects.

| Customer Segment | Key Needs | 2024/2025 Highlights |

|---|---|---|

| Retail Customers | Everyday banking, loans, digital services | Substantial growth in customer base; surge in digital banking demand. |

| SMEs | Working capital, trade finance, business accounts | Highest SME Net Promoter Score in over three years (H1 2025). |

| Large Corporations & Institutions | Corporate lending, treasury management, trade finance | Key financier for Dubai infrastructure projects in 2024. |

| High-Net-Worth Individuals (HNWIs) | Wealth management, investment advisory | Growing global wealth management market; HNWIs seeking expert guidance. |

| Government & Public Sector | Public finance management, project financing | Supporting national development initiatives; alignment with government economic agendas. |

Cost Structure

Employee salaries and benefits represent a substantial cost for Commercial Bank Dubai (CBD). In 2024, as in previous years, the bank's commitment to attracting and retaining skilled talent meant significant expenditure on compensation packages, health insurance, retirement contributions, and ongoing professional development. This investment in human capital is crucial for a service-driven organization like CBD, especially given its focus on programs like Emiratisation and management trainee development, which aim to build a strong local talent pipeline.

Commercial banks in Dubai are significantly increasing investments in digital transformation, with technology and digital infrastructure forming a core part of their cost structure. These expenditures encompass crucial areas like IT infrastructure upgrades, software licensing, robust cybersecurity measures, and sophisticated data management systems.

The drive towards digital innovation means substantial outlays for hybrid cloud environments, the integration of artificial intelligence (AI) into banking operations, and the continuous development of new digital platforms. For instance, global spending on financial technology (FinTech) is projected to reach over $300 billion by 2024, reflecting the scale of these necessary investments for banks to remain competitive.

The cost of operating Commercial Bank Dubai's physical network, comprising 11 branches and 147 ATMs/CDMs, is significant. These expenses include rent for prime locations, utilities to power facilities, ongoing maintenance to ensure functionality, and robust security systems to protect assets and customers.

Despite the increasing adoption of digital banking, the physical branch and ATM network remains a crucial touchpoint for a substantial portion of CBD's customer base. This continued reliance necessitates ongoing investment in maintaining and upgrading these physical assets to meet customer expectations and operational requirements.

Marketing and Sales Expenses

Marketing and sales expenses are critical for a commercial bank in Dubai to expand its customer base and build brand loyalty. These costs encompass a wide range of activities designed to reach diverse customer segments, from individual consumers to large corporations.

In 2024, the banking sector in the UAE, including Dubai, continued to invest heavily in digital marketing and customer acquisition. For instance, a significant portion of these expenses goes towards online advertising, social media campaigns, and content marketing to promote new digital banking services and mobile applications. Banks also allocate funds for traditional advertising channels like television, radio, and print media to maintain broad brand visibility.

The sales force also represents a substantial cost. This includes salaries, commissions, and training for relationship managers and sales teams who are responsible for acquiring new clients and deepening existing relationships. Efforts to engage specific customer segments, such as high-net-worth individuals or small and medium-sized enterprises (SMEs), often involve tailored marketing strategies and dedicated sales resources.

- Digital Marketing: Investment in online advertising, SEO, social media campaigns, and content creation to attract new customers and promote digital offerings.

- Brand Promotion: Costs associated with advertising across various media (TV, print, radio, outdoor) and public relations activities to enhance brand image and awareness.

- Sales Force Costs: Salaries, commissions, bonuses, and training for relationship managers and sales teams focused on customer acquisition and retention.

- Customer Engagement: Expenses related to targeted campaigns, events, and loyalty programs aimed at specific customer segments like SMEs or affluent individuals.

Regulatory Compliance and Risk Management Costs

Adhering to the UAE's robust financial regulations, including those from the Central Bank of the UAE (CBUAE), necessitates substantial investment. These costs encompass legal counsel for interpreting and implementing new directives, dedicated compliance officers, and sophisticated risk assessment software to monitor market, credit, and operational risks. For instance, in 2024, banks globally saw compliance costs rise, with a significant portion attributed to evolving anti-money laundering (AML) and know-your-customer (KYC) requirements.

These expenditures are not merely overhead; they are fundamental to maintaining operational integrity and safeguarding the bank from hefty penalties. Robust risk management frameworks, essential for stability, also involve continuous training for staff and investment in technology to detect and mitigate fraud and cyber threats. For example, the average cost of a data breach for financial institutions in 2023 was reported to be around $5.9 million, underscoring the financial imperative of strong security and compliance measures.

- Legal Fees: Engaging legal experts to navigate complex regulatory landscapes and ensure adherence to CBUAE mandates.

- Compliance Personnel: Salaries and training for dedicated compliance officers and teams focused on regulatory adherence.

- Risk Assessment Tools: Investment in technology and software for credit risk modeling, market risk monitoring, and operational risk management.

- Technology Infrastructure: Maintaining secure and compliant IT systems to protect customer data and prevent financial crime.

Operational costs for Commercial Bank Dubai (CBD) include the expenses related to its physical infrastructure, such as rent for branches and ATMs, utilities, and maintenance. These are essential for providing accessible banking services across Dubai, even as digital channels grow. The bank's commitment to a strong physical presence, with 11 branches and 147 ATMs/CDMs as of 2024, necessitates ongoing investment in maintaining these facilities to ensure customer convenience and operational efficiency.

Technology and digital infrastructure represent a significant and growing cost for CBD, driven by the need for digital transformation. This includes substantial outlays for IT upgrades, cybersecurity, data management, and the development of new digital platforms, reflecting a global trend where financial technology investments are projected to exceed $300 billion by 2024.

Marketing and sales efforts are crucial for customer acquisition and retention, encompassing digital advertising, social media, and traditional media campaigns, as well as the costs associated with a dedicated sales force. These investments are vital for promoting new digital services and engaging diverse customer segments, from individuals to SMEs.

Compliance and regulatory adherence, mandated by bodies like the Central Bank of the UAE, form another major cost component. This involves legal fees, salaries for compliance officers, and investment in risk assessment technology, a necessity underscored by the rising global costs of compliance, particularly for AML and KYC measures.

Revenue Streams

Net Interest Income (NII) is the cornerstone of Commercial Bank Dubai's (CBD) revenue generation. This income is primarily earned from the spread between the interest rates on loans and investments made by the bank and the interest paid out on customer deposits and other borrowings. In 2024, CBD continued to see robust performance in this area, driven by strategic loan portfolio expansion and a stable, growing deposit base.

The bank's ability to attract a diverse range of deposits, from current accounts to fixed term deposits, allows it to manage its funding costs effectively. This, coupled with a strong focus on growing its lending activities across various sectors, including corporate, retail, and SME segments, directly bolsters its NII. For instance, a significant portion of CBD's loan book in 2024 was concentrated in areas showing healthy demand, contributing to higher interest earnings.

Commercial Bank Dubai generates significant revenue through fees and commissions. This includes charges for account maintenance, various transactions, and credit card usage. In 2024, banks globally saw a continued reliance on these fee-based income streams, especially in areas like trade finance and wealth management, which are key services for a commercial bank.

The bank earns commissions from trade finance activities, a vital service for businesses engaged in international commerce. Additionally, fees associated with wealth management services contribute to this revenue stream. This diversified approach ensures a stable income, as evidenced by the consistent growth in fee income reported by many financial institutions in 2024 across transactional banking, trade, mortgage, and credit card services.

Foreign exchange income is a significant revenue stream for a commercial bank in Dubai, stemming from the profits made on currency conversion services. This is especially true given Dubai's status as a global trade and tourism hub, facilitating numerous cross-border transactions for both individuals and businesses.

In 2024, the UAE's foreign exchange market saw substantial activity, with the dirham remaining pegged to the US dollar. Banks profit from the bid-ask spread on currency exchanges, a consistent revenue source as businesses import and export goods, and tourists exchange currencies.

Investment Income

Investment income is a crucial revenue stream for commercial banks, stemming from the returns generated by their investment portfolios. This includes earnings from securities like bonds and equities, as well as other financial instruments the bank holds. Effectively managing this portfolio, often within treasury and investment divisions, directly contributes to the bank's profitability.

- Interest Income: Revenue earned from lending activities and investments in debt securities.

- Dividend Income: Profits distributed by companies to their shareholders, which the bank may own.

- Capital Gains: Profits realized from selling investment assets for more than their purchase price.

- Trading Income: Profits generated from actively buying and selling financial instruments.

In 2024, global investment banking revenues saw a significant rebound, with many major banks reporting substantial gains from their trading and wealth management arms, which heavily rely on investment income. For instance, some leading financial institutions in the Middle East, including those in Dubai, reported double-digit percentage increases in their fee and commission income, a significant portion of which is derived from investment management services.

Other Operating Income

Other Operating Income for commercial banks encompasses diverse, non-traditional revenue streams that bolster overall financial health. These can include profits from selling off bank-owned assets, reimbursements for previously uncollectible loans, and income generated from activities outside core lending and deposit-taking. This diversification is crucial for risk management, reducing the bank's vulnerability to fluctuations in its primary business areas.

For instance, in 2024, many regional banks saw a notable increase in recoveries on written-off loans as economic conditions improved. Gains from the sale of non-core assets, such as real estate or investments, also contributed to this income category. This multifaceted approach to revenue generation demonstrates a strategic effort to enhance profitability and stability.

- Gains on Sale of Assets: Profits realized from selling off assets like property, equipment, or investment portfolios.

- Recoveries on Written-off Loans: Funds collected from borrowers after a loan has been previously deemed uncollectible.

- Other Non-Core Income: Revenue from miscellaneous activities not directly related to traditional banking operations.

- Risk Mitigation: Diversifying income sources reduces reliance on any single revenue stream, enhancing overall financial resilience.

Commercial Bank Dubai's revenue streams are multifaceted, extending beyond traditional interest income. These include a robust fee and commission structure, significant foreign exchange gains, and returns from its investment portfolio. Additionally, other operating income, such as asset sales and loan recoveries, contributes to the bank's overall financial performance.

| Revenue Stream | Description | 2024 Context/Impact |

|---|---|---|

| Net Interest Income (NII) | Profit from lending and deposit interest rate spreads. | Driven by strategic loan growth and a stable deposit base in 2024. |

| Fees and Commissions | Income from account services, transactions, and wealth management. | Key for financial institutions, with growth in trade finance and transactional services noted in 2024. |

| Foreign Exchange Income | Profits from currency conversion services. | Significant in Dubai due to its global hub status; benefited from active FX markets in 2024. |

| Investment Income | Returns from securities, bonds, and equities. | Global investment banking saw a rebound in 2024, boosting income from trading and wealth management. |

| Other Operating Income | Gains from asset sales, loan recoveries, and non-core activities. | Regional banks saw increased loan recoveries and asset sale profits in 2024 due to improved economic conditions. |

Business Model Canvas Data Sources

The Commercial Bank Dubai Business Model Canvas is built using a blend of internal financial data, extensive market research on the UAE banking sector, and insights from regulatory filings. This comprehensive approach ensures each component of the canvas is grounded in verifiable information and industry realities.