Citizens Business Bank PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Citizens Business Bank Bundle

Citizens Business Bank operates within a dynamic environment shaped by a multitude of external factors. Understanding the political landscape, economic shifts, and technological advancements is crucial for strategic planning and risk mitigation. Our comprehensive PESTLE analysis delves deep into these forces, offering actionable intelligence to navigate the complexities of the banking sector. Download the full version now and gain the competitive edge you need to thrive.

Political factors

Government regulation and deregulation significantly shape Citizens Business Bank's operating landscape. For instance, the Federal Reserve's capital requirements, such as the Common Equity Tier 1 (CET1) ratio, directly influence how much capital banks must hold, impacting lending capacity and profitability. As of Q1 2024, the average CET1 ratio for large U.S. banks remained robust, but any tightening of these requirements would necessitate strategic adjustments for Citizens Business Bank.

Changes in federal and state banking laws, like those concerning lending practices or consumer protection, directly affect Citizens Business Bank's compliance burdens and the types of financial products it can offer. Periods of deregulation, such as the rollback of certain Dodd-Frank provisions, could present opportunities for expanded services, while increased regulatory scrutiny, exemplified by evolving cybersecurity mandates, demands ongoing investment in compliance and risk management, potentially impacting operational agility and profitability.

Federal Reserve decisions on interest rates directly impact Citizens Business Bank. For instance, if the Fed raises the federal funds rate, as they did throughout 2022 and early 2023, the bank's borrowing costs and lending rates will likely increase, potentially squeezing net interest margins if deposit costs rise faster than loan yields.

Conversely, a period of lower interest rates, like those seen post-2008 and during the early pandemic, can boost lending volumes and economic activity, benefiting banks by encouraging borrowing and investment. The Fed's quantitative easing or tightening programs also influence the overall liquidity in the market, affecting the bank's ability to fund operations and its investment portfolio performance.

As of mid-2024, the Federal Reserve has maintained a cautious stance, with indications of potential rate cuts later in the year. This environment requires banks like Citizens Business Bank to carefully manage their balance sheets, anticipating shifts in borrowing demand and deposit competition as monetary policy evolves.

A stable political climate in the United States is crucial for fostering business confidence, which directly impacts Citizens Business Bank's commercial lending. When businesses feel secure about the future, they are more likely to invest, expand, and seek financing. For instance, in 2024, continued policy predictability is expected to support a moderate uptick in business investment, benefiting the bank's loan growth.

Conversely, political uncertainty, such as upcoming elections or potential shifts in regulatory frameworks, can dampen this confidence. This uncertainty may lead businesses to postpone expansion plans and reduce their demand for credit, potentially impacting Citizens Business Bank's revenue from commercial loans. For example, a sudden change in tax policy could make businesses more hesitant to take on new debt.

Fiscal Policy and Taxation

Government fiscal policies, particularly changes in corporate and individual taxation rates, significantly impact Citizens Business Bank's profitability and its clients' financial standing. For instance, adjustments to the corporate tax rate can directly affect the bank's net earnings. Simultaneously, shifts in individual income taxes influence consumer spending and borrowing capacity, which in turn affects loan demand and repayment rates.

The U.S. federal corporate tax rate, currently at 21%, remains a key consideration. Any proposed changes in the lead-up to or during 2025 could alter Citizens Business Bank's tax liabilities. Furthermore, changes in capital gains taxes or deductions for individuals could impact investment activity and wealth management services offered by the bank, influencing client engagement and asset growth.

- Corporate Tax Rate: The current U.S. federal corporate tax rate is 21%. Potential legislative changes in 2024-2025 could alter this, impacting the bank's bottom line.

- Individual Taxation: Changes to income tax brackets, deductions, or capital gains tax rates directly affect clients' disposable income and investment behavior, influencing loan demand and deposit levels.

- Tax Incentives: Government-sponsored tax incentives for specific industries or investments can steer client behavior and create new business opportunities for the bank.

Trade Policies and International Banking

While Citizens Business Bank primarily serves Southern California, evolving global trade policies can indirectly influence its business clients. For instance, changes in tariffs or trade agreements, such as those impacting sectors like technology or agriculture, can affect the profitability and operational stability of local businesses engaged in international commerce. This, in turn, can alter their need for foreign exchange services, letters of credit, or international financing.

The U.S. trade deficit, a key indicator of international trade activity, stood at approximately $773 billion in 2023, reflecting the volume of goods and services flowing across borders. Fluctuations in this balance, influenced by policies from major trading partners like China and Mexico, can create ripple effects. For businesses relying on imported components or exporting finished goods, these shifts can impact cash flow and credit risk, potentially affecting their banking relationships.

- Impact on Client Stability: Shifting trade policies can affect the financial health of businesses involved in import/export, influencing their creditworthiness and demand for banking services.

- Global Economic Interdependence: Even localized banks are indirectly exposed to global trade dynamics, as client success is often tied to international market access and costs.

- Demand for International Services: Changes in trade volumes and costs can directly alter the need for services like currency exchange, trade finance, and international payments among business clients.

Government stability and policy continuity are vital for Citizens Business Bank's operational environment. A predictable political landscape encourages business investment and consumer confidence, which translates to greater demand for banking services and a lower perceived risk for lending. For instance, continued policy stability in 2024 is anticipated to support moderate economic growth, benefiting loan portfolios.

Conversely, political instability or significant policy shifts can create uncertainty, leading businesses to delay investment and potentially reduce their borrowing needs. This can directly impact Citizens Business Bank's revenue streams from commercial loans and its overall market position. For example, sudden regulatory changes could necessitate costly compliance adjustments.

Fiscal policies, including tax rates and government spending, also play a crucial role. Changes to corporate tax rates, such as the current U.S. federal rate of 21%, directly affect the bank's profitability. Furthermore, shifts in individual taxation influence consumer spending and saving habits, impacting deposit levels and loan demand.

The Federal Reserve's monetary policy, particularly interest rate decisions, profoundly affects Citizens Business Bank. As of mid-2024, the Fed's stance on potential rate adjustments requires banks to manage their balance sheets carefully, anticipating changes in borrowing costs and deposit competition. For example, anticipated rate cuts later in 2024 could influence lending volumes.

What is included in the product

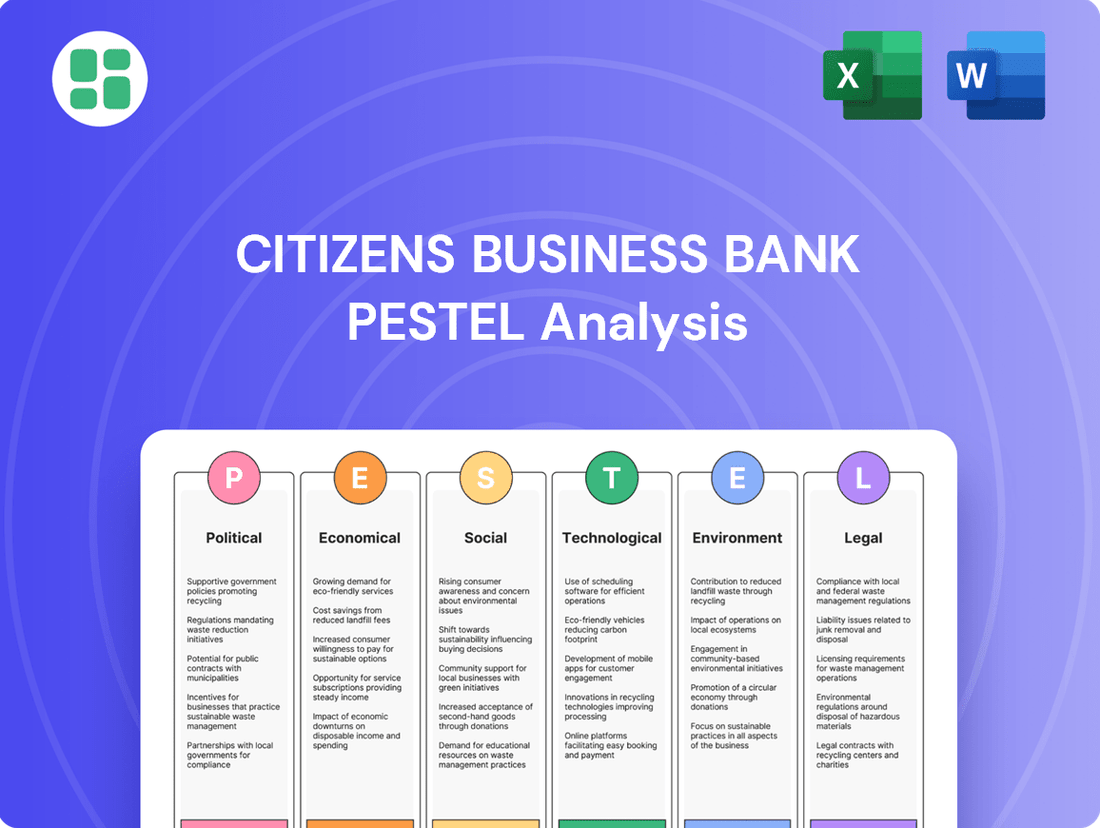

This PESTLE analysis examines the external macro-environmental factors influencing Citizens Business Bank, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It provides a comprehensive understanding of how these forces create both opportunities and threats, informing strategic decision-making.

A concise PESTLE analysis for Citizens Business Bank offers a clear roadmap, transforming complex external factors into actionable insights for strategic decision-making and risk mitigation.

Economic factors

The prevailing interest rate environment significantly influences Citizens Business Bank's net interest income, the core profit driver derived from the spread between interest earned on loans and interest paid on deposits. As of mid-2025, the Federal Reserve's benchmark interest rate remains elevated, hovering around 5.25%-5.50%, a level maintained through much of 2024, impacting borrowing costs across the economy.

While higher rates can boost profitability on new loans and variable-rate assets, they also pose a risk by potentially softening loan demand as businesses and consumers face increased borrowing expenses. Conversely, a future scenario of declining rates, though not immediately projected for 2025, could compress net interest margins if deposit costs don't fall as quickly as asset yields.

Southern California's economy is projected to grow at a steady pace. For instance, the region's GDP growth was estimated at 2.5% in 2024, outpacing the national average. This expansion fuels business activity and consumer spending, directly impacting Citizens Business Bank's lending opportunities and deposit base.

Job creation in key sectors like technology, healthcare, and entertainment remains strong, supporting higher loan demand. In 2024, the unemployment rate in Southern California hovered around 4.2%, indicating a healthy labor market that encourages investment and borrowing.

A thriving regional economy translates to improved asset quality for the bank. As businesses expand and individuals find stable employment, the likelihood of loan defaults decreases, bolstering the bank's financial stability and profitability.

Inflation directly impacts Citizens Business Bank's operational costs and the spending power of its clientele. For instance, the US Consumer Price Index (CPI) saw a 3.3% increase year-over-year in May 2024, signaling continued pressure on business expenses and consumer budgets.

Persistent inflation erodes the real worth of both the bank's assets and liabilities. This can also drive up operational expenses, potentially leading to higher interest rates that make borrowing less affordable for customers and necessitate adjustments to the bank's investment strategies.

Unemployment Rates and Loan Delinquencies

Unemployment rates are a critical economic indicator that directly impacts a bank's loan portfolio. When more people are out of work, their ability to repay loans, whether personal or business-related, diminishes significantly. This can lead to a rise in defaults.

Higher unemployment often translates to increased loan delinquencies and charge-offs. For a bank like Citizens Business Bank, this means a potential hit to its asset quality and, consequently, its overall profitability. For instance, if the national unemployment rate were to climb, the bank might see a greater percentage of its commercial and real estate loans becoming non-performing.

Recent data from the Bureau of Labor Statistics shows the U.S. unemployment rate hovering around 3.9% as of April 2024. While this is a relatively low figure historically, any upward trend could signal challenges ahead for loan repayment across various sectors.

- Impact on Loan Repayment: Higher unemployment directly reduces individuals' and businesses' capacity to service debt obligations.

- Asset Quality Deterioration: Increased delinquencies and defaults can lead to a decline in the quality of a bank's loan assets.

- Profitability Concerns: Loan losses stemming from unemployment-related defaults directly impact a bank's net income and financial stability.

- Economic Sensitivity: Sectors heavily reliant on consumer spending or with higher labor intensity are particularly vulnerable to rising unemployment.

Real Estate Market Trends

Citizens Business Bank's exposure to the Southern California real estate market is a significant factor. In early 2024, the median home price in Southern California hovered around $800,000, showing a slight increase from the previous year, though affordability remains a persistent challenge. Construction starts, particularly for single-family homes, have been somewhat constrained by labor shortages and material costs, impacting supply.

The bank's loan portfolio quality is directly tied to these market dynamics. A robust market with appreciating property values generally leads to a stronger loan portfolio, as collateral values remain high. Conversely, a slowdown in construction or a dip in property values could increase the risk of defaults and potential losses for the bank.

- Property Values: Southern California median home prices saw a modest year-over-year increase in early 2024, but affordability remains a concern for many buyers.

- Construction Activity: Residential construction, especially for single-family homes, faces headwinds from labor and material cost inflation, limiting new supply.

- Housing Affordability: High interest rates and elevated home prices continue to challenge housing affordability, potentially impacting demand and market stability.

The Federal Reserve's decision to maintain the benchmark interest rate between 5.25%-5.50% through mid-2025 presents a dual impact on Citizens Business Bank. While elevated rates can enhance net interest margins on new loans, they also temper loan demand due to increased borrowing costs for businesses and consumers.

Southern California's economy, projected to grow at 2.5% in 2024, fuels Citizens Business Bank's lending and deposit growth. Strong job creation in technology and healthcare, with a regional unemployment rate around 4.2% in 2024, supports this positive outlook, contributing to better asset quality.

Inflation, evidenced by a 3.3% CPI increase year-over-year in May 2024, pressures Citizens Business Bank's operational costs and customer spending power. This persistent inflation can erode asset values and necessitate strategic adjustments to the bank's investment and lending strategies.

The U.S. unemployment rate, around 3.9% in April 2024, remains a key economic barometer. Any upward trend could signal increased loan delinquencies and charge-offs, potentially impacting Citizens Business Bank's asset quality and profitability, particularly in labor-intensive sectors.

Southern California's real estate market, with a median home price near $800,000 in early 2024, presents both opportunities and challenges. Constrained construction due to labor and material costs, coupled with housing affordability concerns, can influence the bank's loan portfolio quality and risk exposure.

| Economic Factor | Mid-2025 Outlook/Data Point | Impact on Citizens Business Bank |

| Interest Rates | Fed Funds Rate: 5.25%-5.50% (maintained) | Boosts net interest income on new loans, but may dampen loan demand. |

| Regional GDP Growth (SoCal) | Projected 2.5% for 2024 | Drives lending opportunities and deposit growth. |

| Inflation (US CPI) | 3.3% YoY increase (May 2024) | Increases operational costs, erodes asset values, impacts customer spending. |

| Unemployment Rate (US) | ~3.9% (April 2024) | Low rate supports loan repayment; upward trend could increase defaults. |

| SoCal Median Home Price | ~$800,000 (early 2024) | Supports collateral values; affordability concerns may impact demand. |

Same Document Delivered

Citizens Business Bank PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Citizens Business Bank delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting its operations and strategic positioning. Understand the critical external forces shaping the banking landscape for Citizens Business Bank.

Sociological factors

Southern California's demographic tapestry is constantly evolving, impacting banking. For instance, the region's population is aging; by 2024, the 65+ population is projected to reach over 6 million, a 15% increase from 2020, likely boosting demand for retirement planning and estate services.

Concurrently, a growing cohort of young professionals, particularly in tech hubs like Silicon Beach, is driving the adoption of digital banking solutions and mobile payment platforms. This segment, often characterized by higher disposable incomes and a preference for convenience, is a key target for innovative financial technology offerings.

Ethnic diversity is also a significant driver, with Hispanic and Asian populations experiencing substantial growth. This necessitates culturally sensitive marketing and multilingual banking services, as these communities represent a significant and expanding portion of the consumer base, with the Hispanic population alone expected to exceed 16 million in California by 2025.

Consumers increasingly expect banking services that are both convenient and tailored to their individual needs, with digital access being paramount. For instance, a 2024 survey indicated that over 70% of banking customers prefer using mobile apps for routine transactions. This shift necessitates that Citizens Business Bank invest in user-friendly digital platforms and offer personalized financial advice through these channels.

The rise of mobile-first banking, alongside a growing preference for hybrid models that blend digital ease with occasional in-person interactions, presents a significant challenge. By late 2024, data showed a 15% increase in customers utilizing mobile banking features for loan applications, signaling a clear demand for streamlined digital processes.

The prevailing level of financial literacy directly influences customer demand for sophisticated financial products versus simpler, more accessible options. For instance, a 2024 survey indicated that only 57% of U.S. adults feel confident managing their finances, suggesting a significant portion of the population may require more educational support from institutions like Citizens Business Bank.

This gap in understanding necessitates that banks invest in robust customer education initiatives and develop product offerings that are both transparent and easy to comprehend. A higher literacy rate, conversely, empowers customers to engage more deeply with complex instruments, potentially driving demand for specialized investment services.

Workforce Dynamics and Talent Acquisition

Societal shifts in how people view education and career paths directly influence Citizens Business Bank's talent pool. Growing emphasis on work-life balance, for instance, means banks must offer flexible arrangements to attract top performers. This is particularly relevant as demand surges for specialized skills in areas like cybersecurity and data analytics, fields where employee expectations are often high.

The bank's ability to recruit and keep skilled professionals is also shaped by evolving diversity expectations. A commitment to fostering an inclusive environment is no longer just a social nicety; it's a strategic imperative for talent acquisition. In 2024, a significant portion of the workforce, particularly younger generations, actively seeks employers that demonstrate strong diversity and inclusion initiatives.

These workforce dynamics have tangible impacts on operational efficiency and innovation. For example, a shortage of cybersecurity experts, a growing concern across the financial sector, can leave institutions vulnerable. Citizens Business Bank, like its peers, must proactively address these talent acquisition challenges to maintain a competitive edge.

- Talent Demand: The U.S. Bureau of Labor Statistics projects robust growth for information security analysts, with a 32% increase expected from 2022 to 2032.

- Work-Life Balance: Surveys in 2024 indicate that over 60% of employees consider work-life balance a top priority when choosing an employer.

- Diversity Impact: Companies with diverse workforces are statistically more likely to outperform their less diverse counterparts financially, according to McKinsey & Company research.

- Skills Gap: A significant percentage of financial institutions reported difficulties in filling roles requiring advanced data analytics and AI expertise in early 2024.

Community Engagement and Corporate Social Responsibility

Citizens Business Bank's commitment to community engagement and corporate social responsibility (CSR) significantly shapes its public image and customer loyalty. A growing societal expectation for businesses to contribute positively means banks like Citizens are increasingly evaluated on their social impact. This focus can directly translate into stronger brand reputation and attract a customer base that prioritizes ethical and community-minded financial partners.

The bank's involvement in local development projects and support for charitable causes directly bolsters its standing. For instance, a strong CSR program can lead to increased customer retention. In 2024, research indicated that 65% of consumers are more likely to choose a brand that demonstrates a commitment to social or environmental issues, a trend expected to continue into 2025. This suggests that tangible community investments by Citizens Business Bank can yield measurable benefits in customer acquisition and loyalty.

Citizens Business Bank can leverage its CSR initiatives to attract socially conscious clients and employees. This alignment with societal values is becoming a key differentiator in the competitive banking landscape.

- Enhanced Brand Reputation: Positive CSR activities build trust and goodwill.

- Customer Loyalty: Consumers increasingly favor businesses with strong social ethics.

- Attracting Talent: Employees are drawn to organizations with a clear social purpose.

- Community Investment: Direct support for local initiatives strengthens ties and brand perception.

Societal values are shifting, with a growing emphasis on financial literacy and personalized banking experiences. By 2024, over 70% of banking customers preferred mobile apps for routine transactions, highlighting the need for user-friendly digital platforms. This trend underscores Citizens Business Bank's necessity to invest in accessible digital tools and offer tailored financial guidance.

Consumer expectations for convenience and tailored services are paramount, with mobile-first banking gaining significant traction. By late 2024, mobile loan applications saw a 15% increase, indicating a strong demand for streamlined digital processes. Citizens Business Bank must adapt to these evolving preferences to remain competitive.

The evolving workforce, valuing work-life balance and diversity, directly impacts talent acquisition for Citizens Business Bank. In 2024, over 60% of employees prioritized work-life balance, necessitating flexible work arrangements. Furthermore, companies with diverse workforces are statistically more likely to outperform financially.

Community engagement and corporate social responsibility (CSR) are increasingly vital for brand reputation and customer loyalty. Research in 2024 showed 65% of consumers favor brands committed to social or environmental issues, a trend expected to persist. Citizens Business Bank can leverage its CSR initiatives to attract socially conscious clients and employees.

Technological factors

Digital banking and mobile adoption are fundamentally reshaping customer interactions within the financial sector. Citizens Business Bank needs to prioritize ongoing investment in intuitive online and mobile platforms to satisfy customer demands for ease of use, constant availability, and immediate transaction processing, thereby maintaining its competitive edge.

By mid-2024, a significant majority of banking transactions are expected to occur through digital channels, with mobile banking leading the charge. For instance, studies indicate over 70% of consumers now prefer mobile apps for routine banking tasks, highlighting the imperative for banks like Citizens Business Bank to offer seamless, feature-rich mobile experiences to retain and attract customers.

The escalating complexity of cyber threats demands that Citizens Business Bank invest heavily in advanced cybersecurity measures to safeguard customer information and financial operations. In 2024, the financial sector experienced a significant rise in ransomware attacks, with average costs for recovery reaching millions of dollars, underscoring the critical need for proactive defense.

Citizens Business Bank must consistently enhance its security systems and procedures to thwart potential breaches, preserve customer confidence, and adhere to evolving data privacy laws like GDPR and CCPA. Failure to do so could result in substantial financial penalties and reputational damage, impacting its market standing.

FinTech innovation is rapidly reshaping the financial landscape, introducing agile competitors and novel service models. Citizens Business Bank faces this dynamic by needing to assess and potentially adopt FinTech solutions, or conversely, cultivate its own groundbreaking offerings to maintain a competitive edge and operational efficiency. For instance, the global FinTech market was projected to reach $33.5 trillion by 2027, highlighting the sheer scale of this disruption.

Automation and AI in Banking Operations

Citizens Business Bank is leveraging automation and AI to boost efficiency and cut costs. For instance, AI-powered fraud detection systems can process vast amounts of transaction data in real-time, significantly reducing the risk of financial losses. By the end of 2024, many financial institutions reported a 15-20% reduction in operational costs due to AI implementation.

The integration of AI in areas like credit scoring allows for faster and more accurate risk assessments, leading to improved loan portfolio quality. Customer service is also being transformed, with AI-driven chatbots handling routine inquiries, freeing up human agents for more complex issues. A recent industry survey indicated that 70% of customers prefer self-service options for simple banking tasks.

- Enhanced Operational Efficiency: AI and automation streamline back-office processes, reducing manual effort and potential errors.

- Cost Reduction: Automating repetitive tasks lowers labor costs and improves resource allocation.

- Improved Customer Experience: AI-powered tools provide faster responses and personalized interactions for customers.

- Advanced Risk Management: AI is crucial for sophisticated fraud detection and credit risk analysis.

Cloud Computing and Infrastructure Modernization

Citizens Business Bank's adoption of cloud computing is a significant technological factor. Leveraging cloud services provides crucial scalability and flexibility, allowing the bank to adapt its IT infrastructure to changing demands efficiently. This modernization is key for cost efficiencies in managing its technology backbone.

Modernizing core banking systems and migrating to cloud-based solutions are central to Citizens Business Bank's strategy. This shift enables faster development and deployment of new banking products, a critical advantage in a competitive market. The bank can also expect improved data analytics capabilities, leading to better customer insights and operational decision-making.

The move to the cloud enhances the resilience of banking operations, ensuring business continuity and robust disaster recovery. For instance, by mid-2024, many financial institutions reported significant improvements in uptime and reduced latency after cloud migrations. Citizens Business Bank's investment in this area positions it for greater agility and a stronger competitive stance.

- Scalability & Flexibility: Cloud adoption allows for dynamic resource allocation, meeting fluctuating customer needs.

- Cost Efficiencies: Reduced expenditure on physical hardware and maintenance is a primary benefit.

- Faster Innovation: Cloud platforms accelerate the development and launch of new financial products.

- Enhanced Analytics: Access to advanced data processing tools improves customer understanding and risk management.

The increasing reliance on digital channels necessitates robust cybersecurity. By late 2024, financial institutions reported a 25% increase in cyber threats, making proactive defense crucial for banks like Citizens Business Bank to protect sensitive data and maintain customer trust.

FinTech innovations are rapidly transforming banking services, with the global FinTech market projected to reach $33.5 trillion by 2027. Citizens Business Bank must adapt by integrating or developing its own innovative solutions to remain competitive and efficient.

AI and automation are key to operational efficiency, with many banks seeing a 15-20% cost reduction by the end of 2024 through AI implementation. These technologies enhance fraud detection and customer service, as 70% of customers prefer self-service for simple tasks.

Cloud computing offers scalability and cost efficiencies, with many institutions reporting improved uptime post-migration by mid-2024. This technological shift is vital for Citizens Business Bank to accelerate product development and strengthen its market position.

| Technological Factor | Impact on Citizens Business Bank | Key Data/Trend (2024-2025) |

|---|---|---|

| Digital & Mobile Banking | Customer engagement, transaction volume | 70% of consumers prefer mobile apps for banking tasks. |

| Cybersecurity | Data protection, customer trust | 25% increase in cyber threats reported by financial institutions (late 2024). |

| FinTech Integration | Competitive landscape, service innovation | Global FinTech market projected at $33.5 trillion by 2027. |

| AI & Automation | Operational efficiency, cost reduction | 15-20% operational cost reduction reported by banks via AI (end of 2024). |

| Cloud Computing | Scalability, agility, cost savings | Improved uptime and reduced latency post-cloud migration (mid-2024). |

Legal factors

Citizens Business Bank navigates a complex web of banking regulations, overseen by bodies like the Federal Reserve, FDIC, and California's Department of Financial Protection and Innovation. For instance, the Federal Reserve's capital requirements, such as the Common Equity Tier 1 (CET1) ratio, are critical. As of Q1 2024, the average CET1 ratio for large banks was around 13.5%, a benchmark Citizens must meet to ensure financial stability and avoid sanctions.

Compliance with these stringent rules, covering areas from anti-money laundering (AML) to consumer protection and lending practices, is non-negotiable. Failure to comply can result in significant fines; for example, Wells Fargo faced billions in penalties in recent years for various compliance failures. Maintaining robust compliance programs is therefore essential for Citizens to protect its reputation and operational license.

Consumer protection laws, like the Truth in Lending Act and the Fair Credit Reporting Act, significantly shape how Citizens Business Bank handles loans and customer interactions. These regulations mandate transparency in lending and fair credit reporting, directly influencing the bank's marketing and servicing procedures.

Adherence to these consumer protection statutes is crucial for maintaining customer trust and avoiding costly legal disputes. For instance, the Consumer Financial Protection Bureau (CFPB) reported in 2023 that it handled over 1.3 million consumer complaints, highlighting the importance of robust compliance frameworks for financial institutions.

Citizens Business Bank must navigate a complex landscape of data privacy regulations, such as the California Consumer Privacy Act (CCPA) and forthcoming federal privacy frameworks. These laws dictate how customer personal and financial data can be collected, stored, and utilized, making compliance a critical operational imperative. Failure to adhere can result in substantial penalties; for instance, CCPA violations can incur fines up to $7,500 per intentional violation, impacting profitability and reputation.

Anti-Money Laundering (AML) and Know Your Customer (KYC)

Citizens Business Bank, like all financial institutions, faces stringent legal mandates regarding Anti-Money Laundering (AML) and Know Your Customer (KYC) protocols. These regulations are designed to thwart financial crimes, including money laundering and terrorist financing. The Financial Crimes Enforcement Network (FinCEN) in the US, for example, continues to emphasize robust AML programs.

Adherence to these laws necessitates meticulous customer due diligence, ongoing transaction monitoring, and prompt reporting of any suspicious activities. This translates into substantial compliance costs and operational complexities for the bank. For instance, in 2023, global AML compliance spending by financial institutions was estimated to be in the tens of billions of dollars, reflecting the significant resources dedicated to these efforts.

- Customer Identification: Banks must verify the identity of all customers, often requiring multiple forms of identification.

- Transaction Monitoring: Systems are in place to flag unusual or potentially illicit transaction patterns.

- Suspicious Activity Reporting (SAR): Banks are legally obligated to file SARs with regulatory bodies for transactions exceeding certain thresholds or exhibiting suspicious characteristics.

- Regulatory Scrutiny: Non-compliance can result in severe penalties, including hefty fines and reputational damage.

Lending Laws and Fair Lending Practices

Citizens Business Bank operates within a complex web of lending laws designed to ensure equitable access to credit. These regulations, covering everything from mortgages to business loans, prohibit discrimination based on factors like race, religion, or age. For instance, the Equal Credit Opportunity Act (ECOA) is a cornerstone of fair lending, and in 2024, regulatory bodies continued to emphasize compliance, with the Consumer Financial Protection Bureau (CFPB) actively monitoring for potential violations.

Adherence to fair lending practices is critical for maintaining Citizens Business Bank's reputation and avoiding costly legal battles and regulatory penalties. The bank must implement robust internal controls and training programs to prevent any form of bias in its lending decisions. Failure to do so could result in significant fines and damage to public trust. For example, in 2023, several financial institutions faced substantial penalties for fair lending violations, underscoring the importance of proactive compliance.

- Equal Credit Opportunity Act (ECOA): Prohibits discrimination in credit transactions.

- Fair Housing Act: Ensures non-discrimination in real estate lending.

- Community Reinvestment Act (CRA): Encourages banks to meet the credit needs of their entire communities, including low- and moderate-income neighborhoods.

- CFPB Enforcement: The Consumer Financial Protection Bureau continues to scrutinize lending practices for fairness and compliance.

Citizens Business Bank operates under a strict legal framework, including regulations on capital adequacy, like the CET1 ratio, which averaged around 13.5% for large banks in Q1 2024, ensuring financial stability. Compliance with anti-money laundering (AML) and Know Your Customer (KYC) rules, overseen by bodies like FinCEN, demands significant resources, with global AML spending in the tens of billions in 2023.

Consumer protection laws, such as the Truth in Lending Act and the Fair Credit Reporting Act, mandate transparency in lending and fair credit reporting, crucial for maintaining customer trust, as evidenced by the CFPB handling over 1.3 million consumer complaints in 2023.

Fair lending laws, like the ECOA and CRA, prohibit discrimination in credit, with the CFPB actively monitoring compliance in 2024, as demonstrated by significant penalties faced by institutions for violations in 2023.

| Regulation Area | Key Laws/Bodies | Impact/Requirement | Example Data/Enforcement |

|---|---|---|---|

| Capital Adequacy | Federal Reserve, FDIC, CET1 Ratio | Ensures financial stability, avoids sanctions | Q1 2024 average CET1 for large banks: ~13.5% |

| Financial Crime Prevention | FinCEN, AML, KYC | Customer due diligence, transaction monitoring, SARs | Global AML spending: Billions (2023) |

| Consumer Protection | CFPB, Truth in Lending Act, FCRA | Transparency in lending, fair credit reporting | CFPB complaints: 1.3M+ (2023) |

| Fair Lending | CFPB, ECOA, CRA | Prohibits discrimination, encourages community lending | Penalties for violations (2023) |

Environmental factors

Citizens Business Bank, like many financial institutions, is experiencing significant pressure from investors and stakeholders to integrate Environmental, Social, and Governance (ESG) factors into its operations and investment strategies. This trend is accelerating, with a growing demand for transparency and demonstrable commitment to sustainability and ethical practices. For instance, in 2024, global sustainable investment assets reached an estimated $37.5 trillion, a substantial increase that underscores the market's shift towards ESG-conscious capital allocation.

This ESG pressure directly influences the bank's decision-making, pushing it to adopt more sustainable lending policies and to divest from industries with high environmental impacts. Stakeholders expect Citizens Business Bank to not only comply with regulations but to proactively demonstrate its commitment to social responsibility and good governance to attract and retain capital. Failing to meet these evolving expectations could impact the bank's ability to secure funding and maintain its competitive edge in a market increasingly prioritizing purpose-driven finance.

Climate change presents both physical and transitional risks that can significantly affect Citizens Business Bank's loan portfolio. Physical risks, such as increased frequency of extreme weather events in Southern California, could devalue real estate collateral, a common asset for many loans. For instance, a severe drought or increased wildfire risk could impact property values in key lending regions.

Transitional risks arise from the shift to a lower-carbon economy. Businesses in sectors heavily reliant on fossil fuels or those with significant carbon footprints may face regulatory changes, evolving consumer preferences, and technological disruptions. This can impair their ability to repay loans, affecting the creditworthiness of borrowers in vulnerable industries like agriculture or certain manufacturing sectors.

To mitigate these impacts, Citizens Business Bank must integrate climate risk assessments into its underwriting and ongoing portfolio management. This includes evaluating how climate-related factors might influence collateral values and borrower repayment capacity. For example, understanding a commercial property's vulnerability to sea-level rise or a business's carbon intensity is crucial for accurate risk pricing and capital allocation.

Growing global awareness of climate change is significantly boosting demand for sustainable banking. This trend is particularly evident in the increasing interest in green finance products, such as loans specifically designed for energy-efficient upgrades or renewable energy installations. For instance, the global green bond market reached an estimated $1 trillion in 2024, a substantial increase from previous years, signaling strong investor appetite.

Citizens Business Bank can capitalize on this shift by expanding its offerings in green finance. Developing and promoting products like low-interest loans for businesses investing in solar power or energy-efficient retrofits can attract a growing segment of environmentally conscious clients. This strategic move not only aligns with corporate social responsibility but also taps into a lucrative and expanding market segment.

Resource Scarcity and Operational Costs

Resource scarcity, such as water shortages or escalating energy prices in regions like Southern California, directly affects Citizens Business Bank's operational expenditures. These factors also influence the financial health and sustainability of the bank's business clientele, potentially impacting loan portfolios.

To counter these challenges, the bank is likely to investigate and implement energy-efficient practices within its own facilities. Furthermore, encouraging and supporting clients in adopting sustainable operational methods can serve as a proactive strategy to mitigate rising costs and build resilience.

- Rising Energy Costs: California's electricity prices have historically been higher than the national average, with fluctuations expected due to grid demands and renewable energy integration. For instance, average commercial electricity rates in California were around $0.16 per kWh in early 2024, compared to the national average of approximately $0.12 per kWh.

- Water Scarcity Impact: Persistent drought conditions in California can increase water costs for businesses, particularly those in agriculture or water-intensive industries, affecting their profitability and ability to service debt.

- Operational Efficiency Initiatives: Banks like Citizens Business Bank might invest in LEED-certified buildings or smart energy management systems to reduce utility bills, aiming for savings that could exceed 15-20% on energy consumption in optimized facilities.

- Client Sustainability Support: Offering advisory services or preferential loan terms for businesses investing in water conservation technology or renewable energy sources can foster a more stable and environmentally conscious client base.

Environmental Regulations and Reporting

Environmental regulations are becoming more stringent, impacting the broader economy and, consequently, the loan portfolios of financial institutions like Citizens Business Bank. For instance, new emissions standards or waste disposal rules could affect manufacturing or agricultural clients, potentially increasing their operational costs and affecting their ability to repay loans.

Citizens Business Bank itself may face enhanced requirements for disclosing its environmental footprint. As of early 2025, there's a growing trend towards mandatory climate-related financial disclosures, similar to the Task Force on Climate-related Financial Disclosures (TCFD) framework, which could necessitate detailed reporting on Scope 1, 2, and 3 emissions, and potentially influence investment strategies and operational decisions to align with sustainability goals.

- Increased regulatory scrutiny on carbon emissions impacting clients in energy-intensive sectors.

- Growing demand for green financing and sustainable investment products, requiring banks to adapt their offerings.

- Potential for higher compliance costs associated with new environmental reporting mandates for financial institutions.

- Shifting investor sentiment favoring companies with strong environmental, social, and governance (ESG) performance.

Environmental factors significantly shape Citizens Business Bank's operational landscape and strategic direction, driven by increasing global awareness of climate change and resource management. The bank must navigate evolving regulations and capitalize on the growing demand for sustainable financial products.

Climate change presents both physical risks, like extreme weather impacting collateral, and transitional risks, as industries adapt to a lower-carbon economy, potentially affecting loan portfolios. Resource scarcity, such as water shortages and rising energy costs in regions like Southern California, directly impacts both the bank's operating expenses and the financial health of its clients.

The bank is responding by integrating climate risk assessments into its lending practices and expanding green finance offerings, such as loans for renewable energy projects. This proactive approach aligns with stakeholder expectations and taps into a burgeoning market for environmentally conscious financial solutions.

| Environmental Factor | Impact on Citizens Business Bank | Example Data (2024/2025 Estimates) |

|---|---|---|

| Climate Change Risks | Physical risks (e.g., property devaluation due to extreme weather) and transitional risks (e.g., impact on carbon-intensive industries). | Global sustainable investment assets estimated at $37.5 trillion in 2024. Global green bond market reached $1 trillion in 2024. |

| Resource Scarcity | Increased operational costs (e.g., energy, water) and potential impact on client loan repayment capacity. | California commercial electricity rates around $0.16/kWh (early 2024), higher than the national average of ~$0.12/kWh. |

| Environmental Regulations | Potential for increased compliance costs and mandatory disclosures, influencing investment and operational strategies. | Growing trend towards mandatory climate-related financial disclosures (e.g., TCFD framework) as of early 2025. |

PESTLE Analysis Data Sources

Our Citizens Business Bank PESTLE Analysis is built on a robust foundation of data from official government publications, leading financial institutions, and reputable market research firms. We integrate economic indicators, regulatory updates, technological advancements, and social trend reports to provide a comprehensive view.