Citizens Business Bank Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Citizens Business Bank Bundle

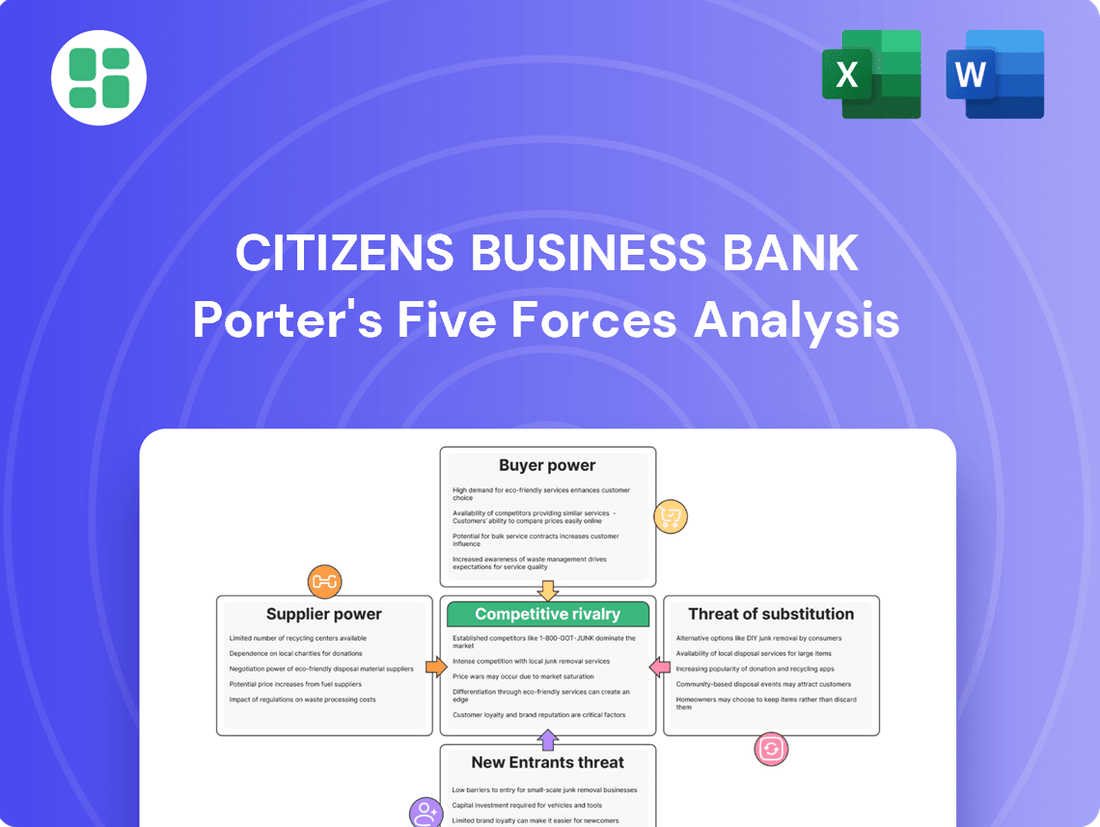

Citizens Business Bank operates within a dynamic financial landscape, where understanding the competitive forces at play is paramount. Our analysis delves into the intensity of rivalry, the bargaining power of customers and suppliers, and the ever-present threat of new entrants and substitutes. This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Citizens Business Bank’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Technology providers, especially those offering core banking systems, cybersecurity, and digital platforms, wield considerable influence. Their leverage stems from proprietary solutions and the significant integration costs involved, making it difficult for banks like Citizens Business Bank to switch vendors. This dependence on critical technology for daily operations and customer engagement amplifies supplier power.

The bargaining power of capital markets and depositors is a critical factor for Citizens Business Bank, akin to suppliers in other industries. The cost and availability of funds from wholesale markets, along with the terms offered to attract significant depositors, directly influence the bank's operational expenses and net interest margin. In 2024, deposit costs have been a key focus, with many banks experiencing upward pressure on rates to retain and attract balances, a trend anticipated to continue into 2025.

The market for highly skilled financial professionals, IT specialists, and wealth management experts can significantly influence supplier power. A scarcity of qualified talent, especially in specialized fields like cybersecurity or intricate lending practices, can escalate compensation expenses and hinder a bank's ability to recruit and retain crucial personnel. This talent crunch is projected to persist into 2025, particularly impacting private banks and wealth management firms.

Regulatory Compliance Services

Citizens Business Bank faces significant bargaining power from providers of specialized regulatory compliance services. These firms, offering crucial legal, auditing, and consulting expertise, are indispensable for navigating the intricate banking regulatory environment. The highly specialized nature of their work and the critical need for banks to adhere to regulations grant them considerable leverage.

The increasing complexity and constant evolution of banking regulations, particularly evident with new directives in 2024 concerning data privacy and cybersecurity, amplify the dependence of financial institutions like Citizens Business Bank on these specialized service providers. For instance, the cost of compliance consulting services for financial institutions can represent a substantial portion of operational budgets, with some estimates suggesting it could range from 5% to 15% of IT spending for compliance-related activities.

- High Specialization: Expertise in banking law and compliance is not easily replicated, limiting the pool of qualified providers.

- Critical Need for Compliance: Failure to comply can result in severe penalties, making these services non-negotiable for banks.

- Intensifying Regulatory Scrutiny: Increased oversight from bodies like the OCC and Federal Reserve in 2024 necessitates ongoing, expert guidance.

- Dynamic Regulatory Landscape: Frequent updates to policies require continuous adaptation, reinforcing the value of specialized knowledge.

Real Estate and Infrastructure

Suppliers of physical branch locations, office spaces, and critical infrastructure like data centers hold significant bargaining power, particularly in desirable Southern California markets where real estate expenses are substantial. For instance, in 2024, commercial real estate prices in areas like Los Angeles and Orange County continued to reflect high demand, potentially increasing lease costs for financial institutions.

The inherent inflexibility and long-term commitments associated with these fixed assets, such as multi-year leases for prime office spaces, can constrain a bank's ability to adapt quickly to market shifts or optimize its cost structure. This reliance on physical locations and infrastructure means suppliers can influence operational efficiency and overall profitability.

- High Real Estate Costs: Southern California commercial property values remain elevated, impacting lease negotiations for banks.

- Limited Flexibility: Long-term leases for branches and data centers reduce a bank's agility in responding to changing business needs.

- Infrastructure Dependency: Critical operational infrastructure, like data centers, represents a concentrated supplier base with considerable leverage.

- Operational Efficiency Impact: Supplier terms directly affect a bank's overhead and its capacity for cost control.

The bargaining power of suppliers for Citizens Business Bank is substantial, particularly concerning technology providers and capital sources. High integration costs for core banking systems and the essential nature of digital platforms grant significant leverage to these tech vendors. Similarly, the ability of depositors and capital markets to dictate terms directly impacts the bank's profitability, with deposit costs seeing upward pressure in 2024.

The market for specialized talent, especially in cybersecurity and compliance, also presents a considerable supplier challenge. A shortage of these skilled professionals drives up compensation, impacting operational costs. Furthermore, regulatory compliance service providers wield considerable power due to the critical need for adherence to complex banking laws, with compliance consulting costs potentially reaching 5-15% of IT spending in 2024.

Physical infrastructure suppliers, particularly in high-cost real estate markets like Southern California, also exert strong influence. Long-term leases for branches and data centers limit flexibility, and elevated commercial property values in areas like Los Angeles continued to pressure lease negotiations in 2024.

| Supplier Category | Key Factors Influencing Power | Impact on Citizens Business Bank | 2024 Data/Trend |

|---|---|---|---|

| Technology Providers | Proprietary solutions, high integration costs | Difficulty in switching vendors, dependence on critical systems | Continued investment in digital transformation increases reliance. |

| Capital Markets & Depositors | Cost and availability of funds, deposit rates | Direct impact on net interest margin and operational expenses | Upward pressure on deposit rates to retain and attract balances. |

| Specialized Talent Providers | Scarcity of skilled professionals (e.g., cybersecurity, compliance) | Increased compensation expenses, recruitment challenges | Talent crunch persists, particularly in niche financial services roles. |

| Regulatory Compliance Services | High specialization, critical need for adherence | Significant operational budgets allocated to compliance consulting | Compliance costs can range from 5% to 15% of IT spending for compliance activities. |

| Physical Infrastructure (Real Estate) | High real estate costs, limited flexibility of long-term leases | Elevated overhead costs, constrained ability to adapt to market shifts | Commercial real estate prices in Southern California remain elevated. |

What is included in the product

This analysis of Citizens Business Bank dissects the intensity of rivalry, the power of buyers and suppliers, the threat of new entrants and substitutes, to understand its competitive environment.

Understand competitive intensity with a dynamic threat assessment that highlights key pressures on Citizens Business Bank.

Customers Bargaining Power

Citizens Business Bank's customers, whether small businesses or individuals, face a landscape brimming with banking alternatives. This includes not only major national financial institutions but also a robust network of regional banks, member-owned credit unions, and increasingly popular online-only banks.

The sheer volume of these choices directly amplifies customer bargaining power. For instance, in 2024, the U.S. banking industry continued to see strong competition, with many institutions actively vying for market share by offering competitive interest rates on deposits and loans, as well as enhanced digital services.

This ease of switching means customers can readily move their accounts if they discover more favorable terms, superior customer service, or more convenient digital tools from a competitor. This competitive pressure compels banks like Citizens Business Bank to continuously innovate and offer compelling value propositions to retain their client base.

Customers face minimal financial hurdles when switching banks, even with the minor administrative tasks involved in moving accounts and direct deposits. This low barrier to entry means consumers can readily explore other financial institutions, putting pressure on banks like Citizens Business Bank to offer attractive rates and superior service to retain their business.

The size and importance of Citizens Business Bank's key clients significantly influence customer bargaining power. Large commercial clients, major real estate developers, and high-net-worth individuals who contribute substantial deposits or require significant loan facilities wield considerable leverage. Losing even a few of these major clients could noticeably affect the bank's revenue streams and overall deposit base, prompting Citizens Business Bank to offer more favorable terms to retain them.

Access to Information and Transparency

Customers today possess unprecedented access to information regarding interest rates, fees, and service offerings from numerous financial institutions. Online comparison tools and financial aggregators empower them to easily evaluate options, significantly enhancing their ability to negotiate better terms. This transparency directly translates to increased bargaining power, particularly as new California legislation aimed at regulating bank fees is set to take effect in 2025, further leveling the playing field.

- Informed Decision-Making: Consumers can now compare granular details of financial products, from mortgage rates to account fees, across dozens of banks in seconds.

- Leveraging Competition: Armed with this data, customers can actively solicit and leverage competitive offers from different banks, driving down costs.

- Regulatory Impact: Upcoming 2025 California laws targeting bank fees are expected to further reduce information asymmetry and bolster customer leverage.

- Shifting Power Dynamics: The ease of information access fundamentally shifts bargaining power towards the customer in the banking sector.

Loan Demand and Creditworthiness

In a competitive lending environment, businesses with strong creditworthiness, especially those requiring substantial commercial or real estate financing, wield considerable bargaining power. Banks eager to establish profitable lending relationships may extend more attractive terms to secure and retain these high-quality clients.

This dynamic is particularly relevant as loan demand is anticipated to strengthen in 2025, especially within the mortgage sector, further empowering creditworthy borrowers.

- High Creditworthiness: Businesses with excellent credit scores and stable financial histories can negotiate better interest rates and loan covenants.

- Large Loan Volumes: Borrowers seeking significant amounts, such as for major commercial projects or real estate acquisitions, have more leverage.

- Competitive Market: The presence of multiple lenders willing to offer financing intensifies competition, giving borrowers more options and thus more power.

- Anticipated 2025 Demand: Projections for increased mortgage demand in 2025 suggest a more borrower-friendly market, enhancing customer bargaining power in that segment.

Citizens Business Bank's customers, from individuals to businesses, benefit from a wide array of banking choices, including national banks, regional institutions, credit unions, and online-only options. This abundance of alternatives, coupled with minimal switching costs, grants customers significant leverage. The ease with which customers can move their funds and banking relationships means banks must consistently offer competitive rates and superior service to retain them, a dynamic amplified by increasing transparency in financial product offerings.

Large commercial clients and high-net-worth individuals represent a crucial segment where customer bargaining power is particularly pronounced. These clients, by virtue of their substantial deposit balances or significant borrowing needs, can command more favorable terms. Losing even a few of these key accounts can impact Citizens Business Bank's revenue and deposit base, incentivizing the bank to cater to their demands.

The increasing accessibility of information empowers customers to compare financial products across institutions, driving down costs and enhancing their negotiation capabilities. For instance, in 2024, many banks actively competed on interest rates and digital services, directly reflecting this customer empowerment. Upcoming legislation in California, slated for 2025, further aims to reduce information asymmetry, bolstering customer leverage.

| Factor | Impact on Customer Bargaining Power | Supporting Data/Trend (as of 2024/2025 projections) |

|---|---|---|

| Availability of Alternatives | High | Continued growth of online-only banks and fintech solutions offering specialized services. |

| Switching Costs | Low | Minimal financial penalties and streamlined digital account opening processes reduce barriers. |

| Information Transparency | High | Widespread use of comparison websites and financial aggregators; 2025 California fee regulations. |

| Customer Concentration (Key Clients) | High | Large commercial clients and HNWIs can negotiate based on substantial deposit or loan volumes. |

Full Version Awaits

Citizens Business Bank Porter's Five Forces Analysis

This preview showcases the complete Citizens Business Bank Porter's Five Forces Analysis, offering a detailed examination of competitive forces within its industry. The document you see here is precisely the same professionally written and formatted analysis you will receive immediately after purchase, ensuring no surprises or missing information.

Rivalry Among Competitors

Citizens Business Bank faces intense rivalry from large national banks such as Bank of America, Wells Fargo, and Chase. These giants possess significant financial muscle, expansive branch footprints across Southern California, and a broad spectrum of financial products. For instance, as of Q1 2024, Bank of America reported total assets of $3.2 trillion, dwarfing smaller regional players.

The sheer scale of these national institutions allows them to benefit from economies of scale, making it harder for Citizens Business Bank to compete on price for certain services. Their ability to cross-subsidize offerings means they can absorb lower margins on some products to gain market share, putting pressure on Citizens Business Bank’s profitability.

Citizens Business Bank faces intense competition in Southern California from a dense network of regional and community banks. This fragmented market means many players are actively seeking the same local businesses and individual customers. For instance, in 2024, the Southern California banking sector saw a continued presence of over 100 community banks, many of which are agile and deeply embedded in their local economies.

This intense rivalry often centers on personalized service, deep understanding of local market needs, and specialized offerings for specific industries or customer segments. Some regional players demonstrated notable resilience and growth throughout 2024, indicating their ability to effectively compete on these relationship-driven factors.

Fintech and digital challenger banks are significantly intensifying competitive rivalry for Citizens Business Bank. These digital-first entities, often unburdened by legacy systems, are aggressively targeting deposit gathering and specific lending segments. For instance, by mid-2024, digital banks were noted for offering highly competitive interest rates on savings accounts, attracting deposits that might otherwise flow to traditional institutions.

This surge in digital competition pressures established banks like Citizens Business Bank to innovate rapidly in areas like user experience and operational efficiency. Companies such as Chime and SoFi, prominent players in the US fintech landscape, have demonstrated the ability to attract millions of customers by focusing on seamless mobile interfaces and lower fee structures. Their success highlights a growing demand for digital-native financial services, particularly among younger, tech-savvy demographics.

While these challengers may not offer the full spectrum of services provided by a traditional bank, their impact on deposit gathering and specific product pricing is undeniable. California, a key market for many financial institutions, is a notable hub for fintech innovation, meaning Citizens Business Bank faces direct competition from these agile players within its operational footprint.

Product and Service Differentiation

Competitive rivalry in banking heavily relies on differentiating core offerings. Banks compete by offering distinct loan terms, attractive deposit rates, sophisticated cash management solutions, and tailored wealth management services. This constant pursuit of unique value propositions fuels aggressive marketing and product development.

For instance, many institutions are investing in digital platforms and personalized financial advice to stand out. By mid-2024, the banking sector continued to see a strong emphasis on digital transformation, with many banks reporting increased investment in technology to enhance customer experience and operational efficiency. This focus on innovation directly impacts how banks differentiate themselves from competitors.

- Loan Terms: Banks differentiate by offering flexible repayment schedules and competitive interest rates on various loan products.

- Deposit Rates: Offering higher Annual Percentage Yields (APYs) on savings and checking accounts is a key differentiator.

- Cash Management: Advanced tools for businesses, such as streamlined payment processing and liquidity management, are crucial.

- Wealth Management: Personalized investment strategies and advisory services attract high-net-worth individuals.

Interest Rate Environment and Economic Conditions

The prevailing interest rate environment directly shapes competitive rivalry. When interest rates are low, banks like Citizens Business Bank often see increased competition for loans, which can squeeze profit margins as lenders vie for business. For instance, in early 2024, the Federal Reserve maintained its benchmark interest rate, leading to a competitive lending landscape.

Economic conditions in Southern California play a crucial role in this rivalry. A robust real estate market and strong business growth typically translate to higher loan demand, potentially moderating the intensity of competition. Conversely, economic slowdowns can exacerbate rivalry as banks compete for a smaller pool of creditworthy borrowers. Analysts anticipate interest rates to decline significantly in 2025, which could further intensify competition for loan origination.

- Interest Rate Impact: Low interest rates in 2024 led to heightened competition for loans, pressuring bank margins.

- Economic Influence: Southern California's real estate market health and business expansion directly affect loan demand and credit quality, influencing rivalry intensity.

- Future Outlook: Expectations for a substantial drop in interest rates during 2025 suggest an even more competitive environment for lending institutions.

Citizens Business Bank faces intense competitive rivalry from national giants like Bank of America, Wells Fargo, and Chase, whose vast financial resources and extensive branch networks in Southern California provide significant advantages. Additionally, a dense landscape of agile regional and community banks, over 100 operating in the region in 2024, compete fiercely on personalized service and local market expertise. The rise of fintech challengers, offering competitive rates and digital-first experiences, further intensifies this pressure, forcing traditional banks to innovate rapidly.

| Competitor Type | Key Differentiators | 2024 Market Impact |

|---|---|---|

| National Banks | Scale, broad product offerings, economies of scale | Dominate market share, pressure on pricing |

| Regional/Community Banks | Personalized service, local market knowledge | Agile, strong customer relationships, resilient growth |

| Fintech/Digital Banks | Digital experience, competitive rates, lower fees | Attracting deposits, targeting specific lending segments |

SSubstitutes Threaten

Fintech lending platforms, including peer-to-peer and crowdfunding sites, present a significant threat of substitutes to traditional bank lending. These platforms often offer faster approval processes and more adaptable terms, attracting businesses and individuals who may find traditional banking too slow or rigid. For instance, in 2023, the global fintech lending market was valued at approximately $14.6 billion and is projected to grow substantially, indicating a strong shift towards these alternative financing channels.

Digital payment solutions from non-bank providers like PayPal, Square, and Apple Pay present a significant threat of substitution for traditional banking services. These platforms offer convenient alternatives for everyday transactions, directly competing with bank-offered payment processing and checking accounts.

The widespread adoption of these digital wallets reduces customer reliance on banks for routine financial activities. For instance, as of early 2024, mobile payment transaction volume globally was projected to exceed $14 trillion, underscoring the substantial shift towards these alternative payment methods.

Clients increasingly have a wide array of choices beyond traditional banks for managing their wealth. Independent financial advisors, for instance, provide personalized service, while robo-advisors offer cost-effective, automated investment solutions. Direct investment platforms, such as brokerage firms and mutual fund companies, also allow individuals to manage their portfolios directly, bypassing bank-led wealth management services.

The Independent Asset Management (IAM) sector is experiencing notable growth, indicating a strong trend towards alternative wealth management solutions. In 2023, the global IAM market was valued at over $5.4 trillion, with projections suggesting continued expansion as clients seek specialized advice and greater control over their investments, posing a significant competitive threat to bank-based wealth management divisions.

Direct Corporate Finance and Equity Markets

Large corporations often bypass traditional bank loans by directly accessing capital markets. In 2024, the U.S. corporate bond market saw significant activity, with investment-grade issuance alone reaching hundreds of billions of dollars, demonstrating a strong alternative to bank financing. Companies with strong credit ratings can issue commercial paper for short-term needs, offering a flexible and often cheaper funding source than bank credit lines.

Equity markets provide another potent substitute, allowing businesses to raise capital by selling shares. For instance, U.S. equity markets facilitated numerous initial public offerings (IPOs) and secondary offerings in 2024, providing substantial funding for growth and operations. This direct access to investors, particularly for well-established firms, reduces reliance on corporate finance departments within banks.

- Corporate Bonds: A primary substitute for bank loans, offering large corporations direct access to debt financing from investors.

- Commercial Paper: Provides short-term funding alternatives, often more cost-effective than revolving credit facilities from banks.

- Equity Issuance: Public and private equity markets allow companies to raise capital by selling ownership stakes, a direct alternative to debt financing.

- Market Access: Well-capitalized and reputable companies can leverage these capital markets, diminishing their dependence on traditional corporate finance services offered by banks.

Credit Unions and Non-Bank Financial Institutions

Credit unions present a significant threat by offering a comparable suite of services to traditional commercial banks, often with a community-centric approach and potentially more favorable fee structures for their members. As of the first quarter of 2024, credit unions held approximately $2.3 trillion in assets, demonstrating their substantial market presence and ability to compete for customer deposits and loans.

Furthermore, a diverse array of non-bank financial institutions act as potent substitutes for specific banking products. These entities, such as specialized lenders in equipment leasing or factoring, cater to niche market needs, directly challenging banks’ traditional revenue streams in these areas. For example, the U.S. equipment leasing market was valued at over $200 billion in 2023, highlighting the scale of these alternative financing options.

- Credit unions offer similar services to commercial banks, often with lower fees.

- Non-bank financial institutions specialize in specific lending areas, acting as substitutes for particular bank products.

- In Q1 2024, credit unions held around $2.3 trillion in assets.

- The U.S. equipment leasing market exceeded $200 billion in 2023.

The threat of substitutes for Citizens Business Bank is multifaceted, encompassing alternative financing, payment solutions, and wealth management avenues. Fintech platforms, credit unions, and specialized lenders offer competitive alternatives to traditional banking services.

Digital payment solutions and direct investment platforms are increasingly drawing customers away from conventional bank offerings. The growth in these sectors highlights a clear shift in consumer and corporate behavior, reducing reliance on traditional banking relationships.

Companies can bypass bank loans by directly accessing capital markets through corporate bonds, commercial paper, and equity issuance, especially those with strong credit profiles.

| Substitute Type | Example | 2023/2024 Data Point |

|---|---|---|

| Fintech Lending | Peer-to-peer lending platforms | Global fintech lending market valued at ~$14.6 billion in 2023 |

| Digital Payments | Mobile payment solutions | Global mobile payment transaction volume projected to exceed $14 trillion in early 2024 |

| Wealth Management | Independent financial advisors, robo-advisors | Global Independent Asset Management market valued at over $5.4 trillion in 2023 |

| Corporate Finance | Corporate bonds, equity markets | Significant U.S. corporate bond issuance in 2024; numerous IPOs in 2024 |

| Banking Services | Credit Unions | Credit unions held ~$2.3 trillion in assets in Q1 2024 |

Entrants Threaten

The banking sector is notoriously difficult for newcomers to enter due to extensive regulations. Significant capital requirements, stringent licensing procedures, and the need to comply with intricate laws like Dodd-Frank and Basel III create substantial hurdles. These regulatory demands make the process of establishing a new bank both time-consuming and expensive, effectively deterring many potential entrants.

Establishing a new bank, particularly one aiming to compete in a dynamic market like Southern California, necessitates a considerable initial capital injection. This capital is crucial for building essential infrastructure, implementing advanced technology systems, and meeting stringent regulatory reserve requirements. For instance, in 2023, the Federal Deposit Insurance Corporation (FDIC) reported that the average capital requirement for new banks can range from millions to tens of millions of dollars, depending on the projected asset size and business model.

This significant capital barrier naturally discourages many potential new entrants from even attempting to enter the banking sector. However, despite these high entry costs, the California banking landscape has seen new charters approved. In 2024, data from the California Department of Financial Protection and Innovation (DFPI) indicates that several new state-chartered banks have received approval, demonstrating that while challenging, entry is not impossible for well-capitalized and strategically positioned new players.

Brand trust and deep customer relationships represent a significant barrier to new entrants in the banking sector. Citizens Business Bank, for instance, has cultivated loyalty over many years, making it difficult for newcomers to attract customers without a compelling reason to switch. In 2024, Citizens Business Bank marked its 50th anniversary, underscoring its long-standing commitment to relationship banking, a cornerstone of its competitive advantage.

Economies of Scale and Scope

Established banks leverage significant economies of scale, enabling them to spread vast operational, technological, and marketing costs across a large customer base. This efficiency translates into more competitive pricing and a wider array of services, creating a substantial barrier for newcomers. For instance, in 2024, major banks continue to invest billions in digital transformation and cybersecurity, a cost that new entrants find difficult to match from the outset.

New entrants often face a steep uphill battle to achieve comparable cost efficiencies. They must invest heavily to build infrastructure, acquire technology, and establish brand recognition, all while operating at a smaller scale. This initial cost disadvantage means they are less likely to compete on price or offer the same breadth of services as incumbents.

- Economies of Scale: Established banks benefit from lower per-unit costs due to high-volume operations in technology, marketing, and administration.

- Cost Disadvantage: New entrants must incur higher initial costs to build comparable infrastructure and achieve market penetration.

- Service Breadth: Incumbents can offer a wider range of products and services, often bundled for customer convenience, which is hard for new players to replicate quickly.

- Brand Loyalty: Years of operation foster customer trust and loyalty, making it challenging for new entrants to attract customers away from established institutions.

Technological Infrastructure and Cybersecurity Costs

The significant cost of building and maintaining advanced technological infrastructure, including sophisticated digital banking platforms and robust cybersecurity systems, presents a substantial barrier for new entrants. These investments are not only substantial upfront but also require continuous expenditure to keep pace with evolving threats and customer expectations.

For instance, in 2024, the global banking sector continued to see increased spending on cybersecurity, with estimates suggesting financial institutions would invest billions to protect against sophisticated cyberattacks. This high cost of entry means that only well-capitalized new players can realistically challenge incumbents.

- High Upfront Investment: New banks must invest heavily in core banking software, digital channels, and data analytics capabilities.

- Ongoing Cybersecurity Costs: Protecting customer data and financial assets requires continuous investment in threat detection, prevention, and incident response.

- Regulatory Compliance: Meeting stringent financial regulations often necessitates expensive technology upgrades and security protocols.

The threat of new entrants in the banking sector, particularly for institutions like Citizens Business Bank, remains relatively low due to substantial barriers. These include high capital requirements, stringent regulatory oversight, and the need for significant technological investment. New players must also overcome established brand loyalty and economies of scale enjoyed by incumbents.

In 2024, the cost of establishing a new bank continues to be a major deterrent. For example, obtaining the necessary charters and licenses, coupled with the capital reserves mandated by bodies like the FDIC, can easily run into tens of millions of dollars. This financial hurdle alone prevents many aspiring banks from entering the market.

Furthermore, the ongoing investment in digital transformation and cybersecurity, estimated to be in the billions for major financial institutions in 2024, creates a significant cost disadvantage for new entrants. They struggle to match the technological sophistication and security infrastructure of established banks without substantial, often prohibitive, upfront capital.

| Barrier | Description | 2024 Relevance |

| Capital Requirements | Significant initial funds needed for licensing, reserves, and operations. | Millions to tens of millions of dollars, as per FDIC guidelines. |

| Regulatory Hurdles | Compliance with complex laws like Dodd-Frank and Basel III. | Time-consuming and costly, requiring specialized expertise. |

| Economies of Scale | Established banks spread costs over larger customer bases. | Allows for more competitive pricing and service offerings. |

| Brand Loyalty & Trust | Long-standing customer relationships are hard to break. | Citizens Business Bank's 50th anniversary in 2024 highlights this enduring advantage. |

| Technology Investment | High costs for digital platforms and cybersecurity. | Billions invested globally in 2024, a difficult cost for newcomers to match. |

Porter's Five Forces Analysis Data Sources

Our Citizens Business Bank Porter's Five Forces analysis is built on comprehensive data from official company filings, including annual reports and SEC disclosures, alongside industry-specific market research reports and economic databases.