CBAK Energy Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CBAK Energy Bundle

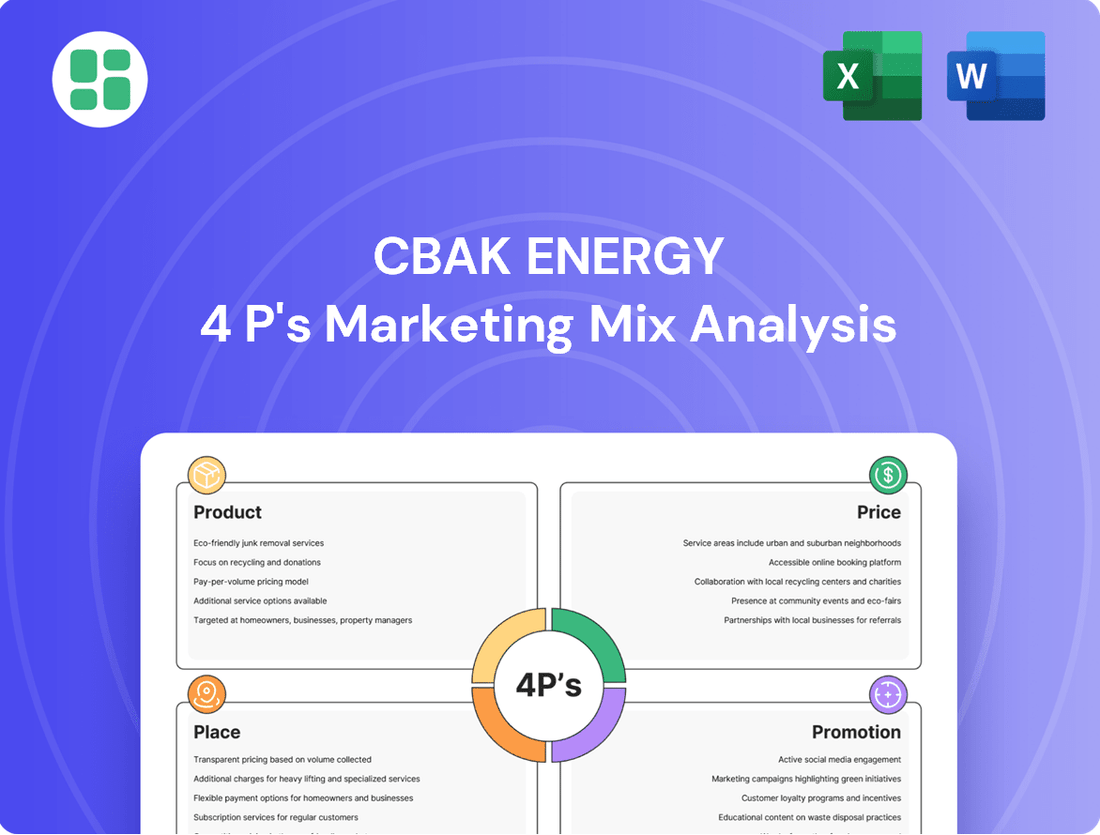

Unlock the secrets behind CBAK Energy's market dominance with our comprehensive 4Ps Marketing Mix Analysis. Discover how their product innovation, strategic pricing, efficient distribution, and impactful promotions create a winning formula.

Ready to elevate your own marketing strategy? This in-depth analysis provides actionable insights and real-world examples, perfect for professionals and students seeking a competitive edge.

Don't settle for a surface-level understanding. Invest in the full, editable report to gain a complete picture of CBAK Energy's marketing prowess and apply its success to your own business endeavors.

Product

CBAK Energy's diversified battery portfolio is a cornerstone of its market strategy, featuring a broad spectrum of lithium-ion rechargeable batteries. This includes cylindrical, pouch, and prismatic formats, designed to meet the demands of various applications across the new energy sector. For instance, in 2024, the company continued to see strong demand for its lithium-ion products in electric vehicles and energy storage solutions.

Further strengthening its product offering, CBAK Energy is actively developing and manufacturing sodium-ion batteries. This expansion into emerging battery chemistries, like sodium-ion, positions the company to capitalize on future market trends and provides customers with alternative, potentially more cost-effective, energy storage solutions. The company's investment in this area reflects a forward-looking approach to battery technology development.

CBAK Energy's battery solutions are strategically positioned within high-growth verticals crucial to the global energy transition. Their primary applications are in electric vehicles (EVs), light electric vehicles (LEVs), and energy storage solutions (ESS). This focus directly addresses the increasing demand for sustainable transportation and reliable power infrastructure.

The company's LFP cylindrical battery models, specifically the 32140 and 40135, are engineered for significant impact in portable power supply and home energy storage systems. These batteries are designed to meet the growing consumer and commercial need for efficient and long-lasting energy storage, supporting the shift towards cleaner energy consumption.

CBAK Energy is keenly focused on producing high-performance battery cells, specifically targeting high-power and high-energy-density applications. This strategic emphasis is evident in their flagship Model 32140 and the more recent Model 40135, both large cylindrical batteries engineered for exceptional performance and dependability. These advanced cells are crucial for meeting the rigorous demands of their business-to-business clientele.

The company's commitment to quality and performance has paid off, with their 32140 cylindrical cells securing a notable global market share in 2024. This achievement underscores CBAK Energy's successful positioning within the competitive battery market, driven by their dedication to technological advancement and client satisfaction.

Continuous Research and Development

CBAK Energy demonstrates a robust dedication to continuous research and development, a cornerstone of its marketing strategy. This commitment is evident in the advancement and upcoming mass production of innovative battery designs, such as the 40135 model. Furthermore, the company is actively pursuing strategic partnerships for the development of next-generation electric vehicle (EV) batteries, ensuring it stays at the forefront of technological progress.

This persistent focus on R&D is crucial for maintaining CBAK Energy's competitive edge in the rapidly evolving battery market. By consistently introducing advanced battery technologies, the company aims to meet the increasing demands of the EV sector. Their R&D and sales divisions are actively engaged in direct dialogue with leading EV manufacturers, participating in strategic discussions concerning the creation of new battery models.

The company's investment in R&D is a key driver for its product development pipeline. For instance, CBAK Energy reported a significant increase in its R&D expenditure in recent filings, reflecting its strategic prioritization of innovation. This investment is directly linked to the development of new battery chemistries and manufacturing processes designed to enhance performance and reduce costs for EV applications.

Key aspects of CBAK Energy's R&D efforts include:

- Development of new battery models: The 40135 battery is a prime example of their innovation pipeline, targeting enhanced energy density and faster charging capabilities.

- Strategic collaborations: Ongoing discussions with major EV manufacturers signal a proactive approach to aligning product development with market needs and future trends.

- Technological advancement: The company is exploring next-generation battery technologies, including solid-state batteries, to address future market demands for safety and performance.

- Market responsiveness: Direct engagement with EV makers ensures that R&D efforts are focused on creating solutions that are commercially viable and meet specific industry requirements.

Quality and Manufacturing Consistency

CBAK Energy emphasizes its superior product qualification rates and consistent output for large cylindrical batteries, a direct result of its advanced, highly automated manufacturing processes. This dedication to quality assurance is paramount for securing and retaining a global clientele in the competitive battery sector.

The company's technological advancements specifically target common production defects such as burrs, surface whitening, and powder loss. These improvements are critical for ensuring reliable and consistent battery performance across all units, a key factor for customers in demanding applications.

- Higher Qualification Rate: CBAK Energy reports a significantly higher product qualification rate for its large cylindrical batteries.

- Manufacturing Consistency: The company achieves good consistency through its exclusive, highly automated production lines.

- Addressing Defects: Technology is employed to resolve issues like burrs, whitening, and powder loss, ensuring performance reliability.

- Client Trust: This commitment to quality is vital for building and maintaining a strong global client base in the demanding battery market.

CBAK Energy's product strategy centers on a diverse range of lithium-ion batteries, including cylindrical, pouch, and prismatic formats, catering to electric vehicles and energy storage. The company is also advancing sodium-ion battery technology, anticipating future market needs. Their 32140 and 40135 cylindrical cells are specifically designed for high-power and high-energy density applications, demonstrating a commitment to performance.

The company's product innovation is driven by significant R&D investment, focusing on new battery models like the 40135 and exploring next-generation technologies such as solid-state batteries. Strategic collaborations with major EV manufacturers are key to aligning product development with industry demands, ensuring CBAK Energy remains at the forefront of battery technology. This proactive approach is crucial for meeting the evolving requirements of the electric vehicle sector.

CBAK Energy's commitment to product quality is highlighted by its high qualification rates for large cylindrical batteries, achieved through advanced, automated manufacturing processes. These processes effectively mitigate common production defects, ensuring consistent performance and reliability. This focus on quality is essential for building trust and maintaining a strong global client base in the competitive battery market.

The company's product portfolio is strategically aligned with high-growth sectors like electric vehicles (EVs) and energy storage solutions (ESS). This focus addresses the increasing global demand for sustainable transportation and reliable power infrastructure. Their LFP cylindrical battery models, such as the 32140 and 40135, are engineered for efficient and long-lasting energy storage in portable power and home energy systems.

What is included in the product

This analysis provides a comprehensive overview of CBAK Energy's marketing mix, detailing their strategies across Product, Price, Place, and Promotion to understand their market positioning.

It's designed for professionals seeking a grounded understanding of CBAK Energy's marketing approach, offering insights into their actual practices and competitive context.

Provides a clear, actionable framework for identifying and addressing market challenges, transforming potential obstacles into strategic advantages.

Simplifies complex marketing strategies into a digestible format, alleviating the burden of extensive research and analysis for busy teams.

Place

CBAK Energy's manufacturing backbone is firmly rooted in China, with key facilities in Dalian, Nanjing, Shaoxing, and Shangqiu acting as crucial hubs for both production and innovation. These sites are instrumental in driving the company's capacity and technological advancements in battery manufacturing.

The Nanjing facility, in particular, is currently undergoing a substantial expansion aimed at boosting the output of its most in-demand battery models, signaling a strategic move to meet growing market needs. This expansion is expected to significantly enhance CBAK Energy's production capabilities.

Looking beyond China, CBAK Energy is actively broadening its international manufacturing presence. The company has established new battery cell manufacturing facilities in Malaysia and has plans for similar ventures in the United States, leveraging strategic partnerships to achieve this global expansion.

CBAK Energy primarily utilizes direct sales to Original Equipment Manufacturers (OEMs) and integrators as its core distribution strategy. This business-to-business approach allows for tailored battery solutions and fosters deep, collaborative relationships with key clients in the electric vehicle and energy storage sectors. For instance, significant orders from Anker Innovations in late 2023 and early 2024 highlight this direct engagement model.

CBAK Energy strategically leverages partnerships to bolster its global presence and manufacturing capacity. A key alliance with Anker Innovations is establishing a manufacturing hub in Malaysia, aiming to tap into the Southeast Asian market. This move is crucial for localized production and distribution.

Furthermore, CBAK Energy's joint venture with Kandi Technologies Group is focused on building battery production facilities within the United States. This venture is designed to capitalize on the growing demand for electric vehicles and energy storage solutions in North America, ensuring regional supply chain resilience.

These collaborations are not just about expanding reach; they are about building robust, localized supply chains. For instance, the Malaysian facility is projected to begin production in late 2024, targeting an initial output of 50,000 battery packs annually, with plans to scale up significantly by 2026.

Targeted Market Penetration

CBAK Energy is strategically targeting markets with significant demand for its electric mobility and energy storage solutions. This focus is clearly demonstrated by substantial orders from Africa's leading electric vehicle manufacturer, indicating a strong foothold in a rapidly expanding market. The company is also actively cultivating key partnerships within India, a region experiencing exponential growth in EV adoption.

This deliberate penetration into high-demand regions ensures that CBAK Energy's products reach areas where there is immediate and escalating need for advanced battery technology. Furthermore, the company is setting its sights on the North American market, specifically aiming to serve the off-road and recreational vehicle sectors, which represent another significant growth opportunity.

- Africa's EV Market: CBAK Energy's large orders from Africa's largest EV player highlight a critical penetration strategy into a continent with burgeoning electric mobility demand.

- India's Growth: Strengthening partnerships in India underscores the company's commitment to a market projected to see substantial growth in electric vehicle sales, with India's electric two-wheeler market alone expected to reach 100 million units by 2030.

- North American Niche: Targeting North America's off-road and recreational vehicle markets signifies an expansion into specialized segments where reliable energy storage is paramount.

Supply Chain and Logistics Efficiency

CBAK Energy is actively bolstering its supply chain and logistics to meet growing market demands. With significant capacity expansions underway in Nanjing and planned facilities in Malaysia and the United States, the company is prioritizing resilience and efficiency. This strategic move ensures that its advanced battery products, particularly the popular 32140 and 40135 models, are available precisely when and where large industrial clients require them.

The company's commitment to efficient logistics is crucial for supporting its industrial clientele, who depend on reliable and timely deliveries for their own large-scale operations. CBAK Energy's proactive approach to increasing production capacity directly addresses the surging demand for its high-performance battery solutions.

- Nanjing Facility Expansion: CBAK Energy's ongoing production capacity enhancements in Nanjing are a cornerstone of its logistics strategy.

- Global Facility Plans: New facilities are planned for Malaysia and the US, aiming to create a more robust and geographically diverse supply chain.

- Product Availability: The focus on logistics efficiency ensures timely delivery of key products like the 32140 and 40135 battery models.

- Addressing Demand: Increased capacity directly responds to the significant surge in demand for CBAK Energy's battery solutions.

CBAK Energy's market presence is defined by its strategic geographic focus and direct engagement with industrial clients. The company is actively expanding its reach into high-demand regions, including Africa and India, where electric mobility adoption is rapidly accelerating. For example, substantial orders from Africa's leading electric vehicle manufacturer underscore this penetration strategy. Furthermore, CBAK Energy is cultivating key partnerships within India, a market projected for exponential growth in EV sales, with the Indian electric two-wheeler market alone anticipated to reach 100 million units by 2030.

The company is also targeting specialized segments within North America, specifically the off-road and recreational vehicle sectors. This expansion into niche markets highlights a deliberate approach to capitalize on areas where reliable energy storage is paramount. These targeted market penetrations ensure that CBAK Energy's advanced battery technology is readily available to meet escalating demand in crucial growth sectors.

| Market Focus | Key Developments | Projected Impact |

|---|---|---|

| Africa | Significant orders from leading EV manufacturer | Establishing a strong foothold in a burgeoning electric mobility market |

| India | Strengthening partnerships | Capitalizing on exponential EV adoption; Indian electric two-wheeler market to reach 100 million units by 2030 |

| North America | Targeting off-road and recreational vehicle sectors | Expanding into specialized segments with high demand for energy storage |

Preview the Actual Deliverable

CBAK Energy 4P's Marketing Mix Analysis

The preview you see here is the actual CBAK Energy 4P's Marketing Mix Analysis document you’ll receive instantly after purchase—no surprises. This comprehensive breakdown covers product, price, place, and promotion strategies for CBAK Energy, offering actionable insights for your business. You can be confident that the detailed analysis you're viewing is precisely what you'll download immediately after checkout.

Promotion

CBAK Energy actively participates in major industry trade shows and conferences, such as the Shenzhen International Battery Technology Conference & Expo (CIBF). These events are vital for displaying their cutting-edge battery technologies and solutions to a broad audience.

These platforms offer invaluable opportunities for CBAK Energy to connect directly with potential customers, forge relationships with industry leaders, and attract investors. For instance, at CIBF 2023, CBAK Energy showcased its advancements in lithium-ion battery technology, drawing significant interest from global manufacturers.

By engaging in these key industry gatherings, CBAK Energy effectively boosts its brand visibility and reinforces its position as a leader in technological innovation within the battery sector.

CBAK Energy's promotion strategy heavily emphasizes direct engagement with key clients and strategic partners. This involves both research and development and sales teams actively visiting major customers, such as the FAW Group. These direct interactions are crucial for understanding client needs and securing significant orders, thereby building enduring business relationships.

The company's direct sales approach has proven effective, as evidenced by recent successful orders from prominent companies like Anker Innovations and Livguard. Furthermore, securing business with an African EV player demonstrates the global reach and success of these targeted client engagements. These wins underscore the value of personalized outreach in a competitive market.

CBAK Energy actively engages its investor base through a robust investor relations program. This includes timely financial result reporting, strategic news releases, and investor conference calls, ensuring the financial community is well-informed about the company's performance and future plans. For example, in the first half of 2024, CBAK Energy reported a significant increase in revenue, demonstrating positive operational momentum.

This commitment to transparency is vital for attracting and retaining sophisticated investors and stakeholders. By clearly communicating its progress and strategic direction, CBAK Energy aims to build and maintain confidence in its long-term prospects. The company also utilizes share buyback programs as a mechanism to directly enhance shareholder value, reflecting a focus on capital efficiency.

Digital Presence and Corporate Website

CBAK Energy utilizes its official investor relations website as a primary channel to disseminate crucial information. This digital presence serves as a central repository for all news releases, quarterly and annual financial reports, and comprehensive corporate details, ensuring stakeholders have readily available data for their analyses.

The company's digital platform is designed to facilitate an analytical, data-driven approach by providing easy access to up-to-date financial performance metrics and corporate governance structures. For instance, as of their latest filings in early 2025, the website offers detailed breakdowns of their revenue streams and operational expenditures, crucial for valuation tools like DCF analysis.

- Investor Relations Website: Serves as the central hub for all corporate and financial disclosures.

- Data Accessibility: Ensures stakeholders can easily access financial reports and news releases for informed decision-making.

- Corporate Governance Transparency: Provides detailed information on management structure and governance policies.

- Supporting Analysis: Offers the necessary data to support analytical frameworks and investment strategies.

Public Relations and News Dissemination

CBAK Energy actively engages in public relations and news dissemination, utilizing newswire services to broadcast key business milestones. These announcements, covering new orders, strategic alliances, and capacity enhancements, are vital for shaping market perception and bolstering investor confidence.

This proactive approach ensures that positive developments reach a wide audience, reinforcing CBAK Energy's standing in the new energy industry. For instance, in early 2024, the company announced a significant new order for its lithium-ion batteries, which was widely covered by industry news outlets.

- New Order Announcements: CBAK Energy's press releases frequently detail new customer orders, providing tangible evidence of market demand and business growth.

- Strategic Partnership News: Dissemination of information regarding new partnerships helps to highlight collaborative efforts and potential market expansion opportunities.

- Capacity Expansion Updates: Publicizing increases in production capacity signals the company's commitment to meeting growing market needs and its operational scalability.

- Market Perception Management: Consistent and positive news flow through these channels is crucial for maintaining a strong and favorable public image, directly impacting investor sentiment.

CBAK Energy's promotional efforts focus on industry presence and direct client engagement. Participating in events like CIBF allows them to showcase technology and connect with stakeholders, reinforcing their innovative image. Their direct sales approach, exemplified by securing orders from Anker Innovations and Livguard, highlights the effectiveness of building personal relationships with major clients.

The company also prioritizes transparent investor relations, utilizing its website for timely financial reporting and news dissemination. This commitment to data accessibility supports analytical decision-making for investors and stakeholders. Furthermore, public relations through newswire services amplify key business milestones, like early 2024 order announcements, shaping positive market perception and investor confidence.

Price

CBAK Energy likely employs a value-based pricing strategy for its advanced lithium-ion and sodium-ion batteries, reflecting their superior performance and reliability. This strategy aligns with the B2B battery market where technical specifications and product quality command premium pricing from industrial clients.

For instance, the strong demand for their 32140 model, which has reportedly exceeded supply, underscores the market's willingness to pay for CBAK Energy's high-value offerings. This indicates that pricing is directly tied to the perceived benefits and operational advantages delivered to customers.

CBAK Energy is poised to implement volume-based pricing and long-term contracts, particularly for substantial orders from Original Equipment Manufacturers (OEMs) and energy solution providers. This approach is designed to foster predictable revenue streams and deepen partnerships with key clients.

This strategy is exemplified by CBAK Energy's significant supply agreements with companies like Anker Innovations and Livguard, which underscore the value of these long-term commitments. Such contracts often incorporate substantial prepayments, demonstrating a strong mutual investment in the partnership.

CBAK Energy's pricing strategy navigates the intensely competitive global battery market, balancing the pursuit of market share with the necessity of profitability. This approach is underscored by their robust gross margins within the battery segment, a testament to their ability to price competitively while ensuring financial viability.

The company's significant market share in large cylindrical batteries highlights a strong competitive standing. For instance, in the first half of 2024, CBAK Energy reported a gross profit margin of 23.8% for its battery products, demonstrating pricing power amidst market pressures.

Cost Efficiency and Production Scalability

CBAK Energy is actively expanding its production capacity, focusing on its 32140 and 40135 battery models. This expansion is a clear move towards achieving economies of scale, which is crucial for reducing per-unit production costs. By the end of 2025, the company aims to have mass production underway, signaling a significant step in cost efficiency.

This increased production volume is expected to translate into lower manufacturing expenses, allowing CBAK Energy to either offer more competitive pricing to customers or to bolster its profit margins. The strategic push for scalability is a core element of their cost management strategy.

- Production Capacity Expansion: CBAK Energy is increasing output for 32140 and 40135 models.

- Economies of Scale: Aiming to lower per-unit costs through larger production runs.

- Mass Production Target: Scheduled to commence by late 2025.

- Cost Efficiency Impact: Potential for more competitive pricing or improved profitability.

Adaptation to Market Demand and Economic Factors

CBAK Energy's pricing strategy is inherently tied to market demand and prevailing economic forces. For instance, the company has demonstrated agility in adjusting prices for specific battery models that experience a surge in demand. This responsiveness ensures that pricing remains competitive and reflective of the immediate market appetite.

The company's financial performance in Q1 2025, which saw a revenue dip attributed to a product transition phase, underscores this dynamic. Management anticipates a rebound as new product lines gain market validation, suggesting a pricing and sales approach that adapts to market acceptance and demand shifts.

- Market Responsiveness: Pricing adjustments are made to align with fluctuating demand for specific battery models.

- Economic Sensitivity: Broader economic conditions and market trends directly influence pricing decisions.

- Product Lifecycle Impact: Revenue can be affected by product transitions, with pricing strategies recalibrated upon new model validation.

- Demand-Driven Adjustments: Sales and pricing are dynamically managed to capitalize on or mitigate demand fluctuations.

CBAK Energy's pricing strategy is a blend of value-based and volume-based approaches, tailored to its B2B clientele and the competitive battery market. The company's ability to command premium pricing for high-performance batteries, as seen with its sought-after 32140 model, highlights its value proposition. Simultaneously, long-term contracts with major OEMs, such as those with Anker Innovations, indicate a strategy focused on stable revenue and client partnerships, often involving upfront payments.

The company's pricing is also sensitive to market demand and economic conditions, allowing for agile adjustments to specific product models experiencing high demand. This responsiveness is crucial for maintaining competitiveness and profitability, as evidenced by their robust gross margins. For instance, CBAK Energy reported a gross profit margin of 23.8% for its battery products in the first half of 2024, showcasing its pricing power.

Furthermore, CBAK Energy's expansion into mass production of its 32140 and 40135 battery models by late 2025 aims to leverage economies of scale. This strategic move is expected to reduce per-unit production costs, potentially enabling more competitive pricing or enhanced profit margins. This focus on cost efficiency is a key driver in their long-term pricing strategy.

| Pricing Strategy Component | Description | Supporting Data/Examples |

|---|---|---|

| Value-Based Pricing | Pricing based on the perceived value and superior performance of batteries. | High demand for 32140 model exceeding supply. |

| Volume-Based Pricing / Long-Term Contracts | Offering competitive pricing and predictable revenue through large orders and partnerships. | Supply agreements with Anker Innovations and Livguard. |

| Market Responsiveness | Adjusting prices based on immediate market demand and economic factors. | Agility in adjusting prices for models with surging demand. |

| Economies of Scale | Reducing per-unit costs through increased production capacity. | Mass production of 32140 & 40135 models targeted by late 2025. |

| Profitability Indicator | Demonstrating pricing power and financial viability. | Gross profit margin of 23.8% for battery products in H1 2024. |

4P's Marketing Mix Analysis Data Sources

Our CBAK Energy 4P's Marketing Mix Analysis is built using a robust foundation of publicly available data. We meticulously examine company filings, investor relations materials, official brand websites, and industry-specific reports to capture Product, Price, Place, and Promotion strategies.