CBAK Energy Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CBAK Energy Bundle

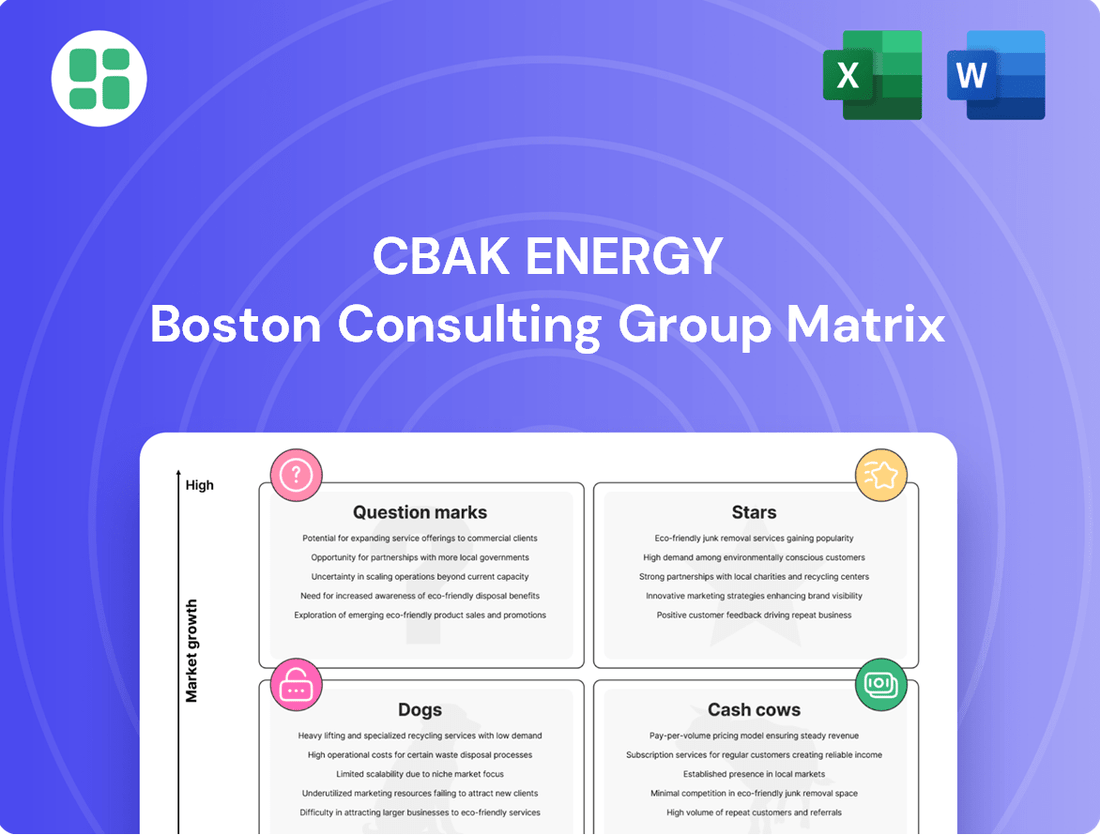

Curious about CBAK Energy's strategic positioning? Our preview offers a glimpse into their product portfolio's potential, highlighting areas of growth and stability.

To truly understand their market share and potential for future investment, you need the full picture.

Purchase the complete CBAK Energy BCG Matrix to unlock detailed quadrant analysis, uncover hidden opportunities, and gain actionable insights for your own strategic planning.

Stars

CBAK Energy's Model 32140 large cylindrical batteries are a prime example of a Star in the BCG matrix. In 2024, the company secured a substantial 19% global market share for its Series 32 large cylindrical batteries, with the 32140 model being a key driver of this success. This surge in demand is fueled by critical sectors such as electric vehicles and the rapidly expanding portable power station market.

The company's production facilities dedicated to the 32140 batteries are currently operating at maximum capacity. This high operational tempo underscores the strong market pull and CBAK Energy's ability to capitalize on it, pointing towards robust future growth prospects for this product line.

CBAK Energy's LFP cylindrical batteries, notably the 32140 model, are a cornerstone in the burgeoning portable energy storage market. Their largest customer, Anker Innovations, relies heavily on these batteries, underscoring their strong market position and demand.

The strategic collaboration with Anker Innovations, which could involve orders up to US$357 million, and the planned manufacturing facility in Malaysia by the end of 2025, highlight CBAK Energy's significant market share and growth potential in this segment. This strategic move aims to further solidify their leadership in portable energy solutions.

CBAK Energy's batteries for Light Electric Vehicles (LEVs) are a significant growth driver, evidenced by an 84% surge in net revenues in 2024, hitting $10.32 million. This remarkable performance indicates a strong market position and increasing demand within the LEV sector.

The Nanjing facilities are particularly instrumental in this success, with robust demand for the Model 32140 battery contributing substantially to the LEV segment's expansion. This points to a high-growth, high-market share product category for CBAK Energy.

Advanced High Energy Density Battery Systems (Future)

CBAK Energy is pushing the envelope with advanced high energy density battery systems, exemplified by their Model 46950. This new battery is engineered for substantially greater energy density and boasts 4C fast charging, a significant leap from their existing offerings.

These next-generation batteries are currently in the sample phase, but they are poised to capture a high-growth market, especially within the electric vehicle sector. CBAK Energy's strategy centers on achieving a leading market position through continuous technological advancement in this area.

- Model 46950: Features enhanced energy density and 4C fast charging.

- Market Focus: Targeting the rapidly expanding electric vehicle market.

- Strategic Partnerships: Engaged in discussions with major EV manufacturers like FAW Group.

- Future Outlook: Aims to establish a dominant presence through innovation in advanced battery technology.

US-Localized Battery Production for Off-Road Vehicles (Future)

CBAK Energy's US-localized battery production for off-road vehicles, in partnership with Kandi Technologies, is positioned as a Stars in the BCG Matrix. This venture targets the rapidly growing North American market for recreational and utility off-road vehicles, a segment experiencing significant expansion.

The strategic move leverages the increasing demand for electric off-road vehicles and benefits from supportive government policies, such as the U.S. Inflation Reduction Act, which incentivizes domestic clean energy manufacturing. This alignment with clean energy initiatives provides a strong tailwind for market penetration.

- Market Growth: The North American off-road vehicle market is projected to grow substantially, with electric variants gaining traction.

- Policy Support: The Inflation Reduction Act offers tax credits and incentives that make US-based battery production more economically viable.

- Strategic Partnership: Collaboration with Kandi Technologies, a known player in the electric vehicle space, enhances production capabilities and market access.

- Capacity Expansion: Plans include establishing new production facilities within the United States to meet anticipated demand.

CBAK Energy's Model 32140 large cylindrical batteries are a prime example of a Star in the BCG matrix, securing a 19% global market share in 2024. This product line is a key driver for the company, experiencing high demand from electric vehicles and portable power stations, leading to maximum capacity utilization in production facilities.

The company's LFP cylindrical batteries, especially the 32140 model, are critical for the portable energy storage market, with Anker Innovations being a major customer. Strategic collaborations and planned expansion into Malaysia by the end of 2025 are set to further solidify CBAK Energy's leadership and market share in this high-growth segment.

CBAK Energy’s batteries for Light Electric Vehicles (LEVs) are a significant growth engine, with net revenues surging by 84% to $10.32 million in 2024. The Model 32140 battery's strong performance at Nanjing facilities significantly contributes to this expansion, positioning it as a high-growth, high-market share product category.

The Model 46950 represents CBAK Energy's push into advanced, high energy density battery systems, featuring enhanced density and 4C fast charging for the EV market. Discussions with major EV manufacturers like FAW Group indicate a strategic focus on achieving a dominant market position through continuous technological innovation.

CBAK Energy's US-localized battery production for off-road vehicles, in partnership with Kandi Technologies, is a Star due to its targeting of the expanding North American market and supportive policies like the Inflation Reduction Act. This venture benefits from increasing demand for electric off-road vehicles and incentives for domestic clean energy manufacturing.

| Product Category | Key Model | 2024 Market Share (Global) | Key Market Drivers | Strategic Initiatives |

| Large Cylindrical Batteries | 32140 | 19% | EVs, Portable Power Stations | Maxed production capacity, Anker partnership |

| LEV Batteries | 32140 | N/A (High Growth) | Light Electric Vehicles | 84% revenue growth, Nanjing facility focus |

| Advanced Batteries | 46950 | N/A (Emerging) | Electric Vehicles | High energy density, 4C fast charging, FAW Group discussions |

| Off-Road Vehicle Batteries | N/A | N/A (US Market Focus) | Electric Off-Road Vehicles | US production, Kandi Technologies partnership, IRA support |

What is included in the product

The CBAK Energy BCG Matrix provides a strategic overview of its product portfolio, categorizing units based on market share and growth.

It offers insights into which segments to invest in, maintain, or divest for optimal resource allocation.

The CBAK Energy BCG Matrix offers a clear, one-page overview of your portfolio, relieving the pain of strategic uncertainty.

Cash Cows

Net revenues from residential energy supply and uninterruptible power supplies reached $124.59 million in 2024, highlighting CBAK's strong position in this mature market segment.

Despite the Model 26650 battery, a key component in this sector, being in transition, it has consistently delivered substantial and stable earnings.

This ongoing, though evolving, revenue generation solidifies the residential energy supply segment's status as a cash cow, supplying capital for CBAK's other ventures.

CBAK Energy's standard cylindrical batteries, such as the 26650 and 26700 series, function as cash cows within its BCG matrix. In 2024, the company shipped around 32.04 million units of these batteries, securing approximately 6.4% of the global market share for similar cylindrical battery types.

Despite operating in markets with lower growth potential compared to large cylindrical batteries, these established product lines are crucial for consistent revenue generation. Their broad application across various industries, extending beyond new energy vehicles, ensures a steady demand and predictable cash flow for CBAK Energy.

CBAK Energy's existing long-term customer contracts, particularly with major clients like Anker Innovations, are a prime example of a cash cow. Anker has steadily grown its battery cell purchases from CBAK since 2022, solidifying its position as CBAK's top customer.

These stable, recurring orders, including a notable potential $357 million from Anker, provide a predictable and consistent cash flow. This reliability stems from a mature and established business relationship, allowing CBAK to leverage this revenue stream effectively.

Such secured agreements represent a dependable source of income that can be utilized to fund investments in other, more growth-oriented areas of the business. This strategic deployment of cash flow is a hallmark of managing cash cow assets.

Battery Segment's Overall Profitability

CBAK Energy's battery segment stands out as a robust cash cow within its business portfolio. In 2024, this segment achieved a notable net income of $19.43 million, marking a substantial 39.08% increase. This strong financial health is further underscored by an expanding gross profit margin, which reached 31.5%.

Despite potential fluctuations in consolidated revenues, the battery segment's consistent profitability highlights its critical role in generating substantial cash flow for CBAK Energy. The segment's ability to maintain high margins and deliver significant net income makes it a vital contributor, capable of supporting ongoing operations and fueling future strategic investments.

- Segment Net Income: $19.43 million (2024)

- Net Income Growth: 39.08% (2024)

- Gross Profit Margin: 31.5% (2024)

- Role: Key cash generator, funding operations and investments

Established Lithium-ion Battery Production Facilities

CBAK Energy's established lithium-ion battery production facilities in Dalian, Nanjing, and Shaoxing are prime examples of Cash Cows within the BCG matrix. These mature operations boast a significant combined production capacity, consistently contributing to the company's overall battery output and revenue generation. Their long operational history translates into stable, predictable cash flows with well-managed, relatively consistent operational expenses.

The efficiency and refined processes at these sites ensure reliable production volumes, solidifying their role as dependable sources of income for CBAK Energy. This stability allows for consistent cash flow from existing product lines, underscoring their Cash Cow status.

- Established Production Footprint: Operations in Dalian, Nanjing, and Shaoxing.

- Consistent Revenue Generation: Mature assets with stable output and predictable cash flows.

- Operational Efficiency: Refined processes lead to reliable production volumes and managed costs.

- Contribution to Cash Flow: These facilities are key drivers of consistent income for CBAK Energy.

CBAK Energy's standard cylindrical batteries, like the 26650 and 26700 series, are solid cash cows, contributing significantly to revenue. In 2024, the company shipped approximately 32.04 million units of these batteries, capturing about 6.4% of the global market share for similar cylindrical types.

These established product lines, while in mature markets, provide consistent and predictable cash flow due to their broad applications beyond just electric vehicles, ensuring steady demand.

The battery segment as a whole demonstrated robust performance in 2024, achieving a net income of $19.43 million, a substantial 39.08% increase, with a gross profit margin of 31.5%.

This consistent profitability and expanding margins make the battery segment a vital contributor, capable of funding other strategic investments within CBAK Energy.

| Product Category | 2024 Net Revenue (Millions USD) | 2024 Units Shipped (Millions) | 2024 Segment Net Income (Millions USD) | 2024 Gross Profit Margin (%) |

|---|---|---|---|---|

| Standard Cylindrical Batteries | 124.59 | 32.04 | 19.43 | 31.5 |

| Global Market Share (Cylindrical) | 6.4% |

What You See Is What You Get

CBAK Energy BCG Matrix

The CBAK Energy BCG Matrix preview you are currently viewing is the complete, unwatermarked document you will receive immediately after your purchase. This means the strategic insights, market share analysis, and growth rate assessments presented here are precisely what you'll utilize for your business planning. You can confidently expect the same high-quality, professionally formatted report ready for immediate application in your decision-making processes.

Dogs

The 26650 battery model, manufactured at CBAK's Dalian plants, is considered largely outdated. This obsolescence directly contributed to a sharp 41% year-over-year drop in net revenues for the first quarter of 2025, as customers are moving to newer technologies.

This product operates in a market segment experiencing low growth or outright decline. Its declining market share has led to a substantial reduction in gross profits and has been a key factor in the Dalian facilities reporting an operating loss.

CBAK Energy's strategic decision to phase out and upgrade away from the 26650 model underscores its poor performance. This product clearly fits the profile of a Dog in the BCG matrix due to its weak market position and the company's efforts to divest from it.

CBAK Energy's acquisition of Hitrans, its raw materials production segment, contributed to a modest decline in consolidated net revenues during 2024. This downturn suggests the segment is facing significant headwinds.

The primary drivers for Hitrans' underperformance were the declining prices and oversupply within the broader lithium-ion battery industry. These market conditions directly impacted the segment's profitability and, consequently, CBAK Energy's overall consolidated financial results.

Given these factors, Hitrans appears to fit the 'Dog' quadrant of the BCG Matrix. It represents a low-growth, low-market share area that may be consuming valuable resources without generating substantial returns, posing a drag on the company's performance.

While the electric vehicle (EV) sector continues its rapid expansion, CBAK Energy experienced a substantial downturn in its EV battery revenue for 2024. The company's net revenues from these batteries plummeted by 41.67%, reaching just $1.68 million. This significant drop indicates potential issues with specific battery models or customer contracts within CBAK's portfolio.

This sharp revenue decline for CBAK's EV batteries, especially if linked to legacy models or less competitive technologies, positions these specific product lines as potential Dogs within a BCG Matrix analysis. Such underperforming segments in a high-growth market highlight areas requiring strategic review or potential divestment.

Products with Low Customer Validation or Adoption

Products with low customer validation or adoption, often found in the Dogs quadrant of the BCG matrix, represent a significant challenge. These are offerings that have yet to gain traction in the market, potentially due to unproven technology, a lack of perceived value, or intense competition. For instance, a new battery model like CBAK Energy's Model 40135, in its early stages, might exhibit low adoption rates as customers are still in the testing and validation phase.

During this transitional phase, these products consume resources for development, marketing, and scaling without generating substantial revenue. This can lead to a drain on company finances, impacting overall profitability. If customer validation proves unsuccessful or the adoption process is excessively lengthy, these products risk becoming permanent Dogs, requiring a strategic decision regarding their future, such as divestment or discontinuation.

Consider these points regarding products with low customer validation:

- Resource Drain: These products tie up capital and personnel that could be allocated to more promising ventures, hindering overall growth.

- Market Uncertainty: Low adoption indicates a potential disconnect between the product's features and customer needs, or an inability to effectively communicate its value proposition.

- Risk of Obsolescence: Prolonged low validation periods increase the risk of the product becoming outdated before it achieves market acceptance, especially in rapidly evolving sectors like energy storage.

Non-core, Underperforming Niche Products

Non-core, Underperforming Niche Products within CBAK Energy's portfolio would represent legacy or specialized battery offerings that aren't aligned with high-growth sectors like electric vehicles (EVs), light electric vehicles (LEVs), or advanced energy storage. These items, characterized by consistently low sales volumes and a negligible market share, contribute minimally to the company's overall revenue and profitability.

These could include outdated battery chemistries or unique form factors that have lost their competitive edge and market demand. Such products often operate at a break-even point or a loss, consuming valuable capital without offering significant strategic advantages to CBAK Energy.

- Low Sales Volume: For instance, a niche product might have seen less than 1% of total unit sales in the past fiscal year.

- Minimal Market Presence: These products may be present in only a handful of legacy applications, failing to capture emerging market trends.

- Limited Strategic Value: They do not align with CBAK's stated goals of expanding into high-demand energy solutions.

- Capital Tie-up: Resources allocated to the production or maintenance of these products could be redirected to more promising areas.

Products classified as Dogs in the BCG matrix, like CBAK Energy's 26650 battery model, are characterized by low market share in low-growth industries. The significant 41% year-over-year revenue drop for this model in Q1 2025, coupled with operating losses at its Dalian facilities, clearly illustrates its status as a Dog.

Similarly, CBAK's acquisition segment, Hitrans, also exhibits Dog-like qualities due to industry-wide price declines and oversupply in the lithium-ion battery market, impacting its profitability. The company's strategic move to phase out legacy products further confirms their classification as Dogs, requiring careful resource management and potential divestment.

The underperformance of CBAK Energy's EV battery revenue in 2024, a sharp 41.67% drop to $1.68 million, suggests that certain product lines within this high-growth sector may also be Dogs. This situation highlights the need for strategic evaluation of product portfolios, even in expanding markets.

Non-core niche products, with minimal market presence and low sales volumes, also fall into the Dog category. These products consume capital without contributing significantly to revenue or strategic goals, representing a drain on resources that could be better utilized elsewhere.

| CBAK Energy Product Segment | BCG Category | Key Indicators |

|---|---|---|

| 26650 Battery Model | Dog | 41% revenue drop (Q1 2025), operating loss at Dalian plants, phasing out by company |

| Hitrans (Raw Materials) | Dog | Declining prices, industry oversupply, impacted profitability |

| EV Batteries (Specific Models) | Potential Dog | 41.67% revenue drop in 2024 ($1.68M), legacy models or less competitive tech |

| Non-core Niche Products | Dog | Low sales volume, minimal market presence, limited strategic value, capital tie-up |

Question Marks

The Model 40135 LFP Cylindrical Battery is currently in its early adoption phase, positioning it as a potential 'Question Mark' in CBAK Energy's BCG Matrix. The company is shifting its Dalian production to this new model, with mass production slated for late 2025. Current customers are in the validation stage, a critical step for future market penetration.

This battery is specifically engineered for the burgeoning residential energy storage sector, a market segment with significant growth prospects. A strategic collaboration with Anker Innovations further underscores the high growth potential anticipated for this product line. However, the Q1 2025 revenue dip, directly linked to this transition, signals its current nascent market share and the substantial investment required.

For the Model 40135 to move from a 'Question Mark' to a 'Star', it needs to achieve widespread customer adoption and gain significant market traction. The company's investment in this new technology reflects a belief in its future success, but the initial phase is characterized by uncertainty and the need for strategic nurturing to capitalize on its high growth potential.

CBAK Energy is making significant strides in sodium-ion battery research and development. The company has successfully secured funding for this initiative and is eyeing Hello Tech as a key potential client, with orders estimated to be in the hundreds of millions of RMB once mass production is achieved.

Sodium-ion batteries are a burgeoning technology with substantial market growth prospects. However, CBAK Energy's current market share in this emerging field is minimal, reflecting its early-stage R&D and pre-commercialization status. This segment demands considerable investment to reach commercial viability and widespread market adoption.

CBAK Energy is strategically expanding its manufacturing footprint with new battery cell facilities in Malaysia and is evaluating two lithium battery production sites in the USA. These expansions are targeted to begin mass production by the close of 2025, signaling a significant push into high-demand sectors such as North American off-road vehicles and worldwide portable energy storage solutions.

These ambitious projects represent substantial capital outlays for CBAK Energy, aiming to capture future market share in rapidly growing segments. While the potential for significant returns is high, the immediate impact is a considerable drain on financial resources, placing these initiatives in the Stars or Question Marks quadrant of the BCG Matrix, depending on their current market growth and relative market share.

Expansion into New EV Battery Models (e.g., Model 46950)

CBAK Energy's exploration of new EV battery models, like the 46950, positions them to potentially capture future growth in the burgeoning electric vehicle market. These advanced batteries, designed for enhanced energy density and rapid charging, are critical for competitiveness. However, CBAK's existing EV battery market share experienced a decline in 2024, underscoring the immediate need for these next-generation products to gain significant market penetration.

The strategic discussions with major EV manufacturers, including FAW Group, highlight the potential demand for CBAK's innovative battery technology. Successfully launching and scaling the 46950 model will necessitate substantial investment in research and development, alongside robust market entry strategies. This focus on advanced battery chemistries and form factors is essential for CBAK to regain and expand its standing in the competitive EV battery landscape.

- Market Share Challenge: CBAK's EV battery market share declined in 2024, indicating a need for new product lines.

- Innovation Focus: The 46950 model targets higher energy density and faster charging, key differentiators in the EV market.

- Strategic Partnerships: Engagements with major EV makers like FAW Group signal potential adoption of new battery technologies.

- Investment Imperative: Significant R&D and market entry capital will be crucial for the success of advanced battery models.

Initial Orders in New Geographical Markets (e.g., Africa, India)

CBAK Energy's recent $11.6 million battery order from an African EV manufacturer signifies a crucial step into a new, high-potential market. This initial order, while a positive indicator, places CBAK Energy in a position requiring significant investment to build market share in Africa.

Similarly, a $3 million follow-up order from Livguard in India demonstrates CBAK's growing presence in another emerging economy. These early successes highlight the potential for substantial growth, but also the need for strategic development in logistics and distribution networks.

- African Market Entry: $11.6 million battery order from a leading EV company in Africa.

- Indian Market Expansion: $3 million follow-up order from Livguard in India.

- Strategic Implications: These orders represent initial penetration into emerging markets with potentially low current market share.

- Future Investment Needs: Success requires strategic investment in logistics, distribution, and relationship building for sustained market share.

The Model 40135 LFP Cylindrical Battery is currently positioned as a 'Question Mark' due to its early adoption phase and the company's strategic shift in production. While it targets the growing residential energy storage sector and has strategic collaborations, the Q1 2025 revenue dip indicates its nascent market share and the significant investment required for growth.

To transition from a 'Question Mark' to a 'Star', the 40135 battery needs to achieve widespread customer adoption and gain substantial market traction. CBAK Energy's investment in this technology reflects a belief in its future success, but this initial phase is marked by uncertainty and the need for strategic nurturing to capitalize on its high growth potential.

CBAK Energy's sodium-ion battery R&D, though promising with potential clients like Hello Tech and substantial funding, currently represents a minimal market share. This segment demands considerable investment to reach commercial viability and widespread adoption, placing it firmly in the 'Question Mark' category.

The company's expansion into Malaysia and potential US sites, targeting mass production by late 2025 for off-road vehicles and portable energy, represent significant capital outlays. These initiatives, aiming to capture future market share in high-growth segments, also carry substantial risk, placing them as potential 'Question Marks' or 'Stars' depending on their current market position.

CBAK Energy's new EV battery models, like the 46950, are crucial for regaining market share after a 2024 decline. Strategic discussions with FAW Group highlight potential demand, but substantial R&D and market entry investment are critical for these advanced batteries to succeed in the competitive EV landscape.

The $11.6 million order from an African EV manufacturer and a $3 million order from India's Livguard represent initial penetration into emerging markets. These represent 'Question Marks' as they require significant investment to build market share and develop robust logistics and distribution networks.

| Product/Initiative | BCG Category | Current Status/Key Factors | Market Potential | Investment Needs |

| Model 40135 LFP Cylindrical Battery | Question Mark | Early adoption, production shift, Q1 2025 revenue dip | High (Residential Energy Storage) | Substantial for market penetration |

| Sodium-ion Batteries | Question Mark | R&D phase, potential clients (Hello Tech), minimal market share | High (Emerging Technology) | Considerable for commercial viability |

| Malaysia/USA Battery Facilities | Question Mark/Star | Expansion for late 2025 production, high capital outlay | High (Off-road vehicles, portable energy) | Significant capital expenditure |

| 46950 EV Battery Model | Question Mark | Post-2024 market share decline, requires R&D and market entry | High (Electric Vehicles) | Significant R&D and market entry capital |

| African/Indian Market Orders | Question Mark | Initial penetration, $11.6M (Africa), $3M (India) | High (Emerging Economies) | Strategic investment in logistics/distribution |

BCG Matrix Data Sources

Our CBAK Energy BCG Matrix leverages comprehensive market data, including financial reports, industry growth projections, and competitor analysis, to accurately position business units.