Cathay. SA/Catai Tours Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Cathay. SA/Catai Tours Bundle

Cathay. SA/Catai Tours operates in a dynamic travel landscape where buyer power is significant due to readily available alternatives and price sensitivity. Understanding the intensity of these forces is crucial for strategic planning.

The complete report reveals the real forces shaping Cathay. SA/Catai Tours’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Supplier concentration significantly impacts Catai Tours. The travel sector, particularly for niche markets like Catai's long-distance and bespoke tours, often depends on a limited pool of major airlines, hotel groups, and global distribution systems. This scarcity can grant these suppliers considerable leverage.

For Catai Tours, the availability of specialized accommodations, unique transport options, and distinctive local experiences is crucial. When these elements are controlled by a few providers, their bargaining power increases, potentially driving up costs for Catai.

However, Catai's position within Ávoris Corporación Empresarial offers a counterbalancing advantage. The consolidated purchasing power of the entire Ávoris group, encompassing various travel brands, can be leveraged to negotiate more favorable terms with these concentrated suppliers, mitigating some of their individual power.

Switching core suppliers for a company like Catai Tours, especially for long-haul routes with airline partners or exclusive hotel contracts, can be a costly endeavor. These transitions often involve substantial operational expenses and contractual penalties, directly impacting Catai's flexibility.

The process of renegotiating terms with new suppliers, updating complex booking systems, and ensuring that service delivery remains seamless during any changeover presents significant challenges. These complexities inherently increase the cost and effort involved, thereby bolstering the bargaining power of existing suppliers.

In 2025, tour operators like Catai are experiencing considerable pressure from rising supplier costs. Reports indicate double-digit percentage increases across various essential services, including hotels, restaurants, motorcoaches, and air travel, directly affecting Catai's operational expenses and profitability.

Catai's commitment to crafting unique, tailor-made travel experiences significantly influences the bargaining power of its suppliers. When suppliers offer specialized and authentic services, their leverage increases because these offerings are difficult for Catai to replicate or source elsewhere.

For instance, suppliers like niche local guides with deep cultural knowledge or boutique accommodations in exclusive, hard-to-reach destinations are highly valued. These providers are essential to Catai's ability to deliver distinctive cultural immersion and adventure tours, directly supporting its core value proposition.

The exclusivity of these supplier services means they can command better terms. In 2024, the luxury travel sector, which Catai operates within, saw continued demand for personalized and unique experiences, further solidifying the bargaining power of suppliers who can deliver on these fronts.

Threat of Forward Integration by Suppliers

Suppliers, such as major airlines or hotel chains, may increasingly move into offering their own packaged tours or direct booking services. This forward integration bypasses traditional tour operators like Catai, potentially reducing Catai's reliance on these suppliers for distribution. For instance, in 2024, several major hotel groups expanded their direct booking incentives, aiming to capture a larger share of the leisure travel market previously served by intermediaries.

This shift poses a threat by allowing suppliers to compete directly with tour operators for specific customer segments. While complex, multi-destination itineraries remain a stronghold for operators, simpler, package-based offerings are vulnerable. The global online travel agency market, a related sector, saw significant growth in direct booking options in 2024, indicating a broader industry trend.

- Potential for Supplier Competition: Airlines and hotel groups could offer bundled packages, directly competing with Catai's core business.

- Reduced Reliance on Tour Operators: Suppliers might find it more profitable to sell directly to consumers, diminishing their need for Catai's services.

- Market Segment Vulnerability: Simpler, pre-packaged tours are more susceptible to this threat than highly customized travel experiences.

Importance of Catai to Suppliers

Catai's specialization in 'Grandes Viajes' and its backing by Ávoris Corporación Empresarial means it commands substantial booking volumes. This scale allows Catai to negotiate favorable terms with its suppliers, leveraging its importance to their business.

Suppliers catering to Catai's niche market are likely to find the company a key client. The consistent demand for high-value, long-distance travel packages translates into significant revenue streams for these suppliers, enhancing Catai's bargaining leverage.

Ávoris Corporación Empresarial anticipates positive financial performance for 2024, with optimistic projections for subsequent years. This robust financial health strengthens Catai's negotiating position, allowing it to secure better pricing and service agreements from its suppliers.

- Significant Volume: Catai's focus on 'Grandes Viajes' generates substantial business for suppliers.

- Group Affiliation: Being part of Ávoris Corporación Empresarial amplifies Catai's market presence and negotiating power.

- Financial Strength: Ávoris's projected positive economic results for 2024 and future optimism bolster Catai's ability to secure favorable supplier terms.

Catai Tours faces significant supplier bargaining power due to the concentration of key travel services like airlines and hotels. This is amplified when suppliers offer unique, hard-to-replicate experiences crucial for Catai's niche market. However, Catai's substantial booking volumes, particularly within the 'Grandes Viajes' segment, and its affiliation with Ávoris Corporación Empresarial, provide considerable leverage to negotiate favorable terms.

| Factor | Impact on Catai Tours | Supporting Data/Observation (2024-2025) |

|---|---|---|

| Supplier Concentration | High leverage for suppliers of niche services. | Limited pool of specialized accommodations and transport options. |

| Switching Costs | High costs and complexity deter supplier changes. | Significant operational expenses and contractual penalties associated with transitions. |

| Supplier Differentiation | Increased power for providers of unique experiences. | Demand for personalized, unique luxury travel experiences in 2024 strengthens supplier leverage. |

| Forward Integration by Suppliers | Potential for direct competition with Catai. | Major hotel groups expanded direct booking incentives in 2024. |

| Catai's Negotiating Power | Mitigated by volume and group affiliation. | Ávoris Corporación Empresarial projects positive financial performance for 2024. |

What is included in the product

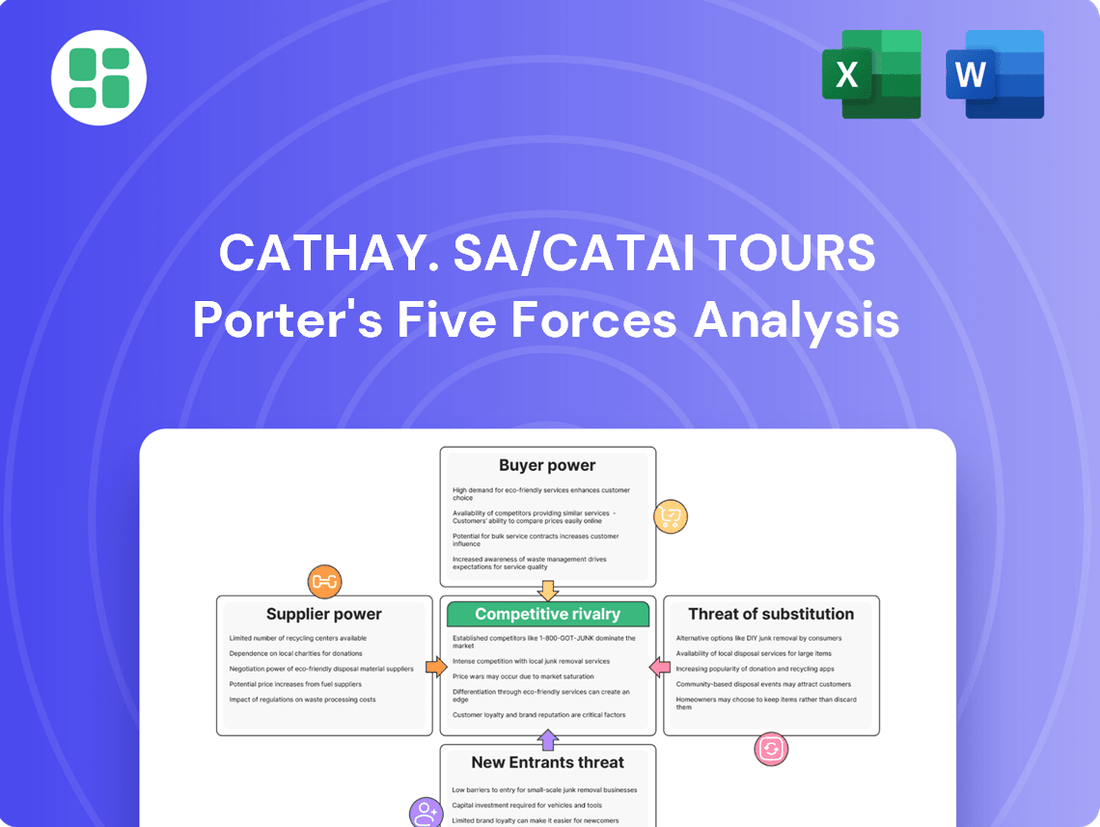

This Porter's Five Forces analysis for Cathay. SA/Catai Tours dissects the competitive landscape, evaluating the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants, and the impact of substitute products.

Uncover hidden competitive advantages by visualizing the interplay of all five forces, transforming complex market dynamics into actionable insights.

Easily identify and address potential threats by simulating different competitive scenarios, empowering strategic planning and risk mitigation.

Customers Bargaining Power

While Catai Tours focuses on unique, personalized travel, customers across the travel sector, even in the luxury market, are increasingly mindful of value. For instance, global inflation trends in 2024 have put pressure on discretionary spending, making travelers more attuned to pricing.

This heightened price sensitivity means Catai needs to carefully calibrate its premium offerings against competitive benchmarks, particularly for its high-end and long-haul packages. Finding that sweet spot between exclusivity and perceived value is crucial for maintaining market share.

The internet and dedicated travel review sites have dramatically increased the availability of information for customers. This means travelers can easily research destinations, compare prices across various providers, and read reviews of different tour packages. This transparency directly impacts Catai's position by empowering customers to make more informed choices.

With readily accessible information, customers can effectively compare Catai's offerings against competitors, including those who offer direct bookings or operate as alternative tour operators. This ability to easily benchmark services and prices significantly amplifies customer bargaining power, as they can identify and leverage better deals elsewhere.

In the Spanish market, online presence is paramount, with a significant 58% of all travel bookings occurring online. This online activity is further divided between direct bookings on company websites and bookings made through Online Travel Agencies (OTAs), highlighting the digital-savvy nature of today's travelers and their reliance on accessible information for decision-making.

Customers can easily switch between tour operators or plan their own trips, as the costs involved are minimal. This low barrier to switching means Catai must consistently deliver attractive value, distinctive travel plans, and superior customer service to keep clients loyal. For instance, in 2024, the global online travel market saw continued growth, indicating a competitive landscape where customer retention is paramount.

Customer Demand for Personalization

Catai's core strength is its ability to craft personalized and unique travel experiences. This specialization, however, inherently empowers customers. They come to Catai expecting a high level of customization and swift responses, which translates into their ability to demand specific inclusions, itinerary modifications, or elevated service standards.

The global market for tailor-made travel is experiencing robust expansion. Projections indicate substantial growth, fueled by an increasing consumer appetite for distinctive and highly personalized travel adventures. This trend directly amplifies customer bargaining power within this segment.

- Customer expectation for bespoke itineraries: Catai's success hinges on personalization, leading customers to expect tailored solutions.

- Demand for flexibility and modifications: Travelers increasingly seek the ability to adjust plans, granting them leverage.

- Growth in the tailor-made travel market: The market's expansion, projected to reach billions by 2028, underscores rising customer demand for unique experiences, strengthening their position.

Group Purchasing Power

While Catai Tours emphasizes individual travel experiences, the collective strength of group bookings, even for bespoke itineraries, significantly amplifies customer bargaining power. Agencies that assemble special interest groups can leverage this volume to negotiate more advantageous terms with Catai. This often necessitates Catai offering more flexible pricing structures or enhanced value-added services to accommodate larger group commitments.

In 2024, Catai demonstrated a strategic focus on supporting agencies that aim to provide differentiated offerings for their long-haul group clientele. This initiative acknowledges the substantial impact of group purchasing power on supplier relationships and pricing dynamics within the travel industry.

- Consolidated Demand: Group bookings, even for customized tours, aggregate customer demand, giving agencies more leverage in negotiations.

- Negotiating Leverage: Agencies organizing groups can demand better pricing or additional amenities from Catai due to the guaranteed volume.

- Catai's 2024 Strategy: Catai's commitment to facilitating agency-led long-distance groups highlights their recognition of this bargaining power.

Customers wield significant power due to the readily available information online, allowing easy comparison of Catai's offerings against competitors. This transparency, coupled with low switching costs, means Catai must consistently deliver exceptional value and unique experiences to retain clients. In 2024, the global online travel market's continued growth underscores the competitive pressure to keep customers engaged.

Catai's specialization in personalized travel inherently empowers its customers, who expect tailored solutions and are willing to demand specific inclusions or itinerary modifications. The expanding tailor-made travel market, projected for substantial growth, further amplifies this customer leverage.

Group bookings, even for bespoke itineraries, consolidate customer demand, granting agencies organizing these groups considerable negotiating power. Catai's 2024 strategy to support agencies with long-haul groups acknowledges this leverage, often leading to demands for better pricing or added amenities.

| Factor | Impact on Catai Tours | 2024 Data/Trend |

|---|---|---|

| Information Availability | Increased customer price sensitivity and comparison | 58% of Spanish travel bookings are online |

| Switching Costs | Low, requiring Catai to focus on value and loyalty | Continued growth in the global online travel market |

| Customization Expectation | Customers demand tailored experiences and flexibility | Robust expansion in the tailor-made travel market |

| Group Purchasing Power | Agencies leverage volume for better terms | Catai's focus on supporting long-haul group agencies |

Preview Before You Purchase

Cathay. SA/Catai Tours Porter's Five Forces Analysis

This preview displays the exact Cathay. SA/Catai Tours Porter's Five Forces Analysis you will receive immediately after purchase, providing a comprehensive examination of the competitive landscape. You're looking at the actual document, meaning the detailed insights into buyer power, supplier power, threat of new entrants, threat of substitutes, and industry rivalry are all present and ready for your use. Once you complete your purchase, you’ll get instant access to this exact, professionally formatted file, ensuring no surprises and immediate utility for your strategic planning.

Rivalry Among Competitors

The Spanish tour operator market is quite crowded, featuring a wide array of companies. These range from big global names to smaller, specialized businesses and online booking platforms. Catai, focusing on long-haul and customized trips, finds itself competing with both broad-service operators and other high-end or niche travel providers.

In 2024, Spain's tourism sector continued its robust recovery, with tour operators experiencing a significant uptick in bookings. This heightened activity means Catai must navigate a dynamic competitive landscape where differentiation is key to capturing market share amidst numerous offerings.

Spain's tourism sector, encompassing tour operators like Cathay, experienced robust growth in 2024, with expectations remaining positive for 2025. This expansion fuels intense competition as companies battle for a larger slice of the market.

While the global travel experiences sector saw a slowdown in its double-digit growth from 2022 and 2023 into 2024, Spain has maintained strong demand. This resilience makes the Spanish market particularly attractive, further intensifying the rivalry among established players and new entrants.

Tour operators like Cathay face intense rivalry due to substantial fixed costs associated with service contracts, marketing, and staffing. These ongoing expenses necessitate a high volume of sales to achieve profitability, intensifying competition among players in the market.

The perishable nature of travel inventory, such as unsold airline seats or hotel rooms, further fuels this rivalry. Unused capacity represents lost revenue, compelling operators to aggressively fill tours, particularly during slower periods or for less sought-after destinations, often resorting to price adjustments.

Differentiation of Offerings

Cathay's competitive edge is built on delivering personalized service and crafting unique travel experiences that set it apart from larger, more standardized tour operators. This focus on bespoke itineraries is crucial in a market where travelers increasingly seek specialized and experience-driven journeys.

The tailor-made travel sector is experiencing significant growth, with consumer demand for niche and experiential travel on the rise. For instance, reports from 2024 indicate a continued upward trend in bookings for customized luxury tours, with some segments seeing double-digit percentage increases year-over-year.

- Personalized Service: Cathay's core strategy emphasizes bespoke travel planning.

- Unique Itineraries: Focus on creating distinctive and memorable travel experiences.

- Market Trend: Growing demand for niche and experience-based travel in 2024.

- Competitive Landscape: Other luxury and niche operators also prioritize differentiation, necessitating ongoing innovation.

Exit Barriers

High fixed costs, such as maintaining extensive booking systems and marketing efforts, combined with specialized assets like unique supplier relationships and expert staff for crafting complex itineraries, significantly increase exit barriers for tour operators like Cathay Tours.

The brand reputation that Cathay Tours has cultivated over its 43 years of experience as a leading long-distance travel operator also acts as a substantial barrier. This deep-seated trust and recognition make it difficult for new entrants to compete and for existing players to simply walk away.

These elevated exit barriers mean that companies are more likely to persevere and compete intensely, even when market conditions are challenging. This persistence fuels a high level of competitive rivalry within the sector.

- High Fixed Costs: Investments in technology, marketing, and operational infrastructure are substantial and not easily recouped.

- Specialized Assets: Unique supplier contracts and highly skilled personnel for complex tour design are difficult to redeploy.

- Brand Reputation: Over four decades of operation, Cathay Tours has built significant brand equity, making departure costly in terms of lost customer loyalty.

- Market Persistence: The inability to easily exit leads to continued competition, even during economic downturns, intensifying rivalry.

Competitive rivalry within Spain's tour operator market is fierce, driven by a crowded field of global, niche, and online players. In 2024, the sector saw a strong rebound in bookings, amplifying this competition as companies vie for market share. High fixed costs and the perishable nature of travel inventory compel operators to aggressively fill capacity, often through price competition, making differentiation crucial for survival.

SSubstitutes Threaten

The most significant threat to Catai Tours comes from independent travel planning. Travelers are increasingly using online resources, booking directly with airlines and hotels, and engaging local service providers to craft their own long-distance and custom trips.

The digital savvy of Spanish travelers, particularly evident in 2024 with a significant portion of the population actively using online platforms for travel arrangements, fuels this trend. The ease of access to booking engines and direct supplier websites empowers individuals to bypass traditional tour operators.

This self-service approach allows for greater flexibility and potentially lower costs, directly challenging Catai's value proposition. For instance, in 2024, online travel agencies (OTAs) and direct booking channels continued to capture a substantial share of the Spanish travel market, indicating a strong preference for independent itinerary creation.

Online Travel Agencies (OTAs) present a significant threat to Cathay Pacific's tour operations by offering a broad spectrum of travel components like flights, hotels, and car rentals. Customers can assemble their own travel itineraries through these platforms, often at competitive prices, though they may lack the specialized expertise and personalized touch Catai provides.

While OTAs also serve as distribution channels for Catai, they simultaneously act as substitutes for consumers looking for more standardized travel arrangements. In Spain, online bookings are prevalent, accounting for 58% of all reservations, with OTAs capturing a substantial 33% of this market, underscoring their competitive reach.

The threat of substitutes for Cathay Pacific's core business of long-haul air travel is significant. Consumers have a wide array of alternative leisure activities for their discretionary spending. These include domestic tourism, which saw a 5% increase in traveler spending in 2023 according to Tourism Australia, cruises, which are experiencing a resurgence, and staycations, becoming increasingly popular as a cost-effective option.

Furthermore, the ongoing cost of living crisis, impacting economies globally throughout 2024, pushes consumers towards less expensive or geographically closer leisure pursuits. For instance, a significant portion of consumers surveyed in the UK in early 2024 indicated they would prioritize domestic holidays over international travel due to budget constraints. This shift directly diverts potential spending away from long-haul flights.

Standardized Package Tours

The threat of standardized package tours as a substitute for Cathay Pacific Holidays (Catai) is moderate. While Catai specializes in tailor-made travel experiences, customers prioritizing cost savings over personalization might choose mass-market operators offering standardized, less expensive package tours. This segment represents a potential alternative for travelers who might otherwise consider Catai's more premium offerings but are budget-conscious.

However, Catai's ability to cater to a range of preferences, from exclusive to regular circuits, helps mitigate this threat. For instance, in 2024, the global package holiday market was valued at approximately $150 billion, indicating a significant consumer base for standardized options. Yet, the increasing demand for experiential and personalized travel, a core Catai strength, suggests that the direct substitution impact may be limited to a specific traveler segment.

- Price Sensitivity: Travelers highly sensitive to price may opt for standardized tours, viewing them as a direct substitute for Catai's customized packages.

- Personalization vs. Cost: The trade-off between bespoke travel experiences and cost savings is a key factor determining the substitutability.

- Market Segmentation: Catai’s ability to serve various segments, including those seeking regular circuits, helps differentiate from purely mass-market operators.

- Experiential Demand: The growing trend towards unique and personalized travel experiences limits the appeal of standardized tours for a significant portion of the market.

Direct Bookings with Airlines/Hotels

Travelers increasingly opt to book flights directly with airlines and accommodations with hotels, especially for straightforward travel plans or when loyal to particular brands. This trend allows customers to bypass tour operators like Catai, particularly for trips that don't involve complex customization or multi-country arrangements.

In 2024, many major suppliers in the Spanish travel market demonstrated robust financial performance. For instance, Iberia reported strong operating profits, indicating a healthy demand for direct airline bookings.

- Direct Booking Convenience: Travelers can easily access airline and hotel websites for booking, often finding competitive pricing and loyalty program benefits.

- Reduced Reliance on Intermediaries: For simpler travel needs, the necessity of a tour operator like Catai diminishes as consumers manage their own arrangements.

- Supplier Financial Health: The profitability of key players like Iberia in 2024 highlights the strength of direct-to-consumer channels in the travel industry.

The threat of substitutes for Catai Tours is substantial, primarily driven by the rise of independent travel planning and online booking platforms. Travelers are increasingly empowered to craft their own itineraries by booking directly with airlines and hotels, bypassing traditional tour operators.

In 2024, this trend was amplified by the digital savviness of Spanish travelers, with a significant portion utilizing online resources for travel arrangements. Online travel agencies (OTAs) and direct booking channels continued to capture a large share of the market, with online bookings accounting for 58% of all reservations in Spain, and OTAs holding a 33% share of this online segment.

While standardized package tours offer a more budget-friendly alternative, Catai's focus on personalized experiences helps differentiate its offerings. However, the global package holiday market, valued at approximately $150 billion in 2024, indicates a considerable consumer base for these standardized options, representing a moderate threat to Catai's more premium services.

| Substitute Type | Description | Impact on Catai | Key Drivers (2024 Data) |

|---|---|---|---|

| Independent Travel Planning | Travelers booking flights, hotels, and activities directly. | High | Digital savviness, ease of online booking, cost savings. |

| Online Travel Agencies (OTAs) | Platforms offering bundled or à la carte travel components. | High | 58% of Spanish travel reservations online; OTAs capture 33% of this. |

| Standardized Package Tours | Mass-market tours with less customization. | Moderate | Global market valued at $150 billion in 2024; appeals to budget-conscious travelers. |

Entrants Threaten

Establishing a tour operator like Catai, which focuses on intricate long-distance and customized travel experiences, demands significant upfront investment. This includes securing contracts with a global network of suppliers, building robust technology platforms for booking and customer management, extensive marketing campaigns to reach target demographics, and assembling a team with specialized destination knowledge and service skills. These considerable capital requirements act as a substantial deterrent for potential new players entering the market.

Ávoris Corporación Empresarial, Catai's parent company, provides a strong financial foundation, enabling consistent investment in enhancing both its product offerings and service quality. This backing from a well-capitalized entity further solidifies Catai's competitive position and raises the bar for any aspiring entrants needing to match such financial muscle and strategic investment.

For Cathay, the threat of new entrants is significantly dampened by its established brand reputation and deep customer loyalty, particularly within the 'Grandes Viajes' niche. With over 43 years of operation, Cathay has cultivated a strong image synonymous with trust, exceptional quality, and highly personalized travel experiences.

Aspiring competitors would face a substantial hurdle in replicating this ingrained trust and loyalty. Building a comparable brand image and securing a dedicated customer base in the luxury and tailor-made travel segments requires immense time, significant financial investment, and a consistent track record of delivering superior service, making it a formidable barrier to entry.

Established tour operators like Catai have cultivated deep-seated relationships with a wide array of trusted suppliers, including airlines, hotels, and local ground operators. These established networks are crucial for securing competitive pricing and reliable service delivery, which are essential for crafting attractive travel packages.

Furthermore, Catai benefits from extensive distribution channels, encompassing traditional travel agencies and burgeoning online platforms. New entrants struggle to replicate this reach, finding it difficult to build comparable partnerships and gain access to the same customer base, hindering their ability to compete effectively in the market.

Spanish tour operators typically maintain relationships with an average of 10 key distribution partners. For new companies entering the Spanish market, establishing a similar breadth and depth of distribution is a significant hurdle, requiring substantial investment and time to build trust and secure favorable agreements.

Regulatory and Legal Hurdles

The travel industry, including companies like Cathay Tours, faces significant regulatory and legal hurdles that act as a barrier to new entrants. These can include obtaining various licenses, adhering to stringent consumer protection laws, and managing complex international travel requirements. For instance, in 2024, the International Air Transport Association (IATA) continued to emphasize the need for compliance with evolving travel regulations, which can vary drastically from one country to another.

Navigating these complexities is a time-consuming and expensive process, especially for businesses aiming for global reach. New players must invest heavily in legal counsel and compliance teams to ensure they meet all obligations, from data privacy (like GDPR) to specific country-by-country entry requirements. Failure to comply can result in hefty fines or outright bans from operating.

Staying current with these ever-changing regulations is an ongoing challenge for all travel agencies. For example, updates to visa requirements or health protocols, as seen throughout 2023 and into 2024, necessitate constant vigilance and adaptation. This continuous need for adjustment creates a high operational burden, deterring potential new entrants who may lack the resources or expertise to manage it effectively.

Key regulatory areas impacting new entrants include:

- Licensing and Permits: Obtaining necessary operating licenses in each jurisdiction.

- Consumer Protection: Adhering to laws regarding refunds, cancellations, and transparent pricing.

- International Travel Compliance: Meeting visa, passport, and health declaration requirements for various destinations.

- Data Privacy: Complying with global data protection regulations like GDPR and CCPA.

Economies of Scale and Experience Curve

Economies of scale significantly deter new entrants in the travel sector, particularly for established players like Catai, which is part of the larger Ávoris group. These scale advantages translate into lower per-unit costs for everything from airline tickets and hotel bookings to marketing campaigns. For instance, Ávoris's substantial purchasing power allows them to negotiate better rates, a feat difficult for a new, smaller operator to replicate. This cost efficiency is a major barrier, as new companies would find it challenging to compete on price or achieve comparable profit margins without matching Catai's operational volume.

The experience curve further reinforces this barrier. As Catai and Ávoris have operated for longer, they have refined their processes, built strong supplier relationships, and developed efficient operational models. This accumulated experience leads to greater efficiency and lower costs over time. New entrants lack this historical advantage and must invest heavily to build similar capabilities, making it harder to achieve cost competitiveness quickly. Ávoris's strategic goal to increase its market share in 2025 underscores its commitment to leveraging these scale and experience advantages against potential new competition.

- Economies of Scale: Catai, as part of Ávoris, benefits from bulk purchasing power, reducing operational costs.

- Experience Curve: Years of operation have allowed Catai to optimize processes and build strong supplier networks.

- Competitive Pricing: Lower costs enable Catai to offer more attractive pricing or achieve higher margins than new entrants.

- Market Share Growth: Ávoris's ambition for increased market share in 2025 highlights their confidence in these competitive advantages.

The threat of new entrants for Catai is considerably low due to substantial capital requirements for establishing a comparable tour operator, especially for customized luxury travel. Ávoris Corporación Empresarial's financial backing for Catai further elevates this barrier, demanding significant investment to match. New players would struggle to replicate Catai's established brand loyalty, built over 43 years, which is crucial in the high-end travel market.

Catai's extensive network of trusted supplier relationships and broad distribution channels, including both traditional and online platforms, present a significant challenge for newcomers. Replicating this reach and securing similar partnerships is a time-consuming and costly endeavor. Spanish tour operators typically work with around 10 key distribution partners, a benchmark difficult for new entrants to meet quickly.

Navigating the complex web of regulatory and legal hurdles, including licensing, consumer protection laws, and international travel compliance, acts as a substantial deterrent. Staying updated on evolving regulations, such as visa and health protocols, requires continuous investment in legal and compliance expertise, a burden many new entrants may find prohibitive.

Economies of scale and the experience curve further solidify Catai's position, allowing for lower per-unit costs and optimized operations. Ávoris's purchasing power and Catai's refined processes, developed over years, create a cost advantage that is difficult for new, smaller operators to overcome. Ávoris's aim to increase market share in 2025 underscores their intent to leverage these advantages against potential competition.

| Barrier Type | Description | Impact on New Entrants |

|---|---|---|

| Capital Requirements | High upfront investment for global contracts, technology, marketing, and specialized staff. | Significant deterrent, requiring substantial funding to even begin operations. |

| Brand Loyalty & Reputation | Over 43 years of building trust and delivering exceptional personalized experiences. | Extremely difficult and time-consuming for new entrants to replicate. |

| Supplier & Distribution Networks | Deep-seated relationships with airlines, hotels, and extensive access to travel agencies and online platforms. | Challenging for new players to establish comparable reach and secure favorable terms. |

| Regulatory Compliance | Navigating licenses, consumer protection, international travel laws, and data privacy. | Requires significant investment in legal expertise and constant adaptation to evolving rules. |

| Economies of Scale & Experience | Leveraging Ávoris's purchasing power and Catai's optimized operational models. | Creates a cost advantage and efficiency gap that new entrants struggle to bridge. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Cathay Tours is built upon a robust foundation of data, including Cathay Pacific's annual reports, industry-specific market research from firms like Euromonitor and Statista, and relevant aviation regulatory filings.

We also incorporate insights from financial news outlets, airline industry trade publications, and macroeconomic data to provide a comprehensive understanding of the competitive landscape.